- Home

- »

- Advanced Interior Materials

- »

-

Solar Cable Market Size And Share, Industry Report, 2030GVR Report cover

![Solar Cable Market Size, Share & Trends Report]()

Solar Cable Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Copper, Aluminum, Others), By Type (AC Cables, DC Cables), By End-use (Utility, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-513-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solar Cable Market Summary

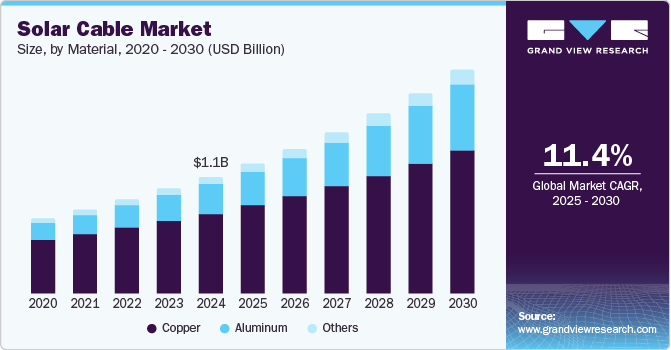

The global solar cable market size was estimated at USD 1.12 billion in 2024 and is projected to reach USD 2.14 billion by 2030, growing at a CAGR of 11.4% from 2025 to 2030. As governments and businesses aim to meet sustainability targets and reduce carbon footprints, solar power has emerged as a leading alternative energy source.

Key Market Trends & Insights

- Asia Pacific solar cable market held the largest share with revenue share of 40.0% in 2024.

- Based on material type, copper held the largest share of 68.4% in 2024.

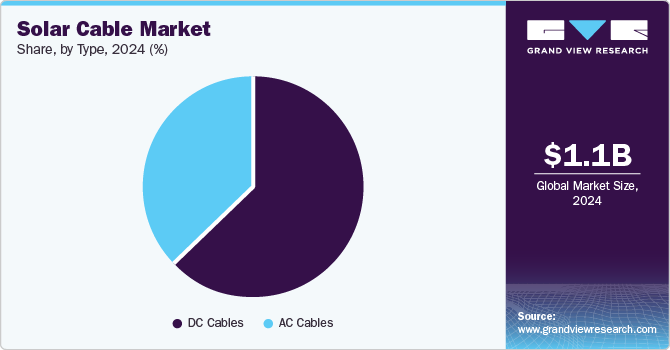

- Based on type, DC cables held the largest market revenue share of 63.2% in 2024.

- Based on end use, utility segment held the largest share of 45.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.12 Billion

- 2030 Projected Market Size: USD 2.14 Billion

- CAGR (2025-2030): 11.4%

- Asia Pacific: Largest market in 2024

This growing emphasis on clean energy has translated into higher investments in solar installations, thereby driving demand for high-quality solar cables for safe and efficient electricity transmission in photovoltaic (PV) systems. The continuous decline in solar PV system costs has made solar power more affordable and accessible to residential, commercial, and industrial sectors.

As solar energy becomes increasingly economical, more consumers and businesses are adopting solar solutions, leading to a surge in demand for solar cables. This price reduction in solar technology has spurred the expansion of the global solar market, further accelerating the need for reliable and durable cable solutions for solar energy systems.

Technological advancements in solar energy systems have also played a significant role in the growth of the solar cable industry. Developing more efficient solar panels, energy storage systems, and other related technologies has resulted in higher energy generation capacity from solar installations. As a result, the demand for cables that can handle higher electrical loads and operate under varying environmental conditions has increased. Solar cables are designed to withstand harsh weather conditions, including extreme temperatures and UV radiation, making them vital for maintaining the performance and longevity of solar power systems. This need for high-performance cables has driven manufacturers to innovate and produce more robust and efficient solar cables.

Government policies and incentives have been pivotal in promoting the use of solar energy, which directly benefits the solar cables market. Various countries have introduced subsidies, tax incentives, and renewable energy mandates that encourage installing solar power systems. These policies have boosted the demand for solar cables by providing financial incentives to residential and commercial consumers. In regions such as Europe, North America, and parts of Asia-Pacific, governments have implemented ambitious renewable energy targets, further catalysing the growth of the solar power industry and the cables that connect these systems to the grid.

Drivers, Opportunities & Restraints

The solar cable industry is primarily driven by the growing global demand for renewable energy and the expansion of solar power installations. Governments worldwide are pushing for the transition to clean energy through policy support, subsidies, and incentives. As a result, the adoption of solar energy systems has surged, directly boosting the demand for high-quality solar cables to connect solar panels, inverters, and other components. Additionally, solar power is considered a long-term investment. As the cost of solar power generation continues to decrease, more commercial and residential users opt for solar installations, further expanding the market for solar cables.

As solar energy systems become more sophisticated, there is a rising need for high-performance cables that can withstand extreme weather conditions, offer longer lifespans, and improve energy transmission efficiency. This has led to innovative cables with better insulation, UV resistance, and fire safety features. Additionally, emerging markets in Asia-Pacific, Latin America, and Africa present a wealth of opportunities, as these regions are increasingly investing in solar energy projects to address energy needs and reduce carbon footprints. The ongoing integration of energy storage systems with solar power further elevates the demand for specialized cables that ensure smooth power transmission and efficiency.

The high initial cost of quality solar cables can deter some small-scale solar power adopters. Furthermore, the solar cable industry is highly competitive, with numerous manufacturers offering various products. This results in price sensitivity and pressure on profit margins, making it difficult for some companies to thrive.

Material Insights

Based on material type, copper held the largest share of 68.4% in 2024. Copper is preferred for electrical wiring in solar power applications due to its excellent electrical conductivity and durability. As the demand for solar installations continues to rise, particularly in residential, commercial, and industrial sectors, copper's superior performance in transmitting electricity with minimal energy loss makes it an ideal choice. Additionally, copper cables offer exceptional resistance to environmental factors like corrosion, ensuring the long-term reliability of solar systems.

Aluminum is anticipated to register the fastest CAGR over the forecast period. Aluminum offers a more affordable alternative to copper, commonly used in electrical cables. This makes aluminum cables an attractive choice for solar power systems, especially for large-scale solar installations, where cost savings on materials are crucial for maximizing overall project profitability. Additionally, aluminum’s light weight makes it easier to handle and install, reducing labour costs and time during the setup of solar energy systems, further enhancing its appeal for residential and commercial projects.

Type Insights

DC cables held the largest market revenue share of 63.2% in 2024. As solar energy continues gaining traction as a clean and renewable energy source, the demand for efficient direct current (DC) electricity transmission has surged. Solar panels generate DC power and require specialized cables to safely and effectively transmit energy to inverters and battery storage systems.

AC cables is anticipated to register the fastest CAGR over the forecast period. Alternating Current (AC) cables are essential for connecting solar inverters to the grid, ensuring the efficient transmission of electricity generated by PV systems. The growing trend of large-scale solar power plants and commercial rooftop solar installations has directly contributed to the rising demand for high-quality AC cables, which are necessary for transferring AC power to the grid.

End Use Insights

Based on end use, utility segment held the largest share of 45.8% in 2024. As the world shifts away from fossil fuels, utility-scale solar power installations are becoming essential to the energy grid. These solar farms require specialized cables capable of withstanding extreme weather conditions, high voltages, and continuous exposure to solar radiation. The need for robust and durable solar cables in these large-scale projects’ fuels market growth.

Residential segment is anticipated to register the fastest CAGR over the forecast period. The solar energy adoption by homeowners seeking to reduce their electricity bills and contribute to environmental sustainability proliferates the market. With the cost of solar panels and related equipment continuing to decline, an increasing number of households are investing in solar power systems, necessitating using solar cables to ensure efficient and safe electricity transmission.

Regional Insights

The North America solar cable market is anticipated to grow significantly over the forecast period. The U.S. and Canada have made significant strides in increasing renewable energy adoption, with solar power playing a key role in these efforts. Government incentives such as the Investment Tax Credit (ITC) in the U.S. and various provincial rebates and tax credits in Canada have lowered the financial barrier to entry for solar installations. As more residential, commercial, and industrial solar projects are initiated, the demand for solar cables to support these systems has steadily risen.

Asia Pacific Solar Cable Market Trends

Asia Pacific solar cable market held the largest share with revenue share of 40.0% in 2024. As countries such as China, India, Japan, and Australia continue to invest heavily in renewable energy infrastructure, the demand for solar cables is steadily rising. For instance, in January 2025, India issued a significant total of 4,419 megawatts (MW) in renewable energy tenders, marking a crucial step towards achieving its ambitious target of 500 GW renewable energy capacity by 2030. These initiatives have created a surge in the installation of solar panels, and as a result, the need for durable, high-performance solar cables to ensure the efficient transmission of energy has significantly increased.

Europe Solar Cable Market Trends

European countries have set ambitious renewable energy targets, with the European Union (EU) aiming to achieve carbon neutrality by 2050. Solar power is at the forefront of this transition, with large-scale solar farms and residential solar installations rapidly increasing. Government policies such as feed-in tariffs, grants, and tax incentives encourage solar adoption, and this surge in solar energy installations directly drives the demand for solar cables, which are crucial for ensuring the safe and efficient transfer of electricity from solar panels to the grid or storage systems.

Central & South America Solar Cable Market Trends

The expansion of solar power in the commercial and industrial sectors is playing a major role in the growth of the solar cables market in Central & South America. Many businesses and industrial facilities are turning to solar energy to reduce their energy costs and achieve sustainability goals. With the region’s rapid urbanization and industrialization, the demand for large-scale solar installations is rising, which drives the need for solar cables capable of handling the increased power output and ensuring optimal energy transmission.

Middle East & Africa Solar Cable Market Trends

Government initiatives to reduce carbon emissions and increase renewable energy capacity fueling the growth of the solar cables market in the MEA region. For instance, Saudi Arabia's Vision 2030 plan aims to diversify the country's energy mix, with solar power expected to contribute significantly to generating 50% of the nation's electricity from renewables by 2030. Similarly, the UAE's push for sustainability, with projects like the Mohammed bin Rashid Al Maktoum Solar Park in Dubai, is driving large-scale solar projects. As these projects continue to scale up, the need for high-quality solar cables that can withstand extreme weather conditions, such as high temperatures and dust storms, will continue to grow, further boosting the market.

Key Solar Cable Company Insights

Some of the key players operating in the market include Alpha Wire, Allied Wire and Cable, and others

-

Alpha Wire offers a comprehensive range of solar cable solutions to withstand harsh environmental conditions while ensuring reliable performance. Their photovoltaic wire features include sizes ranging from 14 AWG to 2 AWG and comply with UL 4703 PV wire standards and TUV Pfg 1169 LSZH wire specifications. The cables are engineered with specially formulated PVC jackets that provide resistance against oil, sunlight, ozone layers, and UV radiation.

-

Allied Wire and Cable is a leading distributor and manufacturer of electrical wire, cable, and related products. The company offers a comprehensive selection of solar cables designed specifically for PV systems. Their product line includes both PV wire and other types of cables that are essential for solar installations. The solar cables are engineered to withstand harsh environmental conditions, ensuring durability and reliability over time.

Key Solar Cable Companies:

The following are the leading companies in the solar cable market. These companies collectively hold the largest market share and dictate industry trends.

- Alpha Wire

- Allied Wire and Cable

- Belden

- Fujikura

- Furukawa Electric

- General Cable

- Havells

- Helukabel

- Hellenic Group

- Kabelwerk Eupen

- KEI Industries

- Lapp Group

Solar Cable Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.24 billion

Revenue forecast in 2030

USD 2.14 billion

Growth rate

CAGR of 11.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, type, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain: France; Italy; Russia; China; India; Japan; Indonesia; Brazil; Saudi Arabia; South Africa

Key companies profiled

Alpha Wire; Allied Wire and Cable; Belden; Fujikura; Furukawa Electric; General Cable; Havells; Helukabel; Hellenic Group; Kabelwerk Eupen; KEI Industries; Lapp Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solar Cable Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global solar cable market report on the basis of material, type, end use, and region:

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Copper

-

Aluminum

-

Others

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

AC Cables

-

DC Cables

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Utility

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global solar cable market size was estimated at USD 1.12 billion in 2024 and is expected to reach USD 2.14 billion in 2025.

b. The global solar cable market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2030 to reach USD 2.14 billion by 2030.

b. The copper segment dominated the market with a revenue share of 68.4% in 2024.

b. Some of the key players of the global solar cable market are Alpha Wire; Allied Wire and Cable; Belden; Fujikura; Furukawa Electric; General Cable; Havells; Helukabel, and others.

b. The key factor that is driving the growth of the global solar cable market is driven by the increasing adoption of renewable energy and the declining costs of solar installations, making solar power more accessible.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.