- Home

- »

- Next Generation Technologies

- »

-

Soldier Systems Market Size, Share & Growth Report, 2030GVR Report cover

![Soldier Systems Market Size, Share & Trends Report]()

Soldier Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment (Personal Protection, Communication, Navigation & Targeting), By Application (Combat Operations), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-400-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Soldier Systems Market Summary

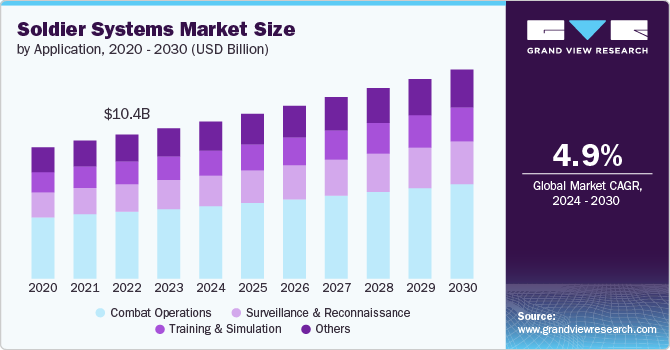

The global soldier systems market size was estimated at USD 10.90 billion in 2023 and is projected to reach USD 15.16 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. Governments and defense organizations globally are investing in modernization programs to enhance the capabilities of their armed forces.

Key Market Trends & Insights

- The soldier systems market in North America accounted for the highest revenue share of nearly 39% in 2023.

- The soldier systems market in Asia Pacific is anticipated to grow at the highest CAGR of over 8% from 2024 to 2030.

- The soldier systems market in the Middle East and Africa (MEA) region is anticipated to grow at a significant CAGR of over 9% from 2024 to 2030.

- Based on equipment, the personal protection segment dominated the market in 2023 with a market share of around 31%.

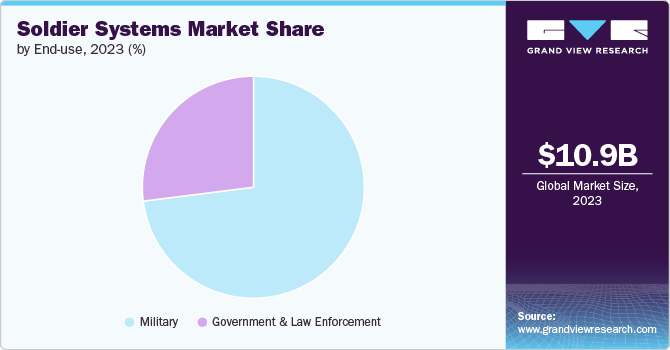

- In terms of end use, the military segment held the highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.90 Billion

- 2030 Projected Market Size: USD 15.16 Billion

- CAGR (2024-2030): 4.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

These programs include upgrading soldier systems with advanced technologies such as improved communication devices, night vision equipment, and body armor. The aim is to equip soldiers with the latest tools to improve their effectiveness and survivability on the battlefield. As nations strive to maintain a competitive edge in defense, the demand for innovative soldier systems continues to grow in the coming years.Moreover, the rapid advancements in technology have led to the development of more advanced and efficient soldier systems. Innovations such as wearable electronics, advanced sensors, and integrated communication systems enhance situational awareness and operational efficiency. These technological improvements make soldier systems more reliable and effective, encouraging defense organizations to adopt new solutions. Continuous research and development in this field ensure a steady flow of innovative products, propelling the market growth.

Many countries are increasing their defense budgets to address growing security concerns and geopolitical tensions. Higher defense spending allows for more significant investments in advanced soldier systems to ensure military readiness and superiority. The allocation of funds towards upgrading and acquiring new soldier systems directly impacts market growth, as defense organizations prioritize equipping their personnel with innovative technology. This trend of rising defense budgets is expected to sustain the demand for advanced soldier systems, thus driving the expansion of the soldier systems market.

In addition, enhancing the safety and survivability of soldiers is a primary concern for defense organizations globally. The need to protect soldiers in various combat scenarios drives the development and adoption of advanced protective gear, medical systems, and life-support equipment. Modern soldier systems are designed to improve the overall survivability of troops by providing better protection, situational awareness, and support in adverse conditions. As the emphasis on soldier safety increases, the demand for comprehensive and advanced soldier systems is expected to increase further.

Furthermore, the nature of modern warfare is shifting towards asymmetric conflicts and counter-terrorism operations, where traditional warfare strategies may not be effective. These operations require specialized equipment and systems to adapt to unpredictable and dynamic combat environments. Soldier systems equipped with advanced communication, surveillance, and reconnaissance capabilities are essential for mission success in these scenarios. The growing need to address unconventional threats and conduct effective counter-terrorism operations fuels the demand for advanced soldier systems market.

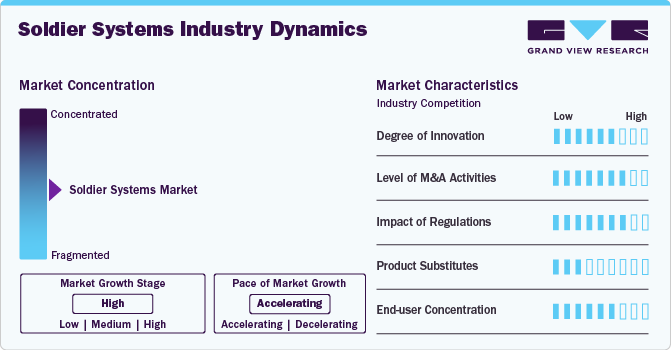

Market Concentration & Characteristics

The soldier systems market is experiencing a significant degree of innovation, driven by advancements in technology and the evolving requirements of modern warfare. This has led to the development of more sophisticated and integrated systems, designed to enhance the operational capabilities and protection of the individual soldier on the battlefield.

Regulations play a significant role in shaping the soldier systems market, imposing standards that ensure the safety, reliability, and effectiveness of equipment used by military personnel. These regulatory frameworks also stimulate innovation by setting benchmarks for performance and environmental sustainability, thereby influencing the development and adoption of new technologies within the sector.

The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The advent of product substitutes in the soldier systems market is reshaping competitive dynamics by offering alternatives that blend cost-effectiveness with advanced functionalities. These substitutes not only challenge established products but also push companies towards further innovation to maintain their market positioning and meet evolving operational demands.

The concentration of end users in the soldier systems market, primarily comprised of military and defense agencies, significantly impacts market dynamics by steering product development towards specific operational requirements and standards. This focused demand pool encourages suppliers to tailor their innovations and product upgrades to meet the nuanced needs of a relatively narrow audience, potentially accelerating the push towards cutting-edge military technologies.

Equipment Insights

The personal protection segment dominated the market in 2023 with a market share of around 31%, due to the increasing focus on enhancing soldier safety and survivability. Advances in materials and technology have led to the development of lighter, more effective body armor, helmets, and protective gear. These innovations provide better protection against ballistic threats and improve mobility, making them essential for modern combat scenarios. As defense organizations prioritize the well-being of their personnel, the demand for advanced personal protection equipment continues to rise, thereby driving the segment growth.

The navigation and targeting segment is expected to record the highest CAGR of over 5% from 2024 to 2030. The growth is attributed to the increasing demand for precision and situational awareness in modern combat. Advanced GPS systems, laser rangefinders, and augmented reality devices enhance soldiers' ability to navigate complex terrains and accurately target adversaries. These technologies improve mission effectiveness and reduce collateral damage, making them indispensable in contemporary military operations. As defense organizations prioritize enhanced operational capabilities, the demand for sophisticated navigation and targeting solutions continues to rise.

Application Insights

The combat operations segment held the highest revenue share in 2023, due to the increasing frequency and complexity of modern warfare scenarios. Enhanced focus on real-time situational awareness, precision targeting, and effective communication systems is driving demand for advanced soldier systems tailored for combat missions. The rise of asymmetric warfare and counter-terrorism efforts further necessitates the deployment of sophisticated equipment to ensure mission success and soldier safety. As military strategies evolve, investment in combat-specific soldier systems continues to grow, propelling the market forward.

The surveillance and reconnaissance segment is estimated to register the highest growth rate from 2024 to 2030, due to the increasing need for real-time situational awareness in modern combat scenarios. Advanced technologies such as drones, wearable sensors, and enhanced optics provide soldiers with critical intelligence, improving decision-making and mission success rates. As asymmetric warfare and counter-terrorism operations rise, the demand for sophisticated surveillance and reconnaissance tools intensifies. This focus on gathering actionable intelligence drives continuous investments and innovations in this segment, fueling its growth.

End Use Insights

The military segment held the highest revenue share in 2023, due to increased investments in modernization programs and the continuous evolution of warfare tactics. Governments and defense organizations are prioritizing the enhancement of soldier capabilities with advanced technologies such as wearable electronics, improved communication systems, and enhanced protective gear. This growth is further fueled by rising defense budgets and the need to maintain military readiness and superiority in various combat scenarios. Consequently, the demand for sophisticated soldier systems continues to expand, driving the overall market growth.

The government and law enforcement segment is estimated to register the highest growth rate from 2024 to 2030, due to increased investment in equipping personnel with advanced technology for enhanced operational efficiency and safety. Governments are prioritizing modernization programs to address rising security concerns and geopolitical tensions, leading to higher demand for state-of-the-art communication, surveillance, and protective equipment. In addition, law enforcement agencies are adopting advanced soldier systems to improve their capabilities in handling sophisticated criminal activities and maintaining public safety. This heightened focus on upgrading capabilities drives the growth of the soldier systems market in this segment.

Regional Insights

The soldier systems market in North America accounted for the highest revenue share of nearly 39% in 2023. In North America, the soldier systems market is driven by increasing defense budgets and a strong emphasis on soldier modernization programs. The push for technological superiority and interoperability within NATO allies also plays a crucial role.

U.S. Soldier Systems Market Trends

The soldier systems market in the U.S. is anticipated to grow at a CAGR of around 3% from 2024 to 2030. In the U.S., the soldier systems market is primarily driven by advancements in technology and increasing defense budgets aimed at enhancing soldier survivability and operational capabilities.

Asia Pacific Soldier Systems Market Trends

The soldier systems market in Asia Pacific is anticipated to grow at the highest CAGR of over 8% from 2024 to 2030. The Asia Pacific region sees its growth in the soldier systems market fueled by rising security concerns, territorial disputes, and the need to enhance the combat capabilities of armed forces amidst growing geopolitical tensions.

The soldier systems market in India is estimated to record a significant growth rate from 2024 to 2030. The rapid modernization of its military forces, coupled with the push for self-reliance in defense production, propels the growth of its soldier systems market.

The China soldier systems market is expected to grow considerably from 2024 to 2030. China's growth in the soldier systems market is powered by its extensive focus on indigenous innovation and the modernization of the People's Liberation Army, emphasizing network-centric warfare capabilities.

The soldier systems market in Japan is projected to witness a considerable growth rate from 2024 to 2030. Japan's market growth is catalyzed by its increasing defense expenditures and partnerships with global defense technology firms to upgrade its Self-Defense Forces.

Europe Soldier Systems Market Trends

Soldier systems market in Europe accounted for a notable revenue share of 24% in 2023. Europe's soldier systems market benefits from collaborative defense projects among EU nations and a consistent focus on enhancing soldier survivability and operational efficiency, driven by the evolving nature of warfare and heightened security challenges.

The soldier systems market in UK is projected to grow considerably from 2024 to 2030. In the UK, the soldier systems market is spurred by ongoing investments in future soldier technology programs and a strong focus on interoperability with NATO forces.

The soldier systems market in Germany is expected to record significant growth from 2024 to 2030. Germany's market benefits from a comprehensive approach to soldier modernization, combining government funding with collaboration between defense industries and research institutions.

Middle East and Africa (MEA) Soldier Systems Market Trends

The soldier systems market in the Middle East and Africa (MEA) region is anticipated to grow at a significant CAGR of over 9% from 2024 to 2030. In the MEA, the growth of the soldier systems market is propelled by increasing defense expenditure to modernize military forces and the requirement for advanced soldier equipment to address security and counterterrorism efforts in a volatile security environment.

Soldier systems in energy market in Saudi Arabia accounted for a considerable revenue share in 2023. Saudi Arabia's soldier systems market growth is driven by its substantial military spending and strategic initiatives to develop a domestic defense manufacturing base, aligning with its Vision 2030 goals.

Key Soldier Systems Company Insights

Some of the key players operating in the market are Lockheed Martin Corporation, BAE Systems plc, and Thales Group.

-

Lockheed Martin Corporation is an aerospace, defense, security, and advanced technologies company with worldwide interests. The company operates in four main business sectors: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space, providing a wide range of products and services for both domestic and international customers.

-

Thales Group is a multinational company that designs and builds electrical systems and provides services for the aerospace, defense, transportation, and security markets. Headquartered in Paris, France, Thales Group plays a crucial role in global infrastructure and information systems, offering a broad spectrum of solutions to support digital transformation and critical decision-making.

Safariland, LLC, Point Blank Enterprises, Inc., and Hosl GmbH, among others are some of the emerging market participants in the soldier systems market.

-

Safariland, LLC is an American company specializing in a variety of equipment for law enforcement, military, and recreational markets. The company offers a broad range of products including body armor, duty gear, forensic supplies, and outdoor and tactical equipment. The company is committed to innovation and quality in providing protective products and gear to professionals and enthusiasts alike.

-

Point Blank Enterprises, Inc. is a development, manufacturing, and distribution of high-performance protective solutions for the U.S. Military and Department of Defense, federal agencies, and law enforcement and corrections professionals. Established in the 1970s, the company offers a wide array of body armor systems, protective vests, and ballistic accessories.

Key Soldier Systems Companies:

The following are the leading companies in the soldier systems market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- BAE Systems plc

- Kopin Corporation

- Thales Group

- Safariland, LLC

- Point Blank Enterprises, Inc.

- Hosl GmbH

- Harris Corporation

- L3Harris Technologies, Inc.

- Rohde & Schwarz GmbH & Co KG

Recent Developments

-

In July 2024, Kopin Corporation partnered with Wilcox Industries to introduce the innovative FUSION CLAW, a head-mounted information system that promises to transform military operations. This cutting-edge system combines a modular design with the ability to smoothly incorporate features such as night vision, communication devices, friend or foe identification, artificial intelligence-driven power management, multi-spectral lighting for enhanced visibility, functionality for mission recording, and a Day/Night Heads-Up Display (HUD). All these capabilities are integrated into a compact and lightweight unit designed for battlefield efficiency.

-

In May 2024, At SOF Week 2024, Galvion is expected to showcase its innovative wireless charging technology for soldier systems, named BATLCHRG, alongside a broader range of the company's systems and solutions at booth 948. Visitors will have the chance to see the BATLCHRG technology in action within two distinct military deployment scenarios: integrated within a vehicle seat and showcased as a wall-mounted mat for use in a ready-room setting.

-

In April 2024, The Bundeswehr has awarded Rheinmetall a significant contract for a project essential to tactical communications across the entire armed forces. This contract involves the supply of as many as 191,000 units of an "intercom system equipped with a hearing protection feature." The agreement spans seven years and could reach a net value of approximately USD 435 million.

Soldier Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.41 billion

Revenue forecast in 2030

USD 15.16 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Lockheed Martin Corporation, BAE Systems plc; Kopin Corporation; Thales Group; Safariland, LLC; Point Blank Enterprises, Inc.; Hosl GmbH; Harris Corporation; L3Harris Technologies, Inc.; Rohde & Schwarz GmbH & Co KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Soldier Systems Market Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global soldier systems market report based on equipment, application, end use, and region.

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal Protection

-

Communication

-

Navigation and Targeting

-

Power and Energy Systems

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Combat Operations

-

Surveillance and Reconnaissance

-

Training and Simulation

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Military

-

Government and Law Enforcement

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global soldier systems market size was estimated at USD 10.90 billion in 2023 and is expected to reach USD 11.41 billion in 2024.

b. The global soldier systems market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 15.16 billion by 2030.

b. The North America region accounted for the largest share of over 39% in the soldier systems market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the soldier systems market include Lockheed Martin Corporation, BAE Systems plc, General Dynamics Corporation, Thales Group, Safariland, LLC, Point Blank Enterprises, Inc., Hösl GmbH, Harris Corporation, L3Harris Technologies, Inc., Rohde & Schwarz GmbH & Co KG.

b. Key factors that are driving the soldier systems market growth include the rise in investment by governments and defense organizations globally in modernization programs to enhance the capabilities of their armed forces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.