- Home

- »

- Advanced Interior Materials

- »

-

Solid-State Battery Materials Market, Industry Report, 2033GVR Report cover

![Solid-State Battery Materials Market Size, Share & Trends Report]()

Solid-State Battery Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use, By Battery Type (Lithium-based Solid-State Batteries, Sodium-based Solid-State Batteries), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-775-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Solid-State Battery Materials Market Summary

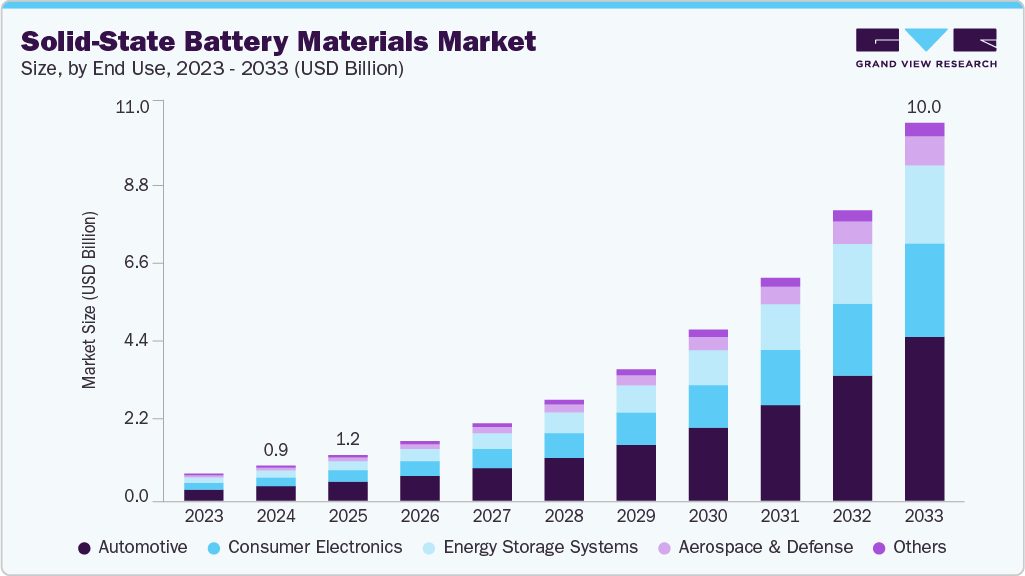

The global solid-state battery materials market size was estimated at USD 0.93 billion in 2024 and is projected to reach USD 10.04 billion by 2033, growing at a CAGR of 30.3% from 2025 to 2033. The growth is driven by the rising demand for safer and higher energy density energy storage solutions across various industries. Solid-state batteries, which replace liquid electrolytes with solid materials, offer enhanced safety by eliminating risks associated with leakage and combustion.

Key Market Trends & Insights

- North America dominated the solid-state battery materials market with the largest revenue share of 32.2% in 2024.

- By battery type, sodium-based solid-state batteries segment is expected to grow at the fastest CAGR of 30.8% from 2025 to 2033 in terms of revenue.

- By end use, automotive segment is expected to grow at the fastest CAGR of 30.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 0.93 Million

- 2033 Projected Market Size: USD 10.04 Million

- CAGR (2025-2033): 30.3%

- Asia Pacific: Largest market in 2024

The increasing adoption of electric vehicles (EVs) has significantly accelerated the need for advanced battery technologies that provide longer driving ranges, faster charging, and greater reliability. This transition is compelling manufacturers to invest heavily in solid-state materials such as ceramics, sulfides, and polymers to enhance battery performance and lifespan.

Technological advancements in battery chemistry and materials science are further propelling the growth of the solid-state battery materials market. Research initiatives focused on improving ionic conductivity and reducing interfacial resistance are enabling the development of more efficient and commercially viable solid-state batteries. Companies and research institutions are collaborating to innovate new material compositions that can achieve higher energy densities while maintaining stability and scalability. Such innovations are not only improving the performance of next-generation batteries but also reducing production costs, making solid-state technologies more accessible to a wider range of applications.

The growing emphasis on sustainability and environmental conservation is another key driver of the market. Solid-state batteries utilize materials that are less hazardous and more recyclable compared to conventional lithium-ion batteries, aligning with global goals for cleaner energy storage solutions. Governments and regulatory bodies across regions are promoting eco-friendly technologies through incentives and funding programs, encouraging industries to adopt greener alternatives. As a result, material manufacturers are increasingly focusing on developing solid-state components that reduce carbon emissions and enhance the recyclability of battery systems.

Market Concentration & Characteristics

The global solid-state battery materials market exhibits a moderate to high degree of innovation, characterized by continuous advancements in electrolyte materials, interface engineering, and manufacturing techniques. Companies and research institutions are investing heavily in R&D to enhance ionic conductivity, energy density, and overall battery stability, driving rapid technological evolution. The market has also witnessed strategic mergers, acquisitions, and collaborations among leading players and startups, aimed at accelerating commercialization and scaling production capabilities. These consolidations are helping firms strengthen their intellectual property portfolios and reduce the time-to-market for innovative solid-state solutions, thereby intensifying competition among key participants.

Regulatory frameworks and environmental policies have a significant influence on market dynamics, particularly in promoting sustainable and safe battery materials. Stringent government regulations on emissions and safety standards are encouraging the adoption of eco-friendly materials and manufacturing processes. The availability of service substitutes remains limited, as solid-state batteries offer distinct advantages in safety and performance compared to conventional lithium-ion technologies. However, ongoing R&D in hybrid and semi-solid batteries presents potential competitive alternatives. End user concentration is notably high in sectors such as electric vehicles, consumer electronics, and renewable energy storage, where the demand for compact, efficient, and durable energy solutions is driving large-scale adoption and sustained investment in solid-state battery materials.

End Use Insights

The automotive segment dominated the global solid-state battery materials market, accounting for a revenue share of 41.4% in 2024, driven by the rising adoption of electric vehicles (EVs) and the demand for safer, higher-capacity energy storage systems. Automakers are increasingly investing in solid-state technology to enhance vehicle range, reduce charging time, and improve battery lifecycle. Stringent emission regulations across major economies are accelerating the transition from conventional lithium-ion to solid-state batteries. Furthermore, collaborations between battery manufacturers and automotive OEMs are expediting large-scale commercialization. The focus on lightweight, compact, and thermally stable materials further strengthens market expansion in this segment.

Energy & power segment is expected to grow significantly at CAGR of 30.5% over the forecast period, driven by growing investments in renewable energy infrastructure and grid storage systems requiring reliable, high-energy-density batteries. Solid-state batteries provide longer operational life, enhanced safety, and better thermal stability compared to traditional systems, making them ideal for energy storage applications. Increasing global energy consumption and the need for sustainable power management solutions are fueling adoption. Additionally, the declining cost of advanced solid electrolytes is improving scalability for large-scale installations. Government initiatives promoting smart grids and clean energy further contribute to segment growth.

Battery Type Insights

Lithium-based solid-state batteries segment dominated the global solid-state battery materials market, accounting for a revenue share of 82.5% in 2024, driven by technological advancements in solid electrolytes, particularly sulfide and oxide-based materials that enhance ionic conductivity and battery performance. These batteries are gaining traction due to their higher energy density and superior safety compared to liquid lithium-ion systems. Growing R&D investments from companies like Toyota, Solid Power are accelerating innovation. The rapid expansion of EV and consumer electronics markets is also increasing demand for efficient lithium-based solid-state materials. Moreover, manufacturing process optimization and cost reduction efforts are improving commercialization potential.

Sodium-based solid-state batteries segment is anticipated to grow at the fastest CAGR of 30.8% during the forecast period, driven by need for cost-effective and resource-abundant alternatives to lithium-based systems. Sodium’s widespread availability and lower material cost make it attractive for large-scale energy storage and grid applications. Research advancements in solid electrolytes and sodium anode materials are enhancing performance and stability. These batteries offer strong potential for regions with limited lithium resources, supporting energy independence and sustainability. In addition, industrial and government-backed projects are focusing on sodium solid-state technologies to diversify the global energy storage landscape.

Regional Insights

The North America solid-state battery materials market is driven by strong investments in electric vehicle innovation and advanced energy storage systems. Major automakers and technology companies are collaborating with research institutions to accelerate the commercialization of solid-state batteries. Government initiatives promoting clean energy and the reduction of carbon emissions are further supporting market growth. The U.S. Department of Energy’s funding programs for next-generation battery research have encouraged the use of solid electrolytes and advanced anode materials. Additionally, the presence of leading EV manufacturers and material suppliers provides a robust ecosystem for innovation. The focus on safety, performance, and sustainability continues to fuel the regional adoption of solid-state battery materials.

U.S. Solid-State Battery Materials Market Trends

In the United States, the market is primarily driven by rapid technological innovation and the expanding EV and renewable energy sectors. The growing need for energy storage systems that offer higher efficiency and safety has prompted R&D in solid ceramic and sulfide-based electrolytes. Federal and state-level policies promoting electric mobility and localized battery production are also fostering growth. Strategic partnerships between battery developers and automobile manufacturers are enhancing the pace of material development and commercialization. The strong intellectual property landscape and access to venture capital are supporting startups in scaling solid-state technologies. Furthermore, the emphasis on reducing reliance on imported lithium-ion materials is strengthening domestic supply chains.

Asia Pacific Solid-State Battery Materials Market Trends

The Asia Pacific held the largest revenue market share of 37.5% in 2024, driven by region’s dominance in electronics manufacturing and electric mobility. Countries like Japan and South Korea are leading in R&D investments to develop high-performance solid electrolytes and anode materials. Government support for renewable energy and advanced battery production is further enhancing the regional outlook. The region benefits from strong industrial infrastructure and established battery supply chains, facilitating large-scale material production. Additionally, the demand for compact, safe, and durable batteries in consumer electronics is boosting market adoption. Increasing collaborations between Asian manufacturers and global technology providers are driving innovation and competitive growth.

China solid-state battery materials market is driven by government-led initiatives to strengthen domestic energy storage and electric vehicle capabilities. The country’s “Made in China 2025” policy supports the development of next-generation battery technologies, including solid-state variants. Leading battery manufacturers are investing in research to achieve higher energy densities and better safety profiles. The rapid growth of the EV market has created strong demand for solid electrolytes and high-capacity anodes. Local companies are also expanding production facilities to ensure cost-efficient scaling. Moreover, the government’s emphasis on sustainability and energy security continues to stimulate technological advancements in solid-state materials.

Europe Solid-State Battery Materials Market Trends

Europe’s solid-state battery materials market is propelled by its aggressive decarbonization targets and strong focus on green mobility. The European Union’s funding programs, such as the European Battery Alliance, are encouraging innovation in advanced material research. Automakers across Germany, France, and the UK are heavily investing in solid-state technologies to comply with stringent emission norms. The presence of advanced research institutions and strategic collaborations with global players are further accelerating innovation. The growing adoption of renewable energy storage solutions is also boosting demand for long-lasting solid-state batteries. Additionally, sustainability regulations and recycling initiatives are shaping material selection and production methods across the continent.

Germany Solid-State Battery Materials Trends

Germany’s solid-state battery materials market is driven by its leadership in automotive engineering and advanced manufacturing technologies. The country’s automakers are investing in solid-state research to enhance EV performance and extend driving ranges. Government funding through initiatives like “Battery Innovation Competence Center” supports large-scale R&D in next-generation materials. Collaboration between universities, research institutes, and industry leaders is fostering a robust innovation ecosystem. Moreover, Germany’s emphasis on sustainability and carbon-neutral mobility is accelerating the shift toward solid-state technologies. The integration of renewable energy systems with high-efficiency battery materials further strengthens the country’s market position.

Central & South America Solid-State Battery Materials Trends

The Latin America solid-state battery materials market is growing steadily, driven by the increasing adoption of renewable energy and electrification initiatives. Countries such as Brazil and Mexico are witnessing rising interest in advanced storage solutions for solar and wind power integration. Investments in sustainable transportation and EV infrastructure are also contributing to demand growth. The region’s access to critical minerals, including lithium and nickel, provides a strategic advantage for material production. Moreover, collaborations with international technology providers are enabling knowledge transfer and local manufacturing development. Supportive government policies and green energy commitments are expected to further stimulate market expansion.

Middle East & Africa Solid-State Battery Materials Trends

The solid-state battery materials market in the Middle East & Africa is driven by the growing focus on renewable energy diversification and sustainable infrastructure. Governments are investing in clean energy projects to reduce dependence on fossil fuels, creating opportunities for advanced battery technologies. The region’s emerging electric mobility and energy storage sectors are increasingly exploring solid-state materials for enhanced performance and safety. Collaborations between regional energy firms and global battery manufacturers are fostering technology transfer. Additionally, the growing demand for off-grid and backup energy systems in remote areas supports material adoption. Environmental regulations and sustainability goals continue to encourage innovation and market growth across the region.

Key Solid-State Battery Materials Company Insights

Some of the key players operating in the market include QuantumScape Corporation, Toyota Motor Corporation:

-

QuantumScape Corporation is a U.S.-based company specializing in the development of next-generation solid-state lithium-metal batteries. The company’s proprietary solid ceramic electrolyte enables higher energy density, faster charging, and improved safety compared to conventional lithium-ion batteries. Its material technology is designed to eliminate the need for a traditional separator, thereby enhancing performance and durability for electric vehicle applications.

-

Toyota Motor Corporation is a global leader in automotive innovation and a key player in solid-state battery research and development. The company focuses on developing sulfide-based solid electrolytes that provide superior ionic conductivity and stability. Toyota’s ongoing R&D efforts aim to commercialize solid-state batteries with longer lifespans and faster charging capabilities, strengthening its electric and hybrid vehicle portfolio.

Solid Power, Inc., Samsung SDI Co., Ltd. are some of the emerging participants in the market.

-

Solid Power, Inc. is a U.S.-based advanced battery developer engaged in manufacturing solid-state battery materials and cells. The company produces sulfide-based solid electrolytes and high-capacity anode and cathode materials designed for electric vehicles and energy storage systems. Its solid-state battery technology enhances energy density while reducing flammability risks, positioning the firm as a leading supplier to global automakers and battery integrators.

-

Samsung SDI Co., Ltd., headquartered in South Korea, is a major producer of high-performance battery materials, including solid-state technologies. The company is advancing oxide and polymer-based solid electrolytes that enhance safety, power density, and life cycle. Samsung SDI’s R&D initiatives focus on integrating these materials into next-generation electric vehicles and portable electronics, aligning with global sustainability goals.

Key Solid-State Battery Materials Companies:

The following are the leading companies in the solid-state battery materials market. These companies collectively hold the largest market share and dictate industry trends.

- QuantumScape Corporation

- Toyota Motor Corporation

- Solid Power, Inc.

- Samsung SDI Co., Ltd.

- LG Energy Solution Ltd.

- Ilika plc

- Murata Manufacturing Co., Ltd.

- Hitachi Zosen Corporation

- Panasonic Holdings Corporation

Recent Developments

In April 2025, Narada Power introduced its 783 Ah solid-state battery cell with a total capacity of 8.3 MWh, marking a major leap in high-density energy storage. The battery offers enhanced safety, longer cycle life, and superior thermal stability compared to traditional lithium-ion systems. This innovation strengthens Narada’s position in large-scale renewable and grid energy storage solutions.

Solid-State Battery Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.21 billion

Revenue forecast in 2033

USD 10.04 billion

Growth rate

CAGR of 30.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, battery type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; India; China; Japan; South Korea

Key companies profiled

QuantumScape Corporation; Toyota Motor Corporation; Solid Power, Inc.; Samsung SDI Co. Ltd.; LG Energy Solution Ltd.; Ilika plc; Murata Manufacturing Co., Ltd.; Hitachi Zosen Corporation; Panasonic Holdings Corporation

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solid-State Battery Materials Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global solid-state battery materials market report based on end use, battery type, and region.

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Energy Storage Systems

-

Aerospace & Defense

-

Automotive

-

Others

-

-

Battery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Lithium-based Solid-State Batteries

-

Sodium-based Solid-State Batteries

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global solid-state battery materials market size was estimated at USD 0.93 billion in 2024 and is expected to reach USD 1.21 billion in 2025.

b. The global solid-state battery materials market is expected to grow at a compound annual growth rate of 30.3% from 2025 to 2033 to reach USD 10.04 billion by 2033.

b. Based on end use, automotive segment dominated the global solid-state battery materials market, accounting for a revenue share of 41.4% in 2024, driven by the rising adoption of electric vehicles (EVs) and the demand for safer, higher-capacity energy storage systems.

b. Key players in the solid-state battery materials market include QuantumScape Corporation, Toyota Motor Corporation, Solid Power, Inc., Samsung SDI Co., Ltd., LG Energy Solution Ltd., Ilika plc, Murata Manufacturing Co., Ltd., Hitachi Zosen Corporation, Panasonic Holdings Corporation

b. Key factors driving the solid-state battery materials market include growing demand for high-energy-density and safer energy storage solutions across electric vehicles, consumer electronics, and renewable energy sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.