- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Solvent Borne Coatings Market Size & Share Report, 2030GVR Report cover

![Solvent Borne Coatings Market Size, Share & Trends Report]()

Solvent Borne Coatings Market Size, Share & Trends Analysis Report By Type (One Component, Two Component), By Application (Automotive, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-116-3

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

The global solvent borne coatings market size was valued at USD 39.14 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030. This growth is attributed to the ability of these coatings to produce high-quality finishes. Solvent-borne coatings have excellent adhesion properties, which produce a durable finish that is resistant to corrosion, abrasion, and weathering. These coatings are also known for their ability to produce a smooth and glossy finish that enhances the appearance of the substrate.

Solvent borne coatings can be used on a variety of surfaces, and they offer good resistance to weathering and corrosion. They are also resistant to UV radiation and can withstand fluctuations in temperature and humidity, making them ideal for outdoor use. Additionally, the rising application of solvent-based coatings for industrial and architectural purposes, owing to their various beneficial properties such as lower drying times and better functionality in open & humid conditions, is anticipated to drive product demand over the forecast period.

However, some of these solvents can be volatile organic compounds (VOCs), which can have negative environmental impacts. For this reason, many countries have introduced regulations that limit the use of VOCs in products, including solvent-borne coatings, which is hindering the growth of the product market.

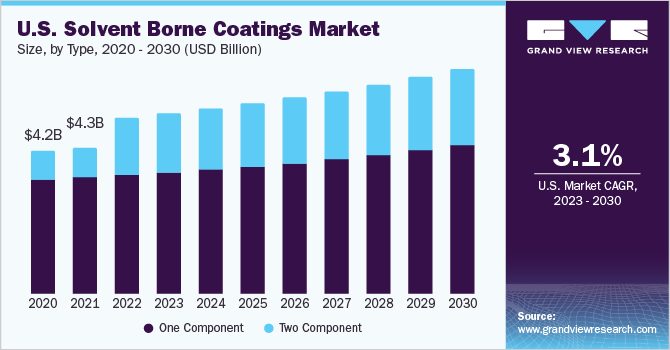

The U.S. is a major consumer of the product in North America, with a revenue share of 53.1% in 2022. The growth of the product market during the forecast period can be attributed to the increasing demand for solvent-borne coatings in the construction and automotive industries in the country. These coatings are used for surface protection, surface preparation, resistance to corrosion, and to improve the appearance of automotive vehicles and infrastructure.

The construction sector in the U.S. is experiencing notable growth, driven by positive market fundamentals for commercial real estate, a strong economy, and increasing state and federal funding for institutional buildings and public works. For instance, in March 2020, the U.S. government announced a USD 2 trillion investment as part of its coronavirus response, aimed at developing infrastructure, including hospitals, roads, and others. All these factors are expected to contribute to the growth of the product market.

Type Insights

One component in the type segment dominated the market with a revenue share of over 66.4% in 2022. This is attributable to the fact that one-component solvent borne coatings consist of a single component that does not require the addition of catalysts or hardeners and requires minimal preparation before application. The one-component system is typically a resin that is dissolved in a solvent, along with additives, pigments, and other components necessary for the desired coating properties. Unlike a two-component or multi-component coating system, one-component systems do not require mixing of different components just before application.

One-component systems can be found in different types of coatings such as automotive, industrial, and architectural. Their applications are mainly in situations where a fast-drying, low-cost coating that needs minimal surface preparation is required. These are generally used in less demanding environments such as painting of household items or garden furniture, exterior walls, and indoor cabinet doors, where long-term durability is not of utmost importance.

The two-component system segment is anticipated to witness strong growth over the forecast period. These are commonly used for demanding applications that require high performance, durability, and resistance to various environmental factors. These systems are composed of two components, a resin and a hardener/catalyst, which are mixed just before application. The first component, the resin, is composed of a polymer and solvent. It provides the pigment with a binder for adherence and stability on the substrate, forming a film that encapsulates it and protects it from environmental factors. Resins used in two-component systems include epoxy, polyurethane, polyester, and vinyl esters.

Application Insights

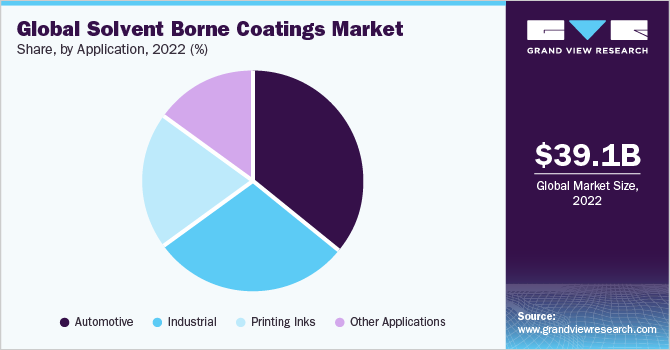

The automotive application segment dominated the market with a revenue share of 36.4% in 2022. This strong demand is attributed to the superior adhesion, corrosion resistance, and durability of solvent-borne coatings, making them a popular choice among automotive manufacturers. They are used for vehicle exterior and interior paint jobs. They provide a durable and long-lasting finish, which can withstand the harsh environmental conditions that vehicles are exposed to.

Clear coatings are used to provide additional protection to the painted surfaces of a vehicle. They enhance the gloss and color of the paint, increase the durability of the finish, and keep the underlying surface from fading or oxidizing over time. Thus, they play a critical role in maintaining the quality and longevity of vehicles, protecting them from harsh environmental factors.

The printing ink industry is projected to expand significantly in the coming years. The coatings utilized in printing inks possess robust adhesion, even flow, and leveling qualities, making them applicable to an array of surfaces, including paper, plastic, metal, and more. These coatings are popular and reliable due to their exceptional performance and durability. They can be altered to meet specific requirements, such as particular colors, opacity, gloss, and film thickness. They play a crucial role in enhancing print quality features such as color intensity, resolution, and contrast.

Regional Insights

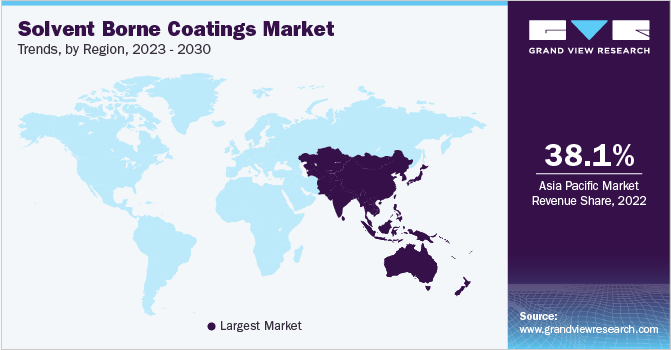

Asia Pacific dominated the market with a revenue share of 38.1% in 2022. This is attributable to the rising construction activities and growing demand from the automotive sector in the emerging countries of the region, such as India, Japan, and South Korea. In addition, the product has significant potential for use in various end-use sectors due to the ready availability of raw materials and less stringent laws regarding VOC emissions when compared to North America and Europe.

The solvent-borne coatings market in Japan is expected to witness strong growth, owing to the presence of leading automobile manufacturers including Toyota, Mazda, Suzuki, and Nissan in the country. Good manufacturing practices and the utilization of technology in the automotive industry are anticipated to promote Japan’s automobile production. Furthermore, increasing R&D activities to promote innovations in the infrastructure and construction industry of the country are anticipated to drive product demand over the projection period.

Europe is another region anticipated to witness noticeable growth over the forecast period. Surging automobile production in Germany, Hungary, Romania, Austria, and the UK, along with strong manufacturing bases of companies such as Volkswagen AG, Chevrolet, Daimler-Chrysler, Mercedes-Benz, and Dodge is expected to drive product demand in the region. With 42 engine production plants & assembly, Germany is the leading automotive market in Europe, accounting for one-third of the total automobile production in the region. Sales of new vehicles have consistently increased due to an improving economy, which reflects consumer confidence. This trend is expected to have a favorable impact on the product market in the coming years.

Key Companies & Market Share Insights

In order to remain competitive in the market, key players are expanding their product portfolio and global presence. They aim to achieve strong market positioning and optimum business growth through various strategies, such as expanding their production capacity, investing in research and development, developing new products, collaborating & forming partnerships, and acquiring other companies.

Players are gravitating towards product launches and installation of research & development facilities to come up with new innovations so as to establish their position in the market. For instance, in April 2023, Akzo Nobel announced the opening of its new research and development center in High Point, North Carolina for product development and innovations in its coatings business. Some of the prominent players in the global solvent borne coatings market include:

-

BASF SE

-

PPG Industries

-

The Sherwin-Williams Company

-

Akzo Nobel N.V.

-

RPM International

-

Axalta Coating Systems

-

Glass Paint Technology

-

The Lubrizol Corporation

-

NEI Corporation

-

DOW

Solvent Borne Coatings Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 40.34 billion

Revenue forecast in 2030

USD 52.67 billion

Growth rate

CAGR of 3.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Netherlands; Switzerland; China; India; Japan; South Korea; Malaysia; Indonesia; Vietnam; Australia; New Zealand; Brazil; Argentina; Chile; Colombia; Saudi Arabia; South Africa; Iran; Oman; UAE; Qatar; Kuwait; Angola; Nigeria

Key companies profiled

BASF SE; PPG Industries; The Sherwin-Williams Company; Akzo Nobel N.V.; RPM International, Inc.; Axalta Coating Systems; Glass Paint Technology; The Lubrizol Corporation; NEI Corporation; DOW

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Solvent Borne Coatings Market Report Segmentation

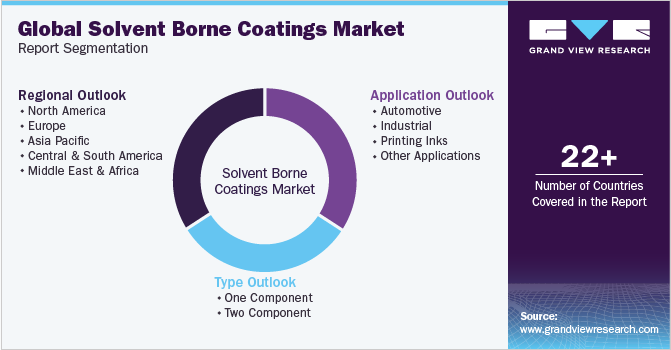

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global solvent borne coatings market report on the basis of type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

One Component

-

Two Component

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Industrial

-

Printing Inks

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Vietnam

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Angola

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global solvent borne coatings market size was estimated at USD 39.14 billion in 2022 and is expected to reach USD 40.34 billion in 2023.

b. The global solvent borne coatings market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 52.67 billion by 2030.

b. Asia Pacific dominated the market with a revenue share of 38.1% in 2022. This is attributable to the rising construction activities and growing demand from the automotive sector in emerging countries, such as India, Japan, and South Korea.

b. Some key players operating in the solvent borne coatings market include BASF SE, PPG Industries, The Sherwin-Williams Company, Akzo Nobel N.V., RPM International, Inc, Axalta Coating Systems, Glass Paint Technology, The Lubrizol Corporation, NEI Corporation, DOW

b. Key factors that are driving the market growth include the rising application of solvent-based coatings for industrial and architectural purposes, owing to their various properties such as lower drying times and better functionality in open & humid conditions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."