- Home

- »

- Plastics, Polymers & Resins

- »

-

Southeast Asia Recycled Polyvinyl Chloride Market Report, 2030GVR Report cover

![Southeast Asia Recycled Polyvinyl Chloride Market Size, Share & Trends Report]()

Southeast Asia Recycled Polyvinyl Chloride Market Size, Share & Trends Analysis Report By Product (Post-consumer Recycled PVC, Post-industrial Recycled PVC), By Application, By Country, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-966-7

- Number of Report Pages: 68

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

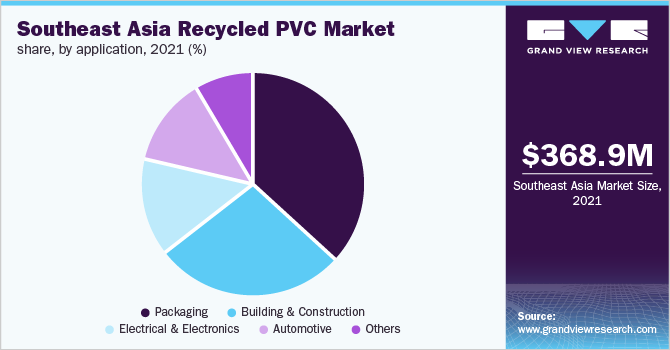

The Southeast Asia recycled polyvinyl chloride market size was valued at USD 368.89 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2022 to 2030. The ban imposed by China on plastic waste imports has made the Southeast Asia region a hotspot for plastics recycling thereby fueling the demand for recycled polyvinyl chloride (PVC). Moreover, the medical waste generated due to increased hospitalization during COVID 19 pandemic and grants provided by the World Bank Group to develop the recycling infrastructure in the region is also expected to support the growth of the recycled PVC market in Southeast Asia.

The electrical & electronics sector has witnessed considerable growth in Southeast Asia due to rapid industrialization and population rise. Polyvinyl chloride is recyclable which has further contributed to its consumption in packaging, automotive, and electrical & electronics applications. The increased demand for electrical & electronics appliances is expected to generate PVC scrap frominsulation jackets stripped from old cables and wires. This is expected to further drive the production of recycled PVC in the region.

According to the Singapore’s Urban Development Authority, the demand for redevelopment projects is on the rise since land availability continues to decline. In June 2022, the country plans to plans add 3,505 private houses. Since PVC is used in window profiles, pipes, flooring, and roofing, the redevelopment projects are expected to generate PVC scrap upon demolition which can result in fueling the market demand for recycled PVC in building & construction applications.

Product Insights

Post-industrial recycled PVC led the Southeast Asia recycled PVC market and accounted for more than 70.0% of the revenue share in 2021. Post-industrial recycled polyvinyl chloride is derived from polyvinyl chloride scrap and is generated as waste from an industrial process. Southeast Asia has become an attractive destination for outsourcing manufacturing operations. The region comprises major automotive global manufacturers and contract manufacturers for electrical & electronics equipment. The outsourcing of production activities is expected to generate waste during finished product manufacturing which has resulted in driving the post-industrial recycled PVC demand in the region.

Post-consumer recycled PVC followed the post-industrial recycled PVC segment. The post-consumer recycled polyvinyl chloride consists of PVC recycled from solid PVC waste once it has served its purpose and finished its life cycle as a consumer item.Post-consumer polyvinyl chloride products entering the waste stream include rigid products such as pipes and window frames or flexible products such as wire & cable scrap insulation, roofing membranes, and flooring. These waste products undergo chemical and mechanical recycling to derive post-consumer recycled polyvinyl chloride resins.

Application Insights

The packaging dominated the application segment in 2021 and accounted for more than 36.0% share of the Southeast Asia revenue in 2021. Polyvinyl chloride has been used for food & beverage packaging needs. It suits many different food types, offering good sealing performance, heat tolerance, and good physical properties. The growing demand for packaged food due to online food delivery is expected to generate more PVC scrap thereby driving the market for recycled PVC.

Building & construction was the next leading application segment in the Southeast Asia Recycled PVC market in 2021. Rapid industrialization and urbanization in emerging economies, such as the Philippines, Indonesia, and Vietnam, are expected to create huge demand for recycled polyvinyl chloride for use in the construction sector, which, in turn, is likely to fuel the market for recycled polyvinyl chloride.

Increasing infrastructure spending and a rising number of government initiatives, such as smart cities in the construction sector, are fueling the growth of the construction industry. Moreover, the growing popularity of green buildings across the globe is anticipated to propel the growth of the construction industry further, which, in turn, is anticipated to fuel the demand for recycled polyvinyl chloride over the forecast period.

Polyvinyl chloride has been widely used in the automotive industry due to its wear resistance, recyclability, and electrical resistance in automotive components such as under bonnet wiring, floor mats, windscreen system components, and dashboard & armrests. Although PVC is recyclable but currently recycled PVC is used in the manufacturing of car floor mats. Also, the automotive industry is shifting towards carbon neutrality which shows growing usage of recycled plastics in automotive components thus presenting an upward trend for the recycled PVC market in automotive applications.

Country Insights

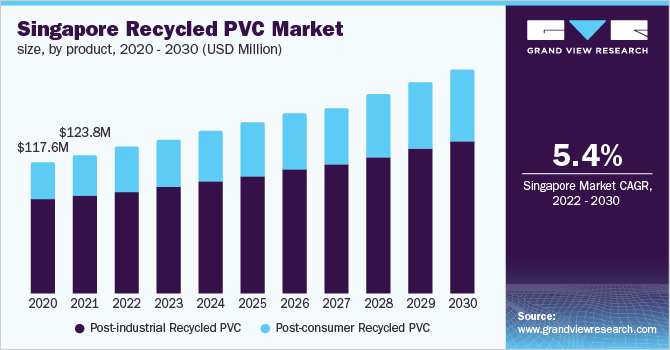

Singapore dominated the recycled PVC market and accounted for more than 33.0% share of the revenue in 2021. Electronics is the major industry contributing to the economic growth of Singapore. Moreover, the production of finished electronics products creates many spin-offs to other segments contributing to the economy including logistics service providers, electronic manufacturing systems companies, chemicals and materials suppliers, and precision component manufacturers. The growing consumption of electronics products is expected to generate PVC scrap thus contributing to recycled PVC production in Singapore in the coming years.

Vietnam emerged as the next leading country in Southeast Asia for recycled PVC production in 2021. Increasing consumption of plastics and mismanagement of waste have prompted Vietnam to develop action plans and set plastic recycling targets. The government of Vietnam has introduced initiatives such as extended producer responsibility and the National Plastic Action Partnership (NPAP). These programs are aimed at shifting the accountability of plastic waste management toward the government, manufacturers, and consumers, which is anticipated to promote the growth of the PVC recycling market in Vietnam.

Key Companies & Market Share Insights

The recycled polyvinyl chloride market in Southeast Asia comprises the presence of a large number of country players. The raw material for recycled PVC is found in abundance from PVC scraps generated in electronics, automotive, building & construction, and packaging. The ongoing waste management activities and awarding of contracts for waste management is expected to provide several growth and expansion opportunities to market players, which in turn is projected to positively influence the overall recycled PVC market in Southeast Asia.

Raw material suppliers play a crucial role in the value chain as they provide basic raw materials that are required to initiate the manufacturing process of recycled PVC. Some prominent players in the Southeast Asia recycled polyvinyl chloride market include:

-

Veolia

-

SUEZ

-

PT. Rejeki Adigraha

-

D.C.L. Plastic Co., Ltd.

-

Global Plasts Center Co., Ltd.

-

Withaya Intertrade Co., Ltd.

-

Dong Phat Plastics

-

CÔNG TY TNHH SẢN XUẤT THƯƠNG MẠI ĐỆ NHẤT

-

TIN THANH PLASTIC MANUFACTURING - TRADING CO., LTD.

-

Tran Thanh Phat

-

Polindo Utama PT

-

Pt. Production Recycling Indonesia

-

K K Asia (HK) Ltd

-

Taiplas Recycle Co., Ltd.

Southeast Asia Recycled Polyvinyl Chloride Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 385.01 million

Revenue forecast in 2030

USD 563.15 million

Growth Rate

CAGR of 4.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Southeast Asia

Country scope

Singapore; Vietnam; Malaysia; Thailand; Indonesia; Philippines

Key companies profiled

Veolia; SUEZ; PT. Rejeki Adigraha; D.C.L. Plastic Co., Ltd.; Global Plasts Center Co., Ltd.; Withaya Intertrade Co., Ltd.; Dong Phat Plastics; CÔNG TY TNHH SẢN XUẤT THƯƠNG MẠI ĐỆ NHẤT; TIN THANH PLASTIC MANUFACTURING - TRADING CO., LTD.; Tran Thanh Phat; Polindo Utama PT; Pt. Production Recycling Indonesia; K K Asia (HK) Ltd; Taiplas Recycle Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Recycled Polyvinyl Chloride Market Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the Southeast Asia recycled polyvinyl chloride market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Post-industrial Recycled PVC

-

Post-consumer Recycled PVC

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Packaging

-

Building & Construction

-

Electrical & Electronics

-

Automotive

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Southeast Asia

-

Indonesia

-

Malaysia

-

Philippines

-

Singapore

-

Thailand

-

Vietnam

-

-

Frequently Asked Questions About This Report

b. The Southeast Asia Recycled Polyvinyl Chloride market size was estimated at USD 368.89 million in 2021 and is expected to reach USD 385.01 million in 2022.

b. The Southeast Asia Recycled Polyvinyl Chloride market is expected to grow at a compound annual growth rate of 4.9% from 2022 to 2030 to reach USD 563.15 million by 2030.

b. Singapore dominated the Southeast Asia Recycled Polyvinyl Chloride market with a share of 33.5% in 2021. Several companies in the country have started producing textiles from recycled plastics to tackle the environmental problems posed by polyvinyl chloride waste. this factor is likely to drive the market during the forecast period.

b. Some of the key players operating in the Southeast Asia Recycled Polyvinyl Chloride market include Veolia, SUEZ, PT. Rejeki Adigraha, D.C.L. Plastic Co., Ltd., Global Plasts Center Co., Ltd., Withaya Intertrade Co., Ltd., Dong Phat Plastics, and K K Asia (HK) Ltd.

b. Key factors driving the Southeast Asia Recycled Polyvinyl Chloride market growth include a shift in preferences toward recycled plastics packaging and strict government regulations and growing use of recycled plastic products

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."