- Home

- »

- Advanced Interior Materials

- »

-

Space Mining Market Size & Trends, Industry Report, 2030GVR Report cover

![Space Mining Market Size, Share & Trends Report]()

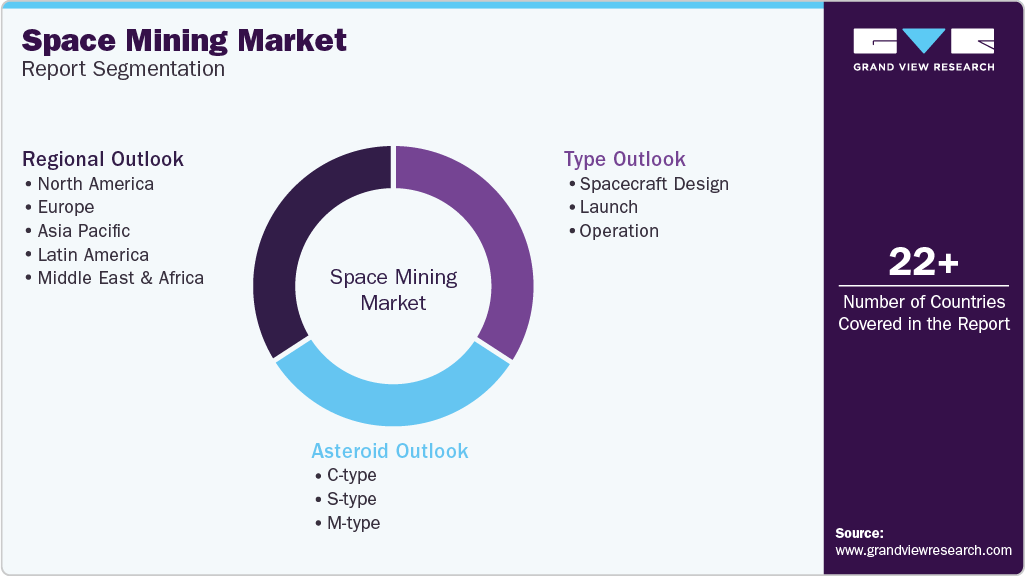

Space Mining Market (2025 - 2030) Size, Share & Trends Analysis Report By Asteroid (C-Type, S-Type, M-Type), By Phase (Spacecraft Design, Launch, Operation), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-338-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Space Mining Market Summary

The global space mining market size was estimated at USD 1.90 billion in 2024 and is projected to reach USD 5.02 billion by 2030, growing at a CAGR of 17.9% from 2025 to 2030. The surge in investments for space mining activities is expected to drive market growth.

Key Market Trends & Insights

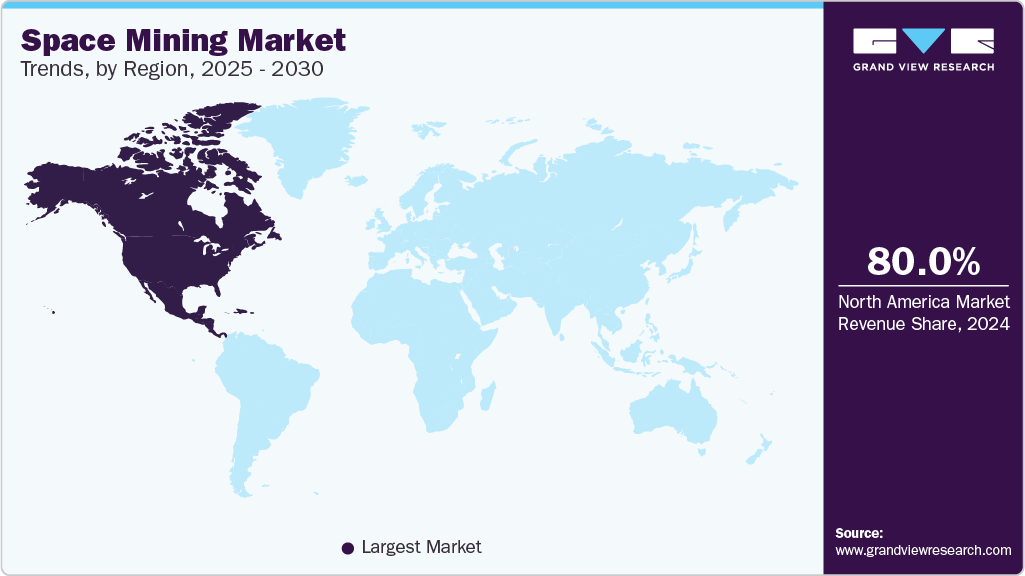

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, the U.S. is expected to register the highest CAGR from 2025 to 2030.

- In terms of asteroids, the C-Type segment held the largest revenue share of over 75.0% in 2024.

- In terms of phase, the spacecraft design held over 47% revenue share of the overall global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.90 Billion

- 2030 Projected Market Size: USD 5.02 Billion

- CAGR (2025-2030): 17.9%

- North America: Largest market in 2024

These investments are supported by the convergence of technological advancements, increasing private sector interest, and strategic anticipation for future resource demands. The advancement has lowered the capital cost for space mining activities and is expected to support market growth.

Advancements in technology have significantly reduced the barriers to accessing space, making it feasible for private and government companies to explore space resources. This technological advancement includes more efficient propulsion systems, reusable rockets, and robotics and automation, which are expected to assist in cost-effective missions to asteroids and other minerals such as platinum, gold, and rare earth elements.

Drivers, Opportunities & Restraints

The increasing scarcity of Earth-bound resources has spurred interest in space mining as a viable solution to meet global demand. With resources for extraction becoming more expensive and depleting at an alarming rate, mining asteroids and other celestial bodies offers a promising alternative. This potential to access vast quantities of metals and minerals in space not only promises economic benefits but is also expected to reduce the environmental impact associated with traditional mining practices on Earth.

Access to rare and valuable resources owing to space mining represents a lucrative opportunity for industries and economies worldwide. Asteroids and other celestial bodies are believed to contain vast quantities of precious metals such as platinum, gold, and rare earth elements, which are critical for advanced technologies ranging from electronics to renewable energy systems.

The high initial costs associated with space mining operations act as a restraint to market growth. Establishing infrastructure for resource extraction requires significant investment in advanced spacecraft, robotic systems, and specialized mining equipment to operate in harsh environments like asteroids or the Moon. These technologies must be not only capable of extraction but also of transportation back to Earth or other destinations, which further increases costs.

Asteroid Insights & Trends

C-Type held the largest revenue share of over 75.0% in 2024, also known as the carbonaceous asteroids segment, are expected to observe rising investments on account of their composition rich in volatiles such as water, ammonia, and carbon-based compounds. These asteroids are valuable for their potential to provide resources essential for sustaining life in space habitats and supporting deep-space missions. Water extracted from C-type asteroids can serve as a critical resource for drinking, agriculture, and manufacturing propellant for spacecraft over the coming years.

S-type asteroids have a stony appearance and higher metal content compared to C-type asteroids. They are important resources in the space mining industry for their potential to yield valuable metals such as nickel, iron, and cobalt. These asteroids can be used in industries requiring metals for manufacturing and technological applications, both in space and on Earth.

Phase Insights

Spacecraft design held over 47% revenue share of the overall global space mining market. The spacecraft design phase is expected to observe increasing investments over the coming years. Design in space mining involves integrating robust technologies capable of operating harsh environment of space. These spacecraft need advanced propulsion systems for maneuverability and efficient travel to distant asteroids or planetary bodies. In addition, they require sophisticated navigation and guidance systems to navigate complex trajectories and safely approach mining targets.

Operating spacecraft in the market requires meticulous planning and execution. Once deployed, these spacecraft autonomously survey potential mining sites, using onboard sensors to assess resource composition and abundance. Advanced robotic arms and drills are used to extract materials from asteroids or planetary surfaces, utilizing precision mining techniques to maximize resource recovery.

Regional Insights

North America space mining industry held over 80% revenue share of the global market for space mining in 2024. North America is anticipated to lead globally with significant investments in technology and infrastructure. Companies in the region focus on developing advanced spacecraft and robotic technologies for efficient resource extraction from asteroids and the Moon. Supportive regulatory frameworks for private sector companies are also anticipated to act as contributing factors for market growth.

U.S. Space Mining Market Trends

The space mining industry in the U.S is expected to witness increased investments from collaborations between space organizations, research institutions, and private companies. The country is significantly advanced in aerospace engineering and satellite communications, which is anticipated to remain a vital factor for market growth.

Asia Pacific Space Mining Market Trends

The space mining industry in Asia Pacific is likely to observe rising capital expenditure for space mining activities in countries like Japan. The region's strong manufacturing base and expertise in robotics are anticipated to benefit market growth over the coming years.

Europe Space Mining Market Trends

The space mining industry in Europe is expected to observe significant investments. The companies in the region are utilizing their expertise in robotics, automation, and materials science to develop technology for space mining and improve their footprint in this emerging market.

Key Space Mining Company Insights

Some of the key players operating in the market include Planetary Resources, Deep Space Industries, and Moon Express.

-

Planetary Resources is involved in space mining activities and has plans to explore and utilize resources from asteroids. The company’s key focus is to extract key resources such as water and precious metals from asteroids.

-

Deep Space Resources is a U.S.-based private company that is involved in space exploration activities. The company plans to build spacecraft technology that will enable space exploration and reduce the costs involved in space mining.

Key Space Mining Companies:

The following are the leading companies in the space mining market. These companies collectively hold the largest market share and dictate industry trends.

- Asteroid Mining Corporation

- Deep Space Resources

- European Space Agency

- ispace

- Moon Express

- Offworld

- Planetary Resources

- Spacefab US

- Transastra

Recent Developments

-

In January 2025, AstroForge launched its Odin spacecraft aboard a SpaceX Falcon 9 rocket to survey asteroid 2022 OB5 for potential mining operations. This mission marked a significant step toward commercial asteroid mining, aiming to assess the feasibility of extracting valuable resources from space.

-

In June 2024, China's Chang'e 6 mission successfully returned to Earth with 1.935 kilograms of lunar samples collected from the Moon's far side, specifically the South Pole–Aitken basin. This achievement provided unprecedented scientific data, including insights supporting the giant impact hypothesis of the Moon's formation.

-

On October 7, 2024, the European Space Agency launched the Hera mission aboard a SpaceX Falcon 9 rocket to study the binary asteroid system Didymos and its moonlet Dimorphos. The mission aims to analyze the aftermath of NASA's DART impact and gather data crucial for future asteroid mining endeavors and planetary defense strategies.

-

In October 2023, Space Exploration Technologies Corporation, along with NASA, launched a mission to the asteroid belt between Jupiter and Mars. This will enable the companies to understand unexplored blocks of iron cores.

-

In January 2023, Astroforge Inc. announced its plans to launch spacecraft for the exploration of platinum group metals and to reduce the cost of mining these metals.

Space Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.20 billion

Revenue forecast in 2030

USD 5.02 billion

Growth Rate

CAGR of 17.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Asteroid, phase, region

Regional scope

North America; Europe; Asia Pacific

Key companies profiled

Asteroid Mining Corporation; Deep Space Resources; European Space Agency; ispace; Moon Express; Offworld; Planetary Resources; Spacefab US; Transastra

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Space Mining Market Report Segmentation

This report forecasts revenue growth at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global space mining market report based on asteroid, phase, and region.

-

Asteroid Outlook (Revenue, USD Million, 2018 - 2030)

-

C-type

-

S-type

-

M-type

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Spacecraft Design

-

Launch

-

Operation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

Asia Pacific

-

Frequently Asked Questions About This Report

b. The global space mining market size was estimated at USD 1.90 billion in 2024 and is expected to reach USD 2.20 billion in 2025.

b. The global space mining market is expected to grow at a compound annual growth rate of 17.9% from 2025 to 2030 to reach USD 5.02 billion by 2030.

b. By asteroid type, c-type dominated the market with a revenue share of over 75% in 2024.

b. Some of the key vendors of the global space mining market are Asteroid Mining Corporation, Deep Space Resources, European Space Agency, ispace, Moon Express, Offworld, Planetary Resources, Spacefab US, and Transastra

b. The key factor driving the growth of the global space mining market is the rising investments in space mining activities to explore resources from asteroids

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.