Spain Draught Beer Market Summary

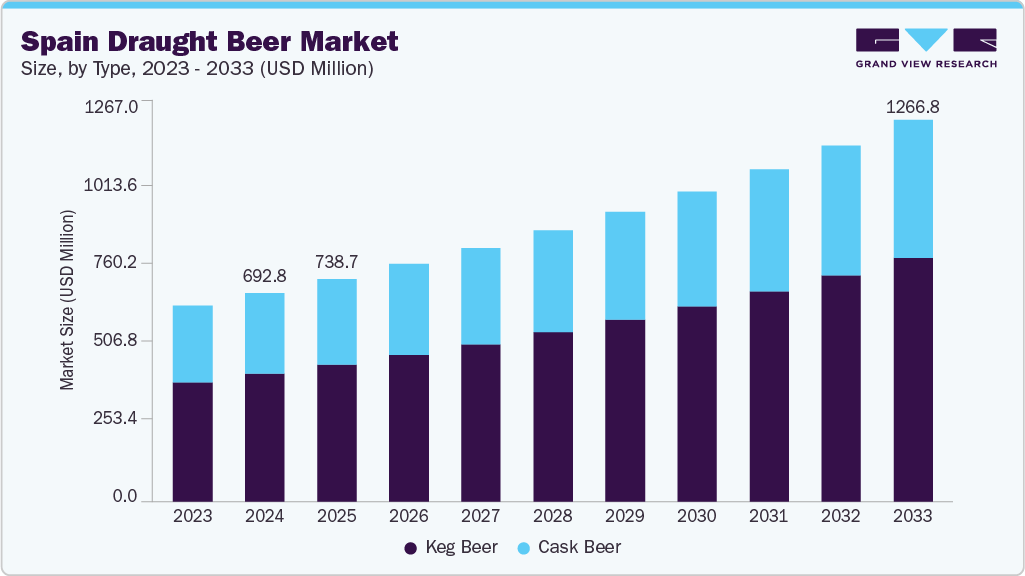

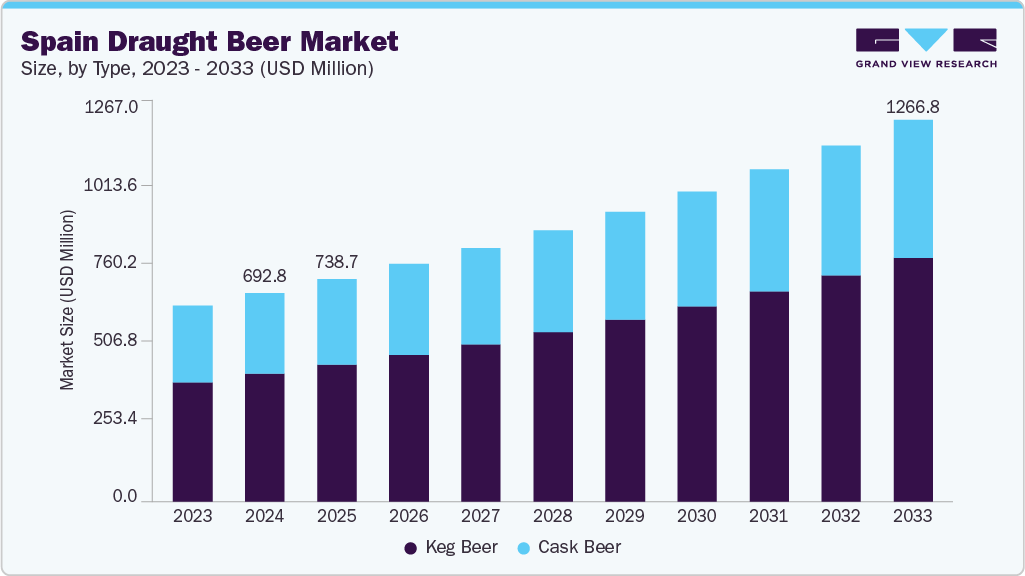

The Spain draught beer market size was estimated at USD 692.8 million in 2024 and is projected to reach USD 1,266.8 million by 2033, growing at a CAGR of 7.0% from 2025 to 2033. The market is significantly shaped by several primary drivers, including the robust hospitality sector and rising preference for fresh and authentic beer.

Key Market Trends & Insights

- By type, the keg beer segment held the largest market share of 61.2% in 2024.

- Based on category, the regular segment held the largest market share in 2024.

- Based on production type, the macro breweries segment accounted for a share of 84.6% in 2024.

- By end use, the home use segment is expected to grow at the fastest CAGR of 7.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: 692.8 Million

- 2033 Projected Market Size: USD 1,266.8 Million

- CAGR (2025-2033): 7.0%

Spanish culture is deeply intertwined with beer consumption, where bars are central to social life, accounting for the highest bar-to-person ratio in the European Union (one bar for every 165 people). Beer is often enjoyed during meals, and a common cultural ritual involves the toast, reflecting the communal and celebratory spirit of their drinking habits.

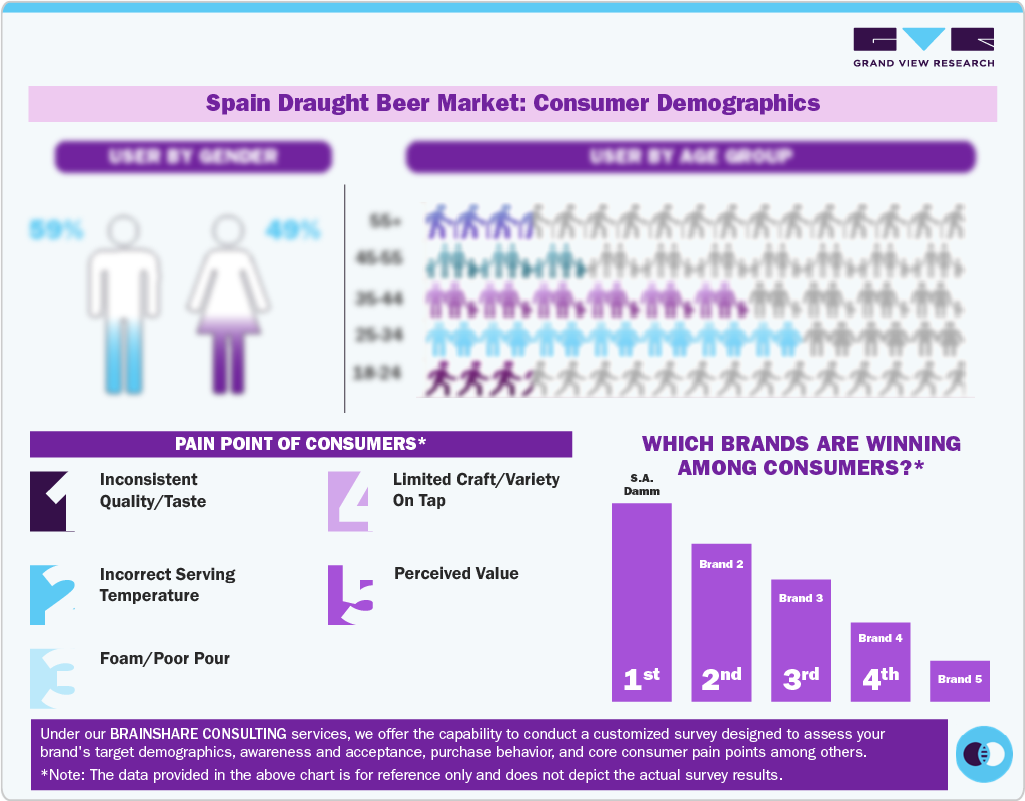

Consumer Insights

Consumer behavior in the Spain draught beer industry is significantly shaped by the country's vibrant social culture and the prominence of beer as a preferred alcoholic beverage. In 2022, Spain ranked among the top beer-consuming nations with approximately 88 kg (roughly 88 liters) of beer consumed per capita. This widespread acceptance and integration into social interactions are expected to drive consistent demand for beer, including its draught format.

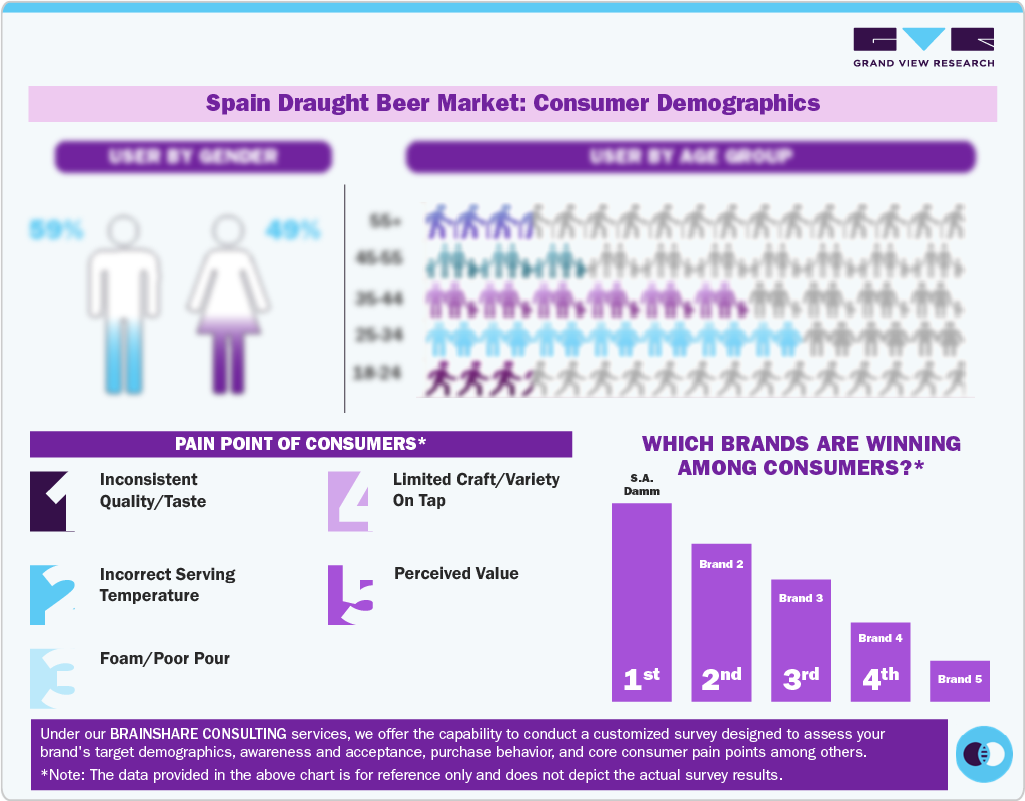

Consumer Demographics

Overall alcohol consumption, which largely reflects beer consumption patterns, shows distinct trends across age groups and genders. The highest percentage of consumers by age group corresponds to the 25 to 34 age group, with 80.6% for men and 64.7% for women, according to a 2020 European Health Survey conducted in Spain.

Type Insights

The keg beer segment dominated the market with the largest revenue share of 61.2% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This dominance is primarily driven by the perceived superior freshness and quality of beer served from a tap, which aligns with consumer demand for a high-quality draught experience. The profitability per volume that kegs offer further augments their leading position in high-volume establishments.

The cask beer segment in the Spain draught beer industry is expected to grow at a CAGR of 6.2% over the forecast period, driven by increasing consumer interest in artisanal and unique beer experiences. This growth aligns with broader trends in the Spanish market, including a rising demand for experimental flavors, traditional styles, and craft offerings, which are increasingly sought after by consumers.

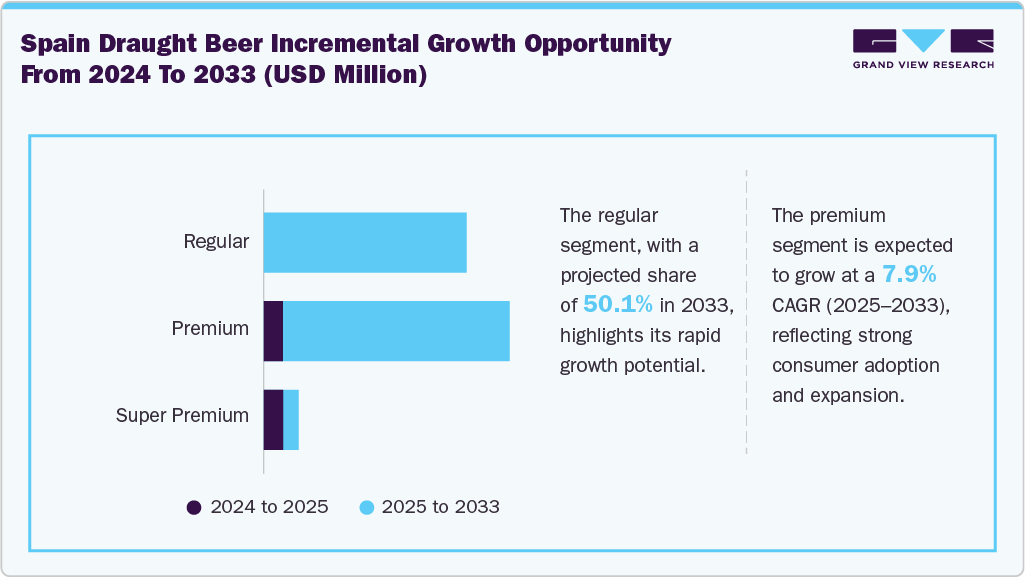

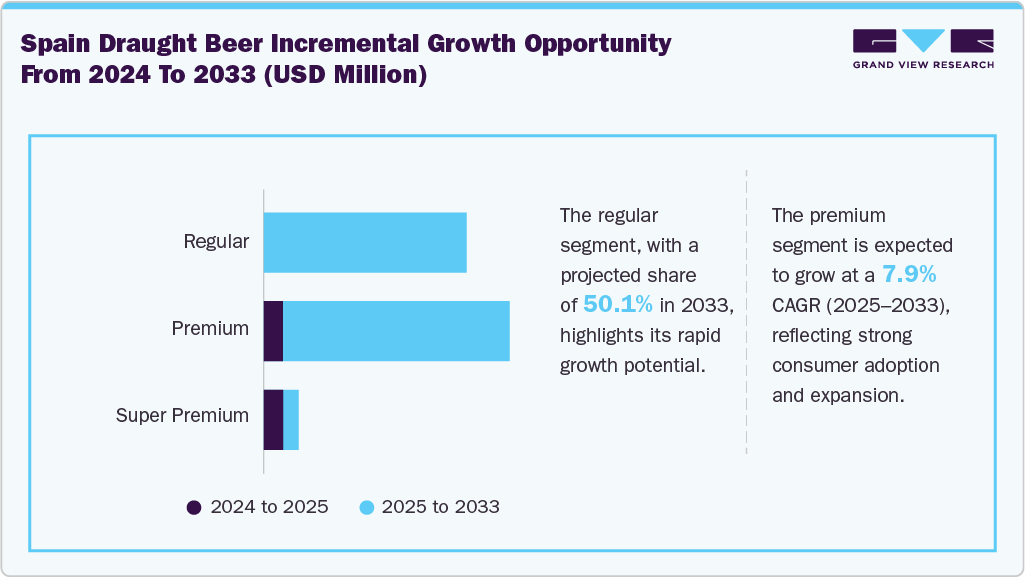

Category Insights

The regular segment dominated the market with a revenue share of 53.9% in 2024, driven by its widespread accessibility and broad consumer appeal across the country. This category, often associated with the offerings of major brewing groups, forms the backbone of the market due to its competitive pricing and pervasive presence in the extensive hospitality network. Its significant consumption volume reflects established consumer habits and its integral role in daily social interactions, making it the most consumed type of beer.

The premium segment is expected to grow at the fastest CAGR over the forecast period, driven by evolving consumer preferences toward diverse, high-quality, specialized offerings. This trend is characterized by an increasing demand for craft beers, experimental flavors, and traditional styles, which consumers actively seek.

Production Type Insights

The macro breweries segment held the largest revenue share of 84.6% in the Spain draught beer industry in 2024. This dominance can be attributed to their immense production capacities and extensive distribution networks, which allow for pervasive presence across the Spanish market, particularly within the hospitality sector.

The microbreweries segment is expected to grow at the fastest CAGR over the forecast period. This growth is primarily fueled by a dynamic shift in consumer preferences toward exotic and locally produced beers. Consumers increasingly seek unique flavor profiles, experimental brews, and traditional styles offering a distinct experience. Many microbreweries foster direct consumer engagement through brewery tours and tasting sessions, enhancing the beer experience and reinforcing its unique appeal.

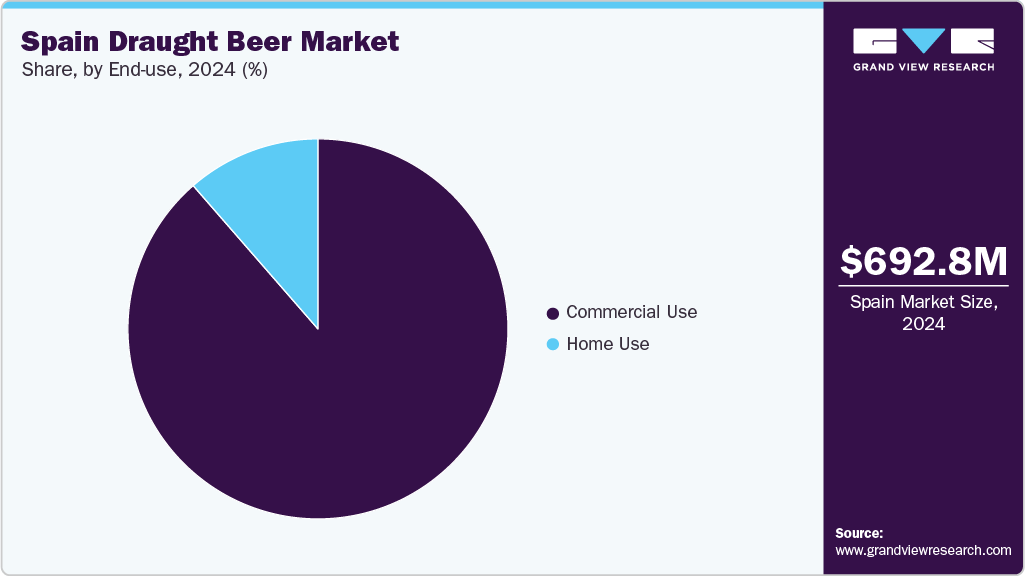

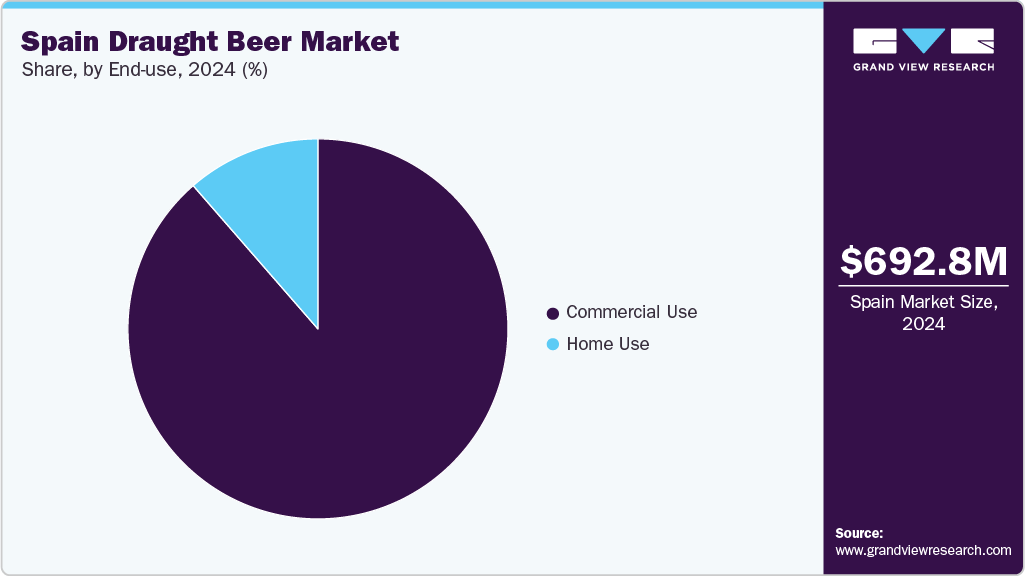

End Use Insights

The commercial use segment held the largest revenue share of 88.6% in 2024, fundamentally driven by the deeply ingrained social culture of beer consumption in the country's extensive hospitality sector. Most beer consumption in Spain traditionally takes place outside the home, primarily in bars and restaurants, which constitute the primary sales channel for brewers.

The home use segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by changing lifestyle trends and the convenience of retail channels. Consumers are increasingly opting for at-home consumption during occasions, a trend supported by the wide variety of beer readily available in supermarkets and retail stores. Notably, in 2024, the retail channel (home consumption) experienced growth, reflecting a shift in consumer behavior.

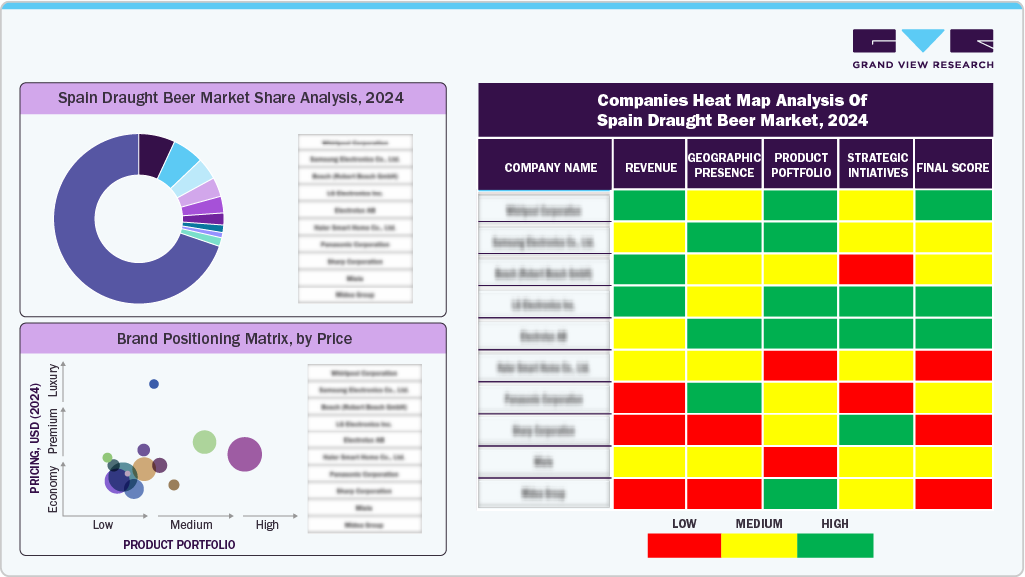

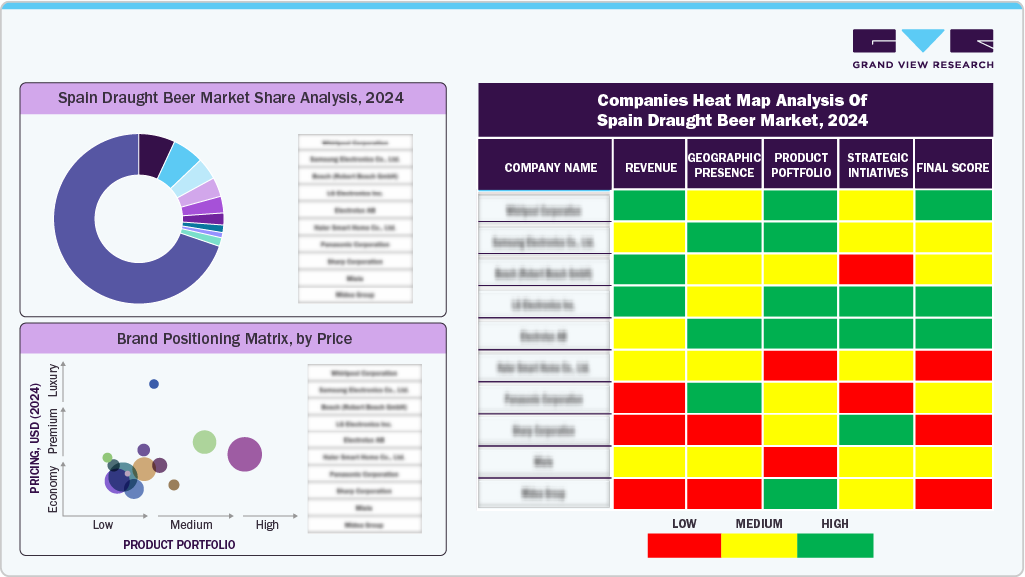

Key Spain Draught Beer Company Insights

Some key players in the Spain draught beer industry include Mahou San Miguel, S.A. Damm, Corporación Hijos de Rivera, and Cervezas Alhambra.

Key Spain Draught Beer Companies:

- Mahou San Miguel

- Hijos de Rivera

- Alhambra

- Damm S.A.

- HEINEKEN España

Spain Draught Beer Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 738.7 million

|

|

Revenue forecast in 2033

|

USD 1,266.8 million

|

|

Growth rate

|

CAGR of 7.0% from 2025 to 2033

|

|

Base year

|

2024

|

|

Historical period

|

2021 - 2023

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD Million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Type, category, production type, end use

|

|

Key companies profiled

|

Mahou San Miguel, Hijos de Rivera, Alhambra, Damm S.A., HEINEKEN España

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Spain Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Spain draught beer market report based on type, category, production type, end use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

Production Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)