- Home

- »

- Homecare & Decor

- »

-

Spain Serviced Apartment Market Size, Industry Report 2033GVR Report cover

![Spain Serviced Apartment Market Size, Share & Trends Report]()

Spain Serviced Apartment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Long-term (>30 Nights), Short-term (<30 Nights)), By End-use (Corporate/Business Traveler, Leisure Travelers, Expats & Relocators), By Booking Mode, And Segment Forecasts

- Report ID: GVR-4-68040-726-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spain Serviced Apartment Market Trends

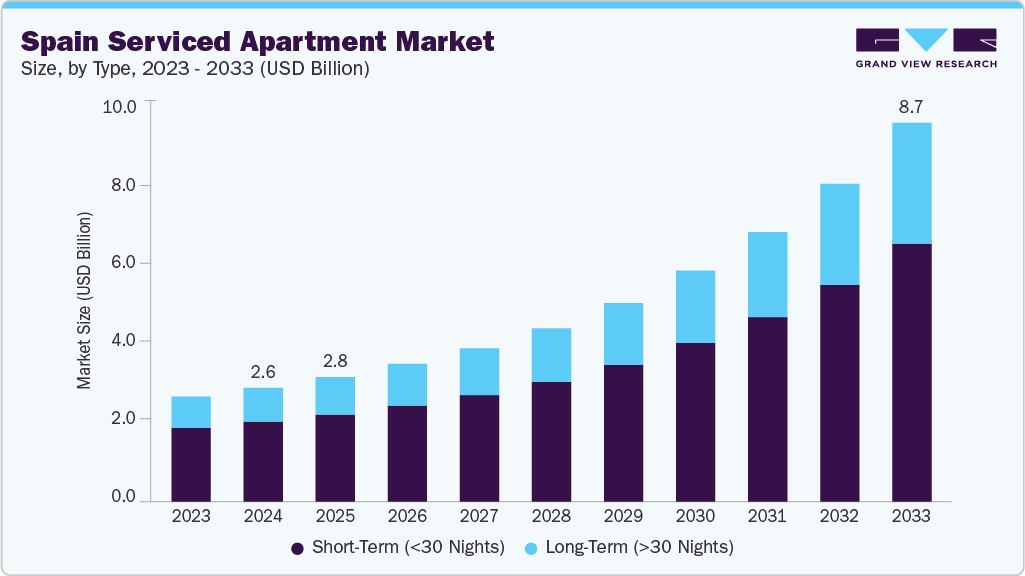

The Spain serviced apartment market size was estimated at USD 2,625.6 million in 2024 and is projected to reach USD 8,737.8 million by 2033, growing at a CAGR of 14.9% from 2025 to 2033. In 2024, Spain’s record rebound in inbound tourism represents a primary demand driver for serviced apartments. Large volumes of international visitors increase demand for mid-to-long-stay accommodation that combines space, kitchen facilities, and consistent services, exactly the value proposition serviced apartments deliver. This is expected to drive market growth during the forecast period.

National statistics show Spain set new visitor records in 2024 (INE reporting c. 93.8 million international tourists in 2024 and continued growth across 2023-24), and industry forecasts from the World Travel & Tourism Council project tourism’s contribution to exceed USD 302.02 billion by 2025. This scale of visitation raises occupancy potential outside core hotel channels. It supports weekday and off-season demand in urban and leisure markets, which drives market growth. Therefore, operators capture transient leisure flows and higher-yield extended stays linked to event calendars and seasonal tourism.

Examples include strong volumes to major hubs, such as Barcelona, Madrid, and the Canary Islands, where serviced apartments absorb overflow and multi-person group travel. Given the magnitude of inbound arrivals and tourism GDP contribution, serviced apartment operators can justify expansion, revenue management investments, and partnerships with corporate travel buyers to convert peak tourist flows into repeat, longer stays. This is estimated to drive market growth.

However, a significant restraint on market growth is evolving regulation targeting short-term rentals and tourist apartments that reduces available stock and complicates new supply development. Municipal and national reforms increase compliance costs and create license scarcity in prime urban zones. Policymakers aim to protect housing supply and mitigate over-tourism, but tighter licensing, moratoria, and potential bans materially affect conversion economics (turning residential stock into aparthotels becomes less viable) and raise uncertainty for investors who historically relied on re-licensing and flexible use.

Another major market driver is the return of corporate travel, combined with hybrid working patterns that prolong average trip duration. Business travel recovered materially after pandemic restrictions eased; corporate programs and meetings resumed, and many business trips now include extended local stays to accommodate blended work and meeting itineraries. Serviced apartments meet corporate buyers’ needs for privacy, workspace, cost efficiency, and operational consistency over multi-night stays.

Serviced apartments outperformed traditional hotels in occupancy gains during business travel recovery, while corporate bookers increasingly prefer apartments for multi-day assignments. As exemplified by large conferences and recurring corporate visits to Spain, financial institutions and multinational employers have shifted a significant share from short-stay hotels to aparthotels and serviced flats for one week or more, driving market growth.

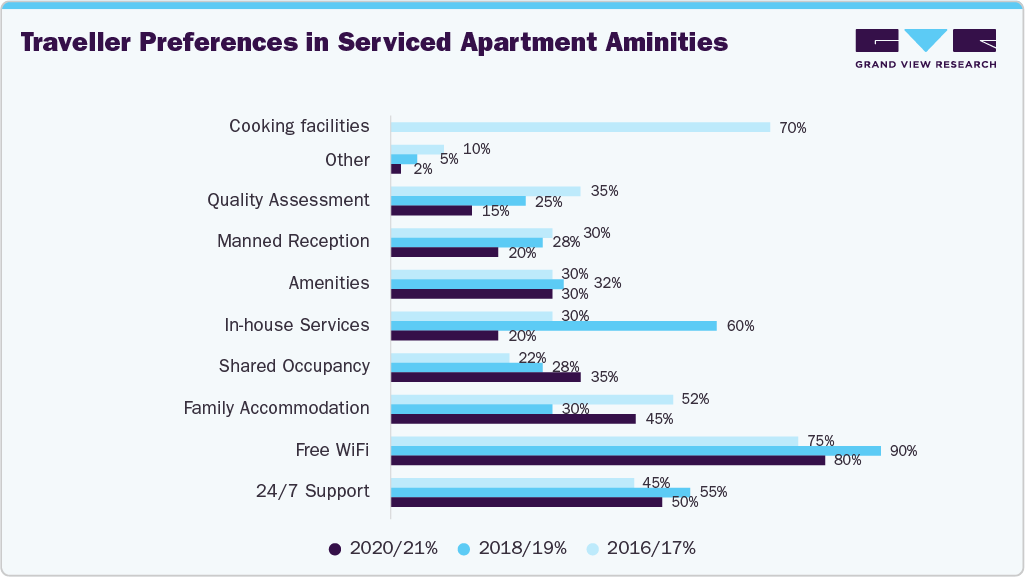

Consumer Behavioral Analysis

Traveler preferences for serviced apartments align strongly with evolving lifestyles and mobility patterns. Over the years, the demand has shifted from traditional hotel-like conveniences toward amenities that enhance independence and comfort. Features such as private support services and reliable digital infrastructure are not just convenience but baseline expectations, particularly for business travelers and digital nomads who need seamless connectivity and assurance of assistance at any time. This reflects how serviced apartments are positioned as hybrid spaces, bridging professional and personal needs.

Another clear development is the rising significance of home-style amenities, which point to the growing importance of long-stay comfort. The increasing preference for spaces that allow cooking and family accommodation indicates that guests want a sense of normalcy and routine while traveling. This demand often comes from expatriates, relocators, and even leisure travelers staying for extended periods, who find hotel rooms restrictive. By integrating these residential features, serviced apartments are gaining an edge as they provide a “home-away-from-home” appeal while offering professional management and security.

At the same time, there is a visible decline in interest for shared or bundled offerings, suggesting a preference for personalization and privacy. Travelers increasingly value tailored, flexible stays where they can choose specific amenities over standardized service packages. This reflects broader lifestyle trends in the post-pandemic era, where health, autonomy, and personalization have become key priorities. The serviced apartment sector, particularly in destinations like Spain, is leveraging these preferences to cater to both short-term corporate clients and long-term relocators, strengthening its position in the accommodation market.

Type Insights

The short-term service apartments accounted for a revenue market share of 70.27% in 2024, driven by the record rebound of inbound tourism and the strong calendar of international events. Travelers seeking more spacious alternatives to hotels, especially families and small groups, favored serviced apartments for their flexibility, self-catering amenities, and cost-effectiveness over multiple hotel rooms. In addition, the popularity of digital booking platforms expanded the visibility and accessibility of short-term serviced apartments, enabling them to capture immediate tourist flows. The high volume of short-duration visits, coupled with Spain’s seasonal peaks in summer and during events like Fitur Madrid, cemented short-term apartments' leadership in the Spain serviced apartment industry.

The long-term serviced apartments are expected to grow at a CAGR of 15.7% from 2025 to 2033, propelled by the structural shifts in work and relocation trends. The rise of hybrid work and remote employment has led professionals, digital nomads, and corporate assignees to extend their stays in Spain’s urban centers and coastal regions. Spain’s introduction of the “digital nomad visa” in 2023, which allows non-EU remote workers to reside in the country for up to five years, further supports long-stay demand (Spanish Ministry of Economic Affairs, 2023). These policy incentives and lifestyle shifts are accelerating the long-stay segment’s expansion, positioning it as the fastest-growing category within the market.

Booking Mode Insights

Booking through direct booking accounted for a revenue share of 49.67% in 2024, due to serviced apartment operators’ adoption of digital-first strategies that prioritized official websites and mobile applications. Enhanced loyalty programs, price-match guarantees, and user-friendly interfaces motivate travelers to bypass intermediaries. Moreover, tourists and short-stay visitors demonstrated higher confidence in direct channels that clarified amenities, cancellation policies, and flexible stay options. This strengthened operators’ control over distribution and increased direct reservations, consolidating the direct booking segment’s leadership in the market.

Booking through corporate contracts is expected to grow at a CAGR of 16.6% from 2025 to 2033, driven by multinational firms’ preference for negotiated agreements that secure consistent pricing and reliable inventory for frequent business assignments. As corporate mobility programs scale with the recovery of global operations, serviced apartment operators benefit from entering structured partnerships with enterprises, offering tailored packages, consolidated billing, and compliance with travel policies. These long-term agreements create predictable occupancy, reduce transaction costs, and provide corporates with standardized housing solutions across Spanish business hubs, making corporate contracting an accelerating growth channel in the Spain serviced apartment industry.

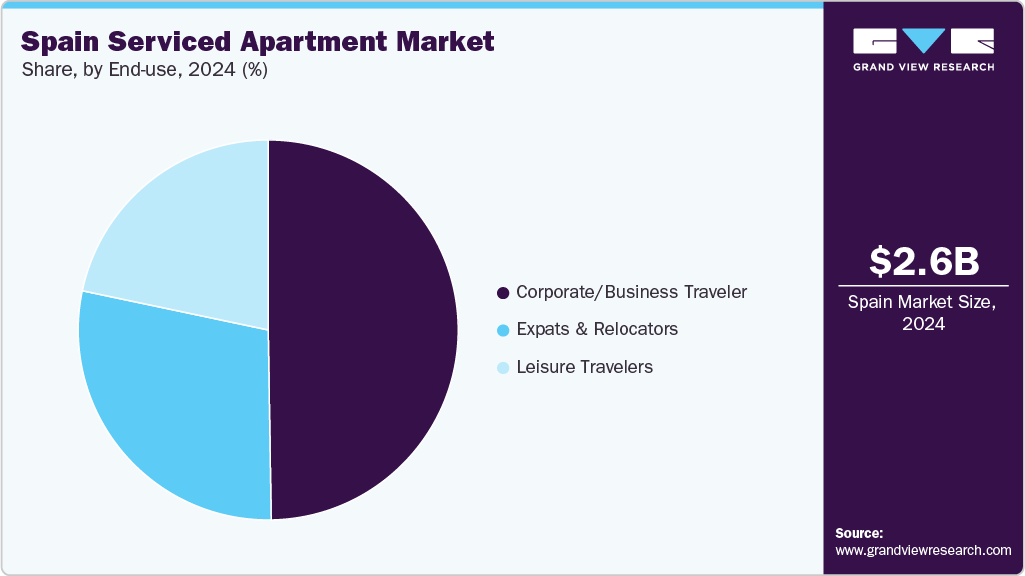

End-use Insights

In 2024, corporate/business travelers accounted for a revenue share of 49.75%, due to the resurgence of international trade fairs, industry conferences, and multinational project work. Major events such as Mobile World Congress in Barcelona and international finance summits in Madrid reinstated steady streams of business visitors who required flexible, well-serviced accommodation for stays extending beyond standard hotel bookings. Serviced apartments offered these travelers a balance of workspace, privacy, and cost efficiency, enabling companies to accommodate employees comfortably during assignments. Though carefully managed post-pandemic, corporate travel budgets prioritized extended-stay efficiency, making serviced apartments the preferred choice for professional mobility in Spain’s business hubs.

The expats & relocators are expected to grow at a CAGR of 15.7% from 2025 to 2033 within the Spain serviced apartment industry, driven by Spain’s growing role as a relocation destination for multinational workforce transfers and international families. Rising direct foreign investment in technology, renewable energy, and shared services has created an influx of employees requiring long-term accommodation solutions. Simultaneously, Spain’s appeal as a relocation destination, owing to lifestyle, international schooling options, and favorable residency policies, encourages professionals and families to choose serviced apartments over conventional rentals, as they offer turnkey solutions without the complexities of long leases. This structural demand ensures rapid expansion of the expat and relocation segment in the market.

Key Spain Serviced Apartment Company Insights

The market consists of three operator types: pan-European branded aparthotel chains pursuing scale and corporate agreements, regional apartment operators differentiating on design and localized guest experience, and asset-light third-party managers and franchisees accelerating footprint without heavy capex. This multi-channel structure creates a competitive set where global brands compete on distribution, loyalty partnerships, and corporate contracting, while local players compete on location, design, and host-style service.

Institutional capital and strategic hotel groups continue to underwrite aparthotel assets for predictable cash flow and diversification; Adagio’s stated openings and Staycity’s pipeline exemplify active expansion and roll-out strategies across Europe, including Spain. Operators favour asset-light franchising and management agreements to accelerate presence while preserving capital. These dynamics support acquisitions, refurbishment programs, and conversion plays in inner-city and airport-proximate assets.

Key Spain Serviced Apartment Companies:

- The Ascott Limited

- Frasers Hospitality

- Marriott International, Inc.

- Eric Vökel Boutique Apartments

- Majestic Hotel Group (Residences)

- Stay U-nique

- Habitat Apartments

- SACO (The Serviced Apartment Company)

- Aparteasy

- Genteel Home

Recent Developments

-

In August 2025, SilverDoor, a global serviced-apartment agent, announced that it would merge operations with Synergy Global Housing under joint ownership. This unification combines capabilities and resources across corporate housing platforms, strengthening reach in markets including Spain.

-

In October 2024, IHG’s Staybridge Suites brand entered Spain with a brand-new property in Málaga. Situated in the landmark Martiricos Towers (one of Andalusia’s tallest residential projects), the aparthotel offers 105 fully equipped suites with kitchens and an ideal setup for extended-stay guests. This launch marks the brand’s first foray into Spain and underscores IHG’s strategy to penetrate new markets with its extended-stay proposition.

Spain Serviced Apartment Market Report Scope

Report Attribute

Details

Market size in 2025

USD 2,872.9 million

Revenue forecast in 2033

USD 8,737.8 million

Growth rate

CAGR of 14.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, booking mode

Country scope

Spain

Key companies profiled

The Ascott Limited; Frasers Hospitality; Marriott International, Inc.; Eric Vökel Boutique Apartments; Majestic Hotel Group (Residences); Stay U-nique; Habitat Apartments; SACO (The Serviced Apartment Company); Aparteasy; Genteel Home

Customization

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Spain Serviced Apartment Market Report Segmentation

This report forecasts revenue growth at the country’s level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Spain serviced apartment market report based on type, end-use, and booking mode:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Long-term (>30 Nights)

-

Short-term (<30 Nights)

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Corporate/ Business Traveler

-

Leisure Travelers

-

Expats and Relocators

-

-

Booking Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct Booking

-

Online Travel Agencies

-

Corporate Contracts

-

Frequently Asked Questions About This Report

b. The Spain serviced apartment market was estimated at USD 2,625.6 million in 2024 and is expected to reach USD 2,872.9 million in 2025.

b. The Spain serviced apartment market is expected to grow at a compound annual growth rate of 14.9% from 2025 to 2033 to reach USD 8,737.8 million by 2033.

b. Short-term service apartments held the largest market share in 2024, with a share of about 70.27%, driven by the popularity of digital booking platforms expanded visibility and accessibility of short-term serviced apartments, enabling them to capture immediate tourist flows.

b. Key players in the Spain serviced apartment market are The Ascott Limited, Frasers Hospitality, Marriott International, Inc., Eric Vökel Boutique Apartments, Majestic Hotel Group (Residences), Stay U-nique, Habitat Apartments, SACO (The Serviced Apartment Company), Aparteasy, and Genteel Home, among others.

b. Key factors that are driving the Spain serviced apartment market growth include the surge in inbound tourism, the return of corporate travel, combined with hybrid working patterns that prolong average trip duration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.