- Home

- »

- Biotechnology

- »

-

Spheroids Market Size And Share, Industry Report, 2030GVR Report cover

![Spheroids Market Size, Share & Trends Report]()

Spheroids Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Method, By Source, By Application (Developmental Biology, Personalized Medicine, Regenerative Medicine), By End Use, By Region And Segment Forecasts

- Report ID: GVR-4-68040-562-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Spheroids Market Size & Trends

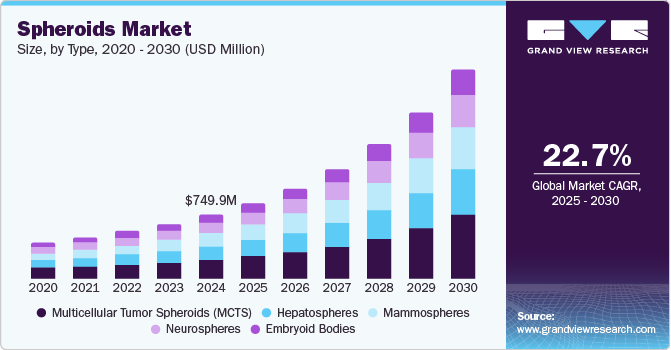

The global spheroids market size was estimated at USD 749.9 million in 2024 and is anticipated to grow at a CAGR of 22.7% from 2025 to 2030. The increasing demand for physiologically relevant 3D cell culture models in drug discovery, cancer research, and regenerative medicine drives the spheroid industry. Spheroids better replicate in vivo cellular interactions, nutrient gradients, and tissue architecture compared to traditional 2D cultures, leading to more predictive data for drug efficacy and toxicity screening.

This has made them particularly valuable in oncology research, where tumor spheroids enable more accurate cancer behavior and treatment response modeling. Moreover, advancements in high-throughput screening technologies, growing interest in personalized medicine, and increased funding for 3D cell culture platforms further accelerate the adoption of spheroid-based systems across pharmaceutical, academic, and biotech sectors.

Researchers and companies are actively advancing the development of spheroids that replicate complex diseases such as colon cancer, lung cancer, chronic kidney disease, and various genetic disorders. This focused innovation is fueling growing demand for spheroids within the scientific community, as these miniature 3D models offer significant potential for disease modeling and deeper biological insights. As of February 2024, ClinicalTrials.gov reports 106 ongoing clinical studies involving spheroids, highlighting their expanding role in translational research. Moreover, recent technological advancements in spheroid model development further enhance their utility in pharmaceutical research, improving accuracy in drug testing and disease analysis.

Technological innovation in The 3D Spheroid Technologies

Technological developments in 3D spheroid technologies are expected to drive the market. For instance, the Cultrex Organoid Progenitor Cells provided by AMS Biotechnology (AMSBIO) can be enhanced by utilizing distinct sets of extracellular matrices, enabling researchers to regulate cellular behavior by manipulating the culture microenvironment. In addition, AMSBIO's Cultrex spheroid proliferation/viability and invasion assays facilitate the creation of cohesive spheroids in low-adhesion conditions, promoting spheroid development.

Likewise, SCIVAX Corporation’s Nano Culture Plate (NCP) and Nano Culture Dish (NCD) are suitable for high-throughput screening applications. Furthermore, spheroids cultivated on NCP are employed for live imaging using fluorescence and bright-field microscopes. As a result, these plates have become widely adopted for developing assays that were previously challenging to develop using other three-dimensional (3D) or monolayer cell culture systems.

Rising demand for tissue engineering & organ transplantation

The rising demand for tissue engineering and organ transplantation is significantly driving the adoption of spheroid and tumor spheroid models, owing to their ability to closely mimic the 3D cellular architecture and microenvironment of human tissues. Unlike traditional 2D cultures, spheroids allow for more physiologically relevant studies of cell-cell and cell-matrix interactions, making them ideal for developing bioengineered tissues, assessing transplant viability, and testing drug efficacy. Tumor spheroids, in particular, are being increasingly utilized in cancer modeling to study tumor growth, metastasis, and treatment response in a manner that better reflects in vivo conditions. This demand is further fueled by the global shortage of donor organs, advancements in regenerative medicine, and the growing emphasis on personalized therapeutic development.

Advantages of tumor spheroid models:

Market Concentration & Characteristics

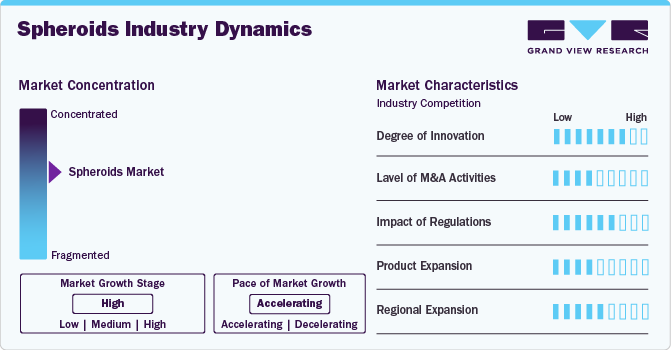

The spheroids industry demonstrates a high degree of innovation, driven by the need for more biologically relevant research and drug development models. Innovations are seen in advanced scaffold-free and scaffold-based culture systems, integration with organ-on-chip technologies, and AI-based analysis tools for 3D imaging and high-content screening. New methods for generating uniform spheroids, co-culturing multiple cell types, and extending viability significantly improve their application in disease modeling and regenerative medicine.

The market has seen a moderate level of mergers and acquisitions, with larger life science and biotech companies acquiring specialized 3D culture firms or technology developers to strengthen their 3D biology portfolios. Strategic acquisitions aim to gain proprietary platforms, enhance high-throughput screening capabilities, and expand into 3D cell culture-based drug discovery. While not yet as frequent as in broader biotech sectors, M&A activity is expected to rise as demand for 3D models and personalized medicine grows.

The spheroid industry currently faces a low-to-moderate regulatory impact, particularly as many products are used for research purposes and not directly regulated as medical devices or therapeutics. However, as spheroids increasingly enter translational and preclinical pipelines, regulatory scrutiny over reproducibility, data integrity, and validation is expected to increase. Agencies like the FDA and EMA are also encouraging the adoption of more physiologically relevant models (such as spheroids) as alternatives to animal testing, which could accelerate regulatory integration.

There is a strong trend in product expansion, with companies introducing new culture platforms (e.g., ULA, hanging drop, microfluidics), specialized reagents, and integrated imaging and automation solutions. Vendors also offer application-specific kits tailored to oncology, hepatotoxicity, and neuroscience, broadening market appeal. The expansion is further supported by collaborations with academic institutes and CROs to develop custom spheroid models for targeted research areas.

The spheroid industry is witnessing steady regional expansion, with North America and Europe leading in adoption due to strong R&D infrastructure and pharmaceutical investments. Asia Pacific is emerging rapidly, driven by increasing biotech activity in countries like China, Japan, and South Korea, and government initiatives to promote innovative drug testing models. Emerging markets in Latin America and the Middle East are also beginning to adopt 3D culture systems, primarily through collaborations with global players and academic networks.

Type Insights

The multicellular tumor spheroids (MCTS) segment accounted for a larger revenue share of 28.91% in 2024 and is expected to have the fastest growth rate over the forecast period. Unlike 2D monolayer cultures, MCTS replicate key tumor features such as hypoxic cores, nutrient gradients, and complex cell-cell interactions, making them highly valuable for cancer biology research and preclinical drug screening. Their relevance in modeling tumor progression, metastasis, and therapeutic response prompts widespread adoption in oncology-focused pharmaceutical and academic research. Moreover, the growing push toward replacing animal models with more ethical and predictive in vitro systems is accelerating the integration of MCTS into high-throughput drug development workflows.

The mammospheres segment is expected to grow significantly over the forecast period. Mammospheres replicate the 3D structure of breast tissue and closely mimic the biology of CSCs, making them invaluable for studying breast cancer progression, metastasis, and therapeutic resistance. As the demand for personalized medicine grows, mammospheres are increasingly used to test the efficacy of new treatments, including targeted therapies and immunotherapies, in preclinical models. Furthermore, their role in understanding the molecular mechanisms of CSCs drives their adoption across academic and pharmaceutical research sectors, further fueling the growth of the spheroid industry.

Method Insights

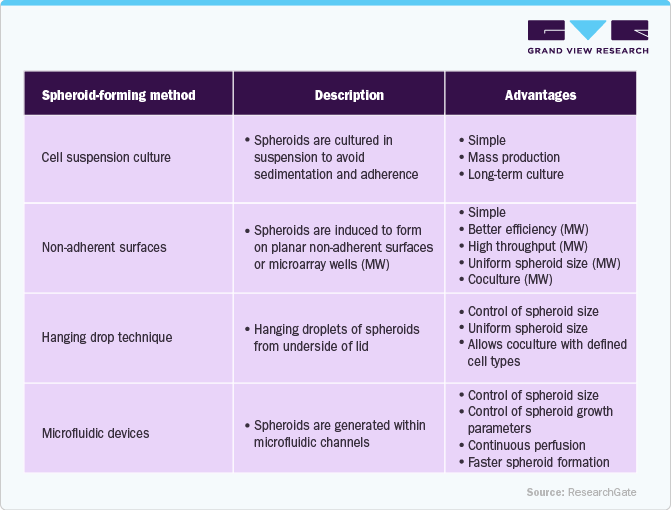

The hanging drop method segment accounted for a larger revenue share of 31.34% in 2024 and is expected to have a fastest growth rate over the forecast period. This method promotes the spontaneous aggregation of cells into spheroids by utilizing gravity, allowing for the formation of structurally intact and physiologically relevant cell clusters. As demand for high-quality, scalable, and cost-effective 3D culture systems increases, the hanging drop method has become a preferred choice in academic and industrial settings for cancer research, drug screening, and regenerative medicine. Its simplicity and versatility in producing spheroids for various applications accelerate its adoption, further fueling spheroid industry growth.

The low cell attachment plates segment is expected to grow significantly over the forecast period. These plates are specially coated to prevent cell adhesion, encouraging cells to aggregate and form spheroids naturally, which closely mimic the in vivo microenvironment. Their compatibility with automated systems and high-throughput screening makes them ideal for pharmaceutical and biotech applications, especially in cancer research and drug toxicity studies. The increasing demand for more physiologically relevant and cost-effective 3D culture tools is driving widespread adoption of low cell attachment plates, supporting the overall growth of the spheroids industry.

Source Insights

The cell line segment accounted for a larger revenue share of 56.64% in 2024. Cell lines are a major source for spheroids because they provide a standardized, reproducible, and cost-effective resource for generating 3D spheroid models across a wide range of research applications. Established cancer cell lines, stem cell lines, and primary cells are routinely used to form spheroids for studying tumor behavior, drug resistance, tissue development, and stem cell differentiation. The vast availability of disease-specific and genetically modified cell lines enables researchers to create spheroids tailored to various pathological conditions, enhancing experimental outcomes' relevance and translational value. Moreover, the compatibility of these cell lines with high-throughput 3D culture platforms further boosts their adoption in pharmaceutical R&D and academic research, propelling the market growth.

The iPSCs derived cells segment is expected to grow fastest over the forecast period. iPSCs can be differentiated into various cell types and organized into spheroids, allowing researchers to model complex biological processes, study patient-specific disease mechanisms, and evaluate drug responses in a personalized manner. This is particularly valuable for regenerative medicine, toxicology, and neurological disease research. The growing demand for predictive, human-relevant models that reduce reliance on animal testing is accelerating the adoption of iPSC-derived spheroids across pharmaceutical, biotech, and academic sectors, fueling the market expansion.

Application Insights

The developmental biology segment accounted for the largest revenue share of 30.17% in 2024. Spheroids drive significant advancements in developmental biology by providing a more realistic 3D model system to study tissue morphogenesis, cellular differentiation, and organogenesis. Unlike 2D cultures, spheroids enable observing cell behavior in a spatial context that closely mimics early embryonic development. This makes them ideal for investigating the signaling pathways and gene expression patterns involved in developmental processes. Researchers are increasingly using spheroids, such as embryoid bodies, to model early-stage tissue formation and stem cell differentiation, which is crucial for understanding congenital disorders and advancing regenerative medicine. This growing application of spheroids in developmental biology fuels demand for more refined and scalable 3D culture systems.

The regenerative medicine segment is expected to witness the highest CAGR over the forecast period. Transplantation of spheroids derived from adult stem cells helps replace diseased tissue or organs. For instance, XanoMATRIX surfaces are used to grow and cultivate mesenchymal stem cells and for regenerative medicine. Such developments boost the segment’s growth.

End Use Insights

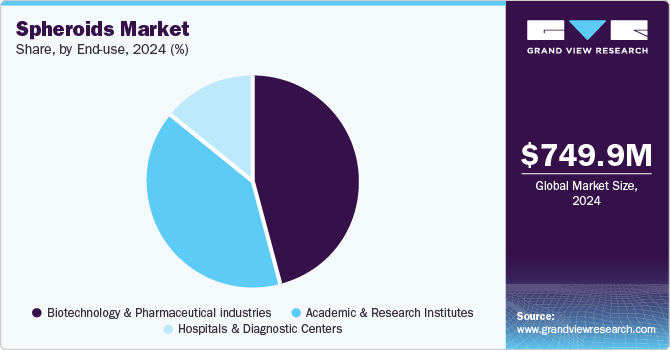

The biotechnology and pharmaceutical industries segment accounted for the largest revenue share of 46.33% in 2024. Spheroids offer a more physiologically relevant environment than traditional 2D cultures, enabling more accurate drug efficacy, toxicity, and pharmacokinetics predictions. This leads to reduced drug development costs and fewer late-stage clinical failures. Moreover, the growing emphasis on personalized medicine and the need for disease-specific models have made spheroids essential tools in oncology, neurology, and regenerative medicine research. Pharmaceutical companies also invest in high-throughput screening platforms compatible with spheroid models, further accelerating their integration into mainstream R&D pipelines.

The academic & research institutes segment is expected to witness the highest CAGR over the forecast period. Spheroids enable researchers to replicate 3D cellular microenvironments, offering more accurate insights into tumor biology, stem cell differentiation, and tissue development compared to conventional 2D models. With increased funding from government agencies and collaborative grants, institutions are leveraging spheroid models for exploratory research, translational studies, and drug screening applications. Moreover, the rise in interdisciplinary research involving bioengineering, materials science, and cell biology is further boosting the adoption of spheroids in academic settings.

Regional Insights

North America accounted for the largest revenue share of 36.12% in 2024. This can be attributed to technological advancements that have enabled the development of 3D spheroids. These innovative models have proven to be more effective than traditional 2D cell culture platforms, as they provide a more accurate representation of human tissue structures. By creating a microenvironment that closely mimics in vivo conditions, researchers can obtain more reliable and predictive results from their experiments.

U.S. Spheroids Market Trends

The spheroids market in the U.S. is experiencing significant growth due to the local presence of key players, such as Corning and Thermo Fisher Scientific, Inc. Moreover, international funding organizations in this region are also anticipated to drive the demand for spheroid culture systems.

Europe Spheroids Market Trends

The spheroids market in Europe is expected to witness significant growth over the forecast period, driven by several factors. One of the primary growth drivers is the increasing demand for personalized medicine, which has led to a surge in demand for patient-specific drug discovery and development models. Spheroids offer an opportunity to create such models by mimicking human tissue structures in a 3D environment. This technology can potentially reduce the time and cost associated with traditional drug discovery methods while improving their efficacy and safety.

The UK spheroids market is growing significantly due to technological advancements. The UK government has invested heavily in genomics research, which has led to the development of cutting-edge technologies for creating spheroids. For instance, in May 2023, Chancellor Jeremy Hunt announced a USD 700.65 million war chest to boost the UK's life sciences sector, which is expected to impact the market positively. The funding will support research and development in various areas of life sciences, including genomics, artificial intelligence (AI), and cell and gene therapies. The funding is also expected to support establishing a new National Institute for Health Protection (NIHP), focusing on improving public health by developing new treatments and vaccines. Such initiatives are expected to drive demand for spheroids, as they provide an ideal model for testing new treatments and vaccines in a preclinical setting.

The spheroids market in France is witnessing growth as the French government has made significant investments in stem cell technology. Stem cells have the potential to differentiate into various cell types and can be used to create spheroids that mimic human tissue structures in vitro. The French government has established several research centers and initiatives focused on stem cell research, such as the Institut Clinique de la Souris (ICS) and the Centre de Recherche en Cancérologie de Marseille (CRCM). These centers have contributed to advancements in stem cell technology and have facilitated research into spheroids for various applications such as drug discovery, disease modeling, and regenerative medicine.

Germany spheroids market is being actively supported by its government in research and development through funding initiatives. For instance, the German Research Foundation (DFG) provides funding for research projects focused on spheroids, including projects focused on disease modeling, drug discovery, and regenerative medicine. Moreover, the German government has established several research centers and initiatives focused on spheroids, such as the Fraunhofer Institute for Cell Therapy and Immunology (IZI) and the German Center for Neurodegenerative Diseases (DZNE). These centers provide a platform for researchers to collaborate and advance in spheroids.

Asia Pacific Spheroids Market Trends

The spheroids market in Asia Pacific is expected to witness the fastest growth over the forecast period, owing to constant developments in stem cell research. A rise in partnerships among key market entities is expected to enhance the market growth. For instance, in March 2020, Nichirei Biosciences and UPM Biomedicals partnered to provide UPM culture products in Japan. This enhanced the availability of natural hydrogels for spheroid culture.

China spheroids market has seen significant advancements in 3D cell culture technology, especially with regard to spheroids. As a result, China's market for these sophisticated cell culture models is expanding. China's 3D cell culture technology has recently advanced thanks to partnerships that promote research in this area. For instance, in October 2020, Merck collaborated with D1Med to advance the application of three-dimensional (3D) cell culture technology in China, with Merck providing 3D cell culture products and expertise. This collaboration reflects the increasing focus on 3D cell culture techniques, which are gaining traction in cell biology and have the potential for various applications, including tissue engineering, regenerative medicine, drug development, toxicity testing, and spheroid formation.

The spheroids market in Japan is primarily driven by the country's strong focus on precision medicine, regenerative therapies, and cancer research. Government initiatives such as the Japan Regenerative Medicine Act and funding support from agencies like AMED (Japan Agency for Medical Research and Development) have accelerated the adoption of advanced 3D cell culture technologies, including spheroids. Japanese pharmaceutical and academic institutions are increasingly utilizing tumor spheroids for drug screening, toxicology studies, and disease modeling due to their ability to better mimic in vivo conditions compared to 2D cultures. In addition, Japan's aging population and the resulting rise in chronic diseases are prompting greater demand for more predictive preclinical models, further propelling the growth of the spheroid market in the region.

Middle East And Africa Spheroids Market Trends

The spheroid market in MEA is driven by a growing focus on advancing healthcare infrastructure, increasing investment in biomedical research, and rising government initiatives to promote precision medicine and biotechnology. Countries such as the United Arab Emirates and Saudi Arabia prioritize life sciences as part of their economic diversification strategies, leading to the establishment of research hubs and collaborations with global biotech firms. The region’s rising burden of chronic diseases, including cancer and diabetes, is also fueling demand for more predictive and patient-relevant 3D cell models like spheroids.

Saudi Arabia spheroids market is witnessing significant growth due to the Saudi Arabian government's investment in research and development in various fields, including healthcare. For instance, the significant investment in healthcare infrastructure under Saudi Arabia's Vision 2030 initiative is expected to significantly boost the country's market. These USD 65 billion investments are facilitating the development of new technologies, products, and services in healthcare, including spheroids, and are leading to their commercialization in the Saudi Arabian market.

Key Spheroids Company Insights

Competition among the existing players has increased owing to developments in technology and its potential applications in the arena of drug discovery. Therefore, key players are continuously involved in the launch of new, improved products. For instance, Perkin Elmer offers a wide portfolio of platforms for detecting, handling, and analyzing spheroids. Researchers have developed mini lungs to study the mechanism of the entry of SARS-CoV-2 and its spread in tissues. Organoids have also been employed to study the defense mechanism of tissues against SARS-CoV-2. This can potentially help in the development of a vaccine for treatment.

Regulatory compliance and ethical considerations play a crucial role in shaping the competitive scenario. Companies that successfully navigate stringent approval processes and develop standardized, scalable spheroid models will dominate the market. As the demand for precision medicine grows, firms investing in personalized spheroid platforms will likely capture significant market share. The competition is further intensified by emerging startups introducing cost-effective, high-throughput spheroid solutions, challenging established players. With continuous advancements and increasing regulatory support, the spheroid market is poised for sustained growth, driving new opportunities across the biotech, pharma, and healthcare sectors.

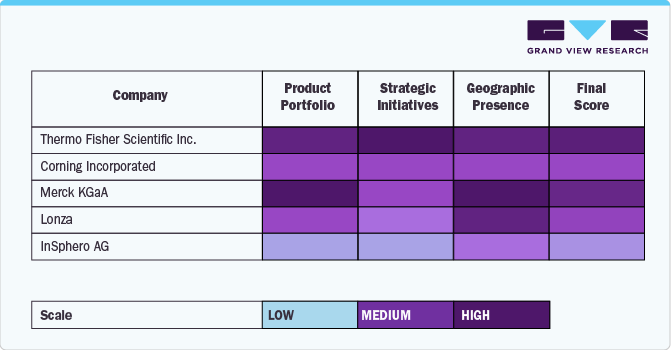

The above analysis highlights the competitive landscape of the companies, with larger firms maintaining a more robust global footprint and strategic engagement. Companies like Merck KGaA, Lonza, and Thermo Fisher Scientific Inc. demonstrate strong positions across all three categories, suggesting a well-rounded market presence. Corning Inc. shows moderate strength, particularly in strategic initiatives and geographic reach.

Key Spheroids Companies:

The following are the leading companies in the spheroids market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Corning Incorporated

- Merck KGaA

- Lonza Group AG

- InSphero AG

- Greiner Bio-One International GmbH

- 3D Biotek LLC

- CN Bio Innovations

- Kuraray Co., Ltd.

- Tecan Group Ltd.

Recent Developments

-

In June 2023, Inventia Life Science partnered with Biotron Healthcare to distribute its RASTRUM miniaturized 3D cell culturing platform in India. This collaboration is expected to benefit the field of organoids and spheroids by making the advanced technology of the RASTRUM platform more accessible to researchers in India.

-

In April 2023, InSphero AG, a leading innovator in 3D cell-based assay technology, expanded its reach into the Indian market by partnering with Bionova Supplies. Through this agreement, InSphero’s patented Akura 96 and 384 Spheroid Microplates will now be accessible to researchers across the country.

-

In January 2023, ReLive Biotechnologies announced that its SpheChon 10-70 spheroids/cm² has received NDA approval from the Health Sciences Authority (HSA) in Singapore. This represents a significant milestone in the company’s global expansion efforts.

Spheroids Market Report Scopes

Report Attribute

Details

Market size value in 2025

USD 0.89 billion

Revenue forecast in 2030

USD 2.46 billion

Growth rate

CAGR of 22.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, method, source, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Corning Incorporated; Merck KGaA; Lonza Group AG; InSphero AG; Greiner Bio-One International GmbH; 3D Biotek LLC; CN Bio Innovations; Kuraray Co., Ltd.; Tecan Group Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spheroids Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global spheroids market report based on type, method, source, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Multicellular tumor spheroids (MCTS)

-

Neurospheres

-

Mammospheres

-

Hepatospheres

-

Embryoid bodies

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Micropatterned Plates

-

Low Cell Attachment Plates

-

Hanging Drop Method

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Line

-

Primary Cell

-

iPSCs Derived Cells

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Developmental Biology

-

Personalized Medicine

-

Regenerative Medicine

-

Disease Pathology Studies

-

Drug Toxicity & Efficacy Testing

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Pharmaceutical industries

-

Academic & Research Institutes

-

Hospitals and Diagnostic centers

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global spheroids market size was estimated at USD 749.9 million in 2024 and is expected to reach USD 887.4 million in 2025.

b. The global spheroids market is expected to grow at a compound annual growth rate of 22.7% from 2025 to 2030 to reach USD 2.46 billion by 2030.

b. North America accounted for the largest revenue share of 36.12% in 2024. This can be attributed to the advancements in technology that have enabled the development of 3D spheroids.

b. Some key players operating in the spheroids market include Thermo Fisher Scientific Inc., Corning Incorporated, Merck KGaA, Lonza, InSphero AG, Greiner Bio-One International GmbH, 3D Biotek LLC, CN Bio Innovations, Kuraray Co., Ltd., Tecan Group Ltd.

b. The spheroid industry is being driven by the increasing demand for physiologically relevant 3D cell culture models in drug discovery, cancer research, and regenerative medicine. Additionally, advancements in high-throughput screening technologies, growing interest in personalized medicine, and increased funding for 3D cell culture platforms are further accelerating the adoption of spheroid-based systems across pharmaceutical, academic, and biotech sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.