- Home

- »

- Next Generation Technologies

- »

-

Sports Analytics Market Size & Share, Industry Report, 2030GVR Report cover

![Sports Analytics Market Size, Share & Trends Report]()

Sports Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Analysis (On-field, Off-field), By Sports, By End-use (Sports Team, Sports Leagues/Associations, Individual Players/Coaches, Sports Betting), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-128-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sports Analytics Market Summary

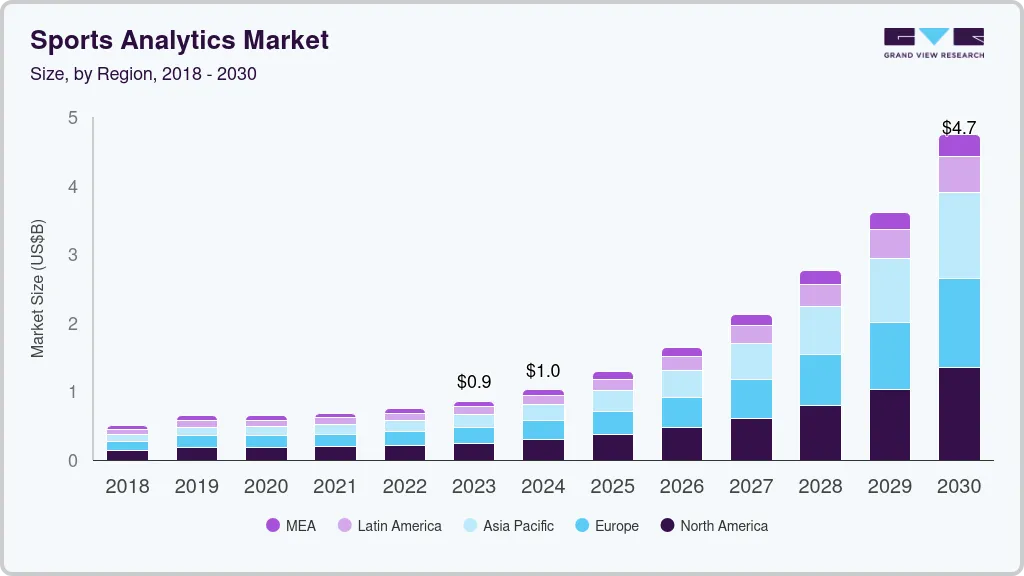

The global sports analytics market size was estimated at USD 4.47 billion in 2024 and is projected to reach USD 14.48 billion by 2030, growing at a CAGR of 20.6% from 2025 to 2030.The market continues to experience rapid growth, driven by the rising demand for performance optimization across professional and amateur sports.

Key Market Trends & Insights

- The Europe sports analytics market was identified as a lucrative region in 2024 with revenue share of 30.3%.

- Germany sports analytics market is evolving rapidly, particularly in football, where clubs are implementing sophisticated data solutions to optimize team strategies and player performance.

- By component, the software segment captured the largest market share of over 62% in 2024.

- By analysis, the off-field segment captured significant market share in 2024.

- By sports, the cricket segment captured a significant market share in 2024.

Market Size & Forecast

- 2024 Revenue: USD 4.47 Billion

- 2030 Projected Market Size: USD 14.48 Billion

- CAGR (2025-2030): 20.6%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Teams increasingly rely on analytics platforms to monitor real-time metrics such as speed, agility, load, and fatigue. This data empowers coaching staff to tailor training programs and minimize injury risks. The integration of wearable technology and AI-powered analytics is enhancing the depth of insight into biometric and physiological parameters. Additionally, advancements in computer vision and video analytics are expanding use cases beyond player performance to include tactical analysis, fan engagement, and recruitment. As franchises seek competitive advantages through data-driven decision-making, investment in sports analytics solutions is increasing.

Growing focus on fan engagement is transforming the sports analytics industry by integrating analytics into audience experience strategies. Organizations are using data to personalize content, suggest merchandise, and improve ticketing decisions based on fan behavior and preferences. These insights are derived from sources such as mobile apps, online platforms, and social media interactions. Enhanced engagement not only boosts revenue but also strengthens brand loyalty for teams and leagues. As a result, the sports analytics market is expanding to support technologies that analyze and respond to fan activity.

The legalization and mainstream adoption of sports betting in several regions has intensified the role of the sports analytics industry. Predictive analytics models are being developed to forecast match outcomes, player statistics, and event probabilities. These models rely on vast datasets that include historical performance, injury reports, and weather conditions. Sportsbooks and fantasy league platforms are investing heavily in analytics engines to offer users a more accurate and engaging experience. This evolution is driving growth in the sports analytics market through advanced forecasting and real-time insights.

The sports analytics industry is witnessing strong momentum due to the integration of video analysis systems in coaching and scouting processes. High-definition footage combined with computer vision is being used to track player movements, detect patterns, and analyze team formations. These visual insights support better tactical decisions and player development strategies. Various sports such as football, basketball, and tennis are now relying on automated video breakdowns to gain a competitive edge. Consequently, the sports analytics market is seeing rising demand for tools that can process and interpret large volumes of visual data.

Health monitoring and injury prevention have become top priorities, significantly impacting the sports analytics industry. Teams are deploying analytics tools to identify injury risks based on workload, biomechanics, and recovery trends. These systems provide alerts that help medical staff intervene before minor issues escalate into major injuries. The focus extends across multiple sports, including baseball, rugby, and athletics, where physical stress levels are high. As athlete longevity becomes critical, the sports analytics market is evolving to offer solutions that ensure optimal health and reduce downtime.

Leading companies in the sports analytics industry specialize in delivering advanced data solutions that empower teams, leagues, and broadcasters to make strategic decisions. Key players such as Catapult Sports, Stats Perform, IBM, SAP SE, and Hudl offer platforms that support everything from player tracking and performance optimization to tactical analysis and fan engagement. These companies integrate technologies such as artificial intelligence, machine learning, and computer vision into their analytics tools to generate real-time, actionable insights. Their offerings are used across a wide range of sports, including football, basketball, cricket, and athletics, reflecting the broad applicability and demand for data-driven decision-making. As the sports analytics market continues to grow, these leaders are investing in innovation and partnerships to maintain their competitive edge and expand their global footprint.

Component Insights

The software segment captured the largest market share of over 62% in 2024. The segment growth is driven by the increasing need for real-time data processing, visualization, and predictive modeling. This segment includes platforms and applications that help coaches, analysts, and management interpret complex datasets from sources such as wearables, cameras, and sensors. Software solutions enable functions such as player performance tracking, game strategy development, injury prediction, and opponent analysis. The growing integration of artificial intelligence and machine learning within these platforms enhances accuracy and enables automated decision-making processes. As a result, the software segment continues to be a critical component of the sports analytics market, catering to the evolving analytical demands of professional teams and organizations.

The service segment is expected to witness the fastest CAGR of 17.9% from 2025 to 2030. The segment plays a vital role by offering expertise, customization, and ongoing support to teams and organizations implementing analytics solutions. This segment includes consulting services, data management, system integration, and training programs tailored to specific sports and performance goals. Service providers assist clients in interpreting analytical outputs, optimizing software tools, and designing strategies based on data insights. As the adoption of analytics becomes more widespread across leagues and levels, the demand for skilled professionals and managed services is rising rapidly. Consequently, the service segment is becoming an essential pillar of the sports analytics market, ensuring that end users can fully leverage the power of their data investments.

Analysis Insights

The off-field segment captured significant market share in 2024. The off-field segment in the sports analytics industry is gaining traction as organizations recognize the value of data beyond in-game performance. This segment focuses on areas such as fan engagement, ticketing strategies, sponsorship valuation, and merchandise optimization using analytics-driven insights. By analyzing consumer behavior, purchasing patterns, and social media activity, teams can tailor marketing campaigns, forecast revenue, and enhance overall business operations. Broadcasters and media outlets also utilize off-field analytics to optimize content delivery and viewer engagement across platforms. As commercial operations become more data-centric, the off-field segment is emerging as a key growth driver in the sports analytics market.

The on-field segment is expected to witness the fastest CAGR from 2025 to 2030. The on-field segment in the sports analytics industry is at the core of real-time decision-making and performance optimization during training sessions and live matches. This segment involves the use of data analytics to assess player fitness, monitor in-game tactics, evaluate opponent strategies, and refine coaching methods. Technologies such as GPS trackers, wearables, and video analysis tools are extensively used to collect data on movement, stamina, positioning, and execution. Coaches and analysts leverage this information to make substitutions, adjust formations, and implement data-informed strategies on the spot. As competitive margins tighten across professional sports, the on-field segment remains a crucial component in driving growth and innovation within the sports analytics market.

Sports Insights

The cricket segment captured a significant market share in 2024. In cricket, the industry is playing an increasingly strategic role in enhancing team performance, tactical planning, and talent management. Advanced analytics platforms are employed to evaluate player efficiency, pitch behavior, bowling patterns, and opposition analysis through the integration of historical data and real-time inputs. Decision-makers utilize metrics such as strike rate against specific bowlers, success rates on varying pitch conditions, and optimal fielding configurations to inform match strategies and selection processes. Professional leagues, including the Indian Premier League (IPL) and Big Bash League (BBL), have adopted analytics as a core component of their competitive operations and recruitment frameworks. As analytics capabilities continue to mature, cricket represents a high-potential segment within the broader sports analytics market, supporting data-informed decision-making at every organizational level.

The football segment is expected to witness the fastest CAGR from 2025 to 2030. In football, the sports analytics industry is transforming how teams approach performance, strategy, and player development. Clubs now rely on advanced data models to evaluate player fitness, track in-game movements, and analyze passing accuracy, defensive positioning, and goal-scoring opportunities. Coaches use heatmaps, xG (expected goals) metrics, and tactical breakdowns to refine formations and counter opponent strategies. Scouting departments are also leveraging analytics to identify talent and make data-backed transfer decisions. With increasing investment in technology and performance science, football continues to be one of the most data-intensive segments driving growth in the sports analytics market.

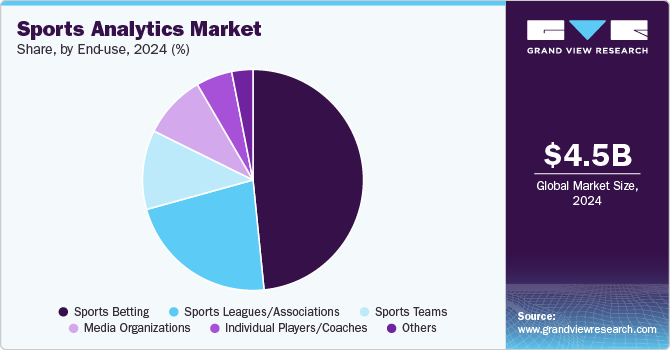

End-use Insights

The sports betting segment captured the highest market share in 2024. In sports betting, including fantasy sports, the sports analytics industry is emerging as a foundational driver of predictive accuracy, user engagement, and platform differentiation. Analytics solutions are utilized to generate real-time odds, model player performance, and simulate game outcomes by processing vast datasets comprising historical results, injury reports, weather patterns, and player statistics. Operators leverage these insights to enhance bet pricing models, minimize risk exposure, and offer dynamic in-play betting options. In the fantasy sports segment, data analytics enable participants to make informed player selections, track live performance metrics, and optimize team rosters based on projections. As consumer demand for interactive and data-driven experiences continues to rise, the sports analytics market is becoming increasingly integral to the success and evolution of the global betting and fantasy sports ecosystem.

The media organizations segment is expected to witness the fastest CAGR from 2025 to 2030. In media organizations, the sports analytics market plays a critical role in enhancing content strategy, viewer engagement, and broadcast innovation. Broadcasters and digital media platforms are leveraging analytics to deliver personalized content, highlight key in-game moments, and provide data-rich storytelling through real-time statistics and visualizations. By analyzing audience behavior, viewing patterns, and engagement metrics, media companies can optimize programming schedules, tailor advertising campaigns, and increase monetization opportunities. Integration of advanced tools such as augmented reality and predictive analytics further enriches the viewer experience with deeper insights and interactive features. As competition for audience attention intensifies, media organizations are increasingly relying on the sports analytics market to drive data-informed content delivery and sustain audience growth.

Regional Insights

The sports analytics market in North America generated a significant revenue share, accounting for over 28% in 2024. In North America, the sports analytics market is experiencing significant growth, driven by the region's deep integration of technology in professional sports. Teams and leagues are increasingly adopting data analytics for performance optimization, fan engagement, and injury prevention. The expanding adoption of sports betting in the U.S. has further accelerated demand for predictive analytics tools. As a result, North America remains a key market, with continuous advancements in software and service offerings tailored to both professional and amateur sports.

U.S. Sports Analytics Market Trends

The U.S. leads the charge in the sports analytics market, with major leagues such as the NFL, NBA, and MLB heavily investing in data-driven decision-making. Predictive analytics, real-time performance tracking, and AI-powered insights are becoming standard in team management, broadcasting, and fan experiences. The U.S. is also witnessing a boom in sports betting, driving demand for analytical tools to enhance betting strategies and provide real-time updates. The market is expected to continue expanding as more technologies and innovative solutions are integrated across various sports segments.

Europe Sports Analytics Market Trends

The Europe sports analytics market was identified as a lucrative region in 2024 with revenue share of 30.3%. In Europe, sports analytics is seeing increasing adoption across football, rugby, and cricket, with top-tier leagues investing heavily in data solutions. Clubs are utilizing advanced player tracking and performance analysis to stay competitive, particularly in football, where in-depth metrics such as expected goals (xG) and player efficiency are becoming industry standards. The region is also embracing the integration of AI and machine learning to support real-time decision-making. As interest in sports betting and fantasy leagues grows, European markets are increasingly seeking data-driven solutions to enhance their offerings.

Germany sports analytics market is evolving rapidly, particularly in football, where clubs are implementing sophisticated data solutions to optimize team strategies and player performance. With a focus on the Bundesliga, teams are incorporating player tracking technologies and performance analysis tools to enhance competitive advantage. The country is also integrating AI-driven technologies to improve tactical decisions and match preparation. As interest in sports technology increases, Germany is positioning itself as a key player in the European sports analytics landscape.

Sports analytics market in the UK is a prominent market, particularly in football and rugby, where advanced data analytics are reshaping team management and match strategies. Premier League clubs are investing heavily in technologies that provide insights into player health, performance metrics, and opponent analysis. The rise of sports betting and fantasy leagues in the U.K. has increased the demand for analytics tools that offer real-time insights. With the integration of AI and machine learning, the U.K. remains a critical hub for sports analytics innovations in Europe.

Asia-Pacific Sports Analytics Market Trends

The sports analytics market in the Asia Pacific region is expected to grow at the highest CAGR of 22.8% from 2025 to 2030. The sports analytics market in the Asia Pacific region is growing rapidly, fueled by increased investments in professional sports and a rising interest in sports technology. Countries such as China and India are increasingly utilizing advanced analytics to improve player performance, optimize team strategies, and enhance fan engagement. Sports leagues in this region are integrating analytics into both traditional sports and emerging sectors like esports. With the growing popularity of sports betting, the demand for data-driven solutions is expected to continue to rise.

China sports analytics market is evolving at a fast pace, driven by significant investments in professional basketball, football, and esports. The country is harnessing data analytics to improve player training, prevent injuries, and refine game tactics, particularly in basketball and football leagues. The surge in esports popularity is also driving demand for analytics tools that track player performance and optimize strategies. As China enhances its sports infrastructure, analytics will play a critical role in shaping the future of sports in the country.

Sports analytics market in India is experiencing rapid growth, particularly in cricket and emerging sports such as kabaddi and field hockey. Teams are increasingly turning to data analytics to boost player performance, analyze opponents, and refine their strategies. The Indian Premier League (IPL) has been a major driver of sports analytics adoption, with franchises using data insights for team selection and tactical planning. With the growing interest in sports technology, India is positioned to become a key player in the global sports analytics market.

MEA Sports Analytics Market Trends

The sports analytics market in the Middle East and Africa (MEA) is gaining momentum, driven by rising investments in professional sports and the adoption of sports technology. Countries like the UAE are integrating data analytics into their sports systems to enhance player performance and fan engagement. The rapid growth of sports betting in the region is also fueling demand for predictive analytics solutions. As the market matures, sports analytics will continue to be crucial in enhancing the sports experience across MEA.

Sports analytics market in UAE is expanding rapidly, supported by the country's investments in high-profile sporting events such as the Dubai World Cup and Formula 1 Grand Prix. Football, cricket, and motorsports are key focus areas where analytics is being used to optimize team performance and strategy. Additionally, the growing interest in sports betting and esports is driving the demand for real-time data and analytics solutions. As the UAE develops into a global sports hub, the adoption of sports analytics in the region is expected to accelerate.

Key Sports Analytics Company Insights

Some of the key players operating in the market include SAP SE and IBM Corporation

-

SAP SE is a recognized leader in the sports analytics market, offering enterprise-level solutions that integrate data across multiple touchpoints. Their solutions are widely used for team and player performance optimization, enhancing fan experiences, and providing data-driven insights for sports leagues and teams. SAP's use of cloud technologies and advanced analytics tools enable organizations to harness data for strategic decision-making. As sports analytics evolves, SAP's continued investment in AI and machine learning solidifies its position as a top-tier player in the industry.

-

IBM Corporation is one of the leading players in the sports analytics market, with its Watson AI platform driving innovations in sports technology. The company offers advanced data analytics solutions that help sports teams, leagues, and broadcasters enhance player performance, optimize game strategies, and engage fans. IBM's partnerships with high-profile sports organizations, including the U.S. Open and Wimbledon, demonstrate its leadership in the sector. Their ability to integrate AI, machine learning, and data visualization makes IBM a key player in shaping the future of sports analytics across a range of applications.

ChyroHego Corporation and Experfy, Inc. are some of the emerging participants in the sports analytics market.

-

Experfy, Inc. is an emerging player in the sports analytics market, offering a range of data-driven solutions tailored to sports teams and organizations. The company specializes in providing AI-powered insights that help sports professionals enhance player performance and improve game strategies. Experfy's use of machine learning algorithms has set it apart in the industry, providing real-time data that supports decision-making. As the demand for advanced analytics grows, Experfy is well-positioned to expand its presence in both traditional sports and emerging sports like esports.

-

ChyroHego Corporation is gaining momentum in the sports analytics market with its cutting-edge solutions designed to optimize athlete training and performance. Their focus is on providing innovative tools that combine wearables and data analytics to give real-time feedback on player health and progress. With its strong presence in the health and performance monitoring sector, ChyroHego is quickly becoming a go-to player for sports teams looking to track and enhance player performance. As the industry shifts toward more personalized analytics, ChyroHego is poised for significant growth, particularly in individual sports and health assessments.

Key Sports Analytics Companies:

The following are the leading companies in the sports analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Agile Sports Analytics LLC

- Catapult Group International Ltd.

- ChyroHego Corporation

- Deltatre S.p.A.

- Experfy, Inc.

- Genius Sports Group

- International Business Machine (IBM) Corporation

- Oracle Corporation

- SAP SE

- Arecont Vision Coaster LLC

- The Sportradar Group

- Stats LLC

Recent Developments

-

In April 2025, Warner Bros. Discovery (WBD) Sports Europe, in collaboration with Amazon Web Services (AWS), launched the Cycling Central Intelligence (CCI) platform at the WHOOP UCI Mountain Bike World Series season opener in Araxá, Brazil. CCI utilizes generative AI technologies like Amazon Bedrock and Anthropic's Claude 3.5 to provide real-time data on riders, venues, and race histories, enhancing live sports coverage. The platform aims to streamline broadcasting by enabling commentators to access comprehensive information through natural language queries, facilitating richer storytelling and improved viewer engagement.

-

In March 2025, STATSports unveiled its next-generation wearable technology, the Apex device, which integrates advanced AI and machine learning to revolutionize athlete performance monitoring. The device boasts a 20Hz double sampling rate, six times faster processing power, and four times more memory capacity, enabling precise positional accuracy in both indoor and outdoor settings. With the introduction of up to 70 new real-time metrics and a USB-C interface for rapid data downloads, the Apex device sets a new standard in sports science, empowering practitioners to optimize athlete performance with unprecedented accuracy and efficiency.

-

In January 2025, HockeyStack raised USD 20 million in a Series A funding round led by Bessemer Venture Partners, with participation from Y Combinator, Uncorrelated Ventures, and Qnbeyond Ventures. The company reported a 4.5x revenue growth from 2023 to 2024 and now manages over USD 20 billion in campaign spend across more than 130 B2B clients, including Outreach, 8x8, and RealPage. The new capital will be used to expand their platform, which includes AI agents like Odin for automating account research and Nova for enhancing account scoring and workflow automation

Sports Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.68 billion

Revenue forecast in 2030

USD 14.48 billion

Growth rate

CAGR of 20.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, analysis, sports, end-use, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Agile Sports Analytics LLC; Catapult Group International Ltd.; ChyroHego Corporation; Deltatre S.p.A.; Experfy, Inc.; Genius Sports Group; International Business Machine (IBM) Corporation; Oracle Corporation; SAP SE; Arecont Vision Coaster LLC; The Sportradar Group; Stats LLC.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sports Analytics Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sports analytics market report based on component, analysis, sports, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Analysis Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Field

-

Players & Team Analysis

-

Video Analysis

-

Health Assessment

-

-

Off-Field

-

Fan Engagement

-

Ticket Pricing

-

-

-

Sports Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Teams

-

Sports Leagues/Associations

-

Individual Players/Coaches

-

Media Organization

-

Sports Betting

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sports analytics market size was estimated at USD 4.47 billion in 2024 and is expected to reach USD 5.68 billion in 2025.

b. The global sports analytics market is expected to grow at a compound annual growth rate of 20.6% from 2025 to 2030 to reach USD 14.48 billion by 2030.

b. Based on analysis type, the on-field analysis segment dominated the sports analytics market in 2024 with a revenue share of over 62% and is expected to continue dominating the market over the forecast period. On-field data metrics enable teams to determine how to improve in-game strategies, nutrition plans, and other methods for elevating their athletes’ performance levels.

b. The football segment is expected to register the highest CAGR of over 22% through 2030 in the sports analytics market. The increasing popularity and global following of football are driving the growth of this segment.

b. Europe accounted for a market share of over 30% in 2024. The promising growth prospects of the market can be attributed to the increasing adoption of advanced technologies such as smart infrastructure, sports data analytics, and digital signage in sports stadiums to attract fans and improve team performance.

b. Some key players operating in the fantasy sports market include Oracle Corporation, IBM Corporation, SAP SE, Sportsradar AG, SAS Institute Inc., Agile Sports Analytics LLC., Experfy Inc., and Others

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.