- Home

- »

- Next Generation Technologies

- »

-

Sports Broadcasting Technology Market Size Report, 2030GVR Report cover

![Sports Broadcasting Technology Market Size, Share & Trends Report]()

Sports Broadcasting Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Technology, By Platform, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-169-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sports Broadcasting Technology Market Summary

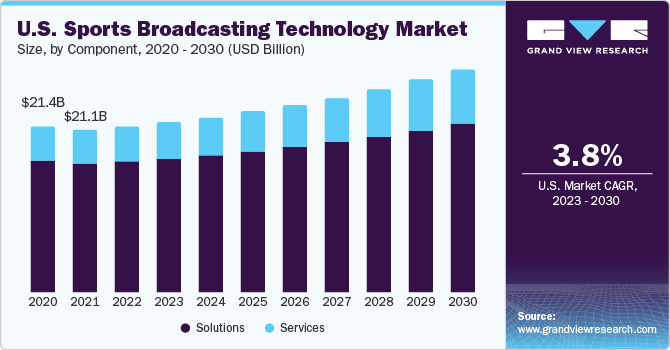

The global sports broadcasting technology market size was estimated at USD 71.57 billion in 2022 and is projected to reach USD 114.21 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. The rapid technological evolvement in sports broadcasting and streaming is set to undergo with the introduction of 5G technology.

Key Market Trends & Insights

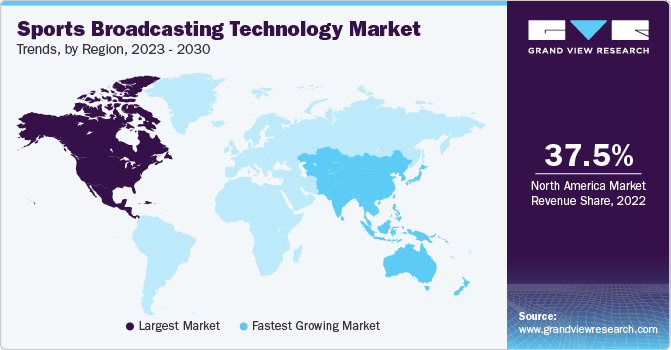

- The North America held a significant market share of 37.5% in 2022.

- By component, the solutions segment dominated the global market in 2022.

- By technology, the digital technology segment is gaining market traction with an outstanding revenue share in 2022.

- By platform, the television segment dominated the global market in 2022.

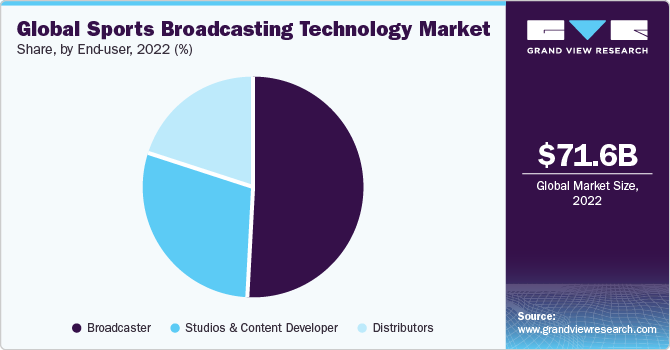

- By end-user, broadcasters held the largest market revenue share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 71.57 Billion

- 2030 Projected Market Size: USD 114.21 Billion

- CAGR (2023-2030): 6.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The technological implementation was expected to boost the way sports are streamed and broadcasted, which provides fans with a seamless and uninterrupted experience of watching sports in real-time.

In September 2023, Rohde & Schwarz partnered with Skylo Technologies to enhance the NTN testing for seamless integration of NB-IoT protocol, ensuring 3GPP release 17 compliance and high-quality connectivity solutions.

The rise of streaming platforms such as Netflix, Amazon Prime Video, and Hulu supports the growth of the market. As consumers are switching their preferences from cable to Over-The-Top (OTT) services, sports broadcasters have had to adapt and invest in new technologies to keep up. One area where this is particularly evident is the use of Augmented Reality (AR) and Virtual Reality (VR) to enhance the viewing experience. For example, AR overlays can provide real-time statistics and player information whereas, VR headsets allow fans to feel the action and experience the game from the perspective of a player or coach. Another area of growth has been the use of Artificial Intelligence (AI) and Machine Learning (ML) to analyze data in real-time and generate insights that can be used to enhance the viewing experience.

Streaming platforms have allowed sports broadcasters to experiment with new technologies, such as AR, Virtual Reality, and AI, and these technologies have enabled broadcasters to provide fans with more immersive and engaging experiences. For example, AR overlays can provide real-time statistics and player profiles. At the same time, AI plays a major role in sports broadcast technology. AI-powered cameras can track the ball and players, while machine learning algorithms can predict game outcomes based on historical data. This experience was great and provided coaches and players with valuable insights, helping them improve their performance.

Component Insights

The solutions segment dominated the global market in 2022 with a significant revenue share. The solutions segment includes hardware and software used in sports broadcasting activities. While sports broadcasting continues to evolve, the demand for innovative and efficient solution components is expected to increase, leading to further growth in the market as new technologies such as AI and ML result. They have opened up new ways to deliver high-quality and personalized experiences. For example, AI-powered systems can analyze player movements to provide commentators and analysts with real-time insights, enhancing the overall viewing experience.

Technology Insights

The digital technology segment is gaining market traction with an outstanding revenue share in 2022. With the upward push of online streaming structures and social media, sports fans now have access to an exceptional amount of sports content material, inclusive of game highlights and evaluations. As a result, sports leagues and broadcasters are investing heavily in new technology to provide consumers with better quality real-time content material. From digital and augmented reality to superior information analytics and cloud-based video processing, the market is constantly evolving and pushing the boundaries.

Analog technology segment is anticipated to witness a significant CAGR in the forecast period from 2023 to 2030. Many broadcasters have diagnosed the cost of incorporating analog technology into their workflows, offering them numerous advantages, such as progressed photo niches, decreased latency, and improved reliability. As a result, the market is showing high adoption of analog technology in sports activities broadcasting.

Platform Insights

The television segment dominated the global market in 2022 with a significant market share. With the development of premium and ultra-high-quality displays, viewers can have an immersive experience while watching sporting events. Besides, advances in camera technology have allowed fans to understand the game better. As technology continues to improve, key players in the market are providing new solutions to give the game a look that will boost fans worldwide.

The OTT platform segment is anticipated to witness a steady CAGR over the forecast period. OTT events have enabled sports organizations to reach new audiences and expand their global reach. With the rise of on-demand streaming services, fans can watch their favorite sports live or on-demand at their convenience. Fans have additional options to acquire sporting information due to the availability of viewing sports on devices such as smart TVs, which has created new revenue sources for sports leagues.

End-user Insights

Broadcasters held the largest market revenue share in 2022. With the growing need for sports activities, content broadcasters are investing heavily in new technology and gadgets to meet the expectations of audiences. This high demand causes a surge in demand for high-end broadcasting cameras, video production software, and other broadcasting equipment that enhance the viewing experience.

In addition, broadcasters have been able to leverage social media and different digital systems to engage with enthusiasts and promote their content. As a result, the marketplace has experienced a massive increase in recent years.

Regional Insights

North America held a significant market share of 37.5% in 2022, with the U.S. as a major player in the region. This may be attributed to the increasing popularity of diverse sports occasions, advancements in broadcasting technology, and the rising demand for tremendous sports content material. The marketplace is also being driven by the emergence of new sports activity leagues and expansion of the current ones, as well as the growing adoption of virtual systems for sports broadcasting. The key developments and elements using the growth of the North American marketplace include the growing call for customized and interactive sports content material, growing reputation of online streaming offerings, and rising adoption of virtual and augmented reality technologies. In addition, the market is being propelled through increasing investments in sports activities', broadcasting infrastructure, and growing demand for amazing sports activities' content across numerous platforms, which include TV, cellular gadgets, and social media.

Asia Pacific is anticipated to witness the fastest CAGR over the forecast period. The area's widespread use of new technology is a factor in the rapid rise of the market. Countries like South Korea, Japan, and China were at the vanguard of this technological revolution, boasting strong infrastructures that have paved the manner for the proliferation of the market. The emergence of recent sports leagues inside the area is using the call for smart stadium infrastructure to compete with international leagues and create new revenue streams.

Key Companies & Market Share Insights

Major players in the market focus on technological development, new product launches, and mergers & acquisitions to strengthen the market position. Strategic collaborations allow these companies to strengthen their product portfolio, providing a broader customer base and a more comprehensive suite of solutions and services.

In October 2023, NEC Corporation collaborated with Freshwave for the Open RAN project to deliver next-generation multi-operator neutral host small cell solutions for high-traffic areas. Project NAVIGATE aims to design, deploy, test, and validate a blueprint for deploying open and sharable, public mobile 4G and 5G capacity in High-Density Deployment (HDD) environments.

Key Sports Broadcasting Technology Companies:

- Broadcast Electronics (Elenos S.r.L.)

- Belden Inc.

- ETL System Ltd.

- NEC Corporation

- Rohde & Schwarz

- AvL Technologies

- OMB Broadcast

- Global Invacom

- Hangzhou HAOXUN Technologies Co. Ltd.

- VSN Video Stream Networks S.L.

- IBM Corporation

- Sportradar AG

- Muvi

- Evertz Microsystems Ltd.

- NEP Group Inc.

- ESPN Sports Media Ltd.

- NBC Universal

- EasyBroadcast

- Orange

- Staige GmbH

Sports Broadcasting Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 75.14 billion

Revenue forecast in 2030

USD 114.21 billion

Growth rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, consumer behavior analysis, leading regional games, competitive landscape, growth factors, and trends

Segments covered

Component, technology, platform, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil, Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Broadcast Electronics (Elenos S.R.L.); Belden Inc.; ETL Systems Ltd.; NEC Corporation; Rohde & Schwarz; AvL Technologies; OMB Broadcast; Global Invacom; Hangzhou HAOXUN Technologies Co. Ltd.; VSN Video Stream Networks S.L.; IBM Corporation; Sportradar AG; Muvi; Evertz Microsystems Ltd.; NEP Group Inc.; ESPN Sports Media Ltd.; NBC Universal; EasyBroadcast; Orange; Staige GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sports Broadcasting Technology Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sports broadcasting technology market report based on component, technology, platform, end-user, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Software

-

Hardware

-

Dish Antennas

-

Amplifiers

-

Switches

-

Encoders

-

Video Servers

-

Transmitters/Repeaters

-

Modulators

-

Others

-

-

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Analog

-

Digital

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

OTT

-

Radio

-

Television

-

Satellite Direct-to-Home

-

Digital Terrestrial Television (DTT)

-

Cable Television

-

IPTV

-

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Broadcaster

-

Studios & Content Developer

-

Distributors

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sports broadcasting technology market size was estimated at USD 71.57 billion in 2022 and is expected to reach USD 75.14 billion in 2023.

b. The global sports broadcasting technology market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 114.21 billion by 2030.

b. Based on the component, the solution segment dominated the market in 2022 with a share of over 76.7%; due to sports broadcasting continuing to evolve, the demand for innovative and efficient solution components is expected to increase.

b. Some key players operating in the sports broadcasting technology market include Broadcast Electronics, ETL System Ltd, IBM Corporation, Muvi, and NEC Corporation, among others.

b. The rapid technological evolvement in sports broadcasting and streaming is set to undergo with the introduction of 5G technology. The technological implementation was expected to boost the way sports are streamed and broadcast, which provides fans with a seamless and uninterrupted experience of watching sports in real time.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.