- Home

- »

- Advanced Interior Materials

- »

-

Stadium Seating Market Size, Share, Industry Report, 2033GVR Report cover

![Stadium Seating Market Size, Share & Trends Report]()

Stadium Seating Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Metal, Wood, Plastic), By Type (Fixed Seating, Telescopic Seating, Bleachers/Grandstands), By Design (Foldable, Non-foldable), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-988-1

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stadium Seating Market Summary

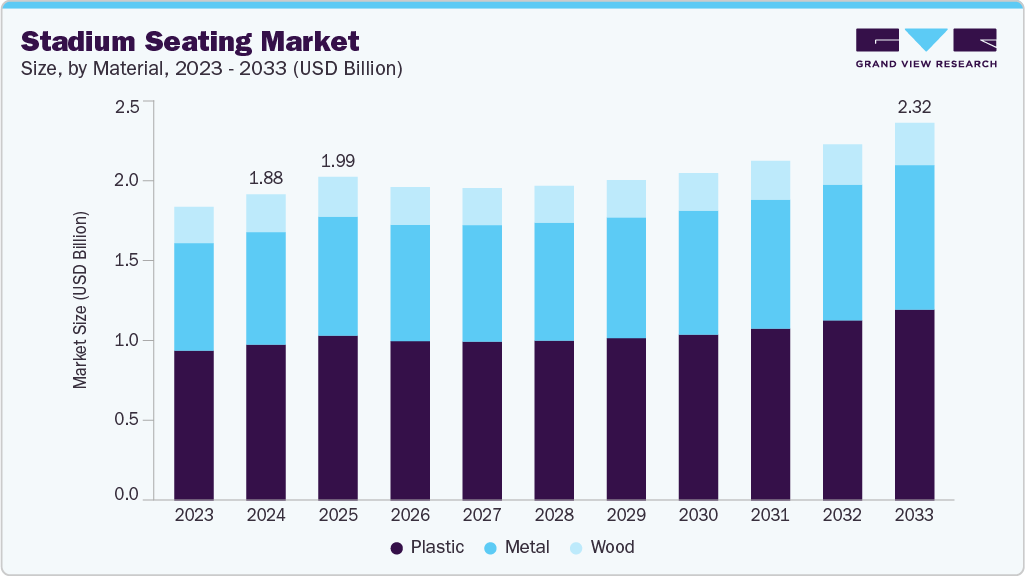

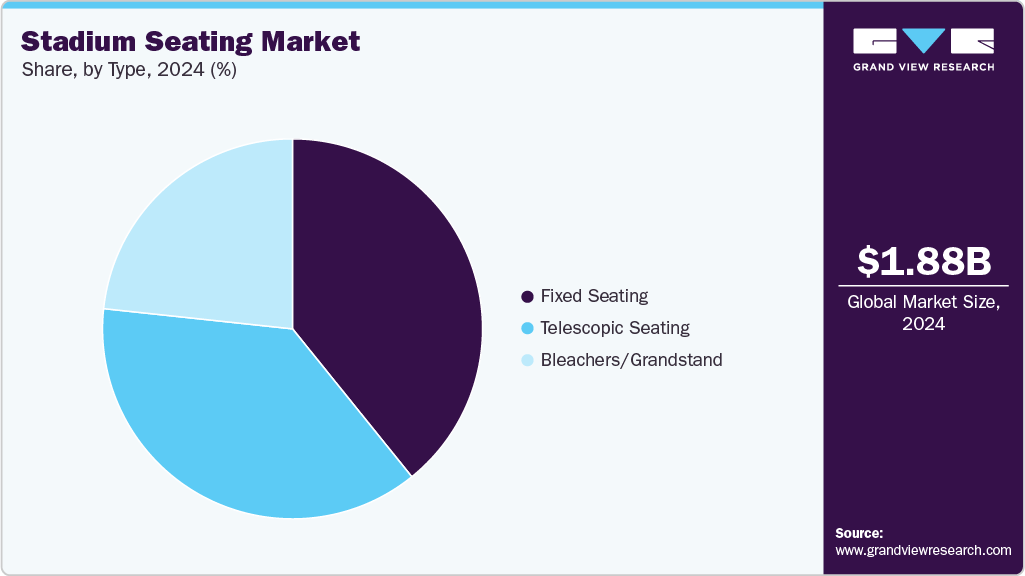

The global stadium seating market size was estimated at USD 1.88 billion in 2024 and is projected to reach USD 2.32 billion by 2033, growing at a CAGR of 1.9% from 2025 to 2033. The demand for stadium seating is rising due to the global surge in sports events, concerts, and entertainment activities, attracting large audiences.

Key Market Trends & Insights

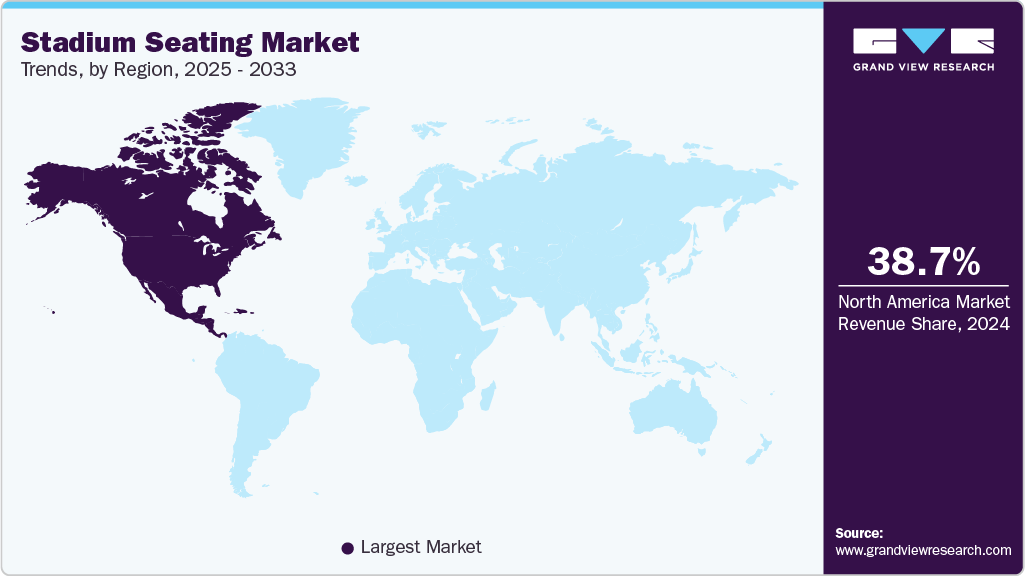

- North America dominated the global market for stadium seating with the largest revenue share of 38.7% in 2024.

- The U.S. stadium seating industry remains a leader in innovation and high-end customization for stadium seating.

- By material, the metal segment is expected to grow at the significant CAGR of 11.2% over the forecast period.

- By type, the telescopic seating segment is expected to grow at the fastest CAGR of 2.5% over the forecast period.

- By design, the foldable segment held the largest market revenue share of 60.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.88 Billion

- 2033 Projected Market Size: USD 2.32 Billion

- CAGR (2025-2033): 1.9%

- North America: Largest market in 2024

- Europe: Fastest growing market

Expanding investments in sports infrastructure by both public and private entities are fueling the eating upgrades and capacity expansion projects. In addition, the growing popularity of international tournaments, such as the FIFA World Cup, the Olympics, and cricket leagues, has driven the modernization of seating. Urbanization and smart city projects are emphasizing multipurpose stadiums with premium spectator comfort. The rise in fan engagement experiences and hospitality zones is boosting adoption of ergonomic and luxury seating.

Technological advancements such as retractable, automatic, and foldable seating systems are key drivers in this market. Increasing investments by governments and sports organizations to upgrade seating capacity with ADA-compliant and safety-certified systems are boosting installations. Sustainability trends are pushing manufacturers to use recyclable materials and low-emission production processes. High demand from new stadium construction projects in the Asia-Pacific and the Middle East also supports market growth. The growing culture of college and professional sports in North America and Europe further fuels demand.

Key innovations include the integration of smart seating with charging ports, sensors, and IoT-enabled maintenance tracking. Lightweight and modular aluminum and polypropylene seating systems are gaining popularity for easy installation. Manufacturers are focusing on antimicrobial and UV-resistant materials for outdoor durability. Foldable and telescopic seating systems are in demand for multipurpose venues. The trend toward inclusive design ensures comfort for people with disabilities. In addition, companies are adopting 3D printing for customized seat molds and faster prototyping. Growing demand for sustainable materials such as bio-based polymers and recycled plastics defines the modern stadium design ethos.

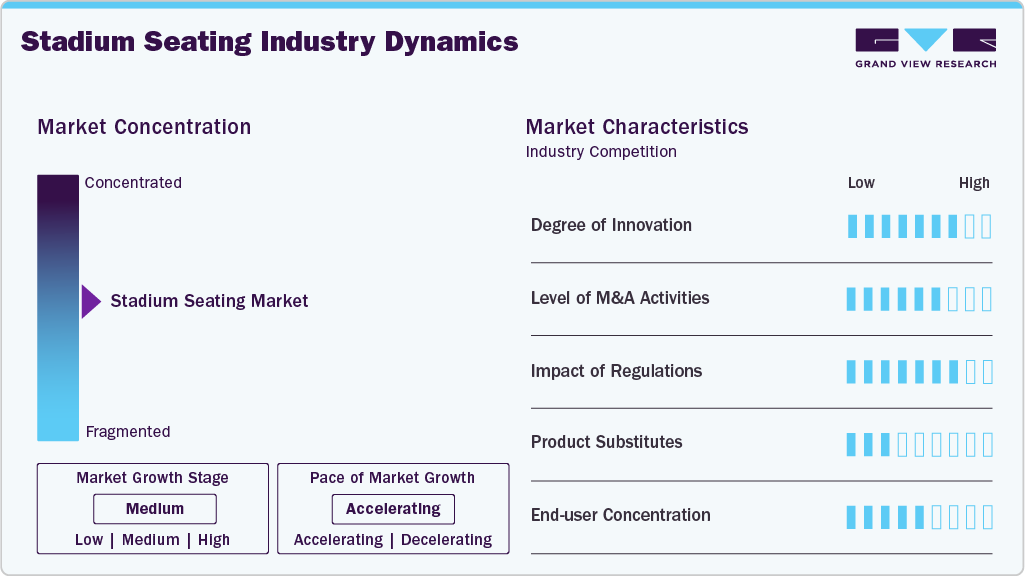

Market Concentration & Characteristics

The stadium seating industry is moderately concentrated, with a mix of established global manufacturers and regional suppliers. Major players, including Avant Seating, Camatic Seating, Ferco Seating Systems, and Kotobuki Seating Co., Ltd., dominate large-scale stadium projects worldwide. Strategic partnerships with architects and contractors enhance competitive differentiation. Technological innovation and design customization serve as key competition parameters. While barriers to entry are moderate, brand reputation and long-term service contracts strengthen the positions of incumbents. The overall market sees periodic consolidation through mergers and project-based collaborations.

The threat of substitutes remains low as stadium seating solutions are purpose-built and require safety certifications. However, alternative materials such as flexible modular flooring or mobile bleacher systems offer temporary solutions for smaller venues. Portable and inflatable seating innovations can partially substitute traditional fixed systems in low-capacity settings. Despite these, permanent seating solutions dominate due to their safety, comfort, and compliance advantages. Customizability and branding capabilities also enhance their value proposition. The rising trend of green and ergonomic designs further differentiates them from low-cost alternatives.

Material Insights

The plastic segment held the largest revenue market share of 51.0% in 2024, primarily due to its cost-effectiveness, design flexibility, and ease of maintenance. High-density polyethylene (HDPE) and polypropylene (PP) are the most preferred polymers for manufacturing durable, UV-resistant seats. The lightweight nature of plastic seating allows faster installation and replacement, reducing operational downtime. Manufacturers are increasingly using recycled or bio-based plastics to meet their sustainability goals. Plastic seating also offers excellent weather tolerance, making it ideal for both indoor and outdoor stadiums. The affordability and wide color customization options continue to secure its leading market share worldwide.

The metal segment is expected to grow at a significant CAGR of 11.2% over the forecast period, driven by its superior durability, load-bearing capacity, and corrosion resistance. Aluminum and steel frameworks are increasingly used for outdoor stadiums due to their weather resilience. Advancements in powder coating and anti-rust finishes have improved lifespan and aesthetics. The rising trend toward sustainable and recyclable materials also favors metal-based structures. Metallic components are widely used in bleachers and modular assemblies, providing a sturdy base for both fixed and telescopic systems. As stadium owners prioritize long-term investments with minimal maintenance, the adoption of metallic seating continues to expand globally. primarily due to its widespread adoption in

Design Insights

The foldable segment held the largest market revenue share of 60.6% in 2024, due to its versatility and space-saving benefits in multipurpose venues. These seats are ideal for stadiums that host sports, concerts, and community events, enabling quick reconfiguration. Their compact design allows easy storage and transport, reducing setup time and labor costs. Manufacturers are developing foldable models with improved locking mechanisms and enhanced stability. The ability to combine comfort with efficient space management gives foldable seating an edge over traditional fixed structures. As flexible venue management becomes the norm, foldable seating continues to lead in adaptability and operational convenience.

The non-foldable segment is expected to grow at a CAGR of 0.7% over the forecast period, particularly in high-capacity outdoor stadiums and permanent sports facilities. These systems are favored for their robust structure, vandal resistance, and lower mechanical wear over time. With modern ergonomic designs, non-foldable seats now offer greater comfort and improved ventilation. The use of reinforced polymers and metallic frames has enhanced durability while maintaining aesthetic appeal. As stadium operators invest in long-term infrastructure with fewer moving parts, demand for fixed, non-folding seating is on the rise. This segment is expected to see consistent installations in large-scale and legacy stadium projects worldwide.

Application Insights

The outdoor segment held the largest revenue market share of 80.7% in 2024, supported by the large number of open-air stadiums hosting football, cricket, and athletics events globally. These systems are designed for weather resistance, UV stability, and long-term performance under varying environmental conditions. Materials like aluminum, galvanized steel, and UV-stabilized polypropylene ensure durability and color retention. The outdoor segment also benefits from frequent renovations and upgrades of municipal and national stadiums. Major international sporting events continue to drive large-scale installations worldwide. With continuous demand for high-capacity and low-maintenance solutions, outdoor seating remains the cornerstone of the global market.

The indoor segment is expected to grow at the fastest CAGR of 1.9% over the forecast period, fueled by the construction of new multipurpose arenas, gymnasiums, and entertainment complexes. Demand is rising for retractable and modular systems that offer flexibility for different event formats. Indoor venues prioritize aesthetics, acoustic comfort, and ergonomic design, driving innovation in compact and foldable seating. The trend toward community-based and corporate sports facilities also boosts installations. Furthermore, climate-controlled environments allow the use of premium materials and integrated smart features. With increasing investments in indoor event infrastructure, this segment is projected to maintain an upward trajectory over the coming years.

Type Insights

The fixed seating segment held the largest revenue market share of 39.2% in 2024, owing to its widespread adoption across large-capacity sports arenas and public venues. These systems offer superior structural stability, low maintenance, and long service life, making them ideal for permanent installations. Fixed seats are preferred for compliance with safety regulations and uniform layout design. Their ability to integrate with premium materials such as polypropylene and aluminum further enhances durability. Fixed seating also provides better alignment for crowd management and optimized space utilization.

The telescopic seating segment is expected to grow at the fastest CAGR of 2.5% over the forecast period, as multipurpose sports and event venues increasingly prioritize the utilization of flexible space. These retractable systems allow quick configuration changes between sports, concerts, and exhibitions. Rising urbanization and limited land availability make telescopic designs highly desirable for indoor arenas and community centers. Manufacturers are integrating automated controls and lightweight materials for faster deployment. The growing number of school gyms, convention halls, and hybrid entertainment venues further supports demand.

Regional Insights

North America stadium seating industry dominated the market and accounted for the largest revenue share of about 38.7% in 2024. North America is witnessing strong growth due to renovation projects in collegiate and professional stadiums. The U.S. and Canada are investing in next-generation retractable and ergonomic seats. Fan experience and accessibility compliance under the ADA act as major design considerations. Sustainability certification, such as LEED, is influencing material selection. Technological advancements such as IoT-linked maintenance tracking are gaining traction. The market benefits from established suppliers like Hussey Seating and Irwin Seating Company. Upgrades for NFL, MLB, and university stadiums will sustain steady demand.

U.S. Stadium Seating Market Trends

The U.S. stadium seating industry remains a leader in innovation and high-end customization for stadium seating. Increasing refurbishment of legacy stadiums with ADA-compliant and VIP seating areas drives spending. Partnerships between seating manufacturers and sports franchises are strengthening supply chains. The focus on premium experiences with features like cup holders, armrests, and smart seats enhances value. Demand for telescopic and retractable seating in multipurpose venues is surging. Sustainability goals are driving the use of recycled materials.

Europe Stadium Seating Market Trends

Europe’s stadium seating industry is fueled by UEFA events and the modernization of aging sports infrastructure. Strong emphasis on eco-design and compliance with EN standards defines the regional landscape. Manufacturers such as Ferco and Figueras dominate high-capacity seating installations. The region is witnessing demand for modular and foldable systems in arenas and concert halls. European consumers prioritize aesthetics and comfort in seating layouts. Public funding for community sports complexes also stimulates market expansion. Sustainability and recyclability remain central to procurement decisions.

Germany stadium seating industry is a leading contributor in Europe’s market, largely due to the frequent renovation of football arenas. Bundesliga clubs invest heavily in fan comfort, safety, and accessibility standards. German engineering emphasizes precision-built, long-life seating systems. Adoption of lightweight aluminum and anti-corrosion materials is increasing. Innovative stadium concepts with IoT-integrated seating are gaining popularity. Local firms focus on energy-efficient production processes. Government support for sports infrastructure underlines steady growth.

Asia Pacific Stadium Seating Market Trends

Asia Pacific stadium seating industry is driven by extensive investments in sports infrastructure in China, India, and Japan. The rising number of sporting leagues and public-private projects is a key growth factor. Government-backed urban development and entertainment complexes further accelerate adoption. The 2032 Brisbane Olympics and other upcoming regional events support capacity expansion. Manufacturers in this region emphasize cost-effective and durable seating systems. Growing middle-class participation in sports entertainment is also boosting demand. Asia Pacific is expected to maintain its lead with the highest installation rates through 2033.

China’s stadium seating industry is propelled by its aggressive urban infrastructure and sports development policies. Hosting international tournaments, such as the Asian Games and National Games, has boosted stadium construction. Domestic manufacturers such as Kotobuki and Shenzhen Yourease dominate local supply. The focus on sustainable materials and automation in seating design is growing. Government regulations for fire safety and environmental compliance shape procurement decisions. Rising disposable income supports greater demand for high-comfort spectator zones. China remains a key exporter of cost-effective seating components worldwide.

Central & South America Stadium Seating Market Trends

Central & South America stadium seating industry shows steady progress driven by football culture and tourism-led sports infrastructure projects. Brazil, Mexico, and Argentina are key contributors with ongoing stadium refurbishment projects. The 2026 FIFA World Cup's potential as a co-host has reignited regional investments. Manufacturers are offering cost-optimized modular seating systems suitable for tropical climates. Economic recovery and foreign investment in sports venues are stimulating demand. Public sector funding and PPP collaborations are increasing. Customizable, UV-resistant seating products are favored due to climatic challenges.

Middle East & Africa Stadium Seating Market Trends

The Middle East & Africa stadium seating industry is witnessing rapid growth with large-scale investments in sports megaprojects. Qatar, Saudi Arabia, and the UAE are leading with world-class stadiums built for global tournaments. Vision 2030 programs in Saudi Arabia and Qatar’s post-FIFA 2022 infrastructure utilization support continued spending. Africa is also emerging with new stadium developments in Nigeria, South Africa, and Egypt. The region prioritizes luxury seating that is both durable and low-maintenance. Global suppliers often collaborate with local contractors to ensure regulatory compliance. Multipurpose arena concepts and tourism-driven sports events will shape future growth.

Key Stadium Seating Company Insights

Some of the key players operating in the market include Avant Seating and Ferco Seating Systems

-

Avant Seating is a global supplier specializing in high-quality, ergonomic stadium and arena seating solutions. The company focuses on providing durable, modular, and cost-effective seating systems for sports venues, auditoriums, and multi-purpose arenas. Its product line emphasizes customization, quick installation, and compliance with international safety standards.

-

Ferco Seating Systems, headquartered in the U.K., is a leading manufacturer of premium stadium and auditorium seating. The company is known for delivering high-comfort, durable, and design-centric seating solutions for major international sports arenas. Its collaboration with architectural firms and stadium operators enables it to provide tailor-made seating configurations with superior ergonomics.

KOTOBUKI SEATING CO., LTD. and SERIES Seating LLC are some of the emerging market participants in the market.

-

Kotobuki Seating Co., Ltd, based in Japan, is one of the most established and respected names in the global stadium seating industry. With decades of expertise, the company is known for its engineering precision and focus on long-term reliability. Kotobuki’s product range includes fixed, retractable, and foldable seating systems for sports venues, theaters, and public facilities.

-

SERIES Seating LLC, headquartered in the United States, is a leading designer and manufacturer of advanced stadium and arena seating systems. The company emphasizes innovation through ergonomic design, high durability, and modern aesthetics tailored for large-scale sports and entertainment venues. SERIES Seating integrates sustainability by using recycled materials and eco-friendly production methods.

Key Stadium Seating Companies:

The following are the leading companies in the stadium seating market. These companies collectively hold the largest market share and dictate industry trends.

- Avant Seating

- Camatic Seating

- KOTOBUKI SEATING CO., LTD

- SERIES Seating LLC

- Mobiliario

- Figueras

- Ferco Seating Systems

- Daplast

- Irwin Seating Company

- Shenzhen Yourease Sports Equipment Co., Ltd.

Recent Developments

-

In February 2025, Ferco Seating Systems was selected to supply over 45,000 ARC series seats for the new Aramco Stadium in Dammam, Saudi Arabia. The project highlights the company’s growing footprint in high-capacity sports infrastructure across the GCC region.

-

In May 2025, Figueras Seating launched a lightweight, high-impact polypropylene seating series for sports and entertainment arenas in Europe. The innovation aims to improve installation efficiency while maintaining durability for high-traffic venues.

Stadium Seating Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.99 billion

Revenue forecast in 2033

USD 2.32 billion

Growth rate

CAGR of 1.9% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, design, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Saudi Arabia; UAE; Qatar; Kuwait; Egypt

Key companies profiled

Avant Seating; Camatic Seating; KOTOBUKI SEATING CO., LTD; SERIES Seating LLC; Mobiliario; Figueras; Ferco Seating Systems; Daplast; Irwin Seating Company; Shenzhen Yourease Sports Equipment Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Take advantage of customized purchase options tailored to meet your exact research needs. Explore purchase options

Global Stadium Seating Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global stadium seating market report based on material, type, design, application, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal

-

Wood

-

Plastic

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed Seating

-

Telescopic Seating

-

Bleachers/Grandstands

-

-

Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Foldable

-

Non-foldable

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Indoor Stadium

-

Outdoor Stadium

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global stadium seating market size was estimated at USD 1.88 billion in 2024 and is expected to reach USD 1.99 billion in 2025.

b. The global stadium seating market is expected to grow at a compound annual growth rate of 1.9% from 2025 to 2033 to reach USD 2.32 billion by 2033.

b. Wood segment held the highest revenue market share of 47.1% in 2024, due to its exceptional strength, elasticity, and chemical resistance. It offers a favorable surface for metal coatings or conductive polymer treatments, ensuring consistent conductivity and durability.

b. Some of the key players operating in the stadium seating market include Avant Seating, Camatic Seating, KOTOBUKI SEATING CO., LTD., SERIES Seating LLC, Mobiliario, Figueras, Ferco Seating Systems, Daplast, Irwin Seating Company, and Shenzhen Yourease Sports Equipment Co., Ltd.

b. Rising investments in sports infrastructure, an increasing number of international sporting events, and the modernization of existing stadiums are key factors driving the stadium seating market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.