- Home

- »

- Food Safety & Processing

- »

-

Starch Derivatives Market Size, Share, Industry Report, 2030GVR Report cover

![Starch Derivatives Market Size, Share & Trends Report]()

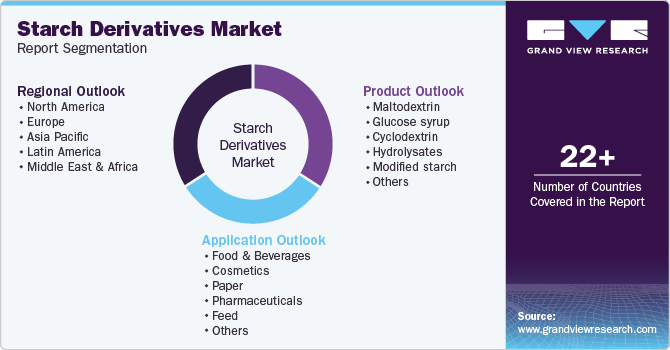

Starch Derivatives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Maltodextrin, Glucose Syrup, Cyclodextrin, Hydrolysates), By Application (Cosmetics, Paper, Food & Beverages), By Region, And Segment Forecasts

- Report ID: 978-1-68038-519-9

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Starch Derivatives Market Summary

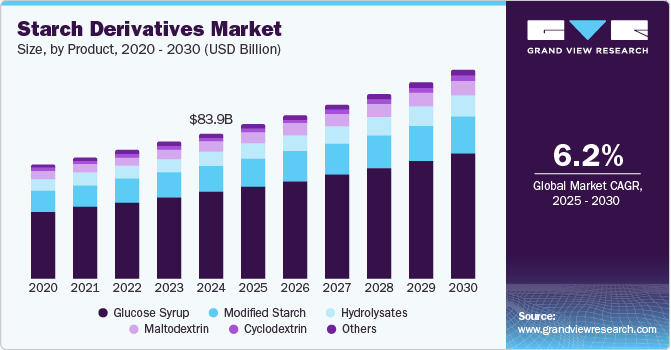

The global starch derivatives market size was estimated at USD 83,866.8 million in 2024 and is projected to reach USD 120,660.1 million by 2030, growing at a CAGR of 6.2% from 2025 to 2030. Growing awareness and adoption of starch and its derivatives in food and non-food industries have rapidly increased demand for these ingredients across various applications.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, glucose syrup accounted for a revenue of USD 53,652.2 million in 2024.

- Maltodextrin is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 83,866.8 Million

- 2030 Projected Market Size: USD 120,660.1 Million

- CAGR (2025-2030): 6.2%

- Asia Pacific: Largest market in 2024

A starch derivative is produced by subjecting natural starch to chemical, physical, and enzymatic treatments to change its properties. This product has a wide range of applications, such as a thickening agent in food items, stabilizers, disintegrants in pharmaceuticals, emulsifiers in various food products, and binders in coated paper.

The use of starch derivatives in bonding and the antibacterial properties of recycled fibers are expected to drive the growth of the starch derivative industry in the coming years. Increasing consumer concerns about health and nutrition and shifting toward healthier diets will further promote market trends. Additionally, the rising demand for natural sweeteners in energy and non-carbonated soft drinks will enhance market penetration worldwide in the years ahead.

Drivers, Opportunities & Restraints

The growth of the food industry and, consequently, the market for starch derivatives is primarily driven by the expanding global population and increasing disposable income. Product markets are popular in various sectors, including pharmaceuticals, paper, and textiles, due to their low manufacturing costs, ease of processing, biodegradability, excellent physiochemical properties, and high calorific value.

The industry is witnessing a notable increase in the use of substitutes like gums, pectin, and cellulose derivatives. These alternatives offer unique functionalities, such as improved texture, stability, and gelling properties in various food and industrial applications. Consumers’ growing preference for natural and clean-label products has further fueled the demand for these substitutes. Additionally, the versatility of these ingredients in different formulations positions them as viable alternatives to traditional starch derivatives.

The industry is increasingly emphasizing animal nutrition, health, and well-being. This trend is driven by a growing awareness of the importance of high-quality diets for livestock and pets, which can enhance their overall health and productivity. Products are key in formulating nutritious feeds that improve digestion and nutrient absorption. As consumer demand for healthier animal products rises, manufacturers are investing in innovative starch-based solutions that support animal well-being.

Product Insights

The glucose syrup segment accounted for the largest revenue share of 60.1% in 2024 and is expected to continue to dominate the industry over the forecast period. Glucose syrup is a significant product segment within the starch derivatives market, primarily derived from the hydrolysis of starch. It is a versatile sweetener and thickening agent commonly used in food and beverage formulations, confectionery, and pharmaceuticals. The syrup's high solubility and ability to retain moisture make it ideal for improving texture and extending shelf life. As consumer demand for natural sweeteners rises, glucose syrup continues to gain traction due to its functionality and cost-effectiveness in various applications.

Modified starch is a prominent product segment in the market, created through physical or chemical alterations to native starch. It enhances the functional properties of starch, such as stability, viscosity, and texture, making it suitable for a wide range of applications in food, pharmaceuticals, and industrial processes. Modified starch is widely used as a thickening agent, stabilizer, and emulsifier, catering to the growing demand for versatile and reliable ingredients in various formulations. Its ability to meet specific performance requirements ensures its continued relevance in consumer products and industrial applications.

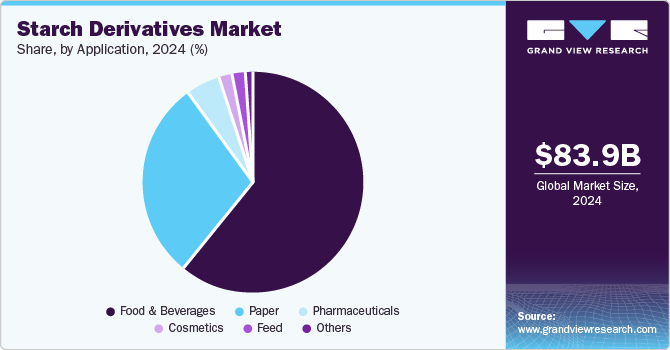

Application Insights

The food & beverage segment dominated the market with a market share of 61.0% in 2024 during the forecast period. The food and beverage category is projected to become the largest market. Starch derivatives have been utilized for a long time, and the food and beverage industry is increasingly focusing on their applications. Due to their functional properties, these derivatives are used in various food products. Product markets have emerged as a highly successful, eco-friendly option, serving as binding and gelling agents. Additionally, the rising sugar levels in products have increased the demand for starch in the food and beverage industry.

The paper industry increasingly recognizes starch derivatives' value as essential additives for improving product quality. These derivatives are utilized as binders, coatings, and finishing agents, enhancing paper products' strength, texture, and printability. Furthermore, their eco-friendly nature aligns well with the industry's shift towards sustainable practices, making starch derivatives a preferred choice for manufacturers aiming to reduce environmental impact. As the demand for high-quality, sustainable paper continues to grow, the role of starch derivatives in this segment is expected to expand.

Regional Insights

North America starch derivatives market is primarily driven by the abundant availability of corn. This corn is utilized in various food, non-food, and feed applications. The growing awareness of the functionalities of starch and its derivatives within the food and non-food industries has driven significant demand for these ingredients, particularly in countries such as the U.S., Canada, and Mexico.

U.S. Starch Derivatives Market Trends

The starch derivatives market in the U.S. is driven by the growing consumer demand for innovation and convenience. Additionally, the region's low cost of corn starch supports market growth. The United States has an abundant supply of raw materials, further contributing to the market's expansion. Furthermore, the country plays a pivotal role in the global supply chain for corn, influencing price trends for starch extraction. Developing new products, such as n-octenyl succinic anhydride-modified starch and various applications for these modified starch products, also drives market growth.

Asia Pacific Starch Derivatives Market Trends

The starch derivatives market in Asia Pacific is anticipated to experience significant growth as the demand for healthier and more nutritional food rises. Countries such as China and India are among the main reasons for the product market to grow in the region.

Europe Starch Derivatives Market Trends

The starch derivatives market in Europe is expected to experience rapid growth. The increasing use of starch derivatives in the food and beverage industries is the main factor driving growth in this sector. Additionally, since starch derivatives are primarily imported from other countries, prices are expected to rise. Germany holds Europe's largest market share for starch derivatives, while the UK is experiencing the fastest growth.

Latin America Starch Derivatives Market Trends

The starch derivatives market in Latin America is growing due to increasing demand in the food, beverage, and pharmaceutical sectors. Starch derivatives, such as glucose, maltodextrin, and modified starches, are crucial for food processing, enhancing texture, and improving shelf life. The region's agricultural capacity and advancements in processing technology further boost market potential, making it an attractive area for investment and innovation.

Middle East & Africa Starch Derivatives Market Trends

The starch derivatives market in the Middle East and Africa is experiencing growth driven by rising demand in the food, beverage, and pharmaceutical industries. The region's diverse agricultural landscape and investments in processing technologies support the production of starch derivatives such as glucose and modified starches. Additionally, expanding consumer markets and focusing on improved food quality and functionality contribute to the market's attractiveness for investment and development.

Key Starch Derivatives Company Insights

Some of the key players operating in the market include Cargill Inc. and Tate & Lyle PLC.

-

Cargill Inc. offers services and products in the food, financial, agricultural, industrial, and risk management sectors. It markets, processes, and distributes oilseeds, grains, meat, sugar, other food products, and cotton. The company operates in more than 70 countries and has over 30 protein processing locations across the globe.

-

Tate & Lyle PLC provides ingredient solutions designed for beverages and healthier food. The company's product portfolio includes texturants, sweeteners, and fiber enrichments. Additionally, Tate & Lyle offers sucrose, crystalline fructose, corn syrup, starches, glucose, dextrose, and animal feeds.

Key Starch Derivatives Companies:

The following are the leading companies in the starch derivatives market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill Inc.

- Avebe U.A.

- Emsland Group

- Tate & Lyle PLC

- Agrana Group

- Roquette Freres

- ADM

- China Essence Group Ltd.

- Ingredion Incorporated

- Global Bio-chem Technology Group Company Limited

- Zhucheng Dongxiao Biotechnology Co.

- Grain Processing Corporation

- Asia Modified Starch Co., Ltd (AMSCO)

- SSSFI

Recent Developments

-

In September 2023, Tate & Lyle, in collaboration with IMCD, is expanding its ingredient distribution in Lithuania, Finland, Estonia, and Latvia. This partnership will enhance Tate & Lyle's geographical reach in the food texture market, allowing them to extend their market share in Finland and the Baltic region.

-

In June 2023, Avebe, an international farmer cooperative known for producing potato starch and protein, partnered with Brenntag, the global leader in chemicals. This partnership expands Brenntag Specialties' product offerings and enhances its international innovative and sustainable solutions portfolio.

Starch Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 89.12 billion

Revenue forecast in 2030

USD 120.66 billion

Growth Rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Germany, China, India, and Brazil.

Key companies profiled

Cargill Inc., Avebe U.A., Emsland Group, Tate & Lyle PLC, Agrana Group, Roquette Freres, ADM, China Essence Group Ltd., Ingredion Incorporated, Global Bio-chem Technology Group Company Limited, Zhucheng Dongxiao Biotechnology Co., Grain Processing Corporation, Asia Modified Starch Co., Ltd (AMSCO), and SSSFI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Starch Derivatives Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global starch derivatives market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Maltodextrin

-

Glucose syrup

-

Cyclodextrin

-

Hydrolysates

-

Modified starch

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Cosmetics

-

Paper

-

Pharmaceuticals

-

Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global starch derivatives market size was estimated at USD 83.86 billion in 2024 and is expected to reach USD 89.12 billion in 2025.

b. The global starch derivatives market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 120.66 billion by 2030.

b. Asia Pacific dominated the starch derivatives market with a share of 35.0% in 2024. This is attributed to the increasing demand for healthier and more nutritional food demand rises in the Asia Pacific region. Countries such as China and India are one of the main reasons for the product market to grow in the region.

b. Some key players operating in the starch derivates market include Cargill Inc., Avebe U.A., Emsland Group, Tate & Lyle PLC, Agrana Group, Roquette Freres, ADM, China Essence Group Ltd., Ingredion Incorporated, Global Bio-chem Technology Group Company Limited, Zhucheng Dongxiao Biotechnology Co., Grain Processing Corporation, Asia Modified Starch Co., Ltd (AMSCO), and SSSFI

b. Key factors driving market growth include growing awareness and adoption of starch and its derivatives in food and non-food industries, which have rapidly increased demand for these ingredients across various applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.