- Home

- »

- Consumer F&B

- »

-

Glucose Syrup Market Size And Share, Industry Report, 2030GVR Report cover

![Glucose Syrup Market Size, Share & Trends Report]()

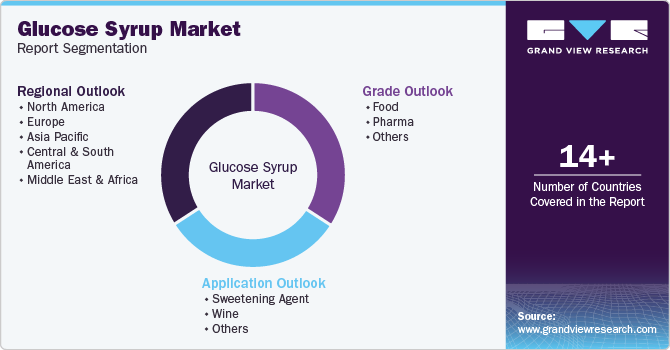

Glucose Syrup Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (Food, Pharma, Others), By Application (Sweetening Agent, Wine, Others), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-108-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glucose Syrup Market Size & Trends

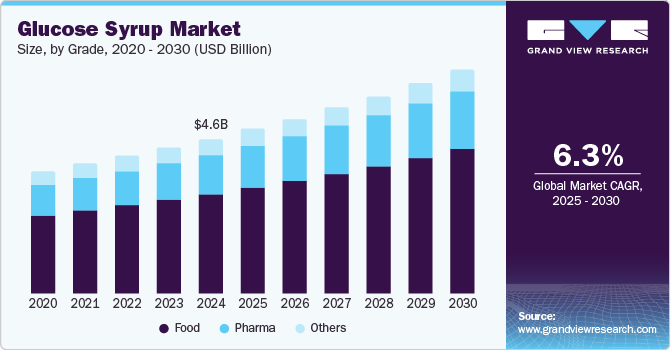

The global glucose syrup market size was valued at USD 4.56 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. Glucose syrups are widely used to enhance various product properties, including stability, volume, smoothness, gloss, and shelf life in baked goods and confectionery items. The increasing demand for convenient food products and the growing use of glucose syrup in processed foods drive market growth. Additionally, glucose syrups play a crucial role in the production of high-demand items like ice cream, chewing gum, chocolate, and canned foods, particularly as consumers seek sugar substitutes

Glucose syrup, a natural sugar derived from ingredients like corn, wheat, and maize starch, is a simple carbohydrate composed of glucose, maltose, and other polysaccharides. It has a long history of use by pâtissiers, confectioners, and chefs as a specialty culinary ingredient. By adding glucose syrup, food products can benefit from increased shelf life and reduced reliance on conventional sugar

The global trend of urbanization and evolving lifestyles has limited home cooking and baking opportunities. As a result, there's a surge in demand for baked goods, confectionery, chocolates, frozen desserts, soft drinks, ice cream, and canned food. To meet this demand cost-effectively, manufacturers are increasingly turning to glucose syrups and their various forms as key ingredients. The availability of longer-lasting products at lower costs, particularly in retail bakeries, is further driving the growth of the glucose syrup industry

Glucose syrups are also employed in pharmaceutical manufacturing due to their excellent humectant properties. They serve as vehicles or carriers in oral dosage forms for pharmaceuticals and nutraceuticals. Additionally, glucose syrups are used as bulk sweeteners and are available in various forms, including blends, granules, and pellet premixes, for pharmaceutical applications. Beyond the pharmaceutical industry, glucose syrup finds application in alcohol manufacturing. As an adjunct, glucose syrup increases yeast biomass, leading to higher alcohol concentrations. The rising demand for high-quality alcohol is directly correlated with an increasing demand for glucose syrup

Grade Insights

The consistently growing demand for convenience and processed foods, particularly among urban populations, has been a primary driver for the food-grade glucose syrup market. Post-pandemic, there has been a resurgence in the consumption of baked goods, driven by various occasions, including seasonal and religious celebrations. Additionally, other consumables, such as candies, chocolates, soft drinks, and ice cream, have experienced significant consumption growth. According to data published by World Atlas, approximately 15.4 billion liters of ice cream are consumed globally each year. Furthermore, an article by The Food Institute indicates that the overall confectionery industry generates revenue exceeding USD 36 billion and is projected to exhibit consistent growth in the coming years.

The pharma segment is expected to experience a significant CAGR from 2025 to 2030. The continuous rise in the consumption of oral medication has boosted the glucose syrup industry. Glucose syrups are used to mask the bitter taste of active agents and make them more palatable. Oral medication for infants is majorly dominated by glucose-based excipients.

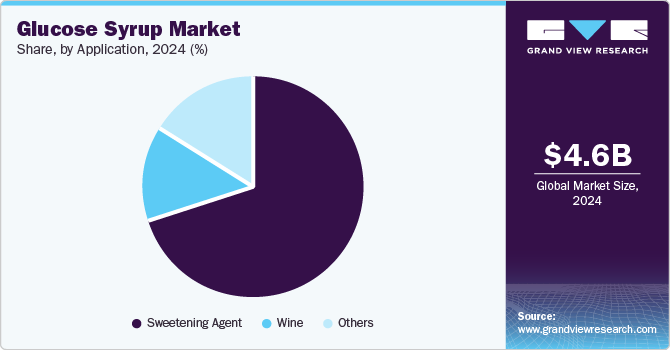

Application Insights

The sweetening agent segment held the largest revenue share of the glucose syrup market in 2024. Glucose syrups are widely employed as sweeteners in various food products. As a highly concentrated sweetener, glucose syrup contains 62 calories and 17 grams of carbohydrates per teaspoon, significantly exceeding the sugar content of white sugar. This characteristic makes it a cost-effective choice for commercial and industrial food processing. Furthermore, glucose syrup offers a lower glycemic index and provides some nutritional value, positioning it as a more favorable alternative to sugar. Consequently, the food manufacturing and processing industry's preference for glucose syrup is driving market growth.

The wine segment is expected to experience the fastest CAGR during the forecast period. Glucose syrup is frequently used in brewing and distilling processes to produce alcohol, offering benefits such as fermentability, mouthfeel, and sweetness. Active yeast consumes glucose syrup to produce alcohol. Additionally, glucose syrup serves as a sweetening agent, enhancing the mouthfeel of spirits by making them smoother and more viscous.

Regional Insights

The North American glucose syrup market dominated the global market with a revenue share of 44.9% in 2024. The region has a high consumption of confectionaries, bakery products, ice cream, and other processed food. Major food processing companies across the region use glucose syrup to increase profit margins. Additionally, the use of glucose syrup in alcoholic spirits is also one of the major factors driving the glucose syrup industry in the region.

U.S. Glucose Syrup Market Trends

The U.S. dominated with a major share in the regional glucose syrup market. The U.S. exhibits significant consumption trends for bakery products and confectionery items. For instance, between 2018 and 2022, approximately 3,180 new biscuit/cookie products and 1,870 new cake, pastry, and sweet goods products were launched. This surge in new product launches clearly demonstrates the country's strong consumer demand for these products. Given the extensive use of glucose syrup in such products, this trend drives the demand for glucose syrup in the U.S. Additionally, 63% of U.S. adults consume alcohol, with 35% preferring beer, 31% wine, and 30% other liquors. This high alcohol consumption is expected to further support the growth of glucose syrup usage in alcohol production.

Asia Pacific Glucose Syrup Market Trends

The Asia Pacific glucose syrup market is projected to experience the fastest CAGR from 2025 to 2030. The demand for processed food has skyrocketed in the region in the past couple of decades. Rising urbanization, changing food consumption patterns, and the adoption of Western culture in developing countries of the region are the major driving factors for the glucose syrup market in the region. Additionally, multilateral & regional trade agreements have led to greater market access for players operating in the food processing industry. This has further expanded the product and consumption of processed food containing glucose syrup, thus, helping the glucose syrup industry to grow in the region.

China dominated the regional glucose syrup market. China's market for processed food has been steadily expanding, primarily driven by changing lifestyles and increasing urbanization. The COVID-19 pandemic further accelerated the consumer demand for processed foods. As glucose syrup is a key ingredient in many sweetened processed foods, its demand is growing in tandem with the processed food industry.

According to a 2022 survey conducted by the China Chain Store & Franchise Association (CCFA), the primary reasons for consumers purchasing prepared foods include time-saving (72%), taste (37%), avoidance of cooking (30%), health considerations (27%), and lack of cooking skills (25%). The fast-paced lifestyle of the urban population has fueled the growth of food products such as bakery items, candies, soft drinks, and canned food

Europe Glucose Syrup Market Trends

The European glucose syrup market is anticipated to experience significant growth during the forecast period. Europe boasts a well-established food and beverage processing industry that demands natural sweeteners for diverse applications. The European Union imposes stringent food regulations regarding labeling and ingredient content. For instance, infant formulas cannot contain more than 0.2 g/100 kJ (0.84 g/100 kcal) of glucose syrup or dried glucose. To comply with these regulations, major players like Cargill offer customized formulations of glucose syrups. Recent events, such as the COVID-19 pandemic and the Ukraine war, have increased the demand for longer-shelf-life foods, further bolstering the use of glucose syrup as a food preservative in confectionery and canned food products

Key Glucose Syrup Company Insights

Some of the key companies operating in the global glucose syrup market are Cargill, Inc., Agrana Group, Avebe U.A., Bakers Kitchen, Archer Daniels Midland, Beneo, DGF Service, Ingredion, Karo Syrup, Dr. Oetker, Grain Processing Corporation, L'Epicerie, Queen Fine Foods, Roquette Freres, Tate and Lyle, and others. The glucose syrup market is fragmented, with several major and medium & small-scale players competing for market share. Most companies are strategizing to improve their product offering to achieve higher profitability and offer products that are in line with local regulations worldwide.

-

Cargill, Inc., is a global leader in food and agriculture, providing a wide range of products and services. The company's role spans securing the global supply chain and sustainable food processing. Glucose syrup is one of the company's diverse product offerings.

-

Ingredion, Inc., headquartered in Chicago, is a leading global ingredient solutions provider. The company has customers from more than 120 countries and uses plant-based ingredients such as grains, fruits, and vegetables in ingredient solutions for food, beverage, animal nutrition, brewing, and industrial markets. The company is one of the few global providers of glucose syrup.

Key Glucose Syrup Companies:

The following are the leading companies in the glucose syrup market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Inc.

- Agrana Group

- Avebe U.A.

- Bakers Kitchen

- Archer Daniels Midland

- Beneo

- DGF Service

- Ingredion

- Karo Syrup

- Dr. Oetker

- Grain Processing Corporation

- L'Epicerie

- Queen Fine Foods

- Roquette Freres

- Tate and Lyle

Recent Developments

-

In September 2022, Cargill, Inc., a key player in the glucose syrup industry, announced that it would invest USD 50 million to build a sustainable corn syrup refinery in Fort Dodge, Iowa, U.S. The plant is expected to reduce CO2 emissions by almost 50% compared to conventional corn syrup production methods. It is expected to be completed before 2025.

-

In September 2022, Ingredion, Inc., a leading global ingredient solutions provider, installed a new specialty starch plant in China. The plant was set up to improve the global F&B supply chain and support local farmers.

Glucose Syrup Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.84 billion

Revenue forecast in 2030

USD 6.57 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, UK, France, Italy, Spain, Japan, China, India, South Korea, ANZ, Brazil, South Africa

Key companies profiled

Cargill, Inc., Agrana Group, Avebe U.A., Bakers Kitchen, Archer Daniels Midland, Beneo, DGF Service, Ingredion, Karo Syrup, Dr. Oetker, Grain Processing Corporation, L'Epicerie, Queen Fine Foods, Roquette Freres, Tate and Lyle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glucose Syrup Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glucose syrup market report based on grade, application, and region.

-

Grade Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food

-

Pharma

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sweetening Agent

-

Wine

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.