- Home

- »

- Advanced Interior Materials

- »

-

Stationary Air Compressor Market Size, Industry Report 2033GVR Report cover

![Stationary Air Compressor Market Size, Share & Trends Report]()

Stationary Air Compressor Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Reciprocating, Rotary/Screw), By Operating Mode, By Lubrication (Oil Free, Oil Filled), By Power Range (Up to 20 kW), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-627-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Stationary Air Compressor Market Summary

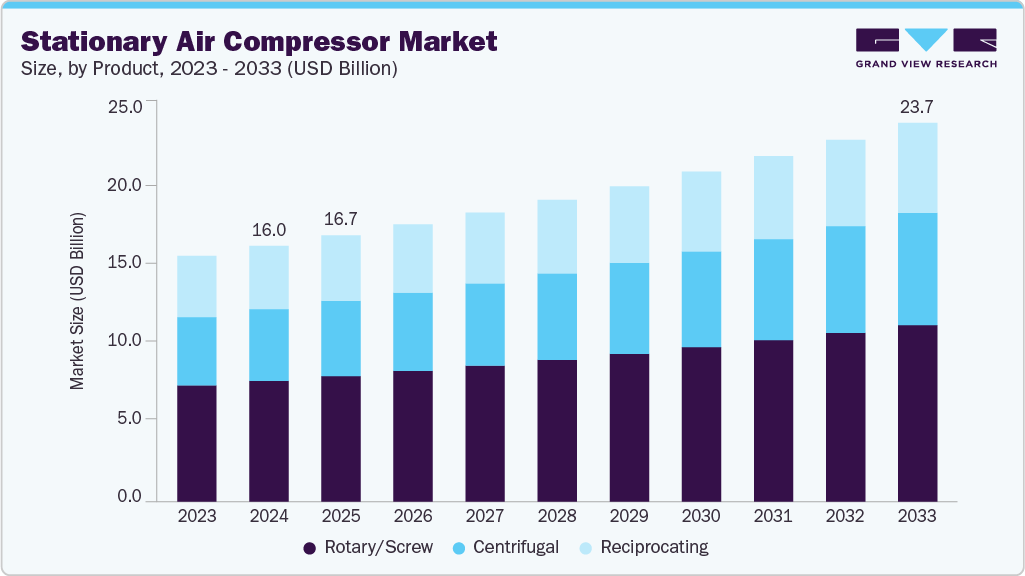

The global stationary air compressor market size was estimated at USD 16,035.0 million in 2024 and is projected to reach USD 23,743.0 million by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The global stationary air compressor industry is experiencing a rising demand from industrial manufacturing sectors such as automotive, food and beverage, and chemical processing.

Key Market Trends & Insights

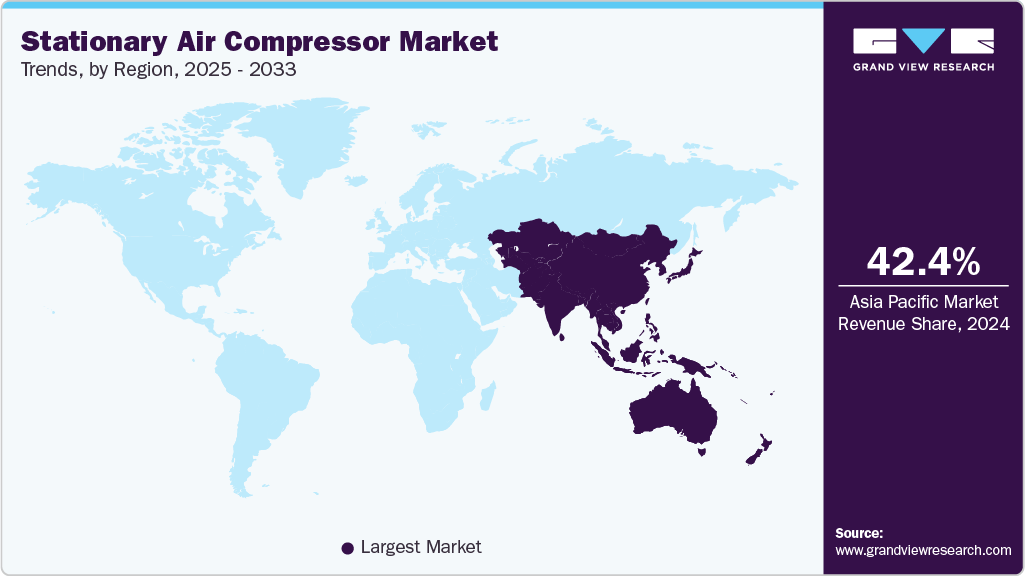

- Asia Pacific dominated the stationary air compressor market with the largest revenue share of 42.4% in 2024.

- The stationary air compressor market in China held a largest share in the Asia Pacific in 2024.

- By product, the rotary/screw compressor segment led the market with the largest revenue share of 47.2% in 2024.

- By lubrication, the oil-filled compressor segment led the market with the largest revenue share of 62.8% in 2024.

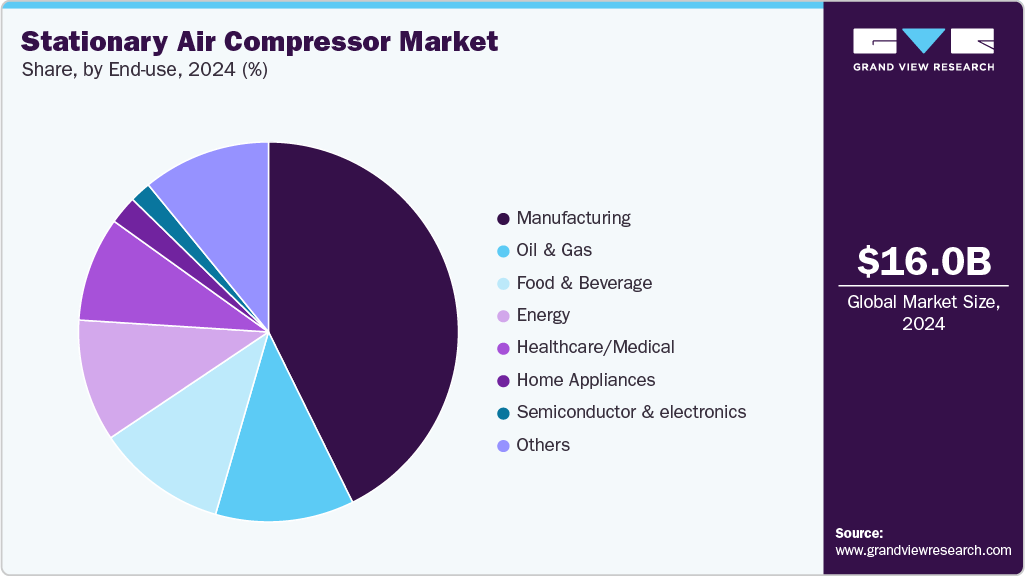

- By end-use, the manufacturing segment led the market with the largest revenue share of 42.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16,035.0 Million

- 2033 Projected Market Size: USD 23,743.0 Million

- CAGR (2025-2033): 4.5%

- Asia Pacific: Largest market in 2024

These industries rely heavily on stationary air compressors for consistent, high-pressure air supply to power machinery, streamline operations, and reduce energy costs through enhanced efficiency. Another major factor is the growing adoption of energy-efficient and technologically advanced compressor systems.

Regulatory pressure to reduce carbon emissions and operational costs has encouraged the development and deployment of oil-free and variable-speed compressors. This technological shift supports the expansion of the market across both developed and emerging economies.

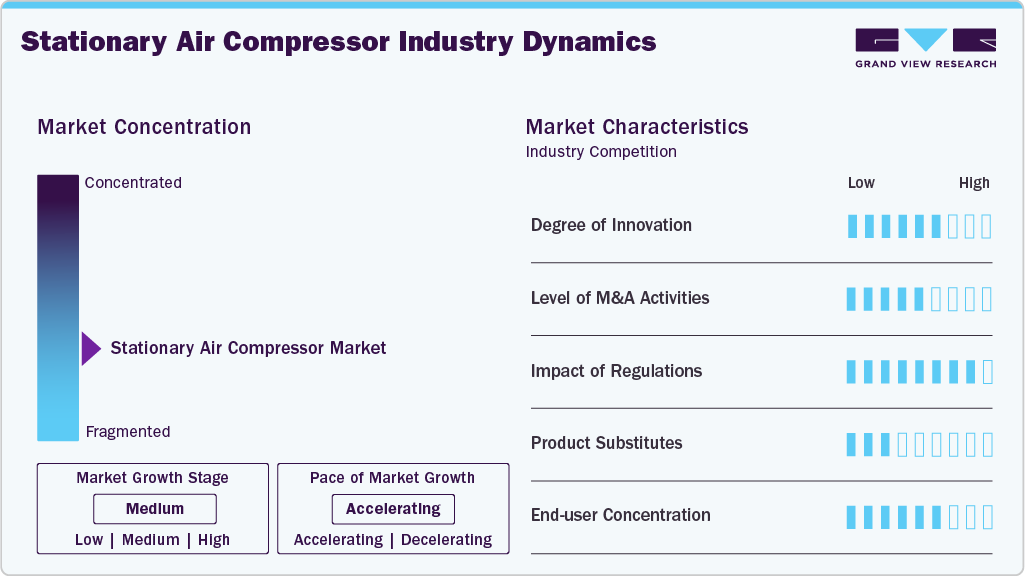

Market Concentration & Characteristics

The stationary air compressor industry is moderately fragmented, with a mix of global and regional players contributing to competition. While a few large manufacturers hold significant market shares due to technological capabilities and broad distribution networks, many smaller firms operate in niche segments or local markets. This diversity in players leads to a competitive landscape with ongoing innovation and price differentiation. The market structure allows new entrants with specialized offerings to gain traction.

The stationary air compressor industry exhibits a moderate to high degree of innovation, driven by the demand for energy efficiency and reduced environmental impact. Manufacturers are investing in oil-free technology, smart monitoring systems, and variable-speed drives to enhance performance. Innovation is also focused on noise reduction and compact design to meet evolving end-user needs. These advancements help differentiate products in a competitive market.

The stationary air compressor industry has witnessed a steady level of mergers and acquisitions, primarily aimed at expanding product portfolios and entering new geographic regions. Larger players often acquire specialized or regional manufacturers to gain technological advantages and market share. M&A activities are also used to streamline supply chains and improve production capabilities. This trend supports market consolidation over time.

Environmental and energy efficiency regulations have a significant impact on the stationary air compressor industry. Governments worldwide are enforcing stricter emission norms and efficiency standards, prompting manufacturers to develop compliant products. Regulations such as ISO standards and local environmental policies influence design and material choices. Compliance is now a key competitive factor in securing industrial contracts.

Drivers, Opportunities & Restraints

Growing industrial automation and the expansion of manufacturing sectors globally are key drivers for the stationary air compressor industry. The need for a reliable, continuous air supply in industries such as pharmaceuticals, electronics, and food processing fuels demand. In addition, advancements in compressor technology, including energy-efficient systems, further support market growth. Increasing infrastructure development in emerging economies also contributes significantly.

There are strong growth opportunities in emerging markets where industrialization is accelerating, particularly in Asia-Pacific and Africa. Demand for oil-free and energy-efficient compressors in environmentally sensitive industries is also opening new market segments. Integration of IoT and remote monitoring solutions offers added value and potential for service-based revenue. Customization for niche applications presents further potential for differentiation and growth.

High initial costs and maintenance expenses of advanced stationary air compressors can deter small and medium-sized enterprises from adoption. In addition, fluctuations in raw material prices and energy costs may impact production economics. Regulatory compliance, while a driver can also act as a restraint due to the cost and complexity of meeting standards. Market saturation in developed regions may limit growth potential for new entrants.

Product Insights

The rotary/screw compressor segment led the market with the largest revenue share of 47.2% in 2024, due to their high efficiency, reliability, and continuous operation capability. They are widely used across industries such as manufacturing, automotive, and food processing, where stable air output is critical. Their relatively low maintenance and energy-efficient performance make them the preferred choice for long-term industrial use. The availability of oil-injected and oil-free variants also broadens their application scope.

The centrifugal compressors segment is anticipated to grow at the fastest CAGR during the forecast period, driven by their ability to handle high-capacity operations with minimal mechanical wear. Their oil-free design and lower maintenance needs make them ideal for industries with strict air purity requirements, such as pharmaceuticals and electronics. Technological advancements are enhancing their efficiency and compactness, encouraging adoption in large-scale facilities.

Operation Mode Insights

The electric compressor segment led the market with the largest revenue share of 53.7% in 2024, owing to its energy efficiency, lower operating costs, and reduced environmental impact. They are widely adopted in indoor and industrial settings where a stable electricity supply is available. Their quiet operation and compatibility with automation systems make them ideal for continuous-use applications. In addition, stricter emission regulations are further encouraging the shift toward electric models.

The internal combustion engine (ICE) segment is anticipated to grow at the fastest CAGR during the forecast period, especially in remote or off-grid industrial and construction sites. Their ability to operate independently of electrical infrastructure makes them highly valuable in fieldwork and mobile applications. Growth is driven by increasing infrastructure development and mining activities in emerging regions. Technological improvements are also enhancing fuel efficiency and performance, boosting adoption.

Lubrication Insights

The oil-filled compressor segment led the market with the largest revenue share of 62.8% in 2024, due to its durability, higher efficiency, and suitability for heavy-duty industrial applications. These compressors offer better cooling and lubrication, resulting in longer operational life and reduced wear and tear. They are widely used in manufacturing, automotive, and construction sectors where slight air contamination is acceptable. Their lower upfront cost compared to oil-free models also supports widespread adoption.

The oil-free compressors segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing demand in industries requiring clean, contaminant-free air, such as pharmaceuticals, food and beverage, and electronics. Strict regulatory standards for air purity and hygiene are accelerating their adoption. Technological advancements have improved their efficiency and reduced maintenance requirements, making them a more viable long-term solution. Their environmental and health benefits further support market growth.

Power Range Insights

The 51-250 kW segment led the market with the largest revenue share of 34.8% in 2024, owing to its widespread use in medium to large-scale industrial operations. These compressors offer the optimal balance of power, efficiency, and capacity needed for continuous, high-demand applications in manufacturing, automotive, and processing industries. Their versatility and ability to support multiple tools and systems simultaneously make them a preferred choice for centralized air systems.

The 20 kW segment is anticipated to grow at the fastest CAGR during the forecast period, driven by rising demand from small and medium enterprises (SMEs), workshops, and localized production units. Their compact size, lower cost, and ease of installation make them ideal for light-duty and space-constrained applications. As more businesses adopt automation and pneumatic tools, the need for smaller, efficient air systems is expanding. Energy-efficient models in this range are also appealing to cost-conscious users.

End-use Insights

The manufacturing segment led the market with the largest revenue share of 42.7% in 2024, driven by the sector's extensive need for continuous and reliable compressed air. Applications such as powering machinery, automation systems, material handling, and tool operations make compressors essential in factories. The broad use across automotive, metalworking, and consumer goods manufacturing sustains consistent demand. High operational efficiency and scalability further strengthen their adoption in this sector.

The semiconductor and electronics segment is anticipated to grow at the fastest CAGR during the forecast period, due to its stringent requirements for ultra-clean, oil-free compressed air. As global demand for chips and high-tech components rises, precision manufacturing environments are expanding rapidly. Oil-free and energy-efficient compressors are critical to maintaining contamination-free production processes. Technological advancements in electronics manufacturing are also driving higher adoption of advanced air compression systems.

Regional Insights

The stationary air compressor market in North America has experienced stable growth, driven by the adoption of advanced, energy-efficient technologies and a revival in domestic manufacturing activity. Stringent environmental regulations are prompting industries to upgrade to cleaner solutions, including oil-free and variable-speed compressors. In addition, increasing investments in automation and smart factory initiatives are boosting demand. Sectors such as food processing and pharmaceuticals are also contributing significantly to the region's market expansion.

U.S. Stationary Air Compressor Market Trends

The stationary air compressor market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by its advanced manufacturing infrastructure, high demand for industrial automation, and stringent environmental regulations. Industries such as automotive, food processing, and pharmaceuticals require reliable, energy-efficient compressed air systems. Technological advancements and the presence of major manufacturers further bolster the market's dominance.

The Mexico stationary air compressor market is experiencing rapid growth, fueled by its expanding manufacturing sector, particularly in automotive and electronics. The country's strategic location, favorable trade agreements like the USMCA, and competitive labor costs attract foreign investments, increasing demand for compressed air solutions. In addition, Mexico's push towards industrial modernization and automation further accelerates the need for advanced compressor technologies.

Asia Pacific Stationary Air Compressor Market Trends

Asia Pacific dominated the stationary air compressor market with the largest revenue share of 42.4% in 2024, driven by rapid industrialization, strong manufacturing growth, and infrastructure development in countries like China, India, and Southeast Asia. The presence of large-scale production facilities and favorable government policies supporting industry and energy efficiency drive demand. In addition, expanding automotive, electronics, and construction sectors contribute significantly. Competitive production costs also attract global investments.

The stationary air compressor market in China held a largest share in the Asia Pacific in 2024, owing to its extensive industrial base, including manufacturing, automotive, and electronics sectors. The country's rapid urbanization and infrastructure development drive significant demand for compressed air solutions.

The India stationary air compressor market is propelled by the expansion of industries such as automotive, textiles, and food processing. The government's initiatives to promote industrialization and infrastructure development create a favorable environment for market growth.

Europe Stationary Air Compressor Market Trends

The stationary air compressor market in India is driven by strict environmental regulations and a strong focus on energy-efficient and sustainable technologies. Mature industrial sectors, especially in Germany, France, and Italy, rely heavily on high-performance stationary compressors. Innovation and early adoption of oil-free and smart compressors also contribute to market growth.

The Germany stationary air compressor market leads the European region in 2024, driven by its robust industrial base encompassing automotive, chemicals, and manufacturing sectors. Germany's emphasis on energy efficiency and stringent environmental regulations further propels the demand for advanced compressor technologies.

The stationary air compressor market in UK is driven by advancements in automation and the expansion of industries such as pharmaceuticals and food processing. The UK's focus on adopting sustainable and energy-efficient technologies aligns with the increasing demand for oil-free and variable-speed compressors.

Middle East & Africa Stationary Air Compressor Market Trends

The stationary air compressor market in the Middle East & Africa is witnessing moderate growth, supported by ongoing infrastructure development, industrial diversification efforts, and government-led initiatives aimed at strengthening non-oil sectors. The expansion of industries such as construction, food & beverage, and chemicals-particularly in countries like the UAE, Saudi Arabia, and South Africa-is driving demand for reliable compressed air solutions.

The Saudi Arabia stationary air compressor market dominates the Middle East & Africa region in 2024, due to its extensive oil & gas industry and ongoing industrial diversification under Vision 2030. Large-scale investments in petrochemical, energy, and infrastructure projects drive consistent demand for high-performance compressors. The need for reliable and efficient compressed air systems in refining, drilling, and processing applications supports market growth.

Latin America Stationary Air Compressor Market Trends

The stationary air compressor market in Latin America is growing moderately, supported by infrastructure development and gradual industrialization in countries like Brazil and Argentina. Expanding mining, oil & gas, and construction sectors are key demand drivers. However, economic instability and fluctuating investment levels can limit large-scale adoption. Rising focus on localized manufacturing offers future growth opportunities.

The Brazil stationary air compressor market leads the Latin American region in 2024, due to its diverse industrial base, including automotive, mining, and manufacturing sectors. The country’s expansive infrastructure projects and growing demand for energy-efficient technologies further drive market growth. Brazil strategic location and trade agreements enhance its position as a regional industrial hub.

Key Stationary Air Compressor Company Insights

Some of the key players operating in the market include Ingersoll Rand, Atlas Copco, Husky Cooperation.

-

Atlas Copco is a global leader in the manufacturing of industrial equipment, including stationary air compressors. Known for its innovation and commitment to sustainability, the company offers a wide range of energy-efficient and reliable compressor solutions tailored to various industries such as construction, mining, and manufacturing. Atlas Copco emphasizes advanced technology, durability, and user-friendly designs, making it a preferred choice worldwide. Their strong focus on customer service and after-sales support strengthens their market presence.

-

Ingersoll Rand is a prominent player in the stationary air compressor industry, recognized for its high-quality and durable products designed for industrial and commercial use. The company delivers innovative compressor technologies that prioritize efficiency, low maintenance, and environmental compliance. Serving diverse sectors such as automotive, construction, and oil & gas, Ingersoll Rand continually invests in research and development to enhance product performance and sustainability. Their extensive global distribution network ensures wide accessibility and reliable customer support.

Key Stationary Air Compressor Companies:

The following are the leading companies in the stationary air compressor market. These companies collectively hold the largest market share and dictate industry trends.

- Ingersoll Rand

- Atlas Copco

- Husky Cooperation

- Zen Air Tech Pvt. Ltd

- Stanley Black & Decker, Inc.

- Ciasons Industrial Inc.

- Kaeser Kompressoren SE

- Makita Cooperation

- Sullair, LLC

- TEWATT

- Quincy Compressor

- Rolair Systems

- Elgi Compressors USA, Inc.

- Hitachi

- Zycon

Recent Developments

-

In May 2025, Tewatt introduced a low-maintenance, oil-free diesel air compressor designed for demanding applications. This model features advanced filtration and cooling systems to ensure clean, dry air delivery. Its robust design and efficient performance make it suitable for industries such as mining, construction, and oil & gas exploration.

-

In June 2024, Ingersoll Rand completed the acquisition of ILC Dover, along with three other companies-Complete Air and Power Solutions, Del PD Pumps & Gear, and Fruvac-for a combined total of $150 million. These acquisitions enhance Ingersoll Rand's capabilities in life sciences, mobile vacuum systems, and precision technologies, thereby broadening its product offerings in the air compressor sector.

Stationary Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16,694.5 million

Revenue forecast in 2033

USD 23,743.0 million

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, operation mode, lubrication, power range, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Pakistan; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Ingersoll Rand; Atlas Copco; Husky Cooperation; Zen Air Tech Pvt. Ltd; Stanley Black & Decker, Inc.; Ciasons Industrial Inc.; Kaeser Kompressoren SE; Makita Corporation; Sullair, LLC; TEWATT; Quincy Compressor; Rolair Systems; Elgi Compressors USA, Inc.; Hitachi; Zycon.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stationary Air Compressor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global stationary air compressor market report based on product, operation mode, lubrication, power range, end-use and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Operation Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Internal Combustion Engine

-

-

Lubrication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil Free

-

Oil Filled

-

-

Power Range Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

Over 500 kW

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Oil & Gas

-

Semiconductor & electronics

-

Home Appliances

-

Healthcare/Medical

-

Food & Beverage

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global stationary air compressor market size was estimated at USD 16,035.0 million in 2024 and is expected to be USD 16,694.5 million in 2025.

b. The global stationary air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 23,743.0 million by 2033.

b. Manufacturing segment is dominating the market and accounted for a share of 42.7% in 2024, driven by the sector's extensive need for continuous and reliable compressed air. Applications such as powering machinery, automation systems, material handling, and tool operations make compressors essential in factories.

b. Some of the key players operating in the global stationary air compressor market include Ingersoll Rand; Atlas Copco; Husky Cooperation; Zen Air Tech Pvt. Ltd; Stanley Black & Decker, Inc.; Ciasons Industrial Inc.; Kaeser Kompressoren SE; Makita Cooperation; Sullair, LLC; TEWATT; Quincy Compressor; Rolair Systems; Elgi Compressors USA, Inc.; Hitachi; Zycon.

b. The global stationary air compressor market is driven by rapid industrialization, increasing demand for energy-efficient systems, and stringent environmental regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.