- Home

- »

- Medical Devices

- »

-

Steerable Sheaths Market Size, Share & Trends Report 2030GVR Report cover

![Steerable Sheaths Market Size, Share & Trends Report]()

Steerable Sheaths Market (2024 - 2030) Size, Share & Trends Analysis Report, By Type (Single Use, Reprocessed), By Application (Electrophysiology Procedures, Interventional Cardiology Procedures), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-251-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Steerable Sheaths Market Size & Trends

The global steerable sheaths market size was estimated at USD 808.5 million in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. Steerable sheaths are instruments that are used for introducing diagnostic and therapeutic devices in the human vasculature, such as intracardiac, renal, and for other peripheral needs. The key factors contributing to market growth demands for minimally invasive procedures, rising prevalence of cardiovascular & neurological diseases, technological advancements, and expanding applications in emerging fields. According to an article by Frontiers Media S.A. in October 2022, the global cardiovascular disease related mortality is projected to be more than 23 million by 2030.

The growing burden of arrhythmia is expected to propel opportunities in the global market. According to an article published by Johnson & Johnson Services, Inc. in 2021 - 22, the prevalence of AFib was over 7 million in the U.S., 20 million in Asia Pacific, 14 million in Europe, and nearly 2 million in Latin America. In Europe, countries such as France, Germany, Italy, and the UK witness over 1 million AFib cases. Furthermore, the region has an aging population, leading to a projected 70% increase in AFib cases within next few years (by 2030). By 2050, Europe is anticipated to witness the most significant rise in AFib cases globally. Consequently, AFib-related stroke events, hospitalizations, and outpatient visits are expected to surge substantially, creating an increased demand for steerable sheaths.

The growing number of catheter ablation procedures is expected to positively impact the market. As the number of ablation procedures rises, a direct increase in demand for steerable sheaths is observed, which are essential components for guiding catheters. Furthermore, steerable sheaths enhance maneuverability for navigating complex anatomies, provide greater flexibility for reaching targeted areas, improve compatibility, and enhance visualization capability through integrated imaging capabilities. According to an article published by Elsevier Inc. in March 2023, the annual rate of cardiac Electrophysiology (EP) procedures increased from 817.9 in 2013 to 1,089.68 per 100,000 beneficiaries in 2019 within U.S. Consequently, catheter-based EP procedures increased from 323.73 in 2013 to 675.01 in 2019.

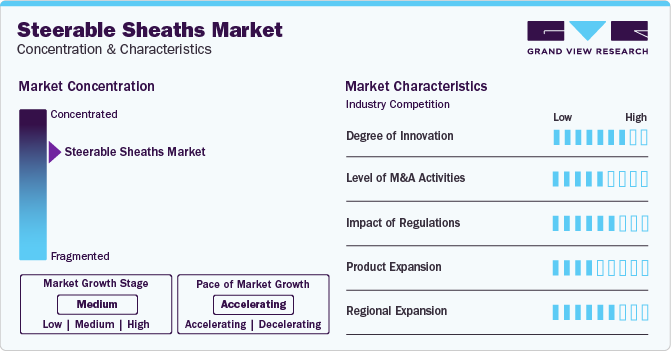

Market Concentration & Characteristics

Technological advancements have supported new application development and aligned procedures with enhanced patency. Incorporating a steerable sheath with visualization technologies, such as an Electroanatomical Mapping (EAM) system, is expected to boost the market growth. According to an article published by the European Heart Rhythm Association in March 2023, using visualizable steerable sheaths for catheter ablation procedures reduced radiation exposure when compared to non-visualizable steerable sheaths.

The steerable sheath market is characterized by a high level of M&A activities, that are undertaken by leading players in the last three years. For instance, in May 2023, Stryker, a global med-tech company, announced the acquisition of Endovascular Ltd, a medical device company focusing on design and development of neurointerventional devices.

The steerable sheath market is experiencing heightened regulatory scrutiny, with various regulatory and government authorities actively working to implement more rigorous guidelines which often leads to application recalls. For instance, in June 2023, Abbott recalled their steerable sheath application, Amplatzer Steerable Delivery Sheath. The reason for the recall was the increased risk for air bubbles (air emboli) during the procedure with this device, which can lead to a sudden reduction in blood flow to the heart.

Some of the key players in the market are focusing on introducing novel applications that can cater to specific needs of patients. For instance, in December 2023, Medtronic, the company received U.S. FDA approval for its PulseSelect Pulsed Field Ablation (PFA) System. It is indicated to treat both paroxysmal and persistent Atrial Fibrillation (AF).

Key companies in the global market are also focusing on market expansion. For instance, in February 2024, Terumo Corporation, a key med-tech player, announced the opening of its new manufacturing facility in Puerto Rico. The facility is close to 64,000 square feet.

Type Insights

Based on type, the single-use segment led the market with the largest revenue share of 95.6% in 2023. This segment is also expected to grow at the fastest CAGR during the forecast period. Growth of the segment can be attributed to the convenience & cost-effectiveness, material innovation, and higher focus on user-friendliness. Unlike traditional fixed sheaths, these single-use steerable sheaths offer increased flexibility and adaptability, allowing clinicians to effortlessly reach challenging anatomical locations.

The reprocessed steerable sheaths is primarily driven by cost savings and environmental sustainability. Reprocessing medical devices allows healthcare facilities to reduce expenses significantly compared to purchasing new devices, making it an attractive option for cost-conscious providers. In addition, reprocessing contributes to environmental sustainability by reducing medical waste. Technological advancements in reprocessing methods have also played a role in driving market growth, ensuring that reprocessed devices meet safety and efficacy standards.

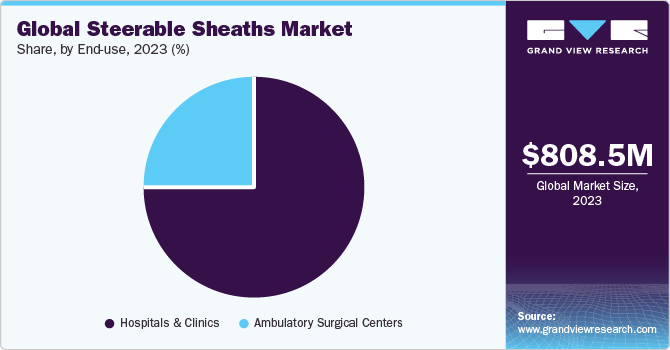

End-use Insights

Based on end-use, the hospitals and clinics segment led the market with the largest revenue share of 75.02% in 2023. The number of arrhythmia procedures in hospitals is estimated to increase over the coming years owing to the availability of a skilled team of cardiologists and a well-equipped facility. Furthermore, a growing number of patients approach hospitals due to proper reimbursement facilities and accessibility to treatment, which drives the segment.

The ambulatory surgical centers segment is anticipated to grow at the fastest CAGR over the forecast period. The segment growth can be attributed to the minimally invasive nature of the procedure with a shorter procedure time, higher cost-efficiency, reduced recovery time, and government bodies promoting steerable sheath-related procedures in an outpatient setting. Moreover, the growing preference to perform ablation procedures in an ASC is expected to boost growth in the developed regions. For instance, in November 2022, Pima Heart & Vascular, an ASC in the U.S., announced the first catheter ablation procedure in their facility.

Application Insights

Based on application, the electrophysiology procedure segment led the market in 2023 with the largest revenue share of 38.8%. Moreover, this segment is anticipated to grow at a significant CAGR of 7.3% over the forecast period. Growth of the segment can be attributed to the rising prevalence of arrhythmias, increasing adoption of catheter ablation, and advancements in steerable sheaths. According to an article by the NCBI in June 2023, the prevalence of arrhythmia was projected to be 1.5% to 5% in the general population.

The interventional cardiology segment is anticipated to grow at the fastest CAGR over the forecast period. Interventional cardiology procedures primarily include Percutaneous Mitral Valve Repair (PMVR), Left Atrial Appendage (LAA) closure, and others. The growing number of Catheter-based LAA Closure (LAAC) device procedures is expected to boost segment growth.

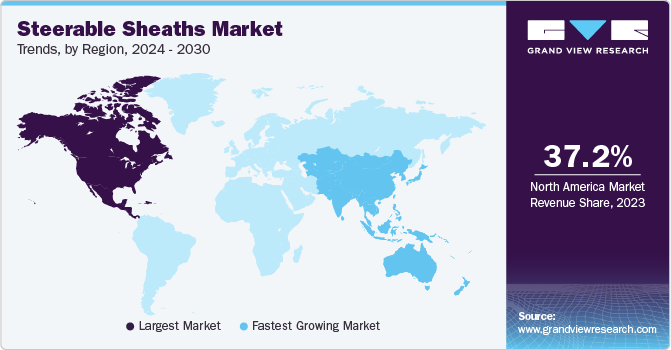

Regional Insights

North America dominates the steerable sheaths market with the revenue share of 37.2% in 2023. The rising incidence of cardiovascular disease, advanced healthcare infrastructure, and the presence of key players. In addition, the increasing number of patients undergoing surgeries and the rising awareness about minimally invasive surgeries are expected to propel market growth in North America.

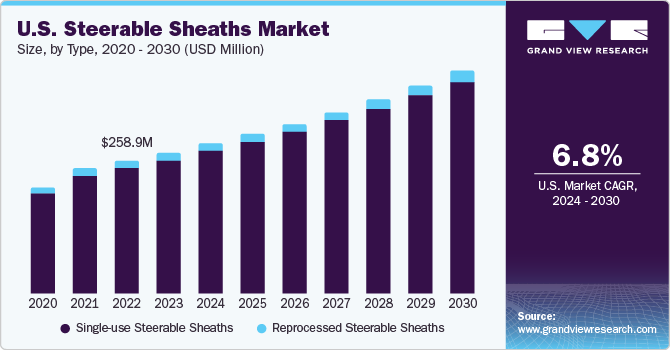

U.S. Steerable Sheaths Market Trends

The steerable sheaths market in U.S. accounted with the revenue share of 91.3% in 2023 and is expected to grow at the fastest CAGR during the forecast period. In the U.S., advanced healthcare infrastructure, the growing patient pool, and the increasing number of new application launches are some of the major factors expected to propel market growth over the forecast period.

Europe Steerable Sheaths Market Trends

The steerable sheaths market in Europe held the second largest revenue market share in 2023. Europe has a robust healthcare system, witnessing a shift from in-patient to out-patient care due to the growing presence of several medical equipment companies offering catheters in the region.

The Germany steerable sheaths market accounted with the largest revenue share of 27.33% in 2023. The increasing prevalence of cardiac disorders is expected to improve the demand for catheters & steerable sheaths for treating narrowing arteries in patients, which is expected to drive market growth during the forecast period.

The steerable sheaths market in UK showed the second largest market share in 2023. The prevalence of cardiovascular diseases, such as coronary artery disease, ischemic heart disease, and other heart-related disorders in the UK is expected to increase the demand for cardiology devices.

Then France steerable sheaths market is anticipated to witness at the significant CAGR of 7.2% during the forecast period. Growth in France is likely to be driven by rising incidence of cardiovascular diseases, growing number of hospitals & clinics, and lifestyle changes in the population. Moreover, the growing geriatric population and number of application launches associated with cardiology are expected to contribute to market growth.

Asia Pacific Steerable Sheaths Market Trends

The steerable sheaths market in Asia Pacific is projected to register the fastest CAGR of 8.6% during the forecast period. The increasing health awareness, a developing private hospital sector, growing government support & spending, the rising prevalence of cardiovascular diseases, and the availability of insurance policies are likely to contribute to market growth over the coming decade.

The China steerable sheaths market held the largest revenue market share of 28.9% in 2023. The increasing prevalence of cardiovascular disease in China due to high blood pressure, unhealthy lifestyle, aging population, urbanization, and high cholesterol levels are anticipated to boost the market growth.

The steerable sheaths market in Japan held the second largest market share in the Asia Pacific region. Japan is considered a major market for cardiology devices in the Asia Pacific. Cardiovascular disorders, including heart disease and stroke, have a considerable impact on Japan’s life expectancy and medical costs. The growing prevalence of cardiovascular diseases is anticipated to drive market growth in Japan.

The India steerable sheaths market is expected to grow at the fastest CAGR of 9.5% during the forecast period. The increasing prevalence of coronary artery disease is expected to boost the need for interventional procedures, which is anticipated to drive the market in India. As per the WHO data published in 2020, about 1,520,034 individuals succumbed to coronary heart disease. In addition, an increasing number of private players and hospitals run by government organizations are providing cardiovascular disease treatment procedures, which is anticipated to propel market growth.

Latin America Steerable Sheaths Market Trends

The steerable sheaths market in Latin America is expected to witness at a lucrative CAGR during the forecast period. CVD is one of the leading causes of death in Latin American countries. Coronary heart disease and stroke account for 42.5% and 28.8% of all CVD deaths in the region. Favorable government initiatives such as health insurance programs are also expected to boost market growth in the region.

The Mexico steerable sheaths market is expected to grow at the fastest CAGR during the forecast period, due to various factors, such as the high incidence of chronic heart diseases, improved medical facilities, and favorable regulatory policies.

Middle East & Africa Steerable Sheaths Market Trends

The steerable sheaths market in Middle East & Africa is expected to grow at a lucrative CAGR over the forecast period. This region is one of the significant developing markets for medical devices. Increased prevalence of ischemic heart disease, vascular disease, and coronary artery disease, as well as a rise in public awareness about the need for prompt diagnosis & usage of advanced devices, are projected to be the main factors driving market demand over the forecast period.

The South Africa steerable sheaths market held the largest revenue market share of 29.1% in 2023. Technology is altering the delivery of healthcare in Africa, allowing more people in distant locations and around the world to receive better care. However, access is the most significant challenge to healthcare delivery in Africa.

Key Steerable Sheaths Company Insights

Leading companies in the market are enhancing their offerings and incorporating new technologies to expand their customer reach, secure a greater market share, and diversify their application range. For example, Merit Medical Systems announced the expansion of its application line, Maestro Microcatheter. The new line includes a longer length of the catheter for better radial embolization procedures.

Key Steerable Sheaths Companies:

The following are the leading companies in the steerable sheaths market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Boston Scientific Corporation

- Abbott

- Stryker

- Teleflex Incorporated

- Johnson & Johnson Services, Inc.

- Integer Holdings Corporation

- Merit Medical Systems

- Terumo Corporation

- OSCOR Inc.

Recent Developments

-

In January 2024, Boston Scientific Corporation received U.S. FDA approval for the FARAPULSE Pulsed Field Ablation (PFA) System. The devices are indicated to treat patients suffering from paroxysmal atrial fibrillation (AF). The system consists of ablation catheter, steerable sheath, and other accessories

-

In January 2023, Terumo and Siemens Healthineers India announced a partnership to enhance cardiac care in India. The partnership entails physician training and development and improved market penetration in Tier 2 and Tier 3 cities of the country

-

In August 2022, Medtronic acquired Affera, Inc. This acquisition allowed the company to expand its application offering in the cardiac ablation industry

Steerable Sheaths Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 863.1 million

Revenue forecast in 2030

USD 1,310 million

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Abbott; Boston Scientific Corporation; Merit Medical Systems; Stryker; Teleflex Incorporated; Terumo Corporation; OSCOR Inc.; Integer Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Steerable Sheaths Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global steerable sheaths market based on type, application, portability, end-use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-use Steerable Sheaths

-

Reprocessed Steerable Sheaths

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrophysiology (EP) Procedures

-

Interventional Cardiology Procedures

-

Peripheral Vascular Procedures

-

Other Procedures

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global steerable sheaths market size was estimated at USD 808.5 million in 2023 and is expected to reach USD 863.1 million in 2024.

b. The global steerable sheaths market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 1,310 million by 2030.

b. North America steerable sheaths market dominated and accounted for 37.2% of the total market share in 2023. The rising incidence of cardiovascular disease, advanced healthcare infrastructure, and the presence of key players. In addition, the increasing number of patients undergoing surgeries and the rising awareness about minimally invasive surgeries are expected to propel market growth in North America.

b. Some of the key players in the global steerable sheaths market include Medtronic, Boston Scientific Corporation, Abbott, Stryker, Teleflex Incorporated, Johnson & Johnson Services, Inc., Integer Holdings Corporation, Merit Medical Systems, Terumo Corporation, and OSCOR Inc.

b. The key factors contributing to steerable sheaths market growth are growing demand for minimally invasive procedures, rising prevalence of cardiovascular & neurological diseases, technological advancements, and expanding applications in emerging fields.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.