- Home

- »

- Medical Devices

- »

-

Sterile Injectable Contract Manufacturing Market Report 2030GVR Report cover

![Sterile Injectable Contract Manufacturing Market Size, Share & Trends Report]()

Sterile Injectable Contract Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report Molecule Type (Small Molecule, Large Molecule), By Route Of Administration, By Therapeutic Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-097-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sterile Injectable Contract Manufacturing Market Summary

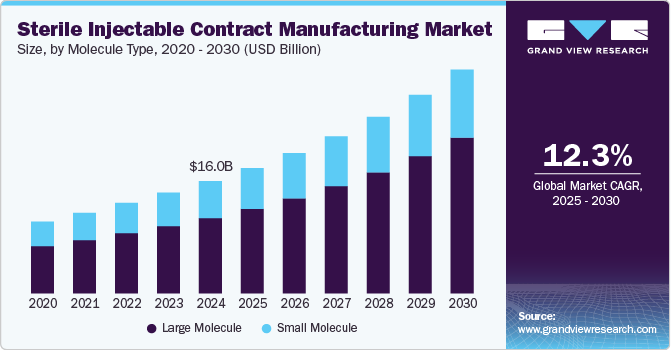

The global sterile injectable contract manufacturing market size was estimated at USD 15,997.7 million in 2024 and is projected to reach USD 31,884.4 million by 2030, growing at a CAGR of 12.3% from 2025 to 2030. The market growth is mainly due to the increasing demand for biologics and biosimilars and the outsourcing trend among pharmaceutical companies seeking to reduce costs and enhance efficiency.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Kuwait is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, large molecule accounted for a revenue of USD 10,730.4 million in 2024.

- Large Molecule is the most lucrative molecule type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 15,997.7 Million

- 2030 Projected Market Size: USD 31,884.4 Million

- CAGR (2025-2030): 12.3%

- North America: Largest market in 2024

Moreover, the rising prevalence of chronic illnesses, coupled with the quicker approval timelines for sterile injectables compared to other drug types, is further driving the demand for injectable formulations.

The increasing trend of outsourcing in the pharmaceutical industry is also contributing to the market growth. Several companies, particularly small to mid-sized firms, are increasingly seeking contract manufacturing organizations (CMOs) to reduce operational costs, enhance efficiency, and focus on their core competencies. By outsourcing sterile injectable production, these companies can leverage the expertise and advanced technologies of specialized manufacturers, reducing the time to market for new products.

In addition, growing investments in pharmaceutical R&D activities are also driving the demand in the market. Companies are prioritizing innovation to develop new therapies, particularly in the sterile injectable segment. For instance, F. Hoffmann La Roche raised its R&D spending to USD 14.72 billion in 2023, up from USD 13.88 billion the previous year. Thus, increasing investment has accelerated the pipeline of injectable products, further catering to the needs of patients with chronic illnesses. Therefore, with the increasing R&D efforts, the demand for sterile injectables is projected to increase.

Technological advancements in sterile manufacturing processes have enhanced production capabilities and efficiency. Innovations such as single-use systems, automation, and advanced containment technologies are making it easier to produce high-quality sterile injectables while minimizing contamination risks. These advancements have not only enhanced the safety and reliability of the manufacturing process but also allowed for greater customization and quicker turnaround times for clients. As companies increasingly seek to differentiate their products and optimize their manufacturing operations, the integration of cutting-edge technologies within contract manufacturing services will continue to be a key driver in the sterile injectable market.

Molecule Type Insights

Based on molecule type, the large molecule segment led the market with the largest revenue share of 67.07% in 2024. The growth of the segment is mainly due to rising investments by contract manufacturers in developing large molecule-based therapeutics, an expanding pipeline of biologics injectables, and a notable increase in U.S. FDA approvals for biosimilars. Moreover, this segment is expected to experience significant growth during the forecasted period owing to the rising number of biologics approvals from 2024 and 2027.

Small molecule medicine discovery has substantially evolved over the past few years, leading to a well-established infrastructure for their production. These compounds are typically easier and less expensive to manufacture compared to large molecules, which often require complex biological processes. The existing expertise in small molecule synthesis allows CMOs to efficiently scale up manufacturing while maintaining quality and compliance with regulatory standards. Moreover, the increasing adoption of advanced technology has led to the growth of small molecule-based injectables in the last few years, thereby augmenting the segment’s growth.

Therapeutic Application Insights

Based on therapeutic application, the cancer segment led the market with the largest revenue share of 28.17% in 2024. The increasing number of cancer cases, rising R&D investments, and growing requirements for oncology drugs & biologics are some of the factors driving the segment growth. According to the statistics published by American Cancer Society in 2024, approximately 2 million new cancer cases are to be registered in the U.S. in 2024. Thus, the rising prevalence of cancer is driving the demand for better treatment options, including sterile injectables that deliver therapies directly to patients.

The central nervous systems diseases segment is projected to grow at the fastest CAGR during the forecast period. Neurological disorders encompass a broad range of conditions affecting the nervous system, leading to disruptions in normal brain function, spinal cord activity, and interactions of peripheral nerves. Most common neurological disorders include Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, epilepsy, and stroke. The growing prevalence of these diseases is expected to increase the demand for effective treatment options that can be delivered through sterile injectables.

Route Of Administration Insights

Based on route of administration, the intravenous (IV) segment led the market with the largest revenue share of 30.35% in 2024. Several healthcare systems are shifting toward personalized medicine, which is boosting the demand for tailored intravenous therapies. Furthermore, growing pipelines of IV sterile injectables coupled with their subsequent approval are projected to contribute to the segment growth during the forecast period. The U.S. FDA stated that the total number of injectables launched in 2021 majorly constituted IV infusion dosages, accounting for approximately 30%-35% of the total volume of injectables.

The subcutaneous (SC) segment is projected to witness at the fastest CAGR during the forecast period. The segment growth can mainly be attributed to the increasing preference among both patients and healthcare providers for self-administration of medications. Moreover, this method allows easier administration, improved patient compliance, and reduced healthcare costs associated with hospital visits. The rise in the prevalence of chronic diseases, such as diabetes and autoimmune disorders, has led to a surge in demand for biologics that can be administered subcutaneously.

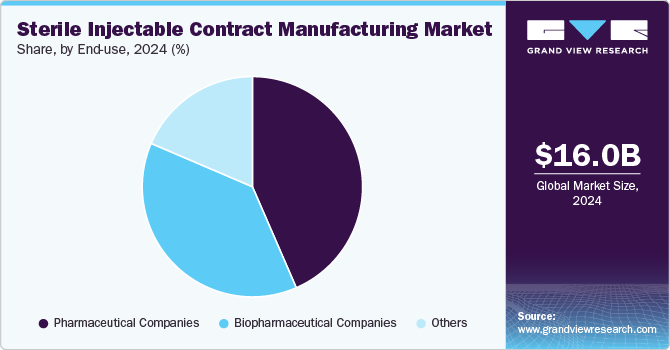

End-use Insights

Based on end use, the pharmaceutical companies segment led the market with the largest revenue share of 43.48% in 2024. Pharmaceutical companies are increasingly outsourcing their drug development and manufacturing operations to Contract Manufacturing Organizations (CMOs) to focus on their core competencies, such as R&D. Moreover, with the increasing complexity of biologics and personalized medicines, several pharmaceutical companies lack the necessary expertise and equipment to handle operations in-house.

The biopharmaceutical segment is projected to witness at the fastest CAGR during the forecast period. Rising demand for biologics and biosimilars, the complexity of biologics manufacturing, and the requirement for specialized facilities and equipment are some of the factors contributing to the segment growth. In addition, increasing R&D activities for the development of biologics and biosimilars, biopharmaceutical companies are increasingly shifting toward outsourcing their activities to CMOs. It is difficult for businesses to produce biologics in-house since they are complex compounds that call for specific production techniques and tools.

Regional Insights

North America sterile injectable contract manufacturing market dominated with the revenue share of 42.86% in 2024. The growth in the region is attributed to the factors such as to the region’s advanced healthcare infrastructure, increasing R&D investment, technological developments, and the presence of major players. In addition, the growing prevalence of chronic diseases and the increasing demand for biologics & biosimilars are expected to boost the demand for sterile injectable formulations.

U.S. Sterile Injectable Contract Manufacturing Market Trends

The U.S. sterile injectable contract manufacturing market is anticipated to experience at a significant CAGR during the forecast period, owing to the robust pipeline of new drug approvals and a focus on innovative therapies, particularly in oncology & chronic disease management. Pharmaceutical companies are increasingly outsourcing their manufacturing needs to CMOs to leverage specialized expertise, reduce operational costs, and expedite time-to-market for new products.Hence, CMOs are investing highly to advance their service offerings. For instance, in November 2020, Baxter, a company offering services in sterile medication production & delivery, invested USD 50 million to expand its sterile fill/finish manufacturing facilities in the U.S.

Europe Sterile Injectable Contract Manufacturing Market Trends

The Europe sterile injectable contract manufacturing market is anticipated to grow at the fastest CAGR over the forecast period. Europe has a robust pharmaceutical sector with numerous drug discoveries, development, and manufacturing companies. The growing number of pharmaceutical activities is anticipated to increase the demand for CMOs. Moreover, the growing trend of outsourcing services to European countries is expected to contribute to the growing demand for sterile injectables CDMO.

The UK sterile injectable contract manufacturing market is projected to witness at the fastest CAGR during the forecast period. Growth can be attributed to the increasing focus on biologics and complex molecules, which often require sterile injectable delivery, is a significant driver for the market. In addition, the UK’s supportive regulatory environment and the presence of FDA- & EMA-approved R&D and manufacturing facilities attract foreign investments that boost the market. Moreover, the rise in chronic diseases and an aging population are expected to propel the demand for injectable medications, emphasizing the importance of sterile injectables in modern healthcare.

The sterile injectable contract manufacturing market in Germany is expected to grow at a considerable CAGR over the forecast period. The increasing demand for biopharmaceuticals and the rising prevalence of chronic diseases are contributing to the country’s market growth. The shift toward more complex drug formulations, particularly biologics & biosimilars, necessitated advanced manufacturing capabilities that several pharmaceutical companies prefer to outsource. This trend is further fueled by the need for cost-effective solutions and the ability to scale production quickly in response to market demands.

Asia PacificSterile Injectable Contract Manufacturing Market Trends

The sterile injectable contract manufacturing market in Asia Pacific is anticipated to witness at a robust CAGR during the forecast period. Growth in the Asia Pacific market can be attributed to the increasing demand for injectable drugs, advancements in biotechnology, the rising prevalence of chronic diseases, and favorable government policies. The region has witnessed increasing cases of chronic diseases, such as diabetes and cardiovascular diseases, which necessitate effective treatment options like injectable medications. For instance, according to an article published in NCBI in April 2023, the prevalence of diabetes in China has reached 11.2%, and the number of adults with diabetes is projected to be at 141 million.

The China sterile injectable contract manufacturing market accounted for the largest market share in the Asia Pacific in 2024, owing to the rising geriatric population and the presence of a large fraction of the population belonging to the middle-income group. These factors are expected to improve the demand for innovative & cost-effective medical equipment, further attracting major medical device companies.Moreover, China has become an attractive destination for outsourcing activities due to its large population, diverse patient demographics, and cost-effectiveness. As a result, domestic and international pharmaceutical companies outsource their sterile testing manufacturing to CMOs.

The sterile injectable contract manufacturing market in Japan is projected to witness at a considerable CAGR during the forecast period. Several pharmaceutical companies in the country are investing heavily in state-of-the-art facilities and technologies to enhance their capabilities. Moreover, CMOs have announced expansions or new facility constructions in Japan to meet the growing demand for sterile injectables.

The India sterile injectable contract manufacturing market is projected to grow at a significant CAGR during the forecast period. The country is expected to emerge as one of the lucrative markets for sterile injectables across the globe. This can be attributed to low costs, the availability of industry experts, and the presence of WHO-cGMP-compliant facilities. In addition, rising government funding for R&D is expected to accelerate the development of new drugs, which is expected to boost the demand for pharmaceutical sterility testing and related services.

KeySterile Injectable Contract Manufacturing Company Insights

Key players operating in the global market are undertaking various initiatives to strengthen their market presence. The companies are adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. Moreover, companies are focusing on expanding their production capacity to position themselves in the market better. For instance, in March 2023, PCI Pharma Services announced the investment of USD 50 million for a new 200,000ft manufacturing facility in Illinois, US. The site is expected to enhance the contract development capacity in injectables of biologics and small molecules.

Key Sterile Injectable Contract Manufacturing Companies:

The following are the leading companies in the sterile injectable contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- Catalent, Inc.

- Vetter Pharma

- Recipharm AB

- Aenova Group

- Fresenius Kabi AG

- Unither Pharmaceuticals

- FAMAR Health Care Services

- Cipla Inc.

- NextPharma Technologies

Recent Developments

-

In January 2024, Cipla entered into a joint venture with Kemwell Biopharma and Manipal Education & Medical Group for the global development and commercialization of innovative cell therapy products

-

In December 2023, Cipla filed a patent for a stable, ready-to-use, extended-release injectable formulation of aripiprazole aimed at treating schizophrenia and related disorders. The patent outlined a formulation that maintains stability over 6 months in sealed, sterile conditions, with total impurities not exceeding 1.0% when stored at 25°C and 60% relative humidity

-

In October 2022, Recipharm ABannounced plans to install a high-speed filling line at its Wasserburg facility in Germany. The new line is expected to enhance the company's capacity for the fill & finish of sterile liquid & lyophilized products and support clients in the development & manufacture of advanced therapies & vaccines

Sterile Injectable Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.9 billion

Revenue forecast in 2030

USD 31.9 billion

Growth rate

CAGR of 12.28% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule type, therapeutic application, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Japan; China; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Baxter; Catalent; Inc.; Vetter Pharma; Recipharm AB; Aenova Group; Fresenius Kabi; Unither Pharmaceuticals; Famar; Cipla Inc.; NextPharma Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sterile Injectable Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sterile injectable contract manufacturing market report based on, molecule type, therapeutic application, route of administration, end-use, and region:

-

Molecule Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small Molecule

-

Large Molecule

-

-

Therapeutic Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer

-

Diabetes

-

Cardiovascular Diseases

-

Central Nervous System Diseases

-

Infectious Disorders

-

Musculoskeletal

-

Anti-viral

-

Others

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Subcutaneous (SC)

-

Intravenous (IV)

-

Intramuscular (IM)

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sterile injectable contract manufacturing market size was estimated at USD 16.0 billion in 2024 and is expected to reach USD 17.9 billion in 2025.

b. The global sterile injectable contract manufacturing market is expected to grow at a compound annual growth rate of 12.28% from 2025 to 2030 to reach USD 31.9 billion by 2030.

b. North America dominated the sterile injectable contract manufacturing market with a share of 42.8% in 2024. This is attributable to the presence of established CMOs specializing in injectable manufacturing services, such as Baxter Biopharma and Catalent Inc.

b. Some key players operating in the sterile injectable contract manufacturing market include Baxter, Catalent, Inc., Vetter Pharma, Recipharm AB, Aenova Group, Fresenius Kabi. etc.

b. Increasing pipeline and approvals of injectables and growing demand for biologics and biosimilars significantly supported the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.