- Home

- »

- Medical Devices

- »

-

Sterile Tubing Welder Market Size And Share Report, 2030GVR Report cover

![Sterile Tubing Welder Market Size, Share & Trends Report]()

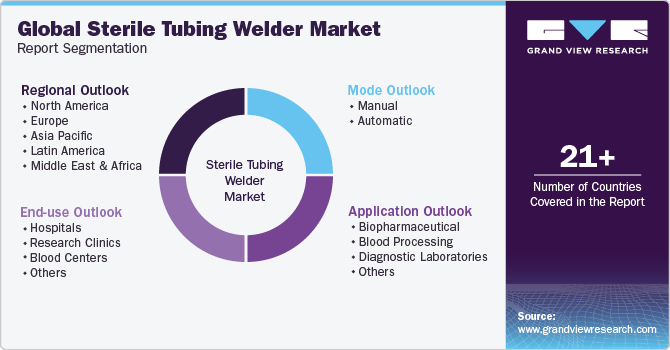

Sterile Tubing Welder Market Size, Share & Trends Analysis Report By Application (Biopharmaceutical, Blood Processing, Diagnostic Laboratories, Others), By Mode (Manual, Automatic), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-193-1

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Sterile Tubing Welder Market Size & Trends

The global sterile tubing welder market size was valued at USD 2.33 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Increasing demand from end use industries and rising investments in R&D projects are anticipated to drive market growth. The growing concerns about contamination and infection control in many healthcare applications, including fluid transfer, aseptic processing, and other sterile tubing welders, are placing greater emphasis on the sterilizing process. A rise in the usage of single-use technologies and increasing demand for blood and blood products due to increasing cases of blood cancer, anemia, hemophilia, and more are anticipated to further boost the market growth. According to America’s Blood Centers, in 2019, more than 15 million RBCs, platelets, and plasma transfusions took place, with patients using approximately 42,000 blood components daily.

Such high demand for blood products is anticipated to fuel the demand for blood processing, sterile processing, and related infrastructure. The extensive ongoing biopharmaceutical research for developing innovative and therapeutically advanced medicines is anticipated to drive the market. R&D spending in the pharmaceutical sector is rising worldwide. For instance, as per the Pharmaceutical Research and Manufacturers of America report published in May 2022, 549 new blood-related medications are being developed by the biopharmaceutical industry using new advances in science and technology to mitigate blood-related problems.

Sterile tubing welders are essential in biotechnology laboratories and cell culture facilities. They are used to create sterile connections for transferring media, buffers, and other fluids between different vessels, such as bioreactors, fermenters, storage containers, or chromatography columns. Medical device manufacturers often employ sterile tubing welders to assemble and connect various components of medical devices or instruments. These could include fluid transfer systems, catheters, blood bags, or devices requiring sterile connections for safe and reliable operation. Numerous technological advances and the purchase of equipment to promote faster turnaround times were witnessed. For instance, in September 2021, a Dover-based company, CPC (Colder Products business), introduced the MicroCNX Series connections, a new line of ultra-compact sterile connections. MicroCNX connectors were created specifically for use with (1.6 mm, 2.4 mm, and 3.2 mm) small-bore tubing, sampling, expanding seed trains, and early cell-culture procedures involving shaker flasks and rocker tables are some of the more popular applications for these tubings.

The increase in demand for personalized pharmaceuticals, rapidly growing healthcare infrastructure, and governments increasing expenditure on healthcare systems and maintenance due to the rise in chronic diseases such as blood cancer and anemia are factors driving the growth of the worldwide sterile tubing market. These illnesses necessitate regular medical interventions, frequently using instruments requiring sterile connections. According to the Centers for Disease Control and Prevention (CDC) stats based on a 2023 study, approximately 9,00,000 Americans are affected with pulmonary embolism (PE) and deep vein thrombosis (DVT) every year.

Regulatory bodies, such as the Food and Drug Administration (FDA) in the U.S., have strict guidelines and regulations for the manufacturing and packaging of medical devices and pharmaceutical products. Compliance with these regulations often requires the use of sterile tubing welders to maintain the integrity of the product. The need for compliance may drive the market growth for these devices.

During COVID-19, many hospitals began to use sterilized equipment on a larger scale for the prevention of coronavirus, which led to an increase in demand. The increase in the number of blood tests to determine governments of different countries boosted COVID-19 by allowing laboratories for blood testing since the number of infections was on constant rise, contributing to augment demand. Blood and plasma transfusion was required for hospitalized COVID-19 patients with weakened immune systems. However, due to pandemic restrictions, many products were suspended, but the pharmaceutical business was at the forefront of developing its capacities.

Application Insights

The blood processing segment held the largest revenue share of over 60% in 2022. The segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. This is attributed to the increasing demand for blood & blood products is anticipated to be the key driver for the segment. This can be attributed to the high demand for personalized medicine, cell & gene therapies, and the high prevalence of blood disorders, such as hemophilia. As per a study by the National Library of Medicine in February 2023, One out of every 5,000 males suffer from hemophilia A, which makes up 80% of all cases of hereditary hemostasis. More than 4,00,000 males globally have hemophilia A, and many of them are misdiagnosed in countries with poor healthcare infrastructure.

Hospitals are adopting sophisticated devices to reduce patient turnaround time and meet the increasing demand. The use of complex, sophisticated devices has, in turn, led hospitals to reevaluate sterile processing departments and equipment to meet the infection control standard. Furthermore, transfusion committees in hospitals are anticipated to ensure the use of sterile equipment for quality transfusions and patient safety. According to World Health Organization (WHO) 2023 stats, 48% of hospitals that provide transfusions have a transfusion committee, with 62% of those institutions being in high-income nations, 35% being in upper-middle-income nations, 31 being in lower-middle-income nations, and 25% being in low-income nations. Based on these statistics, it is estimated that the needs will increase over the forecast period. Hence the demand for sterile tubing welders is also expected to witness a lucrative growth rate from 2023 to 2030.

Mode Insights

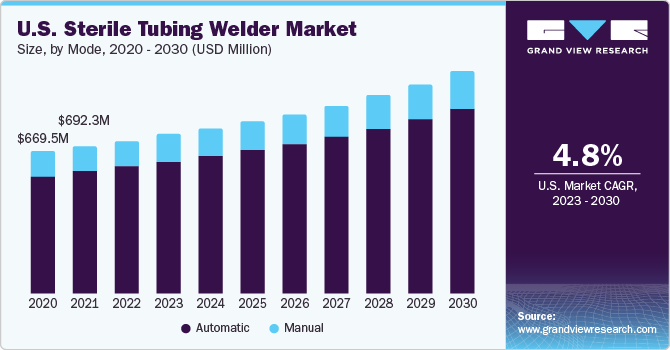

The automatic segment held the largest market share of over 80% in 2022. The segment is anticipated to retain its leading position throughout the forecast period. Automatic Sterile Tubing Welders offer advantages in terms of efficiency and productivity compared to manual welding processes. These machines are designed to automate the welding process, reducing the need for manual labor and improving production throughput. As industries strive for increased productivity and cost-effectiveness, the demand for automatic sterile tubing welders is expected to grow.

Manual sterile tubing welders are typically more affordable than their automated counterparts. This cost advantage can make them an attractive option for smaller-scale operations, research laboratories, or facilities with limited budgets. The affordability factor can contribute to the growth of the manual sterile tubing welder market, particularly in sectors where cost considerations play a significant role. Manual sterile tubing welders require skilled operators who are trained in the welding process. While automation is gaining prominence, manual welding may still be preferred when specific operator control is necessary or for processes requiring a high degree of precision. Industries that prioritize manual welding techniques, such as research and development, such factors contribute to the demand for manual sterile tubing welders over the forecast period.

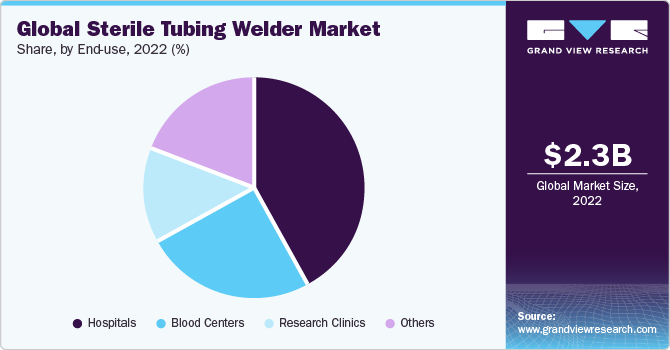

End-use Insights

The hospitals segment accounted for the largest revenue share of over 40% in 2022. This is attributed to the availability of a range of wide treatment options in hospital facilities and the increased number of visits to diagnose and treat blood disorders in these facilities. Hospitals have strict protocols and guidelines to prevent the spread of infections. Sterile tubing welders play a critical role in maintaining the sterility of medical devices, such as IV lines, catheters, and surgical instruments used in patient care. The growing emphasis on infection control in hospitals may drive the demand for sterile tubing welders. As the population grows and healthcare needs increase, hospitals often expand their facilities to accommodate more patients. With the expansion of hospitals, there may be a higher demand for sterile tubing welders to support the increased production and maintenance of sterile medical devices.

Blood centers are also expected to grow at the fastest CAGR rate during the forecast period. This can be attributed to an increase in the demand for blood and blood products for the treatment of various blood disorders, such as thalassemia, severe anemia, leukemia, and others. In addition, an increase in the cases of road accidents across the globe is anticipated to drive the demand for blood.

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 35% in 2022. The rising incidence of chronic illnesses, current technical developments, and the high demand for a sterile and hygienic environment to prevent contamination are some of the major drivers of the market expansion in the area. According to the National Health Council 2020 report, about 157 million individuals are estimated to have at least one chronic condition.

The increasing investment in the biopharmaceutical and pharmaceutical industry also drives the market. For instance, as per the Pharmaceutical Research and Manufacturers of America, the U.S. economy's most R&D-intensive business is the pharmaceuticals sector compared to all other manufacturing industries, the biopharmaceutical industry invests an average of six times more on R&D as a percentage of revenues. Furthermore, the U.S. biopharmaceutical industry has been at the forefront of developing new medications around the globe. In 2020, the U.S. biopharmaceutical industry as a whole invested approximately USD 122 billion in R&D. These development drugs offer treatment for a number of important therapeutic areas, including cancer, hemophilia, genetic disorders, and Amyotrophic lateral sclerosis, which promotes market expansion.

The Asia Pacific region is expected to grow at the fastest CAGR of 5.8% during the forecast period. An increase in major multinational companies investing in research & development in this region has proved to be a major factor driving the growth of the pharmaceutical & biopharmaceutical industries. China ranked second globally regarding the number of patent end uses and authorizations in life sciences and biotechnology in 2018, according to the "2019 China Life Science and Biotechnology Development Report" published by the Chinese Ministry of Science and Technology.

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. For instance, in May 2021, CPC (Colder Products Company), introduced the AseptiQuik G DC Series Connector to make closed-system liquid processing easier for biopharmaceutical firms by allowing tubing to be connected and disconnected aseptically utilizing a single, sterile connection technology.

Key Sterile Tubing Welder Companies:

- Sartorius AG

- Terumo BCT, Inc.

- GE Healthcare

- MGA Technologies

- Vante Biopharm / Sebra.

- Genesis BPS

- Biomen Biosystems Co., Ltd.

- SynGen, Inc.

- Sentinel Process Systems, Inc.

- Flex Concepts, Inc.

- Shanghai Le Pure Biological Technology Co., Ltd.

Sterile Tubing Welder Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.43 billion

Revenue forecast in 2030

USD 3.46 billion

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Sartorius AG; Terumo BCT, Inc.; GE Healthcare; MGA Technologies; Vante Biopharm / Sebra.; Genesis BPS; Biomen Biosystems Co., Ltd.; SynGen, Inc.; Sentinel Process Systems, Inc.; Flex Concepts, Inc.; Shanghai Le Pure Biological Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sterile Tubing Welder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sterile tubing welder market report based on application, mode, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical

-

Blood Processing

-

Diagnostic Laboratories

-

Others

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Research Clinics

-

Blood Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sterile tubing welder market size was estimated at USD 2.33 billion in 2022 and is expected to reach USD 2.43 billion in 2023.

b. The global sterile tubing welder market is expected to grow at a compound annual growth rate of 5.20% from 2023 to 2030 to reach USD 3.46 billion by 2030.

b. The blood processing segment held a significant share of the sterile tubing welder market in 2022 owing to the increasing demand of blood and blood products.

b. Some key players operating in the sterile tubing welder market include Sartorius Stedim Biotech S.A., Terumo BCT Inc, GE Healthcare, MGA technologies, VANTE Biopharm, Genesis BPS, Biomen Biosystems Company Ltd, Flex Concepts Inc, and Shanghai Le Pure Biological Technology Co., Ltd.

b. Increase in usage of single use technologies and increasing demand for blood & blood products is also anticipate to growth of sterile tubing welder market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."