- Home

- »

- Clinical Diagnostics

- »

-

STI And Vaginitis PCR Testing Market, Industry Report, 2030GVR Report cover

![STI And Vaginitis PCR Testing Market Size, Share & Trends Report]()

STI And Vaginitis PCR Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Condition (Sexually Transmitted Infections, Vaginal Infections), By Test Type (STI PCR Panels, Vaginitis PCR Panels), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-608-9

- Number of Report Pages: 179

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

STI And Vaginitis PCR Testing Market Trends

The global STI and vaginitis PCR testing market size was estimated at USD 660.97 million in 2024 and is projected to reach USD 1,111.9 million by 2030, growing at a CAGR of 9.21% from 2025 to 2030. This is attributed to the rising global incidence of sexually transmitted and vaginal infections.

Key Market Trends & Insights

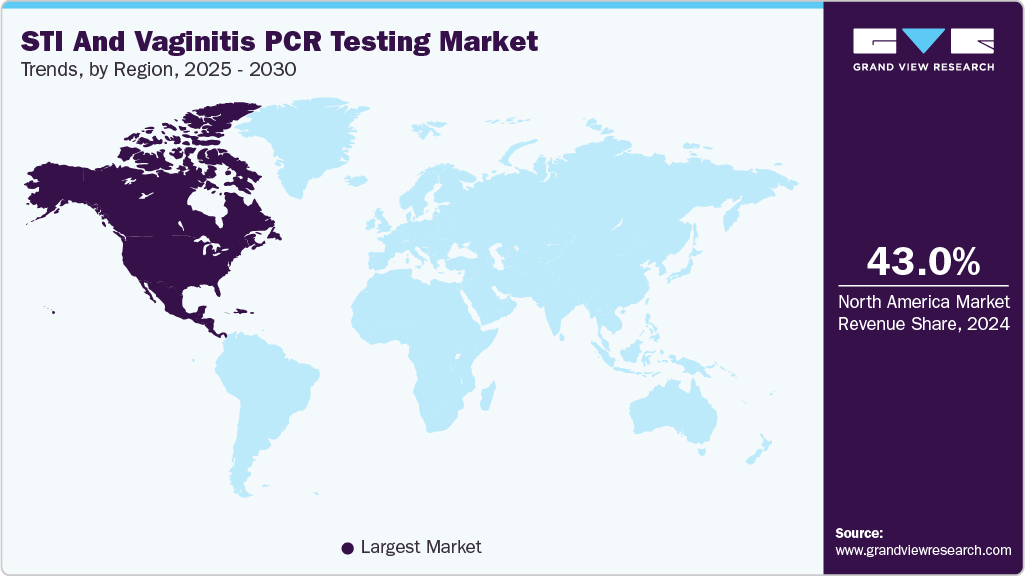

- North America STI and vaginitis PCR testing market dominated globally with a revenue share of 43.03% in 2024.

- The STI and vaginitis PCR testing market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- By condition, the sexually transmitted infection (STI) segment held the largest share of 66.37% in 2024.

- By test type, the STI PCR panels segment accounted for the largest share of 66.37% in 2024.

- By end-use, the diagnostic laboratories companies segment held the largest share of 43.05% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 660.97 Million

- 2030 Projected Market Size: USD 1,111.9 Million

- CAGR (2025-2030): 9.21%

- North America: Largest market in 2024

Increasing public awareness of sexual and reproductive health, and the increasing preference for highly sensitive molecular diagnostic methods such as PCR testing, significantly drive the market expansion. According to CDC data in 2023, more than 2.4 million cases of syphilis, gonorrhea, and chlamydia were diagnosed and reported in the U.S. This total comprised over 209,000 cases of syphilis, more than 600,000 cases of gonorrhea, and upwards of 1.6 million cases of chlamydia. Additionally, expanding access to at-home testing kits, technological advancements in multiplex PCR assays, and greater investment in public health infrastructure are expected to further drive market growth over the forecast period.

Developing regions are witnessing particularly sharp increases in STIs and vaginitis prevalence, primarily due to inadequate healthcare infrastructure and limited screening programs. Urbanization, migration, and high-risk sexual practices contribute to this rising disease burden. These factors increase the need for accessible, sensitive diagnostic tools capable of handling high sample volumes and delivering reliable results. With its ability to detect low levels of pathogen DNA or RNA, PCR testing meets these demands effectively and is increasingly adopted in public health screening initiatives across such regions.

Regulatory approvals for new PCR diagnostic tests significantly impact the growth trajectory of the STI and vaginitis PCR testing industry. Obtaining approvals from authorities such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regional bodies facilitates faster market access and builds confidence among healthcare providers. Recent approvals of multiplex PCR kits that detect multiple STIs and vaginitis-causing pathogens in a single test streamline the diagnostic process, enhancing clinical workflow efficiency. These authorized products set quality and performance benchmarks that encourage widespread adoption.

Recent Regulatory Approvals Driving Growth in the STI & Vaginitis PCR Testing Market

Company

Test Name

Approval Body

Approval Date

Test Description

Significance

Roche

Cobas Liat STI Assays

FDA

February 2025

Point-of-care PCR tests for Chlamydia trachomatis, Neisseria gonorrhoeae, and Mycoplasma genitalium.

Enables rapid STI diagnosis in clinics; results in ~20 minutes.

BD

BD Vaginal Panel on BD COR System

FDA (510(k))

March 2023

High-throughput PCR panel detecting bacterial vaginosis, candidiasis, and trichomoniasis.

Supports automated processing of up to 2,000 samples in 24 hours; improves lab efficiency.

Cepheid

Xpert Xpress MVP

FDA

November 2022

Multiplex PCR test detecting pathogens linked to vaginosis, candidiasis, and trichomoniasis.

Results in ~1 hour from a single sample; aids precise antimicrobial treatment.

Abbott

Alinity m STI Assay

FDA

May 2022

PCR test detecting and differentiating 4 STIs: chlamydia, gonorrhea, trichomoniasis, and M. genitalium.

First to offer 4-in-1 STI detection; supports high-throughput testing on the Alinity m platform.

Source: Grand View Research

Technological advancements in PCR testing are transforming the STI and vaginitis diagnostics landscape by improving accuracy, speed, and ease of use. Multiplex PCR technology allows simultaneous detection of multiple pathogens from a single sample, saving time and reducing costs. This capability is particularly important in STI and vaginitis testing due to the frequent co-occurrence of infections and overlapping symptoms. Improved assay designs with enhanced sensitivity and specificity reduce false positives and negatives, leading to better clinical decision-making and patient outcomes.

The integration of multiplex PCR diagnostic panels in both hospital laboratories and decentralized settings has enhanced the rapid and sensitive detection of co-infections. Technological innovations, including syndromic testing platforms, point-of-care molecular diagnostics, and automated PCR analyzers, have streamlined workflows and improved diagnostic accuracy. Notably, companies like QIAGEN have achieved CE-marking for their NeuMoDx platforms under the new EU in Vitro Diagnostic Regulation (IVDR), reflecting compliance with stringent regulatory standards. Further, in June 2022 CE-IVD marking of Bosch Healthcare Solutions' Vivalytic MG, MH, UP/UU test, developed in partnership with BioGX, represents a significant advancement in the European STI and vaginitis PCR testing market. This real-time PCR rapid test is designed to detect four sexually transmitted pathogens-Mycoplasma genitalium (MG), Mycoplasma hominis (MH), Ureaplasma parvum (UP), and Ureaplasma urealyticum (UU), with results available within an hour directly at the point of care.

Multiplex PCR panels have become the standard in many European clinical microbiology labs, supported by EU regulatory harmonization efforts and growing patient demand for comprehensive STI screening. Recent product launches from Roche, Hologic, and Seegene, alongside innovations in rapid and POC testing, are driving competitive dynamics. In April 2025, Seegene announced the development of CURECA, a next-generation, fully automated PCR solution designed to streamline laboratory workflows. The system aims to automate the entire PCR testing process, from sample pre-treatment to result analysis, enhancing efficiency and reducing human error.

Market Concentration & Characteristics

The STI and vaginitis PCR testing market demonstrates a high degree of innovation, driven by ongoing technological advancements in multiplex PCR platforms, automation, and integration of AI for result interpretation. Companies are investing in next-generation assays that provide faster, more accurate detection of multiple pathogens simultaneously. In February 2023, Thermo Fisher Scientific introduced the Applied Biosystems TrueMark STI Select Panel, a research-use-only (RUO) multiplex real-time PCR assay designed to simultaneously detect four common STIs: Chlamydia trachomatis, Neisseria gonorrhoeae, Trichomonas vaginalis, and Mycoplasma genitalium. The panel includes RNase P as an internal control and is optimized for use with QuantStudio real-time PCR instruments. This assay aims to streamline laboratory workflows by enabling the simultaneous detection of multiple pathogens in a single reaction well.

The STI and vaginitis PCR testing industry experiences a high level of mergers and acquisitions (M&A), as major players seek to broaden their technological capabilities, enhance their product portfolios, and enter new regional markets. Several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. Key players engaged in this growth strategy. In June 2022, R-Biopharm acquired AusDiagnostics, an Australian company specializing in multiplex molecular diagnostics. This acquisition expands R-Biopharm's capabilities in developing and manufacturing PCR-based assays, potentially enhancing its portfolio in STI and vaginitis testing.

Regulatory frameworks play a pivotal role in shaping the market. Compliance with evolving IVD (in vitro diagnostics) standards and timely approvals from regulatory bodies such as the FDA (U.S.), EMA (Europe), and NMPA (China) is critical for market entry and expansion. Strict requirements for sensitivity, specificity, and cross-reactivity testing drive manufacturers to enhance diagnostic accuracy. In September 2023, the U.S. FDA granted 510(k) clearance to Aptima BV and CV/TV assays by Hologic for the detection of bacterial vaginosis and candida vaginitis, strengthening regulatory trust in PCR-based vaginitis diagnostics.

Product expansion is currently high in the market for STI and vaginitis PCR testing, with companies diversifying their offerings by launching broader panels that cover more pathogens, introducing sample-to-answer systems, and targeting both clinical and at-home segments. For instance, in May 2025, Seegene announced the development of Cureca, a next-generation, fully automated PCR solution featuring customizable pre-treatment automation. This innovation underscores the industry's shift toward enhancing laboratory efficiency and diagnostic flexibility, which supports broader adoption in various clinical settings.

The STI and vaginitis PCR testing industry is witnessing a medium to high level of regional expansion as companies aim to tap into growth opportunities in emerging markets while solidifying their presence in established regions. Asia Pacific, led by China, Japan, and India, is experiencing accelerated growth due to increased government investment in sexual health programs, improved diagnostic infrastructure, and rising disease burden.

Condition Insights

The sexually transmitted infection (STI) segment held the largest market share of 66.37% in 2024, driven by the high prevalence and wide range of pathogens involved. Conditions such as Chlamydia and Gonorrhea drive significant demand, as they are among the most commonly reported infections globally and often remain asymptomatic. For instance, according to the CDC’s 2023 report, over 2.4 million cases of syphilis, chlamydia, and gonorrhea were diagnosed and reported. This contains over 209,000 cases of syphilis, over 600,000 cases of gonorrhea, and over 1.6 million cases of chlamydia. Importantly, the integrated count consists of 3,882 cases of congenital syphilis, including 279 congenital syphilis stillbirths and infant deaths. PCR testing offers a significant advantage in STI detection due to its ability to deliver high sensitivity and specificity, even in asymptomatic individuals. Multiplex assays are increasingly used to detect co-infections in a single sample, reducing time to diagnosis and optimizing treatment decisions. Healthcare providers rely on these tests in both routine screenings and symptomatic cases, especially in sexually active and high-risk populations.

Vaginal infections is expected to grow at the fastest CAGR during the forecast period. Rising awareness of the clinical implications of vaginal infections is prompting healthcare systems to prioritize molecular diagnostics. Multiplex PCR assays enable simultaneous detection of key pathogens like Gardnerella vaginalis, Candida spp., Trichomonas vaginalis, and Atopobium vaginae, offering clinicians a broader view of vaginal health in a single test. For instance, In March 2023, BD (Becton, Dickinson, and Company) received expanded FDA clearance for its BD MAX Vaginal Panel, which demonstrated improved diagnostic performance for BV and VVC, reflecting growing regulatory support for PCR-based diagnostics. Hospitals, diagnostic laboratories, and OB/GYN clinics increasingly utilize these tools to guide precise treatment strategies and reduce recurrence.

Test Type Insights

The STI PCR panels segment accounted for the largest share of 66.37% in 2024. STI PCR panels are multiplex molecular assays designed to simultaneously detect various sexually transmitted pathogens, including Chlamydia trachomatis, Neisseria gonorrhoeae, Trichomonas vaginalis, Mycoplasma genitalium, Ureaplasma species, Herpes Simplex Virus (HSV), Human Papillomavirus (HPV), and others. These panels offer a comprehensive and efficient approach to STI diagnosis, minimizing the need for multiple individual tests and reducing overall diagnostic costs. For instance, in February 2023, Thermo Fisher Scientific launched the TrueMark STI Select Panel, a multiplex PCR test that detects six common STIs simultaneously. The test enhances sensitivity and speed on QuantStudio PCR systems, improving clinical outcomes. This launch propels molecular diagnostics forward and streamlines lab workflows. The high sensitivity and specificity of PCR technology facilitate accurate detection, even in asymptomatic cases or low pathogen loads.

The vaginitis PCR panels segment of the STI and vaginitis PCR testing market is expected to grow at the fastest CAGR during the forecast period. Vaginitis PCR panels are multiplex molecular assays designed to detect a broad range of pathogens responsible for common vaginal infections, including Candida species, Gardnerella vaginalis, Trichomonas vaginalis, Atopobium vaginae, and other key microorganisms. For instance, In November 2022, Cepheid announced the U.S. launch of the Multiplex Vaginal Panel (MVP), a rapid PCR test detecting 14 pathogens linked to vaginitis and vaginosis. The test delivers results in about 75 minutes using the GeneXpert system. This launch enhances diagnostic accuracy and speeds up clinical decision-making in women’s health. These panels enable comprehensive diagnosis by simultaneously identifying multiple causative agents, which is essential given the overlapping symptoms and frequent co-infections in vaginitis cases.

End-use Insights

The diagnostic laboratories companies segment held the largest share of 43.05% in 2024. Diagnostic laboratories play a vital role in the STI & vaginitis PCR testing market by providing specialized molecular diagnostic services that enable accurate detection and management of infections. These labs are equipped with advanced multiplex PCR platforms, allowing simultaneous detection of multiple pathogens from a single sample with high sensitivity and specificity. Leading diagnostic providers such as Quest Diagnostics in the USA and Synlab in Europe implement standardized protocols to ensure consistent and reliable results. The increasing need for rapid and precise diagnostics has accelerated the adoption of PCR assays in these facilities.

The homecare and at-home testing segment is projected to experience the fastest CAGR during the forecast period. The widespread availability of internet access and smartphones worldwide facilitates the growth of at-home STI and vaginitis testing by enhancing information accessibility and service delivery. Patients gain increased control over their sexual and reproductive health by diagnosing infections early and seeking timely treatment. Collaborations between diagnostic companies and online healthcare providers are intensifying, broadening the market’s reach and building consumer confidence. Regulatory frameworks and reimbursement policies are adapting to support these products, fostering further innovation and accessibility.

Regional Insights

North America STI and vaginitis PCR testing market dominated globally with a revenue share of over 43.03% in 2024. The region's strong emphasis on early detection and routine screening has played a vital role in boosting market demand. The surge in sexually transmitted infections, particularly among young adults, is driving the need for efficient, accurate, and rapid diagnostic solutions like PCR-based tests. The market is also benefiting from continuous investments in molecular diagnostics and a favorable reimbursement landscape. Notably, in March 2025, the Visby Sexual Health Test has recently received FDA De Novo authorization for over-the-counter use, marking a significant milestone as the first-ever at-home PCR test for sexual health, empowering individuals with discreet and convenient access to STI screening. Further, the widespread acceptance of CLIA-waived tests, provincial screening initiatives, and public reimbursement strategies reinforces this market’s forward momentum.

U.S. STI and Vaginitis PCR Testing Market Trends

The U.S. leads the STI and vaginitis PCR testing industry, propelled by its high disease burden, sophisticated healthcare facilities, and proactive regulatory environment. The CDC’s guidelines supporting routine STI screening, particularly for sexually active populations, are encouraging broad adoption. Technological advancements in multiplex PCR assays, which allow for the simultaneous detection of multiple pathogens, have significantly enhanced diagnostic efficiency. For instance, in January 2025, Roche announced the launch of a new molecular PCR-based diagnostic test for vaginitis, aiming to improve the accuracy of diagnosing common vaginal infections such as bacterial vaginosis, vulvovaginal candidiasis, and trichomoniasis. The test is integrated into the cobas molecular platform, enabling high-throughput and reliable results suitable for clinical laboratories.

Europe STI and Vaginitis PCR Testing Market Trends

The Europe STI and vaginitis PCR testing industry is evolving rapidly. European governments and NGOs are collaborating with private labs to ensure equitable access to diagnostic services. Advances in laboratory automation and the integration of AI in result analysis are gaining traction. The market is also experiencing a push toward decentralizing testing services, including self-sampling kits, to enhance compliance and accessibility.

The UK STI and vaginitis PCR testing market is experiencing significant growth. The UK has witnessed a notable increase in STI cases, with Chlamydia trachomatis remaining the most commonly diagnosed STI. The National Health Service (NHS) has emphasized early detection and treatment, leading to widespread implementation of PCR-based testing in both public and private laboratories. In 2022, Preventx, the UK's leading provider of remote sexual health testing, reported a significant increase in gonorrhoea positivity rates among users of online STI testing services across England. The data, derived from over 2.2 million tests conducted through 70 NHS services, revealed a 55% rise in gonorrhoea positivity from 1.28% in 2019 to 1.99% in 2022. This uptick was notably higher among individuals aged 18-21, men, those identifying as gay or bisexual, and individuals from Asian and Latin American ethnic backgrounds.

The STI and vaginitis PCR testing market in Germany is expanding, driven by diagnostic laboratories across Germany, which are increasingly adopting automated PCR platforms capable of detecting multiple pathogens in a single test. Recent innovations include mobile diagnostic units and AI-enhanced lab technologies that enhance accuracy and speed.

Asia Pacific STI and Vaginitis PCR Testing Market Trends

The Asia Pacific STI and vaginitis PCR testing market is expected to experience substantial growth at a CAGR of 11.56% during the forecast period. The Asia Pacific market is characterized by a combination of multinational corporations and regional players. Key companies include Seegene Inc., a Korean biotechnology firm specializing in multiplex PCR technologies; Roche Diagnostics, which offers comprehensive molecular diagnostic solutions; Abbott Laboratories, providing a suite of diagnostic tools, including PCR-based assays; Hologic Inc., known for its Aptima series; BD (Becton, Dickinson and Company), which offers molecular diagnostic platforms; Qiagen NV, offering a range of nucleic acid testing solutions; and Thermo Fisher Scientific Inc., providing PCR instruments and assays applicable in STI diagnostics.

The China STI and vaginitis PCR testing market held a substantial share in 2024. The market is advancing steadily due to the recent innovations. The country is experiencing significant advancements in PCR diagnostics, with domestic manufacturers developing portable and rapid test kits targeting key pathogens. Urban centers are particularly witnessing high demand for STI testing, driven by improved access and changing attitudes toward sexual health. China’s centralized healthcare policy has facilitated public health screenings and subsidized diagnostic testing in some regions. In March 2024, BioPerfectus, a leading Chinese molecular diagnostics company, announced two strategic product launches to expand its sexually transmitted diseases (STD) diagnostic portfolio using real-time PCR technology. On March 11, 2024, the company introduced a comprehensive PCR kit targeting eight common STDs, including Neisseria gonorrhoeae, Chlamydia trachomatis, Mycoplasma genitalium, Ureaplasma urealyticum, Ureaplasma parvum, Trichomonas vaginalis, Treponema pallidum (syphilis), and Herpes Simplex Virus types 1 and 2.

The STI and vaginitis PCR testing market in Japan is progressing steadily, driven by high healthcare standards, an aging population with comorbidities, and cultural shifts that are improving acceptance of STI testing. The market is witnessing an uptick in demand for multiplex PCR tests that enable rapid diagnosis of co-infections like chlamydia and gonorrhea.

Latin America STI and Vaginitis PCR Testing Market Trends

The STI and vaginitis PCR testing industry in Latin America, encompassing countries such as Brazil, Chile, Peru, Argentina, and Colombia, is poised for significant growth driven by technological advancements in the healthcare sector. Latin America's market for STI and vaginitis PCR testing is experiencing steady growth, propelled by a high prevalence of infectious diseases, advancements in diagnostic technologies, and supportive regulatory environments.

The STI and vaginitis PCR testing market in Brazil is witnessing substantial growth, fueled by the rising prevalence of infections. Brazil faces a significant burden of STIs. According to the Pan American Health Organization (PAHO), in 2022, there were approximately 3.36 million new cases of syphilis in the Americas, with Brazil accounting for a substantial portion due to its large population.

Middle East & Africa STI and Vaginitis PCR Testing Market Trends

The Middle East and Africa (MEA) STI and vaginitis PCR testing industry is poised for growth during the forecast period. The rising demand for advanced diagnostic solutions is further fueled by the region’s high prevalence of communicable and infectious diseases. For instance, during the COVID-19 pandemic, the surge in cases across MEA led to a significant increase in demand for IVD tests. According to the Institute for Health Metrics and Evaluation, COVID-19 became the fourth leading cause of death in the region by 2021, highlighting the critical role of diagnostics in managing public health crises.

In September 2024, Nanostics Inc., a precision health company, partnered with OncoHelix, a precision diagnostics provider, to introduce ClarityDX Prostate, a diagnostic tool for detecting aggressive prostate cancer, to the Middle East and North Africa (MENA) region. OncoHelix operates a state-of-the-art facility, OncoHelix-coLAB, in Abu Dhabi, in collaboration with Burjeel Holdings. This partnership aims to improve patient diagnostics and treatment outcomes by bringing advanced molecular diagnostics to the region.

The Africa STI and vaginitis PCR testing market is expected to grow over the forecast period. A pivotal development was highlighted in May 2024, when researchers in South Africa validated a new rapid test for gonorrhea using both NG-LFA and the Xpert CT/NG PCR assay in a study involving 400 patients. The molecular component, based on PCR, demonstrated high sensitivity and specificity, reinforcing the reliability of molecular platforms in field settings. This study not only supports the shift from syndromic to etiological diagnosis but also strengthens the case for scaling up multiplex PCR panels across urban and peri-urban clinics in Africa.

Key STI and Vaginitis PCR Testing Company Insights

Key players operating in the STI and vaginitis PCR testing industry aim to drive innovation, expand market reach, and strengthen their competitive position. The players are seeking regulatory approvals, such as FDA and CE-IVD, for their products to ensure compliance and expand their market access.

Key STI and Vaginitis PCR Testing Companies:

The following are the leading companies in the STI and vaginitis PCR testing market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Abbott

- Danaher Corporation (Cepheid)

- Seegene Inc.

- bioMérieux (BioFire Diagnostics)

- QIAGEN

- Thermo Fisher Scientific, Inc.

- DiaSorin S.p.A (Luminex)

- Sansure Biotech Inc

- R-Biopharm AG

- altona Diagnostics GmbH

- CERTEST BIOTEC

Recent Developments

-

In January 2025, Roche received FDA 510(k) clearance and CLIA waiver for its cobas liat STI multiplex assay panels, including tests for Chlamydia trachomatis and Neisseria gonorrhoeae (CT/NG) and a three-pathogen panel adding Mycoplasma genitalium (CT/NG/MG). These assays enable rapid, point-of-care PCR testing with results in about 20 minutes, allowing diagnosis and treatment decisions during a single visit.

-

In January 2024, The FDA granted expanded clearance along with a Clinical Laboratory Improvement Amendments (CLIA) waiver for the Xpert Xpress MVP test. This approval allows the test to be used in near-patient settings, enabling rapid diagnosis of BV, VVC, and TV in women aged 14 and older.

-

In January 2024, QIAGEN received FDA clearance for its NeuMoDx CT/NG Assay 2.0, designed for the direct detection of Chlamydia trachomatis (CT) and Neisseria gonorrhoeae (NG). This assay is compatible with both NeuMoDx 96 and 288 Molecular Systems, offering rapid results and aiming to improve accessibility and timeliness in STI testing in the U.S.

-

In May 2023, Bengaluru-based NeoDx Biotech Labs introduced seven real-time PCR-based kits targeting infectious diseases, including HBV, HCV, and HIV. A standout product is the PathoPlex HIV, HBV & HCV Qualitative RT-PCR Detection Kit, a multiplex assay capable of detecting all three viruses in a single-tube reaction within 90 minutes.

STI and Vaginitis PCR Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 715.59 million

Revenue forecast in 2030

USD 1,111.9 million

Growth rate

CAGR of 9.21% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, clinical trials outlook, volume analysis

Segments covered

Condition, test type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Portugal; Hungary; Turkey; Slovenia; Norway; Denmark; Sweden; Estonia; Finland; Latvia; Lithuania; Poland; Russia; Ukraine; Japan; China; India; Australia; South Korea; Thailand; Malaysia; Indonesia; Vietnam; Taiwan; Mongolia; Brazil; Argentina; Colombia; Chile; Ecuador; Peru; Saudi Arabia; UAE; Kuwait; Africa

Key companies profiled

BD; F. Hoffmann-La Roche Ltd. (Net sale); Hologic, Inc.; Abbott; Danaher Corporation (Cepheid); Seegene Inc.; bioMérieux (BioFire Diagnostics); QIAGEN; Thermo Fisher Scientific, Inc.; DiaSorin S.p.A (Luminex); Sansure Biotech Inc.; R-Biopharm AG; altona Diagnostics GmbH; CERTEST BIOTEC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global STI And Vaginitis PCR Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global STI and vaginitis PCR testing market report based on condition, test type, end-use, and region:

-

Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Sexually Transmitted Infections (STIs)

-

Chlamydia

-

Gonorrhea

-

Trichomoniasis

-

Herpes Simplex Virus (HSV-1 & HSV-2)

-

Human Papillomavirus (HPV)

-

Syphilis

-

Other

-

-

Vaginal Infections

-

Bacterial Vaginosis

-

Vulvovaginal Candidiasis

-

Other

-

-

-

Test type Outlook (Revenue, USD Million, 2018 - 2030)

-

STI PCR Panels

-

Vaginitis PCR Panels

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Diagnostic Laboratories

-

Homecare/At-home Testing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Portugal

-

Hungary

-

Turkey

-

Slovenia

-

Norway

-

Denmark

-

Sweden

-

Estonia

-

Finland

-

Latvia

-

Lithuania

-

Poland

-

Russia

-

Ukraine

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Malaysia

-

Indonesia

-

Vietnam

-

Taiwan

-

Mongolia

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Ecuador

-

Peru

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Africa

-

-

Frequently Asked Questions About This Report

b. The global STI and vaginitis PCR testing market size was estimated at USD 660.97 million in 2024 and is expected to reach USD 715.59 million in 2025.

b. The global STI and vaginitis PCR testing market is expected to grow at a compound annual growth rate of 9.21% from 2025 to 2030 to reach USD 1,111.9 million by 2030.

b. North America dominated the STI and vaginitis PCR testing market with a share of 43.03% in 2024. This is attributable to the rising infection rates, advancements in molecular diagnostics, and broader public health initiatives

b. Some key players operating in the STI and vaginitis PCR testing market include BD, F. Hoffmann-La Roche Ltd. (Net sale), Hologic, Inc., Abbott, Danaher Corporation (Cepheid), Seegene Inc., bioMérieux (BioFire Diagnostics), QIAGEN, Thermo Fisher Scientific, Inc., DiaSorin S.p.A (Luminex), Sansure Biotech Inc., R-Biopharm AG, and altona Diagnostics GmbH.

b. Key factors that are driving the market growth include the rising prevalence of sexually transmitted infections (STIs) and vaginitis, regulatory approvals for new PCR diagnostic tests and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.