- Home

- »

- Plastics, Polymers & Resins

- »

-

Stick Packaging Market Size, Share, Industry Report, 2033GVR Report cover

![Stick Packaging Market Size, Share & Trends Report]()

Stick Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (BOPP, PE, Paper, Metallized Films), By End Use (Food & Beverages, Cosmetics, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-351-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Stick Packaging Market Summary

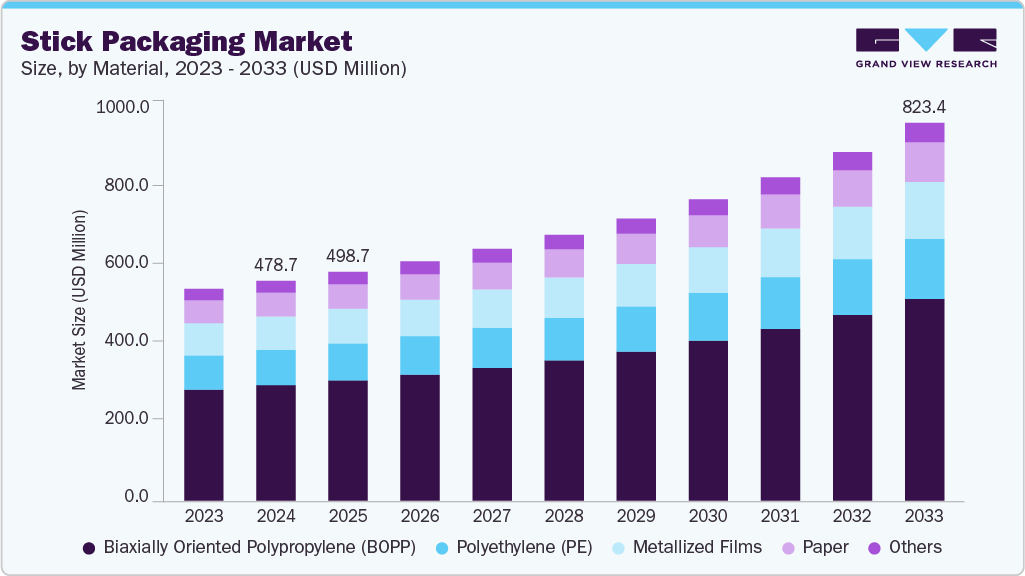

The global stick packaging market size was valued at USD 478.7 million in 2024 and is expected to reach USD 823.4 million by 2033, expanding at a CAGR of 6.5% from 2025 to 2033. The global industry is driven by rising demand for convenient, single-serve, and portable packaging solutions across the food, beverage, and pharmaceutical sectors.

Key Market Trends & Insights

- Asia Pacific dominated the stick packaging market with the largest revenue share of over 36.0% in 2024.

- Country-wise, the stick packaging market in the U.S. accounted for the largest revenue share in North America in 2024.

- By material, the biaxially oriented polypropylene (BOPP) led the market with the largest revenue share of over 52.0% in 2024.

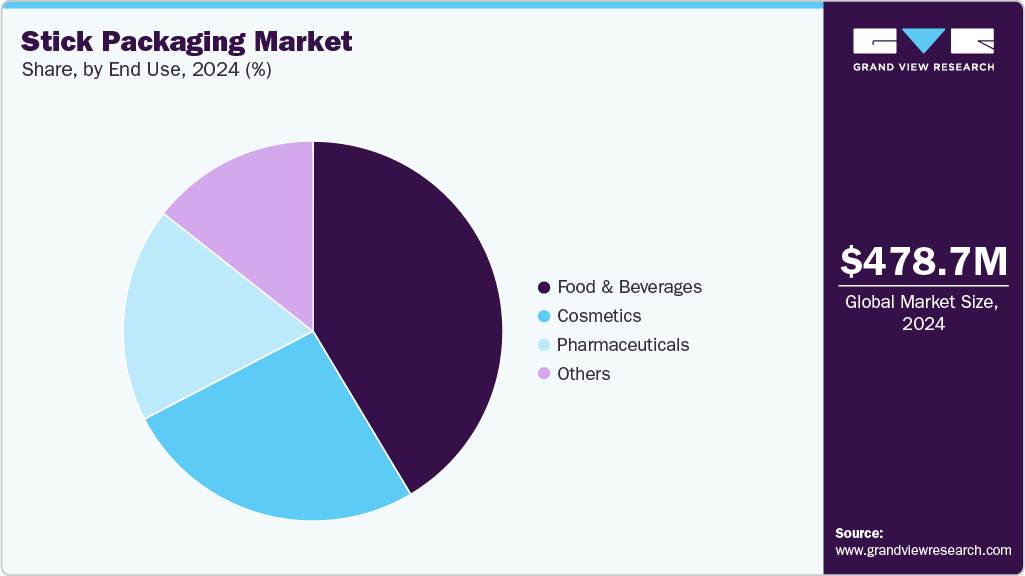

- By end use, the food & beverages segment led the market with the largest revenue share of over 41.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 478.7 Million

- 2033 Projected Market Size: USD 823.4 Million

- CAGR (2025-2033): 6.5%

- Asia Pacific: Largest Market in 2024

- North America: Fastest Growing Market

Additionally, growing consumer preference for lightweight, sustainable, and easy-to-use packaging formats boosts market growth. The fast-paced lifestyle of urban consumers has led to an increased preference for compact and easy-to-use packaging formats, particularly for food, beverages, nutraceuticals, and pharmaceuticals. Stick packs are lightweight, portable, and require minimal storage space, making them ideal for products such as instant coffee, drink mixes, energy gels, powdered supplements, and condiments. This convenience-driven shift is particularly evident among millennials and working professionals who prioritize portability and portion control.The versatility of stick packaging has led to its widespread adoption across multiple end-use industries. In the food and beverage industry, it is increasingly used for products like sugar, salt, spices, and powdered beverages, helping maintain freshness and prevent contamination. In pharmaceuticals and nutraceuticals, stick packs are used for powdered formulations, rehydration salts, and dietary supplements, offering precise dosage and improved user compliance. The pharmaceutical sector, in particular, favors stick packaging for its hygienic, single-use format that ensures product integrity and minimizes wastage. This expanding application base continues to drive market growth across regions.

Sustainability trends are playing a major role in driving the industry forward. Manufacturers are increasingly focusing on developing eco-friendly materials such as recyclable mono-layer films, biodegradable plastics, and paper-based laminates. These innovations align with global sustainability goals and appeal to environmentally conscious consumers. Moreover, advancements in barrier technologies have improved moisture and oxygen resistance, extending product shelf life without compromising sustainability. Companies are investing in lightweight, resource-efficient packaging solutions that reduce carbon footprints during transportation and disposal, further fueling market demand.

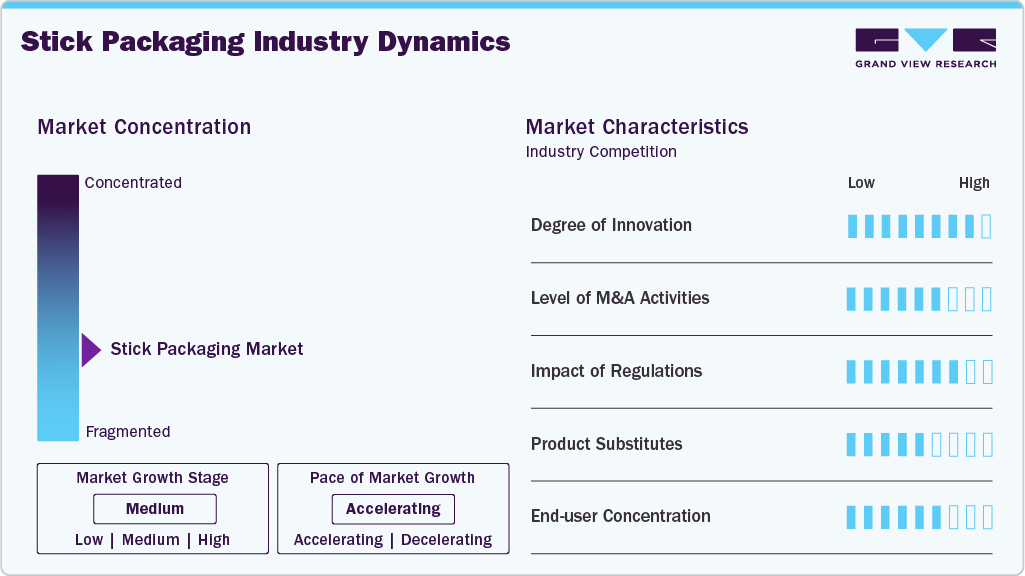

Market Concentration & Characteristics

The industry is characterized by its high growth potential, strong focus on convenience, and increasing emphasis on sustainability. It operates within the broader flexible packaging sector and is defined by lightweight, single-serve packaging formats designed for easy dispensing and portability. The industry caters to diverse end-use sectors, including food & beverages, pharmaceuticals, nutraceuticals, personal care, and household products. Its growth is driven by evolving consumer lifestyles favoring on-the-go consumption and portion-controlled packaging. The ability of stick packs to reduce packaging material usage and transportation costs makes them attractive for both manufacturers and consumers.

The industry is strongly influenced by regulatory standards and sustainability initiatives. Increasing regulations on plastic usage and growing environmental awareness have accelerated the adoption of recyclable, compostable, and bio-based materials. Moreover, stringent safety and labeling requirements in the food and pharmaceutical sectors necessitate compliance with international packaging standards such as the FDA and EU directives. These regulatory and environmental pressures, combined with consumer demand for eco-conscious packaging, are shaping the future trajectory of the global stick packaging industry toward greater innovation, sustainability, and efficiency.

Material Insights

The BOPP segment recorded the largest revenue share of over 52.0% in 2024 and is expected to grow at the fastest CAGR of 6.7% during the forecast period. BOPP is one of the most widely used materials in stick packaging due to its excellent mechanical strength, moisture resistance, and clarity. The biaxial orientation process enhances tensile strength and barrier properties, making it suitable for food, pharmaceuticals, and cosmetics. BOPP films are lightweight, printable, and sealable, which allows for attractive branding and improved shelf appeal. They are commonly used for packaging products like instant coffee, sugar, powdered drink mixes, and nutritional supplements.

Polyethylene (PE), particularly Low-Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE), is widely used in stick packaging for its flexibility, chemical resistance, and superior sealing properties. PE films provide an excellent moisture barrier, making them ideal for products such as sauces, condiments, dairy powders, and energy gels. PE is often combined with other substrates (such as PET or aluminum foil) to enhance performance. Manufacturers prefer PE for its easy processability in form-fill-seal machines and for applications that require a soft, squeezable texture.

End Use Insights

The food & beverages segment recorded the largest market share of over 41.0% in 2024 and is projected to grow at the fastest CAGR of 6.7% during the forecast period. This positive outlook is due to its convenience, portion control, and extended shelf life. Common applications include instant coffee sticks, powdered drink mixes, sugar sticks, energy drink powders, and snack sticks. The packaging is usually made from laminated films, paperboard, or plastic composites to ensure product protection from moisture, oxygen, and light. Leading brands such as Nescafé and Nestlé often use stick packaging for single-serve products to appeal to busy consumers and enhance portability. The expansion of modern retail and e-commerce channels boosts the adoption of stick packaging for easy distribution and consumer accessibility.

Stick packaging is increasingly applied in the pharmaceutical sector for powders, supplements, oral rehydration salts, vitamins, and nutraceuticals. This format ensures precise dosing, hygiene, and easy transport, especially in single-dose formats for hospitals, pharmacies, and home use. Materials like high-barrier aluminum laminates or multi-layer plastics are often used to protect sensitive compounds from moisture, light, and oxygen. Regulatory emphasis on dosage accuracy and hygiene, growth in over-the-counter (OTC) supplements, and increased health awareness among consumers are key drivers for this segment.

Regional Insights

Asia Pacific stick packaging market recorded the largest share of over 36.0% in 2024. The region has witnessed a significant shift toward convenience-oriented consumption patterns, particularly in ready-to-drink beverages, instant coffee, and powdered food products, which are ideally suited for stick packaging. Countries such as China, India, and Japan have a high prevalence of on-the-go lifestyles, particularly among younger demographics, fueling demand for portable, single-serve packaging. Additionally, the expansion of the food service industry, online retail, and e-commerce platforms has accelerated the adoption of stick packs for individual servings, allowing consumers to order powdered beverages, health supplements, and condiments conveniently.

Europe Stick Packaging Market Trends

Thestick packaging market in Europe is driven by stringent sustainability regulations, growing demand for convenient and eco-friendly packaging, and high consumer preference for premium products. Countries such as Germany, France, and UK have actively adopted sustainable solutions in line with EU directives on recyclability and single-use plastics, encouraging manufacturers to switch from traditional sachets to recyclable or mono-material stick packs. Additionally, the prevalence of health-conscious consumers and dietary supplements in Europe supports high demand for stick packs in nutraceutical and pharmaceutical applications.

North America Stick Packaging Market Trends

The stick packaging market in North America is expected to grow at the fastest CAGR of 7.0% over the forecast period. This positive outlook is due to high consumer awareness, premiumization of packaged foods, and strong demand for convenience products. The region has a mature market for instant beverages, powdered nutritional supplements, and single-serve snacks, making stick packaging a preferred solution. Consumers increasingly prefer products that offer portion control, hygiene, and portability, particularly in urban areas where busy lifestyles dominate. Brands like Nestlé, Starbucks, and Kraft Heinz leverage stick packaging for powdered coffee, drink mixes, and condiments to cater to these needs.

The U.S. is a leading market for stick packaging due to high consumption of instant beverages, powdered nutritional supplements, and condiments. Busy lifestyles and increasing demand for single-serve, portable packaging drive the adoption of stick packs in households and offices. Brands such as Kraft Heinz, Starbucks, and GNC utilize stick packaging to offer convenience while maintaining hygiene and portion accuracy.

Key Stick Packaging Companies Insights

Key players operating in the stick packaging market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Stick Packaging Companies:

The following are the leading companies in the stick packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Constantia Flexibles

- Glenroy, Inc.

- Catalent, Inc

- Huhtamaki

- ePac Holdings, LLC

- Taghleef Industries

- Polynova Industries Inc

- Elitefill

- Kimac Industries

- CarePac

- ProAmpac

- Qingdao Haide Packaging Co., Ltd

Recent Developments

-

In April 2025, Amcor plc completed its all-stock acquisition of Berry Global Inc., creating a global packaging leader with around 400 facilities, 75,000 employees, and operations in 140 countries. The merger, valued at approximately USD 13.0 billion, enhances Amcor's portfolio with expanded material science and innovation capabilities, positioning it to deliver more consistent growth and improved margins.

-

In March 2025, ProAmpac, in partnership with Aptar CSP Technologies, expanded its ProActive Intelligence platform with Moisture Protect MP-1000-an advanced sustainable film using Aptar’s 3-Phase Activ-Polymer technology. Designed for moisture-sensitive products such as probiotic stick packs, it eliminates the need for desiccant packets, streamlining production, reducing inventory, and extending shelf life.

-

In February 2025, Karma Water launched its new Probiotic and Energy Stick Packs, representing a significant innovation in portable wellness hydration by delivering the same premium ingredients and functional benefits as their bottled waters in a compact, easy-to-mix powder format.

Stick Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 498.7 million

Revenue forecast in 2033

USD 823.4 million

Growth rate

CAGR of 6.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Amcor plc; Constantia Flexibles; Glenroy, Inc.; Catalent, Inc; Huhtamaki; ePac Holdings, LLC; Taghleef Industries; Polynova Industries Inc; Elitefill; Kimac Industries; CarePac; ProAmpac; Qingdao Haide Packaging Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

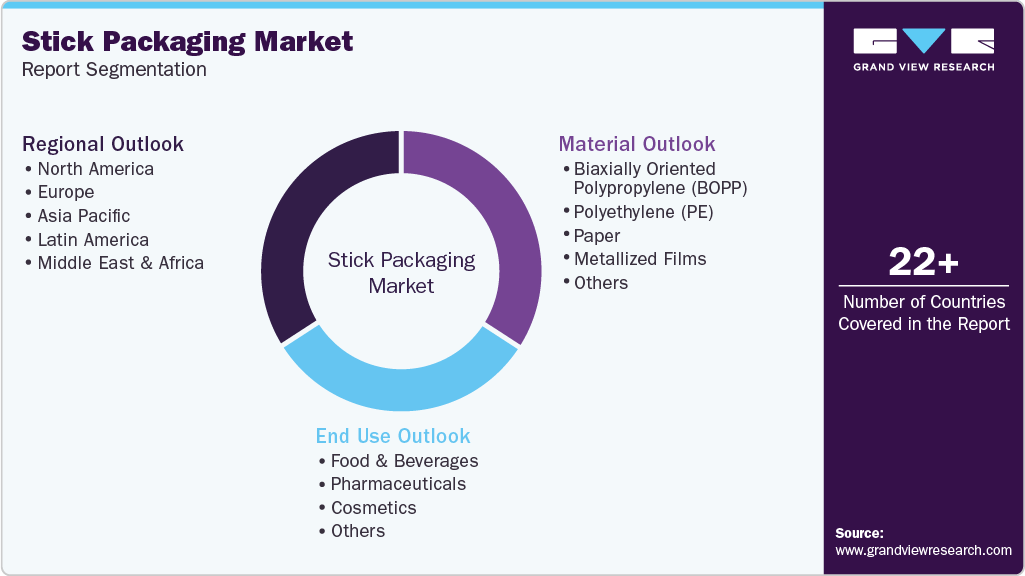

Global Stick Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global stick packaging market report on the basis of material, end use, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Biaxially Oriented Polypropylene (BOPP)

-

Polyethylene (PE)

-

Paper

-

Metallized Films

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Pharmaceuticals

-

Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global stick packaging market was estimated at around USD 478.7 million in the year 2024 and is expected to reach around USD 498.7 million in 2025.

b. The global stick packaging market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2033 to reach around USD 823.4 million by 2033.

b. The food & beverages segment dominates the stick packaging market due to its high demand for convenient, single-serve, and on-the-go packaging formats that enhance portability and portion control.

b. Key players in the market include Amcor plc; Constantia Flexibles; Glenroy, Inc.; Losan Pharma; Catalent, Inc; Fres-co System USA, Inc; GFR Pharma; ARANOW Packaging Machinery, S.L.; ePac Holdings, LLC; Korpack; Polynova Industries Inc; Elitefill; FLEXI Srl; Kimac Industries; CarePac; T.H.E.M.; and Associated Labels & Packaging.

b. The global stick packaging market is experiencing significant growth due to several key drivers and emerging opportunities. The increasing demand for convenient and portable packaging solutions is one of the primary factors propelling market growth. Stick packaging offers an easy-to-use, single-serve format that is ideal for on-the-go consumption, making it highly popular in the food & beverage, pharmaceutical, and cosmetics industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.