- Home

- »

- Advanced Interior Materials

- »

-

Stone Paper Market Size & Share, Industry Report, 2033GVR Report cover

![Stone Paper Market Size, Share & Trends Report]()

Stone Paper Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Packaging Papers, Labeling Papers, Self-adhesive Papers), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa) And Segment Forecasts

- Report ID: GVR-1-68038-099-6

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Stone Paper Market Summary

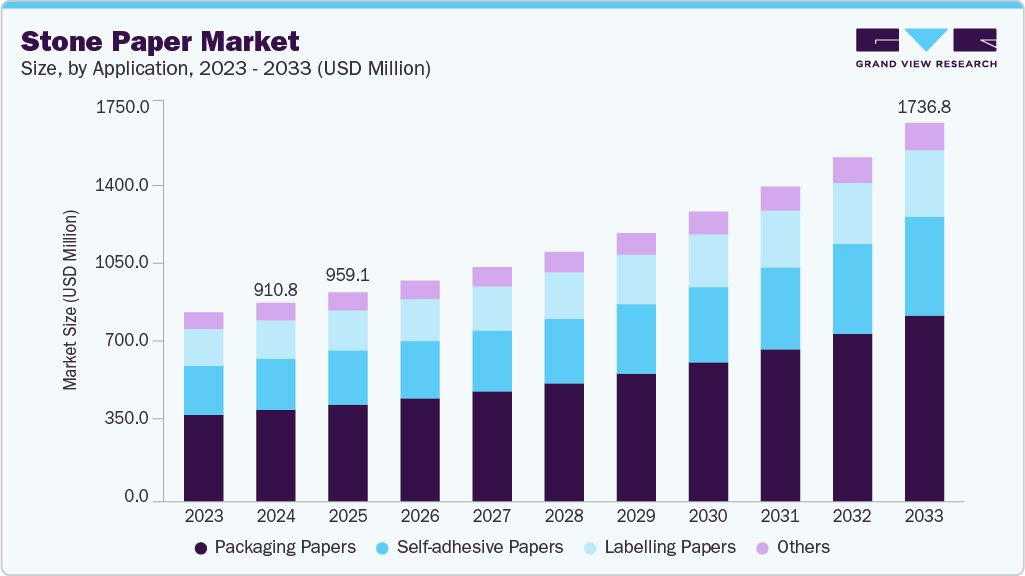

The global stone paper market size was estimated at USD 959.1 million in 2025 and is projected to reach USD 1,736.8 million by 2033, growing at a CAGR of 8.0% from 2026 to 2033. Product demand is expected to witness significant growth over the projected period on account of ecofriendly, recyclable, and waterproof qualities of stone paper.

Key Market Trends & Insights

- Asia Pacific dominated the stone paper industry with the largest revenue share of 50.4% in 2025.

- The stone paper industry in India is expected to grow at a substantial CAGR of 9.0% from 2026 to 2033.

- By application, the packaging papers segment is expected to grow at a considerable CAGR of 8.8% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 959.1 Million

- 2033 Projected Market Size: USD 1,736.8 Million

- CAGR (2026-2033): 8.0%

- Asia Pacific: Largest market in 2025

In addition, increasing environmental concerns regarding deforestation to synthesize wood pulp is expected to fuel the product demand over the forecast period to replace the conventional paper. In addition, bolstering global trade due to advanced e-commerce platforms are raising the demand for sustainable packaging products including bags and cardboard boxes made from stone paper. This is expected to add immense opportunities to the market over the forecast period.Presence of highly advanced packaging industry is anticipated to fuel the product demand in the U.S. Presence of manufacturers such as Ball Corporation, International Paper and Sealed Air are anticipated to further expand the packaging industry in the U.S and thus promoting the product market in the country. The manufacturers such as Stone Paper and Kapstone are located in U.S and they strive hard to develop stone papers for advanced packaging applications.

The stone paper industry is an emerging industry that is expected to have a positive environmental impact by reducing reliance on wood pulp for conventional paper production. While the manufacturing process is relatively simple, the raw materials used undergo multiple stages of processing before being converted into finished stone paper products. The value chain of the GCC stone paper industry comprises several interconnected stakeholders, including raw material suppliers, manufacturers, distributors and suppliers, end users, and aftermarket participants. Each stage of the value chain plays a critical role in ensuring material efficiency, product quality, and the increasing adoption of stone paper across packaging, labeling, and stationery applications in the region.

Furthermore, the supply chain matrix can be primarily divided into four stages namely raw-material procurement, production, distribution, sales, and aftermarket services. The procurement process involves the operation of procuring raw materials including calcium carbonate and high-density polyethylene. Key suppliers are vertically integrated into the value chain, as they extract limestone and further process it to form calcium carbonate. The suppliers get the limestone from countries such as China, the U.S., India, Russia, Brazil, and Japan.

Key players in the stone paper industry are focusing on achieving optimal operational costs, enhancing the product quality, maximizing production output and expanding geographical presence in order to sustain in the competitive market. Product launch and expanding its reach to the consumer are being focused on by the players. Moreover, R&D for innovating the packaging methods is also a factor considered by the players to stay in the competition.

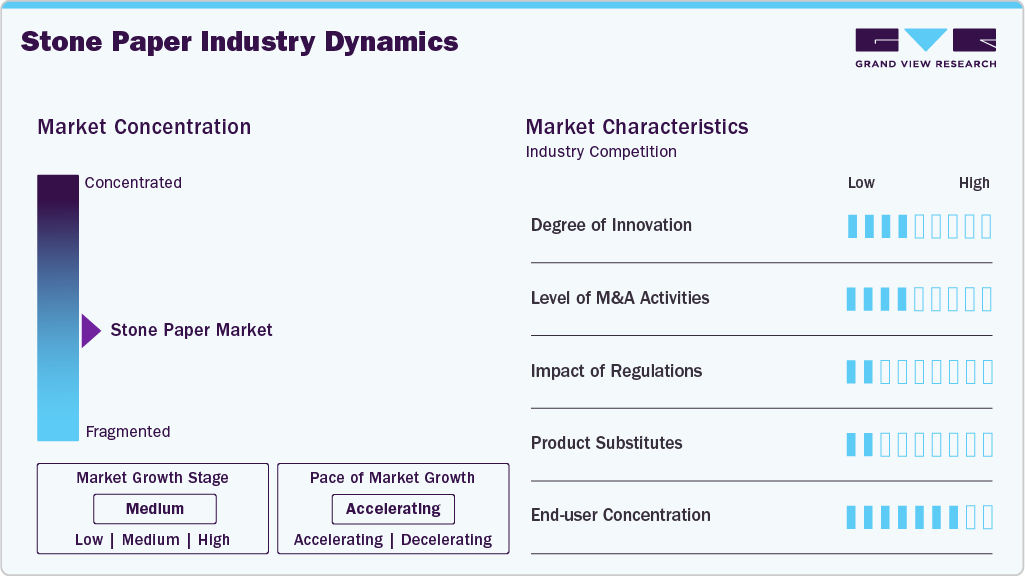

Market Concentration & Characteristics

The market growth stage is medium, and pace of the growth is accelerating. The industry includes several small and medium-size companies which compete on the basis of patent & brands, product portfolio, application area, and geographical presence. Market concentration is expected to be moderately consolidated as KapStone, Taiwan Longmeng Composite Materials Co., Ltd., and AM Packaging Company Limited caters to a significant share of the market on a global basis.

The stone paper industry is characterized by a medium degree of innovation. Key industry participants are focusing on introduction of advanced, durable, tear-resistance, and waterproof solutions to conventional papers. For instance, TBM Co., Ltd. under its LIMEX brand produces high-performance masterbatch (HPM) and plastics products made from stone paper used to produce various stationery products and bag carriers.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by the players. Key companies such as TBM Co., Ltd, The Stone Paper Company, and Stone Paper® have the highest market coverage in over 25 countries. M & A activities significantly strengthened the company’s market positioning and company’s product portfolio in the foreign market.

The market is also subject to increasing regulatory scrutiny. Various regulations for manufacturing stone paper and process involved must be passed from Environment Management Code EC014 for lean and green workflow. The stone paper must be KIwa and Cradle to Cradle certified for eco-friendly and sustainable convention.

Substitute for stone paper is a conventional paper that is being used in the market for a long time. However, higher negative aspects of conventional paper utilization including requirement of wood pulp, which is directly procured by cutting trees remains an unsustainable option. Therefore, substitution threat can be considered to remain low in global stone paper industry.

End user concentration is a significant factor in the market. Key end use industries for the stone paper include printing, retail shops, cosmetics, healthcare, and food & beverage.In addition to food and beverages, demand for stone paper is on the rise from other end user industries such as pharmaceutical and personal care.Several manufacturing companies enter long-term supply agreements with customers from various end use industries to gain a competitive edge in the market and save on their sales costs.

Application Insights

In 2025, the packaging paper application segment dominated the market and is expected to witness the fastest growth rate as it is expected to grow at a CAGR of 8.8% over the forecast period from 2026 to 2033 owing to the increasing product demand to replace plastic as a traditional packaging material. Moreover, increasing use of recyclable stone paper containers is further expected to fuel the application industry growth over the forecast period.

The labeling papers application was valued at USD 183.3 million in 2025 and is expected to grow at a substantial CAGR over 2026 to 2033. The demand for labeling applications is driven by its cost effectiveness and flexibility. Labeling applications include applications on wrappers, colored notes, sticky notes, shelf tags, shelf signage, product tags and labeling, office uses, multi-purpose notes, flags, wine bottles, identity cards, air-line luggage, bottle tags, and door hangs.

Demand for labeling is high in food and beverages packaging applications as labeling provide detailed information of ingredients used. To make product identification and draw customer attraction, manufacturers use labeling of their brands. Moreover, labeling and packaging beautifies and gives visual appeal to a product, thus use of stone papers in labelling applications are anticipated to grow over the forecast period.

Self-adhesive papers emerged as the second largest application segment for the industry in terms of revenue for 2025. Demand for self-adhesive wall stickers are rapidly increasing in the building and construction industry. They are increasingly used in the roof tiles, walls and decorative areas. Easy installation, wide availability of choices, 3D and 2D appearances, and recent design trends in living rooms, kitchens, bedrooms and bathrooms are anticipated to propel the demand for self-adhesive stone paper applications.

Regional Insights

Asia Pacific stone paper industry dominated the market and accounted for 50.4% of global revenue in 2025 owing to the rapid urbanization, rise in awareness on sustainability and implementation of plastic regulations. Increasing demand for advanced packaging applications acts as a key factor driving the market across Asia Pacific. Moreover, China’s decision to ban plastic import is anticipated to create a substantial expansion opportunity for the market in Asia Pacific region.

The stone paper industry in China is growing rapidly due to its abundant raw materials, cost-efficient production, and strong push for sustainable industrial practices. As environmental regulations tighten and demand for eco-friendly alternatives increases across packaging and printing sectors, both domestic use and export opportunities continue to expand.

North America Stone Paper Market Trends

The North America stone paper industry is witnessing rising demand for stone paper, which can be ascribed to the increasing investment in research and development activities aimed on developing sustainable products with advanced features. Need for high quality materials for packaging applications is considered a key factor driving the demand. In North America, U.S accounted for the largest share followed by Canada and Mexico.

U.S. Stone Paper Market Trends

The U.S. stone paper industry is witnessing growth demand, fueled by increasing consumer preference for sustainable, tree-free products. Eco-conscious brands are adopting stone paper for premium packaging and labeling, while broader awareness of plastic and paper waste reduction is supporting further market penetration.

Europe Stone Paper Market Trends

Europe stone paper industry is a major consumer of fuelwood and biomass products, largely due to strong government support for renewable energy and climate goals. Many European countries offer subsidies for biomass heating systems, driving the demand for fuelwood, pellets, and briquettes in both residential and industrial sectors. The region's focus on reducing carbon emissions has led to increased adoption of modern biomass technologies and stricter regulations around sustainable forestry and emissions control.

Germany’s stone paper industry is growing as industries seek sustainable alternatives that align with national recycling and carbon reduction goals. High demand from the luxury packaging, industrial labeling, and office stationery sectors is supported by a strong cultural and regulatory commitment to eco-friendly innovation.

Central & South America Stone Paper Market Trends

The stone paper industry in in Central & South America has presence of packaging giants such as Empresas CMPC, Envases Venezolanos, Suzano, Klabin, and Cristalerias de Chile, which is expected to offer attractive future for stone paper as these companies are looking for plastic alternative materials having low environmental risks. Rules for plastic reduction has already enforced in countries such as Chile, Argentina, Ecuador, Brazil, and Colombia and regulations on plastic consumption will result in the enhanced the need for plastic alternatives such as stone papers.

Middle East & Africa Stone Paper Market Trends

The stone paper industry In the Middle East & Africa is witnessing gradual increase in demand for stone paper as governments and businesses focus more on sustainable development. Its water-resistance and durability make it suitable for harsh climates, while sectors like education and advertising are adopting it as a cost-effective, eco-friendly alternative.

Key Stone Paper Company Insights

Some of the key players operating in the market include The Stone Paper Company,Guangzhou Myhome Wallpaper Co. Ltd, AM Packaging Company Limited, Shenzhen Stone Paper Enterprise, and kapstone:

-

The Stone Paper Company is engaged in designing and manufacturing stone paper for various stationery, labeling, and packaging applications. The stone paper products offered by the company are 100% non-toxic and pulp-free, which adds to the company’s active contribution to help the environment reducing carbon emissions.

-

Guangzhou Myhome Wallpaper Co. Ltd is a subsidiary of MyHome Group Ltd, which is engaged in providing interior construction materials in China. Guangzhou Myhome Wallpaper Co. Ltd designs manufacture and supplies wallpaper for commercial and residential applications.

TBM Co., Ltd., STP STONE PAPER GmbH, Sphera International, Anyde Sign srl, and Pishgaman Sanat Sabz Co. are some of the emerging market participants in the market.

-

TBM Co., Ltd is engaged in research & development, manufacturing, and sales of environmentally friendly materials and products made from stone paper. It includes products in the form of a high-performance masterbatch, sheet products, and plastics products. The company markets its stone paper products under the brand name of ‘LIMEX’ which was patented by the company in 2014, Japan as an alternative to paper and plastics products.

-

STP STONE PAPER GmbH is engaged in designing, manufacturing, and supplying products made from stone paper. The company’s product portfolio includes stone paper bags, alternative advertising materials including placemats & product labels, stone paper packaging material, and stone books. It also manufactures other products made out of stone paper including envelopes, maps, calendars, notepads, and workbooks.

Key Stone Paper Companies:

The following are the leading companies in the stone paper market. These companies collectively hold the largest Market share and dictate industry trends.

- The Stone Paper Company

- AM Packaging Company Limited

- Shenzhen Stone Paper Enterprise

- Kapstone

- Taiwan Longmeng Composite Materials Co., Ltd.

- STP STONE PAPER GmbH

- TBM Co., Ltd

- Pishgaman Sanat Sabz Co.

- Sphera International

- Anydesignsrl

Recent Developments

- In October 2023, Shenzhen Stone Paper Enterprise unveiled wholesale stone powder synthetic paper tailored for vegetable packaging, emphasizing durability and safety for food applications.

Stone Paper Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,013.8 million

Revenue forecast in 2033

USD 1,736.8 million

Growth rate

CAGR of 8.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; Brazil; Argentina

Key companies profiled

The Stone Paper Company; AM Packaging Company Limited; Shenzhen Stone Paper Enterprise; Kapstone; Taiwan Longmeng Composite Materials Co., Ltd.; STP STONE PAPER GmbH; TBM Co., Ltd; Pishgaman Sanat Sabz Co.; Sphera International; Anydesignsrl

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stone Paper Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global stone paper market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Packaging Papers

-

Labelling Papers

-

Self-adhesive Papers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global stone paper market size was estimated at USD 959.1 million in 2025 and is expected to reach USD 1,013.8 million in 2026.

b. The global stone paper market is expected to grow at a compound annual growth rate of 8.0% from 2026 to 2033 to reach USD 1,736.8 million by 2033.

b. Packaging papers application dominated stone paper market with a share of 46.4% in 2025 owing to the increasing product demand to replace plastic as a traditional packaging material.

b. Some of the key players operating in the stone paper market include The Stone Paper Company, Kapstone, Anydesignsrl, Sphera International, Taiwan Longmeng Composite Materials Co., Ltd.

b. The key factor which is driving stone paper market is the ecofriendly, recyclable, and waterproof qualities of the product and increasing environmental concern regarding deforestation for wood procurement to synthesize wood pulp.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.