- Home

- »

- Food Safety & Processing

- »

-

Beverage Packaging Market Size And Share Report, 2030GVR Report cover

![Beverage Packaging Market Size, Share & Trends Report]()

Beverage Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Glass), By Product (Can, Bottle & Jar), By Application (Alcoholic Beverages, Non-alcoholic Beverages), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-2-68038-181-8

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beverage Packaging Market Summary

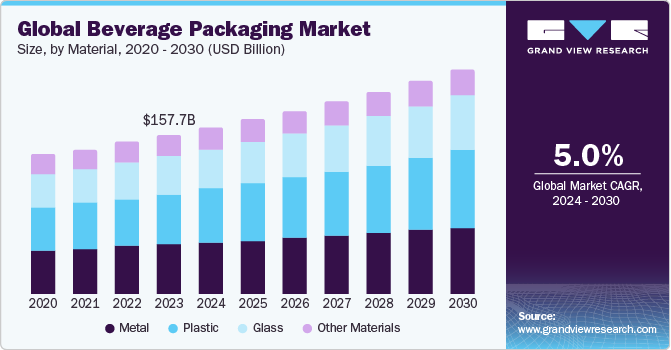

The global beverage packaging market size was estimated at USD 157.73 billion in 2023 and is projected to reach USD 222.08 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. Rising beverage consumption in emerging economies and growing adoption of bioplastics in beverage packaging is expected to accelerate the growth of the market during the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of over 33.0% in 2023.

- Based on material, plastic segment dominated the overall market with a market share of over 31.0% in 2023.

- Based on the application, alcoholic beverages application segment dominated market and accounted for largest revenue share of 50.0% in 2023.

- Based on the product, bottle & jar product segment dominated the market and accounted for largest revenue share of 34.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 157.73 billion

- 2030 Projected Market Size: USD 222.08 billion

- CAGR (2024-2030): 5.0%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

The global market is witnessing a huge demand from alcoholic as well as non-alcoholic beverage segments in the emerging economies. The overall market is also observing growth on account of a surge in the demand for functional drinks. Rapid urbanization and growth of the middle-class population in developing economies have resulted in lifestyles changes, including a rise in the demand for beverages.Global alcoholic beverage consumption is mainly driven by the increasing consumption of alcohol coupled with growing demand for premium products, aided by rising disposable income. In countries such as Belarus, Moldova, Lithuania, Russia, Romania, the UK, Ukraine, Andorra, Hungary, Slovakia, and Portugal, cultural as well as traditional aspects play a vital role in supplementing the demand for alcohol. Meanwhile, in emerging nations such as China and India, the demand is witnessing a rapid pace. China, U.S., Brazil, Germany, Russia, Mexico, Japan, the UK, and Poland are among the major beer-producing countries in the global market.

The health awareness among consumers across numerous geographies is growing gradually, thereby supplementing the demand for nutrient-rich beverages. Consumers are switching to fortified functional drinks that are high in nutritional content. Energy drinks, ready-to-drink teas, soy beverages, fruit juices, yogurt, and sports drinks are among the popular functional drinks in the global market.

Moreover, the rising demand for probiotic drinks is significantly driving the growth of the market. Probiotics, which are live bacteria and yeasts that provide health benefits when consumed in adequate quantities, have gained immense popularity among health-conscious consumers. As a result, the demand for probiotic-infused beverages, such as kombucha, kefir, and probiotic juices, has skyrocketed on a global level. These drinks require specialized packaging solutions that can protect the delicate probiotic cultures while ensuring product freshness and extended shelf life. Therefore, beverage packaging manufacturers are investing in innovative packaging materials, including glass bottles, specialized plastic containers, and aseptic cartons, designed to maintain the potency and viability of the probiotic strains. For instance, in September 2023, SIG and AnaBio Technologies collaborated to launch the first long-life probiotic yogurt packaged in aseptic cartons, representing a significant breakthrough in the beverage packaging industry.

Market Concentration & Characteristics

Prominent beverage packaging market companies include Bemis Company, Inc., Sonoco Products Company, Scholle IPN, Mondi, Amcor plc, Reynolds Group Ltd., Crown, Stora Enso, Tetra Laval International S.A., Ball Corporation, WestRock Company, Graham Packaging, SIG, Berry Global Inc., and Amber Packaging.

Companies are increasingly focusing on the introduction of sustainable packaging products in the market. For instance, in April 2024, Amcor plc introduced a groundbreaking one-liter polyethylene terephthalate (PET) carbonated soft drink (CSD) bottle made entirely from post-consumer recycled (PCR) material. This innovative stock bottle aligns with company’s sustainability goals, aiming for 100% recyclable, reusable, or compostable packaging by 2025.

In February 2024, The Paper Bottle Company launched its Next Gen Paper Bottle by initiating full-scale production. This marks a significant milestone in the company's journey towards creating a fully biobased paper bottle. The Next Gen Paper Bottle is made from 85% paper and 15% high-density polyethylene (HDPE) barrier, offering a durable and splash-resistant package that is fully recyclable as paper packaging.

Material Insights

Based on material, the global market has been segmented into plastics, glass, metal, and other materials. Plastic dominated the overall market with a market share of over 31.0% in 2023 and is expected to witness robust growth over the forecast period. Plastic is lightweight compared to materials such as glass and metal, making plastic bottles and containers easier to transport and carry, which is desirable for beverages, especially those consumed on-the-go.

Furthermore, Metal cans and bottles are highly durable and resistant to breakage, making them suitable for packaging and transporting beverages safely. Metals such as aluminum and steel are widely used materials in the beverage packaging industry. Aluminum cans, has a distinctive and recognizable appearance that is often associated with certain beverage brands, contributing to brand recognition and consumer preference.

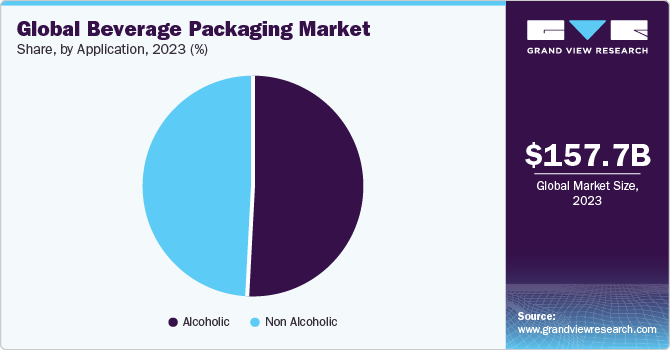

Application Insights

Based on the application, the market is segmented into alcoholic beverages and non-alcoholic beverages. Alcoholic beverages application segment dominated market and accounted for largest revenue share of 50.0% in 2023 and is projected to progress at the fastest CAGR over the forecast period. Alcoholic beverage companies put a lot of emphasis on distinctive and appealing packaging designs to make their products stand out on retail shelves. The packaging plays a major role in the perceived quality and branding of alcoholic products such as beer, wine, and spirits.

On the other hand, the non-alcoholic beverages application segment is expected to witness substantial growth rate due to the growing demand for the bottled water. Moreover, consumers are increasingly opting for functional beverages such as energy drinks, sports drinks, and enhanced waters that offer additional benefits like hydration, vitamins, and minerals. These products require specialized packaging to preserve their functional properties.

Product Insights

Based on the product, the market is segmented into can, bottle & jar, pouch, carton, and other products. Bottle & jar product segment dominated the market and accounted for largest revenue share of 34.0% in 2023. Bottles and jars, especially those made of glass or certain types of plastic, provide an effective barrier against oxygen, moisture, and light, which can degrade the quality and shelf life of beverages. This helps preserve the taste, aroma, and freshness of the beverages for a longer period.

On the other hand, carton product segment is expected to witness robust growth over the forecast period. Cartons are made primarily from renewable materials such as paperboard, which is derived from wood pulp. This makes them more environmentally friendly compared to plastic bottles or aluminum cans, appealing to eco-conscious consumers and brands.

Regional Insights

North America market is projected to expand at the fastest CAGR of 6.6% from 2024 to 2030. The region's busy lifestyle and the growing trend of consuming beverages outside the home have fueled the need for portable, lightweight, and easy-to-carry beverage packaging options. Additionally, the rising preference for sustainable and eco-friendly packaging materials, such as recyclable plastics, aluminum, and glass, is shaping the market dynamics.

U.S. Beverage Packaging Market Trends

The U.S. is a dynamic and ever-evolving industry, driven by changing consumer preferences, sustainability concerns, and technological advancements. Moreover, new product launches in beverage and beverage packaging industry are expected to benefit the overall market in U.S. For instance, in August 2023, GoodPop, a frozen treat brand, disrupted the beverage category with the launch of its first beverage, Mini Cans. These 7.5-ounce cans include real fruit juice and sparkling water, with no added sugars, sweeteners, or flavors. The Mini Cans are also a sustainable choice with plastic-free, BPA-free, and recyclable packaging.

Canada beverage packaging market is expected to witness growth, owing to the growing demand for convenient and sustainable packaging solutions. Canadian consumers are increasingly seeking beverages packaged in eco-friendly materials that are easy to transport and consume on-the-go. This trend has led to a surge in the popularity of lightweight and recyclable packaging options, such as aluminum cans and plastic bottles made from recycled materials.

Asia Pacific Beverage Packaging Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of over 33.0% in 2023. The region is particularly witnessing growth on account of the increasing demand for packaged beverages from the emerging economies of the region, including India and China, among others.

Furthermore, Asia Pacific has witnessed significant investments and new beverage packaging product launches by the major players operating in the beverage market. For instance, in October 2023, Budweiser Brewing Company APAC launched its lightest aluminum can for beer in China, which weighs 330ml and 9.57g, making it 4% lighter than the industry average. The company is committed to enhancing its efforts to promote circularity to mitigate its impact on the climate and environment while empowering its value chain partners to reduce their carbon emissions. Hence, this outlook contributes to the overall growth of the market in Asia Pacific.

Japan beverage packaging market is primarily driven by the increasing environmental consciousness and sustainability concerns among the beverage packaging manufacturers are shaping the market in Japan. Japanese beverage companies are responding by adopting packaging solutions made from renewable sources, such as plant-based plastics and paper-based containers. For instance, in December 2021, SUNTORY HOLDINGS LIMITED introduced 100% plant-based PET bottle prototypes as part of its sustainability goals. These prototypes, made from plant-based materials, were a significant step towards achieving the company's aim to use 100% sustainable PET bottles globally by 2030. The bottles are produced for Suntory's Orangina brand in Europe and Suntory Tennensui mineral water brand in Japan. The technology behind these bottles involves a combination of plant-based paraxylene derived from wood chips and plant-based mono ethylene glycol (MEG) made from molasses. This innovation is expected to significantly reduce carbon emissions compared to traditional plastic-based bottles, contributing to Suntory's path to net zero emissions by 2050.

Europe Beverage Packaging Market Trends

Europe held a revenue share of 24.0% in 2023. The region has experienced increased demand for the personalization of beverages packaging products such as bottles and cans. Besides, the significant presence of many of the prominent beverage manufacturing companies in the region is positively influencing the market across Europe. Some of the major beverage-producing companies operating in Europe are AB InBev, Diageo, Heineken N.V., Pernod Ricard, Carlsberg Breweries A/S, The Coca-Cola Company, PepsiCo, Red Bull, and Nestlé.

UK beverage packaging market is driven by the changing preference of consumers toward energy and sports drinks owing to health concerns. Besides, increasing demand for beverages at cricket and football events such as Barclays Premier League and Ashes is opportunistic for the market. Soft drinks exhibited low growth in comparison to alcoholic and functional beverages owing to the increasing demand for alcoholic beverages by the younger population in the country.

Central & South America Beverage Packaging Market Trends

Central & South America market is projected to expand at a moderate CAGR from 2024 to 2030 owing to the rising middle-class population, especially in countries such as Brazil, Argentina, and Chile. The countries are supporting the increasing consumption of beverages, such as carbonated soft drinks, alcoholic beverages, and functional beverages in the region, thereby creating favorable growth prospects for beverage packaging companies in the region.

Brazil beverage packaging market is expected to register a healthy growth rate over the forecast period. The demand for beverage cans, packaged water bottles and pouches is expected to be influenced by sports events such as the annual football leagues, CONCACAF Champions League, Copa Libertadores, and Big-League World Series. Furthermore, in August 2022, CANPACK invested USD 140 million in a new Greenfield Aluminum Beverage Can Plant in Poços de Caldas, Brazil. This investment represented the company's commitment to developing the Brazilian packaging sector and strengthening its presence in the Brazilian market. The new facility was anticipated to have a total capacity of approximately 1.3 billion cans per year.

Middle East & Africa Beverage Packaging Market Trends

The market in Middle East & Africa is influenced by increasing disposable income of consumers in the Middle East and the presence of a large base of the middle-aged and young population. The emergence of food & beverages as a potential industry for foreign investments is further supported by the easy availability of workforce and low production capacity of food in African economies. In Africa, prevalent food production patterns, changing lifestyles of the masses, and existing marketing practices have led to the rising consumption of processed food & beverage items, thus positively influencing the market in the region.

South Africa beverage packaging market growth is attributed to the rising demand for convenience food and beverages owing to the increased household income is anticipated to have a positive impact on the demand for beverages in the country. This outlook is expected to benefit the growth of the market in the country. Moreover, the country is witnessing a shift in consumer preferences wherein the younger populations are looking toward consuming low alcohol by volume (ABV) drinks, which can further create more growth opportunities for the market in South Africa.

Key Beverage Packaging Company Insights

The market is fragmented with the presence of a significant number of companies. Beverage packaging industry has been witnessing a significant number of new product launches, merger & acquisitions, and expansions over the past few years. This can be attributed to the circular economy initiatives, innovation in materials and technologies, and consumer demand for sustainability.

Key Beverage Packaging Companies:

The following are the leading companies in the beverage packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Bemis Company, Inc.

- Sonoco Products Company

- Scholle IPN

- Mondi

- Amcor plc

- Reynolds Group Ltd.

- Crown

- Stora Enso

- Tetra Laval International S.A.

- Ball Corporation

- WestRock Company

- Graham Packaging

- SIG

- Berry Global Inc.

- Amber Packaging

Recent Developments

-

In October 2023, CPMC Holdings Limited announced its plans to build a new beverage can plant in Hungary. This initiative was part of a joint venture with ORG to establish Europe's second China-owned beverage can plant. The plant will be a two-piece beverage can facility, marking a significant development in the beverage cans market.

-

In August 2023, TricorBraun acquired CanSource, a manufacturer of brite, shrink-sleeved, and printed cans, to the craft beer, wine, spirits, and non-alcoholic beverage markets. The transaction value was not disclosed by the organizations. This helped TricorBraun to expand its market penetration in North America.

Beverage Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 165.25 billion

Revenue forecast in 2030

USD 222.08 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, Volume in billion liters, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Bemis Company, Inc.; Sonoco Products Company; Scholle IPN; Mondi; Amcor plc; Reynolds Group Ltd.; Crown; Stora Enso; Tetra Laval International S.A.; Ball Corporation; WestRock Company; Graham Packaging; SIG; Berry Global Inc.; Amber Packaging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beverage Packaging Market Report Segmentation

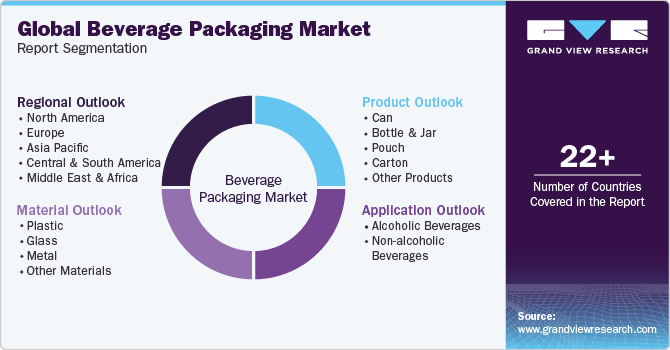

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global beverage packaging market report based on material, product, application, and region:

-

Material Outlook (Revenue, USD Billion; Volume, Billion Liters, 2018 - 2030)

-

Plastic

-

Glass

-

Metal

-

Other Materials

-

-

Product Outlook (Revenue, USD Billion; Volume, Billion Liters, 2018 - 2030)

-

Can

-

Bottle & Jar

-

Pouch

-

Carton

-

Other Products

-

-

Application Outlook (Revenue, USD Billion; Volume, Billion Liters, 2018 - 2030)

-

Alcoholic Beverages

-

Non-alcoholic Beverages

-

-

Regional Outlook (Revenue, USD Billion; Volume, Billion Liters, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beverage packaging market was estimated at around USD 157.73 billion in the year 2023 and is expected to reach around USD 165.25 billion in 2024.

b. The global beverage packaging market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach around USD 222.08 billion by 2030.

b. Asia Pacific dominated the market and accounted for the largest revenue share of over 33.0% in 2023. The region witnessed the growth on account of the increasing demand for packaged beverages from the emerging economies of the region, including India and Australia, among others.

b. Some key players operating in the beverage packaging market include Bemis Company, Inc., Sonoco Products Company, Scholle IPN, Mondi, Amcor plc, Reynolds Group Ltd., Crown, Stora Enso, Tetra Laval International S.A., Ball Corporation, WestRock Company, Graham Packaging, SIG, Berry Global Inc., and Amber Packaging.

b. Key factors that are driving the market growth include rising beverage consumption in emerging economies and growing adoption of bioplastics in beverage packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.