- Home

- »

- Next Generation Technologies

- »

-

Storage Area Artificial Intelligence Network Market Report, 2030GVR Report cover

![Storage Area Artificial Intelligence Network Market Size, Share & Trends Report]()

Storage Area Artificial Intelligence Network Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Storage Medium, By Storage Architecture, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-504-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Storage Area Artificial Intelligence (AI) Network Market Summary

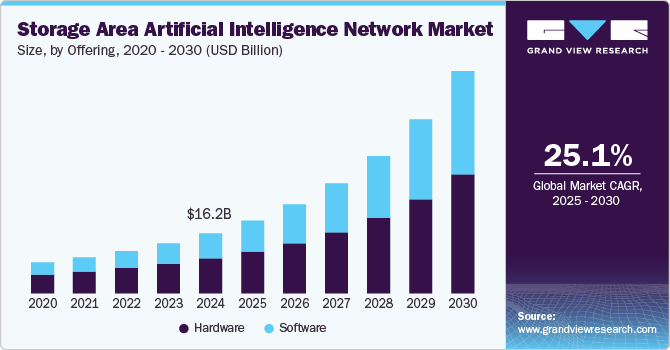

The global storage area artificial intelligence network market size was estimated at USD 16.23 billion in 2024 and is projected to reach USD 60.2 billion by 2030, growing at a CAGR of 25.1% from 2025 to 2030. The market growth is driven by increased benefits such as improved flexibility, scalability, and performance.

Key Market Trends & Insights

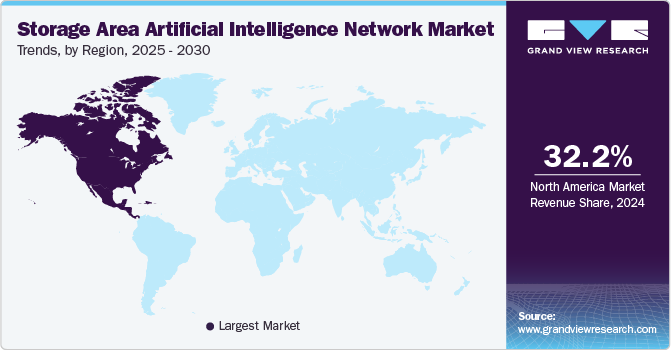

- North America leads the global storage area artificial intelligence network market, accounting for a leading share of 32.2% in 2024.

- The storage area artificial intelligence network market in the U.S. is experiencing significant growth.

- In terms of offering, the hardware segment dominated the market and is anticipated to hold 58.0% in 2024.

- The solid-state drive (SSD) segment accounted for the largest market share in 2024.

- Based on storage architecture, file storage is accounted to hold the highest revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.23 Billion

- 2030 Projected Market Size: USD 60.2 Billion

- CAGR (2025-2030): 25.1%

- North America: Largest market in 2024

In addition, the rising adoption of cloud-based services and their applications contributes to creating lucrative market growth opportunities during the forecast period.

Significant initiatives by key players are augmenting the market expansion. For instance, in June 2024, NVIDIA unveiled a groundbreaking lineup of systems powered by its Blackwell architecture at COMPUTEX, showcasing the potential for AI factories and advanced data centers. The company emphasized the shift towards accelerated computing, stating that leading manufacturers like ASRock Rack, ASUS, and GIGABYTE collaborate to create versatile AI solutions for cloud, on-premises, and edge applications. The new offerings include a range of configurations from single to multi-GPUs and various cooling technologies. The NVIDIA MGX™ modular reference design platform will support these innovations, facilitating rapid development and deployment of over 100 system designs. Notably, the new GB200 NVL2 platform is optimized for large language model inference and data analytics, promising significant performance improvements.

Offering Insights

In terms of Offering, the hardware segment dominated the market and is anticipated to hold 58.0% in 2024. This is largely due to the increasing need for faster, more scalable storage solutions as AI models and data analytics continue to advance. As the demand for efficient data processing grows, companies are turning to specialized hardware, including AI-optimized GPUs, FPGAs, and high-bandwidth storage systems, to handle the immense computing power required for AI workloads. Moreover, Key innovations in solid-state drives (SSDs) and non-volatile memory (NVM) have played a big role in speeding up data access. New storage networking technologies like NVMe over Fabrics enable much faster data transfers. At the same time, there’s a strong push to develop more energy-efficient and cost-effective hardware solutions to keep up with the growing demand.

Software is experiencing significant growth, driven by the increasing demand for intelligent storage solutions. The rise of AI and machine learning (ML) has led to more advanced data management and automation capabilities, enhancing storage systems' efficiency, scalability, and performance. Software innovations focus on improving data processing, predictive analytics, and self-healing capabilities within storage infrastructure. As enterprises generate vast amounts of data, AI-driven software is helping to optimize storage, reduce latency, and improve security. Moreover, AI software solutions are becoming more integrated with cloud platforms, driving further across various industries. This growth is expected to continue, with software solutions playing a key role in managing increasingly complex and large-scale storage environments.

Storage Medium Insights

The Solid-State Drive (SSD) segment accounted for the largest market share in 2024. The solution segment dominates the cloud AI industry, offering ready-to-deploy platforms and software tailored to specific use cases. These solutions address diverse business needs, including automation, predictive analytics, and advanced decision-making. Enterprises prefer solutions for their ease of implementation, scalability, and ability to deliver immediate results. Significant initiatives by key players are augmenting market growth. For instance, in September 2024, Samsung Electronics officially launched the 990 EVO Plus SSD, featuring cutting-edge PCIe 4.0 technology that delivers outstanding performance and power efficiency. With sequential read speeds reaching up to 7,250 MB/s and write speeds of 6,300 MB/s, this SSD is designed for demanding gaming, business, and creative applications.

The hard disk drive (HDD) accounts for registering the highest CAGR growth during the forecast period. While SSDs are favored for their speed and low-latency performance, HDDs continue to be useful for storing large amounts of data at a lower cost. AI models need massive amounts of data for training, and HDDs are well-suited for long-term storage of things like raw datasets, logs, and archived information. As AI-driven industries generate huge volumes of data that don’t require immediate access, HDDs are a cost-effective solution. Moreover, improvements in HDD technology, like higher storage capacities and better energy efficiency, help maintain their relevance for certain AI workloads.

Storage Architecture Insights

Based on storage architecture, file storage is accounted to hold the highest revenue in 2024. Storage architecture in the context of Storage Area Networks (SANs) integrated with Artificial Intelligence (AI) is undergoing significant transformation. The growing demand for data-driven insights and real-time analytics pushes organizations to adopt more intelligent storage solutions. AI is being leveraged to optimize data placement, enhance data retrieval speed, and automate capacity management, improving efficiency and reducing operational costs. Furthermore, AI-driven predictive analytics enable proactive maintenance, minimizing downtime. The integration of edge computing with storage networks is also gaining traction, allowing faster data processing closer to the source. Furthermore, advancements in software-defined storage (SDS) and multi-cloud environments enable greater scalability and flexibility in AI-powered storage networks.

The object storage sector is experiencing growth due to its ability to handle massive volumes of unstructured data generated by AI and machine learning applications. The need for scalable, efficient, and cost-effective storage solutions has surged as AI models become more complex. Object storage’s inherent scalability, durability, and support for metadata tagging make it ideal for storing large datasets required for training AI models. In addition, its integration with cloud platforms and ability to support hybrid storage architectures have further fueled its adoption. The growth of AI-driven applications, particularly in industries like healthcare, finance, and autonomous systems, pushes the demand for flexible storage solutions. Consequently, object storage is evolving to offer faster data retrieval and optimized management features to meet the specific needs of AI workloads.

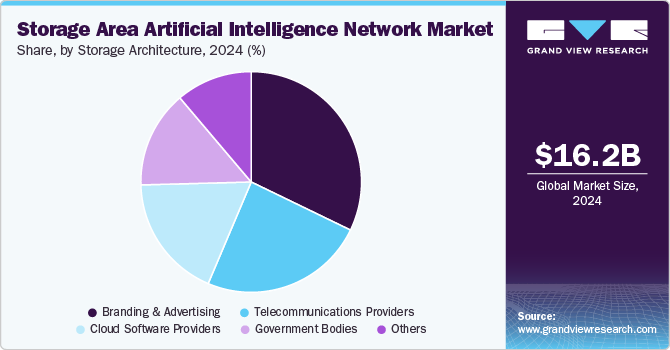

End-use Insights

The enterprises segment accounted for the largest market share in 2024. The growth is driven by the increasing demand for efficient data management and enhanced automation. AI-powered storage solutions have enabled organizations to streamline their data workflows, improving scalability and performance. The rise of big data, cloud computing, and edge computing has further accelerated the need for intelligent storage systems. These systems utilize machine learning algorithms to optimize storage allocation, predict failures, and automate data migration. Moreover, AI-driven analytics have empowered businesses to derive valuable insights from their data, leading to more informed decision-making. As companies continue to embrace digital transformation, integrating AI into storage infrastructures is becoming a strategic imperative for achieving competitive advantages.

Cloud software providers is accounted to register the highest CAGR growth during the forecast period. The increasing demand for efficient data storage and intelligent processing capabilities drives the growth. AI integration into storage solutions has allowed businesses to automate data management, improve predictive analytics, and optimize resource allocation, leading to better performance and cost savings. Cloud providers leverage AI to enhance data security, reduce latency, and enable real-time decision-making. Companies are also focusing on expanding their AI-driven storage offerings with advanced capabilities like automated data classification and anomaly detection. This growth has been fueled by the rise of big data, machine learning, and IoT applications, which require scalable, AI-powered storage infrastructures. Moreover, the increasing adoption of hybrid and multi-cloud environments is further propelling cloud providers to innovate in AI-powered storage solutions.

Regional Insights

North America leads the global storage area artificial intelligence network market, accounting for a leading share of 32.2% in 2024. Enterprises across various sectors in this region, including healthcare, finance, and e-commerce, embraced AI-powered storage systems to optimize data access, improve security, and enhance decision-making capabilities. The region saw advancements in AI technologies such as machine learning, deep learning, and automation, which helped enhance storage efficiency, predictive analytics, and real-time data processing. Moreover, the integration of cloud storage and edge computing further accelerated adoption. Leading tech companies and startups have invested heavily in AI-driven storage solutions, fostering innovation and expanding the market.

U.S. Storage Area Artificial Intelligence Network Market Trends

The storage area artificial intelligence network market in the U.S. is experiencing significant growth. The integration of generative AI tools has accelerated, with firms investing heavily in tailored AI technologies and expanding their workforce with AI-skilled professionals. Furthermore, the U.S. government is actively promoting AI's safe and secure development through executive orders to establish robust evaluation standards and address security risks associated with AI technologies. This multifaceted approach highlights the U.S.'s commitment to leveraging AI for economic growth while ensuring responsible usage.

Europe Storage Area Artificial Intelligence Network Market Trends

The storage area artificial intelligence network market in Europe has shown significant growth, driven by advancements in AI technology, data storage capabilities, and digital transformation across industries. With an increasing reliance on data-driven decision-making, companies are integrating AI into storage infrastructure to optimize data management, enhance security, and improve operational efficiency. European organizations, particularly in sectors like finance, healthcare, and manufacturing, are adopting AI-enhanced storage solutions to handle massive data volumes generated by IoT devices and cloud platforms.

Asia Pacific Storage Area Artificial Intelligence Network Market Trends

The storage area artificial intelligence network market in Asia Pacific has experienced significant growth, driven by rapid digital transformation and increasing demand for data storage and analytics. The adoption of AI technologies in storage solutions has been propelled by industries such as manufacturing, finance, and healthcare, which are looking to leverage AI for more efficient data management, predictive maintenance, and real-time insights. Cloud computing and big data are central to this expansion, with major regional players investing heavily in AI-driven storage infrastructures. Countries like China, Japan, South Korea, and India lead the charge, fostering innovation and collaboration across tech companies.

Key Storage Area Artificial Intelligence Network Company Insights

Some key companies in the Storage Area Artificial Intelligence (AI) Network industry include Samsung, Oracle, Microsoft Corporation, and others. Organizations focus on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Oracle is a global provider of cloud applications and infrastructure, recognized for its innovative data management and AI solutions. The company offers the Exadata X11M, a next-generation intelligent data architecture designed for extreme performance across AI, OLTP, and analytics workloads. In addition, Oracle's Cloud Infrastructure (OCI) supports over 150 AI services, enabling organizations to leverage powerful data storage and processing capabilities in hybrid environments. Their advancements in Generative Development for Enterprise further enhance application development, demonstrating Oracle's commitment to integrating AI into its offerings.

-

Dell Technologies is a leading global technology company committed to driving human progress through innovative solutions. Dell focuses on transforming the digital landscape with offerings that include hybrid cloud solutions and high-performance computing. In Storage Area Networks (SAN), Dell provides advanced storage solutions designed to enhance data management and accessibility, ensuring businesses can scale efficiently and securely. Their commitment to sustainability, diversity, and ethical practices underpins their operations, fostering an inclusive environment that drives technological advancements. Dell's vision is to empower organizations to navigate the complexities of the digital economy effectively.

Key Storage Area Artificial Intelligence Network Companies:

The following are the leading companies in the storage area artificial intelligence network market. These companies collectively hold the largest market share and dictate industry trends.

- NVIDIA Corporation

- IBM

- Intel Corporation

- NetApp

- SAMSUNG

- Hitachi Vantara

- Microsoft Corporation

- SAP

- Oracle

- Huawei

- Cisco

- Lenovo

Recent Developments

-

In January 2024, Samsung Electronics unveiled its "AI for All" vision at CES 2024, emphasizing how artificial intelligence will enhance the connected device experience by making it safer, more inclusive, and energy efficient. CEO Jong-Hee Han highlighted that AI operates seamlessly in the background to improve daily life through intuitive interactions and innovative products, including advanced visual displays and digital appliances. The announcement also showed partnerships to integrate AI across various platforms, reinforcing Samsung's commitment to a hyper-connected future.

-

In January 2025, Cisco announced the launch of its new AI Defense solution, designed to enhance security for enterprises undergoing AI transformation. This innovative technology aims to protect organizations from emerging threats while enabling them to leverage AI capabilities effectively. Cisco's AI Defense integrates advanced analytics and machine learning to provide real-time threat detection and response, ensuring a secure digital environment for businesses. The announcement comes as companies increasingly adopt AI technologies to drive growth and efficiency.

Storage Area Artificial Intelligence Network Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.64 billion

Revenue forecast in 2030

USD 60.20 billion

Growth rate

CAGR of 25.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Offering, storage medium, storage architecture, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

NVIDIA Corporation; IBM; Intel Corporation; NetApp; SAMSUNG; Hitachi Vantara; Microsoft; SAP; Oracle; Huawei; Cisco; Lenovo

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Storage Area Artificial Intelligence (AI) Network Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global storage area AI network market based on offering, storage architecture, storage medium, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Storage Medium Outlook (Revenue, USD Million, 2018 - 2030)

-

Hard Disk Drive (HDD)

-

Solid State Drive (SSD)

-

-

Storage Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

File Storage

-

Object Storage

-

Block Storage

-

Hybrid Storage

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecommunications Providers

-

Branding & Advertising

-

Government Bodies

-

Cloud Software Providers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.