- Home

- »

- IT Services & Applications

- »

-

Storage Area Network Market Size, Industry Report, 2033GVR Report cover

![Storage Area Network Market Size, Share & Trends Report]()

Storage Area Network Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By SAN Type (Hyperscale Server SAN, Enterprise Server SAN), By Technology, By Organization Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-708-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Storage Area Network Market Summary

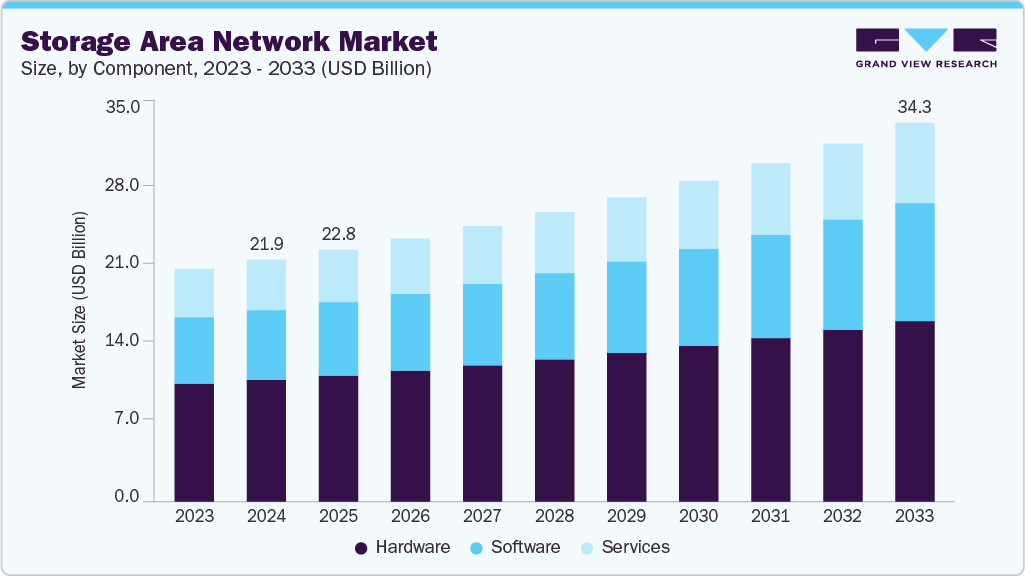

The global storage area network market size was estimated at USD 21.92 billion in 2024 and is projected to reach USD 34.33 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The storage area network (SAN) market is primarily driven by the surge in enterprise data generation, fueled by digital transformation, AI/ML adoption, IoT expansion, and high-volume transactions.

Key Market Trends & Insights

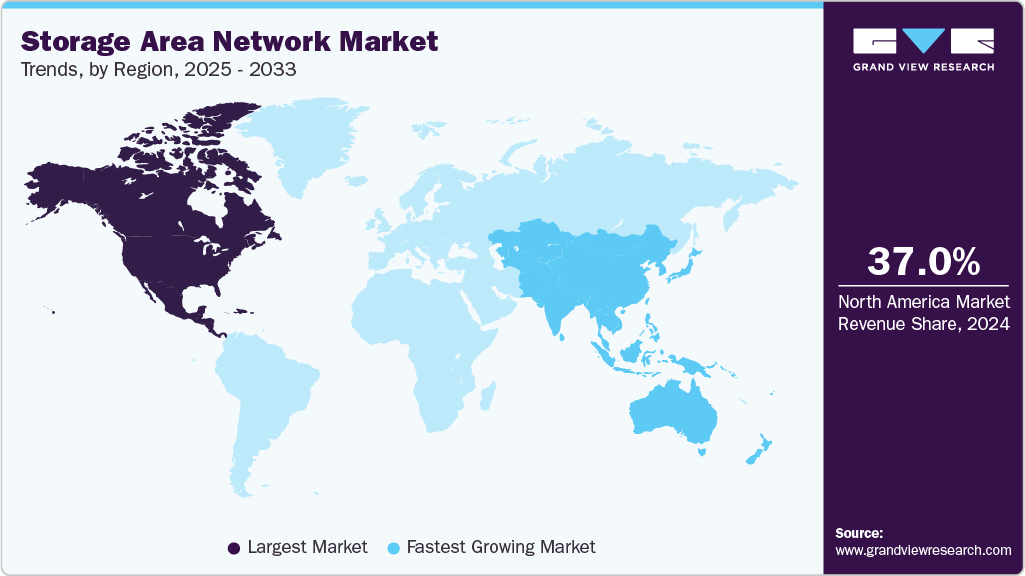

- North America storage area network (SAN) dominated the global market with the largest revenue share of over 37.0% in 2024.

- The server storage area network (SAN) industry in the U.S. is expected to grow significantly over the forecast period.

- By component, hardware led the market and held the largest revenue share of 50.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.92 Billion

- 2033 Projected Market Size: USD 34.33 Billion

- CAGR (2025-2033): 5.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Organizations increasingly require storage solutions offering high availability, scalability, and robust data protection. SAN meets these needs by delivering reliable, high-performance storage infrastructure, making it a preferred choice for enterprises handling critical applications and large-scale data workloads. The growing number of hyperscale data centers, particularly those operated by major cloud providers such as AWS, Microsoft Azure, and Google Cloud, has helped the market. These hyperscalers require vast, high-performance storage networks that can handle massive workloads, multi-tenant environments, and dynamic scaling needs, capabilities that SAN infrastructure is well-positioned to deliver.

SANs provide the speed, redundancy, and centralized control essential for large-scale operations. At the same time, the rise of software-defined storage (SDS) and SAN virtualization technologies has democratized SAN access for small and medium enterprises. These advancements enable organizations to deploy SAN-like functionality over standard hardware, reducing costs and complexity. By leveraging SDS, businesses can achieve flexible scaling, simplified management, and improved cost efficiency, making SAN a viable option outside large enterprise environments. This shift has expanded the addressable market for SAN vendors and fueled broader adoption across industries.

High initial capital expenditure (CapEx) required for deployment can hamper market growth in the coming years. SAN solutions involve significant investment in specialized hardware like storage arrays, switches, host adapters, and dedicated SAN management software. These costs often exceed the budget capacity of small and mid-sized enterprises. Beyond acquisition, the ongoing operational expenses, such as system maintenance, upgrades, and skilled personnel for administration, add to the financial burden. Managing SAN infrastructure demands specialized expertise, given its configuration, scaling, and performance optimization complexity. High setup costs and operational complexity make SAN adoption challenging for smaller organizations.

Component Insights

The hardware segment dominated the market and accounted for a revenue share of 50.35% in 2024. The exponential growth of structured and unstructured enterprise data will help the hardware segment grow in the coming years. Rapid digital transformation, the rise of AI/ML applications, IoT proliferation, and the surge in big data analytics generate massive volumes of data requiring efficient storage and fast retrieval. Enterprises need high-capacity, high-performance SAN hardware such as storage arrays, SAN switches, and host adapters to handle this data surge effectively. These hardware solutions provide the scalability, reliability, and speed essential for mission-critical operations. As data grows, organizations are compelled to upgrade or expand their SAN infrastructure, fueling sustained demand for advanced hardware solutions.

Software is anticipated to grow at the highest CAGR of 6.0% during the forecast period. The growing demand for SAN virtualization and management software is driven by enterprises' need to optimize storage utilization and simplify complex storage environments. As data volumes increase, organizations seek centralized tools for SAN management, provisioning, monitoring, and automation to enhance operational efficiency and reduce manual intervention. Virtualization enables better resource allocation, scalability, and cost control, while management software helps streamline day-to-day operations, improve performance, and ensure high availability. This trend fuels adopting advanced SAN software solutions across industries seeking efficient and flexible storage management.

SAN Type Insights

The enterprise server SAN segment dominated the market and accounted for the largest revenue share in 2024. As organizations move toward hybrid environments combining private clouds, public clouds, and on-premise infrastructure, they often rely on dedicated SAN systems to manage core applications that demand low latency, high availability, and strict data control. These SAN deployments provide enterprises with the flexibility to run critical workloads securely on-premise while leveraging the scalability and cost benefits of the cloud for less sensitive operations. This approach enables seamless integration, better data governance, and enhanced business continuity, making SAN a key component in enterprise hybrid cloud strategies.

The hyperscale server SAN segment is expected to grow significantly during the forecast period. The rapid expansion of hyperscale data centers by leading cloud providers such as AWS, Microsoft Azure, Google Cloud, and Alibaba will help the Hyperscale Server SAN segment grow. These data centers support vast, multi-tenant environments and global digital services, requiring highly scalable, high-performance SAN deployments. SAN infrastructure enables hyperscalers to manage enormous data volumes, AI/ML workloads, and critical enterprise applications with the necessary speed, availability, and reliability. This ongoing expansion fuels demand for advanced SAN solutions tailored to hyperscale environments.

Technology Insights

The fibre channel SAN segment dominated the market and accounted for the largest revenue share in 2024. Fibre Channel SANs are widely recognized for their proven performance, ultra-low latency, and high throughput, making them the preferred storage networking solution for mission-critical enterprise applications. The protocol's dedicated storage network architecture ensures reliable, uninterrupted data transfer with minimal congestion and high fault tolerance. Its ability to support large-scale, high-speed data movement without compromising security or performance has solidified its position as a trusted choice for organizations requiring robust, enterprise-grade storage infrastructure for critical business operations.

InfiniBand SAN is expected to grow significantly during the forecast period. InfiniBand is a leading interconnect technology in high-performance computing (HPC) environments, valued for its ultra-low latency, high bandwidth, and efficient data transport. These attributes make it the preferred choice for supercomputing applications, scientific research, engineering simulations, and other compute-intensive tasks. Its ability to support rapid data exchange between compute nodes and storage systems enables faster processing and improved overall system performance. As HPC workloads grow in complexity and scale, the demand for InfiniBand SAN solutions continues to rise, especially in research institutions, defense, and advanced analytics sectors.

Organization Size Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2024. Large enterprises operate data-intensive business processes, generating massive volumes of structured and unstructured data. Managing this data efficiently requires high-performance, scalable, and reliable storage solutions. Server SAN infrastructure meets these demands by providing centralized, high-throughput storage networks supporting mission-critical applications. As enterprise data grows exponentially, robust SAN solutions are essential to ensure seamless operations, data integrity, and business continuity across global and multi-site environments.

The small and medium-sized enterprises segment is expected to grow at a significant CAGR during the forecast period. The growing adoption of software-defined SAN solutions and virtualization has lowered entry barriers for small and medium enterprises (SMEs). Unlike traditional SAN systems that require expensive, proprietary hardware, software-defined SAN enables SMEs to leverage standard servers and storage devices, reducing upfront capital costs. Virtualization further simplifies storage management, offering scalability, flexibility, and easier integration with existing IT infrastructure. This shift allows SMEs to access enterprise-grade storage capabilities such as centralized management, data protection, and high availability without the complexity and cost typically associated with traditional SAN deployments.

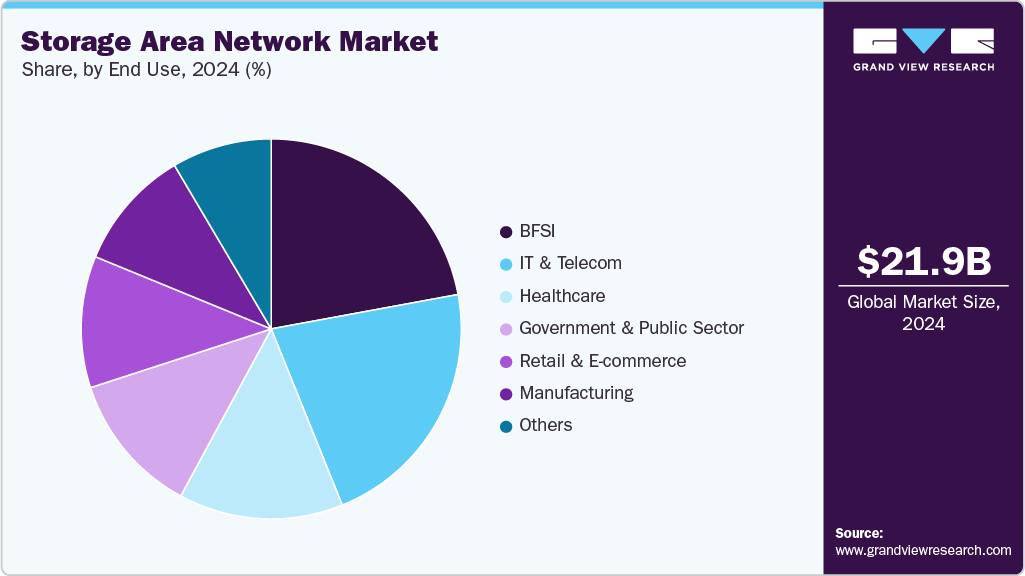

End Use Insights

The BFSI segment dominated the market and accounted for the largest revenue share in 2024. The BFSI sector processes enormous volumes of financial transactions, digital payments, customer records, investment data, and real-time financial analytics daily. Managing this critical data requires storage systems that deliver high performance, low latency, and absolute reliability. Server SAN solutions meet these needs by offering centralized, high-speed data storage with built-in redundancy and continuous availability, ensuring seamless transaction processing and uninterrupted access to essential financial information. Data integrity and security are paramount in the financial industry, where even minor disruptions can lead to significant financial and reputational risks. As a result, BFSI organizations rely heavily on SAN infrastructure to support their core banking, trading, and payment systems.

The IT & Telecom segment is expected to grow at a significant CAGR over the forecast period. The IT & Telecom sector drives strong demand for Server SAN solutions due to its need to manage massive data traffic, cloud services, and communication networks. Telecom operators and IT service providers require high-performance, scalable storage infrastructure to support subscriber data, content delivery, mobile services, and enterprise cloud platforms. SAN systems enable efficient data handling, low-latency access, and high availability, essential for maintaining service quality and uptime. With the rise of 5G, IoT, and edge computing, IT & Telecom firms increasingly invest in SAN solutions to meet growing data storage and processing demands.

Regional Insights

North America's storage area network (SAN) market dominated with a revenue market share of 37.18% in 2024. The region has a mature and expansive data center ecosystem that fuels ongoing demand for high-performance SAN systems. Enterprises and hyperscalers in the region rely on advanced SAN infrastructure to support large-scale data processing, storage-intensive applications, and critical workloads across diverse industries and cloud platforms.

U.S. Storage Area Network Market Trends

The storage area network (SAN) market in the U.S. is expected to grow significantly at a CAGR of 3.8% from 2025 to 2033. The U.S. hosts leading hyperscalers such as AWS, Microsoft Azure, and Google Cloud, making it a key hub for cloud and hyperscale data centers. These providers drive strong demand for advanced SAN infrastructure to support large-scale cloud services, AI workloads, and high-performance, multi-tenant data processing environments.

Europe Storage Area Network Market Trends

The storage area network (SAN) market in Europe is anticipated to grow considerably from 2025 to 2033. Europe's strong financial institutions and advanced manufacturing sectors are key drivers of SAN demand in the region. Financial firms rely on SAN for secure, high-speed data management, transaction processing, and regulatory compliance. Meanwhile, manufacturing companies use SAN systems to support ERP platforms, supply chain operations, and real-time production data monitoring. These critical applications require reliable, high-performance storage networks, making SAN a vital component of enterprise IT infrastructure in Europe.

The UK storage area network (SAN) market is expected to grow rapidly in the coming years. Significant investments, such as USD 13 billion from Blackstone and USD 10.45 billion from AWS, fuel hyperscale data center expansion in the UK. These large-scale facilities demand advanced SAN infrastructure to support cloud services, AI workloads, and enterprise data needs, driving robust growth in the country’s server SAN market.

The storage area network (SAN) market in Germany held a substantial market share in 2024. Germany’s Industry 4.0 initiative is driving strong demand for advanced SAN solutions in manufacturing. As smart factories adopt IoT, automation, and real-time data analytics, manufacturers require low-latency, high-performance storage such as iSCSI and NVMe-oF SAN systems.

Asia Pacific Storage Area Network Market Trends

The storage area network (SAN) market in the Asia Pacific held a significant global market share in 2024. The accelerating digital transformation across manufacturing, e-commerce, government, and smart city projects in the Asia Pacific is driving strong demand for Server SAN solutions. As enterprises and governments deploy IoT devices and data-driven applications, they require reliable, scalable SAN systems to manage vast data volumes, enable real-time analytics, and support low-latency edge processing. This trend is boosting SAN adoption, particularly in industries embracing automation, AI, and connected infrastructure initiatives.

Japan storage area network (SAN) market is expected to grow rapidly in the coming years. Japan’s government-backed digitalization efforts, including the “Smart City Tokyo” initiative and METI-supported infrastructure programs, drive significant data center expansion, aiming for a 40% capacity increase by 2028. This surge boosts demand for robust Server SAN solutions to support enterprise applications, public sector digital services, and smart city platforms.

The storage area network (SAN) market in China held a substantial market share in 2024. China’s “Eastern Data, Western Computing” initiative, backed by over USD 6.1 billion investments, is driving large-scale expansion of data centers with nearly 2 million server racks across eight clusters. This massive infrastructure growth creates strong demand for scalable Server SAN systems to support high-volume data processing, storage, and cloud services.

Key Storage Area Network Company Insights

Key players operating in the storage area network (SAN) industry are Dell Technologies, Hewlett Packard Enterprise (HPE), IBM Corporation, Cisco Systems, Inc., Broadcom Inc., NetApp, Inc., Hitachi Ltd., Fujitsu Limited, Huawei Technologies Co., Ltd., Lenovo Group Limited, Pure Storage, Inc., DataCore Software Corporation, StarWind Software Inc., Nutanix, Inc., and NEC Corporation. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Storage Area Network Companies:

The following are the leading companies in the storage area network market. These companies collectively hold the largest market share and dictate industry trends.

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Cisco Systems, Inc.

- Broadcom Inc. (Brocade)

- NetApp, Inc.

- Hitachi Vantara (Hitachi Ltd.)

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Lenovo Group Limited

- Pure Storage, Inc.

- DataCore Software Corporation

- StarWind Software Inc.

- Nutanix, Inc.

- NEC Corporation

Recent Development

-

In May 2025, DataCore acquired StarWind to expand its hyper‑converged infrastructure (HCI) capabilities, bringing virtual SAN technology to edge environments, remote offices, and small businesses. This acquisition enhances DataCore’s software-defined storage portfolio by adding StarWind’s lightweight, high-performance SAN virtualization, which delivers iSCSI, NVMe-oF, and RDMA block storage via virtual SAN appliances. The combined platform simplifies deployment across core data centers, edge sites, and ROBO locations, offering robust, scalable SAN solutions with centralized management and reduced hardware and hypervisor lock-in.

-

In February 2025, NetApp unveiled a new family of enterprise block storage systems designed for simplicity, performance, and affordability. These solutions are tailored to modern workloads featuring high throughput for critical applications and integrated ransomware detection and recovery services, making them well-suited for businesses seeking secure, efficient block storage.

-

In February 2024, Hewlett Packard Enterprise (HPE) released the third iteration of HPE GreenLake for Block Storage, powered by the Alletra Storage MP platform, a pioneering scale‑out, disaggregated block storage solution. It features shared-everything architecture, allowing independent scaling of performance and capacity, supports NVMe-oF/TCP as well as Fibre Channel and iSCSI, and includes advanced AI-driven analytics and a 100% data availability guarantee.

Storage Area Network Report Scope

Report Attribute

Details

Market size in 2025

USD 22.84 billion

Revenue forecast in 2033

USD 34.33 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Organization Size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, SAN type, technology, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Dell Technologies; Hewlett Packard Enterprise (HPE); IBM Corporation; Cisco Systems, Inc.; Broadcom Inc. (Brocade); NetApp, Inc.; Hitachi Ltd.; Fujitsu Limited; Huawei Technologies Co., Ltd.; Lenovo Group Limited; Pure Storage, Inc.; DataCore Software Corporation; StarWind Software Inc.; Nutanix, Inc.; NEC Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Storage Area Network Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the storage area network market report based on component, SAN type, technology, organization size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

SAN Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hyperscale Server SAN

-

Enterprise Server SAN

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Fibre Channel (FC) SAN

-

Fibre Channel over Ethernet (FCoE) SAN

-

InfiniBand SAN

-

Internet Small Computer Systems Interface (iSCSI) SAN

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium-Sized Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Government & Public Sector

-

Healthcare

-

Retail & E-commerce

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global storage area network market size was estimated at USD 21.92 billion in 2024 and is expected to reach USD 22.84 billion in 2025.

b. The global storage area network market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 34.33 billion by 2033.

b. The large enterprises segment dominated the market and accounted for the largest revenue share in 2024. Large enterprises operate data-intensive business processes, generating massive volumes of structured and unstructured data. Managing this data efficiently requires storage solutions that offer high performance, scalability, and reliability. Server SAN infrastructure meets these demands by providing centralized, high-throughput storage networks capable of supporting mission-critical applications.

b. Key players operating in the storage area network industry are Dell Technologies, Hewlett Packard Enterprise (HPE), IBM Corporation, Cisco Systems, Inc., Broadcom Inc., NetApp, Inc., Hitachi Ltd., Fujitsu Limited, Huawei Technologies Co., Ltd., Lenovo Group Limited, Pure Storage, Inc., DataCore Software Corporation, StarWind Software Inc., Nutanix, Inc., and NEC Corporation.

b. The server SAN market is primarily driven by the surge in enterprise data generation, fueled by digital transformation, AI/ML adoption, IoT expansion, and high-volume transactions. Organizations increasingly require storage solutions offering high availability, scalability, and robust data protection. SAN meets these needs by delivering reliable, high-performance storage infrastructure, making it a preferred choice for enterprises handling critical applications and large-scale data workloads.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.