- Home

- »

- Next Generation Technologies

- »

-

Streaming Analytics Market Size, Industry Report, 2030GVR Report cover

![Streaming Analytics Market Size, Share & Trends Report]()

Streaming Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Hosted), By Application (Fraud Detection), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-679-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Streaming Analytics Market Summary

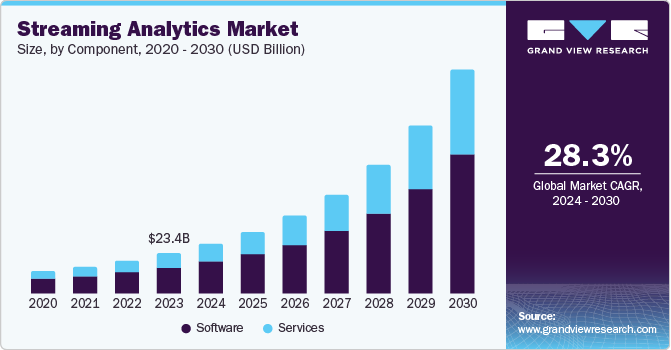

The global streaming analytics market was valued at USD 23.4 billion in 2023 and is projected to reach USD 128.4 billion by 2030, growing at a CAGR of 28.3% from 2024 to 2030. Market growth is driven by the increasing reliance on real-time forecasting, digitalization, and emerging technologies such as big data, IoT, and AI.

Key Market Trends & Insights

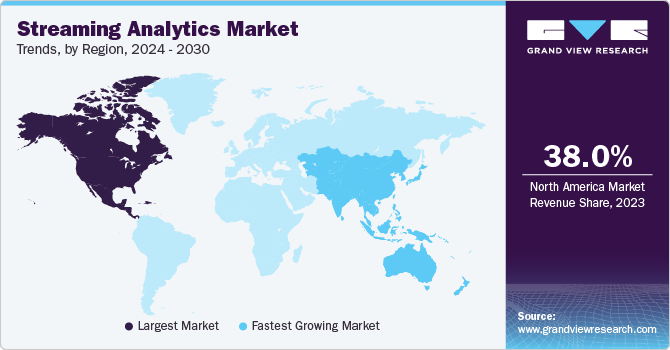

- North America streaming analytics market dominated the global streaming analytics market in 2023 with a revenue share of 38.0%.

- Asia Pacific streaming analytics market is anticipated to witness the fastest growth of 32.0% over the forecast period.

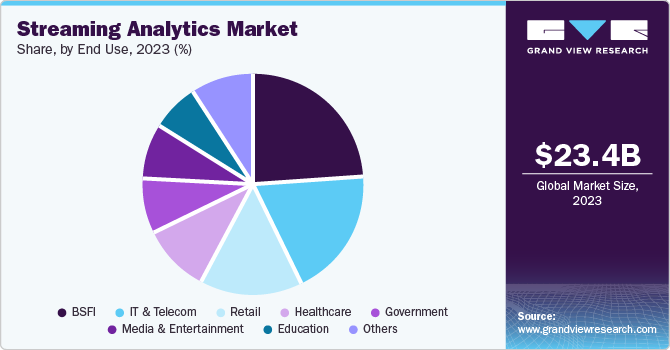

- Based on end Use, BSFI accounted for the largest market revenue share of 23.8% in 2023.

- In terms of application, fraud detection led the market with a revenue share of 18.8% in 2023.

- Based on deployment, the hosted segment accounted for the largest revenue share of 51.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.4 Billion

- 2030 Projected Market Size: USD 128.4 Billion

- CAGR (2024-2030): 28.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, the trend of bringing one’s own devices (BYOD ) has created a pressing need for enhanced security measures to ensure data protection. As IoT devices and sensors proliferate, streaming analytics enables organizations to extract valuable insights from the constant flow of data, driving real-time decision-making and business agility. Moreover, the growing trend of industrial automation fuels demand for real-time data monitoring and analysis, leading to improved efficiency, reduced downtime, and enhanced productivity.

The need for real-time insights and precise forecasting is another key market driver. Streaming analytics allows organizations to automate, optimize, and guide decisions based on specified business goals. According to the International Data Corporation, by 2025, approximately 30% of generated data is expected to be in real-time, driving market demand. By analyzing data in motion, companies can recognize and respond to opportunities and risks quickly, reducing potential costs and increasing business agility. This enables businesses to make data-driven decisions, enhance their competitiveness, and stay ahead of the curve.

The growing adoption of advanced analytics tools by small and medium enterprises (SMEs) is also a significant driver in the industry. As SMEs embrace streaming analytics, they can gain real-time insights and make data-driven decisions to enhance their competitiveness. Moreover, the growing adoption of cloud services is a vital catalyst for digital transformation, enabling real-time synchronization across cloud or on-premise environments and surpassing traditional data processing and access options. For instance, in December 2023, Striim integrated with Microsoft Fabric, enabling real-time data streaming and analytics for businesses, providing a seamless and unified solution for extracting actionable insights from diverse data sources.

Component Insights

Streaming analytics software dominated the market with a revenue share of 65.5% in 2023. The focus on KPI monitoring, real-time data analysis, and actionable insights is driving the dominance of this market segment. Real-time processing enables companies to adapt to market changes, trends, and consumer habits in real-time, ensuring relevance in volatile markets. KPIs also facilitate continuous performance monitoring, allowing for strategic adjustments.

Streaming analytics services are expected to register the fastest CAGR of 30.1% over the forecast period. The flexibility of these services, such as professional & managed services, allows companies to find the right solution for their unique needs and effectively address industry-specific issues. Hence, these factors will be crucial in fueling the expansion of the segment.

Deployment Insights

The hosted segment accounted for the largest revenue share of 51.7% in 2023, as it eliminates the need for substantial upfront investments in infrastructure, allowing businesses to allocate resources based on demand. It enables organizations to focus on data analysis and insights rather than infrastructure management, providing a scalable solution that is accessible to businesses of all sizes, including those with limited IT resources.

On-premise streaming analytics is projected to grow at the fastest CAGR of 32.3% over the forecast period. Companies are leveraging on-premises analytics platforms to detect fraudulent transactions in real-time, enabling swift action to mitigate losses and safeguard customer security. This critical capability is driving the growth of the segment, as businesses prioritize minimizing financial losses and ensuring customer trust.

Application Insights

Fraud detection led the market with a revenue share of 18.8% in 2023. As fraudsters increasingly employ sophisticated tactics, traditional methods are no longer sufficient to detect and prevent fraudulent activities. Streaming analytics enables real-time analysis of large data sets, enabling organizations to identify emerging fraud patterns and trends. This technology is critical for compliance, providing immediate insights into suspicious behavior and ensuring regulatory adherence.

Location intelligence is projected to be the fastest-growing application segment with a CAGR of 31.1% over the forecast period. Streaming analytics empowers organizations to rapidly analyze location data, fostering swift and informed decision-making. This capability is particularly crucial in industries such as logistics, retail, and public safety. By leveraging location intelligence, businesses can craft tailored experiences based on customer behavior and preferences, enhancing customer satisfaction and loyalty.

End Use Insights

BSFI accounted for the largest market revenue share of 23.8% in 2023. The increasing complexity of financial crimes demands swift detection and prevention. Streaming analytics enables real-time analysis of transaction data, identifying suspicious patterns and halting illegal activities promptly. This technology is essential for BSFI institutions, helping them proactively monitor market changes, credit risk, and operational risk, and reducing risk through timely intervention.

The education segment is anticipated to register the fastest CAGR of 30.8% over the forecast period. Streaming analytics enables educational institutions to rapidly analyze vast amounts of student data, empowering personalized learning experiences. By examining factors such as learning speed, strengths, and weaknesses, institutions can tailor content and teaching methods to individual students. This technology also optimizes resource allocation, scheduling, and campus operations, fostering data-driven decision-making.

Regional Insights

North America streaming analytics market dominated the global streaming analytics market in 2023 with a revenue share of 38.0%. The proliferation of IoT devices has driven regional expansion, with analytics playing a crucial role in monitoring and interpreting the vast amounts of data generated. North American companies, particularly Facebook and Twitter, leverage real-time analytics for instant insights and responses, including sentiment analysis and content moderation, solidifying the region’s market dominance.

U.S. Streaming Analytics Market Trends

The streaming analytics market in the U.S. led North America in 2023. The robust technological infrastructure, comprising advanced data centers, high-speed networks, and a skilled workforce, enables efficient handling of vast real-time data volumes. A culture of data-driven decision-making pervades many U.S. industries, driving demand for streaming analytics tools to extract actionable insights and inform strategic business decisions.

Europe Streaming Analytics Market Trends

Europe streaming analytics market was identified as a lucrative region in the global streaming analytics market in 2023. European governments leverage analytics to optimize public sector operations, including traffic management, public safety, and environmental monitoring. The region’s strong demand for analytics is driven by the need for real-time data insights to stay competitive in various sectors. Notably, Europe’s emphasis on data confidentiality and security highlights the importance of analytics for risk management and compliance.

The streaming analytics market in Germany is expected to grow rapidly in the coming years. In Germany, industries utilize IoT and automation to enhance production cycles and supply chains. Streaming analytics enables real-time monitoring of equipment performance, predictive maintenance, and quality improvement. Given the country’s emphasis on data security and regulatory compliance, robust solutions are crucial. Industry 4.0 initiatives have accelerated adoption of streaming analytics, driving efficiency and competitiveness gains.

Asia Pacific Streaming Analytics Market Trends

Asia Pacific streaming analytics market is anticipated to witness the fastest growth of 32.0% over the forecast period. The rapid growth of e-commerce in certain countries in the region has driven the adoption of analytics for instant order processing, inventory management, and customer insights. As technology continues to evolve, this trend is expected to accelerate, stimulating the growth of the local market and fostering innovation in the e-commerce sector.

The streaming analytics market in China held a substantial market share in 2023 due to the rapidly expanding digital economy and widespread adoption of IoT devices. As urbanization accelerates, industries are generating vast amounts of data, prompting businesses to invest in AI and cloud infrastructure for real-time analysis. Government initiatives are further driving the adoption of streaming analytics to foster economic growth and innovation.

Key Streaming Analytics Company Insights

Key companies in streaming analytics market include IBM; Informatica Inc.; Microsoft; and SAP SE; among others. Key market players are adopting strategies to stay competitive, including integration of AI/ML, cloud-based solutions, real-time insights, and addressing challenges such as legacy system integration and data security.

-

SAP SE provides comprehensive solutions to optimize business operations and customer relationships. Its flagship product, SAP S/4HANA, is an advanced ERP system that utilizes in-memory computing to process vast data volumes in real-time, serving diverse industries including finance, healthcare, and manufacturing. The SAP HANA Streaming Analytics solution enables seamless integration with IoT applications, fostering advanced analytics through machine learning and driving business insights across various industries.

-

SAS Institute Inc. is an analytics software provider, offering a range of solutions, including streaming analytics. Its platform enables real-time data analysis, providing enhanced decision-making and operational efficiency through fraud detection, risk management, and customer analytics.

Key Streaming Analytics Companies:

The following are the leading companies in the streaming analytics market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Informatica Inc.

- Microsoft

- SAP SE

- Striim

- Oracle

- SAS Institute Inc.

- Software AG

- Cloud Software Group, Inc.

Recent Developments

-

In July 2024, IBM acquired StreamSets and webMethods from Software AG, strengthening its automation, data, and AI offerings, and offering clients a comprehensive integration platform.

-

In June 2024, Informatica Inc. launched new generative AI and Snowflake native app offerings on the Snowflake AI Data Cloud, streamlining data integration and access management.

-

In May 2024, Striim appointed Neil Holloway as Senior Vice President of Strategic Partnerships to accelerate revenue growth through partnerships. Holloway brought 35 years of leadership experience from Microsoft, further strengthening Striim’s partnership with Microsoft Azure.

-

In February 2024, SAS Institute Inc. partnered with Carahsoft to bring analytics, AI, and data management solutions to the public sector, making SAS products available to U.S. agencies.

Streaming Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.7 billion

Revenue forecast in 2030

USD 128.4 billion

Growth Rate

CAGR of 28.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

IBM; Informatica Inc.; Microsoft; SAP SE; Striim; Oracle; SAS Institute Inc.; Software AG; Cloud Software Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Streaming Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the streaming analytics market report based on component, deployment, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

Professional Services

-

Managed Services

-

Other Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-Premise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fraud Detection

-

Marketing & Sales

-

Risk Management

-

Predictive Asset Management

-

Network Management & Optimization

-

Location Intelligence

-

Supply Chain Management

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BSFI

-

IT & Telecom

-

Retail

-

Healthcare

-

Government

-

Media & Entertainment

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.