- Home

- »

- Medical Devices

- »

-

Stretch Marks Treatment Market Size, Industry Report, 2030GVR Report cover

![Stretch Marks Treatment Market Size, Share & Trends Report]()

Stretch Marks Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (Topical Products (Creams, Oils & Serums, Lotions), Laser (Fractional Laser, Pulse-dye Laser), Microdermabrasion), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-977-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stretch Marks Treatment Market Trends

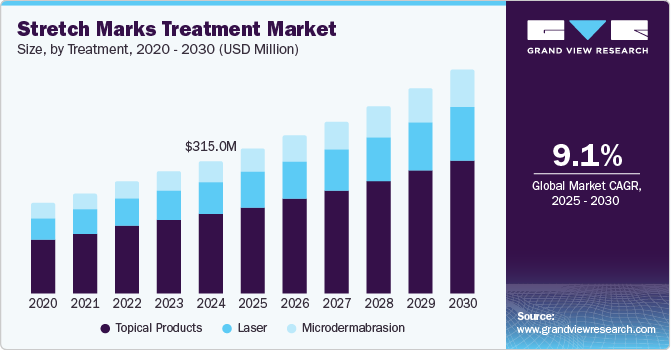

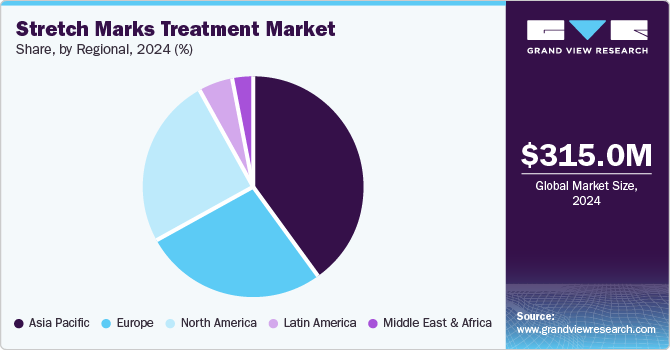

The global stretch marks treatment market size was estimated at USD 315.0 million in 2024 and is projected to grow at a CAGR of 9.1% from 2025 to 2030. Increasing incidence of obesity globally, rising number of pregnancies and concerns about stretch marks, and advancements in treatment technologies, are factors boosting market growth. The rising global incidence of obesity and related health concerns have significantly influenced market growth. According to the World Health Organization, one in eight individuals worldwide were affected by obesity in 2022. Approximately 2.5 billion adults aged 18 and older were classified as overweight, with around 890 million living with obesity.

The increasing number of pregnancies contributes to the demand for stretch mark treatments. According to the CDC, the number of births in the U.S. reached approximately 3,591,328 in 2023. Despite a teenage birth rate of 13.2 births per 1,000 females, indicating a commitment to family planning and education, concerns regarding pregnancy-related skin issues, particularly stretch marks, continue to grow. As awareness of stretch marks during pregnancy rises, so does the demand for effective solutions tailored for expectant mothers.

A 2023 study in the European journal Pflügers Archiv reported an innovative treatment utilizing topical formulations containing beta-glucan alongside nano-fractional radiofrequency. This approach demonstrated significant improvements in skin elasticity, thickness, and collagen density, offering a means to minimize the appearance of stretch marks without adverse effects. Such innovations appeal to consumers seeking aesthetic enhancements and bolster confidence in modern treatment efficacy, thus aiding market growth worldwide.

Moreover, rapid weight fluctuations remain a major risk factor for developing stretch marks. According to Health Line, dramatic weight loss can stress the skin, leading to dermal tears that manifest as stretch marks. While gradual weight loss is advised to allow the skin to adapt, genetic predispositions, hormonal changes, and other factors exacerbate the issue. This widespread prevalence of contributing factors highlights a critical market opportunity for effective stretch mark treatments as individuals increasingly seek solutions to manage their skin health during periods of significant body changes.

Regulations significantly impact the market by ensuring safety, efficacy, and quality standards. Stringent regulatory requirements can delay product approvals, affecting market entry and innovation. However, they also enhance patient confidence and device reliability, ultimately supporting the market's growth by ensuring that only safe and effective devices are available for clinical use.

There are currently no direct substitutes. However, various complementary approaches can support primary treatments. Nutritional supplements such as vitamins A, C, and E, along with zinc and silica, aid in skin health from within. Adequate hydration and a balanced diet rich in antioxidants and essential fatty acids help maintain skin elasticity and repair. Regular exercise improves circulation and overall skin health, contributing to the prevention and reduction of stretch marks.

Market players in the stretch marks treatment sector are expanding their presence by entering new geographical markets, forming strategic partnerships with local distributors, and tailoring their product offerings to align with specific regional skincare requirements.

Treatment Insights

The topical products segment held the largest share of over 60.2% in 2024 due to the increasing prevalence of stretch marks due to factors such as pale skin, pregnancy, twin deliveries, rapid weight fluctuations, and obesity. The demand for treatment options is further fueled by the use of corticosteroid medications. Topical products, including creams, oils, serums, and lotions, are particularly favored for stretch mark management. According to a ResearchGate article from December 2023, formulations containing Centella Asiatica have been clinically shown to significantly enhance the appearance of stretch marks, offering effective skin healing and texture improvement.

The laser segment is expected to grow at the fastest CAGR of 9.3% over the forecast period. Increasing demand for non-invasive and effective solutions to improve skin appearance, advances in laser technology, and enhanced stretch mark reduction through combined treatments. According to the Medical News article published in May 2023, using a combination of treatments, such as radiofrequency and pulsed dye laser therapy, has shown superior results in reducing stretch marks. According to a study, nearly 90% of participants reported good to very good improvement in their stretch marks after undergoing a series of these combined treatments.

Regional Insights

North America stretch marks treatment market is expected to register significant growth over the forecast period. Significant market drivers include growing R&D investments, an increasing obesity population, and advanced stretch mark treatment technologies. According to a CDC article from September 2023, population data from 2022 revealed a concerning rise in adult obesity rates in the U.S. Over 22 states reported an obesity prevalence of 35% or higher, up from 19 states in 2021. This surge in obesity heightens the demand for stretch mark treatments, as obesity is a known risk factor for developing stretch marks. The rising number of affected individuals emphasizes the urgent need for effective solutions to manage and reduce the appearance of stretch marks.

U.S. Stretch Marks Treatment Market Trends

The stretch marks treatment market in U.S. held the largest market share in the North America region in 2024. The rising geriatric population, which is more susceptible to CVD cases, increasing cardiac surgery patients, and technological advancements. According to the Food Research & Action Center article published in July 2024, the data reveal that 39.6% of U.S. adults are classified as obese, with an additional 31.6% being overweight and 7.7% categorized as severely obese. This high prevalence of obesity significantly contributes to the development of stretch marks, highlighting an increasing demand for effective treatments.

Asia Pacific Stretch Marks Treatment Market Trends

APAC stretch marks treatment market dominated the global market with a revenue share of 39.8% in 2024. Market growth is attributable to the increasing obesity rates and rising pregnancies, alongside changing consumer preferences for these procedures. In June 2024, the Asia Pacific Society of Cardiology reported that the prevalence of stretch marks in West Asian countries, including Qatar, Saudi Arabia, and the United Arab Emirates, ranges from 20.0% to 40.0%. In Southeast Asia, Malaysia has the highest obesity rate at approximately 20.0%. Moreover, nations such as China, Indonesia, and India have seen alarming increases in obesity rates among children and adolescents over the past decade.

The stretch marks treatment market in China dominated the Asia Pacific market with a revenue share of 22.8% in 2024. Key factors driving market growth include the rising prevalence of obesity and stretch mark conditions, along with supportive government initiatives. An article from the World Obesity Federation published in March 2023 emphasized the urgent need for a “Healthy China,” a program aimed at integrating health into policymaking. Over 50.0% of Chinese adults and approximately 20.0% of school-aged children were reported to be overweight, making obesity prevention a primary focus for the Chinese National Health Commission. This initiative has attracted significant attention from governmental bodies, academic institutions, and international organizations committed to addressing obesity.

Stretch marks treatment market in Japan accounted for the second largest share of the market in the Asia Pacific region in 2024 due to the launch of new types and collaborations between industry players, increased adoption of advanced stretch mark treatments, rising obesity cases, and pregnancy incidence. For instance, in August 2023, Japan reported an obesity rate of just 4.5%. This rate of obesity can influence the demand for stretch marks treatments in Japan. With fewer individuals experiencing obesity-related skin issues, the market for stretch marks treatments in Japan may be less pronounced compared to regions with higher obesity rates.

The India stretch marks treatment market is experiencing significant growth, driven by several key factors, growing incidence of obesity, increasing pregnancy cases, and expanding healthcare infrastructure. According to an article in “The Indian Express” published in March 2024, over the past thirty years, obesity rates among women have surged dramatically, climbing from 1.2% in 1990 to 9.8% in 2022. In 2022, there were approximately 44 million women affected by obesity. During the same period, obesity among men also increased, though by a smaller margin of 4.9 percentage points, resulting in around 26 million men living with obesity. This sharp rise in obesity rates is likely to drive demand for stretch marks treatments, as the condition is closely linked with significant weight fluctuations and obesity.

Europe Stretch Marks Treatment Market Trends

The European stretch marks treatment market held a substantial market share in 2024. This trend can be attributed to the rising number of individuals experiencing obesity and rapid weight fluctuations. For example, in January 2024, one in six EU citizens was classified as obese, with over half of adults in the EU considered overweight. These statistics highlight the growing urgency to address obesity-related health issues across the region.

The stretch marks treatment market in Germany is expected to grow lucratively over the forecast period. Market growth in the country is driven by the presence of key players, increasing obesity rates, and advanced healthcare infrastructure. For instance, in September 2022, approximately 19.0% of adults in Germany were classified as obese, defined as having a BMI of 30 kg/m² or higher. This figure marked a continuous rise in obesity rates, particularly among older adults aged 45–64, highlighting the pressing need for effective interventions.

The stretch marks treatment market in the UK held the second-largest market share in the Europe region in 2024. The rise in pregnancies and the increasing obesity incidence highlight the need for continued innovation and advancements in stretch mark treatment to reduce this trend effectively. According to the Office for National Statistics article published in March 2023, the UK and Wales experienced an increase in pregnancies, rising from 817,515 in 2020 to 824,983 in 2021. This uptick, the first in six years, highlights a growing demand for effective stretch marks treatments. As the number of pregnancies rises, so does the prevalence of stretch marks, prompting increased interest in both preventive and corrective skincare solutions. Expectant mothers and others affected by stretch marks are seeking more effective treatment, driving growth in the market for products and therapies to manage and reduce stretch marks' appearance.

The France stretch marks treatment market is anticipated to witness a significant CAGR of 9.4% during the forecast period. The rising number of obesity cases and increased demand for stretch marks treatment are boosting the market's growth. For instance, in October 2023, nearly 21% of the adult population in France was classified as obese, a figure that has doubled over the past 20 years, highlighting the severity of the issue. Additionally, approximately 8% of children in France are also affected by obesity, emphasizing the need for early intervention and preventative measures to address this growing problem.

Latin America Stretch Marks Treatment Market Trends

The Latin American stretch marks treatment market is growing due to several factors. The growing number of obesity cases, increasing pregnancy incidence, and rising government initiatives fuel the market's growth.

Brazil's stretch marks treatment market is expanding due to several distinct growth drivers. Rising healthcare expenditure and government initiatives aimed at improving cardiac care infrastructure. For instance, in December 2023, the World Obesity Atlas forecasts that by 2030, Brazil will experience a prevalence of obesity, affecting 33% of women and 26% of men. This projection positions Brazil among the top 11 countries with the highest obesity rates for women and the top 9 for men. The anticipated rise in obesity is expected to significantly impact the stretch marks treatment market, as the condition frequently results from substantial weight changes.

MEA Stretch Marks Treatment Market Trends

The MEA stretch mark treatment market is expected to grow at a lucrative CAGR in the coming years, driven by the rising incidence of obesity and the increasing adoption of advanced stretch mark treatment technologies in the region.

The South African stretch marks treatment market held a 39.3% share in 2024. Increasing obesity cases and rising healthcare expenditure. For instance, in March 2024, In South Africa, the obesity rate stood at 31% for men and a striking 68% for women. In addition, the National Health and Nutrition Survey reveals that 13% of children aged one to five are obese, significantly higher than the global average of 6.1%. This high prevalence of obesity across different age groups is likely to drive demand for stretch marks treatments, as rapid weight fluctuations often contribute to the development of stretch marks.

Key Stretch Marks Treatment Company Insights

Some of the key players operating in the industry include Alliance Pharma PLC; basq NYC; Clarins; Candela Corporation; and Dermaclara. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Weleda AG Source and Union Swiss (Pty) Ltd are some of the emerging players in stretch marks treatment.

-

Basq NYC provides pregnancy-safe skincare designed to prevent stretch marks and enhance skin elasticity, utilizing plant extracts and moisturizing ingredients such as shea butter. They offer both spa treatments and retail products, including stretch mark butter and body oils.

-

Dermaclara focuses on stretch mark treatments through Silicone Fusion Technology, offering reusable patches made from 100% medical-grade silicone. These patches create a microclimate to enhance moisture, regulate collagen, and diminish the appearance of stretch marks and scars, with dermatologist approval.

Key Stretch Marks Treatment Companies:

The following are the leading companies in the stretch marks treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Alliance Pharma PLC

- basq NYC

- Clarins

- Candela Corporation

- Dermaclara

- E.T. Browne Drug Co., Inc. (Palmers)

- Helix BioMedix, Inc.

- Perrigo Company plc (HRA Pharma)

- Laboratoires Expanscience

- Union Swiss Private Limited

- Weleda

Recent Developments

-

In August 2024, Candela Corporation announced FDA clearance for its Matrix system in the U.S., expanding the Matrix Pro RF microneedling applicator's indication for facial wrinkle reduction in Fitzpatrick Skin Types I-IV.

-

In November 2023, BEAUTYLAB introduced its new Microneedling Pen System, a professional-grade treatment designed to boost cellular renewal by leveraging the skin’s natural healing process. The system uses fine needles to create temporary microscopic traumas on the skin's surface, triggering a natural wound-healing response.

-

In May 2022, Givaudan Active Beauty launched Centella CAST, a natural extract derived from Centella Asiatica using green fractionation. This innovative ingredient targets the mechanisms behind stretch marks by enhancing skin elasticity, density, and firmness, thereby improving the appearance of stretch marks for a wide range of users.

-

In April 2022, Skin Science Solutions introduced Icoone Roboderm, an advanced device that leverages innovative cellular technologies for painless, non-invasive facial and body rejuvenation. This technology provides versatile, customizable treatments for both facial and body concerns, including the reduction of stretch marks and wrinkles.

Stretch Marks Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 342.7 million

Revenue forecast in 2030

USD 529.1 million

Growth rate

CAGR of 9.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Treatment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Alliance Pharma PLC; basq NYC; Clarins; Candela Corporation; Dermaclara; E.T. Browne Drug Co., Inc. (Palmers); Helix BioMedix, Inc.; Perrigo Company plc (HRA Pharma); Laboratoires Expanscience; Union Swiss Private Limited; Weleda

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stretch Marks Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global stretch marks treatment market report based on treatment, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Products

-

Creams

-

Oils & Serums

-

Lotions

-

-

Laser

-

Fractional Laser

-

Pulse-Dye Laser

-

Others

-

-

Microdermabrasion

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global stretch marks treatment market size was estimated at USD 315 million in 2024 and is expected to reach USD 342.7 million in 2025.

b. The global stretch marks treatment market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030 to reach USD 529.1 million by 2030.

b. Asia Pacific dominated the stretch marks treatment market with a share of 39.8% in 2024. This is attributable to growing consciousness for cosmetic procedures & fashion and rise in disposable income of consumers in the region.

b. Some key players operating in the stretch marks treatment market include Laboratoires Expanscience, Clarins Group, Merz North America, Inc., Syneron Medical Ltd., E.T. Browne Drug Co., Inc., Cynosure, Inc., Centre Light Solutions, LLC, Basq Skincare, Union-Swiss (Pty) Ltd., Ellipse A/S, The Boppy Company LLC, Helix BioMedix, Inc., Dermaclara, Inc., Mama Mio US, Inc., and Weleda AG

b. Key factors that are driving the market growth include increasing obesity issues due to the prevalence of unhealthy lifestyles and growing cosmetic concerns among pregnant women.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.