- Home

- »

- Next Generation Technologies

- »

-

Subscription Economy Market Size, Industry Report, 2033GVR Report cover

![Subscription Economy Market Size, Share & Trends Report]()

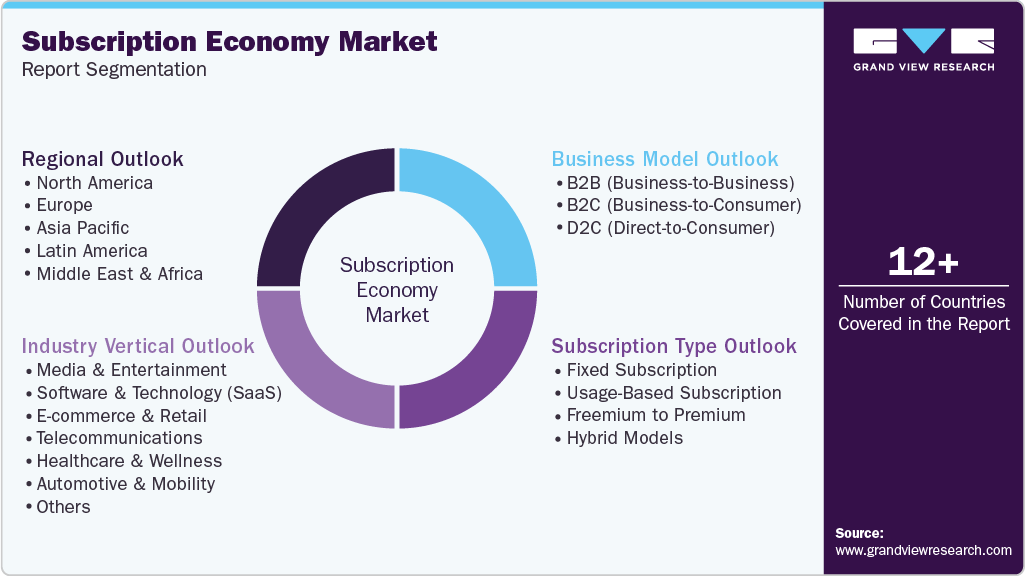

Subscription Economy Market (2025 - 2033) Size, Share & Trends Analysis Report By Business Model (B2B (Business-to-Business), B2C (Business-to-Consumer), D2C (Direct-to-Consumer)), By Subscription Type, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-691-2

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Subscription Economy Market Summary

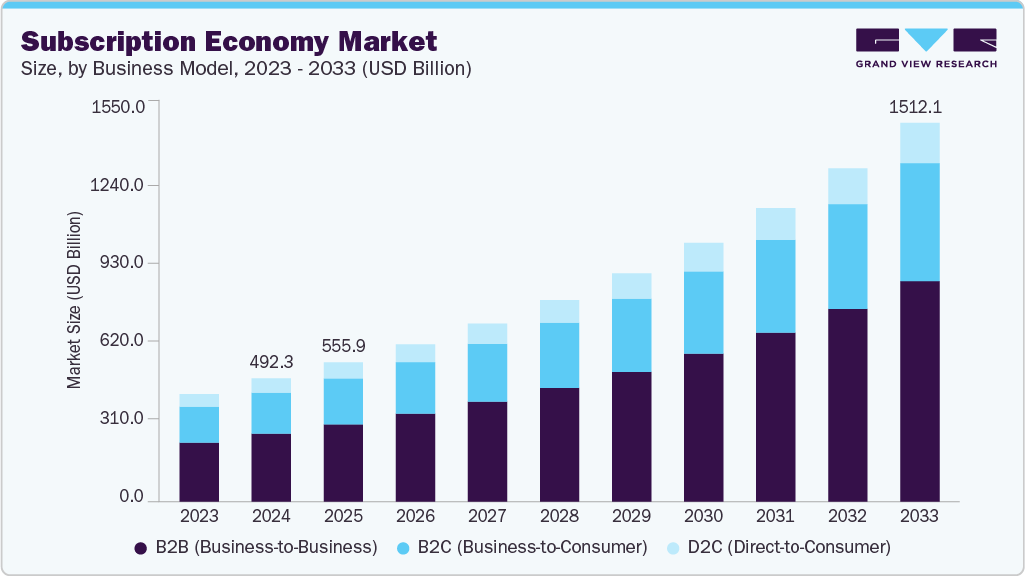

The global subscription economy market size was estimated at USD 492.34 billion in 2024 and is projected to reach USD 1,512.14 billion by 2033, growing at a CAGR of 13.3% from 2025 to 2033. The subscription economy is expanding as businesses adopt recurring revenue models to ensure predictable income and stronger customer relationships.

Key Market Trends & Insights

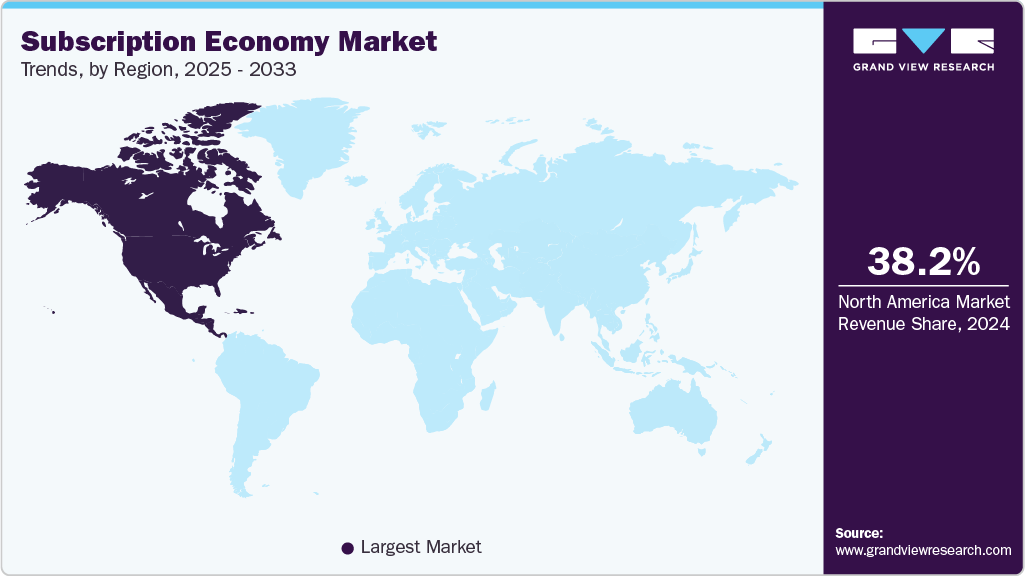

- North America subscription economy dominated the global market with the largest revenue share of 38.2% in 2024.

- The subscription economy market in U.S. led the North America market and held the largest revenue share in 2024.

- By business model, B2B (Business-to-Business) segment led the market and held the largest revenue share of 55.2% in 2024.

- By subscription type, the fixed subscription segment held the dominant position in the market and accounted for the largest revenue share of 48.1% in 2024.

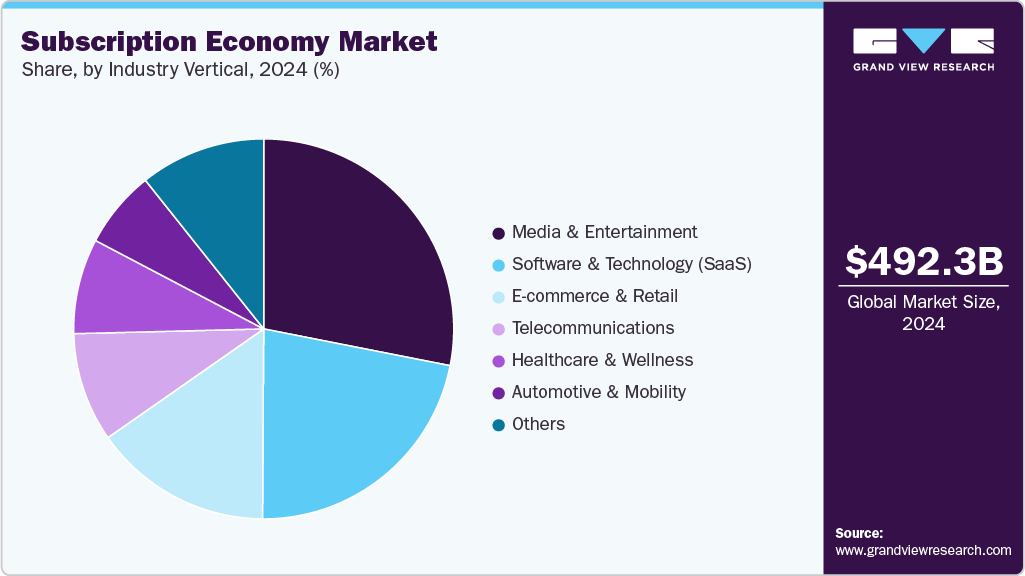

- By industry vertical, the software & technology (SaaS) segment is expected to grow at the fastest CAGR of 15.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 492.34 Billion

- 2033 Projected Market Size: USD 1,512.14 Billion

- CAGR (2025-2033): 13.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

Improved digital payment systems, including wallets and embedded billing, support seamless transactions and user retention. Consumers increasingly prefer flexible, automated services, driving growth across media, software, retail, and health sectors. This change is fueling consistent market expansion supported by digital infrastructure and evolving consumption patterns. Businesses are increasingly shifting toward subscription-based analytics platforms. These platforms give clients continuous access to real-time consumer and market data. Organizations use this data to improve decision-making and boost performance. The subscription model ensures predictable, recurring revenue for providers. It also reflects growing demand for accessible, insight-driven solutions across different sectors. For example, in May 2025, Zepto Marketplace Private Limited, a quick-commerce company in India, launched Zepto Atom, a subscription-based analytics and commerce platform powered by Zepto GPT and NLP, offering brands real-time consumer insights and hyperlocal targeting. Over 7,000 products and major brands have joined the initiative, marking Zepto’s move into data-driven services within the subscription economy.

Offering personalized digital services through recurring billing models is becoming more common across industries. This shift is driven by the need for more customized and engaging user experiences. Businesses are improving standard features with AI and real-time user data. These enhanced features are then offered as premium options under paid plans. Subscription-based personalization lets companies stand out in competitive markets. It also helps generate a reliable stream of recurring revenue. Consumers benefit from more relevant and engaging content tailored to their needs. Over time, this approach boosts customer loyalty and user retention. For example, Polar Electro, a Finnish sports tech company, has launched a premium Fitness Program that builds on its existing FitSpark feature by offering personalized, long-term training plans via a subscription model. This illustrates how fitness tech firms are now earning steady income by charging for advanced coaching and health features.undling and aggregation are becoming central to subscription strategies across industries.

Consumers increasingly prefer accessing multiple services such as content streaming, digital fitness, home automation, and cloud storage through a single provider. This reduces the hassle of managing separate accounts, credentials, and billing cycles. A unified subscription experience enhances user convenience and satisfaction. It also strengthens the perceived value of the subscription, as users feel they are receiving more for what they pay. For companies, bundling increases average revenue per user and supports cross-selling opportunities. It also helps lower churn by deepening customer reliance across multiple services. Aggregated offerings create stronger customer relationships by expanding the scope of engagement. This change shows a broader move in digital consumption toward simplification, personalization, and efficiency. As competition intensifies, providers are using aggregation not only to retain users but to differentiate their platforms through comprehensive ecosystems.

Business Model Insights

The B2B (Business-to-Business) segment dominated the subscription economy market in 2024, accounting for a 55.2% share. This dominance was driven by strong demand for enterprise software, data services, and cloud-based platforms. Businesses adopted subscription models to streamline operations and reduce upfront costs. The model enabled vendors to build long-term client relationships through value-added services and personalized support. With the rise of digital transformation, B2B customers prioritized scalable and flexible solutions. The environment created favorable conditions for subscription-based offerings to grow across sectors such as SaaS, cybersecurity, and data analytics.

The B2C (Business-to-Consumer) segment plays a significant role in the subscription economy due to its large user base and frequent digital interactions. Services in areas like entertainment, wellness, e-learning, and food delivery focus on engaging users through smooth digital experiences. Companies are adopting freemium models and flexible billing to attract individual customers. Personalization, convenience, and on-demand access are key factors that drive customer interest. Platforms are highlighting content variety, app ease of use, and value-driven offerings. This approach helps enhance user retention and extend subscription lifespans. The segment stays competitive, with providers aiming to stand out through service quality and customer experience. Pricing innovation and bundled options continue to shape user preferences in this market.

Subscription Type Insights

Fixed Subscription maintained a dominant position in the subscription economy market in 2024, driven by its simplicity and consistent pricing. Customers prefer this model for its straightforward structure, paying a set fee irrespective of usage levels. It offers financial predictability and minimizes the complexity often associated with metered or tiered billing systems. For businesses, fixed subscriptions provide stable recurring revenue and support accurate long-term financial planning. This approach remains effective across industries such as media, SaaS, and streaming, where constant access is more valued than on-demand usage.

Hybrid models are becoming increasingly prominent in the subscription economy as providers adapt to diverse user preferences. By combining fixed pricing with usage-based or freemium features, these models offer flexibility and wider appeal. Users value the ability to start with a basic service and pay more only when additional value is needed. Providers use this approach to attract both light and heavy users, maximizing reach without sacrificing revenue consistency. It also improves customer retention by allowing service customization based on behavior or demand. Hybrid models are gaining popularity in software, digital platforms, and enterprise solutions, where customization is essential.

Industry Vertical Insights

Media & Entertainment holds the largest share in the subscription economy market in 2024, driven by strong consumer demand for constant content access. Streaming platforms, digital news, and gaming services maintain strong engagement with predictable subscription revenue. The nature of content consumption supports long-term subscriptions, driving platform stickiness and reducing churn. This sector benefits from frequent updates and low switching costs, which keep users subscribed over time. Companies in this space focus on exclusive content and bundled offerings to stay competitive. Its position remains strong as content becomes central to daily digital engagement.

Software & Technology (SaaS) is becoming more important in the subscription economy as businesses shift toward cloud-based services and digital workflows. This model offers flexibility, scalability, and lower initial costs, making it ideal for startups and large companies. As organizations focus on remote operations and automation, demand for SaaS solutions grows across areas such as CRM, productivity, and security. Providers use tiered pricing, usage-based plans, and integration features to address diverse client needs. The subscription model fosters ongoing customer relationships, helping companies with retention and upselling.

Regional Insights

North America holds the largest share in the subscription economy market at 38.2%, supported by extensive digital infrastructure and high consumer readiness. Businesses across sectors such as media, software, fitness, and retail have deeply adopted subscription models. Consumers in this region are used to recurring digital payments and appreciate continuous service access. Well-developed ecosystems and early adoption of cloud and SaaS platforms drive its leadership. Companies in North America often lead in developing new models, which are later adopted elsewhere.

U.S. Subscription Economy Market Trends

U.S. continues to account for a substantial portion of the North American share, driven by tech giants and content providers. Consumers are heavily engaged in streaming, subscription retail, and productivity tools. High per capita income and digital literacy support recurring revenue models across industries. U.S.-based companies lead in subscription technology development and pricing experimentation.

Europe Subscription Economy Market Trends

Europe remains an important region in the subscription economy market due to increasing consumer acceptance of digital services. The adoption of subscription models spans across industries such as streaming, health, learning, and productivity tools. Regulatory frameworks such as GDPR promote user trust, supporting recurring digital transactions. Regional diversity encourages localized offerings and flexible service models.

Asia Pacific Subscription Economy Market Trends

Asia Pacific is the fastest-growing region in the subscription economy market. Increasing internet penetration and smartphone usage are accelerating this growth. The expanding middle class is driving demand for digital services. Streaming, e-commerce, and SaaS subscriptions are gaining significant traction. Companies are utilizing hybrid models to address varying spending capacities. Localized pricing and digital payment systems support broader market access.

Key Subscription Economy Company Insights

Some of the key companies in the subscription economy industry include Apple Inc., Dropbox, Microsoft, Netflix, Peloton, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Microsoft continues to strengthen its presence in the subscription economy through cloud and productivity services. Office 365 and Azure offer flexible subscription tiers for individuals and enterprises. Regular feature updates and integration across platforms enhance long-term user engagement. The company leverages bundled plans to increase value perception. Its strategy emphasizes stability, scalability, and consistent revenue generation.

-

Netflix remains a key force in the subscription economy through its global streaming platform. It invests heavily in localized and original content to retain subscribers. Tiered pricing and ad-supported plans offer affordability and reach. Continuous platform improvements support user engagement. The company’s focus lies in content innovation and retention-driven monetization.

Key Subscription Economy Companies:

The following are the leading companies in the subscription economy market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Amazon.com, Inc.

- Apple Inc.

- Dropbox

- Microsoft

- Netflix

- Peloton

- Salesforce, Inc.

- Spotify

- Zoom Communications, Inc.

Recent Developments

-

In July 2025, Spotify launched Audiobooks+ and Audiobooks+ for Plan Members, offering Premium subscribers extra audiobook listening hours beyond the standard 15-hour limit. These new subscription add-ons provide greater flexibility and personalization, targeting avid audiobook listeners and expanding Spotify's footprint in the subscription economy.

-

In February 2025, Spotify, a digital audio streaming company in Sweden, and Warner Music Group signed a multi-year agreement to introduce more paid subscription tiers, fan experiences, and content bundles. The deal supports Spotify’s expansion into premium offerings, including a superfan tier, boosting its presence in the subscription economy.

-

In September 2024, Salesforce Inc., a U.S.-based software company, introduced its AI-powered platform Agentforce at the Dreamforce conference. The platform aims to automate routine business tasks and enhance real-time insights within its subscription-based model.

Subscription Economy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 555.92 billion

Revenue forecast in 2033

USD 1,512.14 billion

Growth rate

CAGR of 13.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Business model, subscription type, industry vertical, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Adobe; Amazon.com, Inc.; Apple Inc.; Dropbox; Microsoft; Netflix; Peloton; Salesforce, Inc.; Spotify; Zoom Communications, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Subscription Economy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global subscription economy market is based on business model, subscription type, industry vertical, and region.

-

Business Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

B2B (Business-to-Business)

-

B2C (Business-to-Consumer)

-

D2C (Direct-to-Consumer)

-

-

Subscription Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Fixed Subscription

-

Usage-Based Subscription

-

Freemium to Premium

-

Hybrid Models

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

Media & Entertainment

-

Software & Technology (SaaS)

-

E-commerce & Retail

-

Telecommunications

-

Healthcare & Wellness

-

Automotive & Mobility

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global subscription economy market size was estimated at USD 492.34 billion in 2024 and is expected to reach USD 555.92 billion in 2025.

b. The global subscription economy market is expected to grow at a compound annual growth rate of 13.3% from 2025 to 2033 to reach USD 1,512.14 billion by 2033.

b. North America dominated the subscription economy market with a share of 38.2% in 2024. This is attributable to widespread digital infrastructure, high consumer adoption of recurring billing models, and the strong presence of key platform providers.

b. Some key players operating in the subscription economy market include Adobe, Amazon.com, Inc., Apple Inc., Dropbox, Microsoft, Netflix, Peloton, Salesforce, Inc., Spotify, and Zoom Communications, Inc.

b. Key factors that are driving the market growth include increasing consumer preference for flexible payment models, rising adoption of digital services, expansion of cloud-based platforms, growing focus on customer retention, and continuous innovation in subscription management technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.