- Home

- »

- Advanced Interior Materials

- »

-

Subsea Thermal Insulation Materials Market Report, 2020-2027GVR Report cover

![Subsea Thermal Insulation Materials Market Size, Share & Trends Report]()

Subsea Thermal Insulation Materials Market (2020 - 2027) Size, Share & Trends Analysis Report By Type (Polyurethane, Polypropylene), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-662-2

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Subsea Thermal Insulation Materials Market Summary

The global subsea thermal insulation materials market size was valued at USD 264.0 million in 2019 and is projected to reach USD 362.2 million by 2030, growing at a CAGR of 4.0% from 2020 to 2027. The growing use of thermal insulation materials in offshore pipeline systems to ensure the flow of oil and gas products is expected to fuel the market growth in the upcoming period.

Key Market Trends & Insights

- Europe led the market for subsea thermal insulation materials and held a share of 34.1% in 2019.

- Asia Pacific emerged as the second-largest regional market for subsea thermal insulation materials in 2019.

- Middle East and Africa is anticipated to expand at the fastest CAGR of 5.6% in terms of revenue over the forecast period.

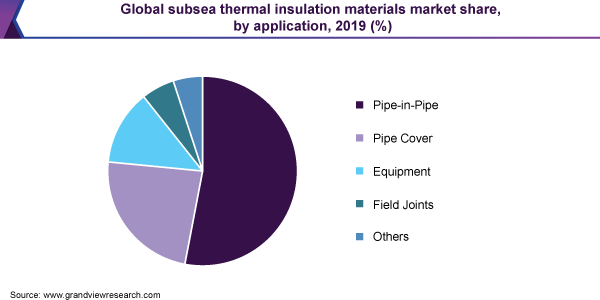

- Based on application, the pipe-in-pipe application segment dominated the market for subsea thermal insulation materials with a revenue share of 53.0% in 2019.

- In terms of type, the polyurethane segment held the largest revenue share of 42.5% in 2019.

Market Size & Forecast

- 2019 Market Size: USD 264.0 Million

- 2027 Projected Market Size: USD 362.2 Million

- CAGR (2020 - 2027): 4.0%

- Europe: Largest market in 2019

- Middle East and Africa: Fastest growing market

According to the United States Energy Information Administration statistics, the offshore oil accounted for about 30% of the total global oil production in 2019. Significant advancements in offshore drilling technology and near exhaustion of shallow water oil reserves are leading to an increased focus on deepwater and ultra-deepwater exploration and drilling activities.

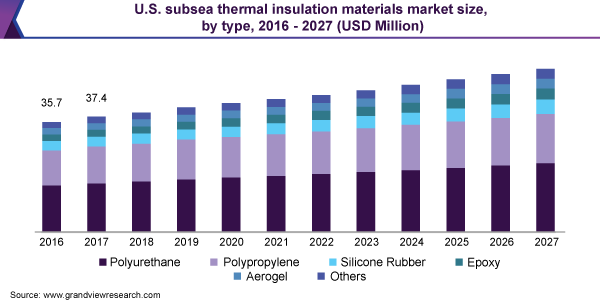

In the U.S., the market for subsea thermal insulation materials is dominated by polyurethane type insulation. Subsea insulation based on polyurethane foam is widely used in deepwater applications owing to their durability, superior adhesion, and impact resistance property across a variety of operating conditions.

There is a high level of state participation in the oil and gas industry. Countries such as Brazil, Malaysia, and Angola are increasingly focusing on developing their offshore oilfields to generate additional revenue for their respective national budgets. However, high operating costs associated with offshore oil projects are projected to pose a challenge to market growth in the future.

In ultradeep water oilfields, the relatively hot petroleum with temperatures as high as 80 °C is extracted from the bottom of the ocean. At these depths, the temperature of the surrounding seawater ranges around 4°C, thereby increasing the probability of pipeline blockage due to hydrate or wax formation. This, in turn, necessitates the use of subsea thermal insulation materials.

Growing offshore complexities and many of the oil spills originating in offshore oil platforms in the past have influenced the newly framed regulations. The new regulations have framed strict directions for some specific areas, which include a piping system on the basis of design, insulation, installation, and maintenance.

Type Insights

The polyurethane segment held the largest revenue share of 42.5% in 2019 and is expected to maintain its lead over the forecast period. Growing demand for cost-efficient insulation material with low thermal conductivity and better overall heat transfer coefficient (U-value) is projected to fuel the growth of the polyurethane segment.

Polypropylene insulation emerged as the second-largest segment with 33.0% share based on revenue in 2019. Wide-ranging use of polypropylene-based foam for pipe covering application, coupled with its durability and relatively low-cost property, has propelled the use of polypropylene insulation in subsea applications.

Polypropylene tapes are widely used by flexible pipe manufacturers to enhance the flow rate and thermal performance of the pipe. These tapes are generally wound around the piping material to decrease the possibility of wax and hydrate formations. As a result, the growing use of deep-sea flexible piping systems is anticipated to drive the demand for polypropylene insulation.

The silicon rubber segment is expected to witness significant growth over the upcoming period owing to its superior adhesion property and corrosion resistance. Increasing product application in a variety of subsea applications, including jumpers, manifolds, trees, and other subsea components, is projected to augment the product demand.

Application Insights

The pipe-in-pipe application segment dominated the market for subsea thermal insulation materials with a revenue share of 53.0% in 2019. Superior insulation performance, mechanical strength, and stability on the seabed are some of the factors that are driving the demand for the pipe-in-pipe system in the subsea application.

Technological advancements such as using electrical trace heating technology, coupled with computational fluid dynamics (CFD), are being used to accurately predict the system performance and ensure a seamless flow of fluid. Furthermore, the use of pipes made from corrosion-resistant alloys is expected to enhance the performance and operational life of the pipe-in-pipe system.

The pipe cover segment is projected to expand at the fastest CAGR of 4.4% over the forecast period. The growing use of wet insulation pipe system as a cost-effective alternative to the pipe-in-pipe segment is expected to fuel the segment growth. Furthermore, reduced installation cost associated with the product is projected to have a positive impact on product demand. The equipment segment is projected to grow at a considerable pace over the upcoming period. The growing use of polyurethane and polypropylene insulation materials for coating various pumping and drilling equipment is expected to drive the segment over the forecast period.

Regional Insights

Europe led the market for subsea thermal insulation materials and held a share of 34.1% in 2019. In this region, Russia is expected to expand at the fastest CAGR of 4.6% in terms of revenue over the forecast period. The country is projected to generate significant demand for subsea insulation materials owing to planned development and expansion of offshore oilfields in the Arctic region.

Asia Pacific emerged as the second-largest regional market for subsea thermal insulation materials in 2019. In this region, countries such as Malaysia, Vietnam, China, and Indonesia are expected to drive the demand for the subsea thermal insulation materials over the forecast period. The market in this region is anticipated to grow in the future owing to increasing exploration and production (E&P) of oil in order to reduce the dependence on imports.

North America held a considerable share in the market in 2019. The development of offshore oilfields in the Gulf of Mexico is the primary factor driving the product demand. Furthermore, the planned development of offshore oilfields in the Baffin Bay is projected to have a favorable impact on market growth.

Middle East and Africa is anticipated to expand at the fastest CAGR of 5.6% in terms of revenue over the forecast period. Increasing spending on exploration and development of offshore oilfields in Angola and Nigeria is expected to be a major factor driving the demand for subsea thermal insulation materials in the Middle East and Africa. Nigeria and Angola are among the largest consumers of subsea thermal insulation materials owing to their well-developed offshore oil industry.

Key Companies & Market Share Insights

Key players in the market are competing based on product innovation, product range, and geographical reach. Moreover, these players are collaborating with major offshore piping system manufacturers and installers to increase their market share. Companies in the subsea thermal insulation materials industry are also making significant investments in R&D activities. They are actively working together with leading E&P players to develop application-specific products and expand their market footprint. Additionally, they are focusing on increasing their distribution network and geographical presence. Some of the prominent players in the subsea thermal insulation materials market include:

-

Trelleborg

-

Advanced Insulation Plc

-

Cabot Corporation

-

Shawcor Ltd.

-

BASF SE

-

Benarx

-

Armacell

-

Balmoral Group

-

TechnipFMC plc

-

Aspen Aerogels, Inc.

-

AFGlobal

Subsea Thermal Insulation Materials Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 273.8 million

Revenue forecast in 2027

USD 362.2 million

Growth Rate

CAGR of 4.0% from 2020 to 2027

Market demand in 2020

6514.4 kilotons

Volume forecast in 2027

8574.0 kilotons

Growth Rate

CAGR of 4.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Norway; Denmark; Russia; China; Indonesia; Malaysia; Philippines Brazil; Angola; Nigeria; Ghana

Key companies profiled

Trelleborg; Advanced Insulation Plc; Cabot Corporation.; Shawcor Ltd; BASF SE; Benarx; Armacell; Balmoral Group; TechnipFMC plc; Aspen Aerogels, Inc.; AFGlobal

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global subsea thermal insulation materials market report on the basis of type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Polyurethane

-

Polypropylene

-

Silicone Rubber

-

Epoxy

-

Aerogel

- Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Pipe-in-Pipe

-

Pipe Cover

-

Equipment

-

Field Joints

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Norway

-

Denmark

-

Russia

-

-

Asia Pacific

-

China

-

Indonesia

-

Malaysia

-

Philippines

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

Nigeria

-

Angola

-

Ghana

-

-

Frequently Asked Questions About This Report

b. The global subsea thermal insulation materials market size was estimated at USD 264.0 million in 2019 and is expected to reach USD 273.8 million in 2020.

b. The subsea thermal insulation materials market is expected to grow at a compound annual growth rate of 4.0% from 2020 to 2027 to reach USD 362.2 million by 2027.

b. The pipe-in-pipe segment dominated the subsea thermal insulation materials market with a share of 53.0% in 2019. This is attributable to superior insulation performance, mechanical strength, and stability on the seabed properties of the pipe-in-pipe insulation.

b. Some of the key players operating in the geotextile tubes market include Trelleborg, Advanced Insulation Plc, Cabot Corporation., Shawcor Ltd, Cabot Corporation, AF Global, Aspen Aerogels Inc., Armacell, and BASF SE

b. The key factors that are driving the subsea thermal insulation materials market include growing investment in the exploration and development of offshore oilfields and increasing use of thermal insulation materials in offshore pipeline systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.