- Home

- »

- Agrochemicals & Fertilizers

- »

-

Sulfur Fertilizer Market Size, Share And Growth Report, 2030GVR Report cover

![Sulfur Fertilizer Market Size, Share & Trends Report]()

Sulfur Fertilizer Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Sulfates, Elemental Sulfur), By Form (Dry, Liquid), By Crop Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-359-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sulfur Fertilizer Market Size

“2030 Sulfur Fertilizer Market value to reach USD 5.44 billion”

The global sulfur fertilizer market size was estimated at USD 4.74 billion in 2023 and is projected to grow at a CAGR of 2.2% from 2024 to 2030. The market is driven by the increasing demand for effective soil supplements such as sulfur fertilizers, the rising level of new agricultural production, and the decline in sulfur output. This trend is further fueled by the growing demand for agro products due to urbanization, the rising demand from the fertilizer manufacturing sector, and the increasing awareness among farmers about the importance of sulfur in achieving optimal crop yields.

Sulfur fertilizers are essential nutrients used to enhance plant growth and development. Sulfur is a vital macronutrient plants require for various physiological processes, including synthesizing amino acids, proteins, and enzymes. These products come in different forms, such as elemental sulfur, sulfate, and sulfide, and they are applied to the soil to address sulfur deficiencies in crops. These fertilizers are crucial for maintaining soil fertility and improving crop yields.

These products also contribute to the overall health and vigor of plants, leading to improved resilience against environmental stressors and diseases. Furthermore, these fertilizers aid in the efficient utilization of other essential nutrients, such as nitrogen and phosphorus, by plants, thereby optimizing overall nutrient uptake.

As more farmers recognize the significance of sulfur in achieving optimal crop yields and quality, the demand for fertilizers is expected to rise. Additionally, the shift towards sustainable agricultural practices and the growing emphasis on maximizing crop productivity further drive the demand for these products.

Type Insights

“Sulfates emerged as the fastest growing type with a CAGR of 2.5%”

Sulfates dominated the market and accounted for a revenue share of 42.8% in 2023. One of the most common forms of sulfate fertilizer is ammonium sulfate, which contains 24% sulfur. This type is highly preferred for crops that require immediate uptake, as it can be easily absorbed by the plant roots. Additionally, gypsum, a calcium sulfate, is another example of a sulfate fertilizer. Gypsum provides a dual benefit of sulfur and calcium, promoting soil structure and improving crop quality.

Elemental sulfur is another important type used in agriculture. Unlike sulfates, elemental ones are not immediately available to plants upon application. It needs to be oxidized by soil microorganisms to transform into sulfate form, which can then be utilized by plants. This slow-release characteristic makes elemental sulfur an ideal choice for addressing long-term deficiencies in soils.

Liquid sulfur fertilizers are formulated to deliver sulfur in a readily available form for plant uptake. These fertilizers are often used as foliar sprays or soil drenches to provide an immediate boost to crops. One major type is ammonium thiosulfate, which contains both ammonium and thiosulfate variants. This type of fertilizer is commonly used in specialty crops and horticultural applications.

Form Insights

“Dry emerged as the fastest growing form with a CAGR of 2.6%”

Liquid dominated the market and accounted for a revenue share of approximately 78.3% in 2023. Liquid sulfur fertilizers are formulated as liquid solutions or suspensions that contain it in a readily available form for plant uptake. They are applied as foliar sprays or soil drenches to provide an immediate boost to crops. These products offer the advantage of rapid sulfur assimilation by plants, making them particularly useful in correcting deficiencies during critical growth stages. Additionally, they provide flexibility in application methods, allowing for precise and targeted supplementation.

Dry sulfur fertilizers are solid forms of nutrients that are applied to the soil to address sulfur deficiencies in crops. They come in various forms, including elemental granules and prilled elemental sulfur. Elemental, often in the form of granules, is a common type of dry fertilizer. It requires oxidation by soil microorganisms to become available to plants. The granular form is designed to gradually release sulfur over time, making it suitable for long-term soil management.

Crop Type Insights

“Oilseeds & Pulses emerged as the fastest growing crop type with a CAGR of 2.5%”

Cereals & Grains dominated the market and accounted for a revenue share of 35.4% in 2023. These crops have varying requirements for sulfur, and the amount of fertilization depends on factors such as crop type, the amount and type of other fertilizers used, soil conditions, and the width and distance between bands. For instance, the application of ammonium sulfate or ammonium sulfate plus nitrogen fertilizer should follow specific guidelines to ensure safe and adequate fertilization.

Oilseed crops, including canola, and pulse crops, such as peas and faba beans, have a higher sulfur requirement compared to cereal crops. Sulfur is crucial for the development of fertile canola flowers and is essential for good nodule development on legume forages and pulse crop roots. Deficiencies can be easily corrected with fertilizers containing sulfate (SO4). The application of fertilizers is critical for oilseed and pulse crops to ensure optimal growth, yield, and quality.

Sulfur fertilization is also vital for the cultivation of fruits and vegetables, contributing to the overall health and quality of these crops. Fruits and vegetables, including tomatoes, potatoes, and leafy crops, benefit from appropriate fertilization for their growth and development. Additionally, sulfur is associated with special metabolisms in plants and is crucial for enhancing the nutritional value of forages and the quality of various vegetables.

Application Insights

“Foliar emerged as the fastest growing application with a CAGR of 2.8%”

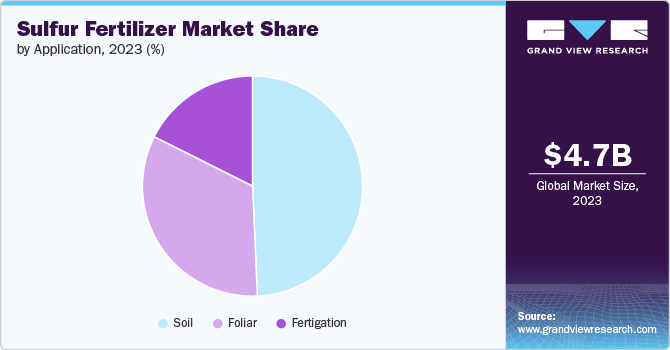

Soil dominated the market and accounted for a revenue share of 49.3% in 2023. Sulfur fertilizers are commonly applied to the soil to address sulfur deficiencies and promote optimal plant growth. Elemental variants, sulfate-based fertilizers, and thiosulfate solutions are often incorporated into the soil to provide a sustainable source of sulfur for crops. Additionally, ammonium thiosulfate solution (ATS) is a commonly used source in fluid fertilizer, providing both sulfate sulfur and elemental one after application to the soil.

Foliar application involves the direct application of sulfur fertilizers to plant leaves, allowing for rapid nutrient uptake and assimilation. However, when applied as foliar or dribble band to a crop, direct contact with plant leaves may cause leaf scorching. It is essential to follow manufacturers' instructions for blending and application to minimize the risk of leaf damage. Foliar fertilization can supplement soil fertilizer applications, especially when the root system is unable to keep up with crop demand or when soil nutrients are unavailable.

Fertigation refers to the injection of fertilizers into irrigation systems, allowing for the simultaneous application of water and nutrients to crops. This method is particularly effective in delivering sulfur fertilizers to plants, ensuring optimal nutrient uptake and utilization. Fertigation increases the rate of nutrient uptake and predictability of plant response to fertilization compared to broadcast and band applications. Potassium thiosulfate fertilizer, for example, can be applied through various methods, including foliar spray, soil application, and fertigation. Fertigation provides a convenient and efficient means of delivering fertilizers to crops, contributing to improved nutrient availability and plant growth.

Regional Insights

“North America emerged as the fastest growing market with a CAGR of 2.7% from 2024-2030”

The North America sulfur fertilizer market has been characterized by increasing research and development investments by key market players and the growing adoption of sulfur in various end-use applications, such as phosphate fertilizers. The region's agricultural sector, coupled with the rising demand for fertilizers, particularly in key countries such as the United States and Canada, contributes to the demand for sulfur fertilizers. Additionally, the region's focus on increasing production to cater to the global demand for sulfur further enhances the growth of the market in North America.

Europe Sulfur Fertilizer Market Trends

Europe's sulfur fertilizers market is expected to grow at a significant CAGR, driven by factors such as the expanding population's need for increased food output and productivity, while the amount of land under cultivation is declining. The use of sulfur fertilizers is anticipated to rise along with modern farming techniques in the region. Europe's dominance in the market is further underscored by its vast agricultural activities and the need to address deficiencies in crops.

Asia Pacific Sulfur Fertilizer Market Trends

Asia Pacific dominated the market and accounted for a 40.5% share in 2023. This region is the largest producer of agricultural commodities and is anticipated to account for a substantial portion of global agricultural output. With a growing population and shrinking arable land, the demand for fertilizers, including sulfur fertilizers, is on the rise. Notably, countries such as China and India are key contributors to the demand for fertilizers in the Asia Pacific region.

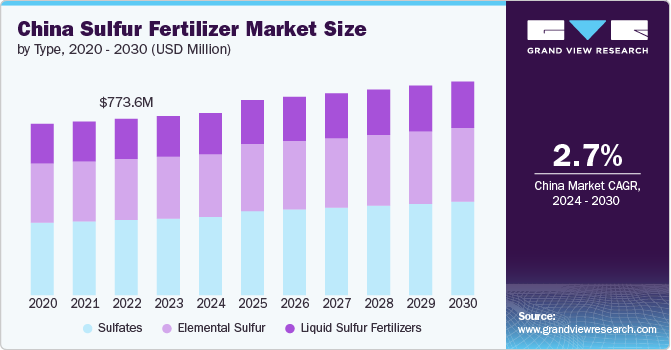

China sulfur fertilizer market is growing due toChina’s extensive agricultural activities, including the production of important crops such as rice, sugar beetroot, fruits, vegetables, cereals, and grains, contribute to the substantial demand for sulfur fertilizers. The direct use of micronutrients, including sulfur fertilizers, to address plant shortages and their frequent use with other fertilizers or additives underscores the significant need for fertilizers in China. Moreover, the growing demand for sulfur in fertilizer and rubber processing from countries such as China further emphasizes the country's pivotal role in driving the market in the region.

Key Sulfur Fertilizer Company Insights

The competitive landscape of the global sulfur fertilizer market is characterized by key players and their strategic initiatives, market trends, consolidation, and other major effects. The elevating trend of using organic food production and sustainable farming practices is a significant factor fueling the demand for sulfur fertilizers. Additionally, the inflating usage of low-impact and natural product variants is contributing to the growth of the market. The extensive applications of these fertilizers in modern farming practices to enhance crop quality are further augmenting the market across the globe.

Some of the key prominent companies operating in the global sulfur fertilizer market include

-

Koch Industries, Inc. is a major player in the sulfur fertilizers market, globally providing products including fertilizer and other plant nutrients for agricultural, turf, and ornamental plant markets. The company, through its subsidiary Koch Fertilizer, LLC, is one of the world's largest makers of fertilizers.

-

Nufarm Limited, based in Australia, is another prominent player in the sulfur fertilizers market. The company specializes in crop nutrition and is engaged in the production and distribution of potash, nitrogen, and phosphate products for agricultural, industrial, and feed manufacturers.

-

Sulphur Mills Ltd. is a significant player focused on providing sulfur-containing fertilizers and agricultural solutions. The company's involvement in the production and distribution of sulfate-containing fertilizers and its contributions to improving productivity sustainably position it as a key player in the market.

Key Sulfur Fertilizer Companies:

The following are the leading companies in the sulfur fertilizer market. These companies collectively hold the largest market share and dictate industry trends.

- Yara International

- Nutrien Inc

- The Mosaic Company

- ICL

- Nufarm Limited

- Koch Industries Inc.

- Shell Sulfur Solutions

- Sulphur Mills Ltd.

- Nutri-Tech Solutions Pvt Ltd.

- Agro Chemicals Ltd.

Recent Developments

-

In November 2022, Anuvia Plant Nutrients signed an agreement with Petronas Chemicals in order to produce and market their fertilizer products in South East Asia. Petronas being a major player in Malaysia is expected to help Anuvia through their extensive distribution system in the region.

-

In March 2021, The Mosaic Company announced that two of its offerings, Sus-Terra fertilizer and Microessentials have been deemed to be Enhanced Efficiency Fertilizers (EEF) by the Association of American Plant Food Control Officials (AAPFCO). This has made the two products eligible for U.S. Department of Agriculture’s conservation stewardship program (CSP) for its sustainability credentials.

Sulfur Fertilizer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.79 billion

Revenue forecast in 2030

USD 5.44 billion

Growth rate

CAGR of 2.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, crop type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Yara International; Nutrien Inc; The Mosaic Company; ICL; Nufarm Limited; Koch Industries Inc.; Shell Sulfur Solutions; Sulphur Mills Ltd.; Nutri-Tech Solutions Pvt Ltd.; Agro Chemicals Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sulfur Fertilizer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sulfur fertilizer market report based on type, form, crop type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Sulfates

-

Elemental Sulfur

-

Liquid Sulfur Fertilizers

-

-

Form Outlook (Volume, Kilotons; Revenue USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Other Crop Types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Soil

-

Foliar

-

Fertigation

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sulfur fertilizer market was valued at USD 4.74 billion in 2023 and is expected to reach USD 4.79 billion in 2024.

b. The global sulfur fertilizer market is anticipated to grow CAGR 2.2% from 2024 to reach USD 5.44 billion by 2030.

b. Asia Pacific dominated the market and accounted for a 40.5% share in 2023. This region is the largest producer of agricultural commodities and is anticipated to account for a substantial portion of global agricultural output.

b. The competitive landscape of the global sulfur fertilizer market is characterized by key players and their strategic initiatives, market trends, consolidation, and other major effects. The elevating trend of using organic food production and sustainable farming practices is a significant factor fueling the demand for sulfur fertilizers

b. The market driven by driven by the increasing demand for effective soil supplements, including sulfur fertilizers, driven by the rising level of new agricultural production and the decline in sulfur output. This trend is further fueled by the growing demand for agro products due to urbanization, the rising demand from the fertilizer manufacturing sector, and the growing awareness among farmers about the importance of sulfur in achieving optimal crop yields.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.