- Home

- »

- Plastics, Polymers & Resins

- »

-

Sunglasses Coating Market Size, Industry Report, 2030GVR Report cover

![Sunglasses Coating Market Size, Share & Trends Report]()

Sunglasses Coating Market (2025 - 2030) Size, Share & Trends Analysis Report By Coating (Anti-reflective Coating, UV Coating, Scratch-resistant Coating), By Material (Titanium Dioxide, Silicon Dioxide), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-551-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sunglasses Coating Market Summary

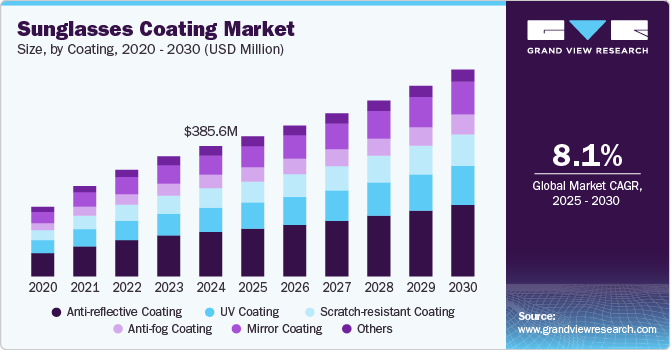

The global sunglasses coating market size was estimated at USD 385.6 million in 2024 and is projected to reach USD 612.3 million by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The market growth is driven by the increased awareness of the harmful effects of UV radiation, leading to a rising demand for sunglasses with UV protection coatings.

Key Market Trends & Insights

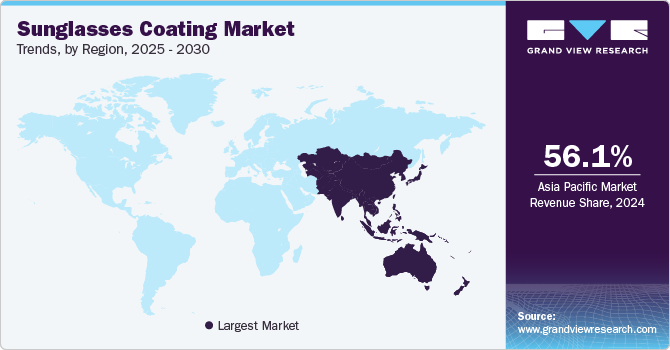

- Asia Pacific was identified as one of the key regions in the global sunglasses coating industry with a revenue share of 56.08% in 2024.

- By coating, the anti-reflective coating segment accounted for the largest revenue share of the global sunglass coatings industry in 2024.

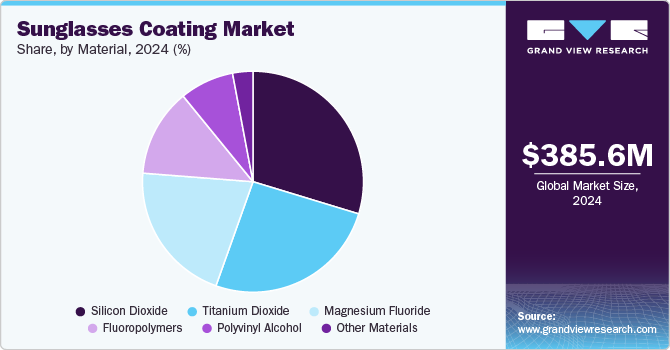

- By material, the titanium dioxide segment accounted for a significant revenue share of the global sunglass coatings industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 385.6 Million

- 2030 Projected Market Size: USD 612.3 Million

- CAGR (2025-2030): 8.1%

- Asia Pacific: Largest market in 2024

Additionally, as more individuals participate in outdoor sports and activities such as hiking, cycling, and water sports, there is a growing interest in specialized coatings that enhance both comfort and protection in sunglasses. The expansion of the solar photovoltaic (PV) market, alongside the increasing demand for consumer electronics, is projected to significantly fuel market growth. Reflective coatings are particularly important in construction, telecommunications, and space industries, with their use in green buildings for heat retention and reduced energy consumption. The surge in demand for portable consumer electronics and handheld devices is expected to bolster this segment further. However, challenges such as price volatility of raw materials, particularly precious metals such as gold and platinum, can restrain market growth by impacting the profitability of manufacturers.

The market is characterized by high levels of innovation, with ongoing research into sustainable coating techniques and nanostructured coatings. Key regulatory bodies, such as The Vision Council and ISO, oversee quality and safety standards in manufacturing. Consumer electronics is the dominant application area of the market, driven by advancements in smart devices.

Drivers, Opportunities & Restraints

The demand for advanced coatings in sunglasses stems from two significant consumer priorities: ocular health protection and aesthetic appeal. As consumers become increasingly aware of the harmful effects of UV radiation on eye health, including risks such as cataracts and macular degeneration, the demand for sunglasses with robust UV-blocking capabilities has surged. Advanced coatings, such as UV 400-certified lenses, provide comprehensive protection against UV rays, enhancing consumer trust in these products.

Consumer price sensitivity significantly impacts the demand for premium sunglasses, especially during economic volatility, such as inflation or recession, when discretionary spending declines. During these times, consumers often prioritize affordability over advanced features, making it difficult for high-priced sunglasses with advanced coatings to appeal to price-sensitive segments. The market is saturated with budget-friendly sunglasses that provide basic UV protection, primarily due to low-cost manufacturing hubs in emerging markets such as China and Southeast Asia. These alternatives attract consumers who prioritize cost over performance, further diminishing demand for premium options.

There is potential to create coatings that combine multiple functionalities, such as anti-scratch, anti-reflective, hydrophobic, and UV protection, into a single layer, enhancing performance and offering convenience to consumers.

Coating Insights

The anti-reflective coating segment accounted for the largest revenue share of the global sunglass coatings industry in 2024. Anti-reflective coatings-based sunglasses are widely preferred by customers owing to significant benefits, such as superior glare reduction and improved eye comfort. These sunglasses are increasingly used by commuters, drivers, outdoor recreation participants, and other individuals with sensitive eyes who frequently drive for longer distances or are exposed to bright lights for a longer duration of time.

UV coatings are increasingly used in application-specific sunglasses, such as sunglasses for sports and military use. Primarily used to achieve protection from UV-A and UV-B rays, these sunglasses provide improved contrast, reduced glare, and comprehensive eye protection from the sun’s harmful UV rays. UV coatings incorporate chemical compounds capable of absorbing UV radiation. UV coatings for sunglasses commonly include additives such as Triazine UV absorbers.

Material Insights

Silicon dioxide is primarily used in the development of sunglass coatings, such as anti-reflective (AR) and anti-scratch coatings. Highly transparent SiO₂ facilitates clear vision and reduces interference in the viewing experience. It is also used to improve UV protection capacities. Silicon dioxide is abundantly available in nature. However, optical-grade applications necessitate specialized extraction and purification. After obtaining high-purity SiO₂, it is applied on lenses with the help of advanced coating technologies, such as vacuum deposition or sol-gel processes. The demand for high-end premium quality sunglasses offered by brands such as Ray-Ban, Oakley, Maui Jim, and Warby Parker is witnessing consistent growth. Factors such as growing demand for performance eyewear, inclination of professional sports participants toward adoption of application-specific premium sunglasses equipped with desired features, and rising outdoor recreation participation are expected to encourage the demand for high purity SiO₂ used in sunglass coatings.

The titanium dioxide segment accounted for a significant revenue share of the global sunglass coatings industry in 2024. The growth of the segment is attributed to the material's capabilities to scatter and reflect visible light, enabling enhanced opacity and facilitating UV absorption. The high refractive index of the material ensures effective light bending and aids thinner lens thickness. Naturally occurring titanium oxide provides low photocatalytic properties and is suitable for sunglass applications, especially in UV protection coatings. These properties eliminate unwanted side effects of strong photocatalysis, which include surface degradation and color changes. The availability of limited substitutes with equivalent light scattering capabilities and high refractive index is expected to fuel demand for Titanium Dioxide.

Regional Insights

The North American sunglasses coating industry is experiencing growth. The presence of multiple brands that offer performance eyewear products, including sunglasses and growing adoption of application-specific product ranges, such as sports and military sunglasses are expected to favor market growth. Product lines offered by key market participants also have an influence on market growth. Multiple companies operating across the region provide high-performance sunglasses designed to match the specific requirements of diverse end users. For instance, Oakley, Inc. operates Oakley Standard Issue (OSI), a dedicated division which offers a variety of products primarily designed for applications in military, law enforcement, government tactical operations, and homeland security, among others. Standard issue ON DUTY SUNGLASSES category product line incorporates a large variety of sunglasses that feature multiple coatings, including anti-fog, UV protection, and others

U.S. Sunglasses Coating Market Trends

Demand for a variety of sunglasses with multiple features is continuously growing in the U.S. In 2024, the U.S. imported 27,996,898 dozen sunglasses, which marked an increase of 2,320,119 dozen from 25,676,779 dozen sunglasses imported in 2023. The U.S. market for sunglass coatings is significantly driven by the growing use of specialized sunglasses designed for sports, military, and other applications.

Asia Pacific Sunglasses Coating Market Trends

Asia Pacific was identified as one of the key regions in the global sunglasses coating industry with a revenue share of 56.08% in 2024, owing to the numerous manufacturing facilities and raw material suppliers in countries such as China. For instance, according to Hangzhou Harmony Chemical Co., Ltd, a key supplier of natural titanium dioxide (TiO2), the total titanium dioxide production in China was nearly 388,200 tons in July 2024. Countries such as China and Japan play a vital role in the growing demand for high-end sunglasses equipped with advanced coatings designed for improved vision and reducing exposure to harmful effects of light. Penetration of online distribution channels for sunglasses, such as e-commerce websites, online portals by brands, and quick-commerce platforms, presents significant growth opportunities for the sunglasses market.

Europe Sunglasses Coating Market Trends

Europe sunglass coatings industry is primarily influenced by noteworthy growth in demand for sunglasses equipped with specialized coatings, such as anti-fogging, and the growing adoption of sports sunglasses and performance eyewear in the region. The region is home to multiple sunglass manufacturers and brands that provide a wide range of products to global customers, including application-specific sunglasses. These include companies and brands such as Essilor, Carl Zeiss Vision, Hoya, OptoTech, and Optical Coating Laboratories (OCLI), Inc.

Latin America Sunglasses Coating Market Trends

Latin America is expected to experience a surge in the demand for sunglasses equipped with innovative coatings, including UV protective and anti-reflective coatings, owing to factors such as the influence of the tourism industry and the increasing adoption of sports sunglasses by professionals and enthusiasts. Rising participation of individuals in the region in outdoor recreation activities such as adventure sports, which necessitate the use of specific eyewear and sunglasses featuring particular coatings, is also expected to favor market growth.

Middle East & Africa Sunglasses Coating Market Trends

Increasing demand for premium-range sunglasses, sports sunglasses, and application-specific performance eyewear in the Middle East & Africa is anticipated to influence the regional market for sunglasses coatings. The presence of multiple key market participants in the regional industry has also benefitted the market growth. For instance, HOYA Corporation operates HOYA Hill Optics South Africa (Pty) Ltd in the region. In the Middle East, the urban population living in and visiting modern infrastructure-driven cities, such as Dubai, and the availability of multiple global brand products through stores and online retail have influenced the demand for sunglasses. This is expected to drive the growth of the regional sunglass coatings industry over the forecast period.

Key Sunglasses Coating Company Insights

Some of the key players operating in the market include PPG Industries, Inc. and HOYA.

-

PPG Industries, Inc. manufactures and distributes a diverse range of paints, coatings, and specialty products globally, serving numerous end-use areas including automotive, aerospace, and residential sectors. PPG's three reportable segments-Global Architectural Coatings, Performance Coatings, and Industrial Coatings-focus on innovative solutions that prioritize product performance, technology, quality, and customer service, with operations in over 70 countries.

-

HOYA Corporation is a global technology and med-tech company focused on high-tech and healthcare products. It operates through two primary segments: Life Care, which includes vision care and medical services, and Information Technology, covering imaging, electronics, and new ventures. Known for its eyeglass lenses, medical endoscopes, and semiconductor components, HOYA prioritizes innovation and global expansion.

Key Sunglasses Coating Companies:

The following are the leading companies in the sunglasses coating market. These companies collectively hold the largest market share and dictate industry trends.

- PPG Industries, Inc.

- Essilor (Essilor Luxottica)

- Nippon Fine Chemical

- HOYA

- Plexus Optix, Inc. (Vision Service Plan)

- ZEISS Group

- Reynard Corporation

- Kering Eyewear S.p.A. (Kering S.A.)

- Shangai Conant Optical Co., Ltd.

- Silhouette International Schmied AG

Recent Developments

-

In February 2023, Mitsui Chemicals, along with SDC and Coburn Technologies, launched a compact tabletop lens coating system in the U.S., enhancing efficiency for small to medium-sized lens processing labs.

-

In November 2024, Revision Military secured a contract to supply the NATO Support and Procurement Agency (NSPA) with a range of high-performance protective eyewear.

Sunglasses Coating Report Scope

Report Attribute

Details

Market size value in 2025

USD 414.5 million

Revenue forecast in 2030

USD 612.3 million

Growth rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in tons, revenue in USD thousand, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

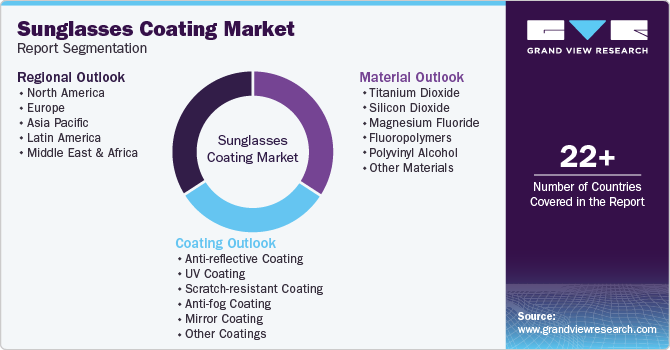

Segments covered

Coating, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

PPG Industries, Inc.; Tazzetti S.P.A.; Nippon Fine Chemical; HOYA; Plexus Optix, Inc. (Vision Service Plan); ZEISS Group; Reynard Corporation; Kering Eyewear S.p.A. (Kering S.A.); Essilor (Essilor Luxottica); Shangai Conant Optical Co., Ltd.; Silhouette International Schmied AG

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sunglasses Coating Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global sunglasses coating market report based on coating, material, and region:

-

Coating Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Anti-reflective Coating

-

UV Coating

-

Scratch-resistant Coating

-

Anti-fog Coating

-

Mirror Coating

-

Other Coatings

-

-

Material Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Titanium Dioxide

-

Silicon Dioxide

-

Magnesium Fluoride

-

Fluoropolymers

-

Polyvinyl Alcohol

-

Other Materials

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sunglass coating market size was estimated at USD 385.56 million in 2024 and is expected to reach USD 414.5 million in 2025.

b. The global sunglass coating market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 612.3 million by 2030.

b. Asia Pacific dominated the sunglass coatings market with a share of 56.1% in 2024. This is attributed to the numerous manufacturing facilities and raw material suppliers in countries such as China. For instance, according to Hangzhou Harmony Chemical Co., Ltd, a key supplier of natural titanium dioxide (TiO2), the total titanium dioxide production in China was nearly 388,200 tons in July 2024. Countries such as China and Japan play a vital role in the growing demand for high-end sunglasses equipped with advanced coatings designed for improved vision and reducing exposure to the harmful effects of light

b. Some key players operating in the sunglass coating market include PPG Industries, Inc., Tazzetti S.P.A., Nippon Fine Chemical, HOYA, Plexus Optix, Inc. (Vision Service Plan), ZEISS Group, Reynard Corporation, Kering Eyewear S.p.A. (Kering S.A.), Essilor (Essilor Luxottica), Shangai Conant Optical Co., Ltd., and Silhouette International Schmied AG

b. Key factors that are driving the market growth include PPG Industries, Inc., Tazzetti S.P.A., Nippon Fine Chemical, HOYA, Plexus Optix, Inc. (Vision Service Plan), ZEISS Group, Reynard Corporation, Kering Eyewear S.p.A. (Kering S.A.), Essilor (Essilor Luxottica), Shangai Conant Optical Co., Ltd., and Silhouette International Schmied AG

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.