- Home

- »

- Disinfectants & Preservatives

- »

-

Surface Disinfectant Products Market Size Report, 2030GVR Report cover

![Surface Disinfectant Products Market Size, Share & Trends Report]()

Surface Disinfectant Products Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Liquid, Wipes), By Raw Material (Synthetic, Biobased), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-079-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surface Disinfectant Products Market Trends

The global surface disinfectant products market size was valued at USD 35.40 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This is attributable to the increasing awareness regarding health & hygiene owing to the growing incidences of infectious diseases.The COVID-19 pandemic has increased the consciousness among consumers about keeping homes and workplaces clean and free from harmful germs along with the usage of sanitizer wet wipes for skin.Public spaces, such as hospitals, schools, and offices, are in greater need of infection control measures. Surface disinfection is a critical component of infection control in hospitals.

Hospitals are high-risk environments for the spread of infectious diseases due to the presence of large numbers of vulnerable patients, as well as the high traffic of healthcare personnel and visitors. While product use can be beneficial for reducing the spread of infectious diseases, it is important to use these products safely and appropriately. Overuse or improper use of disinfectants can lead to health and environmental hazards. In addition, it is important to choose disinfectants that are appropriate for the specific application and to consider the potential environmental impacts of these products.

Raw materials for manufacturing the products include active ingredients, surfactants, chelating agents, stabilizers, and fragrances. Active ingredients are the chemicals that kill or inactivate the microorganisms that cause infection. Common active ingredients in surface disinfectants include Quaternary Ammonium Compounds (QACs), hydrogen peroxide, sodium hypochlorite (bleach), and alcohol. Surfactants help improve the spread and wetting of the disinfectant on the surface being treated. Surfactants can also help solubilize and emulsify dirt and other organic matter, making it easier to remove.

Raw Material Insights

The synthetic segment dominated the market with a revenue share of over 87% in 2022. This is attributed to their broader spectrum efficacy as compared to their counterparts. However, they may be toxic or harmful to humans and the environment. Bio-based disinfectants may require longer contact times to achieve maximum efficacy, while synthetic disinfectants typically work faster.Bio-based products are expected to grow at a higher CAGR over the forecast period owing to the increasing adoption of green products across the globe. They are produced from natural, non-toxic ingredients but may have limited efficacy against certain types of microorganisms.

It may be a better choice for those who are concerned about the potential health and environmental impacts of chemicals.Blends combine the advantages of both bio-based ingredients and chemical disinfectants. These products are designed to provide effective disinfection while also incorporating elements of sustainability. Blending bio-based ingredients with chemicals allows for reduced reliance on petroleum-based chemicals and promotes the use of renewable resources.

Product Insights

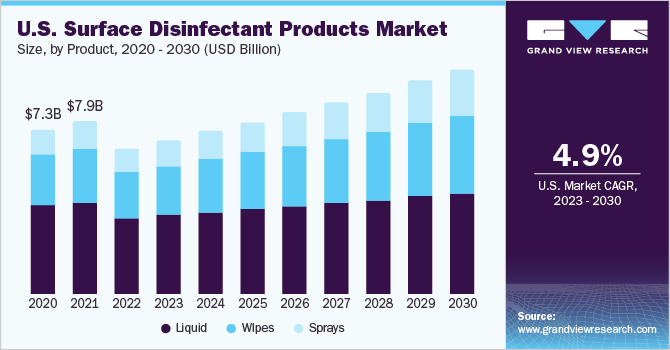

The liquid segment dominated the market with a revenue share of over 63% in 2022. This is attributed to its usage in a variety of applications, such as cleaning floors, walls, and other large surfaces. Liquid disinfectants are easy to apply with a mop, cloth, or sprayer, and can be used in combination with other cleaning products to achieve a higher level of cleanliness. The wipes segmentis expected to grow at a higher CAGR over the forecast period as wipesare easy to use and do not require any additional equipment or tools.

Users simply need to spray the disinfectant onto the surface and allow it to air dry. They can provide even coverage over surfaces. Surface disinfectant sprays often have rapid kill times, meaning, they can quickly eliminate pathogens on surfaces. This can help reduce the risk of cross-contamination and promote a safer environment. They typically come in spray bottles or aerosol cans, allowing for convenient and targeted application.

Distribution Channel Insights

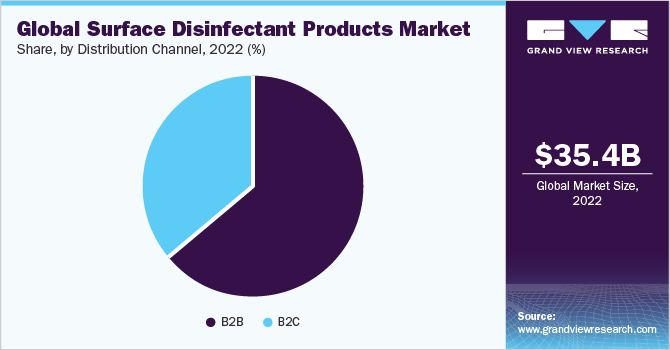

The B2B distribution channel dominated the market with a revenue share of over 64% in 2022. This is attributed to the growing demand for disinfection from hospitals, medical laboratories, and nursing homes since the outbreak of COVID-19. Hospitals and laboratories are at the forefront of identifying and managing infectious disease outbreaks. Rapid and effective disinfection of surfaces is crucial in containing outbreaks, limiting the spread of pathogens, and protecting the wider community.According to the Centers for Disease Control, Healthcare Acquired Infections (HAIs) in American hospitals account for an estimated 1.7 million infections and 99,000 deaths annually.

HAIs occur in healthcare settings including surgical centers, hospitals, ambulatory clinics, rehabilitation facilities, and others. The B2C segment is predicted to grow at a CAGR of 5.1% over the forecast period. This is attributed to the growing adoption rate of disinfectant products owing to the increasing health awareness amongconsumers across the globe. Hypermarkets and supermarkets are the most popular channels as they usually offer a wide range of product and brand options. Customers can choose from different formulations, scents, sizes, and price ranges based on their preferences and needs.

Regional Insights

North America was the dominating region and accounted for a revenue share of over 33% in 2022. The growth is attributed to increasing health-related spending along with the presence of a large number of surface disinfectant formulators in the region. The product usage in North America is not limited to healthcare settings. Several businesses and households also use these products to maintain a clean and hygienic environment.In the U.S., the Environmental Protection Agency (EPA) regulates surface disinfectants as pesticides under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA).

The EPA maintains a list of registered disinfectants that have been tested and found to be effective against specific pathogens, such as bacteria and viruses. Asia Pacific is expected to grow at a higher CAGR over the forecast period. This is attributed to the increasing awareness about the importance of maintaining clean and hygienic environments. Several hospitals and clinics in the region now use surface disinfectants as part of their standard infection prevention and control protocols. For instance, in India, the Ministry of Health and Family Welfare has issued guidelines on the use of disinfectants in healthcare settings.

Key Companies & Market Share Insights

The market is characterized by the adoption of various strategic initiatives, such as investments and new product developments to gain a competitive edge. For instance, PDI launched three products namely sani-24 germicidal disposable wipes, sani-hypercide germicidal spray, and sani-hypercide germicidal disposable wipes in 2022 for preventing infections and promoting wellness. In addition, in April 2023, SC Johnson launched FamilyGuard disinfectant spray and FamilyGuard disinfectant cleaner for various types of surfaces, which kills 99.9% of germs. Some of the prominent players in the global surface disinfectant products market include:

-

3M

-

GOJO Industries, Inc.

-

Reckitt Benckiser Group PLC

-

BODE Chemie GmbH

-

Ecolab

-

Procter & Gamble

-

The Clorox Company

-

Whiteley Corp.

-

Lonza

-

BASF SE

-

Evonik Industries AG

Surface Disinfectant Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.25 billion

Revenue forecast in 2030

USD 53.49 billion

Growth Rate (Revenue)

CAGR of 5.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

3M; GOJO Industries, Inc.; Reckitt Benckiser Group PLC; BODE Chemie GmbH; Ecolab; Procter & Gamble; The Clorox Company; Whiteley Corp.; Lonza; BASF SE; Evonik Industries AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surface Disinfectant Products Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the surface disinfectant productsmarket based on raw material, product, distribution channel, and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Biobased

-

Blends

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Wipes

-

Sprays

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

Hospitals

-

Nursing Homes

-

Medical Laboratories

-

Others

-

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global surface disinfectant products market size was estimated at USD 35.40 billion in 2022 and is expected to reach USD 37.25 billion in 2023.

b. The global surface disinfectant products market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 53.49 billion by 2030.

b. North America dominated the surface disinfectant products market with a share of 33.7% in 2022. This is attributable to increasing health-related spending along with the presence of large number of surface disinfectant formulators in the region.

b. Some key players operating in the surface disinfectant products market include 3M, GOJO Industries, Inc., Reckitt Benckiser Group PLC, BODE Chemie GmbH, Ecolab, Procter & Gamble, The Clorox Company, Whiteley Corporation, Lonza, BASF SE, and Evonik Industries AG

b. Key factors that are driving the surface disinfectant products market growth include increasing awareness regarding health & hygiene owing to the growing incidences of infectious diseases and growing incidences of hospital-acquired infections across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.