- Home

- »

- Medical Devices

- »

-

Surgical Clips Market Size, Share And Trends Report, 2030GVR Report cover

![Surgical Clips Market Size, Share & Trends Report]()

Surgical Clips Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Ligating, Aneurysm), By Material (Titanium, Polymer), By Surgery, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-332-4

- Number of Report Pages: 132

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Clips Market Size & Trends

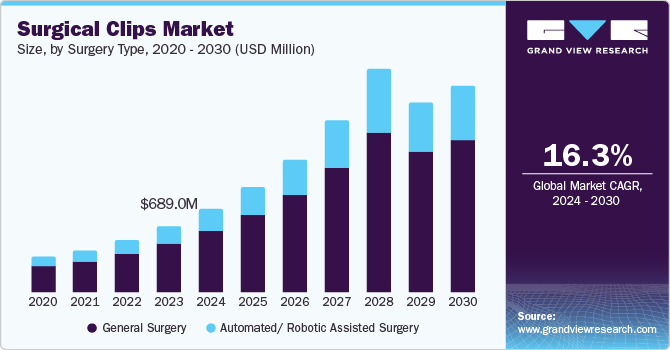

The global surgical clips market size was valued at USD 689.0 million in 2023 and is expected to expand at a CAGR of 16.3% from 2024 to 2030. The growing adoption of minimally invasive techniques to reduced length of hospital stays, improve recovery time, convenience of treatment during surgeries even among the geriatric population and minimalized post-surgery complications are some of the factors propelling the market growth. The use of ligating clips in minimally invasive surgeries has been proven to prevent bile, blood leakage and minimize incisions. Companies such as Boston Scientific, B. Braun, and Grena Ltd. have developed ligating clips to improve the accuracy and pace of their placement during surgical operations and prevention of clips slippage from the site of adherence. As surgical procedures are one of the major treatment options for neurological problems, aneurysm clips pave the way for the precise treatment of the cranial aneurysm. Technological advancements undertaken by the market leaders and the cost-effectiveness of surgical clips have led to market growth.

Furthermore, the increasing need for minimally invasive surgery (MIS) and improvements in surgical technology, including the innovation of laparoscopic and robotic-assisted surgeries, are leading to a positive market forecast. Following this trend, new materials and designs are being introduced by manufacturers for surgical clips in order to enhance performance and simplify usage. This is also due to the growing healthcare industry and strict healthcare regulations that prioritize safety and effectiveness in invasive surgeries.

Moreover, a rise in the disposable income of the population is driving the need for healthcare services, such as surgeries. In addition, the increasing knowledge among patients and healthcare professionals about the advantages of surgical clips, such as faster surgery time and less noticeable scarring, combined with the development of dissolvable surgical clips that can be broken down or absorbed by the body over time, is helping to boost the market growth. Furthermore, the growing population of trained healthcare professionals, including surgeons and nurses, who are skilled in using surgical clips, is helping drive the market expansion. Additionally, surgical clips are becoming more popular worldwide as they help lower the occurrence of postoperative complications and decrease issues related to diagnostic imaging.

The COVID-19 pandemic negatively impacted the market. This was due to the heavy reduction of elective surgeries and reduced surgeon capacity to perform them. The operating rooms where these surgeries are performed were highly prone to COVID-19 infection spread, thus risking the life of surgeons and patients. In addition, the unavailability of surgical staff and the willingness of the patients to undergo surgeries were the major drawbacks observed during the pandemic. Manufacturing facilities remained shut leading to the shortage of surgical tools, which also hindered the market growth.

Surgery Insights

General surgery held the largest share of 74.2% in 2023. Vascular, Thoracic, gynecological, urologic, bariatric, and other general surgeries all require a continuous supply of surgical clips. The main benefits of surgical clips compared to sutures include lower infection risk, quicker healing, less noticeable scarring, and higher patient satisfaction.Surgical clips are used to secure the cystic duct and artery in cholecystectomy procedures.

The automated/robotic-assisted surgery segment is still in the initial growth phase. The lack of financial aid, infrastructure, and skilled personnel and insufficient clinical evidence related to automated surgery are the major reasons behind its smaller market share. However, reduction in human errors and improved efficiency have led to the improved adoption of this surgery in economically developed countries.

End Use Insights

The hospital segment held the largest share of 65.5% in 2023 due to the large procedural volume and preventive surgeries. Hospitals hold the largest market share as they perform surgeries in large volumes and have high footfall, requiring a variety of surgical clips for different procedures. With an increase in the number of surgical procedures, such as neurosurgery and abdominal laparoscopy, and the growing incidence of trauma, the demand for surgical clips has significantly increased in hospitals. In developed regions, medical bills containing ligature expenditure are reimbursed by insurance agencies. This led to the increase in surgical procedures performed using clipping equipment at hospitals, which positively impacted the segment growth.

Clinics are anticipated to register the fastest CAGR of 17.2% during the forecast period. Lower costs to patients, improved availability for patients, and reduced facility expenses can explain this phenomenon.

Ambulatory Surgical Centers (ASCs) are anticipated to register CAGR of 16.3% during the forecast period. Most Asian and Middle Eastern countries lack the economy and infrastructure for establishing ambulatory centers, but they are soon to develop the same to minimize the surgical burden on hospitals.

Type Insights

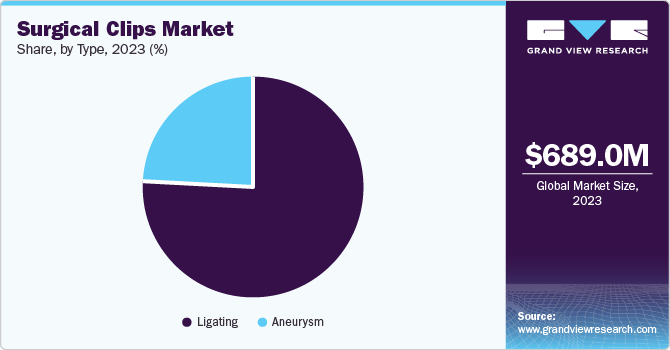

The ligating clips segment accounted for the largest revenue share of 75.8% in 2023. Ligating clips have numerous benefits like structural and dimensional stability, compatibility with open and endoscopic clip appliers, tactile feedback to allow surgeons to ensure accurate locking, high biocompatibility, and they effectively prevent biofluid leakage (such as bile and blood) post-surgical applications. Hence, it makes them a top choice for surgical ligature. The most commonly used ligating clips are Hem-o-lok and Hemoclip. They are available in various sizes ranging from microchips to large clips depending on the ligature dimensions.

Nowadays, research is being undertaken to develop dissolvable surgical clips to prevent its movement from the site of application and avoid its removal post-recovery. Aneurysm clips are expected to witness lucrative growth during the forecast period. Decreased post-operative brain contusions, prolonged efficacy of aneurysm clipping, and reduced serious complications led to the increased adoption of the aneurysm clipping technique, which positively impacted the market growth.

Regional Insights

North America held the largest share of 43.4% in 2023 and is expected to witness the fastest growth over the forecast period. This growth can be mainly attributed to factors such as the increasing number of preventive surgeries, the high adoption of technologically advanced devices, and the rising preference for minimally invasive surgical procedures. Most market players are in the U.S., which makes it the hub of the market.

U.S. Surgical Clips Market Trends

Most market participants are based in the U.S., making it the hub of the market. With its sizable patient population and its advanced healthcare market, the region is projected to experience rapid market growth. According to the Journal of Infectious Disease Adviser, approximately 27 million surgical procedures are done in the U.S. annually.

Europe Surgical Clips Market Trends

It is expected that the European region will experience growth in the coming years. The increase is due to factors such as increasing prevalence of chronic illnesses and higher reimbursements for surgeries.

Asia Pacific Surgical Clips Market Trends

Asia Pacific surgical clips market to witness significant growth in the coming years. The high patient population and a large volume of surgeries are some of the reasons fueling the regional market growth. Advancing healthcare infrastructure in the region and the growing medical tourism market in the region is attracting global market players in the region. The presence of price-sensitive customers and the non-availability of reimbursement policies in the region provide a favorable environment for the entry of local market players offering products at competitive prices.

Key Surgical Clips Company Insights

The market is highly fragmented due to the presence of local manufacturers and sellers in most regions of the globe. Major players offer these clips in different sizes and styles and market them exclusively for specific applications. Strong marketing and affordable pricing play an important role in the competition and are considered to be the major deciding factors for customers.

Key Surgical Clips Companies:

The following are the leading companies in the surgical clips market. These companies collectively hold the largest market share and dictate industry trends.

- Ackermann Medical GmbH & Co.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Grena Ltd.

- Johnson & Johnson (Ethicon)

- Scanlan International, Inc.

- Teleflex Incorporated.

- MERIL LIFESCIENCES Pvt. Ltd.

- Anrei and Sinolinks

Recent Developments

-

In July 2020, Olympus announced the commercial availability of EZ Clip endotherapy device. It is a 510(k) cleared rotatable and reloadable hemostasis clip designed to control bleeding and defect closure during GI endoscopy, requiring more than one clip.

Surgical Clips Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 865.9 million

Revenue forecast in 2030

USD 2,143.7 million

Growth rate

CAGR of 26.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, surgery, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; India; China; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ackermann Medical GmbH & Co.; B. Braun Melsungen AG; Boston Scientific Corporation; Edwards Lifesciences Corporation; Grena Ltd.; Johnson & Johnson (Ethicon); Scanlan International, Inc.; Teleflex Incorporated; MerilLifesciences Pvt. Ltd.; Anrei and Sinolinks

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs.

Global Surgical Clips Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global surgical clips market report on the basis of type, material, surgery, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ligating

-

Aneurysm

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium

-

Polymer

-

Others

-

-

Surgery Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated/ Robotic Assisted Surgery

-

General Surgery

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.