- Home

- »

- Medical Devices

- »

-

Surgical Power Tools Market Size, Share & Growth Report 2030GVR Report cover

![Surgical Power Tools Market Size, Share & Trends Report]()

Surgical Power Tools Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Surgical Drill, Electric Pen Drive), By End-use, (Hospitals, Ambulatory Surgical Centers, Others) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-051-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

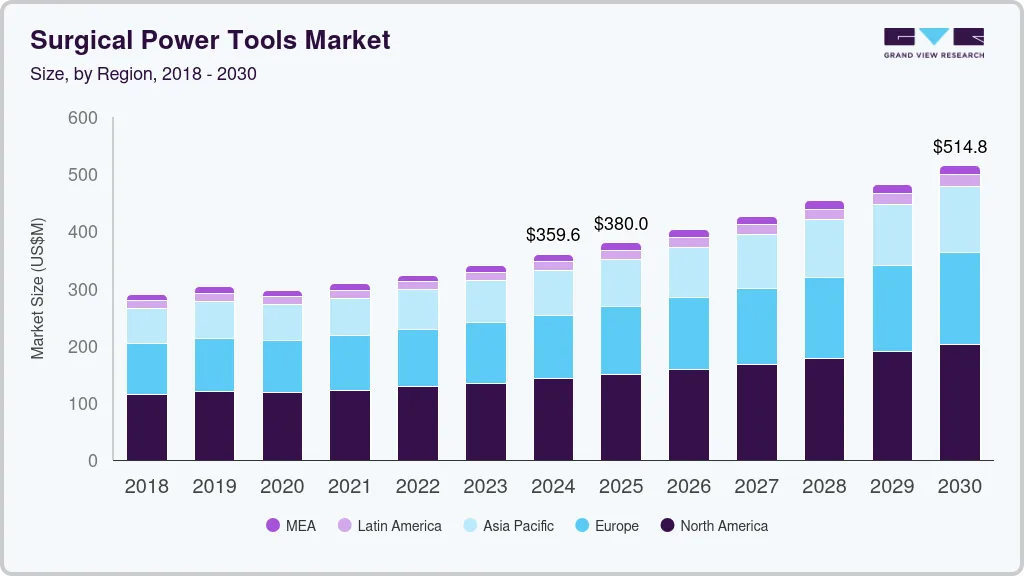

The global surgical power tools market size was valued at USD 359.6 million in 2024 and is estimated to grow at a compound annual growth rate (CAGR) of 6.2% from 2025 to 2030. Technological advancements in surgical devices, an increasing number of facial and head injuries, and an increase in the global geriatric population are some of the major factors driving the growth of the market. The geriatric population is at higher risk for surgical injuries and disorders due to factors such as osteoporosis, falls, and other age-related problems. As the global population continues to age, the demand is expected to increase. Furthermore, increasing awareness about deformity correction, as well as improvements in healthcare access and affordability, are driving market demand. This is particularly true in developing countries, where there is a growing middle class with greater access to healthcare services.

Technological advancements in surgical devices have greatly improved the treatment options available for patients with facial deformities or injuries. These tools allow for more precision and efficient procedures, reducing surgical time & increasing safety, and enable surgeons to perform complex procedures with greater accuracy & speed, resulting in improved patient outcomes and reduced recovery time. Moreover, the use of robotics has further enhanced surgical procedures. Robotic-assisted surgery enables surgeons to perform procedures with more control, reducing the risk of damage to the surrounding tissue. For instance, in May 2017, researchers and scientists at the University of Utah created a computer-powered automated drill in the U.S., which plays a crucial role in performing surgical procedures. The drill can produce clean, fast, and safe cuts, minimizing the time to leave a wound open. This can help surgeons perform complex cranial surgery 50 times faster than standard procedures, lowering the incidence of human error, infection, and surgical costs.

Facial and head injuries can occur due to a variety of reasons, including falls, car accidents, sports injuries, and violence. These injuries can range from minor cuts and bruises to severe fractures & skull deformities that require surgery. Surgical tools are used in a range of procedures to treat these injuries, including skull reconstruction, facial bone fixation, and jaw surgery. As per the National Library of Medicine, Traumatic Brain Injury (TBI) caused due to head trauma is the most frequent presentation in Emergency Departments (EDs) and accounts for over 1 million visits annually. It is a common cause of disability and death among children & adults. Furthermore, head trauma and facial injury are more common in children, adults up to 24 years of age, and individuals older than 75 years. TBI is three times more common in males than females. However, even though only 10% of TBIs occur in the older population and accounts for up to 50% of TBI-related deaths.

However, the lack of availability of a skilled workforce to perform surgical procedures in developing countries is a significant challenge for the market growth. This is a highly specialized field that requires a team of healthcare professionals with diverse skill sets, including maxillofacial surgeons, plastic surgeons, neurosurgeons, anesthesiologists, and nurses. In many developing countries, there is a shortage of trained healthcare professionals in general, and even fewer are trained in Surgical treatments. This shortage is caused due to various factors, including a lack of educational opportunities, limited funding for medical education & training programs, and brain drain, where trained professionals leave developing countries for better opportunities elsewhere. Furthermore, this can have a significant impact on the quality of care provided to patients with surgical injuries or other conditions in developing countries. Patients may have to wait longer for treatment, receive suboptimal care, or even travel to other countries for treatment, which can be costly and logistically challenging.

Product Insights

The surgical drill segment dominated the market and held the largest revenue share of 84.3% in 2022. Surgical drills are a crucial tool in Surgical surgeries and are used in a wide range of surgical procedures. These procedures include craniotomy, neurosurgery, orthognathic surgery, maxillofacial surgery, dental implant surgery, etc. Surgical drills are used to cut and shape bone and other hard tissues, allowing surgeons to perform precise and accurate surgeries with minimal tissue damage. Advancements in technology have resulted in the development of more efficient and advanced surgical drills, such as high-speed electric drills and pneumatic drills, which have further increased the demand for these tools in the market.

The electric pen drive segment is anticipated to witness the fastest CAGR of 6.3% over the forecast period. Electric pen drives offer a high precision and control in surgeries, making them an ideal choice for delicate procedures. They are designed to operate at high speeds, allowing the surgeons to perform accurate and precise cuts with minimal tissue damage. This results in faster healing times for patients and reduces the risk of complications. These tools are lightweight, compact, and easy to handle, which makes them highly versatile and easy to use in different surgical settings. They are also quieter than traditional pneumatic or electric drills, which can help reduce the stress and anxiety associated with surgical procedures. Furthermore, technological developments have resulted in the development of more advanced and efficient electric pen drives, such as those with variable speed settings, oscillating tips, and improved battery life.

End-use Insights

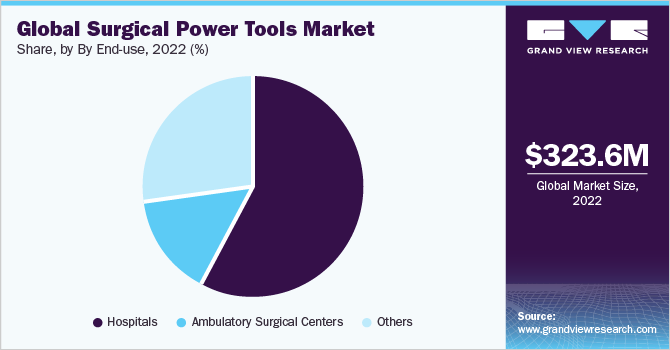

The hospitals segment dominated the market and held the largest revenue share of 56.5% in 2022. Hospitals are the primary location where most surgeries are performed. As a result, they are the primary purchasers of power tools for these surgeries. Hospitals have well-equipped operation theaters and skilled staff to handle complicated surgical procedures, which require sophisticated tools like surgical power tools. Many hospitals also have long-term relationships with manufacturers, which can result in favorable pricing and better customer support. Additionally, hospitals have strict protocols for maintaining and sterilizing surgical instruments, including power tools. Manufacturers often must meet these standards to sell their products to hospitals. Hospitals also have strict regulations and standards to follow when it comes to the quality and safety of medical devices.

The others segment is expected to witness the fastest growth rate of 6.4% over the forecast period. It includes dental clinics, research institutes, and private practices that use power tools in various procedures related to the skull, jaw, and face. Dental clinics are one of the primary users of power tools. These tools are used in dental implant surgeries to prepare the jawbone for implant insertion. Furthermore, technological advancements in dental implant procedures have led to an increase in demand for specialized surgical power tools, such as guided surgery systems, which require precision and accuracy for better results. Additionally, dental clinics have a growing patient base, and as more people seek dental implant procedures, the demand for surgical power tools in the dental industry is expected to increase.

Regional Insights

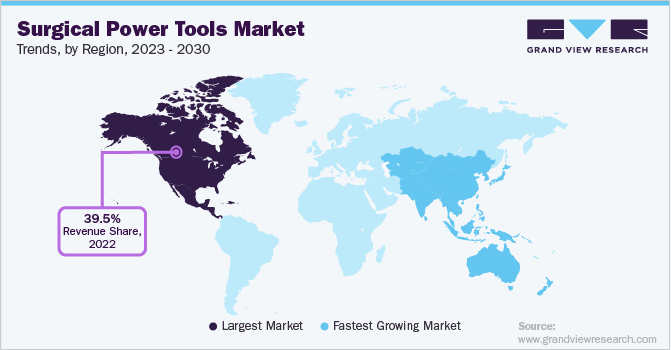

North America has dominated the global market and held the largest revenue share of 39.5% in 2022. The North American surgical power tools market is a dynamic and evolving industry that is driven by technological advancements, growing demand for these surgical tools, increasing awareness about facial deformity correction surgical procedures, and the presence of recognized healthcare facilities and services are some of the factors that contributed to the notable market growth. These technologies allow for better precision and accuracy in surgery, which can lead to improved outcomes and minimize complications. Furthermore, encouraging government initiatives, such as the establishment of the American Society of Craniofacial Surgery (ASCFS), for increasing awareness about CMF surgical procedure and their associated advantages among the population is likely to increase the demand for the CMF power tools market during the forecast period.

Asia Pacific is anticipated to witness the fastest CAGR of 6.5% in the forecast period. Asia Pacific has seen significant developments in the healthcare infrastructure in recent years, driven by increasing demand, technological advancements, and increasing geriatric population. These developments are expected to continue in the coming years, further strengthening the region's position as a leading player in the global CMF power tools market. Additionally, many countries in the Asia Pacific region, such as Japan, China, India, South Korea, and Singapore, have invested heavily in their healthcare infrastructure. These countries have well-developed healthcare systems, with advanced medical facilities and highly skilled healthcare professionals. This has enabled them to provide high-quality care to patients. Furthermore, the Asia Pacific region has become a hub for medical tourism, with many patients traveling to countries such as India, Thailand, and Malaysia for surgical procedures as the services are offered at a low cost.

Key Companies & Market Share Insights

The key companies operating in the global surgical power tools market are attempting to enhance their product portfolio by upgrading their products and exploring acquisitions and government authorizations to increase their client base and acquire a larger market share. Furthermore, the key players in the market are implementing strategies such as partnerships, mergers and acquisitions, product and service launches, agreements, joint ventures, collaboration, and expansion to strengthen their position in the surgical power tools market. For instance, In March 2023, Stryker, a global medical technology provider launched CD NXT System, the modern innovation in the company's power tools. This technology offers real-time depth measurement as the specialist drills allow for accurate, fast, consistent digital depth measurement throughout various surgical procedures.

Similarly, in November 2021, DePuy Synthes, a global medical devices provider, and Orthopaedics Business of Johnson & Johnson launched the UNIUM System as the latest addition to its power tools portfolio. The system is specially designed with a dedication to ergonomics, efficiency, and reliability, in the Trauma care setting and can be used throughout sports medicine, small bone, spine, and thorax procedures. Some of the major players in the global surgical power tools market include:

-

DePuy Synthes (Johnson & Johnson)

-

Orthopromed Inc.

-

B Braun

-

CONMED Corporation

-

Zimmer Biomet

-

Stryker

-

KLS Martin Group

-

Medtronic

Surgical Power Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 380.0 million

Revenue forecast in 2030

USD 514.8 million

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DePuy Synthes (Johnson & Johnson); Orthopromed Inc.; B Braun; CONMED Corporation; Zimmer Biomet; Stryker; KLS Martin Group; Medtronic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Power Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global surgical power tools market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Drills

-

Electric Pen Drive

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

The Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

The Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical power tools market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 514.7 million by 2030.

b. North America dominated the surgical power tools market with a share of 35.9 % in 2022.growing demand for these surgical tools, increasing awareness about facial deformity correction surgical procedures, and the presence of recognized healthcare facilities and services are some of the factors that contributed to the notable market growth

b. Some key players operating in the surgical power tools market include, DePuy Synthes (Johnson & Johnson), Orthopromed Inc., B Braun, CONMED Corporation, Zimmer Biomet, Stryker, KLS Martin Group

b. Technological advancements in craniomaxillofacial devices, an increasing number of facial and head injuries, and an increase in the global geriatric population are some of the major factors driving the growth of the craniomaxillofacial power tools market

b. The global surgical power tools market size was estimated at USD 323.6 million in 2022 and is expected to reach USD 340.9 million in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.