- Home

- »

- Medical Devices

- »

-

Surgical Retractors Market Size, Share, Industry Report 2030GVR Report cover

![Surgical Retractors Market Size, Share & Trends Report]()

Surgical Retractors Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Handheld, Self-retaining), By Product (Abdominal Retractor, Finger retractor), By Application (Neurosurgery, Ob/Gyn), By End -use (Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-562-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Retractors Market Summary

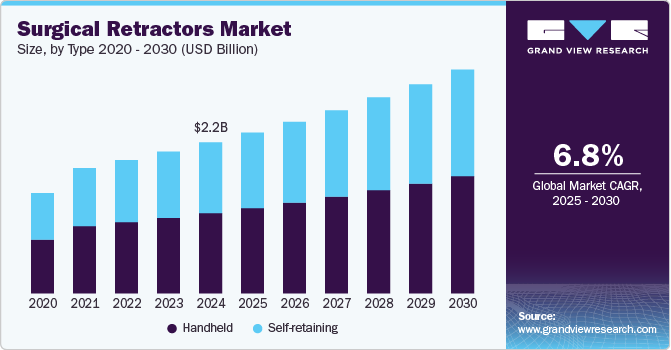

The global surgical retractors market size was estimated at USD 2.2 billion in 2024 and is projected to reach USD 3.3 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. A steep rise in procedural volume with the rising prevalence of chronic diseases, advancement in surgical technology, increasing adoption of minimally invasive surgeries, growing geriatric population, and high R&D focus by major market players are some factors driving the market.

Key Market Trends & Insights

- North America surgical retractors market held a dominant position, capturing 30.3% of the global revenue share in 2024.

- The surgical retractors market in the U.S. held a significant share of North America's surgical retractors market in 2024.

- By type, the handheld retractors segment accounted for the largest revenue share of 53.2% in 2024.

- By application, the neurosurgery segment is expected to witness a CAGR of 7.8% over the forecast period.

- By end-use, the hospital’s segment dominated the market and accounted for the largest revenue share of 49.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.2 Billion

- 2030 Projected Market Size: USD 3.3 Billion

- CAGR (2025-2030): 6.8%

- North America: Largest market in 2024

According to the WHO, 17.9 million people die of cardiovascular disorders yearly. Coronary artery bypass graft surgery is a common treatment for blocked coronary arteries. B. Braun and Medtronic plc. offer a wide range of surgical tools required in all types of cardiovascular surgery. According to the World Federation of Neurology, 12.0% of the total neurology patients succumb to these conditions each year, and according to Medico Experts, 22.6 million people suffer from neurological injuries, of which 13.8 million require surgery. In addition, according to the WHO, the number of Disability-Adjusted Life Years (DALYs) lost due to neurological diseases are anticipated to increase from 95 million in 2015 to 103 million in 2030 across the globe. Surgical procedures are one of the major treatment options for neurological problems. An increasing number of neurological surgeries and the high demand for surgical retractors specially designed for these procedures are expected to drive the market.Moreover, the increasing awareness regarding women's health and the consequent increase in check-ups and diagnoses are expected to increase the number of surgeries performed and drive the demand for surgical retractors. According to an article published by the World Health Organization in June 2023, polycystic ovary syndrome (PCOS) affects approximately 8 to 13% of women of reproductive age worldwide, whereas 70% remain undiagnosed.

Several manufacturers focus on developing technologically advanced surgical retractors to maintain a strong market presence. For instance, in 2019, Thompson Surgical developed a table-mounted hip retraction system. It uses flexible tethers to secure retractor blades in place and decreases the staff needed to hold the retractor. Also, in October 2020, June Medical announced a product launch under the Galaxy II surgical retractor series specifically designed for the male anatomy. It comes with an innovative penile hammock that can lower the need for sharp hook penetration, improve recovery, and reduce infection risk. In April 2022, Cureus developed low-cost three-dimensional printed retractors. The retractor was developed to comfort the surgeons and felicitate pedicle screw insertion in transforaminal lumbar interbody fusion surgery.

Market Concentration & Characteristics

The surgical retractors industry is characterized by moderate concentration, with global leaders like B. Braun, Medtronic, and Stryker competing alongside regional manufacturers. It caters to diverse surgical specialties, including general, orthopedic, and minimally invasive procedures, with products ranging from hand-held to self-retaining retractors. Key industry traits include innovation in materials like titanium and stainless steel for durability and precision, regulatory compliance, and competitive pricing. Increasing surgical volumes, advancements in technology, and rising healthcare expenditure drive market growth. Emerging economies present significant opportunities, fueled by expanding healthcare infrastructure and unmet surgical needs, making the industry dynamic and growth focused.

The surgical retractors industry has seen notable innovation with the development of the TITAN CSR, designed by Dr. Ramon Cestero, a trauma surgeon and former U.S. Navy officer in September 2021. Frustrated by outdated tools like the Balfour retractor, he created a device combining speed and superior exposure. The TITAN CSR sets up in six seconds-50 times faster than traditional designs-without compromising functionality. Supported by UT Health San Antonio’s Office of Technology Commercialization and internal funding, Dr. Cestero patented the design in multiple countries and founded Advanced Surgical Retractor Systems, Inc. in 2019, advancing surgical efficiency and improving patient outcomes.

Regulations in the surgical retractors industry ensure safety, efficacy, and quality of devices used in medical procedures. Governing bodies like the FDA in the U.S. and the CE marking system in Europe require rigorous testing and compliance with standards such as ISO 13485 for medical device quality management. These regulations mandate pre-market approvals, clinical evaluations, and post-market surveillance to minimize risks. Strict adherence impacts innovation timelines and production costs, but also enhances patient safety and trust. Evolving regulatory frameworks, particularly for advanced devices, encourage manufacturers to balance compliance with innovation, fostering safer and more effective surgical retractor solutions.

Mergers and acquisitions (M&A) in the surgical retractors industry are rapidly increasing as companies aim to bolster their technological capabilities and market reach. For instance, in August 2024, CooperCompanies announced that CooperSurgical had acquired obp Surgical, a U.S.-based medical device company, for USD 100 million. Specializing in single-use cordless surgical retractors with integrated LED lights and smoke evacuation features, obp Surgical’s ONETRAC portfolio generated USD 14.5 million in trailing twelve-month revenue. This acquisition, expected to be earnings-neutral in fiscal 2024 and accretive thereafter, strengthens CooperSurgical’s portfolio, which includes products like INSORB, Lone Star, and Doppler Blood Flow Monitors. This strategic acquisition aims to improve product offerings and accelerate the development of innovative health solutions. Additionally, partnerships between established firms and startups are becoming common, enabling knowledge sharing and resource pooling, which fuels growth and innovation within the surgical retractors industry.

Product substitutes in the surgical retractors industry pose a challenge by offering alternative solutions for surgical exposure and access. Innovations such as advanced robotic surgical systems, laparoscopic tools, and table-mounted retraction devices provide precise functionality, reducing reliance on traditional retractors. Additionally, self-retaining and disposable retractors cater to specific needs, offering convenience and efficiency. These substitutes are often preferred due to enhanced performance, minimized invasiveness, and adaptability in various procedures. However, their adoption depends on factors like cost, ease of use, and compatibility with existing surgical workflows. As a result, the availability of substitutes influences market dynamics and competitive positioning.

The surgical retractors industry is witnessing significant regional growth driven by increasing healthcare demands and technological advancements. JUNE Medical recently secured an agreement with a leading US hospital group to provide the Galaxy II self-retaining surgical retractors to over 1,600 hospitals starting April 15, 2023. This innovative device enhances surgical retraction safety and efficiency for both patients and medical professionals. Its ergonomic design revolutionizes surgical workflows, making it an excellent choice for group purchasing organizations aiming to equip hospitals with high-quality, cost-effective products.

Type Insights

The handheld retractors segment accounted for the largest revenue share of 53.2% in 2024. Handheld retractors primarily assist in maintaining the desired position of a given tissue area. It requires the assistance of a surgeon or other medical professional to hold the tissue during the procedure, thus restricting the surgeon’s free usage of hands. Various types of retractors are available based on the surgical procedure being performed. Some common retractors are rectal, finger, nerve, abdominal, orthopedic, thoracic, and ribbon retractors. In June 2021, Ethicon launched an advanced bipolar energy device, ENSEAL X1 Curved Jaw Tissue Sealer, that offers more robust sealing. This device is used in bariatric, gynecological, colorectal, and thoracic procedures.

Self-retaining surgical retractors are expected to experience the fastest growth during the forecast period, owing to their ease of use. These retractors do not require assistance to hold them in place, which permits surgery to be conducted without second assistance, thus, allowing less crowding. Various advantages, such as decreased infection risk, adequate surgical site exposure, and low assistance requirement during the process, are expected to contribute to segment growth.

Product Insights

The orthopedic retractors dominated and is expected to grow at the fastest CAGR over the forecast period. the market and for the largest revenue share of 18.4% in 2024. Orthopedic retractors protect the surgical incision and gain access to surgical sites during various surgeries by handling arteries, veins, tendons, and other tissues covering the site. Alexis orthopedic protector/retractor by Applied Medical Resources helps protect fat, muscles, skin, and nerves from contact with sharp devices used during wound surgeries. Similarly, the hip tether system by Thompson Surgical is used by orthopedic surgeons during hip replacement. In June 2023, Thompson Retractor announced the launch of its Pectus Assist System, which is a stable 2-in-1 device that offers assistance in both Pectus Excavatum and Pectus Carinatum procedures.

Nerve retractors are specialized surgical instruments designed to gently hold and protect delicate nerve tissues during procedures, ensuring optimal visibility and access to the surgical site. Commonly used in neurosurgery, spinal surgery, and orthopedic procedures, these retractors minimize trauma to nerves, reducing the risk of postoperative complications. They come in various designs, including handheld and self-retaining models, with smooth edges or cushioned surfaces to prevent nerve damage. Advanced retractors may incorporate integrated lighting or suction for enhanced precision. Their ergonomic and versatile design supports surgeons in achieving effective nerve retraction while prioritizing patient safety and procedural efficiency.

Application Insights

The Obstetrics and Gynecology (Ob/Gyn) segment dominated the surgical retractors market and accounted for the largest revenue share of 24.6% in 2024. Some of the common surgical procedures involving female reproductive organs include cervical cerclage and episiotomy. Minimally invasive gynecologic surgeries can lead to fewer problems, such as postoperative pain, thus resulting in shorter hospital stays.

The neurosurgery segment is expected to witness a CAGR of 7.8% over the forecast period. The growing number of orthopedic patients is expected to boost segment growth. As per Gelenk Klinik orthopedic hospital, more than 24,000 patients are treated yearly. In addition, 2,400 surgical procedures are performed every year. This growing number of orthopedic surgical procedures is expected to drive the need for orthopedic retractors.

End-use Insights

The hospital’s segment dominated the market and accounted for the largest revenue share of 49.3% in 2024. The growth is owing to a large number of cases and preventive surgeries being performed in these end use settings. According to CDC, 125.7 million outpatient department visits were recorded in the U.S. An increase in surgical procedures, such as angioplasty and kidney and liver transplants, and the growing incidence of trauma, has led to the increased demand for surgical equipment from hospitals.

Ambulatory surgical centers (ASCs) are anticipated to register the highest growth rate over the forecast period. This growth can be attributed to lower out-of-pocket costs, better patient accessibility, and decreased facility costs. In November 2022, AEW Capital Management and Flagship Healthcare Trust acquired eight ambulatory surgery centers in a joint venture.

Regional Insights

North America surgical retractors market held a dominant position, capturing 30.3% of the global revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40–50 million surgeries annually for conditions like cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments. Additionally, 702,880 heart disease deaths in 2022 highlight growing demand for minimally invasive techniques, boosting market growth.

U.S. Surgical Retractors Market Trends

The surgical retractors market in the U.S. held a significant share of North America's surgical retractors market in 2024. This dominance can be attributed to advanced technological innovations, increasing demand for wearable health monitoring devices, and a growing focus on patient-centric healthcare solutions. The U.S. is home to key players and research institutions that drive innovation in surgical retractors technology. Additionally, regulatory support and investment in healthcare technology contribute to market growth. As the adoption of surgical retractors applications expands across various sectors, including medical, consumer electronics, and robotics, the U.S. market is poised for continued growth and development.

Europe Surgical Retractors Market Trends

The European surgical retractors market is the second largest globally in 2023, is growing due to rising chronic diseases like diabetes, affecting 61 million people in Europe, projected to reach 67 million by 2030. Increased adoption of robotic-assisted surgeries and expanding outpatient clinics further drive demand for advanced handheld tools.

In the UK, the surgical retractors market is witnessing significant growth due to the rising incidence of chronic diseases like diabetes and the expanding elderly population. For instance, according to the Department of Health & Social Care in the UK the population aged 85 and older is expected to increase by one million between 2021 and 2036.

The surgical retractors market in France is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

The surgical retractors market in Germany is primarily fueled by the rising prevalence of chronic diseases. According to the International Diabetes Federation, in 2021, 10% of Germany's adult population of 62,027,700 had diabetes, amounting to 6,199,900 cases. This growing burden significantly drives the demand for advanced surgical tools. Furthermore, the presence of stainless-steel retractor manufacturers in Germany is also expected to fuel market growth. For instance, MPM Medical Supply is a global medical distributor that operates completely from Germany and has been offering high-quality stainless-steel retractors manufactured in the country across the globe since the 1600s.

Asia Pacific Surgical Retractors Market Trends

The Asia Pacific surgical retractors market is growing rapidly due to rising chronic diseases like cancer, diabetes, and cardiovascular conditions, particularly in China, India, and Japan. With 1.4 million cancer diagnoses in India in 2022, demand for advanced surgical tools is surging. Additionally, the adoption of minimally invasive techniques and innovations in surgical technology, such as robotic systems, is enhancing patient outcomes. Hospitals are increasingly investing in modern instruments to improve care, driving market growth across the region.

The surgical retractors market in Japan is growing, primarily driven by the country’s aging population, with approximately 30% aged 65 and older in 2023, according to World Bank data. Growth is further fueled by the introduction of advanced surgical tools and frequent product launches. Manufacturers are heavily investing in R&D to develop innovative instruments that enhance precision, efficiency, and patient care.

The surgical retractors market in China is expected to grow in the Asia Pacific in 2023. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the surgical retractors market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The surgical retractors market in India is set for significant growth, driven by the increasing prevalence of gastrointestinal disorders and colorectal cancer. With colorectal cancer cases rising at an estimated 5% annually, the demand for minimally invasive procedures has surged. India's aging population, projected to reach 20% by 2050, further fuels this demand. Government initiatives, such as the Ayushman Bharat scheme, are enhancing access to advanced healthcare, boosting surgical snare adoption.

Latin America Surgical Retractors Trends

The Latin American surgical retractors market is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Surgical Snare Market Trends

The Middle East and Africa surgical snare market is growing due to the increasing prevalence of gastrointestinal disorders and colorectal cancer. The adoption of minimally invasive procedures is expanding, driven by a growing awareness of endoscopic techniques. Investments in healthcare infrastructure, particularly in the UAE and Saudi Arabia, are increasing, enhancing access to advanced medical devices. Additionally, the aging population in the region, expected to reach 7% by 2030, further supports market growth alongside government initiatives promoting advanced diagnostic and therapeutic solutions.

The surgical retractors market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Surgical Retractors Company Insights

The market has the presence of some major players engaged in the manufacturing of surgical retractors. Availability of raw materials and advanced manufacturing technology are some of the major factors deciding final product prices. Product differentiation and price are two major factors deciding the purchase decisions in developing countries where private companies mostly provide reimbursements and insurance. Strategic partnerships with local distributors and region-based product variations are some of the initiatives adopted by global players. In March 2021, Ascension, the largest Catholic health and non-profit system at a national level, collaborated with Regent Surgical Health to serve and provide patients with easy access to high-quality outpatient services.

The competitive scenario in the market is highly competitive, with key players such as MC10, Xenoma; and VivaLNK holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Surgical Retractors Companies:

The following are the leading companies in the surgical retractors market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- BD

- Medical Devices Business Services, Inc.

- Teleflex Incorporated

- Medline Industries, Inc.

- B. Braun Melsungen AG

- Applied Medical Resources Corporation

- Thompson Surgical

- Innomed, Inc.

- LiNA Medical ApS

- Vivo Surgical Private Limited

- BVI

- CooperSurgical Inc.

- Stryker

- Terumo Corporation

- June Medical Group

- Mediflex Surgical Products

- Chamfond Biotech Co., Ltd

- Applied Medical Technology, Inc. (AMT)

- Microcure (Suzhou) Medical Technology Co., Ltd.

- Boston Scientific Corporation

- Coloplast

Recent Developments

-

In December 2024,Nua Surgical, an Irish medical device company focused on maternal health innovation, has announced the successful completion of a USD 6.95 million Series A funding round. The investment will support the manufacturing, testing, regulatory approval, and initial commercialization of their SteriCISION C-Section Retractor, a groundbreaking device developed to tackle the specific challenges faced during C-section surgeries.

-

In April 2023, Orthofix Medical Inc. launched two access retractor systems for minimally invasive spine procedures: the Lattus Lateral Access System and Fathom Pedicle-Based Retractor System. These systems target the USD 1.8 billion MIS surgery market. The Lattus system enhances spine access, disc preparation, interbody placement, and integrates with intraoperative monitoring, offering versatility and ease of use.

-

In December 2023, JUNE Medical's Galaxy II self-retaining surgical retractor received MDR certification from BSI Group for use in the EU. This innovative device enhances patient safety and surgical efficiency by enabling single-handed adjustments. The versatile Galaxy II Slider adjusts retraction tension in situ, offering multiple frame and hook options for various surgeries.

Surgical Retractors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.4 billion

Revenue forecast in 2030

USD 3.3 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end-use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic; Becton, Dickinson and Company (BD); Medical Devices Business Services, Inc.; Teleflex Incorporated; Medline Industries, Inc.; B. Braun Melsungen AG; Applied Medical Resources Corporation; Thompson Surgical; Innomed, Inc.; LiNA Medical ApS; Vivo Surgical Private Limited; BVI; CooperSurgical Inc.; Stryker; Terumo Corporation; June Medical Group; Mediflex Surgical Products; Chamfond Biotech Co., Ltd; Applied Medical Technology, Inc. (AMT); Microcure (Suzhou) Medical Technology Co., Ltd.; Boston Scientific Corporation; Coloplast

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Retractors Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global surgical retractors market report on the basis of type, product, application, end-use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hand-held

-

Self-retaining

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Abdominal Retractor

-

Finger Retractor

-

Nerve Retractor

-

Orthopedic Retractor

-

Rectal Retractor

-

Thoracic Retractor

-

Ribbon Retractor

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery

-

Wound Closure

-

Reconstructive Surgery

-

Cardiovascular

-

Orthopedic

-

Ob/Gyn

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Clinics

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical retractors market size was estimated at USD 2.2 billion in 2024 and is expected to reach USD 2.4 billion in 2025.

b. The global surgical retractors market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach USD 3.3 billion by 2030.

b. North America dominated the surgical retractors market with a share of 30.3% in 2024. This is attributable to numerous collaborative efforts by key players to improve their R&D proficiencies and ensure high-quality standards.

b. Some key players operating in the surgical retractors market include Johnson & Johnson, CONMED Corporation, Becton Dickinson and Company, Sklar Surgical Instruments, Teleflex Incorporated, BR Surgical, Medtronic, Olympus Corporation, and CooperSurgical, Inc.

b. Key factors that are driving the surgical retractors market growth include the increasing rise in surgical procedures, the increasing global geriatric population and technological advancements, the rising prevalence of lifestyle disorders, and increased per capita healthcare expenditure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.