- Home

- »

- Medical Devices

- »

-

Surgical Robot Procedures Market, Industry Report, 2033GVR Report cover

![Surgical Robot Procedures Market Size, Share & Trends Report]()

Surgical Robot Procedures Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Urology, General Surgery, Gynecology), By Procedure Type (Endoscopic Robotic Procedures), By Procedure Complexity, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-707-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Robot Procedures Market Summary

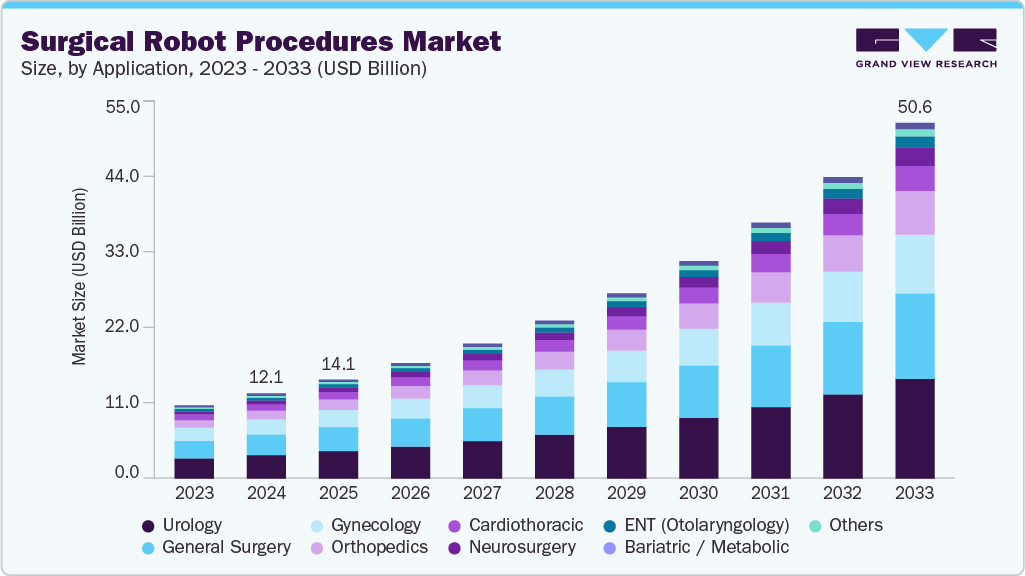

The global surgical robot procedures market size was estimated at USD 12.11 billion in 2024 and is projected to reach USD 50.63 billion by 2033, growing at a CAGR of 17.32% from 2025 to 2033.The convergence of advanced technology integration, broader procedural applicability, and rising institutional investment is driving the adoption of surgical robotics.

Key Market Trends & Insights

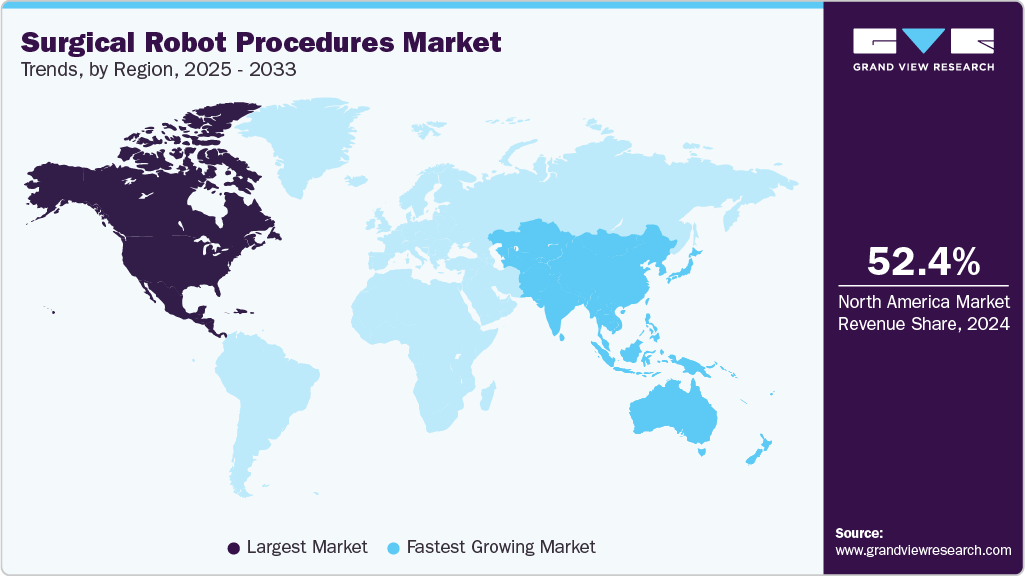

- North America surgical robot procedures market dominated the global industry in 2024 and accounted for the largest revenue share of 52.40%.

- The U.S. surgical robot procedures market is anticipated to register the fastest growth rate during the forecast period.

- In terms of applications, the urology segment held the largest revenue share of 27.71% in 2024.

- In terms of procedure type, the minimally-invasive laparoscopic robotic-assisted segment held the largest revenue share in 2024.

- In terms of procedure complexity, the medium-complexity procedures segment held the largest revenue share in 2024.

- In terms of end use, the large hospital systems segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.11 Billion

- 2033 Projected Market Size: USD 50.63 Billion

- CAGR (2025-2033): 17.32%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hospitals are incorporating robotic systems across a wider range of specialties and procedure types, supported by growing clinical validation and operational efficiency. These developments are contributing to the standardization of surgical robotics within routine hospital workflows. In April 2024, Ohio State completed its first surgeries using the da Vinci 5 system, the latest-gen surgical robot with advanced tactile feedback and precision.Rising demand for minimally invasive surgeries continues to be a primary catalyst for surgical robot adoption. Patients and providers alike are prioritizing procedures that offer reduced trauma, faster recovery, and fewer complications. Robotic systems enhance the precision and control required for these techniques, enabling surgeons to perform complex maneuvers through small incisions. In April 2025, Johnson & Johnson MedTech completed the first clinical cases using its OTTAVA robotic system for Roux-en-Y gastric bypass at Memorial Hermann-Texas Medical Center. The trial focuses on evaluating minimally invasive performance across general surgeries. Data will support a De Novo FDA submission for multi-procedure use.

Technological advancement is rapidly evolving the capabilities and appeal of surgical robotics. Integrations such as AI-assisted navigation, improved imaging, and ergonomic consoles are transforming surgical robots into fully integrated digital platforms. Modular architectures and specialty-specific toolkits have made systems more adaptable, while innovations in automation and analytics are improving intraoperative efficiency. In January 2025, Queen Elizabeth Hospital in King's Lynn, UK, introduced the USD 1.3M Versius surgical robot to treat cancer patients. Initially used for colorectal procedures, the system enables longer, complex surgeries with greater precision and comfort. The robot is expected to treat 100 patients in its first year and expand into urology and gynecology.

The expansion of procedural indications across multiple specialties is significantly accelerating system utilization. Robotic surgery, once limited to urology and gynecology, is now being deployed in general, bariatric, colorectal, orthopedic, and cardiothoracic procedures. As clinical evidence supports efficacy and payers broaden reimbursement, hospitals are leveraging robotic platforms across diverse departments. In June 2025, a surgeon in Orlando remotely performed a prostatectomy on a patient in Angola using a robotic system, marking the first FDA-approved human trial of transcontinental telesurgery. Conducted over 7,000 miles via fiber optic cables, the procedure showcased safe, real-time precision.

Case Study: Expanding the Role of Robotic Surgery in Emergency General Procedures (2013 to 2021)

Background

While robotic surgery (RS) is well established in elective cases, its use in emergency general surgery (EGS) has been more limited. Historically, open and laparoscopic techniques dominated urgent procedures due to logistical and training challenges. This study, published in JAMA Surgery in March 2024, evaluated trends and outcomes in RS adoption for four common EGS procedures across 829 US hospitals between 2013 and 2021.

Scope & Methodology

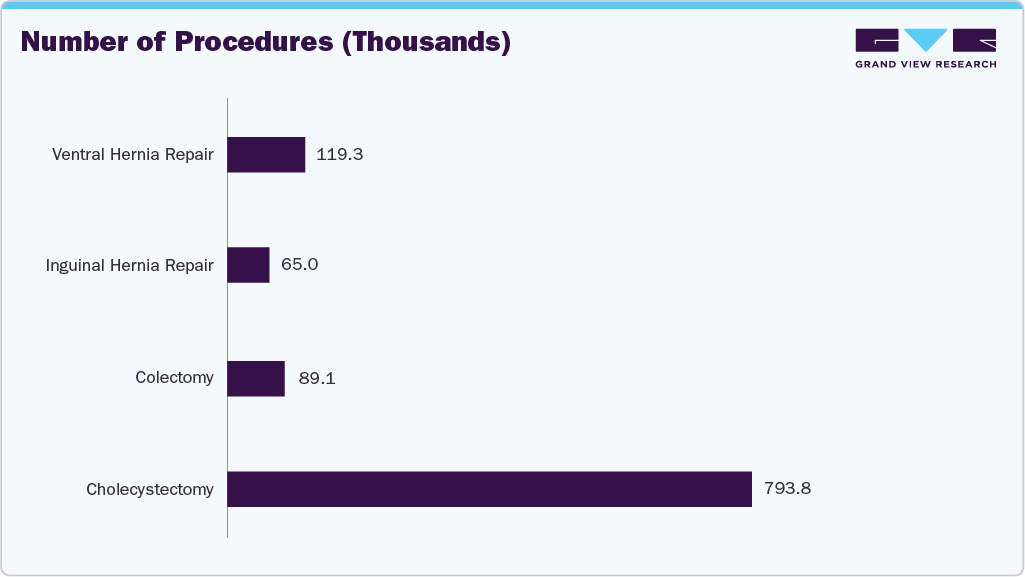

Over 1 million urgent and emergent cases were analyzed, including:

Using a large discharge database (PINC AI), the study tracked procedure types (open, laparoscopic, robotic), conversion to open, and length of stay (LOS). Propensity score matching controlled for patient, hospital, and surgeon variables.

Key Findings

-

Rising Adoption: Robotic surgery saw a steady annual increase in usage across all four procedures. Inguinal hernia repairs led the trend, growing from 0.4 percent to 15.3 percent over eight years.

-

Reduced Conversions: Compared to laparoscopy, RS consistently showed lower conversion rates to open surgery up to four times lower in some procedures (for example, 2.4 percent vs 10.7 percent in inguinal hernia repair).

-

Shorter Hospital Stays

: Robotic approaches were associated with modestly shorter postoperative LOS - especially in colectomy and hernia repairs.

Implications

-

Clinical Outcomes: The data suggest RS may provide meaningful benefits in EGS mirroring its success in elective surgery with lower conversion rates and shorter recovery times.

-

Operational Considerations: Despite clinical advantages, widespread RS adoption in emergencies may be constrained by factors like training gaps, OR access, and system level readiness.

- Trend Toward Minimally Invasive: The shift reflects broader trends in general surgery favoring precision, minimally invasive methods, even in time sensitive scenarios.

Conclusion

Robotic surgery, while still not the dominant approach in emergencies, is gaining traction across US hospitals. Its performance in high volume urgent procedures signals a possible paradigm shift in acute surgical care, especially as robotic platforms become more accessible and integrated into EGS protocols.

Case Study: Emergence of Surgical Robotics in Africa (2003 - 2023)

Background

Robotic surgery has transformed minimally invasive surgical practice worldwide, but adoption in Africa has been limited due to infrastructure, cost, and training challenges. This 2024 study in the Journal of Minimally Invasive Surgery provides the first continent-wide scoping review and meta-analysis of robotic surgery, examining procedures, platforms, and outcomes in African healthcare systems.

Scope & Methodology

Researchers conducted a systematic search across PubMed, Google Scholar, Web of Science, and African Journals Online, identifying 1,266 articles. After screening, 16 studies from South Africa, Egypt, and Tunisia met inclusion criteria. Together, they represented 1,328 robotic procedures across four surgical specialties - urological, general, gynecological, and cardiothoracic. Platforms included da Vinci (Intuitive Surgical), Versius (CMR Surgical), and Senhance (Asensus Surgical).

A meta-analysis in R software calculated pooled conversion, morbidity, and mortality rates with 95% confidence intervals.Key Findings

-

Geographic Concentration: 82.9% of procedures were performed in South Africa, 16.3% in Egypt, and 0.8% in Tunisia.

-

Specialty Distribution: Urological surgery dominated (90.1%), with robotic prostatectomy most common (49.3% of all cases). General surgery accounted for 7.4%, gynecology 2.5%, cardiothoracic 0.1%.

-

Platform Use: da Vinci was the primary system (used in 68.8% of studies), with limited use of Versius and Senhance.

Outcomes:

-

Conversion to open surgery was rare - 0.2% pooled rate.

-

Morbidity prevalence was 21.2%, with complications such as ileus, urine leaks, and hemorrhage most frequent.

-

No mortality reported in reviewed cases.

-

Trend: Marked rise in reports and adoption after 2020.

Implications

-

Clinical Performance: Outcomes suggest robotic surgery, when implemented, is safe and effective in African contexts, aligning with global performance data.

-

Operational Challenges: Widespread adoption is hindered by high equipment costs, limited training programs, unreliable electricity in many hospitals, and infrastructure deficits.

-

Strategic Opportunities: Newer lower-cost robotics platforms and targeted training could accelerate adoption, especially in high-volume tertiary centers.

Conclusion

Robotic surgery in Africa remains limited but shows promise, with excellent safety, low conversion rates, and potential for broader impact. Concentrated currently in a few countries and specialties, expansion will require investment, policy support, and training infrastructure. These early results provide a strong foundation for scaling this technology to improve surgical outcomes across the continent.

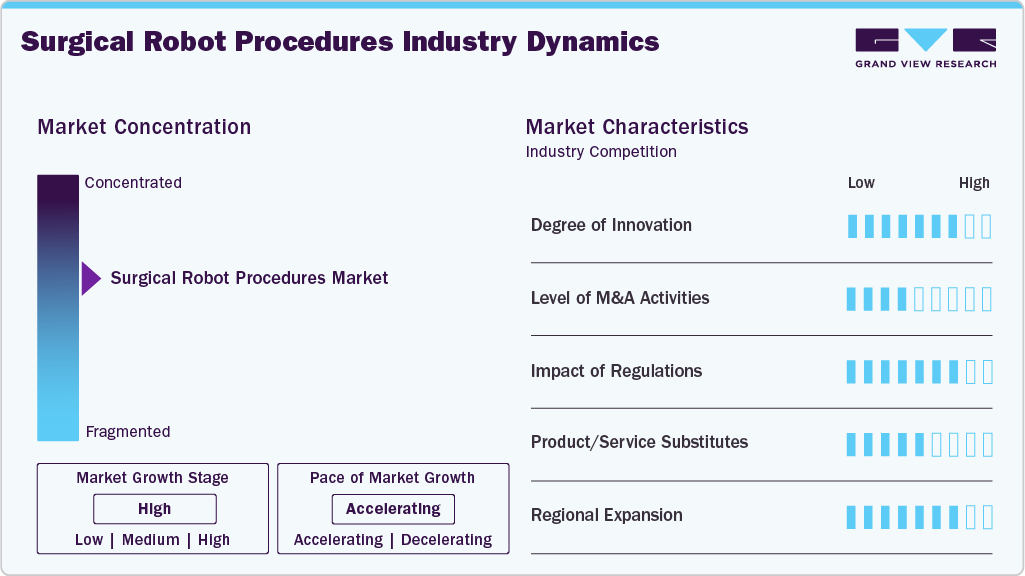

Market Concentration & Characteristics

The industry demonstrates a high level of innovation, underscored by rapid integration of AI, augmented reality, and real-time analytics into surgical workflows. Platforms are evolving toward greater automation, enhanced dexterity, and specialty-specific capabilities. The shift from single-use robotics to multi-specialty, interoperable systems is reshaping how providers approach complex and minimally invasive procedures. In May 2024, Sony unveiled a prototype microsurgery assistance robot in Yokohama, Japan, at the ICRA conference. The system features automatic instrument exchange, wrist-like precision control, and 4K imaging, aiming to support surgeons in highly delicate procedures.

M&A activity in this space remains at a medium level, with select transactions targeting startups with differentiated technologies such as soft-tissue robotics, navigation software, and AI-enabled workflow optimization. While a few large players have made strategic acquisitions to bolster portfolios or enter new verticals, most consolidation remains opportunistic rather than systemic. High development costs and long regulatory lead times limit deal frequency, but interest is steady as companies seek to close capability gaps and accelerate time to market.

The regulatory environment surrounding surgical robotics imposes a high level of oversight, shaped by stringent device classification, safety protocols, and evolving standards for digital components. Approval pathways often require multi-phase clinical validation, post-market surveillance, and compliance with interoperability and cybersecurity frameworks. Emerging guidelines for AI-enabled surgical systems are adding complexity, requiring firms to balance innovation with rigorous documentation and risk mitigation strategies.

The scope of service expansion is at a medium level, as vendors increasingly move beyond system sales to offer value-added solutions like cloud-based analytics, predictive maintenance, virtual training simulators, and robotic procedure optimization tools. These offerings are particularly appealing to smaller hospitals and regional networks aiming to improve return on investment. In August 2025, Lee Health expanded its robotic surgery capabilities with a new stand-alone ambulatory surgery center in Fort Myers featuring the advanced Da Vinci Xi surgical robot system, used across multiple specialties for minimally invasive procedures.

Regional expansion efforts are occurring at a high level, with companies aggressively targeting underserved markets in Asia-Pacific, the Middle East, and Latin America. Localization strategies include in-market assembly, regulatory partnerships, and clinician training hubs to facilitate adoption and reduce entry barriers. In April 2025, Aster Hospital Mankhool inaugurated the UAE’s first robotic surgery center within the Aster Hospitals network, equipped with the ROSA Robotic Knee Joint Replacement System.

Application Insights

The urology segment dominated the market with the largest revenue share of 27.71% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This dominance is driven by the high volume of robotic-assisted urological procedures, particularly prostatectomies, where surgical robots offer enhanced precision, reduced recovery times, and improved outcomes.In July 2025, UTMB Health reported zero readmissions and no positioning-related adverse events following over 40 single-port robotic urologic procedures. The team emphasized the system’s precision, faster recovery, and its growing role in treating complex cases like pyeloplasty and partial cystectomy.

The orthopedics segment is anticipated to grow at the fastest CAGR over the forecast period, driven by rising demand for joint replacement surgeries and innovations in robotic-assisted orthopedic procedures. The increasing prevalence of musculoskeletal disorders and aging populations is also fueling market expansion in this specialty.In August 2024, DePuy Synthes received FDA clearance and introduced its Velys active robotic-assisted system for spine surgery. The platform supports robotic planning and navigation for cervical, thoracolumbar, and sacroiliac spinal fusion procedures, aiming to enhance precision in complex orthopedic interventions.

Procedure Type Insights

The minimally-invasive laparoscopic robotic-assisted segment dominated the market with the largest revenue share of 60.49% in 2024. Its broad clinical utility, particularly in general surgery, urology, and gynecology, has made it the preferred modality across diverse healthcare settings. Continued emphasis on reducing surgical morbidity and improving efficiency has further driven institutional adoption. In April 2025, research featured in the Journal of the Society of Laparoscopic & Robotic Surgeons and Annals of Surgery Open underscored the role of robotic-assisted surgery in expanding access to minimally invasive procedures. To enhance surgical training, improve access in underserved areas, and increase adoption across procedures like hernia repair and colorectal surgery.

The percutaneous / catheter-based robotic procedures segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is fueled by increasing adoption in interventional cardiology and vascular procedures, where precision and minimally invasive access are critical. Advancements in catheter navigation, imaging integration, and remote operation capabilities are further driving demand for these systems.In February 2025, researchers published in Scientific Reports a study introducing a master–slave robotic system for cardiac ablation featuring magnetorheological fluid-based haptic feedback to enhance operator control and collision detection.

Procedure Complexity Insights

The medium-complexity procedures segment dominated the market with a revenue share of 43.20% in 2024. This is attributed tothe growing adoption of robotic systems in urologic, gynecologic, and colorectal surgeries, which strike a balance between clinical demand, reimbursement viability, and surgeon preference for precision and minimally invasive techniques. In April 2025, Medtronic announced that its Expand URO clinical trial for the Hugo robotic-assisted surgery system met both safety and effectiveness endpoints, marking a major milestone for urologic robotic procedures in the U.S.

Thelow complexity segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is driven by the rapid shift of routine laparoscopic procedures to robotic platforms, growing surgeon proficiency, and wider adoption in community hospitals and ASCs. Shorter operative times and faster patient recovery are also making these procedures increasingly viable in outpatient settings. In May 2025, Washington Health expanded use of the da Vinci Xi robotic system across its ambulatory and specialty surgical centers. The initiative focuses on minimally invasive, lower-complexity procedures in gynecology, urology, and general surgery.

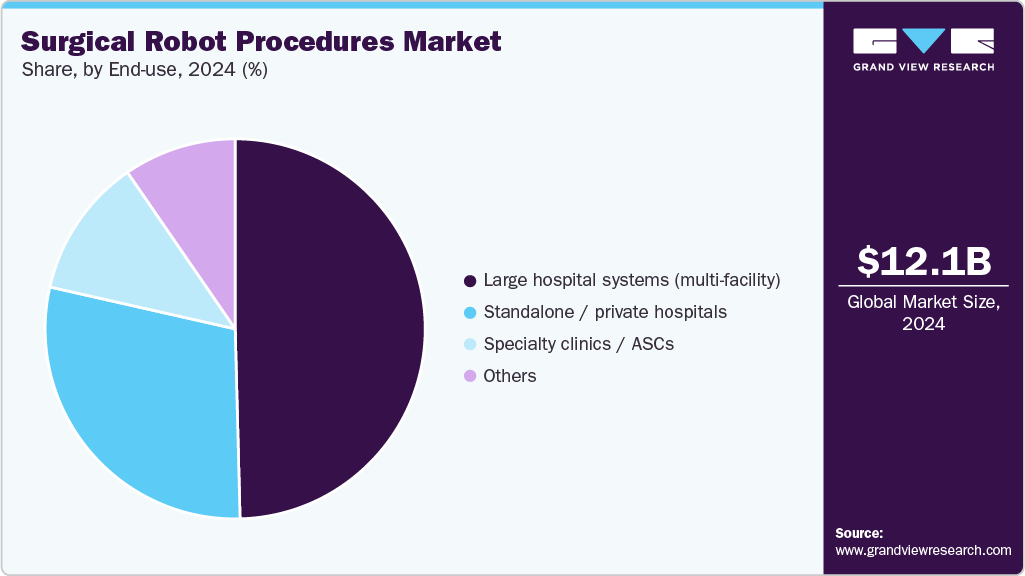

End-use Insights

The large hospital systems segment dominated the market with a revenue share of 49.59% in 2024. This dominance is driven by their greater capital resources, higher surgical volumes, and strategic focus on integrating advanced technologies to enhance surgical outcomes. These institutions are also more likely to invest in training and infrastructure required for robotic surgery adoption.In February 2025, Warren Memorial Hospital launched its robotic-assisted general surgery program using the da Vinci Xi Surgical System. The technology is being used for abdominal procedures like hernia and gallbladder surgeries, enhancing surgical precision and patient recovery.

The specialty clinics / ASCs segment is expected to grow at the fastest rate during the forecast period, driven by increasing demand for same-day minimally invasive procedures, lower overall costs, and growing investments in outpatient robotic surgery programs. Technological advancements have enabled compact, cost-efficient robotic systems that suit outpatient settings.In June 2025, AdventHealth adopted multiple DEXTER robotic systems from Distalmotion to expand minimally invasive surgery across its ambulatory and outpatient care sites. Designed for soft tissue procedures like hernia repair and cholecystectomy, DEXTER’s compact, mobile setup supports efficient workflows and greater surgical access beyond traditional hospital ORs.

Regional Insights

North America surgical robot procedures market dominated the global industry with a revenue share of 52.40% in 2024. High volumes in urology and general surgery continue to anchor procedural demand. Robust hospital infrastructure and favorable reimbursement frameworks have supported widespread adoption. In March 2024, Intuitive Surgical announced FDA clearance of its fifth-generation da Vinci robotic system, da Vinci 5, in the U.S. Building on the successful da Vinci Xi, this next-gen platform features over 150 enhancements, including advanced force-sensing technology that lets surgeons feel tissue resistance, next-level 3D imaging, improved precision, and streamlined OR workflow.

U.S. Surgical Robot Procedures Market Trends

The surgical robot procedures market in the U.S. dominated the North American region in 2024, due to early and comprehensive integration of robotic platforms across specialties. A dense network of tertiary and academic hospitals facilitated high volumes of complex procedures. Robotic-assisted methods are steadily replacing traditional laparoscopy. In November 2024, Surgical Endoscopy reviewed 20 upcoming robotic surgery systems nearing FDA approval. The study highlights growing competition driving innovation and cost reduction, signaling strong continued growth in minimally invasive robotic surgery.

Europe Surgical Robot Procedures Market Trends

The surgical robot procedures market in Europe is expected to grow significantly over the forecast period. Healthcare systems are prioritizing minimally invasive solutions to improve outcomes and reduce recovery times. Gynecology and general surgery are emerging as key adoption areas. Partnerships between hospitals and medtech firms are accelerating platform rollout. In July 2025, Intuitive’s da Vinci 5 surgical system received CE mark approval in Europe for adult and pediatric minimally invasive procedures across multiple specialties. The fifth-generation system introduces enhanced precision, operational efficiency, and advanced analytics.

The UK surgical robot procedures industry is expected to grow significantly during the forecast period.NHS initiatives expand access to robotic systems across high-demand regions. Uptake is increasing in oncologic urology and colorectal surgery based on strong clinical data. In April 2025, NICE approved 11 robotic surgery systems 5 for soft tissue and 6 for orthopedics under conditional use while evidence is gathered over three years. Orthopedic robotic procedures rose from around 300 in 2018/19 to over 4,000 in 2023/24, while non-urological use grew from 20% in 2011/12 to 49% in 2023/24.

Asia Pacific Surgical Robot Procedures Market Trends

The surgical robot procedures industry in Asia Pacific is expected to register the fastest growth rate over the forecast period. Rising surgical case volumes and growing demand for precision have pushed hospitals to modernize with robotic platforms. Medical tourism destinations are scaling robotic capacity to enhance competitiveness. In January 2025, India’s first indigenous surgical robot, SSI Mantra 3, performed two remote cardiac surgeries across 285 km between Gurugram and Jaipur following CDSCO approval. The system demonstrated stable, low-latency performance during telesurgery.

China surgical robot procedures market is anticipated to register considerable growth during the forecast period. Policy support for innovation and localization is accelerating system development and deployment. Major hospitals in Tier 1 cities are scaling robotic capabilities for complex procedures. In January 2022, Shanghai MicroPort MedBot announced NMPA approval of its Toumai Laparoscopic Surgical Robot, the first four-arm laparoscopic robot developed and commercialized in China.

Latin America Surgical Robot Procedures Market Trends

The surgical robot procedures industry in Latin America is anticipated to witness considerable growth over the forecast period. Private healthcare networks are turning to robotics as a premium service differentiator. International training partnerships are helping to build regional surgical expertise. In February 2025, Genesis MedTech completed its first robotic-assisted surgeries using its OMNIBOT system at Clínica Andes Salud Concepción in Chile. The system combines 3D visualization and precise instrument control to enhance complex procedures across specialties.

Brazil surgical robot procedures industry is anticipated to register considerable growth during the forecast period. Private hospital groups are investing in robotic platforms to expand advanced surgical services. Partnerships with international training centers are improving surgeon proficiency. In December 2024, MicroPort MedBot’s Toumai laparoscopic surgical robot received market approval from Brazil’s ANVISA, signaling its entry into Latin America. The launch event featured a live remote animal surgery performed across continents, showcasing the system’s cross-border tele-surgical capabilities and potential for broader regional access to advanced minimally invasive procedures.

Middle East & Africa Surgical Robot Procedures Market Trends

The surgical robot procedures market in the Middle East and Africa is anticipated to witness considerable growth over the forecast period. Tertiary hospitals in Saudi Arabia, the UAE, and South Africa are expanding robotic surgery programs. Government-backed health initiatives are prioritizing digital and surgical innovation. International OEMs are establishing regional training and service hubs. In March 2025, the University of the Free State in Bloemfontein, South Africa, became the first in Southern Africa to use the Versius Surgical Robotic System. Nine successful procedures were completed at Universitas Academic Hospital.

UAE surgical robot procedures industry is anticipated to register considerable growth during the forecast period. Flagship hospitals are adopting robotic systems to position themselves as regional surgical leaders. In July 2025, Yas Clinic Khalifa City, alongside the Abu Dhabi Stem Cells Centre, launched a robotic spine surgery program powered by AI-based navigation. The initiative began with two successful procedures for patients with spinal stenosis, positioning the clinic as a leader in cutting-edge, minimally invasive spine care in the region.

Key Surgical Robot Procedures Company Insights

Key players operating in the surgical robot procedures market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Surgical Robot Procedures Companies:

The following are the leading companies in the surgical robot procedures market. These companies collectively hold the largest market share and dictate industry trends.

- Intuitive Surgical

- THINK Surgical, Inc.

- Smith+Nephew

- Medtronic

- Stryker

- Zimmer Biomet

- CMR Surgical

- Asensus Surgical US, Inc.

- Renishaw PLC.

- MOON Surgical

Recent Developments

-

In July 2025, a surgical robot developed at Johns Hopkins autonomously executed part of a gallbladder removal on a lifelike model. Trained on surgical videos and guided by voice commands, the robot successfully performed 17 complex tasks, adapting in real time. The system demonstrated expert-level precision and reliability, representing a significant step toward clinical use of autonomous surgical robots.

-

In March 2025, Kolkata’s IPGMER became the first government hospital in Eastern India to introduce a robotic surgery system, marking a key advancement in public healthcare. Initially deployed for general surgery, urology, and gynecology, the system is expected to expand into head, neck, and cardiac procedures.

-

In August 2024, Yale New Haven Health surpassed 30,000 robotic-assisted surgeries across specialties. The health system performed 4,238 da Vinci robotic procedures in 2023 alone, with an average length of stay of 1.5 days, compared to 1.9 for laparoscopic and 6 for open surgeries.

-

In February 2024, Sheikh Shakhbout Medical City in Abu Dhabi introduced robotic knee replacement surgeries for osteoarthritis patients, enabling more precise, minimally invasive procedures and faster recovery.

Surgical Robot Procedures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.11 billion

Revenue forecast in 2033

USD 50.63 billion

Growth rate

CAGR of 17.32% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, procedure type, procedure complexity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Intuitive Surgical; THINK Surgical, Inc.; Smith+Nephew; Medtronic; Stryker; Zimmer Biomet; CMR Surgical; Asensus Surgical US, Inc.; Renishaw PLC.; MOON Surgical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Robot Procedures Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global surgical robot procedures market report based on application, procedure type, procedure complexity, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Urology

-

General Surgery

-

Gynecology

-

Orthopedics

-

Cardiothoracic

-

Neurosurgery

-

ENT (Otolaryngology)

-

Bariatric / Metabolic

-

Other specialties

-

-

Procedure Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Minimally-invasive Laparoscopic Robotic-Assisted

-

Percutaneous / Catheter-based Robotic Procedures

-

Endoscopic Robotic Procedures

-

Open-assisted (Hybrid Open Procedures)

-

Others

-

-

Procedure Complexity Outlook (Revenue, USD Million, 2021 - 2033)

-

High Complexity (Oncologic, Cardiac, Neuro)

-

Medium Complexity (Advanced Laparoscopy, Joint Replacements)

-

Low Complexity (Simple Laparoscopic Cases)

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Hospital Systems (Multi-facility)

-

Standalone Hospitals / Private Hospitals

-

Specialty Clinics / ASCs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical robot procedures market size was estimated at USD 12.11 billion in 2024 and is expected to reach USD 44.3 billion in 2025.

b. The global surgical robot procedures market is expected to grow at a compound annual growth rate of 17.32% from 2025 to 2033 to reach USD 50.63 billion by 2033.

b. North America dominated the surgical robot procedures market with a share of 52.40% in 2024. THigh volumes in urology and general surgery continue to anchor procedural demand. Robust hospital infrastructure and favorable reimbursement frameworks have supported widespread adoption.

b. Some key players operating in the surgical robot procedures market include Intuitive Surgical, THINK Surgical, Inc., Smith+Nephew, Medtronic, Stryker, Zimmer Biomet, CMR Surgical, Asensus Surgical US, Inc., Renishaw PLC., MOON Surgical.

b. The convergence of advanced technology integration, broader procedural applicability, and rising institutional investment is driving the adoption of surgical robotics. Hospitals are incorporating robotic systems across a wider range of specialties and procedure types, supported by growing clinical validation and operational efficiency. These developments are contributing to the standardization of surgical robotics within routine hospital workflows.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.