- Home

- »

- Medical Devices

- »

-

Surgical Snare Market Size, Share & Growth Report, 2030GVR Report cover

![Surgical Snare Market Size, Share & Trends Report]()

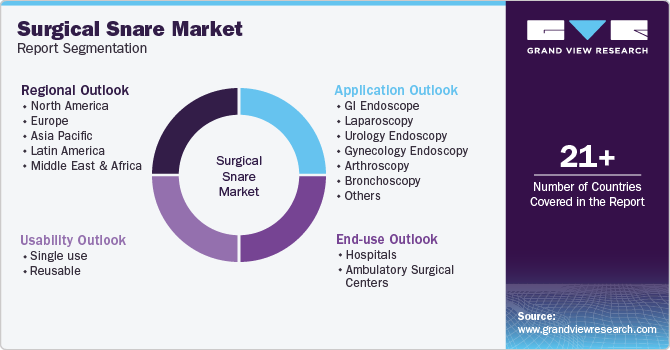

Surgical Snare Market (2025 - 2030) Size, Share & Trends Analysis Report By Usability (Single-use, Reusable), By Application (GI Endoscope, Laparoscopy, Urology Endoscopy, Arthroscopy, Bronchoscopy, By End-use (Hospitals, ASCs), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-754-4

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Snare Market Size & Trends

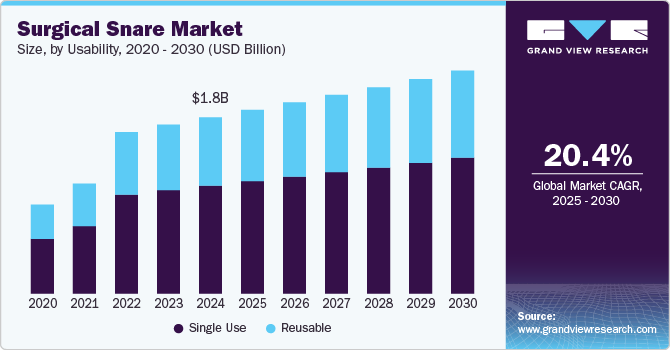

The global surgical snare market size was estimated at USD 1.8 billion in 2024 and is projected to grow at a CAGR of 3.9% from 2025 to 2030. The market growth is primarily driven by the rising number of ambulatory surgery centers (ASCs) offering polypectomy procedures and the growing preference for minimally invasive surgeries. A significant increase in gastrointestinal procedures in the U.S. and other developed economies is anticipated to support the market growth over the forecast period. Moreover, the increasing prevalence of chronic kidney diseases, the growing geriatric population suffering from chronic conditions, and rising patient awareness are other factors aiding the market growth.

Increased patient awareness about cancer is also propelling the market growth. According to WHO, cancer is the leading cause of death, accounting for nearly 10 million deaths worldwide. The most common type of cancer was breast cancer, accounting for nearly 2.26 million cases, followed by lung and colon cancer, accounting for approximately 2.21 and 1.93 million cases, respectively. The increasing prevalence of cancer is one of the key factors expected to contribute to the growth of the endoscopes market over the forecast period. According to the World Cancer Research Fund International, 2020 there were 18.1 million cancer cases worldwide; of these, 8.8 million cases were in women and 9.3 million in men.

The rising incidence of cancer is expected to boost the demand for biopsies for cancer diagnosis. Endoscopy for biopsies and endoscopic ultrasound are preferred for cancer diagnosis. Thus, increased demand for surgical procedures is expected to result in market growth during the forecast period.

Technological advancements are further expected to drive the demand for endoscopy procedures, fueling the market growth. For instance, in August 2022, Medtronic, a U.S. based healthcare technology company, launched GI Genius intelligent endoscopy module, powered by a computer-aided polyps detection system with artificial intelligence. This module aims to empower physicians to detect and treat colorectal cancer by providing enhanced visualization during colonoscopy.

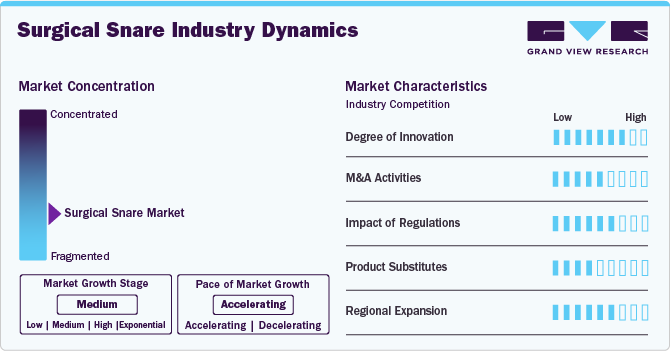

Market Concentration & Characteristics

The surgical snare market is moderately concentrated, with key players dominating through technological advancements, product innovation, and strategic partnerships. Companies focus on producing high-precision, single-use, and reusable snares tailored for diverse surgical needs, including polyp removal and endoscopic procedures. The market is characterized by stringent regulatory standards, a demand for minimally invasive procedures, and increasing adoption of advanced materials to enhance performance. Emerging players compete by offering cost-effective solutions, while established firms leverage strong distribution networks and R&D investments. The industry's growth is driven by rising surgical procedures and the need for safer, efficient devices in healthcare systems globally.

The surgical snare industry is highly innovative, focusing on advancing minimally invasive solutions. In October 2019, Olympus launched its Hot/Cold Polypectomy Snare, designed for versatility and precision in removing polyps during endoscopic procedures. This innovative device enables both hot and cold resection, offering enhanced efficiency and safety. Its advanced design provides improved control, reflecting Olympus's dedication to developing cutting-edge medical technologies that optimize patient outcomes. The introduction of such versatile devices highlights the industry’s focus on meeting the growing demand for safer, more efficient surgical tools, while supporting advancements in healthcare through innovation and patient-centered solutions.

Regulations significantly impact the surgical snare industry, ensuring product safety, quality, and efficacy. Regulatory bodies like the FDA and CE impose strict standards for material usage, manufacturing processes, and clinical evaluations. Compliance drives innovation, pushing manufacturers to develop safer, more reliable devices. Regulatory delays or stringent approvals can extend product launch timelines, impacting market growth. Adherence to post-market surveillance and reporting requirements ensures continued safety and performance. Global harmonization of regulations influences international trade, while evolving policies around reusable and single-use devices affect production strategies. Overall, regulations shape the industry's landscape, fostering trust among healthcare professionals and patients.

Mergers and acquisitions (M&A) play a crucial role in shaping the surgical snare industry, driving market consolidation and innovation. Leading companies acquire smaller firms to expand their product portfolios, enhance R&D capabilities, and strengthen distribution networks. These deals foster technological advancements, such as improved snare designs and materials, catering to evolving surgical needs. M&A also enable companies to penetrate emerging markets and achieve economies of scale. Regulatory approvals and integration challenges can impact deal success. Overall, M&A activities enhance competitive positioning, promote innovation, and support the industry's growth by aligning resources with global demand for advanced surgical solutions.

Product substitutes in the surgical snare industry include alternative tools for polyp removal and tissue resection, such as biopsy forceps, electrocautery devices, and laser-based systems. These substitutes offer varying advantages, such as precise cutting, reduced thermal damage, or compatibility with specific procedures. However, their adoption depends on factors like cost, procedure type, and surgeon preference. While substitutes can address specific challenges, surgical snares remain favored for their versatility, efficiency, and ability to handle both hot and cold resections. Advancements in substitutes may pose competition, but snares continue to dominate due to their established reliability and ease of integration in endoscopic procedures.

The surgical snare industry is driven by increasing healthcare investments, rising demand for minimally invasive procedures, and enhanced distribution networks. Emerging markets in Asia-Pacific and Latin America are experiencing growth due to improved healthcare infrastructure and rising awareness of endoscopic procedures. North America and Europe lead in innovation and adoption, supported by advanced healthcare systems and strong regulatory compliance. Companies focus on strategic partnerships, localized manufacturing, and tailored product offerings to cater to regional needs. This expansion enables access to untapped markets, fostering global growth while meeting the diverse demands of a rapidly evolving healthcare landscape.

Usability Insights

The single-use segment accounted for the largest revenue share of 61.3% in 2024. The single-use snares include soft wire oval, crescent-shaped, oval, and hard wire oval snares. Various shapes and wire characteristics are required in various application areas, including thick wires for higher coagulation and hard snares for flat polyps. Increasing adoption of single-use instruments in healthcare facilities to ensure convenience and safety is expected to accelerate the growth of the segment.

The reusable segment is expected to witness the fastest CAGR over the forecast period. The rising demand for cost-effective and sustainable medical devices, coupled with the increasing focus on reducing medical waste and environmental impact, has fueled the adoption of reusable surgical snares. These devices offer advantages such as durability, ease of sterilization, and long-term cost savings for healthcare facilities.

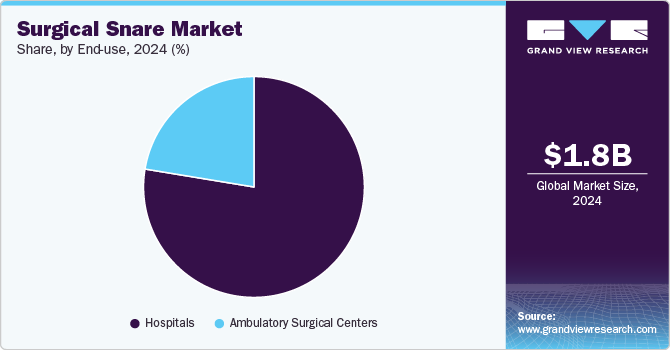

End-use Insights

The hospital's segment captured the largest revenue share of 77.6% in 2024. The hospital segment is the largest revenue-generating segment due to the high surgery volume. According to the CDC, a steep increase in surgical procedures, such as angioplasty and kidney and liver transplants, has been observed in the past few years. Coupled with the growing incidence of trauma, hospitals' demand for surgical equipment has significantly increased in recent years.

The ambulatory surgical centers (ASCs) segment is anticipated to register the fastest CAGR over the forecast period. It can be attributed to lower out-of-pocket costs, better patient accessibility, and decreased facility costs.

Application Insights

The GI endoscope segment held the largest revenue share of 31.5% in 2024 and is expected to maintain its dominance over the forecast period. The increasing number of gastroscopies, the rising adoption of endoscopes for diagnosing and treating gastrointestinal (GI) diseases, and the availability of advanced products for gastroscopy are some of the factors boosting the use of gastroscopy.

The arthroscopy is expected to expand at the fastest CAGR over the forecast period. The adoption of arthroscopic procedures is expected to increase owing to the rising geriatric population at risk of age-related disorders, such as arthritis, and rising incidence of joint injuries, such as knee and shoulder. According to the Centers for Disease Control and Prevention estimates, about one in four adults, or about 58.5 million people in the U.S., have been diagnosed with arthritis by doctors.

Regional Insights

North American surgical snare market held a dominant position, capturing 44.1% of the global revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40-50 million surgeries annually for conditions like cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments. Additionally, 702,880 heart disease deaths in 2022 highlight growing demand for minimally invasive techniques, boosting market growth.

U.S. Surgical Snare Market Trends

The surgical snare market in the U.S. held a significant share of North America's market in 2024, supported by a well-developed healthcare system and advanced treatment facilities. Growth is driven by rising minimally invasive surgeries across aesthetics, dentistry, orthopedics, and more. Cosmetic surgeries grew 5% in 2023, totaling 1,575,244 procedures, fueled by self-awareness of aging and weight loss trends.

Europe Surgical Snare Market Trends

The European surgical snare market, the second largest globally in 2024, is growing due to rising chronic diseases like diabetes, affecting 61 million people in Europe, projected to reach 67 million by 2030. Increased adoption of robotic-assisted surgeries and expanding outpatient clinics further drive demand for advanced handheld tools.

The UK surgical snare market is steadily expanding, driven by factors such as high per capita income, a well-established healthcare system, a large pool of healthcare professionals, easy access to medical services, advanced device availability, and supportive reimbursement policies. These elements collectively fuel the market's growth in the region.

The surgical snare market in France is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

The Germany surgical snare market is primarily fueled by the rising prevalence of chronic diseases. According to the International Diabetes Federation, in 2021, 10% of Germany's adult population of 62,027,700 had diabetes, amounting to 6,199,900 cases. This growing burden significantly drives the demand for advanced surgical tools.

Asia Pacific Surgical Snare Market Trends

The Asia Pacific surgical snare marketis growing rapidly due to rising chronic diseases like cancer, diabetes, and cardiovascular conditions, particularly in China, India, and Japan. With 1.4 million cancer diagnoses in India in 2022, demand for advanced surgical tools is surging. Additionally, the adoption of minimally invasive techniques and innovations in surgical technology, such as robotic systems, is enhancing patient outcomes. Hospitals are increasingly investing in modern instruments to improve care, driving regional market growth.

Japan surgical snare market is growing, primarily driven by the country’s aging population, with approximately 30% aged 65 and older in 2023, according to World Bank data. Growth is further fueled by the introduction of advanced surgical tools and frequent product launches. Manufacturers are heavily investing in R&D to develop innovative instruments that enhance precision, efficiency, and patient care.

The surgical snare market in China is anticipated to grow quickly, driven by the rising prevalence of orthopedic conditions among the population. A study published by BioMed Central Ltd. in July 2023 revealed that osteoporotic fractures are prevalent in the Chinese elderly population. In addition, the study reported that the prevalence has increased significantly from 2000 - 2010 to 2012 - 2022.

India surgical snare market is set for significant growth, driven by the increasing prevalence of gastrointestinal disorders and colorectal cancer. With colorectal cancer cases rising at an estimated 5% annually, the demand for minimally invasive procedures has surged. India's aging population, projected to reach 20% by 2050, further fuels this demand. Government initiatives, such as the Ayushman Bharat scheme, are enhancing access to advanced healthcare, boosting surgical snare adoption.

Latin America Surgical Snare Market Trends

The Latin American surgical snare market is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Surgical Snare Market Trends

The Middle East and Africa surgical snare market is growing due to the increasing prevalence of gastrointestinal disorders and colorectal cancer. The adoption of minimally invasive procedures is expanding, driven by a growing awareness of endoscopic techniques. Investments in healthcare infrastructure, particularly in the UAE and Saudi Arabia, are increasing, enhancing access to advanced medical devices. Additionally, the aging population in the region, expected to reach 7% by 2030, further supports market growth alongside government initiatives promoting advanced diagnostic and therapeutic solutions.

The surgical snare market in Saudi Arabia is anticipated to grow significantly due to the increasing geriatric population and the large number of surgical procedures being performed in the country. The geriatric population is expected to boost the demand for surgical instruments as they predominantly suffer from various health conditions. According to an article published by the Arab News in October 2023, the aging population in Saudi Arabia is predicted to increase from 1.11 million in 2022 to 3.58 million by 2035. Thus, the rising geriatric population is anticipated to increase the demand for surgical snares in the coming years.

Key Surgical Snare Company Insights

The competitive scenario in the surgical snare market is highly competitive, with key players such as Cook, Medtronic and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Surgical Snare Companies:

The following are the leading companies in the surgical snare market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Boston Scientific Corporation

- Medline Industries, Inc.

- Olympus Corporation

- Cook

- CONMED Corporation

- Steris (U.S.)

- Merit Medical Systems

- Avalign Technologies

- Hill-Rom Holdings, Inc.

- Sklar Surgical Instruments

Recent Developments

-

In February 2018, Teleflex launched two next-generation versions of its 0.035" snares for peripheral procedures in the U.S. These devices feature enhanced precision, flexibility, and control, supporting advanced retrieval and manipulation in challenging vascular cases. The launch demonstrates Teleflex's commitment to innovation and improving clinical outcomes in minimally invasive peripheral interventions.

Surgical Snare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.9 billion

Revenue forecast in 2030

USD 2.3 billion

Growth rate

CAGR of 3.9% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Usability, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic; Boston Scientific Corporation; Medline Industries, Inc.; Olympus Corporation; Cook; CONMED Corporation; Steris (U.S.); Merit Medical Systems; Avalign Technologies; Hill-Rom Holdings, Inc.; Sklar Surgical Instruments

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Snare Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the surgical snare market report based on usability, application, end-use, and region:

-

Usability Outlook (Revenue, USD Million, 2018 - 2030)

-

Single use

-

Reusable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

GI Endoscope

-

Laparoscopy

-

Urology Endoscopy

-

Gynecology Endoscopy

-

Arthroscopy

-

Bronchoscopy

-

Mediastinoscopy

-

Laryngoscopy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East And Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical snare market size was estimated at USD 1.8 billion in 2024 and is expected to reach USD 1.9 billion in 2025.

b. The global surgical snare market is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2030 to reach USD 2.3 billion by 2030.

b. North America dominated the surgical snare market with a share of 44.1% in 2024. This is attributable to favorable reimbursement policies, the local presence of key players, and government initiatives that enable access to colorectal cancer screening programs.

b. The key players operating in the surgical snare market are Olympus Corporation, Boston Scientific, Cook Medical, CONMED Corporation, Medtronic, Steris (U.S.), Medline Industries, Merit Medical Systems, Avalign Technologies, Hill-Rom Holdings, Inc., and Sklar Surgical Instruments.

b. Key factors driving the surgical snare market growth include the rising demand for minimally invasive procedures, the growing prevalence of gastrointestinal disorders, and the aging population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.