- Home

- »

- Medical Devices

- »

-

Surgical Snare Market Size, Share & Growth Report, 2030GVR Report cover

![Surgical Snare Market Size, Share & Trends Report]()

Surgical Snare Market Size, Share & Trends Analysis Report By Usability (Single-use, Reusable), By Application, By End-use (Hospitals, ASCs), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-754-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global surgical snare market size was estimated at USD 1.67 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.0% from 2023 to 2030. The market growth is primarily driven by the rising number of Ambulatory Surgery Centers (ASCs) offering polypectomy procedures and the growing preference for minimally invasive surgeries. A significant increase in gastrointestinal procedures in the U.S. and other developed economies is anticipated to support the market growth over the forecast period. Moreover, the increasing prevalence of chronic kidney diseases, the growing geriatric population suffering from chronic conditions, and rising patient awareness are other factors aiding the market growth.

Canceling or delaying elective surgeries significantly impacted the market during the COVID-19 pandemic. Increased risks of hospital-acquired infection and the unavailability of skilled staff for non-COVID-19 treatments caused a significant loss in revenue generated during the pandemic. The market started to normalize after the second wave with stricter guidelines for elective surgeries. Rapid vaccination against COVID-19 is expected to play an important role in market growth during the pandemic.

The increasing prevalence of cancer is one of the key factors expected to contribute to the growth of the endoscopes market over the forecast period. According to the World Cancer Research Fund International, 2020 there were 18.1 million cancer cases worldwide; of these, 8.8 million cases were in women and 9.3 million in men.

Increased patient awareness about cancer is also propelling the market growth. According to WHO, cancer is the leading cause of death, accounting for nearly 10 million deaths worldwide. The most common type of cancer was breast cancer, accounting for nearly 2.26 million cases, followed by lung and colon cancer, accounting for approximately 2.21 and 1.93 million cases, respectively.

The rising incidence of cancer is expected to boost the demand for biopsies for cancer diagnosis. Endoscopy for biopsies and endoscopic ultrasound are preferred for cancer diagnosis. Thus, increased demand for surgical procedures is expected to result in market growth during the forecast period.

Technological advancements are further expected to drive the demand for endoscopy procedures, which is expected to fuel the market growth. For instance, in August 2022, Medtronic, a U.S.- based healthcare technology company, launched GI Genius intelligent endoscopy module, powered by a computer-aided polyps detection system with artificial intelligence. This module aims to empower physicians to detect and treat colorectal cancer by providing enhanced visualization during colonoscopy.

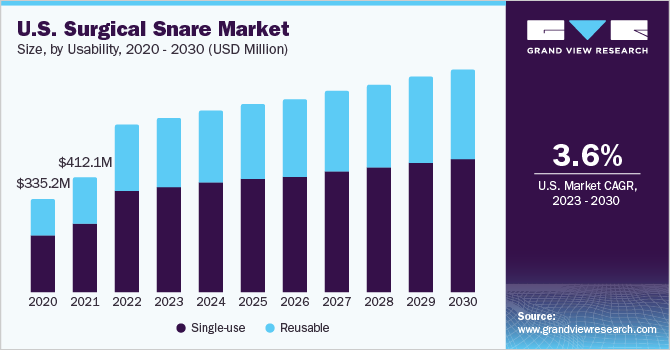

Usability Insights

The single-use segment accounted for the largest revenue share of over 61.4% in 2022. The single-use snares include soft wire oval, crescent-shaped, oval, and hard wire oval snares. Various shapes and wire characteristics are required in various application areas, including thick wires for higher coagulation and hard snares for flat polyps. Increasing adoption of single-use instruments in healthcare facilities to ensure convenience and safety is expected to accelerate the growth of the segment.

The reusable segment is expected to witness the fastest growth at a CAGR of 4.2% over the forecast period. The rising demand for cost-effective and sustainable medical devices, coupled with the increasing focus on reducing medical waste and environmental impact, has fueled the adoption of reusable surgical snares. These devices offer advantages such as durability, ease of sterilization, and long-term cost savings for healthcare facilities.

End-use Insights

The hospital's segment captured the largest revenue share of over 77.8% in 2022. The hospital segment is the largest revenue-generating segment due to the high surgery volume. According to the CDC, a steep increase in surgical procedures, such as angioplasty and kidney and liver transplants, has been observed in the past few years. Coupled with the growing incidence of trauma, hospitals' demand for surgical equipment has significantly increased in recent years.

The Ambulatory Surgical Centers (ASCs) segment is anticipated to register the fastest CAGR of 4.1% over the forecast period. It can be attributed to lower out-of-pocket costs, better patient accessibility, and decreased facility costs.

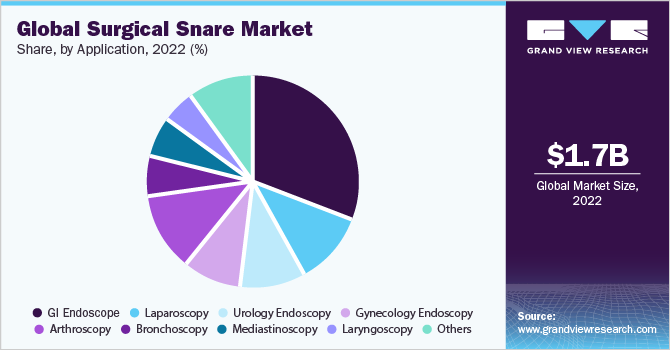

Application Insights

The GI endoscope segment held the largest revenue share of over 31.3% in 2022 and is expected to maintain its dominance over the forecast period. The increasing number of gastroscopies, the rising adoption of endoscopes for diagnosing and treating gastrointestinal (GI) diseases, and the availability of advanced products for gastroscopy are some of the factors boosting the use of gastroscopy.

The arthroscopy is expected to expand at the fastest CAGR of 4.4% over the forecast period. The adoption of arthroscopic procedures is expected to increase owing to the rising geriatric population at risk of age-related disorders, such as arthritis, and rising incidence of joint injuries, such as knee and shoulder. According to the Centers for Disease Control and Prevention estimates, about one in four adults, or about 58.5 million people in the U.S., have been diagnosed with arthritis by doctors.

Moreover, according to the estimates published by the Arthritis Foundation, the number of people with doctor-diagnosed arthritis is expected to be over 78 million by 2040. Hence, such factors are anticipated to provide significant growth opportunities for the market in the upcoming years.

Regional Insights

North America accounted for the largest revenue share of over 44.6% in 2022. An increase in the adoption of new and advanced devices, a rise in the demand for minimally invasive surgical procedures, and a growth in chronic disease burden are among the factors driving the market. The growing burden of gastrointestinal disorders and cancer in the region is also one of the significant factors propelling the market growth. Rising cancer incidence and the availability of advanced diagnostic procedures are expected to boost market growth.

Furthermore, favorable reimbursement policies and well-established healthcare infrastructure in North America facilitate the adoption of surgical snares. The reimbursement coverage provided by the government and private insurance companies for endoscopic procedures, including the use of surgical snares, encourages healthcare facilities to invest in these devices.

The Asia Pacific region is experiencing rapid growth, exhibiting the highest CAGR of 4.9% over the forecast period. The region's increasing prevalence of gastrointestinal diseases and colorectal cancer has led to rising demand for surgical snares for effective diagnosis and treatment. Moreover, the growing geriatric population in countries like China and India has increased the need for minimally invasive surgical procedures, driving the demand for surgical snares.

Key Companies & Market Share Insights

The market is highly competitive, with many manufacturers accounting for most of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies market participants use to maintain and grow their global reach. For instance, in November 2022, Boston Scientific Corporation acquired Apollo Endosurgery, Inc. for approximately USD 615 million. The company aims to expand its global capabilities in Endoluminal Surgery (ELS) with the acquisition. Some prominent players in the global surgical snare market include:

-

Medtronic

-

Boston Scientific Corporation

-

Medline Industries, Inc.

-

Olympus Corporation

-

Cook

-

CONMED Corporation

-

Steris (U.S.)

-

Merit Medical Systems

-

Avalign Technologies

-

Hill-Rom Holdings, Inc.

-

Sklar Surgical Instruments

Surgical Snare Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.75 billion

Revenue forecast in 2030

USD 2.31 billion

Growth Rate

CAGR of 4.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Usability, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medtronic; Boston Scientific Corporation; Medline Industries, Inc.; Olympus Corporation; Cook; CONMED Corporation; Steris (U.S.); Merit Medical Systems; Avalign Technologies; Hill-Rom Holdings, Inc.; Sklar Surgical Instruments

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Snare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global surgical snare market report based on usability, application, end-use, and region:

-

Usability Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-use

-

Reusable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

GI Endoscope

-

Laparoscopy

-

Urology Endoscopy

-

Gynecology Endoscopy

-

Arthroscopy

-

Bronchoscopy

-

Mediastinoscopy

-

Laryngoscopy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East And Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical snare market size was estimated at USD 1.67 billion in 2022 and is expected to reach USD 1.75 billion in 2023.

b. The global surgical snare market is expected to grow at a compound annual growth rate of 4.0% from 2023 to 2030 to reach USD 2.31 billion by 2030.

b. North America dominated the surgical snare market with a share of 44.6% in 2022. This is attributable to favorable reimbursement policies, the local presence of key players, and government initiatives that enable access to colorectal cancer screening programs.

b. The key players operating in the surgical snare market are Olympus Corporation, Boston Scientific, Cook Medical, CONMED Corporation, Medtronic, Steris (U.S.), Medline Industries, Merit Medical Systems, Avalign Technologies, Hill-Rom Holdings, Inc., and Sklar Surgical Instruments.

b. Key factors driving the surgical snare market growth include increasing number of surgical procedures, increasing healthcare spending, rising incidence of colorectal cancer, and rising geriatric population worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."