- Home

- »

- Plastics, Polymers & Resins

- »

-

Sustainable Aerosol Packaging Market, Industry Report, 2030GVR Report cover

![Sustainable Aerosol Packaging Market Size, Share & Trends Report]()

Sustainable Aerosol Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Aluminum & Steel, rPET, Polylactic Acid, Polyhydroxyalkanoates, Paper-Based), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-553-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

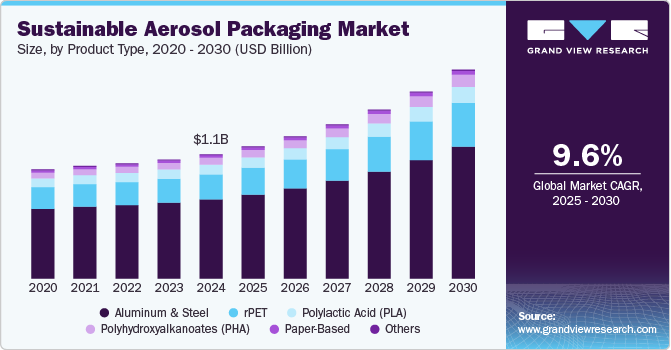

The global sustainable aerosol packaging market size was estimated at USD 1.09 billion in 2024 and is expected to grow at a CAGR of 9.56% from 2025 to 2030. The market growth is primarily driven by the increasing environmental concerns and stringent regulatory measures aimed at reducing plastic waste and promoting recyclability. In addition, governments and regulatory bodies worldwide are implementing policies that encourage the use of eco-friendly packaging solutions, further boosting product demand.

Additionally, evolving consumer preferences play a significant role in propelling the demand for sustainable aerosol packaging. Modern consumers are increasingly prioritizing products that align with their environmental values, leading brands to innovate and offer eco-friendly packaging options.

Companies are also responding by investing in research and development to create recyclable and biodegradable aerosol packaging solutions. For example, Beiersdorf's initiative to incorporate at least 50% recycled aluminum in its deodorant cans and reduce material usage exemplifies the industry's commitment to sustainability. Such efforts not only cater to consumer demand but also provide brands with a competitive edge in the sustainable aerosol packaging industry.

Companies are investing in the development of non-flammable, low-GWP (Global Warming Potential) propellants such as compressed air, nitrogen, or carbon dioxide, replacing traditional hydrocarbon-based propellants. Additionally, advancements in materials like post-consumer recycled (PCR) aluminum, biodegradable plastics, and refillable containers are supporting more sustainable product designs. These innovations not only reduce the environmental footprint but also maintain performance and functionality, encouraging adoption among both brands and consumers.

Global FMCG, cosmetics, and personal care companies are committing to reduce plastic waste, cut carbon emissions, and use sustainable packaging across product lines. These internal goals are pushing companies to shift toward greener aerosol formats as part of their broader brand strategy and stakeholder accountability. The push is also being reinforced by increasing scrutiny from investors and consumers, making sustainable packaging not just an environmental concern but a competitive and reputational advantage.

However, the high cost and limited scalability of eco-friendly materials and technologies pose a challenge to the industry growth. Sustainable alternatives such as bio-based plastics, recyclable aluminum, or low-GWP propellants often come with higher production and sourcing costs compared to conventional materials. For many small- and mid-sized manufacturers, the transition to greener solutions can be economically challenging, especially without large-scale infrastructure or subsidies.

Product Type Insights

The aluminum & steel segment recorded the largest revenue share of over 63.63% in 2024 due to their durability, recyclability, and barrier properties. In the context of sustainability, these metals offer a distinct advantage-infinite recyclability without loss of quality. As more brands commit to circular economy principles, the use of post-consumer recycled (PCR) aluminum and steel in aerosol cans has surged. These metals are particularly favored in personal care, cosmetics, and household cleaning sectors for their premium look and ability to protect contents from UV light, oxygen, and moisture.

Polyhydroxyalkanoates (PHA) is projected to grow at the fastest CAGR of 10.6% during the forecast period, as they represent one of the most sustainable plastic alternatives for aerosol packaging. PHAs naturally degrade in marine and soil environments, making them ideal for single-use or short-lifespan products where environmental leakage is a concern. In the aerosol market, PHAs are being explored for low-pressure systems, wipes, and packaging components where biodegradability is a strong selling point.

rPET is gaining ground in the sustainable aerosol packaging industry due to its lightweight nature and the growing availability of recycled plastic streams. As consumer goods companies shift away from virgin plastics, rPET offers a more eco-friendly alternative that is compatible with various spray and dispensing systems. It is particularly used in personal care, haircare, and hygiene products where clarity, flexibility, and a lower carbon footprint are desired.

PLA, a biodegradable thermoplastic derived from renewable resources such as corn starch or sugarcane, is emerging as a promising material in sustainable aerosol packaging. It appeals to eco-conscious brands looking to reduce reliance on fossil-fuel-based plastics. PLA offers high rigidity and transparency, making it suitable for non-pressurized spray bottles and low-pressure aerosol systems in sectors like personal care and natural cleaning products.

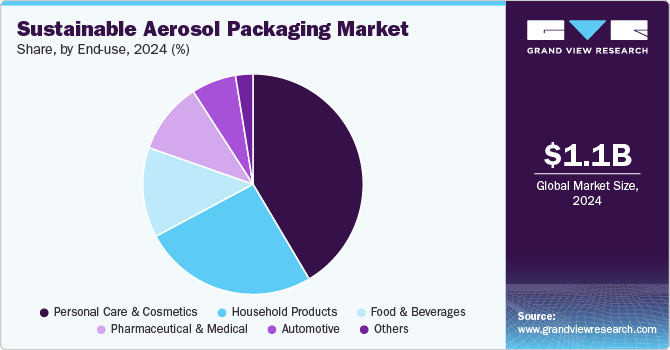

End Use Insights

Personal care & cosmetics recorded the largest market share of 41.50% in 2024, driven by consumer demand for environmentally conscious beauty and hygiene products. Products like deodorants, hair sprays, dry shampoos, and facial mists traditionally rely on aerosol formats for convenience and effectiveness. As eco-awareness grows among younger consumers, brands are under pressure to reduce plastic usage and carbon emissions and improve recyclability. In response, companies are shifting toward aluminum cans with high PCR content, refillable systems, and bio-based containers that maintain the look and feel of premium packaging while being more sustainable.

Household products are projected to grow at the fastest CAGR of 10.1% during the forecast period. With growing scrutiny over indoor air quality, packaging waste, and chemical exposure, brands are focusing on eco-friendly propellants and recyclable materials to improve product safety and sustainability. Demand for low-emission aerosols and reusable dispensing systems has seen a notable uptick, especially in eco-conscious households and urban areas.

The use of aerosols in the food & beverage sector in products such as whipped cream, cooking oils, and flavor sprays is also evolving with a growing focus on food-safe, sustainable packaging materials. Aluminum aerosol cans dominate this segment due to their excellent barrier properties and safety profile. However, increasing awareness of packaging waste and food safety concerns is pushing manufacturers to explore recyclable, non-toxic, and lightweight alternatives that comply with food-grade regulations.

The pharmaceutical & medical sector is a specialized yet growing sustainable aerosol packaging industry, particularly in products like inhalers, antiseptic sprays, and topical treatments. While product safety, efficacy, and sterility remain the top priorities, there is increasing pressure to reduce the environmental impact of medical aerosol devices. Initiatives to replace HFA (hydrofluoroalkane) propellants with lower-GWP alternatives and use recyclable or bio-based packaging components are gaining traction, especially in over the counter (OTC) healthcare products.

Regional Insights

Asia Pacific dominated the sustainable aerosol packaging industry and accounted for the largest revenue share of over 43.23% in 2024 and is anticipated to grow at the fastest CAGR of 9.9% over the forecast period. It is fueled by rapid urbanization, expanding middle-class populations, and increasing environmental awareness-especially in countries like China, India, Japan, and South Korea. The demand for eco-conscious packaging is gaining momentum in personal care, cleaning, and food sectors. Although recycling infrastructure is still developing in parts of the region, policy shifts and foreign investment are improving sustainable packaging ecosystems.

China sustainable aerosol packaging market accounted for a substantial revenue share of 61.18% in 2024. The Chinese government has introduced mandates to reduce single-use plastics, encourage material recycling, and support green manufacturing initiatives, which directly influence the adoption of sustainable aerosol packaging. Major Chinese FMCG companies are responding with initiatives to incorporate rPET, PLA, and recyclable aluminum into their packaging portfolios.

The growth of the sustainable aerosol packaging market in India is spurred by a combination of regulatory reforms, urbanization, and growing consumer eco-consciousness. The Indian government’s push toward plastic waste reduction, coupled with the rise of sustainability-driven startups and consumer brands, is helping shift the packaging landscape. Although the market is still emerging compared to more developed regions, demand for natural personal care, herbal sprays, and organic food aerosols is growing quickly.

North America Sustainable Aerosol Packaging Market Trends

North America is a leading region in the sustainable aerosol packaging industry, driven by strong regulatory frameworks, robust recycling infrastructure, and high consumer awareness around environmental issues. The U.S. and Canada have seen a growing demand for eco-friendly personal care, household, and food products, prompting packaging manufacturers to adopt recyclable materials, low-GWP propellants, and refillable systems.

U.S. Sustainable Aerosol Packaging Market Trends

The U.S. sustainable aerosol packaging industry holds the largest share in North America, underpinned by its diverse product landscape and strong R&D capabilities. Leading brands across the personal care, cleaning, and pharmaceutical sectors are driving demand for aluminum cans with high PCR content, eco-propellants, and biodegradable packaging alternatives.

Europe Sustainable Aerosol Packaging Market Trends

Europe is at the forefront of the global sustainable aerosol packaging industry due to progressive environmental regulations and high consumer demand for green products. The European Union’s Green Deal, Single-Use Plastics Directive, and Circular Economy Action Plan are transforming the packaging industry by mandating recyclability, material reduction, and lifecycle assessments. This has led to a surge in the use of aluminum aerosols with PCR content, rPET, PLA, and bag-on-valve (BoV) technologies across key industries.

Germany's sustainable aerosol packaging market growthis largely driven bystrong environmental policies, industrial leadership, and consumer activism. As one of the largest producers and exporters of personal care and cleaning products in the EU, German companies are innovating rapidly with biodegradable polymers, refillable aluminum systems, and CO₂-neutral manufacturing practices.

Central & South America Sustainable Aerosol Packaging Market

Central & South America is gradually embracing sustainable aerosol packaging, led by environmental campaigns, regulatory advancements, and increased brand accountability. Brazil, in particular, has been proactive in promoting recycling and material recovery programs, which support the use of recyclable metals and bio-based plastics in packaging application.

The Brazil sustainable aerosol packaging market is expected to grow during the forecast period. The Brazilian Packaging Association (ABRE) and other environmental NGOs are working actively to encourage sustainable design practices across industries. As a major producer of cosmetics and household products, Brazil’s market is witnessing growing interest in aluminum aerosol cans with recycled content, eco-propellants, and biodegradable components.

Middle East & Africa Sustainable Aerosol Packaging Market

The Middle East & Africa region is in the early stages of adopting sustainable aerosol packaging, but momentum is building as awareness grows and regulatory pressures increase. Countries like the UAE and South Africa are introducing environmental policies aimed at reducing plastic waste and encouraging recycling. These developments are creating a favorable environment for lightweight, recyclable, and bio-based aerosol packaging solutions.

Key Sustainable Aerosol Packaging Company Insights

The competitive environment in the sustainable aerosol packaging market is increasingly dynamic, driven by innovation, brand differentiation, and regulatory adaptation. Strategic partnerships between packaging companies and consumer brands are also on the rise, aiming to co-develop customized sustainable formats. With growing consumer demand and mounting regulatory pressure, competition is shifting toward who can deliver scalable, compliant, and cost-effective green alternatives, making sustainability a core differentiator in market positioning.

-

In April 2025, Koehler Paper and Wimbée announced a 100% cardboard cap for aerosol cans. Koehler NexCoat Smart, a high-performance flexible packaging paper, underpins the innovation. This advanced material significantly enhances the durability and performance of the cap while adhering to sustainable design principles. As regulatory pressures and consumer preferences shift toward sustainability, such advancements represent a pivotal step toward reducing plastic waste without compromising functionality or aesthetics.

Key Sustainable Aerosol Packaging Companies:

The following are the leading companies in the sustainable aerosol packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Signature Filling Company, LLC.

- Koehler Paper

- Weener Plastics

- Ball Corporation

- Crown Holdings, Inc.

- Trivium Packaging

- Lindal Group

- Tubex GmbH

- Montebello Packaging

- CCL Container

- Nussbaum Matzingen AG

- Precision Valve Corporation

Sustainable Aerosol Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.16 billion

Revenue forecast in 2030

USD 1.83 billion

Growth rate

CAGR of 9.56% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

Signature Filling Company, LLC.; Koehler Paper; Weener Plastics; Ball Corporation; Crown Holdings, Inc.; Trivium Packaging; Lindal Group; Tubex GmbH; Montebello Packaging; CCL Container; Nussbaum Matzingen AG; Precision Valve Corporation

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sustainable Aerosol Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sustainable aerosol packaging market report based on product type, end use, and region:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aluminum & Steel

-

rPET

-

Polylactic Acid (PLA)

-

Polyhydroxyalkanoates (PHA)

-

Paper-Based

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Personal Care & Cosmetics

-

Household Products

-

Food & Beverages

-

Pharmaceutical & Medical

-

Automotive

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sustainable aerosol packaging market was estimated at around USD 1.09 billion in 2024 and is expected to reach around USD 1.16 billion in 2025.

b. The global sustainable aerosol packaging market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030, reaching around USD 1.83 billion by 2030.

b. The personal care & cosmetics segment recorded the largest market revenue share of over 41.50% in 2024, driven by consumer demand for environmentally conscious beauty and hygiene products.

b. The key players in the sustainable aerosol packaging market include Signature Filling Company, LLC., Koehler Paper, Weener Plastics, Ball Corporation, Crown Holdings, Inc., Trivium Packaging, Lindal Group, Tubex GmbH, Montebello Packaging, CCL Container, Nussbaum Matzingen AG, and Precision Valve Corporation.

b. The sustainable aerosol packaging market is driven by increasing environmental concerns and stringent regulatory measures aimed at reducing plastic waste and promoting recyclability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.