- Home

- »

- Automotive & Transportation

- »

-

Swappable Electric Vehicle Battery Market Size Report, 2030GVR Report cover

![Swappable Electric Vehicle Battery Market Size, Share, & Trends Report]()

Swappable Electric Vehicle Battery Market (2023 - 2030) Size, Share, & Trends Analysis Report By Battery Type (Lead Acid, Lithium-ion), By Capacity, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-063-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Swappable Electric Vehicle Battery Market Summary

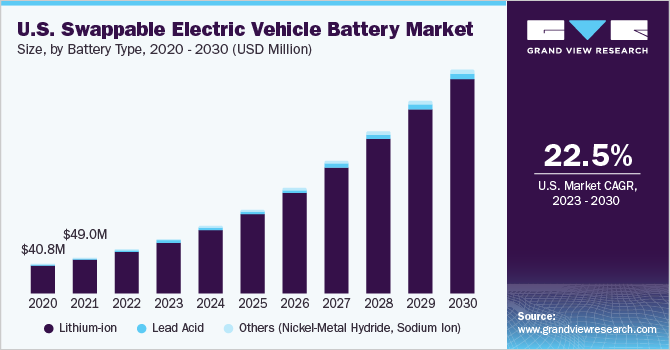

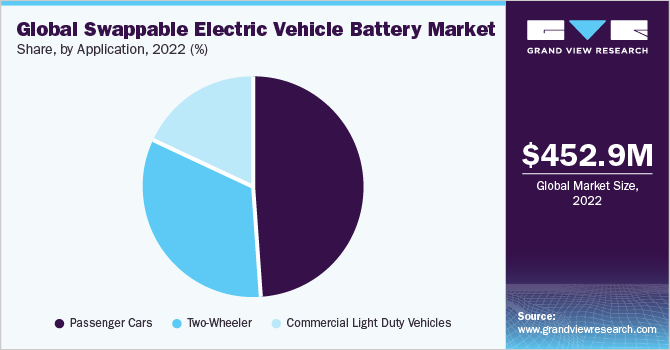

The global swappable electric vehicle battery market size was valued at USD 452.9 million in 2022 and is expected to reach USD 2.36 billion by 2030, growing a CAGR of 22.8% from 2023 to 2030. The need to mitigate the increase in carbon emissions and other noxious gases caused by transportation has prompted the adoption of electric vehicles.

Key Market Trends & Insights

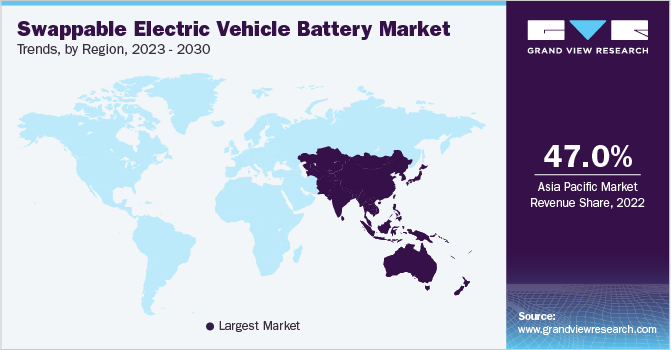

- The Asia Pacific segment dominated the market and accounted for more than a 47.0% share of the global revenue in 2022.

- By battery type, the Lithium-ion segment led the market and accounted for more than 94.0% share of the global revenue in 2022.

- By capacity, the >5 kWh segment dominated the market and accounted for more than 62.0% share of the global revenue in 2022.

- By application, the passenger cars segment accounted for over 48.0% share of the market in 2022.

Market Size & Forecast

- 2022 Market Size: USD 452.9 Million

- 2030 Projected Market Size: USD 2.36 Billion

- CAGR (2023-2030): 22.8%

- Asia Pacific: Largest market in 2022

In addition, increasing strategies by automakers to develop EVs with swappable batteries to reduce the upfront cost of the vehicles are expected to increase the demand for swappable electric vehicle batteries in the upcoming years. Moreover, increasing partnerships between electric automakers and swappable battery manufacturers are expected to further drive the market.

The growth of the market for swappable electric vehicle batteries can be attributed to the increasing demand for electric vehicles and the need for charging solutions that are both efficient and convenient. As the popularity of electric vehicles grows, the demand for more effective charging solutions becomes more evident. Concerns about carbon emissions are driving the demand for battery-swapping technologies and infrastructure, prompting companies to make swift advances in these areas to meet the needs of electric vehicle owners. In addition, several market players are contributing to reducing CO2 emissions by developing swappable batteries. Gogoro Inc. reported that since 2015, the company has facilitated around 400,000 battery swaps daily, and over the course of its operation, the total number of battery swaps has exceeded 370 million. These swaps have helped to reduce approximately 250,000 tons of CO2 emissions.

The demand for rechargeable and removable batteries in electric vehicles, including light electric vehicles (LEVs) is steadily increasing. According to the "Global Supply Chains of EV Batteries" report by the International Energy Agency (IEA), fixed EV batteries typically make up 30% to 40% of the cost of electric vehicles. Thus, to minimize the additional cost of fixed batteries, several EV makers are developing EVs equipped with swappable batteries, which can reduce the upfront cost of an electric vehicle considerably, which is ultimately driving the growth of the market. Furthermore, the increasing utilization of battery-swapping infrastructure can be attributed to the reduced upfront costs of buying an electric vehicle, decreased charging time, and favorable government subsidies.

Leading suppliers in the swappable battery market are utilizing the most advanced technologies to improve the durability and lifespan of batteries during usage. These suppliers are also implementing strategic measures and utilizing sophisticated techniques to achieve net-zero emissions targets and to increase the effectiveness of the batteries. These initiatives result in batteries that have longer lifespans, contribute less e-waste, and have a smaller environmental footprint associated with their manufacturing and usage.

The increasing adoption of swappable batteries is mainly due to supportive government policies aimed at achieving net zero emissions in the coming years and growing consumer interest in electric cars. These types of batteries can be reused multiple times, which helps to reduce waste and prolong their lifespan, making them essential for achieving a zero-carbon footprint. Furthermore, in the electric vehicle market, the safe disposal of batteries is a significant concern due to the risk of environmental contamination. However, with swappable batteries, the responsibility of recycling and disposing of batteries will reduce as the burden for safe battery disposal and recycling will shift to private players.

COVID-19 Impact Analysis

The COVID-19 pandemic has adversely impacted the global economy and the swappable electric vehicle battery market growth. Many countries experienced significant challenges such as economic downturns and supply chain disruptions due to the pandemic. To mitigate the spread of the virus, governments worldwide enforced complete lockdowns, resulting in industry shutdowns and subsequent supply chain disruptions. The lockdowns also caused a shortage of labor and materials worldwide, leading to a delay in the manufacturing and distribution of batteries. Additionally, the pandemic adversely impacted the sales of electric vehicles, which led to detrimental impacts on the demand for batteries.

Battery Type Insights

The Lithium-ion segment led the market and accounted for more than 94.0% share of the global revenue in 2022. The segment is also anticipated to expand at the highest CAGR during the forecast period. Lithium-ion batteries have become popular in electric vehicles due to their rechargeable feature. Compared to lead-acid batteries, they offer several advantages such as being significantly lighter by 50% to 60% in weight and having a higher energy density, which allows battery manufacturers to reduce the battery pack's overall and size save space. Lithium-ion batteries are preferred by electric vehicle manufacturers as they are efficient and can be fully charged within a short span of one to three hours. With these benefits, the adoption of lithium-ion swappable batteries by electric vehicle manufacturers has been increasing rapidly.

The lead acid segment is expected to register significant growth over the forecast period. Lead acid batteries are a commonly used type of rechargeable battery with a significant capacity. They are known for their reliability and low cost per watt, making them an attractive option for various applications. For instance, in applications where a large capacity is required, there are only a few battery types that offer cost-effectiveness equivalent to that of lead acid batteries. Therefore, lead acid batteries are widely used in electric vehicles and automobiles.

Capacity Insights

The >5 kWh segment dominated the market and accounted for more than 62.0% share of the global revenue in 2022. Swappable batteries with a capacity of >5 kWh provide convenience and flexibility and improve efficiency owing to their higher capacity. In addition, swappable batteries with a capacity of >5 kWh such as 50 kWh offer greater flexibility for electric vehicles as they can be swapped quickly, increasing productivity, and reducing downtime. In addition, the use of large-capacity batteries can also help reduce greenhouse gas emissions, increase energy independence, and improve grid stability.

The <5 kWh segment is expected to grow at the highest CAGR over the forecast period. Rising development of swappable electric vehicle batteries with a capacity of <5-kWh for applications such as electric bikes and scooters is propelling the segment’s growth. For instance, in March 2022, Gogoro Inc. collaborated with ProLogium Technology, a prominent player in solid-state battery technology, to develop a solid-state lithium ceramic battery for two-wheeler battery swapping. The newly developed solid-state battery technology would be seamlessly integrated with the existing Gogoro swapping network and vehicles. The battery has a target capacity of 2 kWh.

Application Insights

The passenger cars segment accounted for over 48.0% share of the market in 2022. The rising sales of electric passenger cars such as SUVs, sedans, hatchbacks, and others (XUV, station wagon, and minivan) are driving the growth of the segment. The key market players are entering into strategic partnerships to offer electric vehicles with swappable batteries. For instance, in January 2022, Geely and Lifan announced a joint venture called Maple to release “Maple 60S”, the first smart battery-swappable electric car. Such launches are creating significant growth opportunities for the market.

The two-wheeler segment is expected to grow at the highest CAGR over the forecast period. According to the "Global EV Outlook 2021" report from the International Energy Agency (IEA), electric two-wheelers make up a significant proportion of the world's electric vehicles, with a current estimated stock of around 290 million, and this number continues to grow. The popularity of two-wheelers among electric vehicles is leading to rising demand for swappable batteries in this segment.Strategic initiatives undertaken by the key market players to launch swappable battery two-wheelers are further fueling the segment’s growth.

Regional Insights

The Asia Pacific segment dominated the market and accounted for more than a 47.0% share of the global revenue in 2022. The vast presence of swappable electric vehicle battery manufacturers such as Gogoro Inc., Nio Inc, Honda Motor Co., Ltd., and SUN Mobility Private Ltd., among others is attributed to the market growth. Countries such as China, Japan, Taiwan, and India are the hub of electric vehicles and are heavily investing in the development of swappable batteries. In January 2022, the Chinese Government announced its plan to invest in the implementation of electric vehicle (EV) infrastructure to meet its goal of supporting 20 million EVs on the road by 2025. Besides, the Indian government has actively been promoting the adoption of EVs as a part of its goal to reduce its dependence on fossil fuels and decrease emissions. At the 26th Conference of the Parties (COP26) held in November 2021, India commitmented to achieve net zero emissions by 2070.

The demand for swappable electric batteries in Europe is being propelled by several factors, such as increasing concerns regarding climate change, technological advancements, and supportive government measures aimed at promoting sustainability and curbing greenhouse gas emissions. For instance, in October 2022, Next.e.GO Mobile SE, an electric vehicle manufacturer, launched e.Xpress, a new, small commercial last-mile urban delivery EV featuring an exchangeable battery to facilitate zero-emission urban delivery and business fleets.

Key Companies & Market Share Insights

The market players are continuously working towards new product development and up-gradation of their existing product portfolio. For strategic growth, these players prefer collaborations with other players or EV manufacturers. In January 2023, Gogoro Inc., Belrise Industries, an India-based automotive systems manufacturer, and, the Indian state of Maharashtra announced a strategic collaboration to create a unique battery-swapping infrastructure for sustainable mobility solutions in urban areas. Both companies intend to establish a 50-50 joint venture and invest around USD 2.5 billion over eight years, in collaboration with the Maharashtra government, to build energy infrastructure throughout the state.

In addition, in October 2022, Contemporary Amperex Technology Co., Limited, SAIC, a car manufacturer in China, and two oil companies, China National Petroleum (CNPC) and Sinopec, collaborated to establish a joint venture to promote electric vehicles with replaceable batteries. SAIC intends to produce vehicles that can support battery-swapping for multiple brands. The joint venture, named Shanghai Jieneng Zhidian New Energy Technology, planned to build roughly 40 battery-swapping stations in major cities such as Beijing, Shanghai, Shenzhen, and Guangzhou in 2022. The objective is to operate approximately 300 of these stations by the end of 2023 and around 3,000 by 2025.

Furthermore, in November 2022, Honda Motor Co. Ltd. began selling its battery swapping station, Honda Power Pack Exchanger e, in Japan. The battery charging station can charge many battery pack units simultaneously and allow smooth battery swapping for electric motorcycle users. The first unit of the battery swapping station was delivered to Gachaco Inc., a battery-sharing service company. Some prominent players in the swappable electric vehicle battery market include:

-

Contemporary Amperex Technology Co., Limited

-

NIO Inc.

-

GOGORO INC.

-

Silence Urban Ecomobility

-

Honda Motor Co., Ltd.

-

SUN Mobility Private Ltd.

-

ONiON Mobility

-

Swap Energi Indonesia

-

Bounce

-

Okinawa Autotech Internationall Private Limited

Swappable Electric Vehicle Battery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 560.3 million

Revenue forecast in 2030

USD 2.36 billion

Growth rate

CAGR of 22.8% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Battery type, capacity, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., France, Germany, China, India, Japan, Taiwan, Vietnam, Indonesia, Thailand, Malaysia, Philippines, South Korea, Singapore, Brazil, Mexico

Key companies profiled

Contemporary Amperex Technology Co.; Limited, NIO Inc.; GOGORO INC.; Silence Urban Ecomobility; Honda Motor Co., Ltd.; SUN Mobility Private Ltd.; ONiON Mobility; Swap Energi Indonesia; Bounce; Okinawa Autotech Internationall Private Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

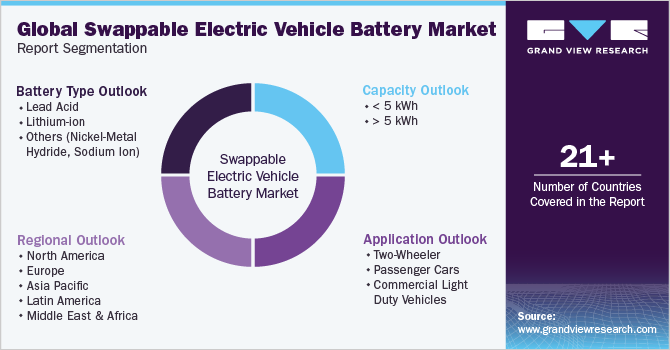

Global Swappable Electric Vehicle Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global swappable electric vehicle battery market report based on battery type, capacity, application, and region:

-

Battery Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Lead Acid

-

Lithium-ion

-

Others (Nickel-Metal Hydride, Sodium Ion)

-

-

Capacity Outlook (Revenue, USD Million, 2017 - 2030)

-

< 5 kWh

-

> 5 kWh

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Two-Wheeler

-

Passenger Cars

-

Commercial Light Duty Vehicles

-

Three-Wheeler

-

Four-Wheeler

-

-

-

Regional Outlook (Revenue, USD Million; Volume, Units, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

Vietnam

-

Indonesia

-

Thailand

-

Malaysia

-

Philippines

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global swappable electric vehicle battery market size was estimated at USD 452.9 million in 2022 and is expected to reach USD 560.3 million in 2023.

b. The global swappable electric vehicle battery market is expected to grow at a compound annual growth rate of 22.8% from 2023 to 2030 to reach USD 2.36 billion by 2030.

b. Asia Pacific dominated the swappable electric vehicle battery market with a share of more than 47.0% in 2022. The vast presence of swappable electric vehicle battery manufacturers such as Gogoro Inc., Nio Inc, Honda Motor Co., Ltd., and SUN Mobility Private Ltd., among others is attributed to the market growth.

b. Some key players operating in the swappable electric vehicle battery market include Contemporary Amperex Technology Co.; Limited, NIO Inc.; GOGORO INC.; Silence Urban Ecomobility; Honda Motor Co., Ltd.; SUN Mobility Private Ltd.; ONiON Mobility; Swap Energi Indonesia; Bounce; and Okinawa Autotech Internationall Private Limited.

b. Key factors that are driving the swappable electric vehicle battery market growth include increasing demand for electric vehicles and the need for charging solutions that are both efficient and convenient.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.