- Home

- »

- Next Generation Technologies

- »

-

Swarm Intelligence Market Size, Share, Growth Report, 2030GVR Report cover

![Swarm Intelligence Market Size, Share & Trends Report]()

Swarm Intelligence Market (2024 - 2030) Size, Share & Trends Analysis Report By Model (Ant Colony Optimization, Particle Swarm Optimization, Others), By Capability, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-188-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Swarm Intelligence Market Summary

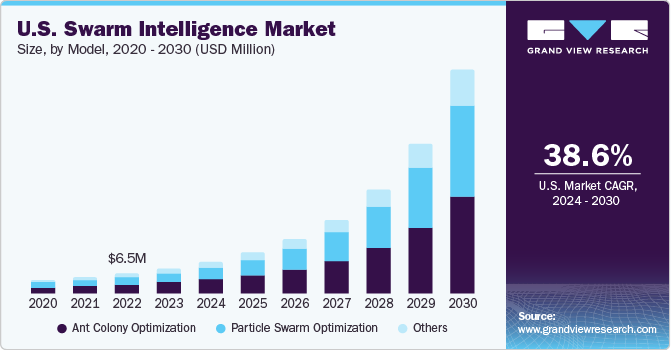

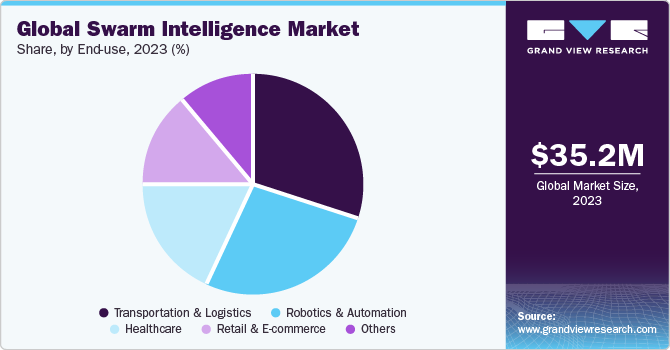

The global swarm intelligence market size was estimated at USD 35.2 million in 2023 and is projected to reach USD 306.1 million by 2030, growing at a CAGR of 38.4% from 2024 to 2030. The rising prominence of collaborative and autonomous systems is driving market growth. Swarm intelligence offers a unique approach to creating collaborative networks where multiple entities work together towards a common goal.

Key Market Trends & Insights

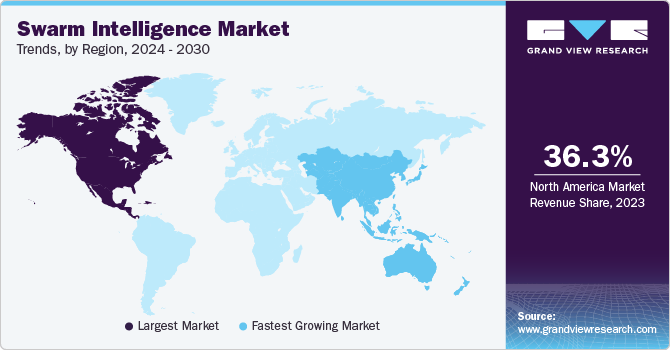

- North America dominated the market with a revenue share of 36.3% in 2023.

- Asia Pacific is anticipated to witness the fastest CAGR over the forecast period.

- Based on model, ant colony optimization dominated the market with a share of 45.0% in 2023.

- In terms of capability, the adaptability of swarm intelligence in addressing real-time optimization challenges drives market growth.

- Based on end-use, retail & e-commerce is projected to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 35.2 Million

- 2030 Projected Market Size: USD 306.1 Million

- CAGR (2024-2030): 38.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This aligns with the increasing deployment of autonomous systems in various industries, including agriculture, manufacturing, and surveillance. The ability of swarm intelligence to facilitate autonomous collaboration among systems, such as robots or unmanned aerial vehicles, drives the trends toward automation.

The market is witnessing accelerated growth due to the increasing adoption of Internet of Things (IoT) devices and the proliferation of interconnected systems. As the number of IoT devices increases across industries, there is a growing need for efficient coordination and communication among these devices. Swarm intelligence is instrumental in managing and optimizing the behavior of interconnected devices, ensuring seamless collaboration and functionality within IoT ecosystems. This integration enhances the overall efficiency and performance of IoT applications, contributing significantly to the demand for swarm intelligence solutions.

Moreover, the expansion of the market is driven by the growing focus on security and risk management. In sectors such as cybersecurity, where threats are dynamic and multifaceted, swarm intelligence offers an adaptable approach to threat detection and mitigation. By emulating the collective behavior observed in natural swarms, swarm intelligence systems can rapidly identify and respond to evolving security threats.

The COVID-19 pandemic has positively impacted the swarm intelligence sector. The initial stages of the pandemic witnessed disruptions in the global supply chain, affecting manufacturing and deployment timelines for swarm intelligence solutions. The uncertainty and economic downturn led to a cautious approach to investment decisions, slowing the adoption of these innovative technologies.

Moreover, the increased reliance on digital technologies during the pandemic fueled interest in swarm intelligence for various applications. The rise of remote working, online education, and the need for resilient, adaptive systems led to a renewed focus on decentralized decision-making and collaborative algorithms. Industries, including logistics, manufacturing, and autonomous systems, recognized the benefits of swarm intelligence in navigating disruptions, optimizing operations, and enhancing overall system efficiency.

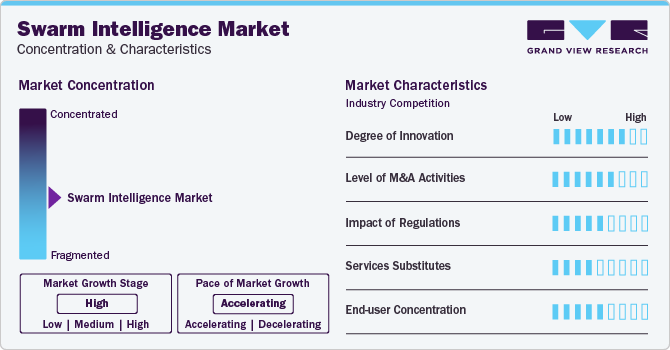

Market Concentration & Characteristics

The market is significantly fragmented in nature and the pace of the market growth is accelerating. It is attributed to the rising complexity of urban environments and smart city initiatives also contribute to the growth of the market. In urban planning and management, swarm intelligence can optimize traffic flow, enhance energy efficiency, and improve overall city infrastructure. Swarm intelligence algorithms address the intricacies of urban challenges and align with the global trend toward creating more sustainable and technologically advanced cities.

Furthermore, the market is driven by the increasing recognition of its applicability in healthcare. In areas such as medical imaging, diagnostics, and drug discovery, swarm intelligence can enhance the speed and accuracy of processes. The collaborative nature of swarm intelligence is particularly valuable in healthcare scenarios where multiple factors and variables need to be considered simultaneously, contributing to improved patient outcomes and more efficient healthcare delivery.

The market is characterized by a medium level of merger and acquisition (M&A) activities by leading players. The mergers and acquisition activities were majorly performed for growth and expansion by the businesses.

The growing adoption of swarm intelligence in autonomous vehicles and transportation systems is driving the market growth. Swarm intelligence is a key technology for enhancing the coordination and efficiency of autonomous vehicles, such as drones and self-driving cars. By mimicking the collective behavior observed in natural swarms, these systems can navigate complex environments, avoid obstacles, and optimize traffic flow.

Moreover, the rise of Industry 4.0 and the implementation of smart manufacturing processes are driving the demand for swarm intelligence. In smart factories, where interconnected devices and sensors communicate to optimize production, swarm intelligence plays a pivotal role in coordinating and adapting to dynamic manufacturing environments. The ability of swarm intelligence to manage and optimize complex manufacturing processes in real time aligns with achieving greater efficiency, flexibility, and adaptability in modern industrial settings.

Model Insights

Ant colony optimization dominated the market with a share of 45.0% in 2023. Ant Colony Optimization (ACO) algorithms are designed to respond to fluctuations in conditions, enabling it for applications where real-time adjustments are crucial. Industries such as traffic management, where conditions on the road can change rapidly, find ACO particularly valuable in optimizing traffic flow and minimizing congestion. This adaptability is driving the adoption of the ACO segment. Furthermore, the increasing integration of ACO in emerging technologies such as the Internet of Things (IoT) contributes to the segment growth. ACO algorithms optimize the routing and communication of IoT devices within networks. It is specifically applicable in smart cities and industrial IoT applications, where efficient communication and resource optimization are essential.

The particle swarm optimization segment is projected to grow at the fastest CAGR over the forecast period. The growing awareness of the need for energy-efficient solutions drives the adoption of particle swarm optimization (PSO). PSO's ability to optimize complex systems for energy efficiency aligns with the global push towards sustainable practices. Industries, especially those with energy-intensive processes such as manufacturing and transportation, utilize PSO to optimize resource utilization, reduce energy consumption, and minimize environmental impact.

Capability Insights

The optimization segment dominated the market in 2023. The adaptability of swarm intelligence in addressing real-time optimization challenges drives market growth. Industries with dynamic and time-sensitive optimization requirements, such as finance and emergency response systems, benefit from swarm intelligence's ability to respond quickly and collectively to evolving situations. Real-time optimization is especially critical in scenarios where decisions must be made swiftly. Swarm intelligence's capacity to provide timely and adaptive solutions positions it as a key player in addressing the demands of industries requiring dynamic optimization capabilities.

The routing segment is projected to grow at the fastest CAGR over the forecast period. Integration of swarm intelligence in routing solutions is the increasing demand for intelligent and autonomous systems in transportation. As industries adopt autonomous vehicles and drones for various applications, the need for sophisticated routing algorithms is critical. Swarm intelligence offers a transformative approach to route optimization, allowing autonomous vehicles to collaborate and navigate complex environments seamlessly. It is particularly beneficial in urban settings, where traffic conditions, road closures, and dynamic obstacles necessitate adaptive routing strategies.

Application Insights

The robotics segment dominated the market in 2023. The increasing complexity of tasks in industries like logistics, where multiple robots are required to work together seamlessly, further drives the need for swarm intelligence in the robotics segment. Swarm intelligence algorithms assign robots to navigate complex and dynamic environments collaboratively. It is specifically beneficial in systems such as autonomous drone swarms for package delivery or collaborative robot teams managing complex assembly lines. The ability of swarm intelligence to distribute tasks efficiently among robotic entities ensures a synchronized and optimized workflow, addressing the intricacies of modern industrial processes.

The human-swarming segment is projected to grow at the fastest CAGR over the forecast period. The increasing importance of decentralized decision-making in various industries drives the human swarming segment. It is particularly evident in sectors such as disaster response, where rapid and adaptive decision-making among groups of responders is critical. The decentralized nature of human swarming aligns with the evolving needs of industries aiming for agile and collaborative solutions in dynamic environments.

End-use Insights

Transportation & logistics dominated the market in 2023. With the rise of e-commerce and the increasing consumer demand for swift and reliable deliveries, companies in the transportation sector now prefer swarm intelligence to optimize their last-mile logistics. Swarm algorithms can enhance the coordination and communication between delivery vehicles, ensuring that packages are delivered promptly and cost-effectively, thus addressing a critical challenge in modern logistics. In the transportation and logistics sector, where supply chains are intricate and involve multiple stages, the ability of swarm intelligence to optimize the flow of goods, manage inventory, and respond dynamically to disruptions is crucial. Swarm intelligence enhances the resilience and adaptability of supply chain operations, ultimately contributing to improved efficiency and reduced operational costs.

Retail & e-commerce is projected to grow at the fastest CAGR over the forecast period. Swarm intelligence technology is increasingly being leveraged in retail operations to optimize various processes, such as inventory management, pricing strategies, and supply chain logistics. The ability of swarm intelligence to analyze and adapt to real-time data, consumer behaviors, and market trends positions it as a valuable tool for retailers aiming to improve decision-making and stay competitive in the dynamic landscape of online and offline commerce.

Regional Insights

North America dominated the market with a revenue share of 36.3% in 2023. The increasing complexity of cybersecurity threats also drives the adoption of swarm intelligence in North America. As the region faces sophisticated and evolving cyber threats, swarm intelligence systems' collective intelligence and adaptability offer a proactive approach to threat detection and mitigation. North American businesses and government entities are investing in advanced cybersecurity measures, including incorporating swarm intelligence algorithms, to enhance their resilience against cyber-attacks and safeguard critical digital infrastructure.

Asia Pacific is anticipated to witness the fastest CAGR over the forecast period. Increasing economic development and urbanization in many Asia Pacific countries are driving market growth. Several Asian nations are adopting digital transformation across various industries, and applying swarm intelligence becomes pivotal for optimizing processes, enhancing decision-making, and improving overall operational efficiency. The versatility and adaptability of swarm intelligence align well with the diverse and dynamic nature of the Asia Pacific business landscape, contributing to its widespread adoption across sectors like manufacturing, logistics, and smart cities.

Key Swarm Intelligence Company Insights

Some of the key players operating in the market include Robert Bosch GmbH, Axon Enterprise, Inc, and Continental AG

-

The Bosch Group is a top international supplier of technology and services. Bosch is a company that operates in four business sectors: industrial technology, mobility solutions, energy and building technology, and consumer goods. Bosch has a global manufacturing, engineering, and sales network that covers almost every country, including sales and service partners, with more than 400 locations worldwide available to cater to the needs of customers.

-

Axon Enterprise, Inc. is a technology company specializing in developing and manufacturing weapons products for military, law enforcement, and civilians. Axon is best known for its flagship product, the Taser electroshock weapon, which has become synonymous with non-lethal law enforcement interventions. In addition to electroshock weapons, the company provides a range of cutting-edge products, including body-worn cameras, evidence management software, and cloud-based platforms that facilitate capturing, storing, and analyzing critical data.

-

Continental AG develops technologies and services for sustainable and connected mobility of goods. Continental AG also caters to trendsetting technologies such as holistic connectivity, smart infotainment, and automated and autonomous driving. The company also provides secure, cost-effective, smart, and practical transportation systems, including vehicles, machines, traffic solutions, and transportation options.

ConvergentAI, Inc., DoBots, and HYDROMEAare some of the emerging market participants in the market.

-

ConvergentAI, Inc. offers real-time advanced and predictive advice to improve operations. ConvergentAI, Inc.'s swarm intelligence AI/ML powers predictive guidance through a decentralized, multi-agent, continuous learning engine. The systems deliver superior pattern recognition and event prediction in dynamic and complex operating environments. ConvergentAI includes solutions for intelligent discovery and intelligent operations.

-

DoBots develops innovative solutions using IoT, robotics, and big data. DoBots' expertise lies in software development for robotics, which is applied to smart buildings and smart robots. Initially, DoBots focused on developing service robotics software and expanded its expertise to include hardware, vision, and sensor technologies. They specialize in robotics software, focusing on making companies more competitive and future-proof.

-

Hydromea specializes in underwater robotics, utilizing water wireless communication networks and navigation. Hydromea develops autonomous subsea data solutions for high-speed, high-volume, and real-time access. Hydromea combines autonomous robotics and wireless communication to eliminate cables, reduce costs, and prevent unsafe jobs.

Key Swarm Intelligence Companies:

The following are the leading companies in the swarm intelligence market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these swarm intelligence companies are analyzed to map the supply network.

- ConvergentAI, Inc

- Robert Bosch GmbH

- DoBots

- Swarm Technology

- Valutico

- PowerBlox

- Mobileye

- Continental AG

- Apium Swarm Robotics

- Kim Technologies

- Hydromea

- Sentien Robotics

- Axon Enterprise, Inc

- SSI Schafer - Fritz Schafer

- Enswarm

Recent Developments

-

In October 2023, Shield AI launched its V-Bat Teams drone swarm technology, designed to function autonomously in high-risk environments without relying on GPS or communications for guidance or instructions. The V-Bat Teams would require minimal human intervention beyond receiving instructions on the target or mission to pursue.

-

In February 2022, Robert Bosch LLC acquired Atlatec GmbH to provide clients with a complete suite of automated driving components. Atlatec's technology complements Bosch's existing road signature system, empowering autonomous vehicles to determine their position through digital maps and swarm intelligence accurately.

Swarm Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 43.6 million

Revenue forecast in 2030

USD 306.1 million

Growth rate

CAGR of 38.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Model, capability, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Netherlands; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

ConvergentAI, Inc; Robert Bosch GmbH; DoBots; Swarm Capability; Valutico; PowerBlox; Mobileye; Continental AG; Apium Swarm Robotics; Kim Technologies; Hydromea; Sentien Robotics; AxonAI; SSI Schafer - Fritz Schafer; Enswarm

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Swarm Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global swarm intelligence market report based on model, capability, application, end-use, and region:

-

Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Ant Colony Optimization

-

Particle Swarm Optimization

-

Others

-

-

Capability Outlook (Revenue, USD Million, 2018 - 2030)

-

Optimization

-

Clustering

-

Scheduling

-

Routing

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Robotics

-

Drones

-

Human Swarming

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation & Logistics

-

Robotics & Automation

-

Healthcare

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Frequently Asked Questions About This Report

b. The global swarm intelligence market size was estimated at USD 35.2 million in 2023 and is expected to reach USD 43.6 million in 2024

b. The global swarm intelligence market is expected to grow at a compound annual growth rate of 38.4% from 2024 to 2030 to reach USD 306.1 million by 2030

b. North America dominated the swarm intelligence market with a market share of 36.3% in 2022. The increasing complexity of cybersecurity threats is also driving the adoption of swarm intelligence in North America. As the region faces sophisticated and evolving cyber threats, swarm intelligence systems' collective intelligence and adaptability offer a proactive approach to threat detection and mitigation.

b. Some key players operating in the swarm intelligence market include ConvergentAI, Inc, Robert Bosch GmbH, DoBots, Swarm Capability, Valutico, PowerBlox, Mobileye, Continental AG, Apium Swarm Robotics, Kim Technologies, Hydromea, Sentien Robotics, AxonAI, SSI Schafer – Fritz Schafer, Enswarm

b. Factors such as the growing prevalence of decentralized e-commerce models are expected to drive market growth. Moreover, increase in integration of decentralized finance (DeFi) and blockchain drives the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.