- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Sweden Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Sweden Nutraceuticals Market Size, Share & Trends Report]()

Sweden Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-653-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sweden Nutraceuticals Market Size & Trends

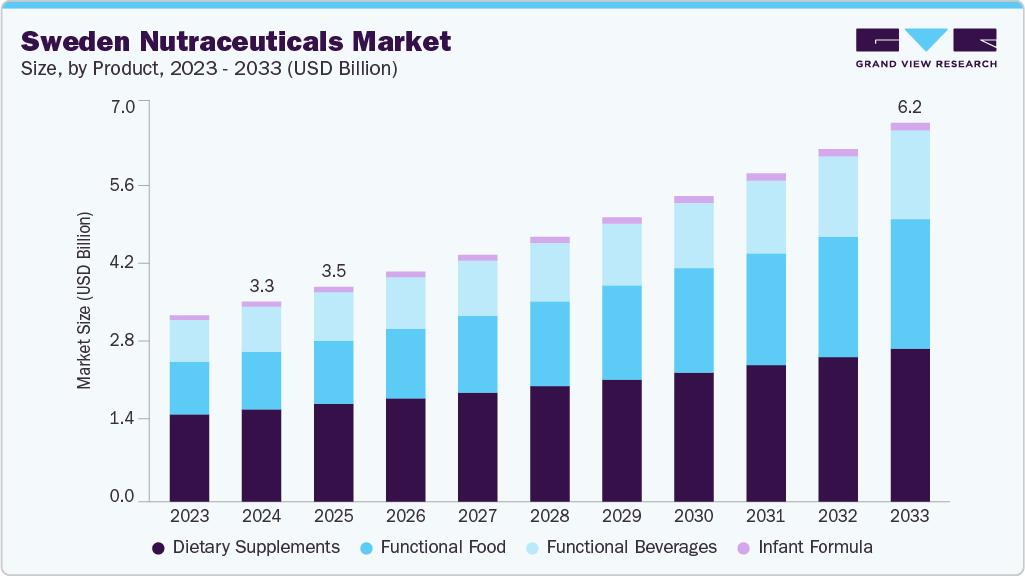

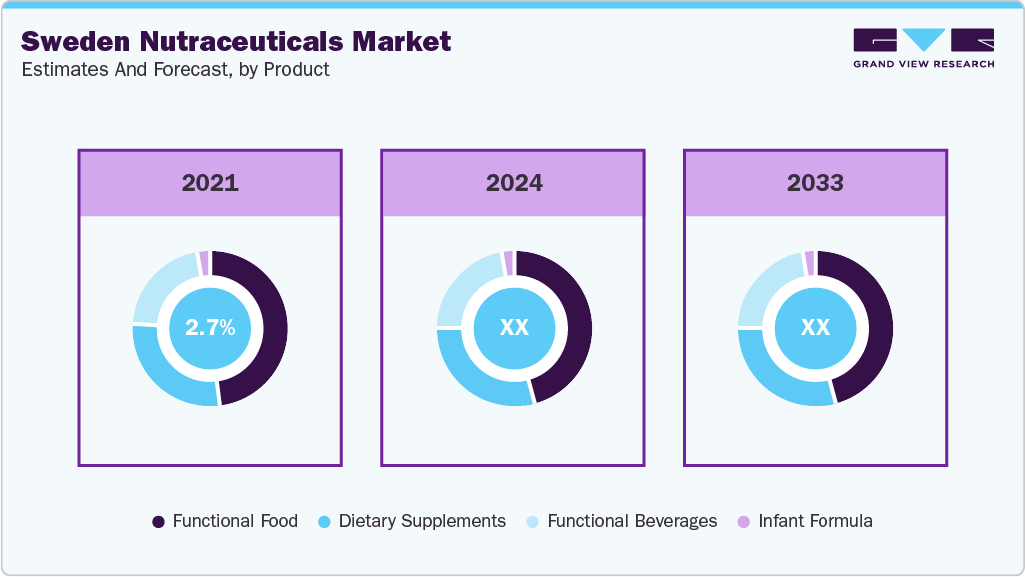

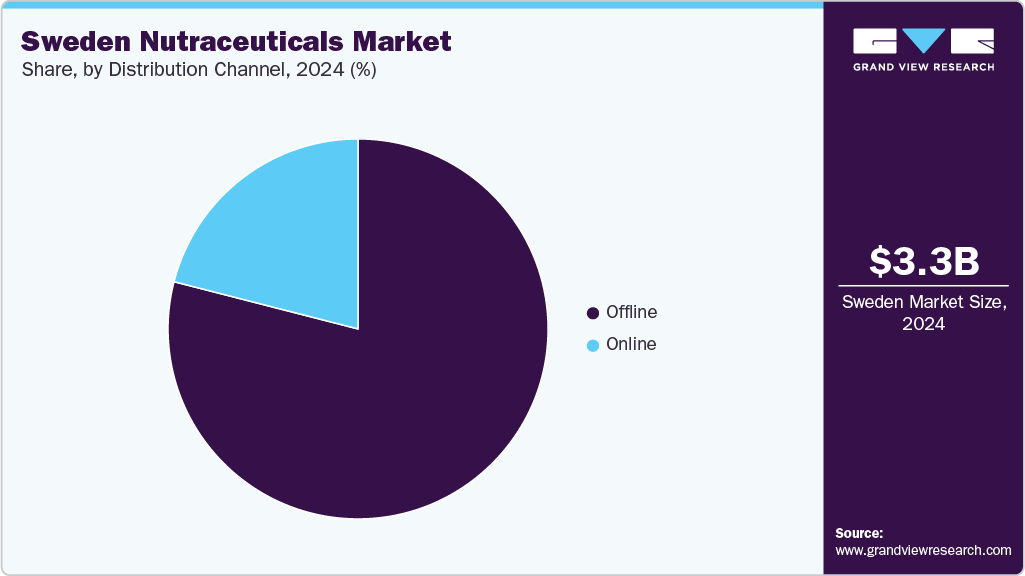

The Sweden nutraceuticals market size was estimated at USD 3.26 billion in 2024 and is projected to reach USD 6.17 billion by 2033, growing at a CAGR of 7.4% from 2025 to 2033. The market is driven by the growing consumer focus on health and wellness, increasing availability and diversification of nutraceutical products, and the country's growing aging population.

Key Market Trends & Insights

- By product, the functional food segment held the highest market share of 46.1% in 2024.

- Based on application, the weight management & satiety segment held the highest market share in 2024.

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.26 Billion

- 2033 Projected Market Size: USD 6.17 Billion

- CAGR (2025-2033): 7.4%

The government of Sweden has a clear public health policy aimed at promoting healthy nutrition and lifestyle. The government's bill, “A Renewed Public Health Policy,” emphasizes improving eating habits and physical activity, targeting children, young individuals, and parents to reduce health risks and promote good dietary habits. The Public Health Agency of Sweden and the Swedish Food Agency are tasked with setting national targets for healthy and sustainable food consumption, including increased intake of vegetables, fruits, and whole grains, and reducing unhealthy food consumption.

The country's strong economy and high disposable income allow consumers to spend more on health and wellness products. According to a Svergies Riskbank report, Swedish households held over USD 1,760 billion of financial assets in 2023, equivalent to about 250% of GDP This reflects high financial stability and purchasing power, supporting greater consumer spending on health and wellness products in the Sweden nutraceuticals industry.

Sweden actively invests in innovation and technology, benefiting the nutraceutical industry through its strengthened national food research and innovation programs. According to an article published by Regeringskansliet, the government has boosted the National Food Research Program by allocating an additional USD 2.62 million in 2025, with funding set to increase permanently to USD 11.5 million annually from 2028 onward. These investments aim to support the development of innovative food processes, advanced products, and value-adding uses of raw materials.

Consumer Insights

In Sweden, health and wellness are deeply embedded in the national culture. Consumers prioritize preventive health strategies, favoring natural products and lifestyle choices that promote long-term well-being. Swedish consumers prefer products with clean labels and those free from artificial additives, preservatives, and genetically modified ingredients. The demand for gender-specific products is also rising, with women seeking supplements that target hormonal balance, beauty, and maternal health, while men show growing interest in performance and vitality products.

The increasing awareness and desire for preventive care drive the Swedish nutraceuticals industry. However, a gradual shift toward healthier food choices, including increased intake of vitamins, minerals, nuts, and seeds, which are key components of nutraceuticals, is expected to drive the demand for the industry. In addition, the socio-economic environment, including high disposable incomes and a culture that values wellness and sustainability, supports the premium pricing and niche positioning of many nutraceutical products in Sweden.

Product Insights

The functional food segment dominated the market with a revenue share of 46.1% in 2024. Rising cases of lifestyle diseases drive the market. According to an article published by PubMed in December 2023, a health screening study in southern Sweden found that 40-year-olds with self-reported psychiatric symptoms had significantly higher rates of unhealthy lifestyle habits such as poor diet, inactivity, smoking, and high-risk alcohol use. These individuals also showed higher BMI and waist-hip ratios, indicating a strong link between mental health challenges and increased risk for heart and metabolic diseases. In addition, growing preference for organic and natural products and technological advancements in food processing and formulation are also driving the nutraceutical market.

The dietary supplements segment in the Sweden nutraceuticals industry is projected to experience the fastest CAGR of 9.3% from 2025 to 2033. Preventive health behaviors are driving the demand for supplements, and digital purchasing habits of the people in Sweden are expected to further drive the demand for dietary supplements. In October 2024, Probi launched Probi Sense in Sweden, introducing a supplement combining the HEAL9 bacteria strain with zinc, iodine, and magnesium to support memory and concentration and reduce fatigue, all backed by four clinical studies.

Application Insights

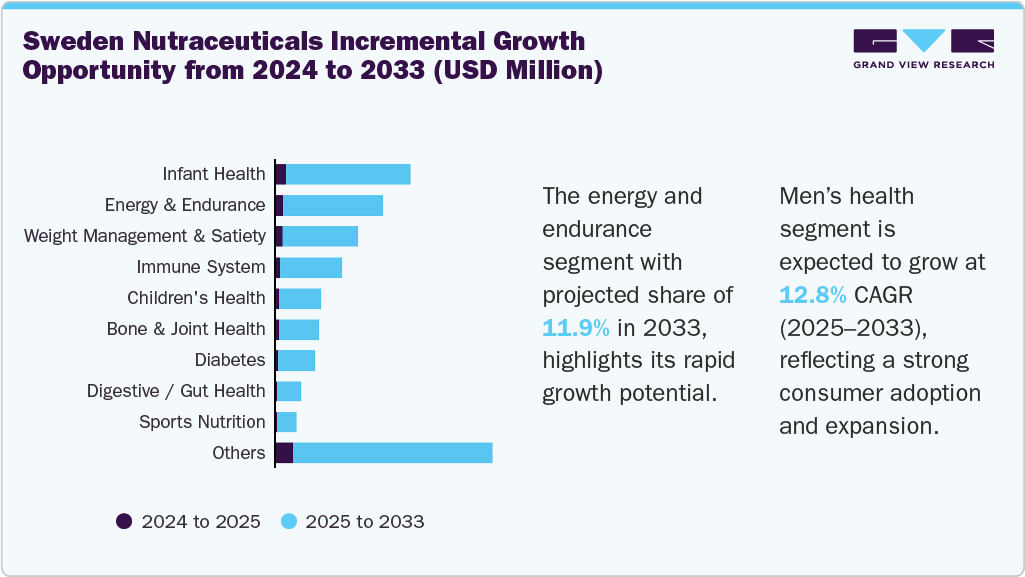

The weight management & satiety segment held the largest revenue share of the Sweden nutraceuticals market in 2024. The segment is driven mainly by rising obesity concerns that fuel consumer interest in weight management products. Government policies and healthcare support also increase the demand for weight management supplements. According to a study indexed in PubMed in March 2025, the Swedish National Board of Health and Welfare introduced the first national guidelines for obesity treatment in 2022. These guidelines are intended to guide the development of clinical management standards and support the nationwide implementation of effective weight-loss strategies from 2023 onward.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. Growing awareness of male-specific wellness concerns, including metabolic disorders, hormonal imbalances, and cardiovascular risk, drives focus on men’s health nutraceuticals in Sweden. Sweden’s diet and nutrition guidelines include tailored nutritional strategies for middle-aged men, stressing adequate protein, healthy fats, and essential micronutrients for maintaining muscle mass, metabolic resilience, and hormonal balance.

Distribution Channel Insights

The offline distribution segment dominated the Sweden nutraceuticals industry in 2024. Factors such as stringent regulatory guidelines for nutraceuticals and access to a wide range of nutraceuticals in stores and pharmacies account for a significant segment share. Offline outlets reassure buyers with immediate product availability, personalized advice, and verified quality, which builds their trust. Some pharmacy chains offering nutraceuticals are Apotek Hjärtat, Kronans Apotek, and Apoteket AB.

The online segment is anticipated to experience the fastest CAGR from 2025 to 2033. The market is driven by rising consumer awareness of preventive health, the convenience of e-commerce, and a growing preference for natural, plant-based, and personalized supplements. Swedish consumers are increasingly turning to digital platforms for products like probiotics, collagen, and immunity boosters, reflecting a broader shift toward self-care and wellness. The expanding range of personalized vitamins tailored to individual health goals and conditions is further accelerating the demand for the online segment.

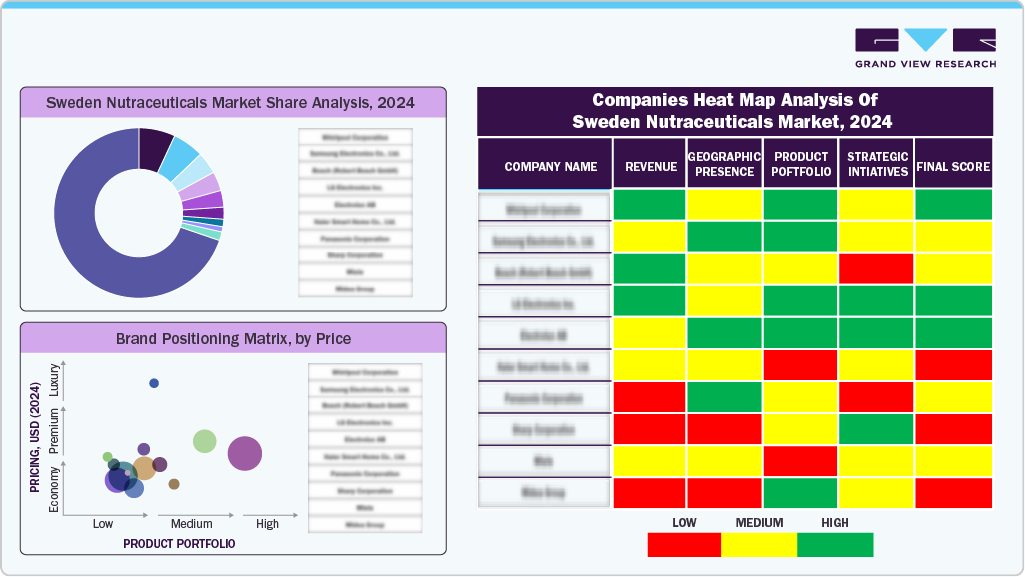

Key Sweden Nutraceuticals Company Insights

Some key players in the Sweden nutraceuticals industry include Probi, New Nordic Ltd, Svenskt Kosttöltsik AB, and Swedish Nutra AB.

-

Probi develops and manufactures scientifically documented probiotic solutions, such as the globally recognized LP299V strain for dietary supplements. Its functional foods and beverages are focused on various health areas, including digestive, immune, metabolic, women's, and oral health.

-

Swedish Nutra is a white label manufacturer specializing in crafting custom nutraceutical formulas using plant extracts, vitamins, minerals, and other bioactive compounds to help businesses create high-quality supplement products. Its liquid formulations are designed to support joint health and skin appearance, with many users reporting noticeable improvements, including reduced wrinkles.

Key Sweden Nutraceuticals Companies:

- Probi

- New Nordic Ltd

- Svenskt Kosttöltsik AB

- Swedish Nutra AB

- Zinzino

- Wellma.

- Vitamin Well AB

- Maurten.

- BioGaia

- Midsona.

Sweden Nutraceuticals Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 6.17 billion

Growth rate

CAGR of 7.4% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

Probi; New Nordic Ltd; Svenskt Kosttöltsik AB; Swedish Nutra AB; Zinzino; Wellma.; Vitamin Well AB; Maurten.; BioGaia; Midsona.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sweden Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Sweden nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars, and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.