- Home

- »

- Animal Health

- »

-

Swine Artificial Insemination Market, Industry Report, 2033GVR Report cover

![Swine Artificial Insemination Market Size, Share & Trends Report]()

Swine Artificial Insemination Market (2026 - 2033) Size, Share & Trends Analysis Report By Solutions (Equipment & Consumables, Semen, Services), By Distribution Channel (Private, Public), By Region (North America, Europe, Asia Pacific), and Segment Forecasts

- Report ID: GVR-4-68040-068-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Swine Artificial Insemination Market Summary

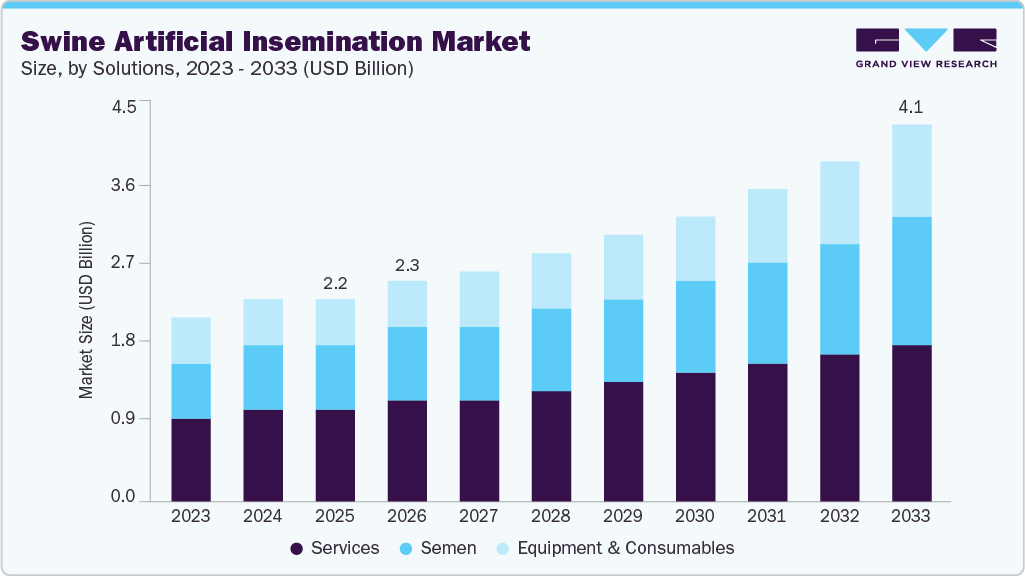

The global swine artificial insemination market size was estimated at USD 2.22 billion in 2025 and is projected to reach USD 4.07 billion by 2033, growing at a CAGR of 8.18% from 2026 to 2033. The market is expanding due to rising focus on genetic improvement and technological advancements, increasing consumption of pork meat, and expansion of commercial swine farming.

Key Market Trends & Insights

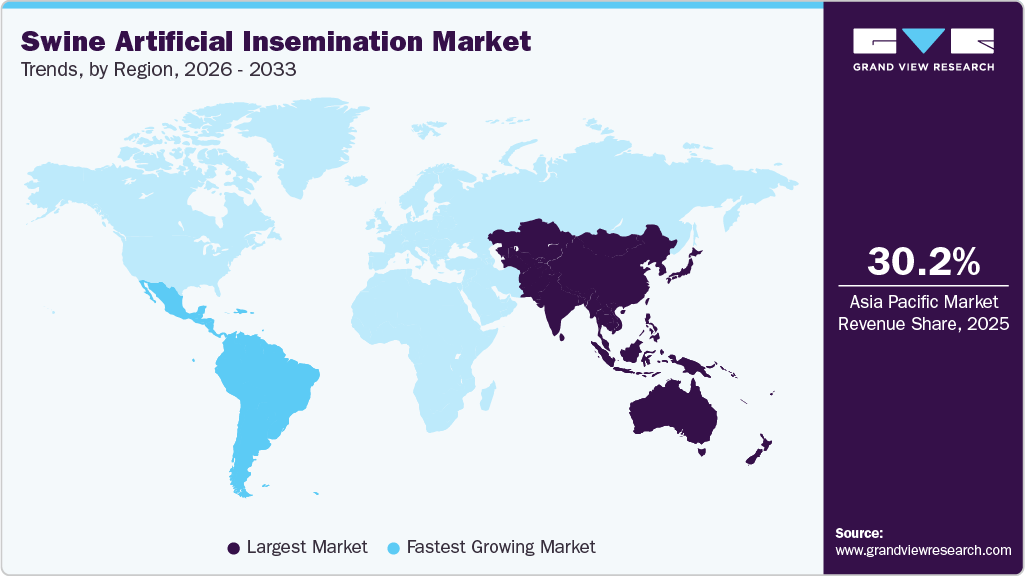

- Asia Pacific dominated the global swine artificial insemination market with the largest revenue share of 30.25% in 2025.

- The India swine artificial insemination market is experiencing notable growth.

- By solutions, the services segment led the market with the largest revenue share of 45.03% in 2025.

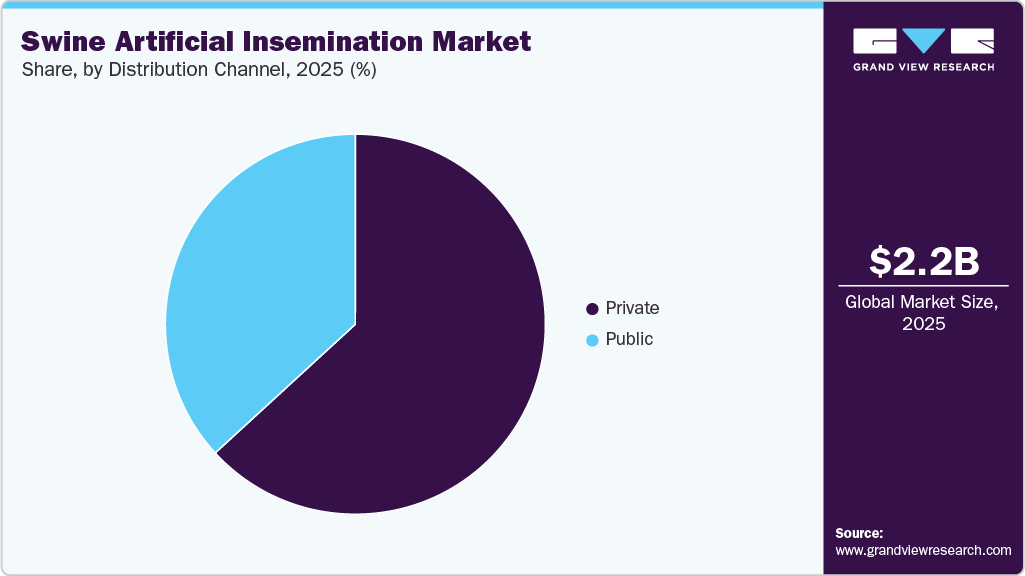

- By distribution channel, the private segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.22 Billion

- 2033 Projected Market Size: USD 4.07 Billion

- CAGR (2026 - 2033): 8.18%

- Asia Pacific: Largest market in 2025

- Latin America: Fastest growing market

Growing demand for high-yield, disease-resistant, and feed-efficient pigs is significantly accelerating the adoption of artificial insemination in the swine industry. As farmers seek faster genetic progress to enhance herd productivity, artificial insemination provides access to superior boar genetics without the need to maintain large boar populations. According to a study published in April 2025, Verility Inc.’s AI-driven Fertile-Eyez enhanced sow conception accuracy by reducing the number of inseminations and semen usage, improving genetic gains, and delivering a strong return on investment, ultimately transforming reproductive efficiency across swine operations. In addition, in August 2024, researchers in South Korea developed the first AI system capable of accurately detecting sow pregnancy using ultrasound images, thereby reducing dependence on skilled technicians and enabling fast and reliable pregnancy confirmation for farms with limited expertise. Such initiatives accelerate adoption of precision AI-based reproductive tools, expanding demand for advanced swine AI technologies and reducing operational costs while ensuring consistent quality across herds. The ability to select traits such as growth rate, carcass quality, and reproductive efficiency strengthens competitiveness for commercial producers.

In addition, increasing consumption of pork meat is one of the leading factor contributing to market growth. According to a study published in June 2025, South Africa recorded the strongest growth in pork consumption, with a rise of 38.5% (about 90,000 tons) from the period of 2015 to 2024. In addition, among the several countries, China is both a major producer and consumer of pork meat and is expected to remain dominant over the forecast period. According to a USDA report, China accounted for 49% of global pork production, generating 57.06 million metric tons in 2024/2025, strengthening its position as the world’s dominant producer.As a result, an increase in consumption prompts farms to enhance reproductive efficiency, shorten production cycles, and optimize litter size outcomes, which AI facilitates through managed breeding, enhanced genetics, and improved conception rates.

Furthermore, the rapid growth of large-scale, commercial pig farms is creating strong demand for artificial insemination as producers seek cost-efficient, standardized, and scalable breeding methods. For instance, in December 2025, Tripura, a state in India, launched its first pig artificial insemination program, training farmers in modern breeding techniques through sessions led by the Indian Council of Agricultural Research (ICAR), aiming to improve genetic diversity, disease control, and productivity across the state’s pig farming sector. Besides this, commercial operations prioritize reproductive efficiency, faster turnover cycles, and uniform herd performance, all of which are supported by artificial insemination. In addition, by enabling the synchronized breeding of large sow populations, artificial insemination reduces downtime and boosts overall production capacity. Moreover, advancements in automated artificial insemination devices, semen extenders, and digital breeding management tools make it more accessible and reliable for commercial users. As consolidation increases across the swine industry, large farms are increasingly integrating artificial insemination into their routine operations, significantly expanding market adoption.

Key Innovations in Swine Artificial Insemination and their Impact

Innovation

Description

Impact on Market Growth

New AI Room Design

Spacious, state-of-the-art AI room designed for future compliance with welfare legislation.

Increases adoption of advanced AI facilities, enhances breeding efficiency, and drives market expansion.

Heat Conductor for Pig Nests

Maintains optimal nest temperature for sows during breeding.

Improves conception rates, reduces stress, and boosts reproductive performance, supporting higher AI utilization.

Flexible Pig Flooring System

Adjustable flooring for comfort and hygiene in breeding areas.

Enhances animal welfare, minimizes disease risks, and promotes sustainable AI practices, encouraging market growth.

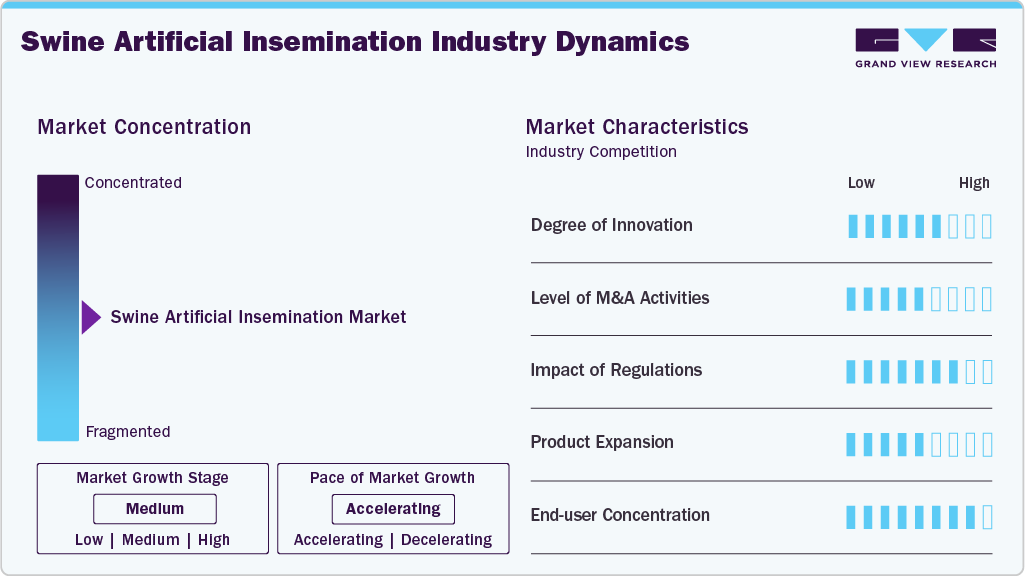

Market Concentration & Characteristics

The swine artificial insemination industry is moderately concentrated, and the pace is accelerating, dominated by a few major genetics and artificial insemination service providers with strong distribution networks. However, regional players and cooperatives maintain a significant presence, creating a competitive but not highly consolidated landscape.

The swine artificial insemination industry is experiencing rapid innovation driven by AI-powered ovulation detection tools, precision reproductive diagnostics, improved semen extenders, and advanced genetic selection technologies. Some of the breakthroughs such as real-time fertility monitoring, automated insemination systems, and data-driven breeding strategies are reshaping productivity benchmarks.

Mergers and acquisitions in the swine artificial insemination industry are rising as companies seek stronger genetic portfolios, expanded distribution, and integrated reproductive solutions. Larger agricultural and biotechnology firms increasingly acquire specialized technology developers and genetic service providers to strengthen market presence.

Regulations act by governing biosecurity standards, semen handling protocols, genetic material movement, and disease prevention measures. The strict animal health norms promote wider adoption of artificial insemination as a safer alternative to natural mating, reducing disease transmission risks. In addition, compliance requirements for traceability, welfare, and antibiotic reduction also encourage producers to adopt standardized AI practices and certified genetic materials, driving market professionalism and growth.

Product expansion is accelerating through the launch of advanced semen extenders, artificial insemination kits, precision diagnostics, wireless heat-detection devices, and portable semen-quality analyzers. In addition, companies are expanding their offerings to include complete reproductive management platforms that integrate analytics, genetic consulting, and breeding optimization.

End user concentration remains high, dominated by commercial swine farms, contract growers, and integrated pork production companies. These large-scale operations rely on this method to improve fertility, manage genetics, and control disease. As industrial pork production expands, demand clusters around high-volume producers capable of adopting advanced reproductive technologies.

Solutions Insights

The services segment led the market with largest revenue share of 45.03% in 2025. The segment is driven by increasing demand for professional its expertise, technical support, and reproductive management solutions. This segment encompasses semen collection, processing, storage, and insemination services provided to pig farms, ensuring optimal conception rates and herd productivity. In addition, adoption of advanced technologies, such as AI-driven ovulation detection and fertility monitoring, further enhances service efficiency. The demand for services such as reproduction consulting, semen collection, breeding programs, artificial insemination, etc. is on the rise thus attributing to the high share of the segment.

The semen segment is expected to grow at the fastest CAGR over the forecast period. The segment is comprised of normal and sexed semen. driven by increasing demand for high-quality genetic material to enhance herd productivity and reproductive efficiency. In addition, producers are prioritizing superior boar semen to improve conception rates, litter size, and overall genetic advancement. Moreover, rising awareness among swine farmers regarding the benefits of artificial insemination over traditional breeding methods is accelerating adoption, making semen a critical growth driver in the market.

Distribution Channel Insights

The private constituted segment accounted for the largest market revenue share in 2025 and is expected to grow at the fastest CAGR during the forecast period. This is due to the increasing adoption of online channels as well as direct sales initiatives and distribution partnerships initiated by market players. Many e-commerce companies such as Alibaba.com offer pig artificial insemination products and supplies to customers. Market players such as Swine Genetics International provide direct sales options to customers. Vetline Services is a private company based in Uganda that provides services and products to the pig sector. Its services include artificial insemination, boar semen analysis, pregnancy scanning, training, and consulting among others. In addition, private operators benefit from superior infrastructure, access to high-quality semen, and skilled personnel, enabling efficient implementation.

The public segment is expected to grow at second fastest CAGR during the forecast period, fueled by government initiatives promoting AI adoption, training programs for farmers, and funding for livestock improvement. In addition, public-sector involvement enhances accessibility of technologies, improves genetic quality, and supports disease prevention, driving widespread adoption and strengthening productivity across small- and medium-scale swine farms.

Regional Insights

The Asia Pacific dominated the swine artificial insemination market with the largest revenue share of 30.25% in 2025.The region's growth can be attributed to high pork production and consumption, the rising adoption of artificial insemination, and the rapid development of commercial pig farming. In addition, the regulatory framework in this region has been tightening around biosecurity, semen quality standards, and disease-free certification to support safer breeding practices. Furthermore, government-supported productivity programs and private genetic companies also accelerate modernization and adoption of advanced artificial insemination systems across the region.

China Swine Artificial Insemination Market Trends

The swine artificial insemination market in China is witnessing new growth opportunities due to rising pork consumption, disease control priorities, and the shift toward large-scale, biosecure farms adopting high-efficiency breeding methods. According to USDA data, China ranked highest for pork production in 2024/2025, accounting for 49% of global production. Furthermore, regulations are tightening as authority’s curb overcapacity, enforce herd-quality standards, and promote genetic improvement programs to stabilize production. For instance, in November 2025, the Ministry of Agriculture and Rural Affairs in China reduced its sow herd to below 40 million as authorities push producers to curb oversupply. Regulators also aim to stabilize the market through tighter capacity controls, efficiency improvements, and support for farming that is appropriately scaled.

The India swine artificial insemination marketis experiencing notable growth, driven by the increasing commercialization of pig farming and the government's emphasis on enhancing productivity and genetic improvement. The regulatory landscape is transforming with ICAR, state livestock boards, and biosecurity guidelines emphasizing disease control, boar semen quality, and organized breeding programs. For instance, in December 2025, ICAR’s National Research Centre on Pig enabled long-distance artificial insemination in Assam by developing a method for preserving boar semen for 7 days, leading to higher litter sizes, superior crossbred piglets, and increased farmer income, which drove wider adoption. Such initiatives are boosting market growth.

North America Swine Artificial Insemination Market Trends

The swine artificial insemination marketin North America is anticipated to grow at a significant CAGR during the forecast period, driven by rising pork demand, large-scale commercial farming, and the push for genetic improvement to enhance productivity and disease resistance. In addition, technological advancements such as AI-driven ovulation detection, automated semen analysis, improved semen extenders, and digital reproductive management platforms are accelerating adoption. These factors strengthen efficiency, profitability, and genetic progress across the region.

The swine artificial insemination market in the U.S. accounted for the largest market revenue share in North America in 2025, owing to rising pork export demand and focus on disease prevention & biosecurity. For instance, U.S. pork exports exceeded USD 8.63 billion in 2024, with shipments totaling over 3.03 million metric tons to global markets, highlighting rising international demand for American pork. In addition, stringent regulatory framework governed by USDA and FDA for semen handling, biosecurity, animal welfare, and interstate genetic material movement, encouraging standardized its adoption.

The Canada swine artificial insemination marketis expected to grow at a significant CAGR during the forecast period,propelled by increased adoption of precision breeding technologies, and a shift toward disease-controlled and biosecure reproductive practices. In addition, genetic improvement programs and fundings, artificial insemination driven heat detection tools, and rising farm consolidation further accelerate artificial insemination uptake to enhance productivity and herd performance. For instance, in October 2024, Animal Health Canada (AHC) announced a USD 13.34 million, five-year funding initiative under the AgriAssurance Program to enhance animal health and welfare.

Europe Swine Artificial Insemination Market Trends

The swine artificial insemination market in Europe is advancing due to breeding programs, strong emphasis on genetic improvement, and strict animal health regulations that promote disease-controlled AI practices. In addition, high demand for premium pork quality and productivity optimization further accelerates adoption. Some of the key players such as Topigs Norsvin, PIC, Hypor, and various national cooperatives, all investing in genomic technologies, high-fertility boar lines, and enhanced semen quality solutions. Moreover, innovation, regulatory compliance, and biosecurity remain key differentiators across the region.

The UK swine artificial insemination marketis expected to grow rapidly over the forecast period. The market is characterized by demand for higher herd productivity, improved genetic merit, and stricter biosecurity standards that encourage artificial insemination adoption over natural mating. In addition, growing investments in advanced breeding technologies and access to global genetics supported by key initiatives by key players is strengthening market growth. For instance, in November 2024, JSR Genetics in partnered with Topigs Norsvinv for offering comprehensive artificial insemination manual covering reproductive physiology, advanced semen handling, and the latest swine artificial insemination techniques. Furthermore, UK’s regulatory framework is governed by APHA and DEFRA that ensure stringent controls on semen collection, storage, and disease prevention, maintaining high welfare standards.

The swine artificial insemination market in Germanyheld the significant share in Europe in 2025. The country’s growth is influenced by rising genetic improvement programs and strict biosecurity standards that encourage artificial insemination adoption to enhance herd productivity and disease control. The country is witnessing rapid technological advancements, including automated semen analysis systems, precision reproductive monitoring, liquid-storage extenders, and data-driven artificial insemination protocols integrated with farm management software. For instance, in January 2024, EU approved USD 1.08 billion in German aid to upgrade pig breeding sites and support higher-welfare farming practices through grants covering major investment and operational costs, strengthening animal welfare and sustainability goals. In addition, German research institutes and breeding companies are also advancing genomic selection and boar fertility assessment tools, further improving success rates and supporting high-efficiency artificial insemination programs nationwide.

Latin America Swine Artificial Insemination Market Trends

The swine artificial insemination market in Latin America is anticipated to grow at the fastest CAGR during the forecast period, driven by rising investments from global genetics companies, the growth of large-scale integrated farming systems, and increasing focus on disease control. The regulatory landscape is strengthening, with countries like Brazil and Mexico enforcing stricter biosecurity, animal welfare, and breeding standards to ensure sustainable production.

The Brazil swine artificial insemination marketis gaining momentum due to rising domestic protein consumption and large-scale commercial farms demanding genetic improvement for higher productivity. The regulatory landscape is governed by MAPA’s stringent biosecurity, semen quality, and animal welfare standards, ensuring safe breeding practices. In addition, in May 2025, the Minitube Symposium marked 50 years of swine artificial insemination in Brazil, uniting experts to address challenges related to hyperprolific sows, celebrate industry pioneers, and highlight major advancements, collaborations, and progress in transforming modern swine reproduction.

Middle East & Africa Swine Artificial Insemination Market Trends

The swine artificial insemination market in MEA is anticipated to grow at a lucrative CAGR during the forecast period, due to supportive regulations that promote biosecurity and disease control, and rising government initiatives that enhance livestock productivity. In addition, technological advancements such as AI-based ovulation detection, precision semen handling, and smart breeding management systems, improving conception rates and herd efficiency. Furthermore, the adoption of automated insemination tools and digital monitoring platforms optimizes reproductive performance, reduces labor, and strengthens profitability across commercial and small-scale swine operations.

The South Africa swine artificial insemination market is growing due to rising pork consumption, demand for improved herd genetics, and efficiency in breeding practices. Regulatory support from the Department of Agriculture ensures adherence to animal health and biosecurity standards, promoting safe AI practices. The country features both local providers and international genetics companies focusing on technological innovation, precision breeding, and genetic improvement. Companies differentiate through service quality, training programs, and integrated solutions, enabling farmers to enhance reproductive efficiency and overall swine production profitability.

Key Swine Artificial Insemination Company Insights

The swine artificial inseminationindustry is characterized by the presence of several small to large players and is competitive. These players are involved in deploying strategic initiatives such as portfolio expansion, partnerships, collaborations, mergers & acquisitions, and more to boost their market share. Swine Genetics International is a U.S.-based company that offers commercial boars, frozen semen, artificial insemination products & supplies, as well as production-related consultation to swine businesses.

Key Swine Artificial Insemination Companies:

The following are the leading companies in the swine artificial insemination market. These companies collectively hold the largest Market share and dictate industry trends.

- Genus Plc

- IMV Technologies

- Shipley Swine Genetics

- Agtech, Inc.

- Neogen Corporation.

- GenePro, Inc.

- MINITÜB GMBH

- Swine Genetics International

- Hypor BV

- Semen Cardona S.L.

Recent Developments

-

In October 2024, Hendrix Genetics’ swine division, Hypor, merged with Danish Genetics to form a strategic alliance, combining expertise, R&D, and global reach to deliver innovative, sustainable swine genetics solutions worldwide.

-

In August 2025,ICAR-KVK Wokha conducted a three-day AI training for 25 farmers across Nagaland, covering reproductive management, nutrition, disease prevention, and entrepreneurship to improve pig productivity and livelihoods. This initiative enhanced swine AI adoption, boosts genetic quality, and strengthens small-scale pig farming across Nagaland.

-

In April 2025, Verility Inc. launched Fertile-Eyez AI technology for improving sow conception with fewer inseminations, reducing labor and semen use, while maintaining 91% conception rates and accelerating genetic progress in swine herds. This drives efficiency and cost-effectiveness in sow AI, promoting precision livestock technologies in commercial pig production.

Swine Artificial Insemination Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.35 billion

Revenue forecast in 2033

USD 4.07 billion

Growth rate

CAGR of 8.18% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Netherlands; Japan; China; India; Thailand; South Korea; Philippines; Australia; Brazil; Argentina; South Africa; Kuwait

Key companies profiled

Genus Plc; IMV Technologies; Shipley Swine Genetics; Agtech, Inc.; Neogen Corporation.; GenePro, Inc. ; MINITÜB GMBH; Swine Genetics International; Hypor BV; Semen Cardona S.L.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Swine Artificial Insemination Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global swine artificial insemination market report based on solutions, distribution channel, and region.

-

Solutions Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment & Consumables

-

Semen

-

Normal Semen

-

Sexed Semen

-

-

Services

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Public

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Philippines

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global swine artificial insemination market size was estimated at USD 2.22 billion in 2025 and is expected to reach USD 2.35 billion in 2026.

b. The global swine artificial insemination market is expected to grow at a compound annual growth rate of 8.18% from 2026 to 2033 to reach USD 4.07 billion by 2033.

b. Asia Pacific dominated the market by region with a share of 30.25% in 2025. This is owing to the high population of pigs, rising adoption of artificial insemination, and need to meet global animal protein demand more sustainably.

b. Some key players operating in the swine artificial insemination market include Genus Plc; IMV Technologies; Shipley Swine Genetics; Agtech, Inc.; Neogen Corporation.; GenePro, Inc. ; MINITÜB GMBH; Swine Genetics International; Hypor BV; and Semen Cardona S.L.

b. Increasing consumption of pork meat, adoption of artificial insemination in swine, demand for sustainable food production, and initiatives by key market players are some of the leading factors contributing to the Swine Artificial Insemination growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.