- Home

- »

- Medical Devices

- »

-

Switzerland Biosensors Market Share Analysis, Industry Report, 2026GVR Report cover

![Switzerland Biosensors Market Size, Share & Trends Report]()

Switzerland Biosensors Market Size, Share & Trends Analysis Report By Technology (Thermal, Electrochemical, Optical, Piezoelectric), By Application (Medical, Agriculture), By Region, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-2-68038-956-2

- Number of Report Pages: 97

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Healthcare

Report Overview

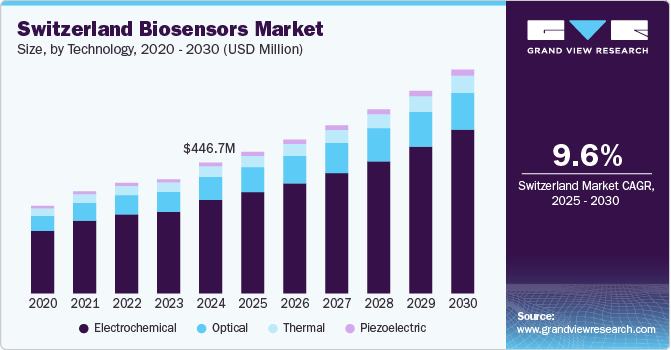

The Switzerland biosensors market size was valued at USD 510.0 million in 2018 and is expected to expand at a CAGR of 7.9% over the forecast period. Various applications of biosensors in medical fields, rising prevalence of diabetes, high demand for miniature diagnostic devices, and rapid technological advancements are anticipated to drive the growth of the market in the near future.

Technological advancements in optical quantum dots are expected to facilitate novel applications in proteomic analysis and biopharmaceutical development. In addition, increasing applications of these devices in cosmetic and environmental analysis is driving the Switzerland biosensors market. Furthermore, the development of Nanoparticle-based electrochemical biosensors is expected to increase the demand for these devices. Thus, rapid technological advancements in all the segments are expected to drive the market. Early and precise disease diagnosis is essential for the survival of patients and successful prognosis of diseases.

In recent years, the demand for simple, disposable, user-friendly, and cost-efficient devices with fast response time has increased extensively. Biosensors fulfill all these criteria. These devices are used for the measurement of glucose, urea, creatinine, and lactate, using both electrochemical and optical modes of transduction, which are being used and commercially developed in laboratories, self-testing, point of care testing, and in glucose monitoring. They find applications in various areas of the healthcare industry such as cardiovascular, cancer, and diabetes. The rising prevalence of diabetes and cardiovascular diseases globally has led to an increase in the use of biosensors for early detection of these diseases. These devices are ideal for new applications in hospitals, for patients at home, and caregivers in non-hospital settings.

Technology Insights

Electrochemical biosensors held the largest market share in 2018 owing to the widespread application of the technology for quantification and analysis in biochemical and biological processes. It has advantages, such as wide linear response range, low detection limits, reproducibility, and optimum stability leading to higher usage of the devices than other biosensing technologies. Moreover, the sensitivity of electrochemical detections and selectivity of biochemical recognition can be achieved by using potentiometric, amperometric, and impedimetric transducers for the conversion of chemical signals into electrical signals. Amperometric transducers are the most sensitive and suitable for mass production of electric signals.

Optical biosensors are expected to witness the fastest growth over the forecast period owing to rising demand for the technology in the analysis due to its versatile analytical coverage. It is used in fermentation monitoring, receptor-cell interactions, concentration, kinetic and equilibrium analysis, thereby resulting in the segment growth over the forecast period. Various benefits associated with optical biosensors over conventional analytical tools include a lack of need for extensive sample pretreatment and capability of a specific selection of biological sensing elements. This offers the opportunity for the development of highly specific analytical devices, which can be employed in real-time analysis of complex mixtures.

Application Insights

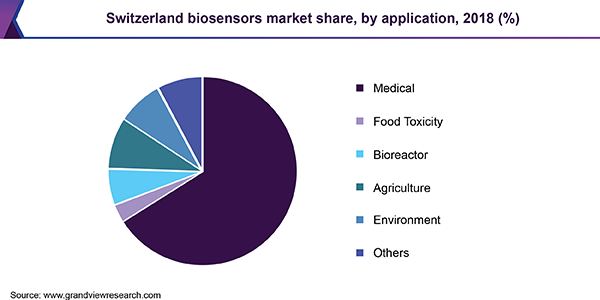

On the basis of application, the market has been segmented into medical, food toxicity, bioreactor, agriculture, environment, and others. The medical application segment held the largest market share in 2018 owing to the extensive usage of biosensors in this field. On the basis of medical application, the market has been sub-segmented into cholesterol, blood glucose, blood gas analyzer, pregnancy testing, drug discovery, and infectious disease. These devices are considered an essential tool for the detection and monitoring of a wide range of medical conditions including diabetes and cancer.

The blood glucose testing segment held the largest share of the medical application segment in 2018. Rising prevalence of diabetes is a major factor contributing to the segment growth. Blood glucose monitoring is a necessary tool in diabetes management. A series of advanced glucose biosensors have been developed to help maintain a normal blood glucose level in patients suffering from diabetes. Furthermore, growing demand for self-monitoring devices has in turn increased the demand for these devices. Such factors have led to the development of small and minimally invasive glucose sensors that measure glucose levels even in outpatient settings.

End-Use Insights

PoC Testing biosensors market held the largest share in 2018. Biosensors in point-of-care diagnostics are expected to witness lucrative growth over the forecast period owing to technological advancements pertaining to novel product development, such as ultrasensitive printable biosensors for point-of-care applications, which help in detecting or monitoring biological fluids such as urine, blood, sweat, and saliva. These systems provide users with rapid and accurate results that facilitate early diagnosis and faster treatment.

Food industry is expected to witness the fastest CAGR over the forecast period. One of the key factors contributing to the rapid growth is their ability to overcome various challenges in food processing industry, which includes minimization of costs incurred during hygiene analysis by providing rapid and accurate test results. Rising concerns about detection of allergic components and pathogens in food has resulted in increase in the requirement for rapid food analysis to maintain product freshness and routine monitoring of raw materials, which are some of the applications of biosensors in food industry.

Switzerland Biosensors Market Share Insights

Prominent market players include Abbott, Biosensor International Group, Ltd, Bayer AG, Xsensio, Lucentix SA, and Sensirion AG Switzerland. Key players are adopting strategies such as mergers and acquisitions and entering into partnerships to strengthen their foothold in the market.

For instance, in April 2019, Sensirion now offers a humidity, multi-gas, and temperature sensor module SVM30. It facilitates product development and sensor integration. In addition, it is suitable for small- and medium-sized companies.In November 2018, Sensirion launched a new variant of high quality flow and environmental sensor- SDP800. These sensors can easily be integrated into medical respiratory applications, VAV controllers, burners, and water heaters.

Switzerland Biosensors Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 591.9 million

Revenue forecast in 2026

USD 932.6 million

Growth Rate

CAGR of 7.9% from 2019 to 2026

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2026

Quantitative units

Revenue in USD million and CAGR from 2019 to 2026

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Technology, application, end use

Country scope

Switzerland

Key companies profiled

Abbott Laboratories; Biosensors International Group Ltd.; Bayer AG; Xsensio; Lucentix SA; Sensirion AG Switzerland

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented Switzerland biosensors market report on the basis of technology, application, and end-use:

-

Technology Outlook (Revenue, USD Million, 2015 - 2026)

-

Thermal

-

Electrochemical

-

Piezoelectric

-

Optical

-

-

Application Outlook (Revenue, USD Million, 2015 - 2026)

-

Medical

-

Cholesterol

-

Blood Glucose

-

Blood Gas Analyzer

-

Pregnancy Testing

-

Drug Discovery

-

Infectious Disease

-

-

Food Toxicity

-

Bioreactor

-

Agriculture

-

Environment

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2015 - 2026)

-

Home Healthcare Diagnostics

-

PoC Testing

-

Food Industry

-

Research Laboratories

-

Security and Bio-defense

-

Frequently Asked Questions About This Report

b. Switzerland biosensors market size was estimated at USD 549.4 million in 2019 and is expected to reach USD 591.9 million in 2020.

b. Switzerland biosensors market is expected to grow at a compound annual growth rate of 7.9% from 2019 to 2027 to reach USD 932.6 million by 2026.

b. Electrochemical segment dominated the Switzerland biosensors market with a share of 69.80% in 2019. This is attributable to widespread applications for quantification and analysis in biochemical and biological processes.

b. Some key players operating in the Switzerland biosensors market include Abbott Laboratories, Biosensors International Group Ltd., Bayer AG, Xsensio, Lucentix SA, and Sensirion AG Switzerland.

b. Key factors that are driving the market growth include myriad applications in the medical field, rising diabetic population, increasing demand for miniature diagnostic devices, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."