- Home

- »

- Plastics, Polymers & Resins

- »

-

Synthetic Leather Market Size, Share & Trends Report 2030GVR Report cover

![Synthetic Leather Market Size, Share & Trends Report]()

Synthetic Leather Market Size, Share & Trends Analysis Report By Type (PU, PVC, Bio-based), By Application (Footwear, Automotive, Furnishing, Clothing, Wallets Bags & Purses), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-821-3

- Number of Report Pages: 119

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Synthetic Leather Market Size & Trends

The global synthetic leather market size was estimated at USD 38.98 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.87% from 2024 to 2030. Globally increasing demand from the footwear sector is expected to be a key factor propelling the overall market growth. The high cost of natural leather is another factor that has driven the need for natural leather replacements. PVC leather is another essential type of synthetic leather that has grown in popularity due to its diverse uses, including shopping bags, cosmetic bags, wallets, suitcases, purses, and travel bags.

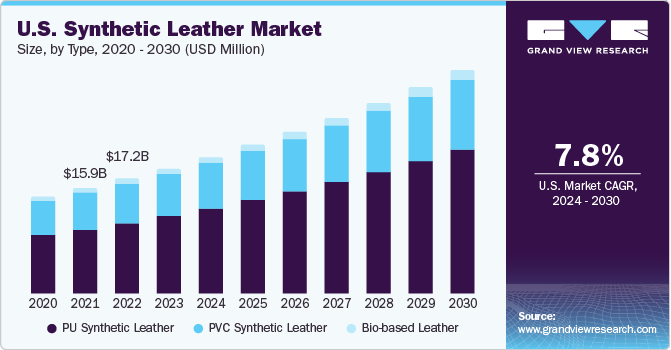

The U.S. synthetic leather market has witnessed a considerable rise in consumption in the recent past. A further increase in consumption is anticipated over the next few years. Significant rise in demand for automotive synthetic leather upholstery is expected to propel the overall market in the U.S. Initiatives taken to strengthen the supply chain are projected to positively impact the market in the U.S. over the forecast period.

Uniroyal Engineered Products LLC, Coaters Inc. Leather, and Textileather Corporation are among the few manufacturers of synthetic leather in the U.S. General Motors, Fiat Chrysler, and Ford are the three largest automotive manufacturers in the U.S., who contribute to the heavy demand for synthetic leather for car interiors.

Footwear was the largest application segment for synthetic leather in 2023. The footwear industry has witnessed a significant growth in recent years owing to the rising demand from emerging markets, as consumer spending in the U.S. and some countries in Europe has slowed down slightly owing to the global recession. There has been a strong demand from countries such as China, India, South Korea, Vietnam, Thailand, and other South Asian countries. This is expected to have a major influence on synthetic leather demand in the Asian market.

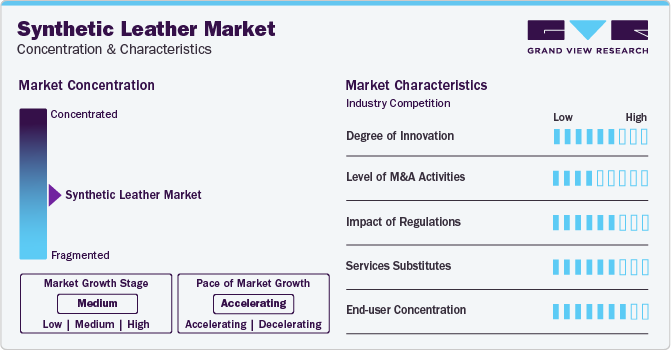

Market Concentration & Characteristics

The global synthetic leather market is fairly fragmented in nature with the presence of various key players such as Kuraray Co., Ltd.; H.R. Polycoats Pvt. Ltd.; Alfatex Italia SRL; Filwel Co., Ltd.; Yantai Wanhua Synthetic Leather Group Co. as well as a few medium and small regional players operating in different parts of the world. The global players face intense competition from each other as well as from the regional players who have strong distribution networks and good knowledge about suppliers & regulations.

Companies in the market compete on the basis of the application quality offered and the technology used for the application of plastics. Major players, in particular, compete on the basis of application development capability and new technologies used in application formulation. Established players such as Kuraray Co., Ltd. are investing in research & development activities to formulate new and advanced plastics compounds, which gives them a competitive edge over the other players.

To maintain a strong and healthy competitive environment across the market space, the global synthetic leather companies have implemented various strategic initiatives such as acquisition & merger, new application launch, application expansion, and various others. In April 2023, General Silicone launched its new product portfolio of vegan leather. This PETA-approved synthetic leather is designed for use in consumer products such as shoes and bags.

Type Insights

The polyurethane (PU) synthetic leather segment led the market in 2023 with a revenue share of above 60.0%. It has been witnessing promising growth in product quality, variety, and yield. Polyurethane is waterproof, softer, and lighter than genuine leather and can be dry-cleaned and torn more easily than genuine hides. It also remains unaffected by sunlight. In addition, it is an eco-friendly substitute for vinyl-based products as it does not emit dioxins. All these factors are expected to increase its demand further.

The PVC synthetic leather segment is expected to grow slowly during the forecast period. PVC was the first form of synthetic leather created in 1920. It was initially produced with carcinogenic chemicals and proved to be an ideal material for applications in furnishing and household items. PVC faced significant competition from PU as PVC gave a sticky feel and could not retain body heat. As a result, its demand decreased in the clothing and bag application segment.

The bio-based product consists of polyester polyol and has 70-75% renewable content. It is softer and has better scratch resistance properties than PU and PVC. Key companies in the global market are focusing on developing new products through collaboration with polyol producers. Rapid industrialization and constant R&D will continue to supplement the segment's growth in the upcoming years.

Application Insights

The footwear segment led the market with a revenue share of above 33.0% in 2023. The use of synthetic leather in footwear is getting nearer to genuine leather, and it is increasingly replacing genuine leather in applications in handbags, briefcases, car furnishings, and clothing. Rising income levels and economic growth, especially in emerging nations, have fueled the demand for footwear. In addition, the segment is led by variations occurring in climatic conditions of different regions, which need different types of footwear.

Synthetic leather is widely used to manufacture shoe uppers, shoe lining, and soles for sports shoes, formal shoes, flip flops, soccer shoes, sandals, slippers, and boots. These shoes also are cost-effective, environmentally friendly, and long-lasting. Synthetic leather shoes possess higher water resistance than genuine leather shoes, which can get stained due to exposure to certain elements. Faux leather shoes are durable enough to be used for a more extended period when walking or running.

The increasing athleisure trend of incorporating athletic shoes into the daily lifestyle is also expected to propel segment growth. The price of faux leather footwear products is three times cheaper than the ones made from animal hide, boosting segment growth. The furnishing industry is also one of the major application areas for synthetic leather as it has become more affordable than animal hides.

There is a wide range of synthetic leather materials available in the market that serve varied requirements of the furnishing industry in terms of color, texture, and fabric look. Moreover, such artificial alternatives can be used in marine furnishing as it is saltwater resistant. Faux leather is used in cars, trucks, motorcycles, buses, and agricultural vehicles as it is lighter than animal hides. Polyurethane is the most widely used material in the automotive sector as it is non-sticky and softer than other products. The wallets, bags, and purses segment are estimated to witness significant growth over the coming years due to the high product demand. Using faux leather enables the production of lightweight, breathable, scratch- and water-proof, and easy-to-maintain bags.

The application of synthetic leather in manufacturing wallets, bags, and purses has increased significantly in recent years. Synthetic leather is extremely popular since it is softer than natural leather and has high durability. Synthetic leather wallets, bags, and purses are easy to maintain as they are lightweight, breathable, waterproof, and scratchproof. The lower cost of synthetic leather has also been a significant factor driving the demand in this market. Baggit, Solo, Zara, Lavie World, and Kenneth Cole Productions, Inc. are some brands that use synthetic leather to create a wide selection of elegant and trendy bags. With the evolving textile technology, consumers prefer vegan fashion, which refers to adopting non-leather products. Thus, synthetic leather serves as the most suitable alternative in textile applications. PU synthetic leather is also used in clothing, where it is used to create spandex and add buoyancy to competitive swimsuits.

Regional Insights

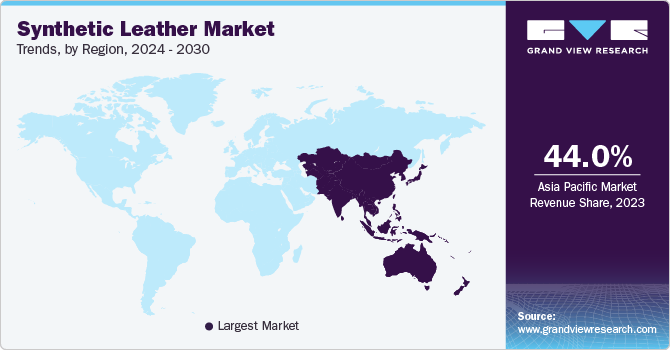

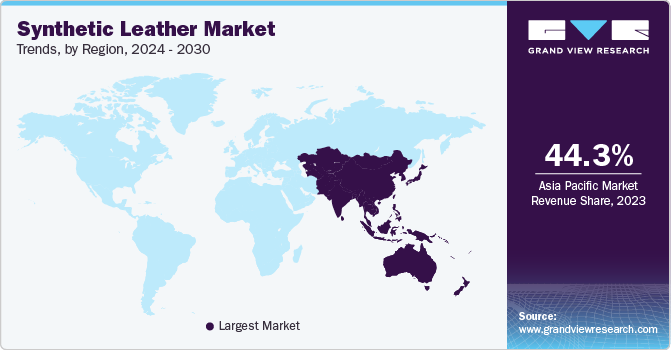

The Asia Pacific dominated the market in 2023 with a revenue share of above 44.0%. China, India, and South Korea are expected to be the significant growth-driving economies in APAC. Rising disposable income, coupled with the increasing population, will provide numerous opportunities for the market. China is one of the prominent markets for leather in terms of production and sales.

However, the coronavirus outbreak has severely affected the country’s manufacturing output. Several manufacturers have either closed or slowed down their operations to contain the spread of the virus. Limited production in the manufacturing industry due to a halt or slowdown in operations, limitations on the supply and transportation in the country, and infrastructure slowdown are anticipated to negatively affect the demand for synthetic leather from the end-use application in the near future.

The market in North America is expected to grow at a slow rate on account of the saturation of more prominent domestic fashion brands. There have been growing concerns from animal rights organizations such as PETA, WWF, and others, resulting in growth restraints in the leather market. The demand for synthetic leather goods in the region has increased.

The European market witnessed significant growth owing to the flourishing automobile and consumer appliances sectors in the region. Amid the global crisis, governments in the region are focusing on bio-based, low-cost, and long-lasting products. This factor is expected to fuel the market growth for synthetic leather in this region.

Key Companies & Market Share Insights

Some of the key players operating in the market include Teijin Limited and Alfatex Italia SRL.

-

In April 2023, General Silicones Co., Ltd. Launched new vegan silicone leather product series under Compo-SiL brand name. This series will be used to manufacture shoes, belts, bags, covers, and book bindings.

-

Teijin Limited is one of the leading manufacturers of synthetic fiber in Japan and operates through 150 subsidiaries and affiliates across the globe. The company provides a range of services and products in the fields of information and electronics, safety and protection, environment and energy, and healthcare. It operates in two business segments, namely materials and healthcare. The materials business segment includes advanced fibers and composites, and electronics materials & performance polymer products.

-

Alfatex Italia SRL is primarily engaged in manufacturing upholstered furniture and also provides leather, bonding fabrics, artificial leather, velvet, and webbing. It is also engaged in manufacturing laminated, and vinyl coated fabrics. The various application needs served by the company’s leathers include residential, marine, and automotive upholstered furniture, iron boards, safety shoes, helmets, carpets, and other indoor furniture.

Key synthetic leather Companies:

The following are the leading companies in the synthetic leather market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these synthetic leather companies are analyzed to map the supply network.

- Kuraray Co., Ltd.

- H.R. Polycoats Pvt. Ltd.

- Alfatex Italia SRL

- Filwel Co., Ltd.

- Yantai Wanhua Synthetic Leather Group Co., Ltd.

- San Fang Chemical Industry Co., Ltd.

- Mayur Uniquoters Limited

- Teijin Limited

- Nan Ya Plastics Corporation.

Recent Developments

-

In April 2023, General Silicones Co., Ltd., a Taiwan-based silicone products manufacturer, announced the launch of vegan synthetic leather, namely Compo-SiL (SL series). This series is designed for business who are manufacturers of bags, wallets, backpacks, and shoes and are seeking vegan leather supplies.

-

In July 2022, Sage Automotive Interiors, a China-based synthetic leather supplier, announced the launch of innovative silicone synthetic leather for automotive applications. The company has commenced manufacturing the synthetic leather in Shanghai, China. The increasing consumer demand for sustainable products has influenced the company to deliver silicone synthetic leather as an innovative, petroleum-free, non-carbon-based solution for today’s automotive interiors.

Synthetic Leather Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.05 million

Revenue forecast in 2030

USD 66.24 million

Growth rate

CAGR of 7.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; Norway; Turkey: China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Kuraray Co., Ltd.; H.R. Polycoats Pvt. Ltd.; Alfatex Italia SRL; Filwel Co., Ltd.; Yantai Wanhua Synthetic Leather Group Co., Ltd.; San Fang Chemical Industry Co., Ltd.; Mayur Uniquoters Limited; Teijin Limited; Nan Ya Plastics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Leather Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Synthetic Leather market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PU Synthetic Leather

-

PVC Synthetic Leather

-

Bio-based Leather

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Furnishing

-

Chairs

-

Sofas

-

Other Furnishing

-

-

Automotive

-

Seats

-

Interior Furnishings

-

-

Footwear

-

Sports Shoes

-

Formal Shoes

-

-

Wallets, bags & purses

-

Wallets

-

Bags

-

Purses

-

-

Clothing

-

Jackets

-

Belts

-

Other Clothing

-

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Netherlands

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global synthetic leather market size was estimated at USD 38.98 billion in 2023 and is expected to reach USD 42.05 billion in 2024.

b. The global synthetic leather market is expected to witness a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 66.24 billion by 2030.

b. The PU synthetic leather segment led the global synthetic leather market and accounting for the largest revenue share of more than 60.8% in 2023.

b. The footwear segment led the global synthetic leather market and accounted for the highest revenue share of more than 33.2% in 2023.

b. Key factors that are driving the synthetic leather market growth include rising applications across furnishing, automotive, clothing, bags, and also artificial alternatives leather can also be used in marine furnishing as it is saltwater resistant is better comparatively.

b. Asia Pacific held the largest share of 44.2% in 2023 owing to rising per capita income in emerging economies, expanding middle-class population, and improving standards of living. Moreover, the rapid development of the construction and automotive manufacturing industries is also supplementing the product demand in the regional market.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Types & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Snapshot, 2023

2.2. Segment Snapshot, 2023

2.3. Competitive Landscape Snapshot

Chapter 3. Synthetic Leather Market Variables, Trends & Scope

3.1. Global Leather Market Outlook

3.2. Industry Value Chain Analysis

3.3. Regulatory Framework

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Opportunity Analysis

3.4.4. Industry Challenges Analysis

3.5. Porter’s Five Forces Analysis

3.5.1. Supplier Power

3.5.2. Buyer Power

3.5.3. Substitution Threat

3.5.4. Threat from New Entrant

3.5.5. Competitive Rivalry

3.6. PESTEL Analysis

3.6.1. Political Landscape

3.6.2. Economic Landscape

3.6.3. Social Landscape

3.6.4. Technological Landscape

3.6.5. Environmental Landscape

3.6.6. Legal Landscape

3.7. East European Geopolitical Implication of the Industry Overview

Chapter 4. Synthetic Leather Market: Type Outlook Estimates & Forecasts

4.1. Synthetic Leather Market: Type Movement Analysis, 2023 & 2030

4.2. Polyurethane (PU)

4.2.1. Synthetic Leather market estimates and forecast, by Polyurethane (PU), 2018 - 2030 (Kilotons) (USD Million)

4.3. Polyvinyl Chloride (PVC)

4.3.1. Synthetic Leather market estimates and forecast, by Polyvinyl Chloride (PVC), 2018 - 2030 (Kilotons) (USD Million)

4.4. Bio-based

4.4.1. Synthetic Leather market estimates and forecast, by Bio-based, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Synthetic Leather Market: Application Outlook Estimates & Forecasts

5.1. Synthetic Leather Market: Application Movement Analysis, 2023 & 2030

5.2. Furnishing

5.2.1. Synthetic Leather market estimates and forecast, by Furnishing, 2018 - 2030 (Kilotons) (USD Million)

5.3. Automotive

5.3.1. Synthetic Leather market estimates and forecast, by Automotive, 2018 - 2030 (Kilotons) (USD Million)

5.4. Footwear

5.4.1. Synthetic Leather market estimates and forecast, by Footwear, 2018 - 2030 (Kilotons) (USD Million)

5.5. Wallets, Bags & Purses

5.5.1. Synthetic Leather market estimates and forecast, by wallets, bags & purses, 2018 - 2030 (Kilotons) (USD Million)

5.6. Others

5.6.1. Synthetic Leather market estimates and forecast, by wallets, bags & purses, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Synthetic Leather Market Regional Outlook Estimates & Forecasts

6.1. Regional Movement Analysis & Market Share, 2023 & 2030

6.2. Synthetic Leather Market: Regional Movement Analysis, 2023 & 2030

6.3. North America

6.3.1. North America Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.3.2. North America Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.3.3. North America Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.4. U.S.

6.3.4.1. U.S. Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.3.4.2. U.S. Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.3.4.3. U.S. Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.5. Canada

6.3.5.1. Canada Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.3.5.2. Canada Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.3.5.3. Canada Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.3.6. Mexico

6.3.6.1. Mexico Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.3.6.2. Mexico Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.3.6.3. Mexico Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4. Europe

6.4.1. Europe Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.2. Europe Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.3. Europe Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.4. Germany

6.4.4.1. Germany Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.2. Germany Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.3. Germany Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.5. France

6.4.5.1. France Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.2. France Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.3. France Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.6. UK

6.4.6.1. UK Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.2. UK Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.3. UK Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.7. Italy

6.4.7.1. Italy Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.7.2. Italy Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.7.3. Italy Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.8. France

6.4.8.1. France Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.8.2. France Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.8.3. France Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.9. Spain

6.4.9.1. Spain Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.9.2. Spain Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.9.3. Spain Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.10. Netherlands

6.4.10.1. Netherlands Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.10.2. Netherlands Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.10.3. Netherlands Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.4.11. Turkey

6.4.11.1. Turkey Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.4.11.2. Turkey Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.4.11.3. Turkey Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5. Asia Pacific

6.5.1. Asia Pacific Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.2. Asia Pacific Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.3. Asia Pacific Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.4. China

6.5.4.1. China Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.2. China Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.3. China Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.5. India

6.5.5.1. India Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.2. India Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.3. India Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.6. Japan

6.5.6.1. Japan Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.6.2. Japan Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.6.3. Japan Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.7. South Korea

6.5.7.1. South Korea Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.7.2. South Korea Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.7.3. South Korea Market estimates and forecast, by end-use, 2018 - 2030 (Kilotons) (USD Million)

6.5.8. Malaysia

6.5.8.1. Malaysia Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.8.2. Malaysia Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.8.3. Malaysia Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.9. Thailand

6.5.9.1. Thailand Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.9.2. Thailand Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.9.3. Thailand Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.10. Indonesia

6.5.10.1. Indonesia Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.10.2. Indonesia Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.10.3. Indonesia Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.11. Vietnam

6.5.11.1. Vietnam Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.11.2. Vietnam Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.11.3. Vietnam Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.5.12. Australia

6.5.12.1. Australia Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.5.12.2. Australia Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.5.12.3. Australia Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6. Central & South America

6.6.1. Central & South America Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.6.2. Central & South America Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.6.3. Central & South America Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.4. Brazil

6.6.4.1. Brazil Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.2. Brazil Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.3. Brazil Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.6.5. Argentina

6.6.5.1. Argentina Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.6.5.2. Argentina Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.6.5.3. Argentina Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.7. Middle East & Africa

6.7.1. Middle East & Africa Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.7.2. Middle East & Africa Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.7.3. Middle East & Africa Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.7.4. Saudi Arabia

6.7.4.1. Saudi Arabia Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.7.4.2. Saudi Arabia Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.7.4.3. Saudi Arabia Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.7.5. United Arab Emirates (UAE)

6.7.5.1. United Arab Emirates (UAE) Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.7.5.2. United Arab Emirates (UAE) Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.7.5.3. United Arab Emirates (UAE) Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

6.7.6. South Africa

6.7.6.1. South Africa Market estimates and forecast, 2018 - 2030 (Kilotons) (USD Million)

6.7.6.2. South Africa Market estimates and forecast, by Type, 2018 - 2030 (Kilotons) (USD Million)

6.7.6.3. South Africa Market estimates and forecast, by application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company Categorization

7.3. Company Market Share/Position Analysis, 2023

7.4. Company Heat Map Analysis

7.5. Strategy Mapping

7.5.1. Expansion

7.5.2. Mergers & Acquisition

7.5.3. Partnerships & Collaborations

7.5.4. New Application Launches

7.5.5. Research And Development

7.6. Company Profiles

7.6.1. Kuraray Co., Ltd.

7.6.1.1. Participant’s overview

7.6.1.2. Financial performance

7.6.1.3. Application benchmarking

7.6.1.4. Recent developments

7.6.2. H.R. Polycoats Pvt. Ltd.

7.6.2.1. Participant’s overview

7.6.2.2. Financial performance

7.6.2.3. Application benchmarking

7.6.2.4. Recent developments

7.6.3. Alfatex Italia Srl

7.6.3.1. Participant’s overview

7.6.3.2. Financial performance

7.6.3.3. Application benchmarking

7.6.3.4. Recent developments

7.6.4. Filwel Co., Ltd.

7.6.4.1. Participant’s overview

7.6.4.2. Financial performance

7.6.4.3. Application benchmarking

7.6.4.4. Recent developments

7.6.5. Yantai Wanhua Synthetic Leather Group Co., Ltd.

7.6.5.1. Participant’s overview

7.6.5.2. Financial performance

7.6.5.3. Application benchmarking

7.6.5.4. Recent developments

7.6.6. San Fang Chemical Industry Co., Ltd.

7.6.6.1. Participant’s overview

7.6.6.2. Financial performance

7.6.6.3. Application benchmarking

7.6.6.4. Recent developments

7.6.7. Mayur Uniquoters Limited

7.6.7.1. Participant’s overview

7.6.7.2. Financial performance

7.6.7.3. Application benchmarking

7.6.7.4. Recent developments

7.6.8. Nan Ya Plastics Corporation

7.6.8.1. Participant’s overview

7.6.8.2. Financial performance

7.6.8.3. Application benchmarking

7.6.8.4. Recent developments

7.6.9. Zhejiang Hexin Industry Group Co., Ltd.

7.6.9.1. Participant’s overview

7.6.9.2. Financial performance

7.6.9.3. Application benchmarking

7.6.9.4. Recent developments

7.6.10. TEIJIN LIMITED

7.6.10.1. Participant’s overview

7.6.10.2. Financial performance

7.6.10.3. Application benchmarking

7.6.10.4. Recent developments

List of Tables

Table 1 Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 2 Synthetic Leather Market estimates and forecasts, by Polyurethane (PU), 2018 - 2030 (Kilotons) (USD Million)

Table 3 Synthetic Leather Market estimates and forecasts, by Polyvinyl Chloride (PVC), 2018 - 2030 (Kilotons) (USD Million)

Table 4 Synthetic Leather Market estimates and forecasts, by Bio-based, 2018 - 2030 (Kilotons) (USD Million)

Table 5 Synthetic Leather Market estimates and forecasts, by Furnishing, 2018 - 2030 (Kilotons) (USD Million)

Table 6 Synthetic Leather Market estimates and forecasts, by Automotive, 2018 - 2030 (Kilotons) (USD Million)

Table 7 Synthetic Leather Market estimates and forecasts, in Footwear, 2018 - 2030 (Kilotons) (USD Million)

Table 8 Synthetic Leather Market estimates and forecasts, in Wallets, bags & purses, 2018 - 2030 (Kilotons) (USD Million)

Table 9 North America Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 10 North America Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 11 North America Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 12 U.S. Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 13 U.S. Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 14 U.S. Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 15 Canada Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 16 Canada Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 17 Canada Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 18 Mexico Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 19 Mexico Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 20 Mexico Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 21 Europe Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 22 Europe Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 23 Europe Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 24 Germany Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 25 Germany Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 26 Germany Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 27 UK Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 28 UK Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 29 UK Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 30 France Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 31 France Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 32 France Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 33 Italy Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 34 Italy Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 35 Italy Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 36 Spain Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 37 Spain Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 38 Spain Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 39 Netherlands Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 40 Netherlands Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 41 Netherlands Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 42 Turkey Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 43 Turkey Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 44 Turkey Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 45 Asia Pacific Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 46 Asia Pacific Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 47 Asia Pacific Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 48 China Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 49 China Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 50 China Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 51 India Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 52 India Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 53 India Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 54 Japan Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 55 Japan Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 56 Japan Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 57 South Korea Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 58 South Korea Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 59 South Korea Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 60 Singapore Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 61 Singapore Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 62 Singapore Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 63 Malaysia Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 64 Malaysia Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 65 Malaysia Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 66 Thailand Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 67 Thailand Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 68 Thailand Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 69 Vietnam Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 70 Vietnam Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 71 Vietnam Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 72 Indonesia Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 73 Indonesia Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 74 Indonesia Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 75 Australia Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 76 Australia Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 77 Australia Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 78 Central & South America Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 79 Central & South America Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 80 Central & South America Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 81 Brazil Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 82 Brazil Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 83 Brazil Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 84 Argentina Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 85 Argentina Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 86 Argentina Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 87 Middle East & Africa Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 88 Middle East & Africa Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 89 Middle East & Africa Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 90 Saudi Arabia Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 91 Saudi Arabia Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 92 Saudi Arabia Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 93 United Arab Emirates (UAE) Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 94 United Arab Emirates (UAE) Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 95 United Arab Emirates (UAE) Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

Table 96 South Africa Synthetic Leather Market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 97 Argentina Synthetic Leather Market estimates and forecasts, by Type, 2018 - 2030 (Kilotons) (USD Million)

Table 98 South Africa Synthetic Leather Market estimates and forecasts, by application, 2018 - 2030 (Kilotons) (USD Million)

List of Figures

Fig. 1 Market segmentation

Fig. 2 Information procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market snapshot, 2023 (USD Million)

Fig. 6 Segmental outlook- Type, application, and application (2023, USD Million)

Fig. 7 Competitive outlook

Fig. 8 Synthetic Leather Market, 2018-2030 (Kilotons) (USD Million)

Fig. 9 Value chain analysis

Fig. 10 Market dynamics

Fig. 11 Porter’s Analysis

Fig. 12 PESTEL Analysis

Fig. 13 Synthetic Leather Market, by Type: Key takeaways

Fig. 14 Synthetic Leather Market, by Type: Market share, 2023 & 2030

Fig. 15 Synthetic Leather Market, by application: Key takeaways

Fig. 16 Synthetic Leather Market, by application: Market share, 2023 & 2030

Fig. 17 Synthetic Leather Market, by end-use: Key takeaways

Fig. 18 Synthetic Leather Market, by end-use: Market share, 2023 & 2030

Fig. 19 Synthetic Leather Market, by region: Key takeaways

Fig. 20 Synthetic Leather Market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Synthetic Leather Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Synthetic Leather Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Other Applications

- Furnishing

- Synthetic Leather Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- North America Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Other Applications

- Furnishing

- U.S.

- U.S. Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- U.S. Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- U.S. Synthetic Leather Market, By Type

- Canada

- Canada Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Canada Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Canada Synthetic Leather Market, By Type

- Mexico

- Mexico Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Mexico Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Mexico Synthetic Leather Market, By Type

- North America Synthetic Leather Market, By Type

- Europe

- Europe Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Europe Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Germany

- Germany Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Germany Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Germany Synthetic Leather Market, By Type

- France

- France Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- France Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- France Synthetic Leather Market, By Type

- UK

- UK Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- UK Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- UK Synthetic Leather Market, By Type

- Spain

- Spain Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Spain Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Spain Synthetic Leather Market, By Type

- Netherlands

- Netherlands Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Netherlands Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Netherlands Synthetic Leather Market, By Type

- Turkey

- Turkey Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Turkey Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Turkey Synthetic Leather Market, By Type

- Europe Synthetic Leather Market, By Type

- Asia Pacific

- Asia Pacific Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Asia Pacific Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- China

- China Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- China Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- China Synthetic Leather Market, By Type

- India

- India Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- India Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- India Synthetic Leather Market, By Type

- Japan

- Japan Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Japan Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Japan Synthetic Leather Market, By Type

- South Korea

- South Korea Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- South Korea Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- South Korea Synthetic Leather Market, By Type

- Malaysia

- Malaysia Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Others

- Malaysia Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Malaysia Synthetic Leather Market, By Type

- Thailand

- Thailand Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Others

- Thailand Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Thailand Synthetic Leather Market, By Type

- Indonesia

- Indonesia Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Indonesia Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Indonesia Synthetic Leather Market, By Type

- Australia

- Australia Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Australia Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Australia Synthetic Leather Market, By Type

- Asia Pacific Synthetic Leather Market, By Type

- Central & South America

- Central & South America Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Central & South America Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Brazil

- Brazil Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Brazil Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Brazil Synthetic Leather Market, By Type

- Argentina

- Argentina Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Argentina Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Furnishing

- Other Clothing

- Argentina Synthetic Leather Market, By Type

- Central & South America Synthetic Leather Market, By Type

- Middle East & Africa

- Middle East & Africa Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Middle East & Africa Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- Saudi Arabia

- Saudi Arabia Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- Saudi Arabia Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Furnishing

- Other Clothing

- Saudi Arabia Synthetic Leather Market, By Type

- United Arab Emirates (UAE)

- United Arab Emirates (UAE) Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- United Arab Emirates (UAE) Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- United Arab Emirates (UAE) Synthetic Leather Market, By Type

- South Africa

- South Africa Synthetic Leather Market, By Type

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Bio-based

- South Africa Synthetic Leather Market, By Application

- Furnishing

- Chairs

- Sofas

- Other Furnishing

- Automotive

- Seats

- Interior Furnishings

- Footwear

- Sports Shoes

- Formal Shoes

- Wallets, bags & purses

- Wallets

- Bags

- Purses

- Clothing

- Jackets

- Belts

- Other Clothing

- Furnishing

- South Africa Synthetic Leather Market, By Type

- Middle East & Africa Synthetic Leather Market, By Type

- North America

Synthetic Leather Market Dynamics

Drivers: Growing Demand for Footwear Sector

The footwear industry has witnessed significant growth in recent years owing to the rising demand from emerging markets, as consumer spending in the U.S. and some countries in Europe has slowed down slightly owing to the global recession. There has been a strong demand from countries such as China, India, South Korea, Vietnam, Thailand, and other South Asian countries. This is expected to have a major influence on synthetic leather demand in the Asian market. Increasing investment by foreign players will further propel industry penetration in emerging economies shortly. Luxury brands have been among the first to respond to global consumer spending shifts. In 2016, brands like Prada opened 27 new stores in Asia Pacific, which amounts to approximately 35% of the total number of stores of the brand. Such initiatives are expected to play a crucial role in improving the market penetration of synthetic leather brands over the next few years.

Viable Alternative to Natural Leather

Natural leather is obtained mostly by animal killing and various guidelines and laws are newly established by countries to protect animal rights. This has become a major hurdle for natural leather manufacturers in several countries. Growing awareness among consumers regarding animal exploitation, aided by programs run by organizations such as PETA, plays a major role in increasing the demand for leather alternatives. The growing supply-demand gap in the natural leather industry is majorly responsible for manufacturers opting for synthetic leather. Another major driving factor is its cheaper manufacturing cost. The cost of production of synthetic leather is less than that of natural leather and has an easier manufacturing process. This leads to increased investment in synthetic leather and helps improve overall market penetration. Manufacturing activities of natural leather, especially tanning, lead to pollution which is another major reason leading to the shift in preference toward synthetic leather. Stringent environmental laws and government regulations have been influential in promoting the demand for synthetic leather.

Restraints: Damaging Effects of PVC and PU

PVC is derived from plastic sources and contains carcinogens and other toxic chemicals that can transfer to the user’s skin through contact. Furthermore, PVC has a very slow rate of biodegradation and therefore harms the environment. Similar toxicity concerns do not apply to PU, as it is only toxic during its production and, once dried and sealed, does not represent a threat as with PVC. The production of PU fabrics can be toxic for factory workers, as it releases harmful chemicals. The production process involves the use of solvents mostly used for painting polyurethane in liquid form on a fabric backing. Solvents required in this process are highly toxic. However, new polyurethane versions use waterborne coatings, which do not have the same kind of damaging impact on the environment as exhibited by other grades. This is expected to be a key aspect in terms of overall product development and sustainability. In addition, synthetic leather made from PU or PVC cannot be remade into leather products, as it does not recycle very well and cannot be reused when it is worn out.

What Does This Report Include?

This section will provide insights into the contents included in this synthetic leather market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Synthetic leather market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Synthetic leather market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the synthetic leather market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for synthetic leather market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of synthetic leather market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Synthetic Leather Market Categorization:

The synthetic leather market was categorized into three segments, namely type (PU Synthetic Leather, PVC Synthetic Leather, Bio-based Leather), application (Furnishing, Automotive, Footwear, Wallets, Bags & Purses, Clothing), region (North America, Europe, Asia Pacific, Central & South America, Middle East and Africa).

Segment Market Methodology:

The synthetic leather market was segmented into type, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The synthetic leather market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Central & South America, Middle East and Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; Mexico; Germany; France; the UK; Italy; Spain; Netherlands; Norway; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Synthetic leather market companies & financials:

The synthetic leather market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Kuraray Co., Ltd. - Kuraray Co., Ltd. was established in the year 1926 and is headquartered in Tokyo, Japan. It is a producer and supplier of plastics, fabric, manmade leather, nonwoven fabric, hook and loop fasteners, chemicals, elastomers, and rubber. It operates through six business segments, namely isoprene, vinyl acetate, functional materials, fibers & textiles, and others. The company offers engineering, design, construction, and maintenance services for manufacturing facilities in the chemicals, pharmaceuticals, electronics materials, and food processing sectors. It also offers resin-based dental materials, dental adhesives, and cement to bond dental structures. The company has laboratories and production & sales facilities in 27 countries worldwide. Geographically, the company classifies its operations into six regions, namely Japan, the U.S., China, Europe, Asia, and other areas.

-

H.R. Polycoats Pvt. Ltd. - H.R. Polycoats Pvt. Ltd. was established in the year 1995 and is based in Haryana, India. Major application sectors served by the company include automotive, leather goods, furnishing, and footwear. Artificial leather produced by the company is used to manufacture various products such as automotive interiors, shoes, furniture, handbags, laptop bags, wallets, mobile covers, and eyewear cases. The company offers a wide range of services including in-house designing, manufacturing, quality control, inspection, and aftersales services of artificial leather. It owns several test facilities equipped with pilot lab coater, hydrometer, spectrophotometer, pigment grind meter, spectra color vision light box, oven, and Brookfield viscometer.

-

Alfatex Italia SRL - Alfatex Italia SRL was founded in 1989 and is headquartered in Matera, Italy. The company is primarily engaged in manufacturing upholstered furniture and also provides leather, bonding fabrics, artificial leather, velvet, and webbings. It is also engaged in manufacturing laminated and vinyl coated fabrics. The various application needs served by the company’s leathers include residential, marine, and automotive upholstered furniture, iron boards, safety shoes, helmets, carpets, and other indoor furniture. It provides an extensive range of artificial leather for application in automotive, marine, residential, healthcare, and footwear industries. The company has in-house facilities of research & development, paints & coatings, printing, flame, adhesive, embossing, and other manufacturing processes. The main production sites of the company are situated at Santeramo and Matera in Italy.

-

Filwel Co., Ltd. - Filwel Co., Ltd. was founded in 2004 as a result of acquiring all the “bellace” businesses of Kanebo, Ltd. Filwel Co., Ltd. is headquartered in Hofu, Japan, with additional offices in Tokyo and Osaka, and is primarily involved in the manufacturing and marketing artificial leather goods and precision polishing pads. The precision polishing pad products are made using polyurethane material, and are of non-woven or suede type, sold under the brand name of Bellatrix. The precision polishing pads of the company are used in various applications including semiconductor material, silicon wafers, precision glasses, and hard memory disks. The artificial or synthetic leather products are manufactured using textile and high polymer technology, under different brand names such as Bellace, Belluria, Air Cool, Selsione, Patora, and Belesa. The artificial leather products find applications in briefcases, shoes, bags, belts, wallets, and other men/women accessories. The company serves its customers in Japan and all over the globe through its manufacturing facility in Hofu, Japan.

-