- Home

- »

- Advanced Interior Materials

- »

-

Synthetic Quartz Market Size, Share & Trends Report, 2030GVR Report cover

![Synthetic Quartz Market Size, Share & Trends Report]()

Synthetic Quartz Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Crystal, Glass), By Application (Electronics & Electrical, Automotive, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-331-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Quartz Market Size & Trends

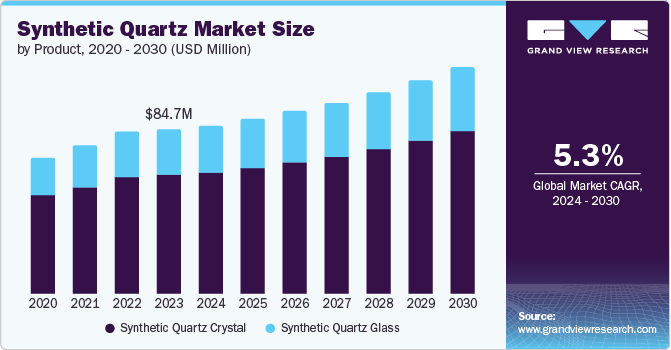

The global synthetic quartz market size was estimated at USD 84.67 million in 2023 and is estimated to grow at a CAGR of 5.3% from 2024 to 2030.The growing production of electronic devices amidst technological advancements is propelling the demand for synthetic quartz. Synthetic crystals are composed of silicon dioxide. They offer exceptional stability and precision in electronic devices such as sensors, filters, and oscillators. They are widely used in optoelectronics, electronics, instrument and radio engineering, and precision optical components production, among others. Rising advancements in 5G technology and IoT present lucrative growth opportunities for the market to flourish.

The high durability performance of synthetic quartz crystals makes them applicable in optical devices for steppers in semiconductor manufacturing. As a result, growth in semiconductor manufacturing is anticipated to be one of the key drivers for the market. As per Semiconductor Manufacturing Association, the U.S. chip manufacturing capacity is expected to triple by 2032. This indicates positivity after the U.S. president signed the CHIPS and Scient Act into law.

Further, the solar industry is anticipated to provide lucrative opportunities for the market. In May 2024, a technological breakthrough was published in a study, where scientists in their new proof-of-concept technology used synthetic quartz crystal for trapping solar energy at temperatures over 1000°C. This demonstrates the potential of using green energy to run processes for some carbon-intensive industries such as chemicals, metal, glass, and cement.

Price fluctuations is one of the key restraints faced by the market players. For instance, as per the Q2 2024 performance report of KDS Daishinku Corp., a producer of synthetic quartz, the company’s operating profit declined by 67.9% on y-o-y basis. This decrease was attributed to the price fluctuations and changes in the volumes and product mix.

Product Type Insights & Trends

“Synthetic Quartz Crystals held the largest revenue share in 2023.”

These are produced using natural crystals and recrystallized into a high-purity product with fewer impurities. They provide resistance to acid, corrosion, high temperature, compression, infiltration, and compression. They are also used in optical components and quartz crystal devices, among other applications.

Initially, the quartz crystal devices utilized natural quartz, and to address issues such as impurities, uneven size, and low quality, synthetic quartz crystals were developed. Upon being produced under high temperature and pressure these crystals are incorporated into electronic components. A quartz device construction undergoes the following steps; processing of the wafer of quartz, frequency adjustment and cleaning, and forming electrodes.

Application Insights & Trends

“Electrical & Electronics held the largest revenue share of 76% in 2023.”

The exceptional physical and chemical properties of synthetic quartz make it very useful in the electrical and electronics industry. Its applications range from clocks and communication equipment to computers and digital cameras. Vehicle communication networks and cellular base stations also utilize synthetic quartz.

Growth in the semiconductor industry is anticipated to augment electronics segment growth over the forecast period. For instance, in February 2024, the New York Governor celebrated an investment of USD 11.6 billion by GlobalFoundries in expanding a semiconductor manufacturing plant in Saratoga County. This investment will be spent over a 10-year period expanding the existing site and building a new 358,000-square-foot facility.

Automotive vehicles are another vital end-user of synthetic quartz, which is used in displays, sensors, and other components. The new era of the automotive industry, with special emphasis on safety and connectivity systems, is expected to augment market growth. Electric vehicle sales surpassed 14 million units in 2023, registering more than 34% growth on a year-over-year basis. Thus, growth in the auto industry is anticipated to prove beneficial for market growth.

Regional Insights

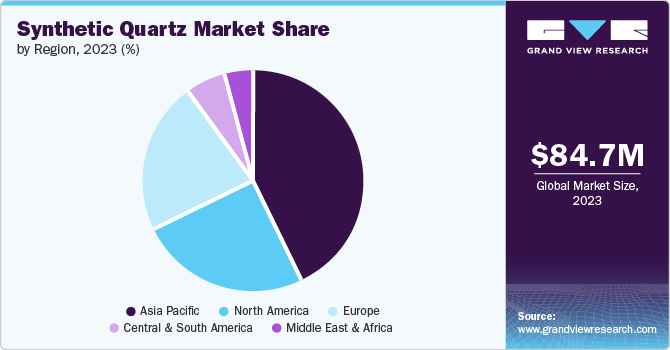

“China held over 52% revenue share of the overall Asia Pacific synthetic quartz market.”

The synthetic quartz market of North America is showcasing considerable growth rate. The growth in electronics industry, coupled with the investments in the automotive sector, is anticipated to benefit market growth over the forecast period. For instance, in February 2024, TT Electronics opened a new manufacturing facility in Mexicali, Mexico, adding capacity and electronics manufacturing solutions capabilities.

Asia Pacific Synthetic Quartz Market Trends

Asia Pacific synthetic quartz marketdominated the industry, accounting for over 43.0% of the global market's revenue share in 2023. Rising electronics production in the region is propelling product demand. For instance, according to JEITA, after a dip in 2023, the production of global electronics and IT industries is expected to grow by over 9% in 2024. The segments of the industries, communication equipment, computers & information terminals, and other electronic equipment are forecasted to register a growth of 4%, 6%, and 6%, respectively.

The synthetic quartz market of China is anticipated to register high growth over the forecast period amidst growing electronics industry. For instance, according to the Ministry of Industry and Information Technology, combined profits of major electronics manufacturers in the country rose by 75.8% on a y-o-y basis, reaching ~USD 20 billion for the first four months of 2024.

Europe Synthetic Quartz Market Trends

Europe synthetic quartz market is anticipated to grow at a sluggish pace, considering the economic scenario. However, growth in automotive industry is expected to keep the momentum. In 2023, the vehicle production in Europe rose by 11.8%, and the EV registrations increased by 17% compared to 2022.

Key Synthetic Quartz Company Insights

Some of the key players operating in the market include Epson, NDK, and Siward Crystal Technology Co. Ltd.

-

Seiko Epson Corporation was founded in May 1942 with headquarters in Nagano, Japan. The company is engaged in development, production, sales, and providing services for products used in the following segments: manufacturing-related and wearables, visual communications, printing solutions, and others. It generated USD 8,682.71 million revenue in FY 2023-24 and employed over 74,400 personnel.

-

NIHON DEMPA KOGYO CO., LTD was founded in April 1948 and is headquartered in Tokyo, Japan. As of March 31, 2024 the group has 2,366 employees and generated a revenue of ~USD 311.6 million. The company is engaged in manufacturing and sales of crystal-related products including crystal devices, synthetic quartz, crystal blank, and ultrasonic transducers.

Key Synthetic Quartz Companies:

The following are the leading companies in the synthetic quartz market. These companies collectively hold the largest market share and dictate industry trends.

- AGC

- CoorsTek

- Daishinku Corporation (KDS)

- Heraeus Group

- Murata Manufacturing Co., Ltd.

- NIHON DEMPA KOGYO CO., LTD

- Seiko Epson Corporation

- Shin-Etsu Chemical Co., Ltd.

- Siward Crystal Technology Co. Ltd.

- Universal Quartz Inc.

Recent Developments

-

In June 2024, Nokia acquired Infinera for USD 2.3, with an aim to expand its optical networking business.

-

In May 2024, Polaris Semiconductor announced plans to expand its manufacturing facility in Minnesota, U.S. The company is expected to invest USD 525 million over a period of 2 years and this is expected to be supported by Minnesota State Incentives and Potential Federal Funding from the CHIPS and Science Act

Synthetic Quartz Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 87.97 million

Revenue forecast in 2030

USD 120.02 million

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; China; India; South Korea; Brazil

Key companies profiled

AGC; CoorsTek; KDS; Heraeus Group; Murata Manufacturing Co., Ltd.; NIHON DEMPA KOGYO CO., LTD.; Seiko Epson Corporation; Shin-Etsu Chemical Co., Ltd.; Siward Crystal Technology Co. Ltd.; Universal Quartz Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Quartz Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global synthetic quartz market report on the basis of product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Synthetic Quartz Crystal

-

Synthetic Quartz Glass

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

Electrical & Electronics

-

Automotive

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global synthetic quartz market size was estimated at USD 84.67 million in 2023 and is expected to reach USD 87.97 million in 2024.

b. The global synthetic quartz market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 120.02 million by 2030.

b. By application, electrical & electronics dominated the market with a revenue share of over 76.0% in 2023.

b. Some of the key vendors of the global synthetic quartz market are Shin-Etsu, EPSON, KDS, NDK, Murata Manufacturing, and Siwata Crystal Technology, among others.

b. The growing investments towards expansion of electronics production is the major growth driver for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.