- Home

- »

- IT Services & Applications

- »

-

System Integrators Market Size, Share & Trends Report 2030GVR Report cover

![System Integrators Market Size, Share & Trends Report]()

System Integrators Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Hardware, Software), By Enterprise Size (SMEs, Large Enterprise), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-456-9

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

System Integrators Market Summary

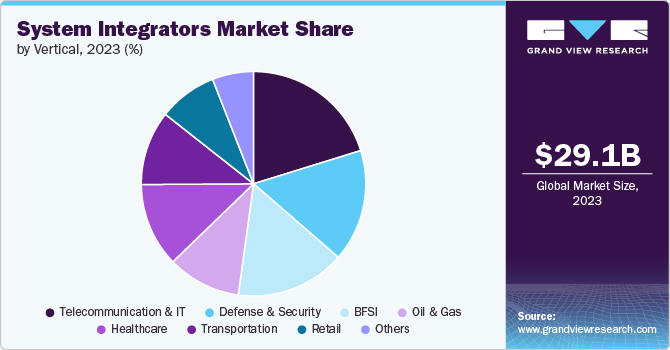

The Global System Integrators Market size was estimated at USD 29.10 billion in 2023 and is projected to reach USD 48.71 billion by 2030, growing at a CAGR of 8.2% from 2024 to 2030. The market is witnessing significant growth driven by several key factors.

Key Market Trends & Insights

- North America held a market share of over 38% in 2023.

- The system integrators market in the U.S. is growing significantly at a CAGR of 8.1% from 2024 to 2030.

- Based on type, hardware segment accounted for the largest market share of over 41% in 2023.

- Based on enterprise size, the large enterprise segment accounted for the largest market share of over 58% in 2023.

- Based on vertical, the IT & telecom segment accounted for the largest market share of over 20% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 29.10 Million

- 2030 Projected Market Size: USD 48.71 Billion

- CAGR (2024-2030): 8.2%

- North America: Largest market in 2023

The rise of digital transformation initiatives across industries is a major catalyst as businesses increasingly seek to streamline operations, enhance connectivity, and improve efficiency through integrated technology solutions. The growing demand for IoT, AI, and cloud-based services is pushing companies to partner with system integrators to manage complex deployments and integrations of new technologies with legacy systems. Major industries, including manufacturing, healthcare, BFSI, and automotive, are increasingly relying on system integrators for automation, data management, and cybersecurity needs, driving market expansion. Governments and enterprises globally are also investing heavily in smart city projects, digital infrastructure, and industry 4.0 initiatives. Thus, these factors are significantly contributing to market growth.

Further, the increasing adoption of AI-powered analytics, edge computing, and 5G connectivity is transforming industries by enabling real-time data processing, predictive maintenance, and enhanced automation capabilities. System integrators are crucial in integrating these advanced technologies to meet the growing demand for data-driven decision-making and advanced security solutions. Moreover, the shift towards cloud-native solutions and hybrid IT environments is reshaping system integration services, with integrators focusing on delivering scalable, flexible, and cost-effective solutions across cloud and on-premise infrastructures.

The increasing complexity of multi-vendor environments and the need for seamless interoperability across diverse technology stacks further drive the demand for system integration services among businesses. System integrators are uniquely positioned to offer comprehensive solutions by bridging gaps between disparate systems, ensuring data flows and processes remain synchronized. Further, the focus on customized solutions tailored to specific business needs is gaining momentum, particularly in sectors such as healthcare, where integration of electronic health records (EHRs), telemedicine platforms, and AI diagnostics require specialized expertise. Thus, in the evolving business landscape, the role of system integrators as strategic partners rather than just service providers is becoming more pronounced.

Businesses across the world are increasingly prioritizing cybersecurity and data privacy in their integration projects, especially considering stricter global regulations such as GDPR and CCPA. System integrators offering specialized services in compliance management and cybersecurity integration will likely see increased demand. The global scenario is also marked by significant growth in Asia Pacific and the Middle East, driven by government initiatives and growing IT infrastructure investments. In addition, the rise of managed services and long-term strategic partnerships with enterprises seeking continuous support for evolving technologies is creating sustained opportunities for system integrators globally.

Type Insights

Hardware accounted for the largest market share of over 41% in 2023. The hardware market segment is driven by the rising need for advanced infrastructure across various industries, including telecommunications, BFSI, healthcare, and education. As businesses shift towards more interconnected systems, the demand for robust networking hardware, servers, and data storage solutions continues to rise. With advancements in IoT, AI, and cloud computing, the requirement for specialized hardware that supports these technologies has surged. In regions like the UAE and KSA, investments in smart city initiatives are fueling the growth of hardware procurement services as governments and private sectors work to integrate more sophisticated devices and physical systems to enable automation and improve operational efficiency.

Services is expected to grow significantly during the forecast period. The market segment is experiencing significant growth due to the increasing complexity of IT systems and the shift towards digital transformation. Services such as consulting, implementation, customization, and support are crucial as organizations look to adopt cloud-based platforms, IoT solutions, and AI technologies. In regions like Qatar, driven by initiatives such as the Smart Qatar Program (TASMU), there is a heightened demand for system integration services that ensure seamless interoperability of these advanced solutions. Focusing on IT infrastructure modernization, cybersecurity, and real-time analytics also drives the need for comprehensive integration services, particularly for industries such as BFSI and healthcare.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of over 58% in 2023. The growing demand for customized, end-to-end integration solutions drives the segment's growth. Large enterprises often operate complex IT environments, requiring advanced solutions for integrating diverse technologies across multiple departments. A key trend in this segment is adopting cloud-based services, as large organizations seek to enhance agility and scalability while reducing operational costs. Cloud integration, combined with advanced analytics and AI-driven technologies, enables enterprises to automate workflows, optimize resource management, and improve decision-making. The rising complexity of digital transformation initiatives also fuels the need for expert system integrators who can manage large-scale projects involving cutting-edge technologies such as 5G, IoT, and cybersecurity.

The SMEs segment is expected to grow significantly during the forecast period. The SMEs market segment is experiencing rapid growth, driven by the increasing adoption of digital technologies among smaller businesses. A key trend in this segment is the rising demand for cost-effective integration solutions that help SMEs streamline their operations without needing significant capital investment. SMEs leverage cloud computing, AI, and automation to enhance efficiency and reduce manual processes. System integrators are crucial in helping these businesses transition to digital-first models by offering scalable solutions that align with their budget and operational needs. As SMEs increasingly adopt hybrid work models, system integrators also provide services to integrate collaboration tools and secure remote working environments.

Vertical Insights

The IT & Telecom segment accounted for the largest market share of over 20% in 2023. The IT & Telecom segment within the market is experiencing significant growth, driven primarily by the rapid digital transformation across industries and the increasing adoption of cloud-based solutions. With enterprises migrating to the cloud and enhancing their networks, the demand for system integrators to manage complex IT infrastructure and ensure seamless integration between legacy systems and modern technologies is rising. Moreover, the expansion of 5G networks and the need for robust cybersecurity measures are pushing telecom operators to partner with system integrators to streamline deployments, improve connectivity, and ensure secure network management. These trends are particularly prominent in regions with aggressive 5G rollouts, where system integrators are vital in building and maintaining next-generation networks.

The BFSI segment is expected to grow significantly during the forecast period. The increasing adoption of digital banking, fintech solutions, and blockchain technology drives the BFSI segment. System integrators are crucial for the BFSI sector as they enable the seamless integration of advanced technologies like artificial intelligence (AI), machine learning (ML), and data analytics to enhance operational efficiency and deliver personalized customer experiences. The shift towards digital banking and contactless payments, accelerated by the COVID-19 pandemic, has also increased the demand for secure, compliant integration of new technologies, pushing financial institutions to work with system integrators for smoother implementation.

Regional Insights

The system integrators market in North America held a market share of over 38% in 2023. The market is growing rapidly, driven by the increasing demand for digital transformation across industries like healthcare, manufacturing, and financial services. The region’s focus on adopting advanced technologies such as AI, machine learning, and IoT fuels the need for system integrators to connect these complex systems and ensure seamless functionality. The widespread shift to cloud computing and edge technologies further enhances opportunities for integrators, especially as organizations seek to modernize legacy systems and improve operational efficiency.

U.S. System Integrators Market Trends

The system integrators market in the U.S. is growing significantly at a CAGR of 8.1% from 2024 to 2030. The US market is benefiting from a surge in cloud adoption, automation, and digitalization across various industries, including healthcare, defense, and retail. The country's large-scale implementation of 5G and expansion of data centers are key drivers as businesses seek advanced integration solutions to leverage high-speed connectivity and efficiently manage vast amounts of data.

Asia Pacific System Integrators Market Trends

The system integrators market in Asia Pacific is growing significantly at a CAGR of 9.6% from 2024 to 2030. The market in Asia Pacific is growing rapidly, driven by the region’s fast-paced urbanization, industrial expansion, and increasing adoption of digital technologies. Countries such as China, Japan, and India invest heavily in smart city initiatives, automation, and cloud computing, creating strong demand for system integrators to manage complex infrastructure projects. The rising need for integrating IoT, AI, and data analytics in manufacturing and transportation opens new opportunities for system integrators to drive digital transformation.

Europe System Integrators Market Trends

The system integrators market in Europe is growing significantly at a CAGR of 5.9% from 2024 to 2030. The European market is witnessing strong growth, primarily driven by the region’s focus on sustainability, smart cities, and digital infrastructure development. With increased investments in renewable energy, electric vehicles, and automation, system integrators are critical in integrating smart technologies to achieve the region’s green goals. The push for Industry 4.0 across European industries further accelerates the demand for integrators, especially in manufacturing and logistics. In addition, stringent data privacy regulations, such as GDPR, provide opportunities for system integrators to help companies comply with these standards while modernizing their IT infrastructure and improving cybersecurity.

Key System Integrators Company Insights

The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key System Integrators Companies:

The following are the leading companies in the system integrator market. These companies collectively hold the largest market share and dictate industry trends.

- Jitterbit Inc.

- John Wood Group PLC

- ATS Automation Tooling Systems Inc.

- Avanceon

- JR Automation

- Tesco Controls, Inc.

- Burrow Global LLC

- Prime Controls LP

- MAVERICK Technologies LLC

- BW Design Group

Recent Developments

-

In December 2023, MDS System Integration, a subsidiary of Midis Group, acquired a majority stake in Smplid, a company specializing in digital transformation and IT solutions. This acquisition aims to strengthen MDS's digital solutions capabilities, enhance its service offerings, and expand its customer base. The partnership aligns with MDS’s strategy to lead in the digital transformation space, providing innovative and comprehensive IT solutions across various sectors.

-

In November 2023, Accenture and Workday announced the expansion of their strategic partnership, aimed at helping organizations reinvent their finance functions to become data-driven, agile, and customer-centric. By leveraging their combined expertise, the two companies will collaborate on developing a suite of advanced, data-led finance solutions designed to meet the evolving needs of businesses in the software and technology, retail, and media sectors.

System Integrators Market Scope

Report Attribute

Details

Market size value in 2024

USD 30.42 billion

Revenue forecast in 2030

USD 48.71 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Jitterbit Inc.; John Wood Group PLC; ATS Automation Tooling Systems Inc.; Avanceon; JR Automation; Tesco Controls, Inc.; Burrow Global LLC; Prime Controls LP; MAVERICK Technologies LLC; BW Design Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global System Integrators Market Report Segmentation

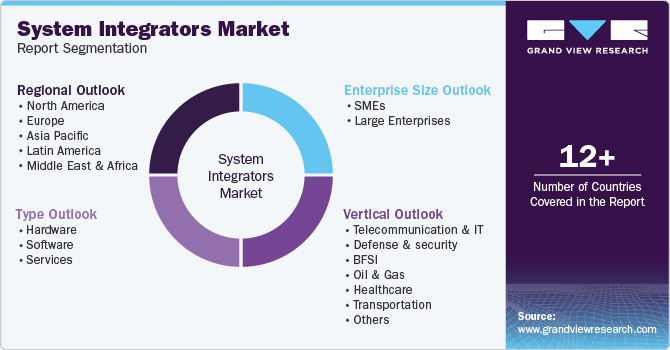

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global system integrators market report based on type, enterprise size, vertical, and region:

-

Type Outlook (Revenue; USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Enterprise Size Outlook (Revenue; USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue; USD Billion, 2018 - 2030)

-

Telecommunication & IT

-

Defense & security

-

BFSI

-

Oil & gas

-

Healthcare

-

Transportation

-

Retail

-

Others

-

-

Regional Outlook (Revenue: USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global system integrator market was valued at USD 29.10 billion in 2023 and is expected to reach USD 30.42 billion in 2024.

b. The global system integrator market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 48.71 billion by 2030.

b. The IT & Telecom segment accounted for the largest market share of over 20.22% in 2023. The IT & Telecom segment within the system integrators market is experiencing significant growth, driven primarily by the rapid digital transformation across industries and the increasing adoption of cloud-based solutions.

b. Key players in the system integrator market include Jitterbit Inc., John Wood Group PLC, ATS Automation Tooling Systems Inc., Avanceon, JR Automation, Tesco Controls, Inc., Burrow Global LLC, Prime Controls LP, MAVERICK Technologies LLC, and BW Design Group.

b. The system integrators market is witnessing significant growth driven by several key factors. The rise of digital transformation initiatives across industries is a major catalyst as businesses increasingly seek to streamline operations, enhance connectivity, and improve efficiency through integrated technology solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.