- Home

- »

- Pharmaceuticals

- »

-

Systemic Scleroderma Treatment Market Report, 2020-2027GVR Report cover

![Systemic Scleroderma Treatment Market Size, Share & Trends Report]()

Systemic Scleroderma Treatment Market (2020 - 2027) Size, Share & Trends Analysis Report By Drug Class (Immunosuppressors, PDE-5 Inhibitors, Endothelin Receptor Antagonist, Prostacyclin Analogues), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-236-6

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

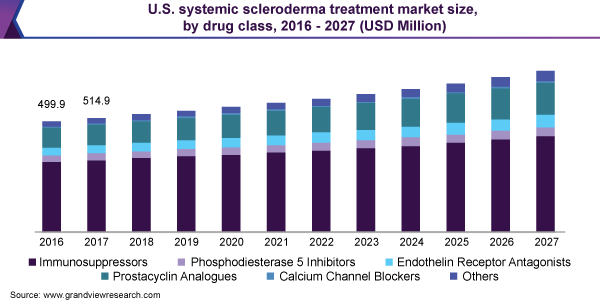

The global systemic scleroderma treatment market size was valued at USD 1.4 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 4.0% from 2020 to 2027. The supplemental approvals for existing treatment options coupled with the emergence of first-in-class therapies that are currently under development are expected to be the key factors driving the market. The market for systemic scleroderma treatment is mainly driven by the off-label use of drugs approved for its symptomatic indications such as rheumatoid arthritis. Lack of curative therapies and high prevalence of off-label drug use are underlying factors spurring interest in rare disease markets. This is expected to fuel the development of targeted biologics and small molecule combination therapies.

Researchers and sponsors are focusing on developing novel potential candidates at a rapid rate. These pipeline products vary in terms of their type and mechanism of actions. For instance, in September 2020, Kadmon Holdings, Inc. received Orphan Drug Designation by the U.S. FDA for its novel drug candidate, belumosudil (KD025), which is intended for the treatment of systemic sclerosis. Belumosudil (KD025) is a Rho-associated coiled-coil kinase 2, having a dual mechanism of actions for addressing both immune and fibrotic components; it is currently under phase 2 clinical trial.

However, the lack of validated result measures and current unique challenges in drug development hamper the growth of the market for systemic scleroderma treatment. Recent clinical trial failure presents the challenge of developing drugs for this disease condition. For instance, in September 2020, Corbus Pharmaceuticals Holdings Inc. pipeline product Lenabasum failed to show benefits across the primary and secondary endpoints despite promising phase 2 clinical trial results.

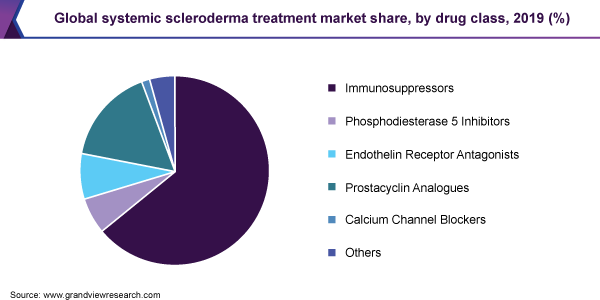

Comorbidities associated with this disease account for the involvement of a wide range of drug classes prescribed in first-, second-, and third-line treatment of the condition. Among the indications, pulmonary arterial hypertension (PAH) garnered the maximum sales. Medication for this comorbidity includes more than one drug class and several branded drugs.

Drug Class Insights

The immunosuppressors segment dominated the market for systemic scleroderma treatment and accounted for the largest revenue share of 64.2% in 2019. Without a curative therapy for this disease, an expansive range of drug classes are prescribed to provide symptomatic relief. Of these, immunosuppressants hold prominence as this class contains several biologics from established players such as Roche. Biologics and small molecule immunosuppressors are a growing segment, with several pipeline drugs for systemic scleroderma focusing on this class.

The introduction of new products in the market for systemic scleroderma treatment coupled with a robust product pipeline is anticipated to fuel industry growth. In September 2019, the U.S. FDA granted approval to Boehringer Ingelheim International GmbH’s product - Ofev (nintedanib) - for treatment of patients with Systemic Sclerosis with Interstitial Lung Disease (SSc-ILD), followed by the EMA in April 2020. Furthermore, novel therapies including nilotinib and ziritaxestat are expected to enter within the forecast period that is classed under ‘other drug classes’.

The PDE-5 inhibitors segment expected to grow over the forecast period. Companies are focusing on label expansion to expand the customer base. For instance, in June 2020, Pfizer Inc. announced the completion of phase 3 clinical studies for Revatio for the treatment of pulmonary hypertension in newborns. ERAs remain in focus as this class of drugs mostly includes branded therapies due to their use in the treatment of the indication with high incidence i.e. PAH.

Regional Insights

North America dominated the systemic scleroderma treatment market and accounted for the largest revenue share of 42.9% in 2019. Developed regions are increasingly witnessing the penetration of biologics that amount to a larger regional market. Access to recently developed immunosuppressants coupled with a favorable reimbursement scenario is the key revenue driver.

In the U.S., there are an estimated 20 cases of systemic scleroderma per million adults annually and about 276 cases of systemic sclerosis per million of the population. In addition, the total direct healthcare cost for the patients was found to be around USD 17,365 to USD 18,396 per patient. The steady burden of the disease supports the growth of the market for systemic scleroderma treatment.

Europe trails with a lower share as compared to the U.S., majorly due to higher use of generics and biosimilars for off-label treatment of systemic scleroderma. In the U.K., the market for systemic scleroderma treatment is anticipated to witness significant growth over the forecast period due to the launch of biologics and small molecules for the treatment of systemic sclerosis and the indications associated with it. In May 2016, Actelion Pharmaceuticals Ltd., a subsidiary of Johnson and Johnson Services, Inc., announced the EMA approval of Uptravi for the treatment of Pulmonary Arterial Hypertension.

In developing regions, generics and OTC drugs are the mainstay therapy for scleroderma and its symptoms. In Japan, the market for systemic scleroderma treatment is experiencing price cuts and has faster access to new orphan therapies. The expected increase in access to biosimilar and generic immunosuppressants will drive growth in Latin America and MEA regions.

Key Companies & Market Share Insights

The market for systemic scleroderma treatment holds significant growth opportunities and high unmet medical needs. The pharmaceutical companies are adopting strategies such as mergers and acquisitions and partnerships, to acquire a larger market share globally. In 2017, Janssen Pharmaceutical, a company of Johnson and Johnson Services, Inc., completed the acquisition of Actelion Pharmaceuticals Ltd. to become the largest player in the field of pulmonary hypertension.

The underlying factor is a high preference for immunosuppressants in the treatment of scleroderma induced PAH and ILD. With the growth in penetration of this class of drugs and their improved efficacy in comparison to existing alternatives - cyclophosphamide, methotrexate, and mycophenolate mofetil - these therapies will reign until the launch of curatives that are undergoing clinical development. Some of the prominent players in the systemic scleroderma treatment market include:

-

Boehringer Ingelheim International GmbH

-

Gilead Sciences Inc.

-

GlaxoSmithKline plc

-

Novartis AG

-

Pfizer Inc.

-

Bayer AG

Systemic Scleroderma Treatment Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.4 billion

Revenue forecast in 2027

USD 1.9 billion

Growth Rate

CAGR of 4.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug Class, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; Japan; India; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

F. Hoffmann La Roche Ltd.; Johnson & Johnson Services, Inc.; United Therapeutics; Boehringer Ingelheim International GmbH; GlaxoSmithKline plc; Pfizer, Inc.; Eli Lilly and Company; Bayer AG; Mylan N.V.; Teva Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global systemic scleroderma treatment market report on the basis of drug class and region:

-

Drug Class Outlook (Revenue, USD Million, 2016 - 2027)

-

Immunosuppressors

-

Phosphodiesterase 5 inhibitors - PHA

-

Endothelin Receptor Antagonists

-

Prostacyclin Analogues

-

Calcium Channel Blockers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global systemic scleroderma treatment market size was estimated at USD 1,380.91 million in 2019 and is expected to reach USD 1,428.67 million in 2020.

b. The global systemic scleroderma treatment market is expected to grow at a compound annual growth rate of 4.0% from 2020 to 2027 to reach USD 1,887.95 million by 2027.

b. North America dominated the systemic scleroderma treatment market with a share of 42.9% in 2019. This is attributable to easy access to recently developed immunosuppressants coupled with a favorable reimbursement scenario. Asia Pacific is expected to be the fastest-growing region, with generics and OTC drugs as the mainstay of therapy for scleroderma and its symptoms.

b. Some key players operating in the systemic scleroderma treatment market include F. Hoffmann La Roche Ltd.; Johnson & Johnson Services, Inc.; United Therapeutics; Boehringer Ingelheim GmbH; GlaxoSmithKline plc; Pfizer, Inc.; Eli Lilly and Company; Bayer AG; Mylan N.V.; and Teva Pharmaceutical Industries Ltd.

b. Key factors that are driving the systemic scleroderma treatment market growth include a strong presence of therapies used off-label, including small molecule therapies such as branded, generics, and OTC drugs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.