- Home

- »

- IT Services & Applications

- »

-

Tag Management System Market Size, Industry Report, 2033GVR Report cover

![Tag Management System Market Size, Share & Trends Report]()

Tag Management System Market (2025 - 2033) Size, Share & Trends Analysis By Component (Tools, Service), By Deployment (On Premises, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-633-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tag Management System Market Summary

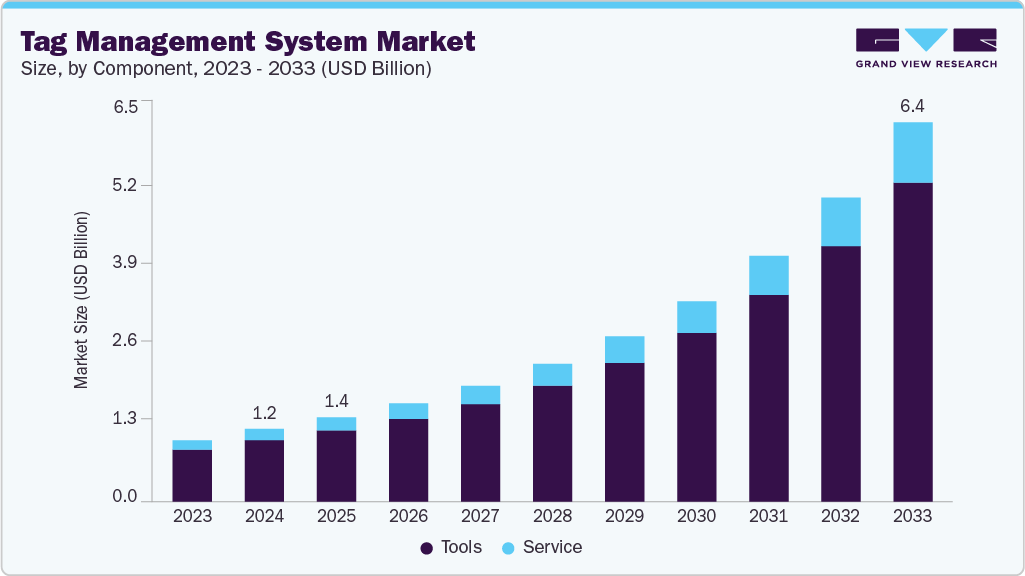

The global tag management system market size was estimated at USD 1.24 billion in 2024 and is projected to reach USD 6.45 billion by 2033, growing at a CAGR of 11.5% from 2025 to 2033, driven by the increasing need for efficient digital marketing operations and improved website performance. As businesses prioritize data-driven strategies and customer personalization, the ability to efficiently manage and deploy marketing tags across digital assets is becoming crucial.

Key Market Trends & Insights

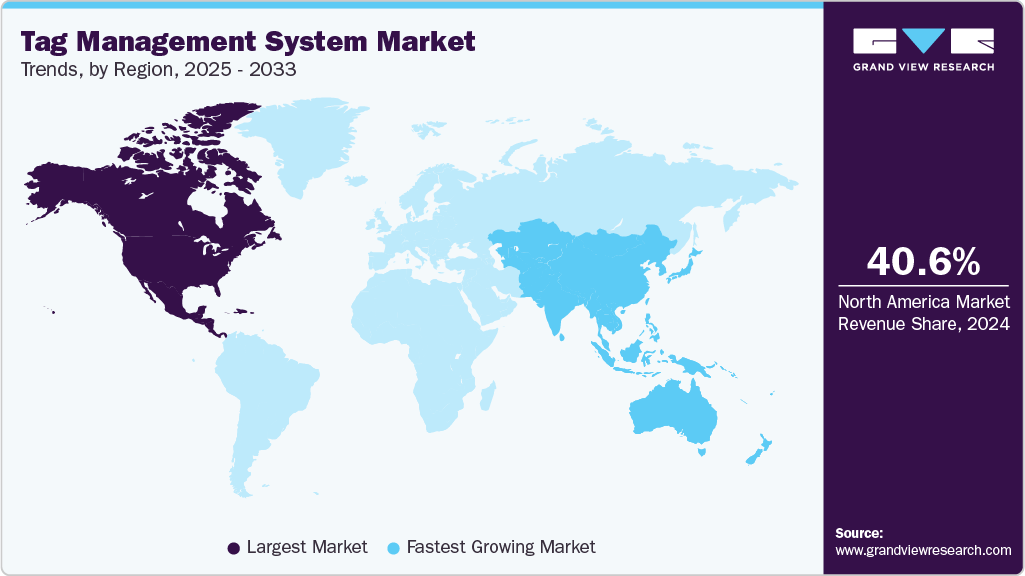

- North America held a 40.6% revenue share of the global tag management system market in 2024.

- In the U.S., the market is driven by the growth in e-commerce, which is fueled by the expanding base of online shoppers.

- By component, the tools segment held the largest revenue share of over 84.7% in 2024.

- By deployment, the cloud segment held the largest revenue share in 2024.

- By end use, the retail and e-commerce segments dominated the market and accounted for the revenue share of over 27.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.24 Billion

- 2033 Projected Market Size: USD 6.45 Billion

- CAGR (2025-2033): 11.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Additionally, tag management systems enable organizations to implement tracking codes without manual coding, thus reducing dependency on IT teams. Moreover, the rising adoption of cloud-based TMS solutions is further fueling market growth, offering real-time tag deployment and greater agility in managing user consent and privacy compliance.The increasing emphasis on data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is significantly influencing the adoption of tag management systems. These regulations necessitate that businesses manage user consent, data collection, and tracking mechanisms precisely. TMS solutions facilitate compliance by providing tools to implement consent management and data governance practices, ensuring that organizations adhere to legal requirements.

In addition, the global shift towards remote work and digital transformation is driving the need for efficient digital marketing strategies. Tag management systems enable organizations to manage and deploy marketing tags across various digital platforms. The capability is crucial for maintaining consistent user experiences and optimizing marketing efforts in a decentralized work environment.

Furthermore, the growing need for improved data security and protection against cyber threats is a key driver accelerating the growth of the tag management system market. As businesses collect and process vast amounts of user data through digital channels, they become prime targets for cyberattacks, including data breaches, injection attacks, and tag-based exploits.

TMS platforms play a critical role in governing which third-party tags are loaded on a website, reducing the risk of malicious code execution. For instance, according to Verizon's Data Breach Investigations Report 2024, ransomware and extortion-related breaches have comprised 59% to 66% of all cyberattacks over the past three years. Data from the FBI further highlights the financial impact, reporting a median loss of USD 46,000 per incident, with 95% of cases resulting in losses between USD 3,000 and USD 1.14 million.

Component Insights

The tools segment dominated the market and accounted for the revenue share of 84.7% in 2024, as tag management system tools are the primary enabler for tag deployment, tracking, and management. They provide the essential infrastructure that allows businesses to add or modify tags without manual coding, trigger tags based on user behavior, and integrate with analytics, ad platforms, and customer data platforms (CDPs).

Additionally, tag management system tools are revolutionizing asset safety management by providing businesses with a secure and efficient way to manage, track, and protect their digital assets. For instance, in Apr 2024, Kiwa partnered with Twintag to launch Digi-Tags, an innovative tool designed to revolutionize Asset Safety Management. The solution enhances safety protocols and operational efficiency, providing businesses with a powerful way to ensure compliance and improve asset protection.

The service segment is anticipated to register the fastest growth during the forecast period, driven by the rise of cloud-based TMS platforms and hybrid infrastructures, which allow businesses to ensure smooth operation. Also, the shift to the cloud requires more consultation and post-deployment services, which is fueling the service segment's growth.

Additionally, TMS platforms require ongoing optimization to adapt to new regulations, security standards, and evolving marketing strategies. As businesses continue to leverage TMS tools for various use cases, there is a constant need for system updates, security patches, and performance enhancements to keep the systems running efficiently. Consequently, the aforementioned factors are expected to drive the growth of the services segment in the upcoming years.

Deployment Insights

The cloud segment dominated the market in 2024, as cloud deployment eliminates the need for costly on-premises infrastructure, hardware, and maintenance. With cloud tag management systems, businesses access robust functionalities at a low cost compared to traditional on-premises solutions. Moreover, cloud TMS allows for remote access, enabling teams to manage tags from multiple locations and collaborate in real time.

Furthermore, cloud providers have robust security protocols to ensure that data is protected, including regular security audits, encryption, and compliance with various industry standards. Additionally, cloud solutions have built-in redundancy and disaster recovery plans, ensuring high availability and minimizing the risk of downtime, which is critical for businesses relying on consistent data management and tracking. In conclusion, the aforementioned factors are driving the adoption of cloud-based deployment in the global tag management system industry.

The on-premises segment is expected to register the fastest growth over the forecast period owing to the increasing concerns about data privacy, security, and regulatory compliance. Many organizations, especially in highly regulated industries such as healthcare, finance, and government, are required to store and manage customer data in a controlled environment. On-premises deployment allows these organizations to maintain full ownership of their data infrastructure, ensuring compliance with stringent data protection laws such as GDPR, HIPAA, and CCPA.

Another key driver for the adoption of the on-premises segment is the need for enhanced security. Businesses dealing with confidential data prefer on-premises solutions as they minimize the exposure to external threats associated with cloud-based environments. By hosting their TMS internally, these organizations enforce strict access controls and monitor systems closely without relying on third-party providers, thereby driving the market size.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024, as large enterprises manage multiple digital properties, including websites, mobile apps, e-commerce platforms, and others across different regions and languages. Managing marketing and analytics tags manually across such a complex digital ecosystem is not only inefficient but also prone to errors. TMS platforms allow these companies to centralize and automate tag deployment, ensuring consistency, accuracy, and faster execution across all digital assets. Therefore, the above-mentioned factors are contributing remarkably to driving the large enterprises segment share in the global tag management system industry.

The SMEs segment is expected to register the fastest growth during the forecast period due to the emergence of cost-effective cloud-based TMS platforms, like Google Tag Manager, which has lowered the entry barrier for SMEs. These tools are either free or come with affordable subscription models, making them accessible to small businesses. In addition, modern TMS platforms are designed with intuitive interfaces that do not require advanced technical expertise, hence are ideal for small enterprises. SMEs benefit from features like tag templates, drag-and-drop interfaces, and built-in privacy tools, further contributing to the deployment of a tag management system in small organizations.

End Use Insights

The retail and e-commerce segments dominated the market and accounted for the revenue share of over 27.0% in 2024. Retail and e-commerce businesses use tag management systems to track user behavior across multiple touchpoints, including product views, add-to-cart actions, and checkout completions, to gain detailed insights.

Additionally, TMS enables easy integration with third-party platforms like Google Ads, Facebook Pixel, and email marketing tools. This helps retailers launch targeted campaigns based on customer behavior, offering discounts and promoting related products based on past browsing. Subsequently, the expanding retail and e-commerce segment is contributing significantly to driving the growth of the global tag management system market. For instance, in 2024, India’s retail sector witnessed growth with over 750 new store openings and USD 1.38 billion raised. Additionally, the market is projected to grow at a CAGR of 10% to reach USD 1.6 trillion by 2026.

The media and entertainment segment is expected to register the fastest growth over the forecast period. The digital shift to cater to the growing demand for streaming services, online content, and digital advertising is driving the adoption of TMS to manage and optimize data collection efficiently. Additionally, the industry is relying on personalized recommendations and targeted ads to boost viewer engagement, and TMS enables real-time data tracking and segmentation, which supports dynamic content delivery based on user behavior.

Additionally, as programmatic advertising becomes more prevalent in media, managing multiple marketing tags across various platforms is crucial. TMS simplifies the deployment and tracking of ad performance, helping companies optimize their ad spend and reach, further contributing to the market expansion. Consequently, the growing media and entertainment industry is contributing notably to spurring market growth. For instance, India’s video OTT market, led by platforms like Amazon Prime Video, Netflix, and Disney+ Hotstar, is expected to grow from USD 1.8 billion in 2022 to USD 3.5 billion by 2027. Meanwhile, the country’s Animation and VFX sector is projected to expand from USD 1.3 billion in 2023 to USD 2.2 billion by 2026, increasing its share in the Media and Entertainment (M&E) industry from 5% to 6%, as per a CII GT report.

Regional Insights

The North America tag management system market emerged as the largest regional market, accounting for a substantial revenue share of 40.6% in 2024, attributed to its well-established digital marketing ecosystem, high adoption of data-driven technologies, and presence of major enterprise-level users. Additionally, increasing cyberattacks and stringent data protection regulations drive organizations to adopt TMS platforms that help manage consent, regulate data flow, enforce security policies, and prevent data breaches, thereby ensuring compliance with cybersecurity standards.

Moreover, the region’s rapid adoption and investments in cloud-based infrastructure have enabled faster deployment and scalability of tag management solutions. For instance, in Oct 2023, AWS invested over USD 108 billion in cloud computing infrastructure across the United States, generating nearly USD 38 billion in contributions to the nation's gross domestic product (GDP).

The tag management system market in the U.S. is expected to register the fastest growth from 2025 to 2033 due to the growth in e-commerce, which is fueled by the expanding base of online shoppers. As e-commerce grows, retailers tend to improve website loading speeds, especially on mobile, and deliver personalized shopping experiences. TMS platforms enable efficient management of marketing and analytics tags, which are essential for tracking user interactions, optimizing campaigns, and providing tailored content to consumers.

Europe Tag Management System Market Trends

The tag management system market in Europe is expected to register considerable growth from 2025 to 2033, fueled by the rising demand for centralized tag management solutions that enhance data collection accuracy, streamline marketing analytics, and improve website performance across diverse digital channels. Additionally, the market benefits from Europe’s strict data privacy regulations, such as GDPR, which compel organizations to adopt TMS platforms for better consent management, data security, and compliance.

The UK tag management system market is expected to grow rapidly in the coming years, as the UK has a highly developed digital marketing industry. Businesses are adopting tag management system platforms to streamline campaign tracking, enable rapid experimentation, and reduce dependence on IT teams. Additionally, with the implementation of UK GDPR and other data protection frameworks post-Brexit, businesses are leveraging TMS to ensure proper data governance, manage consent, and comply with user privacy standards.

Germany tag management system market held a substantial revenue share in 2024 as the country’s advanced digital infrastructure and strong industrial base contribute to increasing adoption of TMS solutions. Additionally, German enterprises prioritize data security and regulatory compliance, which are critical drivers for tag management system deployment to manage tags securely and ensure adherence to GDPR and other standards.

Asia Pacific Tag Management System Market Trends

The Asia Pacific tag management system market is expected to register a robust CAGR of 13.1% from 2025 to 2033. This growth is primarily driven by high mobile and internet penetration across Southeast Asia and India, which is prompting businesses to adopt advanced digital marketing tools, including tag management systems, to effectively track and analyze user behavior across mobile apps and websites. Also, the expanding e-commerce in Asia Pacific countries and the rise of platforms including Lazada, Shopee, and Flipkart, businesses are adopting TMS to manage complex digital environments and improve ROI on digital ad spend.

Japan tag management system market is expected to grow rapidly in the coming years as Japanese corporations maintain high standards for data quality and privacy, and TMS tools are seen as essential for controlled, compliant data collection. In addition, many large enterprises are dealing with internal systems, requiring customized TMS implementation strategies, thus favoring vendors that offer strong local support and integration services.

China tag management system market held a substantial revenue share in 2024, as Chinese brands operate across multiple native platforms (WeChat, JD.com, Douyin), requiring localized tag management solutions that work within these proprietary environments. Also, China's Personal Information Protection Law (PIPL) is accelerating the demand for TMS platforms to manage user consent and data flow compliance for multinational companies operating in China.

Key Tag Management System Company Insights

Key players operating in the tag management system industry are Google LLC, Adobe Inc., Tealium Inc., Ensighten Inc., and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2025, Google Tag Manager (GTM) introduced an update whereby GTM containers will automatically load Google Tag before firing any Google Ads or Floodlight event tags. The change aims to improve tracking accuracy, streamline data collection, and provide easier access to features like Enhanced Conversions and Cross-domain tracking.

-

In September 2023, Atlan launched Tag Management, becoming one of the first Snowflake data governance partners to enable bi-directional tag synchronization between Atlan and Snowflake. This allows data teams to manage and protect data assets seamlessly across their data ecosystem by using Atlan as a central control plane for tag-based access control.

-

In April 2023, Tealium launched Consent Integrations for its tag management solution Tealium iQ (TiQ), enabling seamless plug-and-play connectivity with leading consent management platforms (CMPs) like OneTrust, Didomi, and Usercentrics. This feature ensures that consumer privacy preferences are respected and enforced throughout the entire customer journey by automating consent management across a company’s data ecosystem, supporting both opt-in and opt-out regulatory frameworks.

Key Tag Management System Companies:

The following are the leading companies in the tag management system market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe Inc.

- BlueConic Inc.

- Cloudsaver, Inc.

- Commanders Act SAS

- Coveo Solutions Inc.

- Ensighten Inc.

- Google LLC

- Heap Inc.

- InnoCraft Ltd. (Matomo)

- Oracle Corporation

- Piwik PRO Sp. z o.o.

- Signal Digital, Inc.

- Tealium Inc.

- Twilio Inc.

- Yottaa, Inc.

Tag Management System Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.43 billion

Revenue forecast in 2033

USD 6.45 billion

Growth rate

CAGR of 11.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Google LLC; Adobe Inc.; Tealium Inc.; Ensighten Inc.; Twilio Inc.; Piwik PRO Sp. z o.o.; Commanders Act SAS; Coveo Solutions Inc.; Signal Digital, Inc.; InnoCraft Ltd. (Matomo); BlueConic Inc.; Heap Inc.; Oracle Corporation; Yottaa, Inc.; Cloudsaver, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tag Management System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global tag management system market report based on component, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Tools

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-Premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Media and Entertainment

-

Healthcare

-

IT and Telecom

-

Retail and E-commerce

-

Manufacturing

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tag management system market size was estimated at USD 1.24 billion in 2024 and is expected to reach USD 1.42 billion in 2025.

b. The global tag management system market is expected to grow at a compound annual growth rate of 11.5% from 2025 to 2033 to reach USD 6.45 billion by 2033.

b. The tools segment dominated the market and accounted for the revenue share of 84.7% in 2024, as tag management system tools are the primary enabler for tag deployment, tracking, and management. They provide the essential infrastructure that allows businesses to add or modify tags without manual coding, trigger tags based on user behavior and integrate with analytics, ad platforms, and customer data platforms (CDPs).

b. Some of the key companies operating in the tag management system market include Google LLC, Adobe Inc., Tealium Inc., Ensighten Inc., Twilio Inc., Piwik PRO Sp. z o.o., Commanders Act SAS, Coveo Solutions Inc., Signal Digital, Inc., InnoCraft Ltd. (Matomo), BlueConic Inc., Heap Inc., Oracle Corporation, Yottaa, Inc., Cloudsaver, Inc., and Others

b. Tag management systems enable organizations to implement tracking codes without manual coding, thus reducing dependency on IT teams. Moreover, the rising adoption of cloud-based TMS solutions is further fueling market growth, offering real-time tag deployment and greater agility in managing user consent and privacy compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.