- Home

- »

- Healthcare IT

- »

-

Tele-epilepsy Market Size, Share And Growth Report, 2030GVR Report cover

![Tele-epilepsy Market Size, Share, And Trend Report]()

Tele-epilepsy Market (2025 - 2030) Size, Share, And Trend Analysis Report, By Patient (Pediatric, Adult), By Component (Hardware, Software, Service), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-995-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tele-epilepsy Market Size & Trends

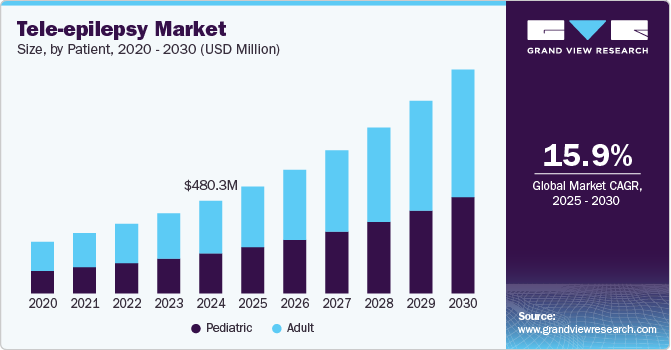

The global tele-epilepsy market size was estimated at USD 480.3 million in 2024 and is projected to grow at a CAGR of 15.9% from 2025 to 2030. The growing adoption of telemedicine services and solutions, favorable government programs for epilepsy in developed countries, rising epilepsy cases in adult and pediatric populations, increasing adoption of mobile and internet services, technological advancements, and reduction in the cost of treatment are factors driving the market growth.

Increasing cases of epilepsy across the globe are fostering market growth. According to the WHO report, approximately 5 million individuals are diagnosed with epilepsy annually around the world. In high-income nations, it is estimated that 49 out of every 100,000 people receive an epilepsy diagnosis each year. In contrast, in low- and middle-income nations, this number can reach up to 139 per 100,000. This increasing prevalence of epilepsy will increase the demand for telehealth services, including tele-epilepsy.

Rapid advancements in telemedicine technology are transforming the global market. Innovations in video conferencing, mobile health applications, and wearable devices enable real-time monitoring and communication between patients and healthcare providers. These technologies enhance the ability to track seizures, manage medication adherence, and provide timely interventions, thus improving patient care. The ease of access to these advanced tools encourages both patients and providers to adopt tele-epilepsy solutions, further fueling market growth.

The increasing acceptance of remote healthcare solutions is a key driver for market growth. According to an article featured in Healthcare Purchasing News, in 2020, 23.4 million patients in the U.S. used remote patient monitoring services; this figure is expected to rise to 30 million by 2024. In addition, according to the MSI International study released in 2021, 80% of Americans support Remote Patient Monitoring (RPM), and almost half of them are strongly in favor of integrating it into healthcare. This shift in mindset has created a favorable environment for tele-epilepsy services.

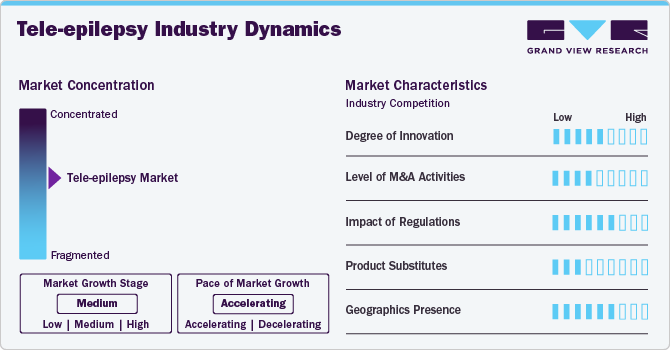

Market Concentration & Characteristics

The degree of innovation in the global market is marked by significant advancements in technology and methodologies that enhance patient care and management. Innovations include the development of sophisticated mobile applications and wearable devices that monitor seizure activity in real-time, allowing for continuous tracking and timely interventions. Telemedicine platforms have evolved to integrate advanced video conferencing, enabling neurologists to conduct remote consultations with high-quality audiovisual capabilities.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for tele-epilepsy.

Regulatory bodies, such as the FDA in the United States and similar organizations in other countries, establish guidelines for telehealth practices, including the use of digital health technologies and remote monitoring tools. These regulations aim to protect patient privacy, ensure data security, and verify the efficacy of tele-epilepsy solutions.

In-person consultations with neurologists remain a primary substitute, allowing for direct assessments and face-to-face interactions, which some patients may prefer for personalized care. In addition, other remote healthcare solutions, such as phone consultations or basic telehealth platforms that lack advanced monitoring capabilities, serve as substitutes.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions.

Patient Insights

Based on patient, the adult segment led the market with the largest revenue share of 56.67% in 2024 and is anticipated to grow at a CAGR of 16.0% during the forecast period. An adult suffering from epilepsy is at more risk of getting into severe conditions after seizures, which increases the role of tele-epilepsy. The growing prevalence of epilepsy among adults is driving market growth. As per the CDC report, nearly 2.9 million adults aged 18 and above in the U.S. reported living with active epilepsy during the years 2021 and 2022. In addition, 38% of U.S. adults suffering from active epilepsy indicated they had a disability. Moreover, advancements in technology enable real-time monitoring and personalized treatment plans, thereby fostering market growth.

The pediatric segment is anticipated to witness at a significant CAGR over the forecast period. Epilepsy cases in children are different from those in adults, particularly regarding seizure types and epilepsy syndromes, as children typically have stronger immune systems and are less susceptible to other diseases. For instance, juvenile convulsions and epileptic syndromes such as Lennox-Gastaut disorder, childhood absence epilepsy, and Dravet syndrome are frequently distinct in the pediatric population. Moreover, increasing cases of epilepsy in children will boost the segmental growth. For instance, according to the National Survey of Children's Health from 2022, approximately 456,149 children in the U.S. aged 17 and younger currently have active epilepsy.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 40.8% in 2024, due to the extensive use of videoconferencing technology, audio equipment, microphones, and other medical accessories to support virtual visits. Moreover, innovations in sensors and connectivity, such as real-time data transmission via mobile applications, enhance the functionality of these devices, thereby boosting industry expansion. In addition, as awareness of epilepsy management grows, the need for specialized hardware that supports remote consultations and telemonitoring becomes increasingly important, thus accelerating market growth.

The service segment is anticipated to witness at the fastest CAGR over the forecast period. The segment growth will be fueled by the widespread usage of teleconsulting between patients and clinicians. These services offer remote consultations, ongoing patient monitoring, and personalized care plans that facilitate timely interventions and improve patient engagement. In addition, the integration of educational resources and support networks within tele-epilepsy services enhances patient understanding and management of their condition. Such aforementioned factors are driving the segment growth.

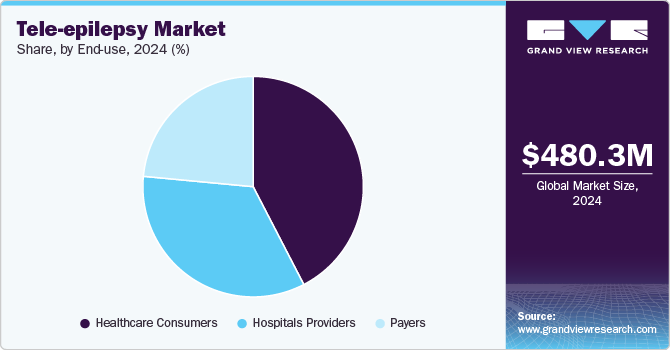

End-use Insights

Based on end use, the healthcare consumer segment led the market with the largest revenue share of 42.4% in 2024, owing to the increasing empowerment of patients and their demand for more personalized and accessible healthcare solutions. In addition, the integration of user-friendly mobile applications and wearable devices allows patients to monitor their condition closely, track seizure activity, and receive immediate feedback, thereby escalating market growth. Furthermore, growing awareness of the availability of telehealth services among the population is propelling market growth.

The hospitals providers segment is anticipated to witness at the fastest CAGR over the forecast period. The growth is anticipated as hospitals are preferred by patients for their treatment process, offering convenience and a variety of products in one location. Moreover, hospitals are omnipresent and easily accessible to all patients, thereby supplementing segmental growth. As of January 2023, there are nearly 7,335 operational hospitals in the U.S., based on the Definitive Healthcare HospitalView product. Between August 2020 and January 2023, the overall number of hospitals monitored in the HospitalView product rose by 88, indicating a mix of new hospital openings and closures.

Regional Insights

North America tele-epilepsy market dominated with the largest revenue share of 37.2% in 2024, owing to the technologically advanced infrastructure, rising number of epilepsy cases, and growing per capita income. In addition, the presence of many market players and supporting government regulations in the region are boosting regional growth.

U.S. Tele-epilepsy Market Trends

The U.S. tele-epilepsy market accounted for the largest market share in North America in 2024. The U.S. leads in North American region owing to advanced healthcare management, innovative software development, and presence of several market players operating across segments, such as mobile & network operations. Rise in younger population that has more awareness & inclination toward health-related issues and growth in disposable income can be attributed to high market share

The Canada tele-epilepsy market is anticipated to register at the fastest CAGR during the forecast period. The increasing adoption of digital technology has contributed to the market growth in Canada. According to a survey conducted in November 2022 by Canada Health Infoway, around 94% of Canadians expressed interest in accessing digital health services.

Europe Tele-epilepsy Market Trends

The Europetele-epilepsy market anticipated to register at a lucrative CAGR during the forecast period, due to increasing number of people accepting digital health technologies, such as Electronic Health Record (EHR), health apps & services, telehealth, and other digital health techniques.

The Germany tele-epilepsy market is anticipated to register at a considerable CAGR during the forecast period. Rising government initiatives in Germany are expected to facilitate market growth. For instance, Germany has witnessed a remarkable growth of digital health products in recent years, as per the Federal Ministry for Economic Affairs and Energy report in 2022. Currently, around 177 telemedicine projects and over 270 digital health technology businesses are being implemented in the country.

The tele-epilepsy market in UK is anticipated to register at a considerable CAGR during the forecast period. Market growth can be attributed to the government backing and equal adoption of digital health includingtele-epilepsy technology by the National Health Services (NHS) & small physicians to improve access to healthcare.

Asia Pacific Tele-epilepsy Market Trends

The Asia Pacific tele-epilepsy market in is anticipated to register at the fastest CAGR during the forecast period,due to the increasing penetration of smartphones & smart wearable devices and the rising adoption of telehealth services. Moreover, the rising demand for remote patient monitoring and associated services due to increased government spending on healthcare is expected to propel the industry expansion.

The Japan tele-epilepsy market is anticipated to register at a considerable CAGR during the forecast period. The growing geriatric population in the country is fostering market growth. This can be attributed to the advent of new technologies and the rising popularity of at-home care & regular monitoring services. Moreover, the introduction of technologically advanced mobile devices & wearable devices is boosting the demand for tele-epilepsy devices.

The China tele-epilepsy market held the largest market share of the Asia Pacific market in 2024. Mobile application providers are focusing on developing healthcare apps due to the increasing smartphone penetration in the country. For instance, according to Counterpoint's Market Pulse Service report, China's smartphone sales saw a 6% year-over-year growth in the second quarter of 2024.

Latin America Tele-epilepsy Market Trends

The tele-epilepsy market in Latin America is anticipated to grow at a significant CAGR during the forecast period. Government support for expanding telehealth & digital health networks is boosting market growth.In addition, increasing expenditure on electronic & mobile devices by buyers is contributing to the development of the market.

The Brazil tele-epilepsy market is anticipated to register at a considerable CAGR during the forecast period. The increasing adoption of digital technology and the growing healthcare sector are some of the key factors facilitating market growth in Brazil.

MEA Tele-epilepsy Market Trends

Thetele-epilepsy market in MEA is anticipated to register at a significant CAGR during the forecast period. Advancements in healthcare systems are expected to bring telehealth including tele-epilepsy solutions into action in these countries.Moreover, improving internet connectivity and increasing smart device penetration are supporting industry expansion.

The South Africatele-epilepsy market is anticipated to register at a considerable CAGR during the forecast period. Digitalization of healthcare in South Africa is expected to continue at a steady rate due to factors such as developing infrastructure, a large population with unmet medical needs, and lucrative market space for investors.

Key Tele-epilepsy Market Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Tele-epilepsy Companies:

The following are the leading companies in the tele-epilepsy. These companies collectively hold the largest market share and dictate industry trends.

- Shimmer

- Empatica

- SOC Telemed

- Eagle Telemedicine

- Sevaro

- Tele Specialists

- Chiron Health

- RTTC

- Science Soft USA Corporation

- Vidyo, Inc.

Recent Developments

-

In October 2023, Ceribell, Inc. revealed the launch of its innovative AI algorithm, ClarityPro, alongside the possibility of extra reimbursement for qualifying Medicare patients.

-

In January 2021, UCB announced the establishment of Nile AI, Inc., a new standalone entity aimed at enhancing care for individuals with epilepsy, their caregivers, and healthcare professionals (HCPs).

Tele-epilepsy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 554.8 million

Revenue forecast in 2030

USD 1,161.5 million

Growth rate

CAGR of 15.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Patient, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Shimmer; Empatica; SOC Telemed; Eagle Telemedicine; Sevaro; Tele Specialists; Chiron Health; RTTC; Science Soft USA Corporation; Vidyo, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Tele-epilepsy Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global tele-epilepsy market report based on patient, component, end-use, and region:

-

Patient Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals providers

-

Payers

-

Healthcare consumers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tele-epilepsy market size was estimated at USD 480.3 million in 2024 and is expected to reach USD 554.8 million in 2025.

b. The global tele-epilepsy market is expected to grow at a compound annual growth rate of 15.9% from 2025 to 2030 to reach USD 1,161.5 million by 2030.

b. North America dominated the tele-epilepsy market with a share of 37.2% in 2024 owing to the technologically advanced infrastructure and increasing disposable income. In addition, a large number of market players and supporting government regulation in the region are contributing to the market growth.

b. Some key players operating in the tele-epilepsy market are Shimmer; Empatica; SOC Telemed; Eagle Telemedicine; Chiron Health; AZmed, among others.

b. Key factors driving the market growth include the growing adoption of telemedicine services and solutions, favorable government programs for epilepsy in developed countries, growing epilepsy adult and pediatric population, increasing adoption of mobile and internet services, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.