- Home

- »

- Healthcare IT

- »

-

Telecare Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Telecare Market Size, Share & Trends Report]()

Telecare Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Activity Monitoring, Remote Medication Management), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-915-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Telecare Market Summary

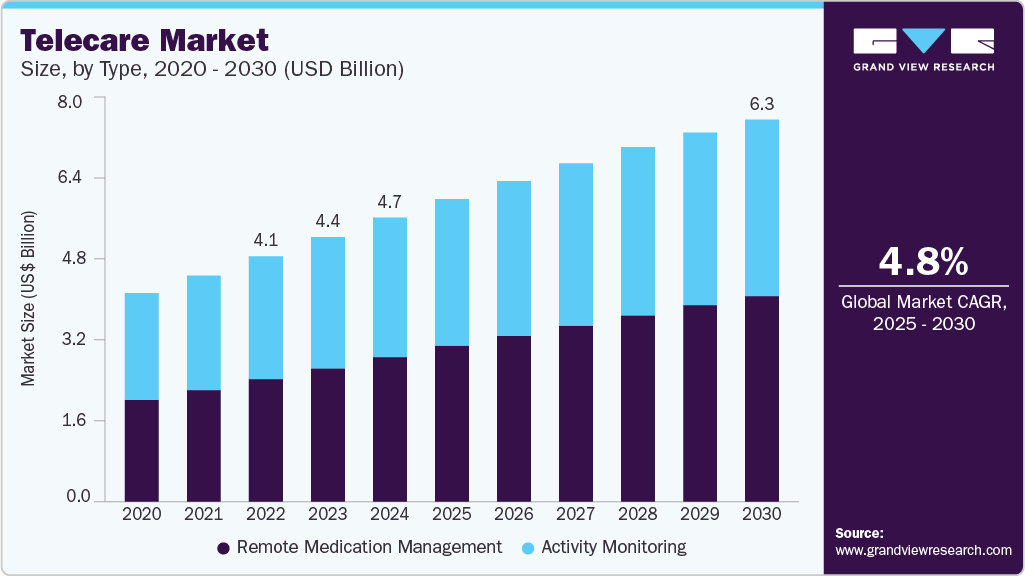

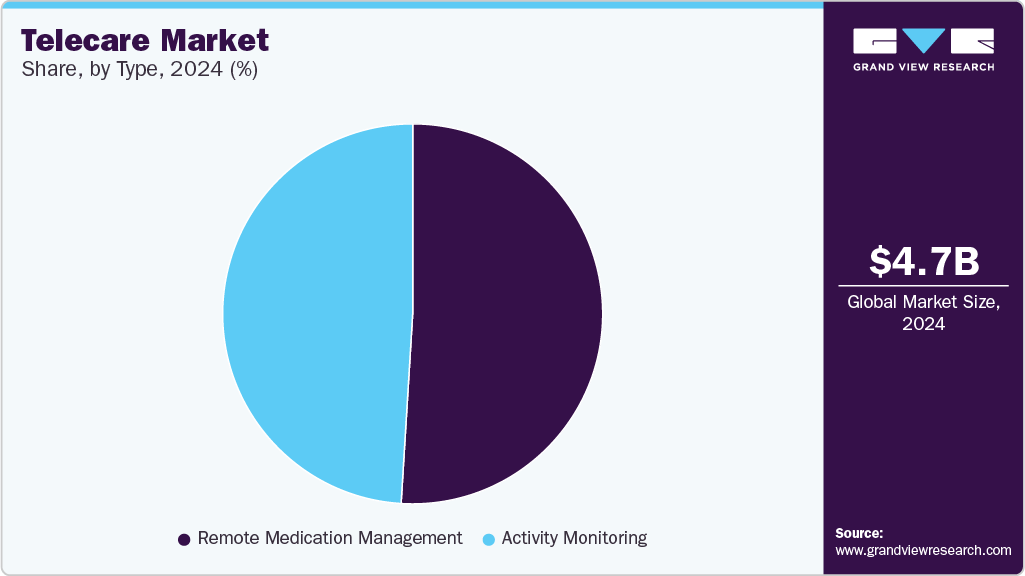

The global telecare market size was estimated at USD 4,708.4 million in 2024 and is projected to reach USD 6,344.1 million by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The increasing advancement of technology to provide more efficient and improved healthcare services to patients is anticipated to drive the market over the forecast years.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, U.S. is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, remote medication management accounted for a revenue of USD 2,213.7 million in 2023.

- Remote Medication Management is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,708.4 Million

- 2030 Projected Market Size: USD 6,344.1 Million

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

For instance, in March 2023, Royal Philips unveiled Philips Virtual Care Management, offering a wide range of adaptable solutions and services for health systems, providers, payers, and employer groups to engage and support patients effectively from any location. In addition, growing awareness of maintaining physical health and increasing penetration of the internet and smartphones also accelerate market growth.

Moreover, advancements in digital health, telecommunication, and electronic health record systems contribute significantly to the growth of the adoption of telecare tools for extending rehabilitation, health, and wellness services. In addition, the growing number of health apps for activity monitoring and continuous improvement of the app quality by the developers is expected to boost the market growth.

In addition, telecare services help in the health monitoring of older adults. The digital platforms and software used by remote monitoring centers can monitor and assist older people with unusual behavior patterns or any warning signs of falls, further boosting their adoption. Furthermore, the growing geriatric population worldwide is anticipated to drive the market for telecare over the forecast years. For instance, according to the World Health Organization (WHO), by 2030, one in six people is expected to be aged over 60 years across the world. Moreover, some telecare technologies track the environmental conditions and unconsciousness of the older adult and automatically trigger the required response. These kinds of technological advancements thereby further support market growth.

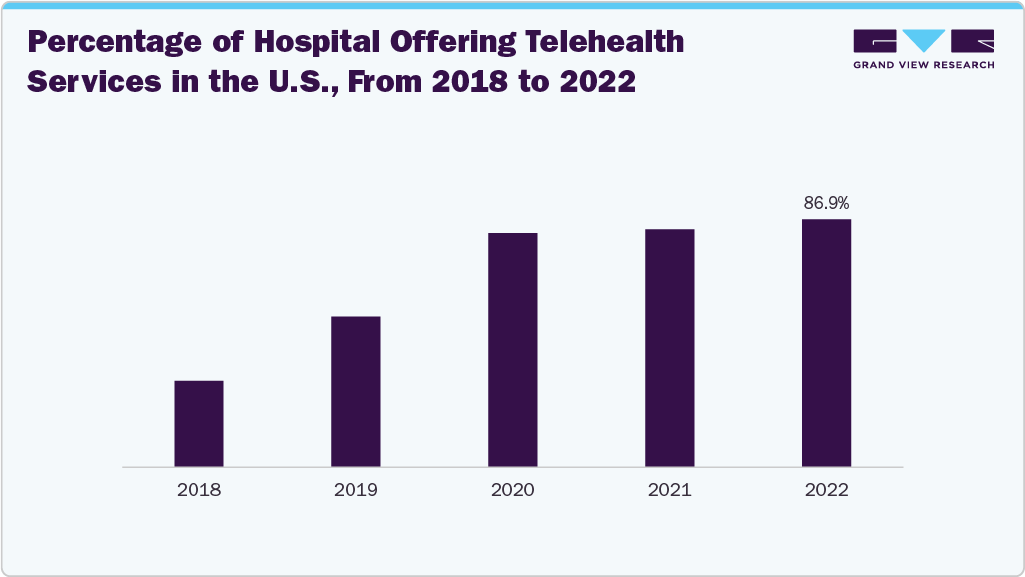

Telecare is an integral component of the broader telehealth ecosystem. It focuses on supporting individuals, particularly the elderly and those with chronic conditions, in managing their daily health needs through technology. This includes services such as activity monitoring, remote medication management, and emergency response systems, all aimed at promoting independence and enhancing quality of life. The use of telehealth has increased significantly, owing to waivers that have allowed a broader range of services to be offered through this method and ensured reimbursement for service providers. It has demonstrated safety and effectiveness, with high levels of satisfaction reported by both patients and clinicians.

The telecare industry is driven by government initiatives to promote healthcare access and reduce healthcare costs. Various governments have launched programs to encourage the adoption of telemedicine services and remote patient monitoring. For instance, the U.S. Centers for Medicare and Medicaid Services (CMS) has launched several initiatives to promote telemedicine adoption, including the Medicare Telehealth Program. These initiatives have created a favorable environment for telecare companies to operate and grow. Other growth drivers in the telecare industry include advances in artificial intelligence and machine learning, which enable more accurate and personalized remote care services, and the increasing adoption of cloud-based solutions, which enable seamless data exchange and storage.

Case Study

Title: Telecare Case Study: Supporting Mrs. X Toward Independent Living

Introduction: The case study examines Mrs. X, a 77-year-old woman whose declining health and frequent falls left her housebound and dependent on emergency services. It explores how a personalized telecare approach-combining remote monitoring, occupational therapy, and community engagement-helped her regain independence, reduce fall risks, and reconnect with her community. The case highlights telecare’s potential to improve quality of life and reduce healthcare burdens.

Aim: To assess the impact of a proactive telecare solution in enhancing independence, reducing fall risk, and improving the overall well-being of an elderly individual living alone.

Objective:

-

To identify and address the causes of frequent falls.

-

To enable Mrs. X to leave her home and participate in meaningful activities safely.

-

To reduce dependency on emergency response services.

-

To improve physical and mental health through community engagement and mobility support.

Outcome/Results:

Telecare Solution Deployed

Telecare Intervention

Details

Occupational Therapy Assessment

Mrs. X was assessed for safe mobility and provided with a walker featuring a seat to support balance and movement.

Community Engagement

Mrs. X was referred to a local gym where she was assigned a personal trainer to help strengthen her legs and improve balance.

Social Inclusion

Mrs. X was connected to a local social day club to enhance social interaction and combat isolation.

Results After 8 Weeks:

-

Zero falls were reported in a three-week follow-up period.

-

No need for emergency responder visits during that time.

-

Significant improvement in confidence, mobility, and mental well-being.

-

Re-engaged with the community by swimming, visiting parks, and attending social gatherings.

Conclusion:

The proactive telecare approach significantly improved Mrs. X’s independence, safety, and quality of life. By combining technology, health assessments, and community resources, telecare enabled her to regain confidence and reduce reliance on emergency services. This case demonstrates how personalized telecare solutions empower elderly individuals to live independently at home, aligning with the broader goals of telehealth systems.

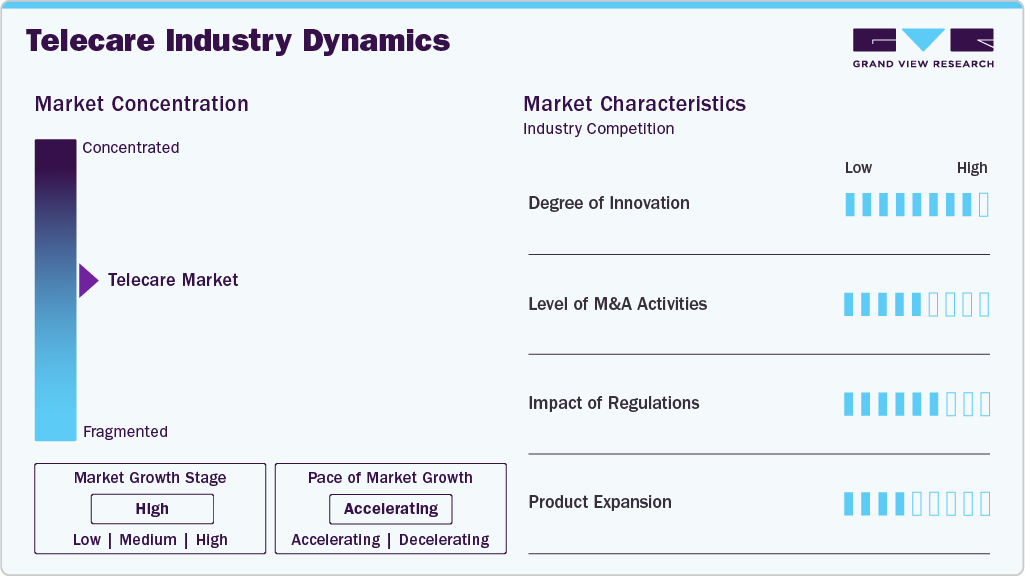

Market Concentration & Characteristics

The telecare industry is characterized by a high degree of innovation, driven by technological advances, changing patient needs, and the need for cost-effective solutions. It is constantly evolving, with new technologies and products emerging regularly. The development of artificial intelligence (AI) and machine learning (ML) enables the development of more sophisticated remote patient monitoring systems, AI telecare apps to analyze data and provide personalized insights to healthcare providers. For instance, in February 2022, Biofourmis, a virtual care and digital therapeutics company, launched Biofourmis Care. This technology-driven care management service provides remote care for individuals with chronic illnesses. It features automated medication management to support care teams modifying medications remotely, ensuring tailored therapy for each patient.

Regulations, especially the 1996 Health Insurance Portability and Accountability Act (HIPAA) and its subsequent amendments through the Health Information Technology for Economic and Clinical Health (HITECH) Act, positively affect market expansion. These regulations are essential for the secure management and privacy of digital health information and for establishing the operational framework and compliance standards for telecare services, particularly in the U.S.

The telecare industry is characterized by a moderate level of merger and acquisition (M&A) activities by leading players. Major players in the telecare industry have acquired smaller companies to gain access to new technologies, talent, and customer bases. For instance, in April 2024, OMRON Healthcare, Co., Ltd. acquired Luscii Healthtech, a digital health and remote consultation service platform. With this acquisition, Luscii is developing a comprehensive service that cohesively aids healthcare professionals, from general practitioners to hospitals, all within one unified platform.

The telecare industry is witnessing significant product expansion, driven by advancements in technologies such as artificial intelligence, the Internet of Things (IoT), and cloud computing. New products and services are emerging to cater to the growing demand for remote patient monitoring, virtual care, and personalized health management. For instance, in January 2024, Pylo Health, a company specializing in remote patient monitoring devices and a partner of Prevounce, introduced two advanced patient devices: the Pylo 900-LTE and the Pylo 200-LTE, blood pressure monitor and weight scale.

Type Insights

The remote medication management segment led the market with the largest revenue share of50.97% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This expansion is attributed to several factors, including the aging population, increased prevalence of chronic diseases, development of elderly telecare apps and technological advancements. Activity monitoring devices offer real-time tracking and analysis of individuals' movements, allowing caregivers and healthcare providers to monitor their patients' activities and well-being remotely. For instance, in October 2023, ActiGraph introduced a revolutionary new generation of Bluetooth Smart activity monitors, the wGT3X-BT, which has wireless communication, data capture, and wear time screening capabilities. When paired with the ActiLife software platform and the ActiLife Mobile app, this innovative device offers the most advanced features in the market.

In addition, the integration of artificial intelligence and machine learning algorithms enhances the capabilities of these devices, enabling them to detect patterns and anomalies in behavior that may indicate potential health issues or emergencies. As a result, there has been a surge in demand for activity monitoring solutions within the telecare industry, driving substantial growth and innovation in this segment.

The activity monitoring segment is anticipated to grow at the significant CAGR over the forecast period, owing to technological advancements and the increasing demand for improved healthcare access and outcomes. With the integration of smart devices and digital platforms, remote medication management solutions offer enhanced medication adherence, dosage tracking, and real-time communication between patients and healthcare providers. For instance, Garmin Malaysia launched the HRM-Fit in March 2024, a new heart rate monitor specifically designed for women. With a clip-on design, it can be easily attached to medium and high-support sports bras for optimal comfort, ensuring precise tracking of real-time heart rate and workout information. This growth trajectory is expected to continue as healthcare systems prioritize remote monitoring and management solutions to optimize patient care and reduce healthcare costs.

Regional Insights

North America dominated the telecare market with the largest revenue share of 49.13% in 2024. This is attributed to several factors such as the high penetration of smartphones and the internet, growing awareness among individuals to maintain physical health and the use of remote healthcare services. In addition, the growing burden of chronic diseases coupled with the increasing geriatric population are among the major factors anticipated to drive the market growth in this region. Besides, the increasing number of telecare providers and the presence of key players in the U.S. are also leading to the adoption of such services in this region.

U.S. Telecare Market Trends

The telecare market in the U.S. accounted for the largest market revenue share in North America in 2024, owing to the demand for remote healthcare solutions. Regulatory oversight is provided by the Food and Drug Administration (FDA), which evaluates and approves telecare technologies through rigorous processes ensuring safety and efficacy. For instance, in March 2024, Analog Devices, Inc. announced the U.S. Food and Drug Administration's (FDA) clearance of the 510(k) application for its Sensinel Cardiopulmonary Management System. The compact wearable device is a non-invasive, remote monitoring system that captures cardiopulmonary measurements, enabling remote management of chronic diseases such as heart failure. The approval process typically involves thorough assessments of device performance, data security, and adherence to regulatory standards. This stringent regulatory framework ensures the reliability and effectiveness of telecare solutions, fostering continued market growth.

Europe Telecare Market Trends

The telecare market in Europe is expected to grow at a significant CAGR over the forecast period. Innovations such as wearable devices, remote monitoring systems, and telemedicine platforms have revolutionized healthcare delivery, promoting independence and improving access to care for individuals across the continent. These technological advancements enable real-time health monitoring, timely interventions, and enhanced communication between patients and healthcare providers, driving the growth of the European telecare industry. For instance, in March 2023, Fractyl Health introduced the Revita+ telehealth program. This program combines behavioral recommendations with Revita treatment for Type 2 diabetes. These platforms now offer sophisticated features such as wearable sensors for remote monitoring, AI-powered rehabilitation algorithms, and virtual reality-based therapy programs.

The UK telecare market is anticipated to register at a considerable CAGR during the forecast period, owing to increasing adoption of remote healthcare solutions. Key players have made strategic moves to expand their market presence through acquisitions and partnerships. For instance, in November 2023, AstraZeneca introduced Evinova, a cutting-edge health-tech business designed to accelerate innovation in the life sciences sector and improve patient outcomes. Evinova focuses on developing digital solutions, including remote patient monitoring and digital therapeutics, with a robust pipeline of innovative products in these areas. These initiatives aim to enhance product offerings and service capabilities, catering to the growing demand for telecare services in the UK. With a focus on innovation and customer-centric solutions, these companies are driving market growth and shaping the future of telecare in the UK.

Asia Pacific Telecare Market Trends

The telecare market in Asia Pacificis anticipated to witness at the fastest CAGR over the forecast period, owing to the large population and increasing demand for remote health management services. In addition, growing users of the internet and -growing smartphone penetration are anticipated to drive the market growth over the forecast period in the Asia Pacific. Moreover, increasing government initiatives to promote digital health platforms further support market growth in this region.

The South Korea telecare market is anticipated to register at a considerable CAGR during the forecast period. The South Korean government started a pilot project in the first half of 2018 with fundamental investments in the digitalization of the healthcare system to boost digital adoption in healthcare. Moreover, high smartphone ownership is expected to accelerate market growth. According to a report by the South Korean Ministry of Science and ICT, smartphone ownership in South Korea was at 96% in 2022.

Latin America Telecare Market Trends

The telecare market in Latin Americais anticipated to witness at a considerable CAGR over the forecast period. With a focus on expanding access to healthcare services in remote and underserved areas, telecare technologies are becoming increasingly popular. Innovations such as mobile health apps, elderly telecare apps, and wearable devices offer efficient and affordable healthcare options, driving the growth market growth across Latin America.

The Argentina telecare market is anticipated to register at a considerable CAGR during the forecast period. Factors such as the increasing adoption of digital health technologies, government initiatives to improve healthcare access, and rising chronic disease prevalence are fueling demand for telecare solutions nationwide. The government in Argentina focuses on providing access to healthcare in underdeveloped parts of the country through the digitalization of healthcare, including telehealth and EHR management. In March 2021, Argentina increased investments in digital health to overcome the gaps in the healthcare system.

Middle East & Africa Telecare Market Trends

The telecare market in Middle East and Africais anticipated to witness at a considerable CAGR over the forecast period. Countries such as South Africa, Saudi Arabia, and UAE in the Middle East are prospering. Advancements in healthcare systems are expected to bring digital health into action in these countries. With technological advancements and improved accessibility, telecare services are becoming more readily available across the region, catering to the growing demand for convenient and efficient healthcare options.

The Kuwait telecare market is anticipated to register at a considerable CAGR during the forecast period. Kuwait’s healthcare sector is experiencing a surge in demand for telecare solutions due to several factors. The increasing prevalence of chronic diseases and an aging population are fueling the need for remote patient monitoring and personalized healthcare options. In addition, rising healthcare costs are prompting the adoption of cost-effective telecare solutions to improve patient outcomes and reduce the strain on the healthcare system.

Key Telecare Company Insights

The key players in the market have been involved in mergers and acquisitions to increase their share and provide innovative solutions for users, which is anticipated to boost the market's growth during the forecast period.

Key Telecare Companies:

The following are the leading companies in the telecare market. These companies collectively hold the largest market share and dictate industry trends.

- Teladoc Health, Inc.

- Abbott Laboratories

- Johnson and Johnson

- AstraZeneca PLC

- F. Hoffmann-La Roche Ltd.

- Novartis AG

- Bristol-Myers Squibb Company

- GlaxoSmithKline plc

- Merck and Co., Inc.

- Pfizer, Inc.

- Sanofi

- Samsung Electronics Co. Ltd

- Qualcomm Technologies, Inc.

- Orange

- Google (Alphabet), Inc

- Allscripts

- Airstrip Technologies, Inc.

- AT&T

- Apple, Inc.

Recent Developments

-

In December 2024, Skyresponse AB, a business-to-business tech company, partnered with OneCo Technologies AS, a telecommunications company. This collaboration aims to combine the strengths of both companies to deliver innovative, integrated telecare solutions for care homes, institutions, independent living, and hospitals across the public and private sectors.

-

In June 2024, Ascom introduced the Activity Monitoring solution, tailored specifically for long-term care facilities. This innovative software provides a comprehensive solution for monitoring residents' health, enabling early detection and prediction of any decline in their well-being.

-

In March 2023, Royal Philips unveiled Philips Virtual Care Management, offering a wide range of adaptable solutions and services for payers, employer groups, and providers to engage and support patients effectively from any location.

-

In October 2023, ActiGraph launched a Bluetooth Smart activity monitor, the wGT3X-BT, which is set to revolutionize the industry with its cutting-edge wireless communication, data capture, and wear time screening capabilities.

Telecare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.02 billion

Revenue forecast in 2030

USD 6.34 billion

Growth rate

CAGR of 4.79% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teladoc Health, Inc.; Abbott Laboratories; Johnson and Johnson; AstraZeneca PLC; F. Hoffmann-La Roche Ltd.; Novartis AG; Bristol-Myers Squibb Company; GlaxoSmithKline plc; Merck and Co., Inc.; Pfizer, Inc.; Sanofi; Samsung Electronics Co. Ltd; Qualcomm Technologies, Inc.; Orange; Google (Alphabet), Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telecare Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global telecare market report based on type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Activity Monitoring

-

Remote Medication Management

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global telecare market is expected to grow at a compound annual growth rate of 4.79% from 2025 to 2030 to reach USD 6.34 billion by 2030.

b. The remote medication management segment dominated the telecare market with a share of 50.97% in 2024. This growth is attributed to several factors, including the aging population, increased prevalence of chronic diseases, development of elderly telecare apps and technological advancements.

b. Some key players operating in the telecare market include Teladoc Health, Inc., Abbott Laboratories; Johnson and Johnson; AstraZeneca PLC; F. Hoffmann-La Roche Ltd.; Novartis AG; Bristol-Myers Squibb Company; GlaxoSmithKline plc; Merck and Co., Inc.; Pfizer, Inc.; and Sanofi

b. Key factors that are driving the telecare market growth include growing awareness to maintain physical health and increasing penetration of the internet and smartphones and increasing advancement of the technology to provide more efficient and improved healthcare services to patients in their own homes.

b. The global telecare market size was estimated at USD 4.71 billion in 2024 and is expected to reach USD 5.02 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.